How robots help people start investing in the stock market: what is roboking and how it works

Image: Unsplash

In our blog, we write a lot about high-frequency trading and the creation of specialized robots to perform operations on the exchange. It may seem that all this applies only to advanced traders, but in fact there is a separate class of robots that help beginners to get used to the market. Such systems are called Robo-Editors - they will be discussed today.

')

What it is

Robot Editing is a tool to get started on the stock market. It originally appeared in the United States, where the developers of financial services sought to offer trust management services for citizens' pension savings.

It is aimed at those who would like to start investing their money, but doubts their ability not to lose all the money. In fact, electronic advisors help those who used only bank deposits to enter the stock market.

In essence, robo-Editing is the automation of a fiduciary management service, within the framework of which investors turn to professional managers, who perform operations with their funds and assets. Despite the assurances of many managers who claim to create a unique trading strategy for each client, in practice from 3 to 9 risk profiles are usually used - from this number those strategies are chosen that are most suitable for the client's tasks.

Among other things, it is also the cheapest of the available investment methods - the cost of the work of a robot advisor will never compare with the price of services of a professional manager.

How it works

In spite of the fact that the idea of entrusting the management of your savings and assets to a robot working with algorithms may not seem very obvious, this type of investment is very popular in the West. Under the management of the largest players in the market, Wealthfront and Betterment's robot edection is about $ 10 billion.

It is important to understand that automated assistants for investors are not used for active trading; here passive strategies are used to extract profits in the long term. In the classical scheme of Roads Editing, funds in certain proportions are invested in different classes of assets - stocks, bonds, ETFs, etc. Then, in accordance with the given weights, a periodic rebalancing of the portfolio is carried out depending on the price changes of various financial instruments.

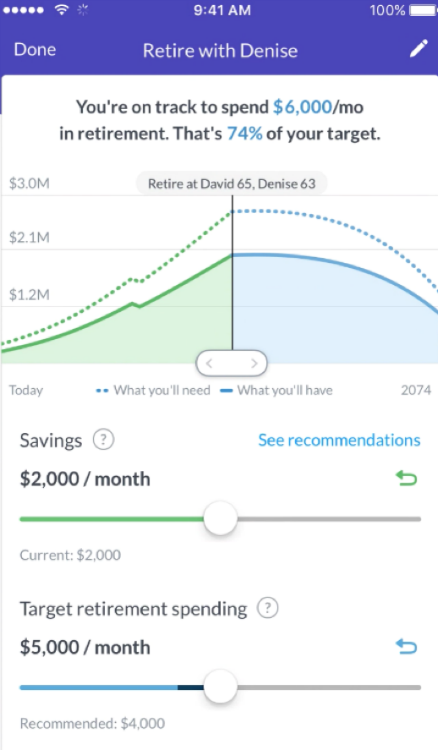

The interface of the Wealthfront Robotudder

Robotvayzery can be "sharpened" for solving specific problems - for example, increasing retirement savings or getting the amount needed to pay for education.

What is in Russia

In spite of the fact that roboedviding appeared for the first time in the USA, initiatives in this direction also appear in our country. One of them is a joint project of the broker ITI Capital and the company ARTQUANT , under which the function of rodo-issuing is available to clients directly in the personal account of the brokerage system.

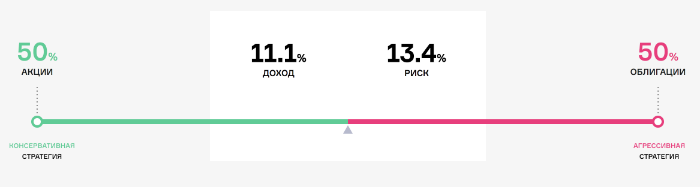

The electronic financial adviser asks the user a few simple questions - for how many years he plans to invest, what level of risk he considers acceptable, etc. Based on the answers, an algorithm for investment and an appropriate risk profile are selected. Currently there are two types of asset classes available - stocks and federal loan bonds (OFZ).

Risk profile, in fact, is responsible for determining the ratio of stocks and bonds in the portfolio being created - in the conservative OFZ portfolio they take up to 90%. In this case, the overall reliability of the strategy is comparable to the use of a bank deposit, although it is important to remember that stock exchange investments do not fall under the protection of the state (but in the future the situation may change ).

The minimum investment amount is 10 thousand rubles, but the higher the amount, the more diversified the portfolio can create a system.

Conclusion

Roads Editing is a tool for getting acquainted with the stock market, which is suitable for people who are thinking about investments, but who are not confident in their abilities. The robot can choose a trading strategy that matches the user's preferences in terms of investment levels, their duration and possible risk. As a result, you can get low-risk strategies (with a high proportion of purchased OFZ), which generate income higher than a bank deposit provides.

In addition, when using rodaEditoring, the investor saves on management fees and only pays the broker commission for making transactions.

On the basis of the described parameters, it can be concluded that roboadvising is well suited, for example, to work with individual investment accounts (IIS) and not only to profit from investments, but also to enjoy various types of benefits .

Other materials on finance and stock market from ITI Capital :

- ITI Capital Educational Resources

- Analytics and market reviews

- How the use of the word “blockchain” allows companies to increase capitalization

- How will be organized trading in Bitcoin futures on the Chicago Stock Exchange

- What to do on holidays: write robots for trading on the exchange in the scripting language TradeScript

- Where it is more profitable to buy currency: banks vs exchange

Source: https://habr.com/ru/post/347672/

All Articles