Where it is more profitable to buy currency: banks vs exchange

If there is a need to exchange currency on a large scale, people usually go to the bank. But in fact, this is not the only way to solve the problem of buying and selling currencies. In some cases, the financial market of the exchange may be a more convenient and profitable tool.

Purchase of currency on the exchange: how it works

The main disadvantage of performing currency transactions through a bank is the difference in exchange rates for the purchase and sale of currency. The difference in purchase and sale prices may be several rubles. When exchanging large amounts, this results in serious losses.

')

The value of the dollar in different banks December 27, 2017. Data: Banks.ru

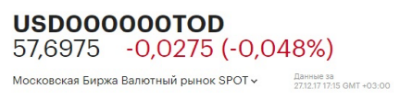

At the same time, the exchange rate of the dollar is always lower:

The exchange rate of the dollar on December 27, data: RBC

The Bank of Russia sets the official ruble exchange rate based on the results of exchange trading. And banks set their course by adding interest. That is, it turns out that during operations with currency in the bank, the buyer loses some of his funds, which he could save when making transactions with currency on the stock exchange.

The Moscow Exchange Foreign Exchange Market is the oldest organized trading platform in Russia where foreign currency trading has been held since 1992. Brokers providing access to it are officially accredited and licensed by the Bank of Russia and comply with Russian legislation. This results in another plus of buying currency at the stock exchange - all actions are carried out on the Internet with minimal risks.

There are other advantages when buying currency on the exchange. One of them is the possibility of using currency purchased in the foreign exchange market as collateral for transactions in other markets - for example, stocks or urgent ones. This opens up good opportunities for professional gambling.

How to get access to the foreign exchange market

In order to be able to make transactions on the stock exchange - whether it be the purchase of currency or shares of companies, you need to conclude an agreement with a broker company. It is important to ensure that the broker has access to the desired exchange market - in our case, foreign exchange. Some brokers provide an opportunity to open an account without going to the office - in our company this can be done using the service Gosuslugi .

After the conclusion of the contract, the client opens an account to which he transfers money, and can begin to perform operations. Today, trades are held electronically, and orders for the purchase and sale are sent using special trading terminals - we have developed our own under the name SmartX .

There are two modes of transactions - non-deliverable and deliverable. In the first case, the physical “delivery” of the parties to the transaction of foreign currency is not assumed - this method is used by investors who implement arbitrage strategies in various markets, or traders to perform speculative operations.

If you need to physically buy real currency, the delivery mode is more suitable. There are two variants of calculations - T + 0, in which the calculations for the transaction take place on the day of its implementation, and T + 1 with the calculations on the next day. Both of these modes are suitable for buying currency. To buy a currency, you need to open a trading terminal and select the desired financial instrument for purchase - for example, if you need to purchase euros, you need to purchase the EURRUB_TOD tool, where the purchase currency is indicated first, then the payment currency, then the due date (today). This is how the price chart for the EURRUB_TOD instrument on the Moscow Exchange looks like:

The important point is that if a person deposits money into a broker account only for their conversion into currency, and then withdraws it, then even if the exchange was successful in terms of the exchange rate, it is not necessary to pay tax on such “income”. But if operations are carried out constantly for the purpose of making a profit on exchange rate differences, the investor will have to file a tax return and pay the tax.

When performing transactions on the stock exchange, there are costs - brokers usually take a commission in the amount of hundredths of a percent of the transaction amount when buying or selling a currency. Some companies also keep a small amount when withdrawing funds from a brokerage account to a bank account - all fees are always indicated in the fees of a particular broker. In the end, the costs when working on the foreign exchange market is still less than when executing exchange operations through banks.

Who needs it

The main disadvantage of the exchange currency market is the presence of several links with which you need to interact in order to buy the currency and withdraw it to your account. Opening an account with a broker, studying a trading terminal, withdrawing money to the bank - all this takes time. Therefore, if you need to exchange currency urgently and the amount is not very large, it is more convenient to use the services of a bank.

However, if the amount is larger (for example, from several thousand dollars or euros) and operations are performed on a more or less regular basis - for example, there are some expenses abroad, such as renting real estate, then the option of working in the foreign exchange market is much more profitable.

Other materials on finance and stock market from ITI Capital :

- ITI Capital Educational Resources

- Analytics and market reviews

- How to cheat traders on cryptocurrency exchanges: the investigation of Business Insider

- The state will pay citizens for familiarity with the stock market

- Trading on the exchange in questions and answers: accounts, insurance and comparison with banks

- Remote opening of a brokerage account through the portal of state services: why and how to do it

Source: https://habr.com/ru/post/345860/

All Articles