10 years have passed, and no one has figured out how to use the blockchain

Everyone says that blockchain - the technology underlying cryptocurrency - will change everything. But after years of effort and multibillion-dollar investments, no one ever figured out how to use blockchain, except for cryptocurrency speculation and illegal financial transactions.

In all described use cases - from payments to legal documents, from depositing to voting systems - the authors resorted to all sorts of tricks to implement a distributed, encrypted, anonymous registry, which was not needed. And what if there is no need to use a distributed registry at all? What if the absence of large-scale projects based on a distributed registry after a decade of development is due to the fact that nobody needs it?

Initially, the blockchain was developed for use in cryptocurrencies like bitcoin - as a way of storing and exchanging valuables, almost like any other currency. Visa and MasterCard were declared dinosaurs, because now there was a free and instant way to exchange valuables without bribe-taking intermediaries. The banking revolution was only the beginning ... governments that are no longer able to issue money will go to the background, because citizens will be free to transfer money outside national systems.

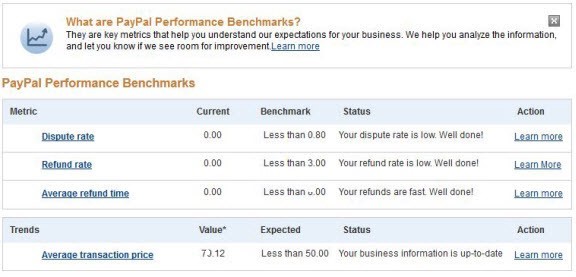

Killer feature: the knowledge that you can get your money back.

')

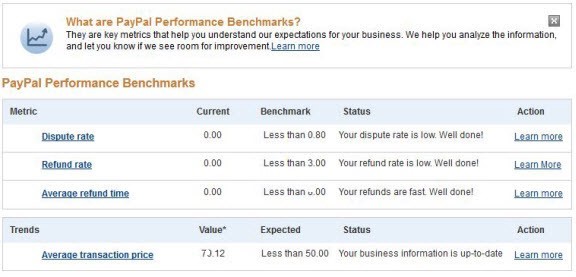

Not much time passed before the dream fell apart. On the one hand, there is already a free and instant way to exchange values without intermediaries - cash. Bitcoins replace dollars, but Visa and MasterCard sit on dollar banking transactions, providing a set of value-added services, such as tracking fraudulent disputes and identifying buyers and sellers. Apparently, for the person paying for the goods, the main feature of the new payment system - as with PayPal in its early years - is the certainty that if the goods turn out to be unsatisfactory, then you can get your money back. And for the person receiving the payment, the main feature of the payment system is the confidence that the buyers really pay and want to use this system. Add points, credit lines and free baggage check-in on all United Airlines flights — and you’ll get a system that users choose and use as merchants. In fact, no one wants to pay Bitcoins, so they have not yet soared.

In order for Visa to work on the blockchain, 5,000 nuclear reactors will be needed.

In addition, it is not so good payment system. Visa can process 60,000 transactions per second, and Bitcoin has historically been trampled by 7. There are technical modifications to improve Bitcoin efficiency, but as a starting point you have something that pulls only about 0.01% of the clearing transactions. And it must be mentioned that for these seven transactions per second, Bitcoin already spends about 35 times more energy than Visa. If you bring the frequency of bitcoin transactions to 60,000 per second, then you need as much energy as is produced throughout the world.

In many countries, the ability to do something without the eyes of the authorities makes the world a better place. In Cuba or Venezuela, many people prefer to transfer money in dollars, and Bitcoin, theoretically, can perform the same function. But there are at least two reasons why this cryptocurrency did not become the desired panacea: the superiority of the government over the individual citizen and the superiority of the government over society.

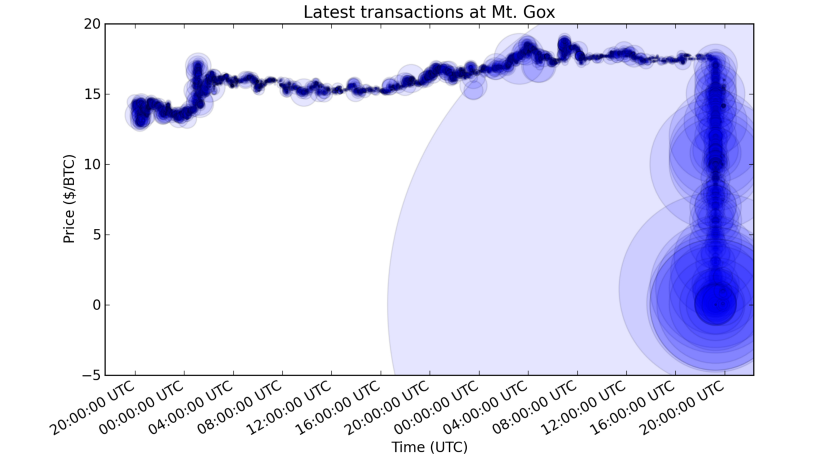

Mt Gox loses users money.

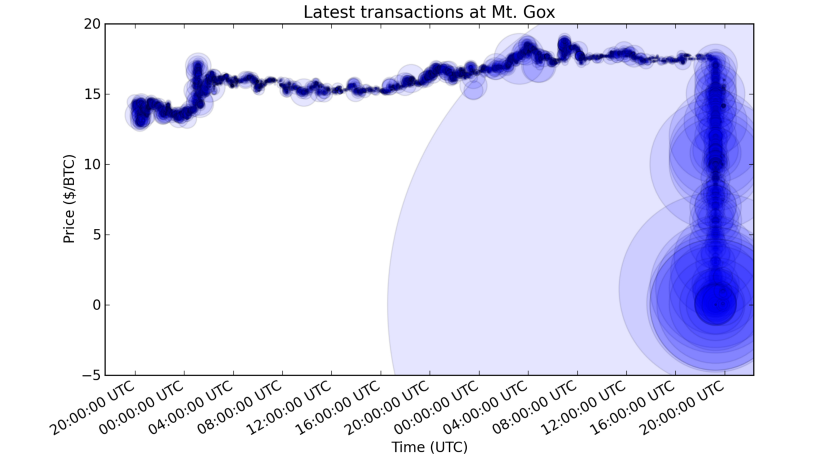

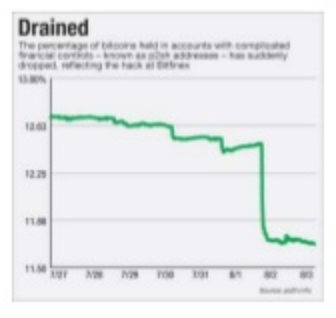

A government-supported banking system provides deposit insurance, reversibility of transfers, identity checks, audit standards and an investigation system in case of problems. Bitcoin, by definition, has none of this. Somehow I came across a remarkable thread on the forum where people write, whose Bitcoin wallets have emptied, hacked mail and stole passwords. They were stunned because they had nowhere to wait for help! And it is widespread: in 2014, the company Mt. Gox, which was then the largest Bitcoin trader, lost $ 400 million of its users due to security holes. The next largest Bitcoin trader, Bitfinex, also closed after losing user money. Imagine a world in which banks would rather lose depositors' money than multiply them. Bitcoin is medieval banking: “here's your libertarian paradise, have a nice day.”

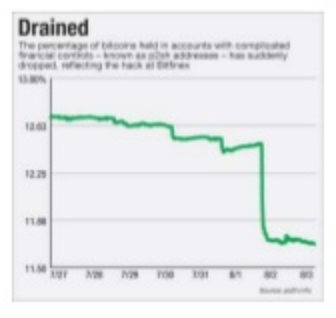

BitFinex loses all user money.

This problem is very close and clear to me, because my own True Link company was created to help vulnerable older people — who are willing to give their credit card numbers by phone, take part in muddy sweepstakes, or donate to questionable organizations, invest in fraudulent companies, or install a crossword puzzle program. stealing passwords. These people most in need of developed means of protection in the banking sector and payment systems, they are highly dependent on modern degrees of protection and will be the first victims of the proposed changes in order to implement instant, private-key identifiable and irreversible transfers. Anyone who looks at banking security from a person’s point of view would have come up with something very different from the blockchain!

With the introduction of sanctions against Russia in the Mongolian banks, the volume of transfers increased more than 4 times.

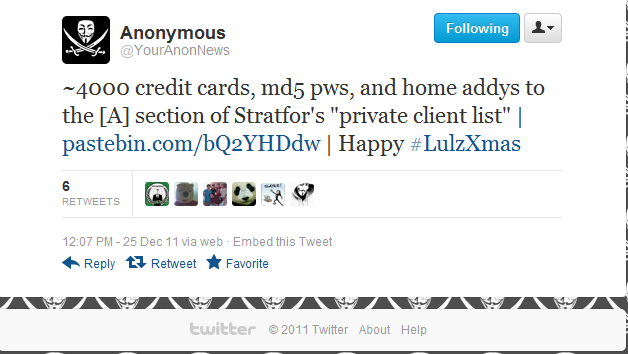

In addition, government-produced decisions are aimed at countering the financing of terrorism and organized crime, at combating the circulation of prohibited goods such as stolen credit card numbers or child pornography. Therefore, the main wish is for transactions to be private, but at the same time they can be opened by order of law enforcement agencies. Ask people: “Should the government be able to get a list of all the people you pay for by order?” And the majority will say no. Ask: "Should the government be able, on orders, to get a list of everyone to whom the collector of child pornography paid?" And most will say "yes." No one wants Bitcoin to increase the circulation of goods that are considered prohibited 100 times. As one Bitcoin enthusiast told me, "if you invented cash today, they would also be banned."

Now let's talk about two situations in which blockchain currencies have a particularly bright future: micropayments and interbank transfers. As for payments, enthusiasts are pushing for free and instantaneous bitcoin transactions. Although in fact the transaction takes about 8 minutes, and its processing costs about 4 cents. We are offered to use Bitcoins for micropayments - for example, to pay two cents to a musician for listening to his song on the network, or four cents for reading a newspaper article. But the infrastructure designed for this - for example, pre-authorization of the source of funds so that you do not have to wait 8 minutes to read the article you just clicked on - in fact, does not require using bitcoins at all. If you are satisfied with the price of four cents per article or two cents per song, then pay once a month from a bank account. In practice, people prefer micropayments subscriptions.

Three years have passed, and Ripple for SWIFT is like toothpicks for the American gross domestic product.

As for interbank payments, many people remember Ripple as a promising way to transfer money between banks. At the time of this writing, over the past 30 days, $ 2 billion of interbank and interpersonal transactions were processed - approximately 40-second volume of the interbank SWIFT network - after three years of banking trade 90% of high-volume currencies. This is the contribution of toothpick sales to US GDP. Why did the banks not prefer this new technology? The fact is that setting up a Ripple gateway is not too different from using an existing correspondent account system - except that losing a password or a token can lead to much larger and faster losses. A bitcoin exchange, I recall, rather contributes to this, but does not prevent. The same properties of the banking system attract both users and banks. There are already registries that do not need to distribute, anonymize, encrypt, publish and make irreversible.

Smart contracts are software contracts, not legal documents. Storage directly on the blockchain allows them to transfer value based directly on the cryptographic agreement of the parties. In other words, “smart” contracts are “self-fulfilling.” In theory, contracts written in the form of software are cheaper to interpret: since they act in a literal sense mathematically and automatically, there are no two ways of interpretation, which means that no expensive legal battles are necessary.

DAO loses all user money.

And in the real world there are already examples of the problematic nature of this approach. The most promising and largest contract to date, an investment structure called Distributed Autonomous Organization (DAO), allowed its participants to invest money directly, using private cryptographic keys to select investment objects. No lawyers, no commission, no backroom meetings. The DAO “excluded the possibility of erroneous investments and the loss of funds by directors and financial managers.” And because of the software bug, the DAO “voted” to “invest” $ 50 million, a third of the depositors' money, into a structure managed by very clever programmers who ate the dog on recursion problems when updating balance sheets. Someone thinks it was a hack or an exploit, because the software did not work the way it was intended. Others believe that there was no hacking - the essence of the software was precisely the autonomy of decision making, this cannot be interpreted in two ways, and if you don’t understand how this software works, then there was nothing to participate. As a result, all participants voted retroactively to reimburse the software contract and return the money to their original owners. What is the conclusion? Even the smartest blockchain enthusiasts actually want a bunch of people to argue about the real goals of a contract, and not allow software to self-execute. Perhaps the “stupid” way turns out to be clever as a result?

Even crypto enthusiasts argue about the value of their contracts.

DAO was an experimental experiment, but what about routine transactions in large companies? Investors and startups in the field of smart contracts promise that the blockchain will provide super-fast execution and payments, for example, in healthcare - “instead of waiting for processing applications for 3-6 months, or spending hours on telephone conversations in an attempt to pay your bill, smart the contract can theoretically be processed instantly. " But this is true for any software purchase systems. Amazon servers used by my company are automatically scaled depending on the traffic to the site, and we pay only for real use. It is a mistake to assume that smart contracts will change this. They imply a legal agreement that comes into effect with the software , and the legal agreement itself is also represented as software . Amazon’s Terms of Service are not a smart contract, but the billing system implementing these terms is automated. And the reason for the lack of automation, say, in health insurance billing is not that the existing software is not smart enough to process incoming applications and their electronic payment, but because insurance companies themselves are slow, either historically or because they prefer to check the application of people.

Please let bitcoin speed it up?

In the end, everyone, from blockchain enthusiasts to insurers, wants to properly discuss the essence of business relations and interpret them on an ongoing basis, and only then write software that deals with processing and payments. The existing one is the status quo.

Another incredible idea of using the blockchain is distributed storage mechanisms. At first glance, it is quite sensible: break your documents into “blocks”, encrypt them and put them in a distributed magazine ... it is scattered across many machines, it is safe and easy to track all actions.

But there are lots of great ways to split files, encrypt and replicate across multiple repositories in different places. There is already a company that has proven itself to be a cheaper alternative - distributed by Dropbox, encrypting and storing files on a variety of user hard drives and paying them a small commission for the space used. Blockchain is a particularly inefficient and insecure distributed storage method.

Ha! Can your blockchain do it?

The blockchain approach has 4 additional drawbacks.

First, you rely on a single encryption point - your private key - and not on a more complex system that can use two-factor authentication, intrusion detection, volume restrictions, firewalls, remote IP tracking, and the ability to disable the system in case of emergency.

Secondly, the price trade-offs are completely implausible: the Bitcoin blockchain has already consumed nearly a billion dollars of electricity, which took on hashing data, which is about 1/6 of the volume of the Dropbox subscription at $ 10 / month.

Third, the systematic choice of where and how much to replicate data is beneficial in the long run. And the blockchain's default data distribution is not that smart either.

Finally, Dropbox, Box.com, Google, Microsoft, Apple, Amazon, and many other companies provide a variety of other useful features that you’d hardly want to develop yourself. Similar to Visa, the problem is not in storing data, but in managing permissions, canceling the sharing of data that you shared earlier, in obtaining a vivid history of documents, in sync between multiple devices and much more.

The same arguments apply to distributed computing as well as secure messaging applications. Encryption, eternal storage and distribution throughout the network is a huge redundant work compared to the main task. There are excellent solutions for computing, exchanging messages and storing data, equipped with all the necessary means of encryption and replication, and better than the solutions based on the blockchain - and a bunch of extra great features in addition.

It was loudly announced that the NASDAQ had launched a blockchain-based domestic exchange for private equity. But wait. Correct me if it’s not right, but the whole point of the NASDAQ (or, for example, the depositary trust and clearing company) is that it has a registry, who owns what shares? Are they worried that their systems without a blockchain will not be able to track their balance sheets soon?

As in other tasks related to tracking transactions, such as buyer-seller payments, the difference between the NASDAQ registry and the blockchain is that the blockchain is distributed - this solves the problem of not having a trusted intermediary. And today for legal transactions, the company itself, its record transfer agent, the clearing house or the exchange are all trusted intermediaries, usually offering value added services. The reason NASDAQ is the right place for the birth of the blockchain-based exchange is because there are experts in compliance with legal requirements and security when trading stocks. Remove the intermediary from the chain (in this case, the NASDAQ itself) and the government, and you will only have companies that decide on clever maneuvers with legal systems, legal compliance systems and tracking systems that are traditional for the main market. As people who sell shares that are not admitted to the stock exchange will tell you, this is a guarantee of losing your money.

What paper documentation is prepared for when issuing securities

And we have already seen it. New companies began to create blockchain-based "coins" convertible into shares of companies themselves, and publicly sell them during Initial Coin Offerings (ICO) as a cheap and more flexible way of raising money compared to traditional initial public offering (IPO) of shares Exchange It is interesting to see how long this madness will last - among other things, the offer of tokens converted into shares is considered to be the offer of securities, so the SEC rules should apply to tokens, like other securities. «» — , , — .

: , , , «» . - , . , , , , , -, , .

. - !

, . , , .

, , . .

, . , , PGP-. , , . , , . - , , .

, - .

, , - - , , , Bitbucket, , , md5-, - . , ------------? , , ?

(domain resolution) — , URL , — , -, , , , . , DAO -, , , , . , : , - bankofamerica.com, disney.com, sony.com . , . , , - — .

.

: , ID-, — , , , . : Second Life ; -, - ; , (!).

, — , — , . - , , . — , .

: . , . -, , . , -, , . , , IPO , … , 20- - , .

- .

In all described use cases - from payments to legal documents, from depositing to voting systems - the authors resorted to all sorts of tricks to implement a distributed, encrypted, anonymous registry, which was not needed. And what if there is no need to use a distributed registry at all? What if the absence of large-scale projects based on a distributed registry after a decade of development is due to the fact that nobody needs it?

Payments and banking

Initially, the blockchain was developed for use in cryptocurrencies like bitcoin - as a way of storing and exchanging valuables, almost like any other currency. Visa and MasterCard were declared dinosaurs, because now there was a free and instant way to exchange valuables without bribe-taking intermediaries. The banking revolution was only the beginning ... governments that are no longer able to issue money will go to the background, because citizens will be free to transfer money outside national systems.

Killer feature: the knowledge that you can get your money back.

')

Not much time passed before the dream fell apart. On the one hand, there is already a free and instant way to exchange values without intermediaries - cash. Bitcoins replace dollars, but Visa and MasterCard sit on dollar banking transactions, providing a set of value-added services, such as tracking fraudulent disputes and identifying buyers and sellers. Apparently, for the person paying for the goods, the main feature of the new payment system - as with PayPal in its early years - is the certainty that if the goods turn out to be unsatisfactory, then you can get your money back. And for the person receiving the payment, the main feature of the payment system is the confidence that the buyers really pay and want to use this system. Add points, credit lines and free baggage check-in on all United Airlines flights — and you’ll get a system that users choose and use as merchants. In fact, no one wants to pay Bitcoins, so they have not yet soared.

In order for Visa to work on the blockchain, 5,000 nuclear reactors will be needed.

In addition, it is not so good payment system. Visa can process 60,000 transactions per second, and Bitcoin has historically been trampled by 7. There are technical modifications to improve Bitcoin efficiency, but as a starting point you have something that pulls only about 0.01% of the clearing transactions. And it must be mentioned that for these seven transactions per second, Bitcoin already spends about 35 times more energy than Visa. If you bring the frequency of bitcoin transactions to 60,000 per second, then you need as much energy as is produced throughout the world.

Ability to transfer funds without government oversight

In many countries, the ability to do something without the eyes of the authorities makes the world a better place. In Cuba or Venezuela, many people prefer to transfer money in dollars, and Bitcoin, theoretically, can perform the same function. But there are at least two reasons why this cryptocurrency did not become the desired panacea: the superiority of the government over the individual citizen and the superiority of the government over society.

Mt Gox loses users money.

A government-supported banking system provides deposit insurance, reversibility of transfers, identity checks, audit standards and an investigation system in case of problems. Bitcoin, by definition, has none of this. Somehow I came across a remarkable thread on the forum where people write, whose Bitcoin wallets have emptied, hacked mail and stole passwords. They were stunned because they had nowhere to wait for help! And it is widespread: in 2014, the company Mt. Gox, which was then the largest Bitcoin trader, lost $ 400 million of its users due to security holes. The next largest Bitcoin trader, Bitfinex, also closed after losing user money. Imagine a world in which banks would rather lose depositors' money than multiply them. Bitcoin is medieval banking: “here's your libertarian paradise, have a nice day.”

BitFinex loses all user money.

This problem is very close and clear to me, because my own True Link company was created to help vulnerable older people — who are willing to give their credit card numbers by phone, take part in muddy sweepstakes, or donate to questionable organizations, invest in fraudulent companies, or install a crossword puzzle program. stealing passwords. These people most in need of developed means of protection in the banking sector and payment systems, they are highly dependent on modern degrees of protection and will be the first victims of the proposed changes in order to implement instant, private-key identifiable and irreversible transfers. Anyone who looks at banking security from a person’s point of view would have come up with something very different from the blockchain!

With the introduction of sanctions against Russia in the Mongolian banks, the volume of transfers increased more than 4 times.

In addition, government-produced decisions are aimed at countering the financing of terrorism and organized crime, at combating the circulation of prohibited goods such as stolen credit card numbers or child pornography. Therefore, the main wish is for transactions to be private, but at the same time they can be opened by order of law enforcement agencies. Ask people: “Should the government be able to get a list of all the people you pay for by order?” And the majority will say no. Ask: "Should the government be able, on orders, to get a list of everyone to whom the collector of child pornography paid?" And most will say "yes." No one wants Bitcoin to increase the circulation of goods that are considered prohibited 100 times. As one Bitcoin enthusiast told me, "if you invented cash today, they would also be banned."

Micropayments and interbank transfers

Now let's talk about two situations in which blockchain currencies have a particularly bright future: micropayments and interbank transfers. As for payments, enthusiasts are pushing for free and instantaneous bitcoin transactions. Although in fact the transaction takes about 8 minutes, and its processing costs about 4 cents. We are offered to use Bitcoins for micropayments - for example, to pay two cents to a musician for listening to his song on the network, or four cents for reading a newspaper article. But the infrastructure designed for this - for example, pre-authorization of the source of funds so that you do not have to wait 8 minutes to read the article you just clicked on - in fact, does not require using bitcoins at all. If you are satisfied with the price of four cents per article or two cents per song, then pay once a month from a bank account. In practice, people prefer micropayments subscriptions.

Three years have passed, and Ripple for SWIFT is like toothpicks for the American gross domestic product.

As for interbank payments, many people remember Ripple as a promising way to transfer money between banks. At the time of this writing, over the past 30 days, $ 2 billion of interbank and interpersonal transactions were processed - approximately 40-second volume of the interbank SWIFT network - after three years of banking trade 90% of high-volume currencies. This is the contribution of toothpick sales to US GDP. Why did the banks not prefer this new technology? The fact is that setting up a Ripple gateway is not too different from using an existing correspondent account system - except that losing a password or a token can lead to much larger and faster losses. A bitcoin exchange, I recall, rather contributes to this, but does not prevent. The same properties of the banking system attract both users and banks. There are already registries that do not need to distribute, anonymize, encrypt, publish and make irreversible.

Smart Contracts

Smart contracts are software contracts, not legal documents. Storage directly on the blockchain allows them to transfer value based directly on the cryptographic agreement of the parties. In other words, “smart” contracts are “self-fulfilling.” In theory, contracts written in the form of software are cheaper to interpret: since they act in a literal sense mathematically and automatically, there are no two ways of interpretation, which means that no expensive legal battles are necessary.

DAO loses all user money.

And in the real world there are already examples of the problematic nature of this approach. The most promising and largest contract to date, an investment structure called Distributed Autonomous Organization (DAO), allowed its participants to invest money directly, using private cryptographic keys to select investment objects. No lawyers, no commission, no backroom meetings. The DAO “excluded the possibility of erroneous investments and the loss of funds by directors and financial managers.” And because of the software bug, the DAO “voted” to “invest” $ 50 million, a third of the depositors' money, into a structure managed by very clever programmers who ate the dog on recursion problems when updating balance sheets. Someone thinks it was a hack or an exploit, because the software did not work the way it was intended. Others believe that there was no hacking - the essence of the software was precisely the autonomy of decision making, this cannot be interpreted in two ways, and if you don’t understand how this software works, then there was nothing to participate. As a result, all participants voted retroactively to reimburse the software contract and return the money to their original owners. What is the conclusion? Even the smartest blockchain enthusiasts actually want a bunch of people to argue about the real goals of a contract, and not allow software to self-execute. Perhaps the “stupid” way turns out to be clever as a result?

Even crypto enthusiasts argue about the value of their contracts.

DAO was an experimental experiment, but what about routine transactions in large companies? Investors and startups in the field of smart contracts promise that the blockchain will provide super-fast execution and payments, for example, in healthcare - “instead of waiting for processing applications for 3-6 months, or spending hours on telephone conversations in an attempt to pay your bill, smart the contract can theoretically be processed instantly. " But this is true for any software purchase systems. Amazon servers used by my company are automatically scaled depending on the traffic to the site, and we pay only for real use. It is a mistake to assume that smart contracts will change this. They imply a legal agreement that comes into effect with the software , and the legal agreement itself is also represented as software . Amazon’s Terms of Service are not a smart contract, but the billing system implementing these terms is automated. And the reason for the lack of automation, say, in health insurance billing is not that the existing software is not smart enough to process incoming applications and their electronic payment, but because insurance companies themselves are slow, either historically or because they prefer to check the application of people.

Please let bitcoin speed it up?

In the end, everyone, from blockchain enthusiasts to insurers, wants to properly discuss the essence of business relations and interpret them on an ongoing basis, and only then write software that deals with processing and payments. The existing one is the status quo.

Distributed storage, computing and messaging

Another incredible idea of using the blockchain is distributed storage mechanisms. At first glance, it is quite sensible: break your documents into “blocks”, encrypt them and put them in a distributed magazine ... it is scattered across many machines, it is safe and easy to track all actions.

But there are lots of great ways to split files, encrypt and replicate across multiple repositories in different places. There is already a company that has proven itself to be a cheaper alternative - distributed by Dropbox, encrypting and storing files on a variety of user hard drives and paying them a small commission for the space used. Blockchain is a particularly inefficient and insecure distributed storage method.

Ha! Can your blockchain do it?

The blockchain approach has 4 additional drawbacks.

First, you rely on a single encryption point - your private key - and not on a more complex system that can use two-factor authentication, intrusion detection, volume restrictions, firewalls, remote IP tracking, and the ability to disable the system in case of emergency.

Secondly, the price trade-offs are completely implausible: the Bitcoin blockchain has already consumed nearly a billion dollars of electricity, which took on hashing data, which is about 1/6 of the volume of the Dropbox subscription at $ 10 / month.

Third, the systematic choice of where and how much to replicate data is beneficial in the long run. And the blockchain's default data distribution is not that smart either.

Finally, Dropbox, Box.com, Google, Microsoft, Apple, Amazon, and many other companies provide a variety of other useful features that you’d hardly want to develop yourself. Similar to Visa, the problem is not in storing data, but in managing permissions, canceling the sharing of data that you shared earlier, in obtaining a vivid history of documents, in sync between multiple devices and much more.

The same arguments apply to distributed computing as well as secure messaging applications. Encryption, eternal storage and distribution throughout the network is a huge redundant work compared to the main task. There are excellent solutions for computing, exchanging messages and storing data, equipped with all the necessary means of encryption and replication, and better than the solutions based on the blockchain - and a bunch of extra great features in addition.

It was loudly announced that the NASDAQ had launched a blockchain-based domestic exchange for private equity. But wait. Correct me if it’s not right, but the whole point of the NASDAQ (or, for example, the depositary trust and clearing company) is that it has a registry, who owns what shares? Are they worried that their systems without a blockchain will not be able to track their balance sheets soon?

As in other tasks related to tracking transactions, such as buyer-seller payments, the difference between the NASDAQ registry and the blockchain is that the blockchain is distributed - this solves the problem of not having a trusted intermediary. And today for legal transactions, the company itself, its record transfer agent, the clearing house or the exchange are all trusted intermediaries, usually offering value added services. The reason NASDAQ is the right place for the birth of the blockchain-based exchange is because there are experts in compliance with legal requirements and security when trading stocks. Remove the intermediary from the chain (in this case, the NASDAQ itself) and the government, and you will only have companies that decide on clever maneuvers with legal systems, legal compliance systems and tracking systems that are traditional for the main market. As people who sell shares that are not admitted to the stock exchange will tell you, this is a guarantee of losing your money.

What paper documentation is prepared for when issuing securities

And we have already seen it. New companies began to create blockchain-based "coins" convertible into shares of companies themselves, and publicly sell them during Initial Coin Offerings (ICO) as a cheap and more flexible way of raising money compared to traditional initial public offering (IPO) of shares Exchange It is interesting to see how long this madness will last - among other things, the offer of tokens converted into shares is considered to be the offer of securities, so the SEC rules should apply to tokens, like other securities. «» — , , — .

: , , , «» . - , . , , , , , -, , .

. - !

, . , , .

, , . .

, . , , PGP-. , , . , , . - , , .

, - .

, , - - , , , Bitbucket, , , md5-, - . , ------------? , , ?

(domain resolution) — , URL , — , -, , , , . , DAO -, , , , . , : , - bankofamerica.com, disney.com, sony.com . , . , , - — .

?

.

: , ID-, — , , , . : Second Life ; -, - ; , (!).

, — , — , . - , , . — , .

: . , . -, , . , -, , . , , IPO , … , 20- - , .

- .

Source: https://habr.com/ru/post/346534/

All Articles