Kickstarter and games in 2017

Top Kickstarter Game Categories

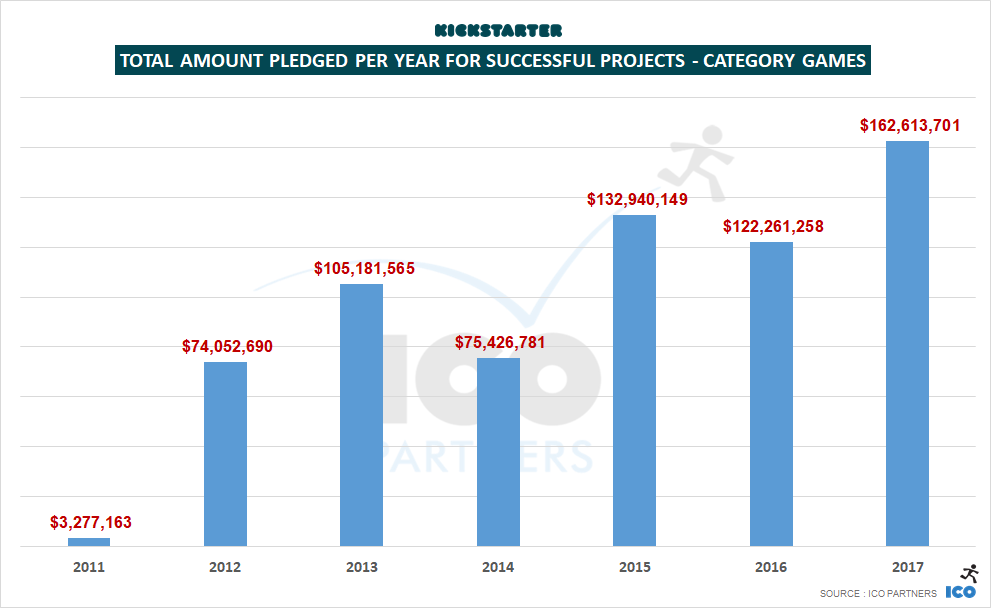

Compared to 2016, the changes are significant. Games represent 26% of all money collected in 2017 and 15% of all funded projects.

It is worth noting two very important aspects.

Firstly, the total amount of money collected by game projects in 2017 increased significantly. Secondly, the total number of games that have tried their luck on this platform remains approximately the same: in general, less than 7,000 campaigns were organized, but compared to the previous year, more of them reached their financial goals.

')

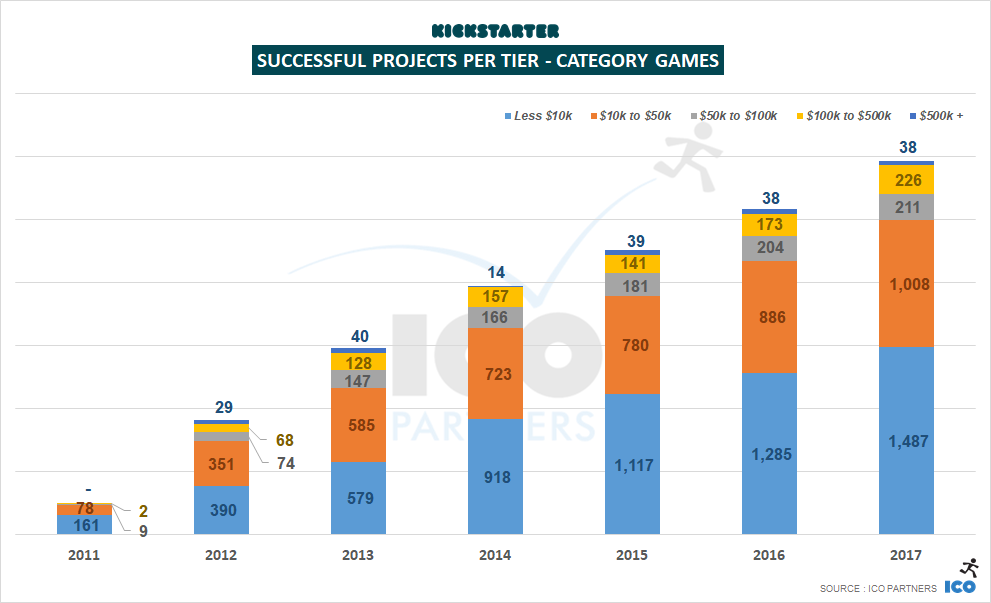

We can assume that the platform has reached a higher stage of maturity — funding-seeking projects understand better what they need to achieve their financial goals. Compared to 2016, 2017 financed 15% of the game projects more.

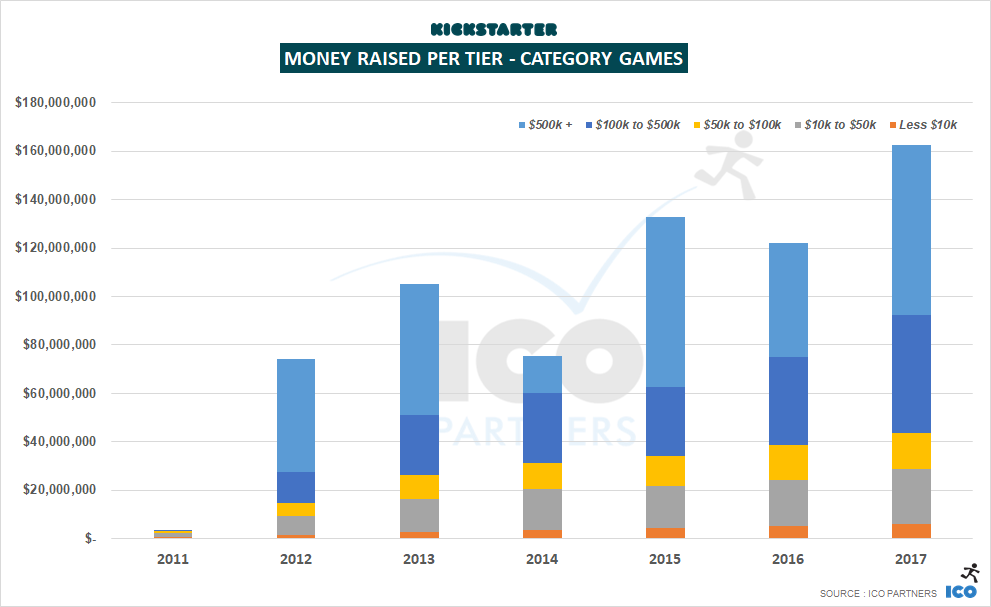

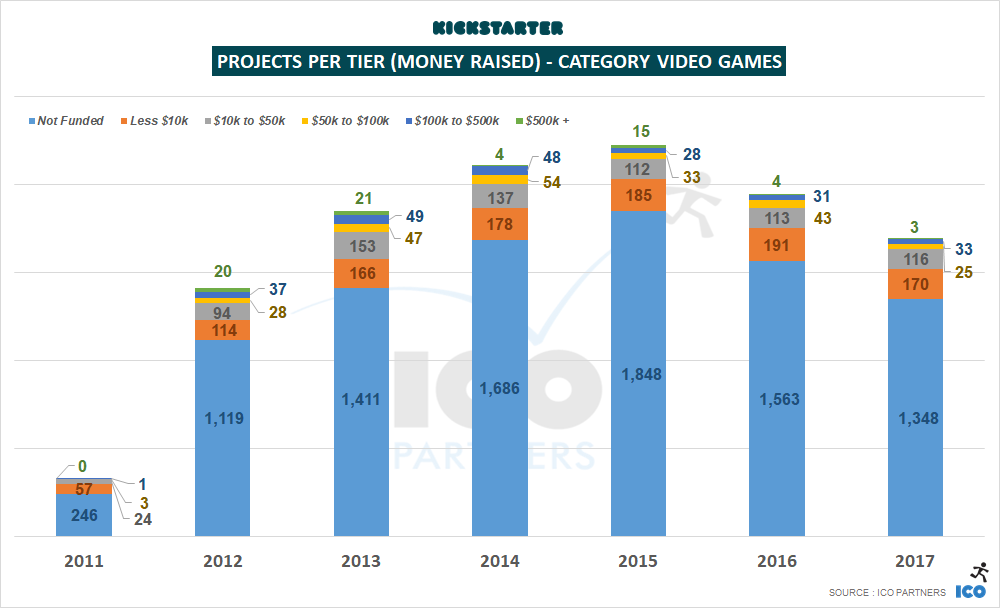

More money was raised at all levels of projects. Of course, the top division, projects with a goal of $ 500k and more, represent a large proportion of the money raised: some of these projects raised $ 70m. But the number of successful projects seeking support in the amount of $ 100k to $ 500K also increased compared to the previous year and makes up almost a third of all the money raised in 2017.

The number of projects in the top division has not changed compared to 2016 - in 2017, more than $ 500k collected 38 game projects, the same number as last year. A small proportion of large projects raised significant sums. Noteworthy are the record breakers of Kingdom Death Monster 1.5 , which became project No. 1 in the games category, collecting $ 12.4m, and The 7th Continent , collecting $ 7m alone. Together, these two campaigns represent more than 12% of all money received in the 2017 games category. Not surprisingly, both of them are board game projects, and both are sequels / reprints of already successful projects with Kickstarter.

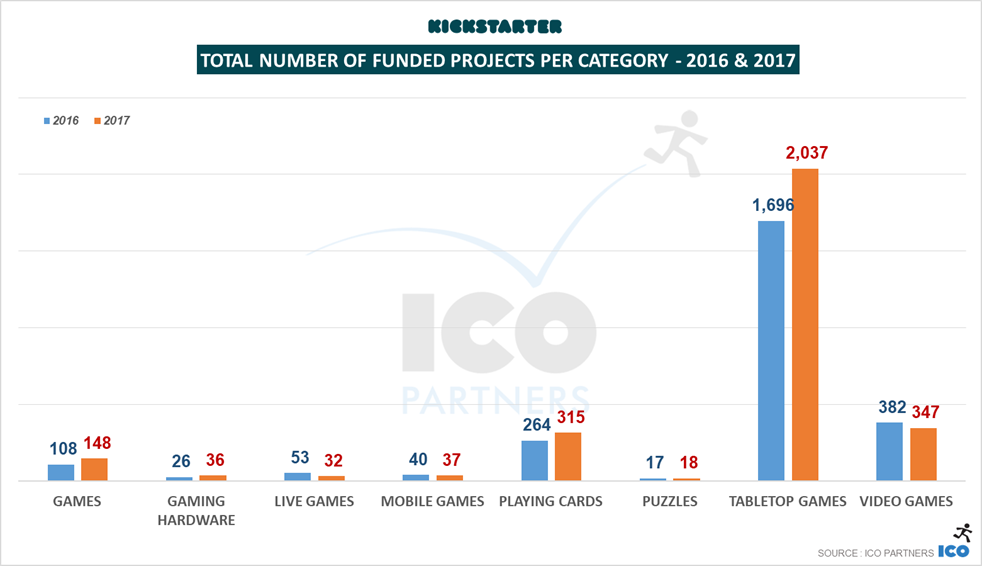

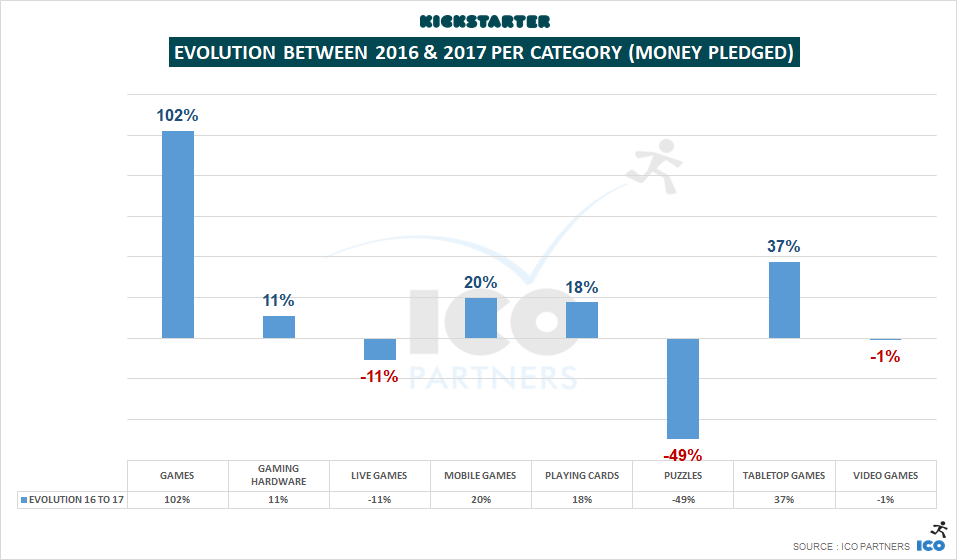

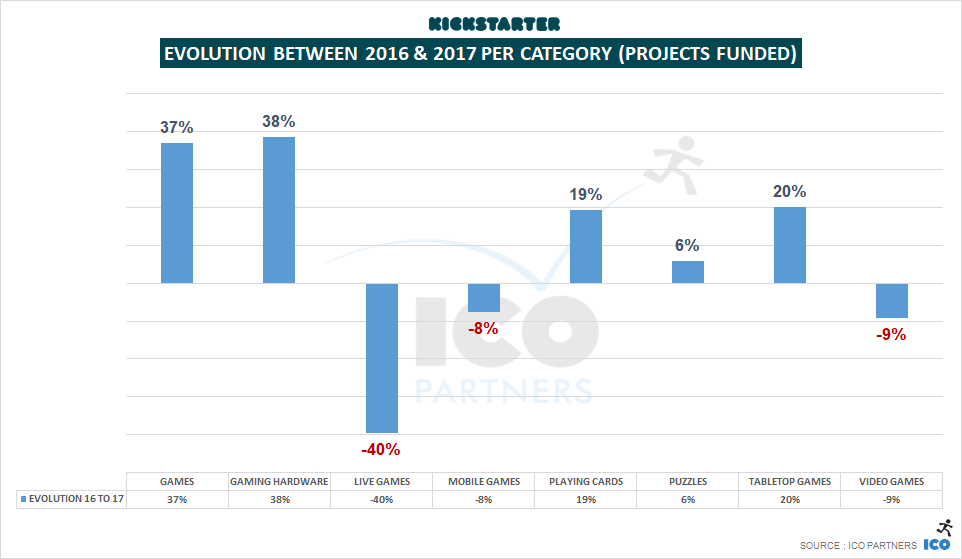

If you look at the subcategories, the number of sponsored video game projects from 2016 fell slightly. It has become much less card projects and general game projects. But, more importantly, the number of board game projects has grown significantly, by 18% compared with 2016.

And of course, almost the entire increase in the total amount of money collected by game projects is related to the subcategory of board games.

Take a look at the small subcategories

- Games is a general category that includes all projects not covered by existing tags. In 2017, its size doubled, both in the total number of sponsored projects, and in the amount of money raised. It is still relatively small, because it contains only those strange projects that are difficult to attribute to something concrete, but worth mentioning. So that you understand what type of projects are included here, I will present the best two projects of 2017. Both are associated with golf: Chip-Down: Golf for the Non-Golfer and Beer Pong Golf: Golf Spieth Can't Master

- Gaming Hardware - in 2017, more gaming equipment projects were funded, but none of them became megahit. But still, it is worth noting that overcame the $ 100k more projects than in the previous year (five in 2017, and only one in 2016). And if you're interested, the retro-console Dreamcade Replay has become the largest project in the category.

- Live Games is a niche subcategory, its performance in 2017 decreased slightly, for the first time after the time it was added. For the first time in this subcategory, one project broke the $ 100k barrier. However, it is a little out of the total number of projects presented here, and probably closer to the two aforementioned golf projects in the Games subcategory. Take a look at CHIPPO: The New Golf Game for the Beach, Backyard & Tailgate .

- Mobile Games - I usually recommend that people don’t raise funds for mobile crowdfunding games, so I’m pretty biased in analyzing this category. In 2017, all in it collected more than $ 500k. I think this is about the same as the marketing budget of one day of Supercell's Clash of Clans. However, in this category, 37 projects were financed, that is, approximately 10% of all projects submitted, far below the average for game projects. One project raised over $ 100k, this is the Epic Digital Card Game , but it turned out to be a port of a very successful board game.

- Playing Cards is the third largest subcategory. In 2017, there was some growth in it, both in the total amount of money collected (+ 21%) and in the number of successfully sponsored projects (+ 19%). It is worth noting that this year the project from the category of Playing Cards, which collected more than $ 500k, first appeared. The Name of the Wind Art Deck scored $ 630k.

- Puzzles is the smallest of all game subcategories, in 2016 it financed 17 projects, and in 2017 - 18 projects. The total amount of money received is less than half the amount of 2016, but with such a small number of projects, large fluctuations should be expected.

And now we will look at two big subcategories.

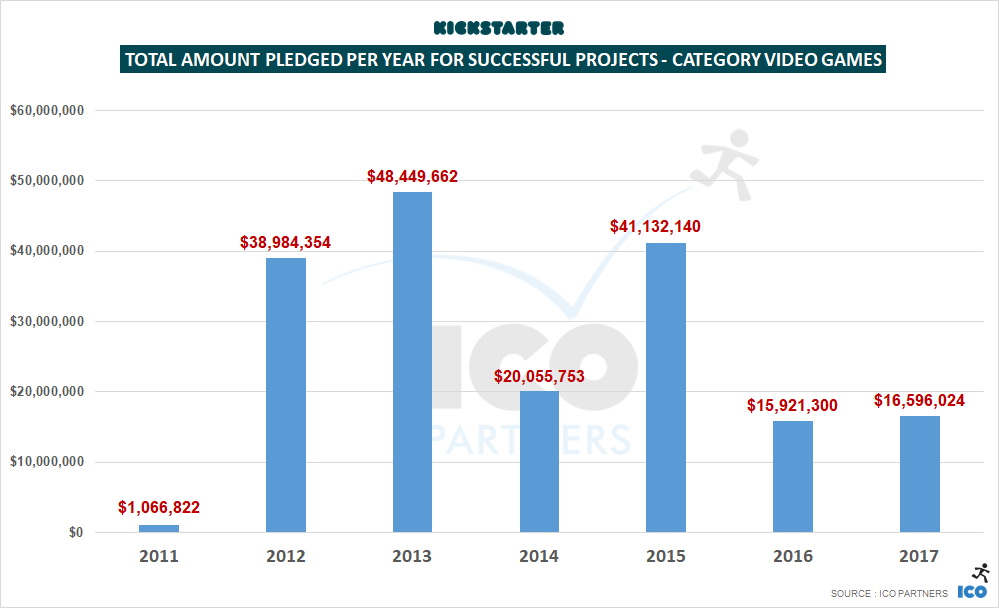

Stable for video games year

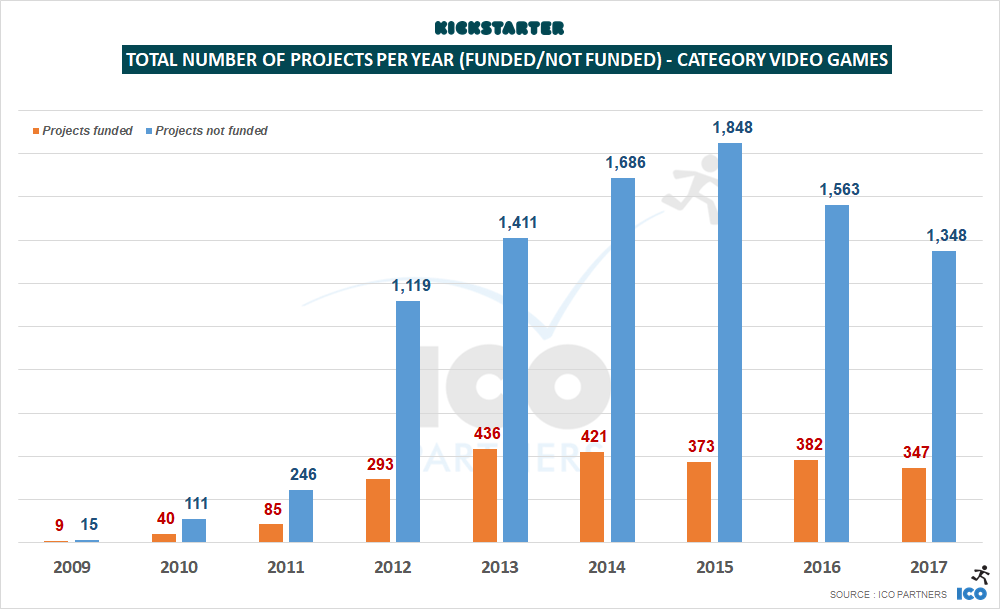

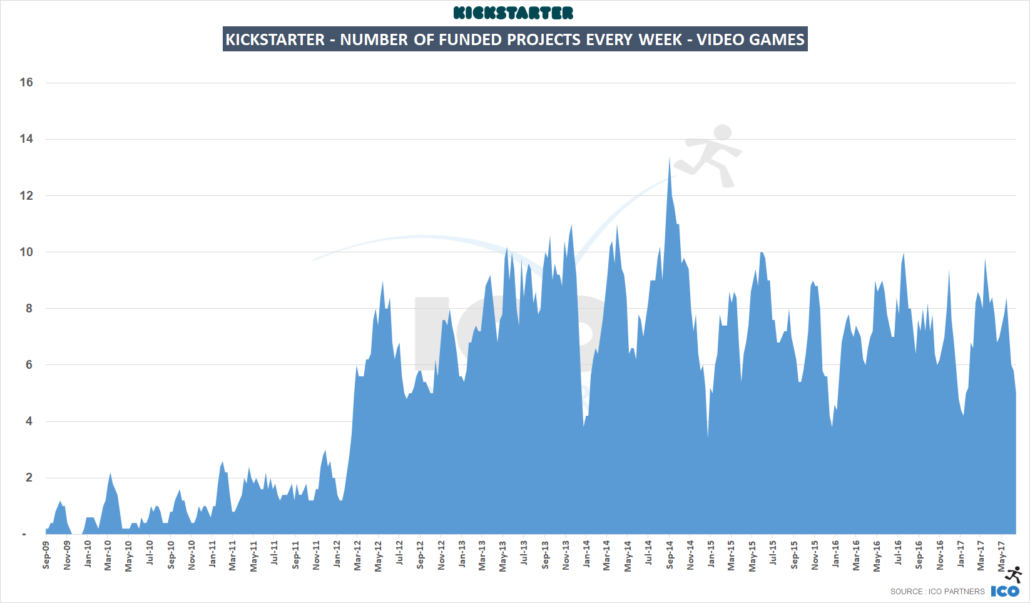

There was a slight increase in the total amount of money received, along with a slight decrease in the total number of sponsored projects, so 2017 did not become exclusive for video games on Kickstarter.

However, it is worth noting a few points:

- The total number of video game projects published on Kickstarter is growing faster than the decrease in the number of funded projects. This means that the share of funded projects is growing.

- This year, for the first time, we saw a decrease in the number of sponsored projects in the “Less than $ 10,000 collected” range. Another interval in which the decline appeared was the interval from $ 50k to $ 100k. That is, in 2017, significant changes occurred with small hobby projects, as well as with projects that collected from $ 50,000 to $ 100,000. At all other levels, the number of funded projects in 2016 and 2017 remained about the same.

My theory is that the reason for the decrease in the number in the lower range is that fewer creators are trying to ensure the crowdfunding of their projects, and this directly affects this interval more than others. Kickstarter is no longer so often mentioned in the media as it used to be, and is no longer considered as a viable platform for small projects.

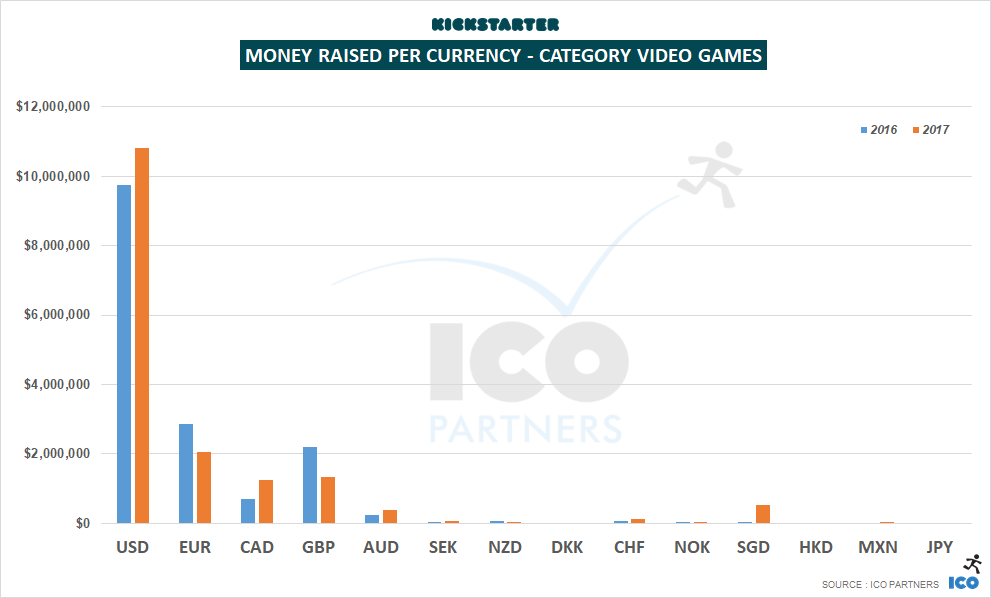

In general, 2017 has become a more successful year for video games produced for US dollars (USD) and Canadian dollars (CAD). A larger proportion of projects in these currencies are sponsored than in euros (EUR) and pounds (GBP).

It seemed to me interesting that they found funding for 12 video game projects launched from Mexico, even though they received a small amount as a result. Also noteworthy is the lack of projects launched through the Japanese version of the portal, especially considering that some of the most sponsored video games are developed in Japan. Kickstarter's entry into the Japanese market in September 2017 looks so far as a failure, and the best illustration of this is the category of video games.

Board Games: Kickstarter Lords

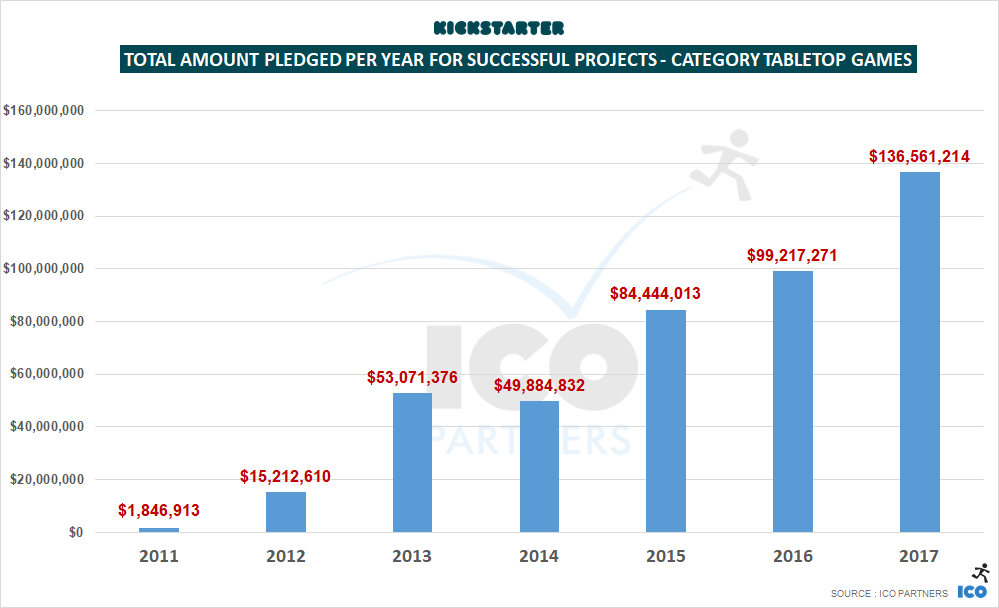

These two graphs tell the most important history of the 2017 indicators.

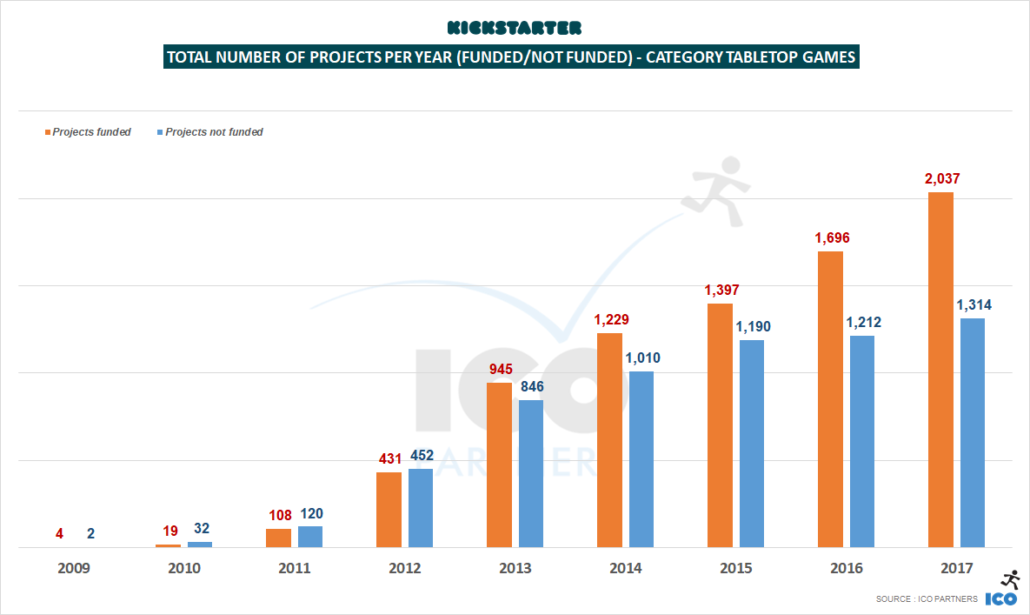

The category Tabletop Games has grown steadily over the past few years, both in terms of the total amount collected and the number of funded projects. After a record 2016, this subcategory in 2017 increased again by 36%. The number of sponsored projects increased by 20%.

However, this growth raises questions. Is this subcategory stabilized? Is it waiting for its collapse? Will it continue to grow?

There are no signs that the upward movement will slow down in the near future, even if the record holders will find it much harder to match the total amounts collected this year.

Now all the indicators of this subcategory look really healthy.

Growth was observed in all ranges of sums. For me, this is a very important indicator of how healthy the environment is in this subcategory. If the results were good only for large, large-scale campaigns, this would be a bad sign; but the growth of projects in all ranges shows that the ecosystem is not built on a pair of metaphorical “black swans” that introduce inaccuracies in the interpretation of the picture.

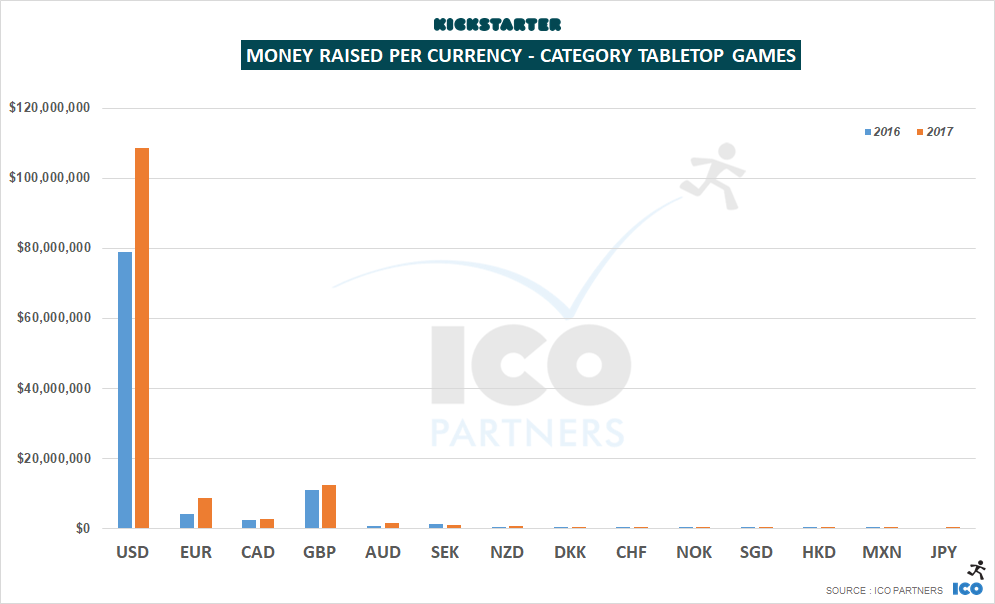

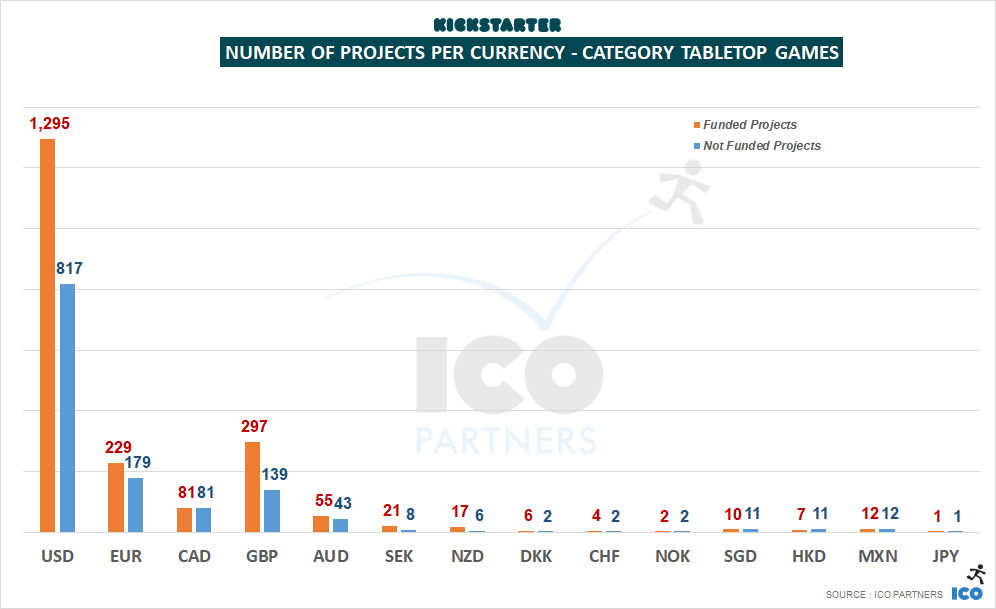

Also projects that are funded in different currencies succeed. Despite the fact that projects in USD demonstrate a wide range of funds raised and the number of sponsored projects, projects in EUR and GBP also feel good and occupy more than 25% of the total number of projects that collected money.

It is especially interesting to watch campaigns that know that they are expected to succeed when launched in USD, regardless of their geographic location. For example, the 7th Continent project of a Paris-based company was launched in USD, not EUR.

Summing up

I recently spoke at PC Connects in London with a presentation on the state of crowdfunding in video games. One of the conclusions I made was that Early Access became a much more serious competitor to Kickstarter than all other platforms. One of the reasons is that over the past year the optimal window for launching a video game crowdfunding campaign has moved closer and closer to the release of the game. This is how it manifested itself:

Gif

It is very interesting that for board games this window has also moved. To receive financing, projects must become more and more polished, but the moment of physical production means that the optimal window cannot continue to move to the right.

Another important difference between video games and board games is that for the latest Kickstarter in most projects it turns out to be the ultimate way of distribution. While for video games, the final selling method is Steam; Kickstarter helps a little, but developers still need to go to Steam.

So if your game in alpha or beta is already beautiful and replayable, and there are chances that it is already suitable for demonstration on Kickstarter, then it is also suitable for launching in early access. Early access requires much less hassle, because you only need to decide on the final platform for selling the game. However, early access does not provide many of the benefits of crowdfunding - creating a community around the game, being able to test your publisher skills and raising awareness about the game; but I suspect that for most studios this is secondary, or they underestimate such aspects.

It is also true, and it is a strong trend, that many video game projects on Kickstarter are games that by their nature do not have high replayability (for example, adventure in the style of Point-and-Click) or instant accessibility and appeal to the audience, which makes impossible for them to access early.

Methodology Note

As in previous posts on this topic, we used the data on the Kickstarter pages themselves (using Potion of Wit ) and the method of collecting them has its own problems. It is necessary to consider these values as estimated.

Source: https://habr.com/ru/post/348506/

All Articles