Bitcoin will not become new digital money: limited emission and money functions

Every day I come across a lot of opinions on Bitcoin. Some are sure that it will be more expensive, others are sure that the bubble will burst, others are interested in the blockchain as a technology. But I have not met the arguments of these people in favor of my opinions. Of course, there were arguments, but they had little in common with current economic models in the world and were more like a sectarian mantra. Sometimes there are articles on large resources tearing covers, but reading them, I start to wonder how obvious things can become a revelation. Some people from IT, those who are the mass of people who popularize Bitcoin, have a bad idea of how the economy works. In turn, economists are still poorly aware of what a blockchain is.

In the cycle of publications, I decided to understand the current state of affairs and draw parallels between bitcoin and fiat money.

Bitcoin originates from an article sent to a cryptography distribution group. The author is an unknown person named Satoshi Nakamoto. The article was titled Bitcoin: A Peer-to-Peer Electronic Cash System. The article dealt with the technology that solved the problem of double waste of the same asset. In the article, the word money occurs only 3 times. The site bitcoin.org provides a decoding of what bitcoin is:

A bitcoin network was later launched and was considered experimental. This fact is quite important. If the goal was only to test the hypothesis, then the current situation around Bitcoin and the presence of critical problems explains everything: the author did not consider and did not design it as the final implementation of the platform.

So, at the moment, bitcoin is called a new kind of money. Money has 3 functions.

')

And what about bitcoin? At the moment, many organizations and people accept bitcoin in exchange for goods, services or money. They voluntarily agreed that Bitcoin would be one of the possible exchange resources. True, there are some, for example, Dell. Dell 2-3 years later refused to accept payments in bitcoin, this will be in the following posts. However, the execution function is there. The measure function is also present, there is an exchange rate of BTC <-> USD, similarly with accumulation.

So, by definition, bitcoin is still money. Until 1922, the German mark was also money, and already in 1923, bread was worth 300 billion marks. In 1924, it ceased to exist and economic policy changed radically. New money was introduced and the economy earned. But Bitcoin only becomes more expensive, you say. Nevertheless, it has a significant drawback - the lack of controlled emissions.

After defeat in the First World War, Germany found itself in a difficult situation: exhausted by the war, with a ruined economy and ruined production. In the appendage, as the losing party, under the Versailles Treaty, Germany was obliged to pay reparations to the winning countries. There was not enough money, production did not grow at the right pace and could not physically recover, because the government decided to print some money. At first, it was hidden from the population and the countries-winners. By the time money was printed a dozen times more than it was before the war, prices began to rise. He, in turn, urged the government to print more money. The spiral spun and the German mark went to the peak. Mark has ceased to be considered money, people have ceased to believe in it!

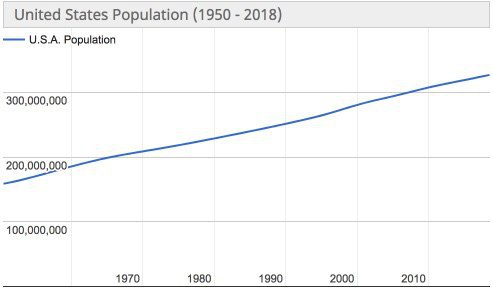

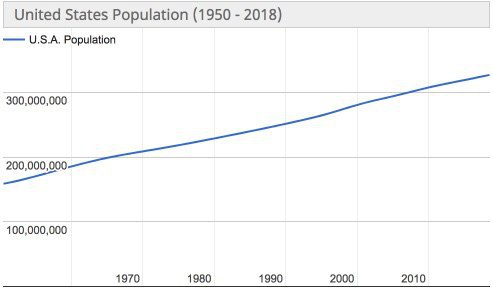

The inclusion of the printing press is one of the types of emissions. Issue - is the release of new money. But does the issue of money always end in failure? Not. Emission is extremely important for the economy. I will give an example. The population in the United States in 1960 was 180 million people , and now there are 323 million.

If dollars were not printed and did not deteriorate, then for every person there would be almost 2 times less dollars than in 1960. Wages would decrease, the cost of goods would decrease. In addition to population growth, the economy is also growing: more goods are produced, more money is spent, more services are provided. If it were not for the new money that was printed, and if there were more goods, then every year prices would fall on everything. And if prices fall, then the question arises: “why spend money at all?”. Then all sensible people would have hamster money under the mattress and would try not to waste anything, because tomorrow everything will be cheaper than today. Young people would earn less, they would not have enough money for them (everyone has money under the mattresses), nobody wants to buy an iPhone X. Production would fall, because there are no sales, and a fall in production would lead to a decrease in jobs, further unemployment, hunger and the thermal death of the universe.

So, in order for people not to homyachi much money, economists have come up with a scheme with a smooth depreciation of money with the help of inflation. Inflation is an increase in the price level. If the prices of all goods grow, money becomes cheaper, because you can buy less for them. If prices fall, then money becomes more expensive and you can buy more goods or services for them. To control inflation, various methods are used: from printing money to changing tax rates. In the United States, inflation over the past 7 years has ranged from 0.1 to 4.1% per year .

I made a calculation ... If a car in 2007 cost $ 10,000, then, taking into account the depreciation of the dollar, it would have cost $ 12,232 by 2017. Selected money under the mattress just would not be enough. With this mechanism, people are encouraged to spend now and today, to take loans, etc. The reverse process is called deflation. With deflation, the $ 10,000 saved in 2007 would have allowed to buy the coveted Lithuanian numbers and another iPhone X to boot. Over the past 10 years, deflation has been observed in Japan, and the authorities are trying in every way to fight it. A good example of negative consequences, although deflation was less than 1% in annual terms.

So what's up with bitcoin? The maximum possible number of bitcoins is equal to 21 million. They are getting harder getting harder every day and the day will come when the last bitcoin will be generated. Thus, the emission decreases now and will stop completely in the future.

Now imagine that the dreams of cryptopanks came true and the cue ball became new money, what then? Collapse. Population growth on the planet will not slow down, there is no emission, Bitcoin costs are rising, everything is homyat and will only increase, plants stop, BMW and iPhones are not let out, the economy is dying. Economists are well aware of this. Bitcoin is not destined to become new world money, although it falls under the definition of money.

In the next publication I will consider whether it can become a means of payment.

In the cycle of publications, I decided to understand the current state of affairs and draw parallels between bitcoin and fiat money.

Bitcoin originates from an article sent to a cryptography distribution group. The author is an unknown person named Satoshi Nakamoto. The article was titled Bitcoin: A Peer-to-Peer Electronic Cash System. The article dealt with the technology that solved the problem of double waste of the same asset. In the article, the word money occurs only 3 times. The site bitcoin.org provides a decoding of what bitcoin is:

Bitcoin is an innovative payment network.

A bitcoin network was later launched and was considered experimental. This fact is quite important. If the goal was only to test the hypothesis, then the current situation around Bitcoin and the presence of critical problems explains everything: the author did not consider and did not design it as the final implementation of the platform.

So, at the moment, bitcoin is called a new kind of money. Money has 3 functions.

')

- The function of the medium. Before the advent of the first money, there was an exchange of goods and services. This exchange had a lot of flaws. It is problematic to change resources that are difficult to manufacture or extract to those that are simply mined, for example, boots for meat. Perishable products to the seller of boots are also of little interest, because they have a limited period of implementation. To solve this problem, people agreed to use a certain resource and introduced it for calculations. In Kievan Rus, salt, honey, hides were used, and island states used pearls and stones. Then everyone caught up with the need to use more rare resources: this is how gold coins, plates and bars appeared.

- Measure function Following the agreement to use a single intermediate resource for the exchange of goods, it became possible to estimate the cost of a kilogram of meat in resource units. From this point on, hunters could sell the meat of animals to everyone, collect resources and exchange them for the results of other people's labor, for the same boots or clothes.

- Accumulation function. As soon as it became possible to sell goods and accumulate a resource called money, it became possible to accumulate money and then spend it on large purchases.

And what about bitcoin? At the moment, many organizations and people accept bitcoin in exchange for goods, services or money. They voluntarily agreed that Bitcoin would be one of the possible exchange resources. True, there are some, for example, Dell. Dell 2-3 years later refused to accept payments in bitcoin, this will be in the following posts. However, the execution function is there. The measure function is also present, there is an exchange rate of BTC <-> USD, similarly with accumulation.

So, by definition, bitcoin is still money. Until 1922, the German mark was also money, and already in 1923, bread was worth 300 billion marks. In 1924, it ceased to exist and economic policy changed radically. New money was introduced and the economy earned. But Bitcoin only becomes more expensive, you say. Nevertheless, it has a significant drawback - the lack of controlled emissions.

After defeat in the First World War, Germany found itself in a difficult situation: exhausted by the war, with a ruined economy and ruined production. In the appendage, as the losing party, under the Versailles Treaty, Germany was obliged to pay reparations to the winning countries. There was not enough money, production did not grow at the right pace and could not physically recover, because the government decided to print some money. At first, it was hidden from the population and the countries-winners. By the time money was printed a dozen times more than it was before the war, prices began to rise. He, in turn, urged the government to print more money. The spiral spun and the German mark went to the peak. Mark has ceased to be considered money, people have ceased to believe in it!

The inclusion of the printing press is one of the types of emissions. Issue - is the release of new money. But does the issue of money always end in failure? Not. Emission is extremely important for the economy. I will give an example. The population in the United States in 1960 was 180 million people , and now there are 323 million.

If dollars were not printed and did not deteriorate, then for every person there would be almost 2 times less dollars than in 1960. Wages would decrease, the cost of goods would decrease. In addition to population growth, the economy is also growing: more goods are produced, more money is spent, more services are provided. If it were not for the new money that was printed, and if there were more goods, then every year prices would fall on everything. And if prices fall, then the question arises: “why spend money at all?”. Then all sensible people would have hamster money under the mattress and would try not to waste anything, because tomorrow everything will be cheaper than today. Young people would earn less, they would not have enough money for them (everyone has money under the mattresses), nobody wants to buy an iPhone X. Production would fall, because there are no sales, and a fall in production would lead to a decrease in jobs, further unemployment, hunger and the thermal death of the universe.

So, in order for people not to homyachi much money, economists have come up with a scheme with a smooth depreciation of money with the help of inflation. Inflation is an increase in the price level. If the prices of all goods grow, money becomes cheaper, because you can buy less for them. If prices fall, then money becomes more expensive and you can buy more goods or services for them. To control inflation, various methods are used: from printing money to changing tax rates. In the United States, inflation over the past 7 years has ranged from 0.1 to 4.1% per year .

I made a calculation ... If a car in 2007 cost $ 10,000, then, taking into account the depreciation of the dollar, it would have cost $ 12,232 by 2017. Selected money under the mattress just would not be enough. With this mechanism, people are encouraged to spend now and today, to take loans, etc. The reverse process is called deflation. With deflation, the $ 10,000 saved in 2007 would have allowed to buy the coveted Lithuanian numbers and another iPhone X to boot. Over the past 10 years, deflation has been observed in Japan, and the authorities are trying in every way to fight it. A good example of negative consequences, although deflation was less than 1% in annual terms.

So what's up with bitcoin? The maximum possible number of bitcoins is equal to 21 million. They are getting harder getting harder every day and the day will come when the last bitcoin will be generated. Thus, the emission decreases now and will stop completely in the future.

Now imagine that the dreams of cryptopanks came true and the cue ball became new money, what then? Collapse. Population growth on the planet will not slow down, there is no emission, Bitcoin costs are rising, everything is homyat and will only increase, plants stop, BMW and iPhones are not let out, the economy is dying. Economists are well aware of this. Bitcoin is not destined to become new world money, although it falls under the definition of money.

In the next publication I will consider whether it can become a means of payment.

Source: https://habr.com/ru/post/345578/

All Articles