Understand what happened with the course of Bitcoin

Why should those who bought the BTC the other day not have to grab hold of validol, and skeptics - gloat that “the bubble has burst”

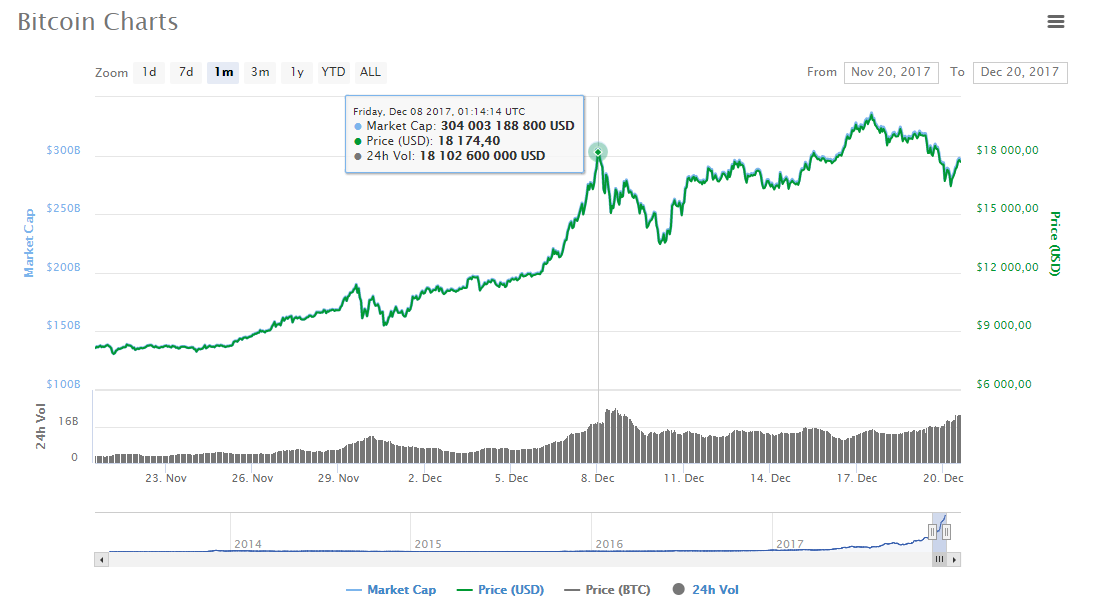

This morning (December 20), the crypto community stirred up two news: the bitcoin rate dropped to $ 16 thousand (the other day a record of $ 20 thousand per coin was broken), and the Bitcoin Cash cryptocurrency - the result of the August hardfork - went up almost 10 times and was trading priced at more than $ 9 thousand

But for those who recently bought Bitcoins or left the stagnant Bitcoin Cash to another cryptocurrency, it is too early to catch hold of validol. Because loud headlines in the media do not give a clear picture. Headlines in the press in general often differ with the content of the material. In this publication, we will analyze what happened and figure out why it’s too early to panic, buy Bitcoin Cash, or be glad that “this soap bubble has finally burst” if you are extremely skeptical about cryptocurrency.

I just got out of stasis and don't understand what's going on.

The last six months about Bitcoin write more and more often, and some popular publications - even with some pleasure. Bitcoin, or rather the fantastic growth of its course, has become the subject of jokes and comparisons with the legendary "son of my mother's girlfriend."

')

In order to sensibly assess the current situation, you need to understand a few fundamental things:

- The cryptocurrency market has tremendous volatility.

- Compared with conventional exchanges, the volume of funds in the cryptocurrency market is scanty (it is now estimated at 350–400 billion, depending on the BTC rate).

- The cryptocurrency market has a speculative, not a pyramidal, nature.

And now we will sort on points.

Volatility (eng. Volatility) is a statistical financial indicator characterizing price volatility. That is, the stronger the fluctuations in the rate of the bidding object on the stock exchange, the higher the volatility in a particular case. Compared with the popular classical objects of trading (shares of large companies, major world currencies and so on), Bitcoin has fantastic volatility, which opens the door for lovers of the game in short positions. And if for an ordinary stock exchange the fluctuation of the cost of any major security (for example, Apple shares or oil companies) by 10–15% per day is fantastic and shock, for Bitcoin this is the norm. That is why around the main cryptocurrency so much noise, including in financial circles.

The emergence of any relatively large capital in the market, depending on the trading strategy, has a significant support or pressure on the bitcoin rate. Recall that by the standards of the real financial sector $ 350 billion is an insignificant amount. Only one NASDAQ traded securities companies total value of more than $ 6 trillion.

A simple pattern is derived from the two statements above: a relatively small market volume, which is concentrated around a single trading object (Bitcoin accounts for the lion's share of the capitalization of the entire cryptocurrency market), and the high activity of traders leads to the fact that we can see sharp jumps in the course. Bitcoin trading itself is a speculative phenomenon, not a pyramid one. People who do not understand the cryptocurrency trading mechanisms often compare BTC with Sergei Mavrodi's well-known MMM, but this is not true. The fact that Bitcoin and cryptocurrencies are devoid of signs of "pyramidality" is also evidenced by the fact that these tools as an object of bargaining are recognized by large exchanges that have not previously worked with cryptocurrencies. Obviously, organizations such as the CME Group will not be compromised because of the desire to grab "a couple of bucks."

What happened in the last month

A month ago, according to CoinMarketCap statistics, Bitcoin cost about $ 8 thousand and showed stable though not very significant growth.

What influenced the rate of cryptocurrency and why in 30 days it has risen in price more than 2 times?

First: the psychological barrier of $ 10 thousand was overcome.

For markets, psychological barriers are always important. Most often, overcoming them is accompanied by a subsequent correction (cost reduction), followed by stabilization of the course or further growth. In the case of Bitcoin, everything went like a textbook: the cost of the main cryptocurrency exceeded $ 10 thousand, after which the course rolled back, and then Bitcoin continued to increase.

It would seem that the barrier of $ 10 thousand is taken and cryptocurrency to grow, if we treat this whole story with a bit of skepticism, by the end of the year there is nothing special. Objectively, the annual increase in the cost of Bitcoin by $ 8–10 thousand (or almost 900%) is too much, holidays were coming and it's time to think about taking profits or quiet horizontal movement. But the events of point 2 occurred.

Second: the Chicago Stock Exchange released Bitcoin futures

The explosive driver of the December rise in the value of the main cryptocurrency was the news that the group of Chicago exchanges CME Group introduces Bitcoin futures, as we wrote earlier in our blog .

The second "explosion" occurred at a time when competitors CME Group, the Chicago-based operator CBOE, began trading in Bitcoin futures a week earlier - December 10. At the same time, CBOE decided to attract the maximum number of cryptocurrency traders and took another step that testifies to tough competition: it was announced that during the month the exchange would not charge a fee for XBT trading (the designation of bitcoin futures). As a result, the expected explosive growth in the cost of Bitcoin occurred 8 days earlier, and one of the local peaks in the value of cryptocurrency in early December is associated with the upcoming start of trading.

As can be seen on the graph, the start of trading on the stock exchanges of the CME Group did not really affect anything: the market reacted calmly to the second player, if not to say “ignored” its appearance.

The text above explains why bitcoin rose to almost $ 20 thousand per coin, but what caused the exchange rate to fall and what about the growth of Bitcoin Cash?

Why did Bitcoin fall

We will not say that Bitcoin is overvalued, but for a sharp drop in its rate by almost 20% in the last 24 hours there were enough reasons.

- Waiting for correction. After the record on December 17 and breaking through the next cost ceiling, already at $ 20 thousand for a coin, all cryptocurrency traders stopped waiting for a bitcoin exchange rate correction. It partially occurred: the cost of the coin at CoinMarketCap dropped to $ 18–19 thousand.

- Increasing pressure due to impending holidays.

- Launch full support for Bitcoin Cash from Coinbase and the opening of trading on its subsidiary GDAX.

If everything is clear with the correction, then the upcoming holidays and Bitcoin Cash on Coinbase deserve special attention.

The common expression “money does not sleep” is quite twofold when it comes to stock trading. On the stock exchange “money is sleeping” during off-hours, and it is hard enough. In addition, traders are sensitive to any external factors, trying to catch the trend: whether it is national holidays in the United States, elections or reports of disasters at the other end of the globe. For the period of Christmas and New Year holidays, trading in securities habitually subsides: traders take profits and “park” until January-February — it is at this time that active work will resume. It is also important that behind the back of Bitcoin, in whose capitalization there is a lot of Asian money, the Chinese New Year is already looming. At the time of this holiday, the business activity of the entire Asia-Pacific region stops, because the business activity of a local giant, China, fades.

Symbol of 2018 on the Chinese calendar - yellow dog

These two factors are predictable, but the real pressure on the Bitcoin rate today was provided by the start of support for Bitcoin Cash at the Coinbase site and the launch of trading on the GDAX exchange.

And where is Bitcoin Cash and GDAX at all?

Bitcoin Cash is one of the Altcoins, which appeared in August of this year after the hard forks of the blockchain Bitcoin. Initially, some hopes were pinned on this token, but then it was “forgotten”: at the start, Bitcoin Cash showed some increase in value, after which it went to the horizontal plane and stagnated for quite a long time, compared to the growth rate of its “big brother” represented by BTC. The dynamics of the course Bitcoin Cash according to CoinMarketCap can be viewed below:

This altcoin had several “peaks”, but it never showed stable growth. One of the reasons for its low popularity is the limited number of trading platforms. For example, Bitcoin Cash is traded on Bittrex, but was not supported by Coinbase and its subsidiary GDAX until this morning.

After the launch of BCH (Bitcoin Cash) support at Coinbase and the start of trading, in just four minutes the cost of the coin flew up to $ 9.5 thousand.

After such a reaction, Coinbase stopped trading Bitcoin Cash at the site and announced the beginning of the proceedings, because such a surge could indicate some kind of insider collusion . At other sites, the BCH rate jumped to $ 3.8 thousand per coin and continues to grow, fluctuating at the threshold of $ 4 thousand on Bittrex and other exchanges.

So, should I run to buy Bitcoin Cash?

Objectively, this step can be called hasty. First of all, because cryptomedia has been full of headlines since morning: “Bitcoin collapsed! Bitcoin Cash has soared to $ 9,000! ”, But if you know that trading on Coinbase was stopped after 4 minutes and there is a suspicion of collusion, this news is perceived completely differently.

Unfortunately, the effect of a broken phone worked with BCH: according to scraps of information, traders rushed to buy Bitcoin Cash, which led to an increase in its rate not only at the Coinbase exchange, but throughout the rest of the cryptospace. In this situation, it is possible to confidently predict a minimum stop in the growth of the BCH rate with a subsequent correction, although, most likely, the value of the coin will roll back to more conventional values in the region of $ 1.2 thousand. Of course, if you recently left BCH on any other coin, then the reason there is a disorder, but the orgy that was caused by the course of taking $ 9.5 thousand from GDAX, from nowhere, will not last long.

This whole situation has put tremendous pressure on the BTC course. First - he allegedly had a competitor, because the price of $ 9.5 thousand per coin is quite comparable with the rate of the main cryptocurrency, which is tens and hundreds of times more expensive than altcoins. Secondly, it is obvious that part of the liquidity was hastily transferred by panicked traders, who saw that BCH had not yet grown to $ 9,000 at their sites and that it was possible to “fill up” with these coins.

The critics, who spoke about the fact that “the bubble has burst” and “we are waiting for the correction to the level of $ 10 thousand,” have behaved wrongly. The current collapse of the Bitcoin exchange rate is a tough but quite logical reaction to the machinations of a group of unknowns with the BCH exchange rate on the GDAX. The fact that it hit exactly Bitcoin is also most strongly expected: in the main cryptocurrency most of the liquidity of the crypto market is concentrated and with its considerable movements between the coins, the money will be “inherited” from the capitalization of BTC.

However, it remains an open question whether a cryptocurrency can recover from this collapse before the start of the holidays. Bitcoin trading opened yesterday at $ 19,118, and closed at $ 17,776 per coin. At the time of writing, the course is $ 17019 (the minimum price for December 20 is $ 16353) and continues to fluctuate.

So what should I do and where to invest?

In the next two months, expect new records from Bitcoin is not worth it, it would be too optimistic. It is also important to wait for the results of the Coinbase internal investigation, although, most likely, the general public will never know the truth.

The best recommendation is to follow the example of most traders and wait out the holidays in some long-term asset, the fluctuations of which will not be so significant and will not spoil the mood. The best option for this is to enter the cache or, if you plan to stay in the field of cryptoeconomics, purchase tokens of any projects. Tokens are by their nature a long investment, and the fluctuation of their course depends only on the authors themselves and how quickly and successfully they implement the project for which the money was collected.

Source: https://habr.com/ru/post/345192/

All Articles