Do not succumb to HYIP, or why the price of Bitcoin does not reflect its real value.

Here are some headlines flashed in financial news in recent weeks:

“The price of bitcoin has finally reached $ 10,000!” - The Economist, November 28, 2017

“Bitcoin crossed the $ 10,000 mark!” - CNBC, November 28, 2017

“BITKOIN RISE OVER $ 11,000 OVER!” - The Guardian, November 29, 2017

No sooner had the news really perekipet on news portals, as just a day later, the price has already increased to $ 11,500. By the time the notes came out about eleven thousand, he had already dropped to nine. And then, while the journalists frantically wrote down the last lines about the “Bitcoin collapse,” it returned to the level of $ 11,000 for BTC.

')

And this is not the first such case.

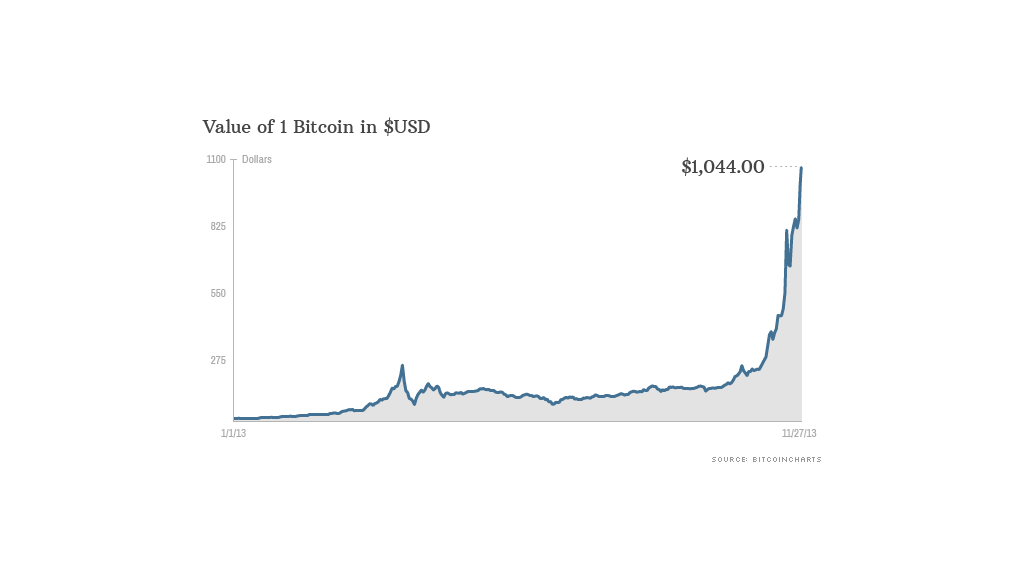

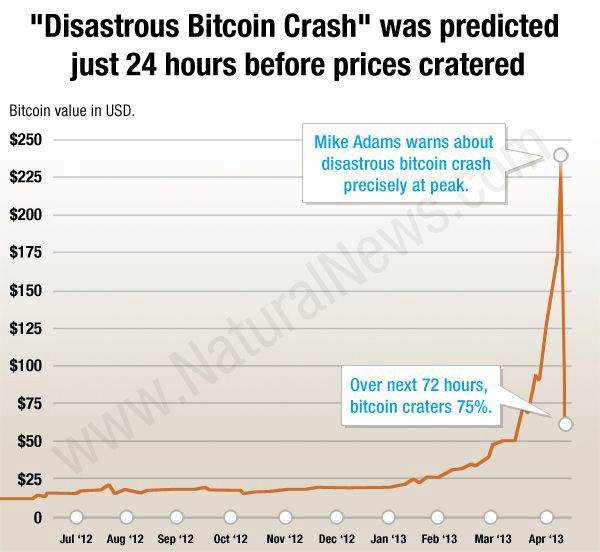

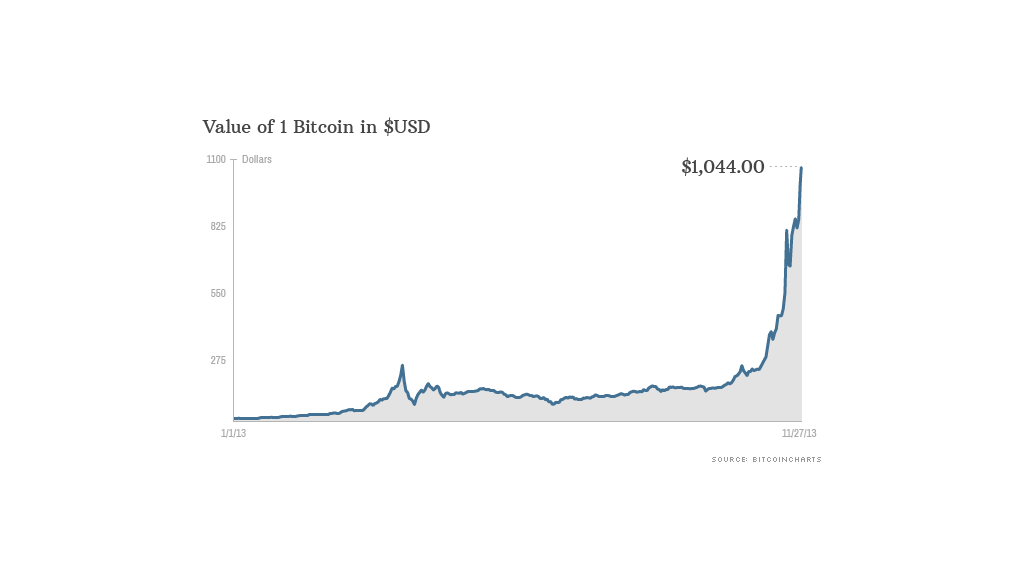

We already encountered something similar in 2013. When the cost of bitcoin came to the mark of $ 1000 , the press raised the hype, which led to the formation of a "bubble". In January 2013, Bitcoin went for about $ 15, by April the price jumped to $ 266, and then collapsed to $ 50. By November, it exceeded $ 1,200, reaching a maximum of $ 1,242 at Mt.Gox. During that year, Bitcoin grew almost a hundred times - this is an order of magnitude more than a tenfold increase, which it went through in 2017.

Charts look almost the same, and news headlines are word for word . Just assign a zero.

The press likes such things, because people read them with great interest. Stories about how someone bought an old computer for 25 bucks and found 5,000 bitcoins on it , or accidentally threw out a hard disk with 7,500 bitcoins and spent a long time looking for it at the dump, or gave 10,000 bitcoins for two pizzas , fanning the hype and bring money.

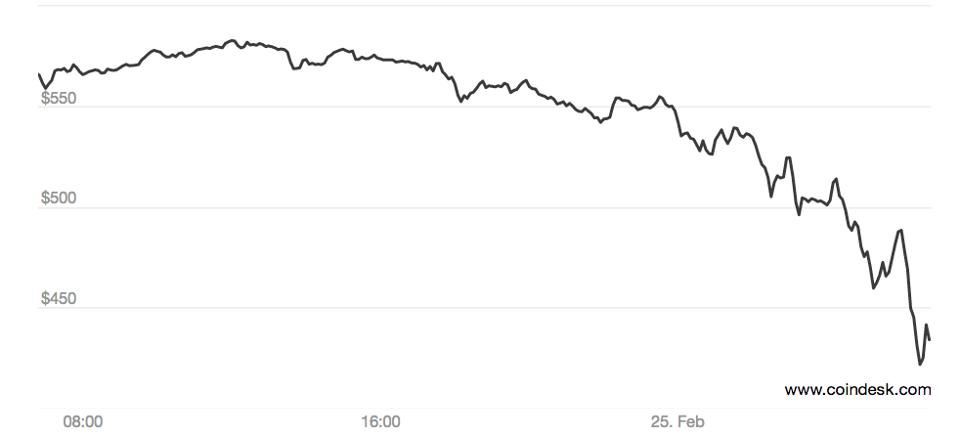

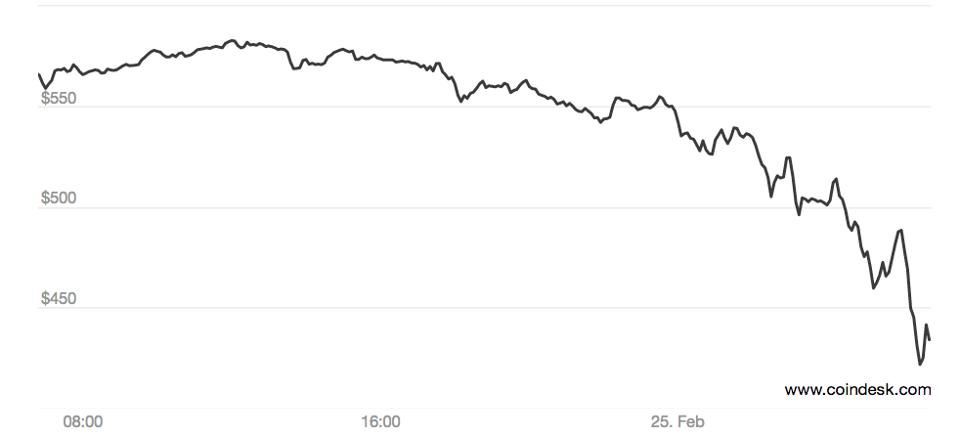

People like to hear about growth, but where growth is, there is a fall, and Bitcoin is no exception to this rule. The history of this currency captures three large "bubbles" and a lot of sharp fluctuations between them. A drop of 20-30% amplitude within twenty-four hours is common for Bitcoin, but it would terrify an ordinary person. For example, if we talk about the day when Bitcoin reached $ 11,000, in a matter of hours it rolled back to $ 9,000 , that is, lost 20% of its value.

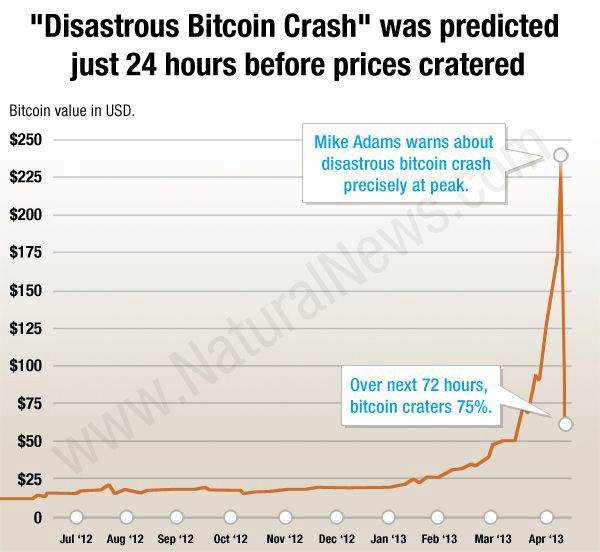

This is not the only example, there are others. Let's say it was such that the price fell from $ 260 to $ 50. Bitcoin is practically buried.

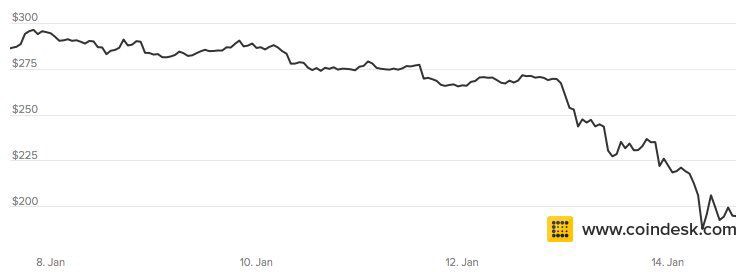

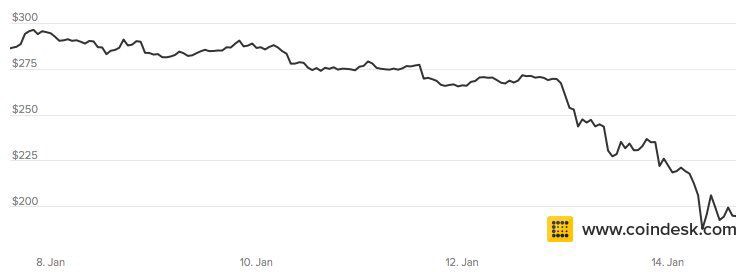

Or here: from $ 300 to $ 160. Despair just hung in the air.

Another example: from $ 600 to $ 150. “But when is this going to end?” People said. Even the most loyal supporters hesitated. Many have surrendered and sold off their savings.

That is, the price of Bitcoin does not just go up smoothly all the time, who would have thought! If you look at short-term line graphs, then yes, absolutely any of them will display serious recessions. Continuous growth for twelve months will not be there.

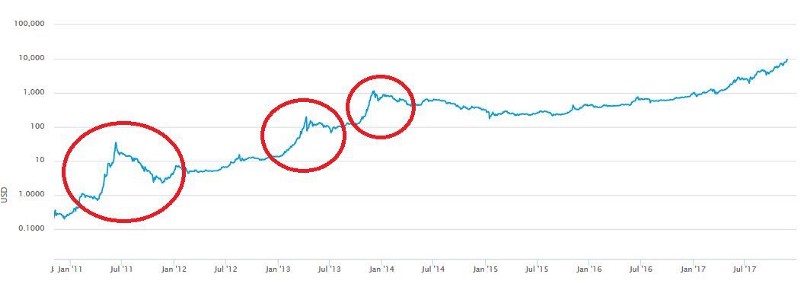

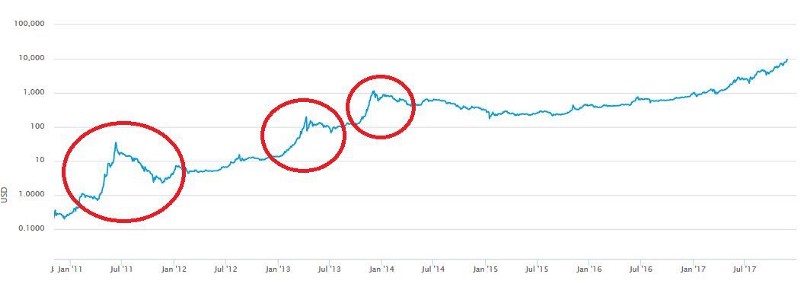

But if you look at the logarithmic graph, which I give below ...

According to logarithmic graphs, it is much more convenient to evaluate the results in the long term than on linear ones. So, in a linear graph, a rise from $ 1 to $ 30 will look much more modest than from $ 100 to $ 200, although in the first case we are talking about a growth of thirty times, and in the second - just two. With a logarithmic graph of such problems does not arise.

According to the schedule, which shows the dynamics of price change since the advent of Bitcoin, it is clear that it is stably in the growth phase, but subject to strong fluctuations. You may have noticed that at first after the appearance of the currency, these fluctuations were more significant.

Three times in the entire history of Bitcoin, the price change chart became parabolic, that is, the line went up almost vertically. This is difficult to achieve, for it is necessary that the course jumped very sharply. So far, there have been three such precedents: in 2011 and twice in 2013. In all three cases, the price of Bitcoin increased by a hundred or more times. As you can see, the 2017 rise did not leave a parabolic section on the chart. In order for this to happen, the cost needs to skyrocket to $ 100,000. And this is still far away.

What is interesting: Bitcoin pricing goes through certain cycles. First, the currency is regularly, at a moderate pace, purchased by people who understand IT and understand its real value, while everyone else considers it empty and bypasses it. Usually this stage of the cycle begins immediately after the next “collapse”. Then the price gradually rises until at some point it attracts the attention of the press. And here the fever begins: everyone, right down to your grandmother, is buying up bitcoins. Finally, the course culminates, falls again, and only those who have enough faith in technology remain to support it even during the period of stagnation. We return to the beginning of the cycle, only the price is now higher, and the user base is more extensive. And so on to infinity.

Price is not the same as value. Water costs us cheap, but its value is very high. If she suddenly becomes missed, the cost will immediately jump to the skies. So with Bitcoin: its real value has nothing to do with the current course.

Even when the price of Bitcoin was exactly zero dollars zero cents, he, in essence, coped with the task of the Byzantine generals , whose solution could not be found for thirty years - it was to reach an agreement with other participants in the absence of a reliable communications system. Bitcoin carried value from the first day of existence, despite the fact that formally cost nothing.

Thanks to Bitcoin, we no longer need intermediaries to make deals - yes there, we have generally eliminated the need to trust each other. We can transfer valuable assets through the network without asking permission from the curators. The Internet at one time allowed us to exchange information as freely: we had to use mail services to send a letter, telephone operator services - to call someone who lived far away, and publisher services, to bring their stories and ideas to the world . Today, bitcoin does the same thing - it gives us the opportunity to transfer funds to each other instantly, at the global level and without securing anyone’s consent.

Just as the value of money is not determined by what material they are made of, the value of Bitcoin is not in the tokens that we exchange, but in the system that allows this exchange to take place.

From all that you can learn about Bitcoin, his course is of the least interest. Its value is that it solves the tasks that were set for it, and it does it better than others. Only with the understanding of the blockchain technology comes the realization of what it really is worth.

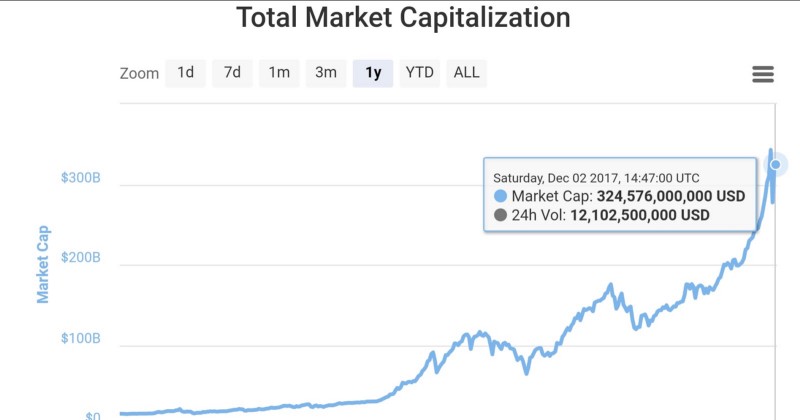

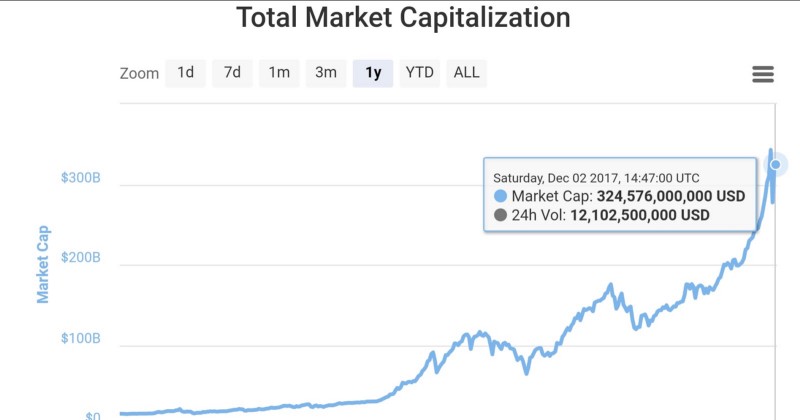

More than a third trillion dollars is how much the total market value of cryptocurrency is. 165 million of this amount accounts for one bitcoin, which shows how dominant the network effect can be. Using Bitcoin technology, every person on the planet now has the opportunity to create and exchange currency - now it is no longer the prerogative of rulers and oligarchs. In the information sphere, a printing press produced a similar revolution in terms of creation and exchange, which opened up the Renaissance and paved the way for the industrial revolution. It is as if we are rediscovering for ourselves why money was invented.

Huge wealth is created before our eyes, but everything happens so fast that most people simply do not notice this. I remember as a child I loved reading the Guinness Book of Records, and one of the most interesting articles for me was the one that spoke of the richest people in the world. From the late 80s to the early 90s, this title was firmly held by the Sultan of Brunei , who had a golden throne, 200 Ferrari and sheathed with gold plates of Rolls-Royce.

But then, in the late 90s , Bill Gates and other geeks suddenly found themselves in the first positions . Where did they come from? How could a bunch of zadrotov who write code, go to sneakers and work in the garages to get around the Sultan with furniture made of pure gold? Why did this happen?

Because in the global system, which allows people to store and transmit information, much more value than in the brilliant yellow pebbles and underground sources of fossil fuels.

The same processes are now unfolding in cryptomir. Suddenly geeks, who for years built the Bitcoin system voluntarily and without any return, begin to receive payment for their work from the very technology that they created. Traders who believed in these projects and, in addition to the time and effort to create them, have also invested their small funds in them, now they see an increase of 1,000 to 30,000%. Pioneers are paving the way for a new generation of financial applications that will attract billions of new users to the Internet economy. Some of them are already approaching the status of billionaires, and over time such people will only become more.

Creating wealth is, in fact, not bad, and there is nothing terrible about the concentration of wealth. The main thing here is how it is acquired - honestly or not. Bitcoin is honest money. The pioneers in cryptocurrency did not need any coercion, no unfair advantages, no abuse of power and violation of labor rights to make a fortune. That is why those who inherited trust funds and “spent decades on the exchanges” do not digest Bitcoin - they cannot accept the fact that geeks who decided to take risks and became early followers of the new technology are now richer than they are. I suppose that the same type on the golden throne, to whom the very idea was ridiculous that some boom in the garage could become richer than he, argued in the same way.

Bitcoin and other cryptocurrencies will give many financial independence, and that's great. Millions of people who have never had access to capital will be able to achieve their goals and, perhaps, create something that will benefit all of humanity.

One Bitcoin developer was once asked (paraphrasing): “If you work on a voluntary basis, then who pays you? Why are you doing all this? ” He replied: "Bitcoin pays me, and in return I give him time and work."

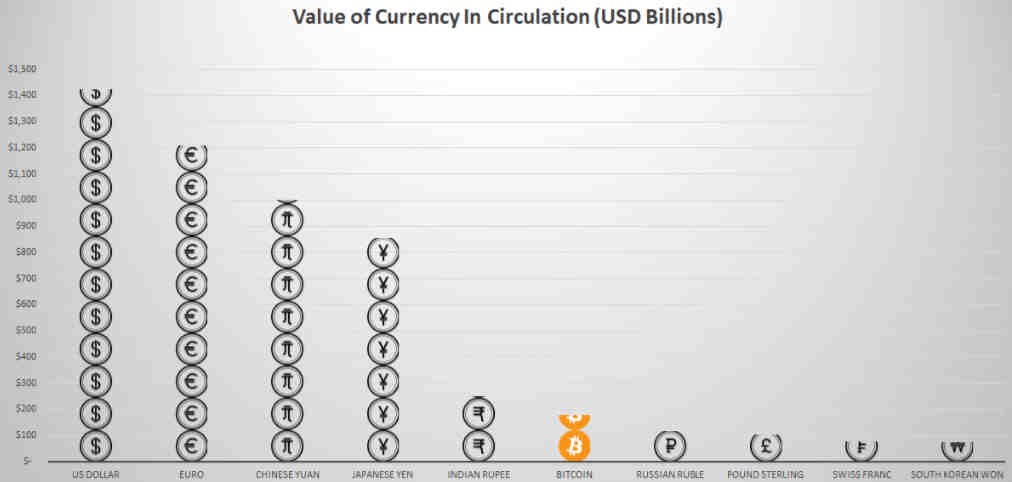

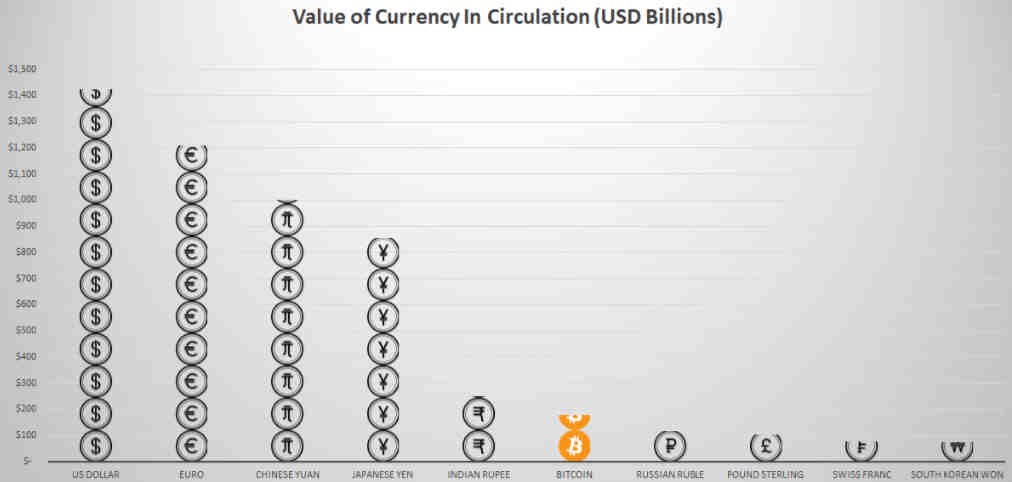

Bitcoin is now in eighth place by capitalization among all the currencies of the world. It took him only eight years to reach this position, despite the fact that only 0.1% of the world's population uses this currency or has it in possession.

So, perhaps, this cryptocurrency will turn out before our eyes one of the largest financial "soap bubbles" in history. On the other hand, there is a serious likelihood that we are witnessing something extremely remarkable - a return to the autonomy of money from state bodies.

People want to be part of the financial world. The world of investment and financial exchange, which was once a fenced platform, where rich and powerful people - mediators and brokers, institutions and organizations - frolicked to thousands of ordinary people of free and open nature, which reports to the blockchain financial operations. These are people who cannot afford to get support from the current system, are eliminated on checks and find themselves at an impasse. They view Bitcoin and other cryptocurrencies as an opportunity to enter the global economic market, bypassing all instances and doing away with mouse fuss. They invest their earnings, a few bucks to and fro, hoping to get an honest profit and are willing to risk money, if only they would not stay at the mercy of consumerism and inflation.

And it works. Young people from different sectors of society and nations, from Kazakhstan to the Philippines, do not spare the time and effort to study the blockchain technology and the fundamentals of crypto trading, find work in this area, earn money, and then teach and encourage others to do the same.

Children who were born in 2009 or later will live in a world where cryptocurrencies have always existed and are perceived as the norm, and not a new trend. They will never be able to understand why they should wait for “3-5 business days” to get the money through, stand in queues at banks, pay 10% commission. Of course, you can say that I wishful thinking, but do not forget: the Internet was also once called the fashion fad. But now we don’t go online - we live on the Internet.

Tomorrow's technologies, such as robotics, artificial intelligence, unmanned vehicles, and the Internet of things, will not use credit cards, which were never intended for online payments, but blockchain and cryptocurrency, and Bitcoin will act as a global reserve. The probability that it will be so, almost one hundred percent.

Will there be a period of slump on crypto market? Probably. Just as almost six trillion dollars burned down on the dotcom bubble in 2000, Bitcoin and other cryptocurrencies will also go through such incidents in their cyclical movement. The bursting bubbles help to identify the main players in the market and to separate those who came quickly to cut the money. The main thing is that this technology is a reality and will not go anywhere from us.

What will be next? Rigorous growth of Bitcoin begins to look logical, if you understand those multi-layered technologies that underlie it. Add to this thousands and thousands of people who, based on their own financial interests, are willing to work hard and fight to the last to keep the blockchain afloat - to build a system, protect the system, become part of the system - and you will get the irresistible power of innovation and value pushes us to the next stage of the evolution of the monetary system.

Although, if you answer strictly to the question: it is impossible to predict exactly what will happen.

We are talking only about hypothetical scenarios that I and other authors are considering. It would be naive to say that we know exactly what this growth trend will lead to. Therefore, the work never stops, and we try to set the direction of movement, and not just move where it leads. By publishing this article, I contribute to the formation of a positive feedback loop and to the self-reinforcing trend that bitcoin set to continue to develop and strengthen without stopping until it leads us to a radically new global paradigm of value transfer.

The future of money will be in the hands of those who use them - people, independent individuals, not the authorities. Money, in fact, is a means of communication. They broadcast information about how much value someone gave to someone. Thanks to the Bitcoin protocol, we finally understood how to use the most powerful of our communication channels - the Internet - to share values with anyone, anywhere, anytime, without external approval and other difficulties, with complete freedom.

We live in a world of the future, where bitcoin gave freedom to money.

“The price of bitcoin has finally reached $ 10,000!” - The Economist, November 28, 2017

“Bitcoin crossed the $ 10,000 mark!” - CNBC, November 28, 2017

“BITKOIN RISE OVER $ 11,000 OVER!” - The Guardian, November 29, 2017

No sooner had the news really perekipet on news portals, as just a day later, the price has already increased to $ 11,500. By the time the notes came out about eleven thousand, he had already dropped to nine. And then, while the journalists frantically wrote down the last lines about the “Bitcoin collapse,” it returned to the level of $ 11,000 for BTC.

')

And this is not the first such case.

We already encountered something similar in 2013. When the cost of bitcoin came to the mark of $ 1000 , the press raised the hype, which led to the formation of a "bubble". In January 2013, Bitcoin went for about $ 15, by April the price jumped to $ 266, and then collapsed to $ 50. By November, it exceeded $ 1,200, reaching a maximum of $ 1,242 at Mt.Gox. During that year, Bitcoin grew almost a hundred times - this is an order of magnitude more than a tenfold increase, which it went through in 2017.

Charts look almost the same, and news headlines are word for word . Just assign a zero.

The press likes such things, because people read them with great interest. Stories about how someone bought an old computer for 25 bucks and found 5,000 bitcoins on it , or accidentally threw out a hard disk with 7,500 bitcoins and spent a long time looking for it at the dump, or gave 10,000 bitcoins for two pizzas , fanning the hype and bring money.

But in other way…

People like to hear about growth, but where growth is, there is a fall, and Bitcoin is no exception to this rule. The history of this currency captures three large "bubbles" and a lot of sharp fluctuations between them. A drop of 20-30% amplitude within twenty-four hours is common for Bitcoin, but it would terrify an ordinary person. For example, if we talk about the day when Bitcoin reached $ 11,000, in a matter of hours it rolled back to $ 9,000 , that is, lost 20% of its value.

This is not the only example, there are others. Let's say it was such that the price fell from $ 260 to $ 50. Bitcoin is practically buried.

Or here: from $ 300 to $ 160. Despair just hung in the air.

Another example: from $ 600 to $ 150. “But when is this going to end?” People said. Even the most loyal supporters hesitated. Many have surrendered and sold off their savings.

That is, the price of Bitcoin does not just go up smoothly all the time, who would have thought! If you look at short-term line graphs, then yes, absolutely any of them will display serious recessions. Continuous growth for twelve months will not be there.

But if you look at the logarithmic graph, which I give below ...

According to logarithmic graphs, it is much more convenient to evaluate the results in the long term than on linear ones. So, in a linear graph, a rise from $ 1 to $ 30 will look much more modest than from $ 100 to $ 200, although in the first case we are talking about a growth of thirty times, and in the second - just two. With a logarithmic graph of such problems does not arise.

According to the schedule, which shows the dynamics of price change since the advent of Bitcoin, it is clear that it is stably in the growth phase, but subject to strong fluctuations. You may have noticed that at first after the appearance of the currency, these fluctuations were more significant.

Three times in the entire history of Bitcoin, the price change chart became parabolic, that is, the line went up almost vertically. This is difficult to achieve, for it is necessary that the course jumped very sharply. So far, there have been three such precedents: in 2011 and twice in 2013. In all three cases, the price of Bitcoin increased by a hundred or more times. As you can see, the 2017 rise did not leave a parabolic section on the chart. In order for this to happen, the cost needs to skyrocket to $ 100,000. And this is still far away.

Cyclic excitement around bitcoin

What is interesting: Bitcoin pricing goes through certain cycles. First, the currency is regularly, at a moderate pace, purchased by people who understand IT and understand its real value, while everyone else considers it empty and bypasses it. Usually this stage of the cycle begins immediately after the next “collapse”. Then the price gradually rises until at some point it attracts the attention of the press. And here the fever begins: everyone, right down to your grandmother, is buying up bitcoins. Finally, the course culminates, falls again, and only those who have enough faith in technology remain to support it even during the period of stagnation. We return to the beginning of the cycle, only the price is now higher, and the user base is more extensive. And so on to infinity.

Price and Value

Price is not the same as value. Water costs us cheap, but its value is very high. If she suddenly becomes missed, the cost will immediately jump to the skies. So with Bitcoin: its real value has nothing to do with the current course.

Even when the price of Bitcoin was exactly zero dollars zero cents, he, in essence, coped with the task of the Byzantine generals , whose solution could not be found for thirty years - it was to reach an agreement with other participants in the absence of a reliable communications system. Bitcoin carried value from the first day of existence, despite the fact that formally cost nothing.

“Many consider e-currencies to be unviable by default, because everyone who has tried to enter them since the 1990s has failed. I hope it is obvious to everyone that the reason for their failure was that these currencies were centralized and controlled from above. In my opinion, <Bitcoin> is the first example of a decentralized system that is not based on trust between participants. ” - Satoshi Nakamoto, 2009.

Thanks to Bitcoin, we no longer need intermediaries to make deals - yes there, we have generally eliminated the need to trust each other. We can transfer valuable assets through the network without asking permission from the curators. The Internet at one time allowed us to exchange information as freely: we had to use mail services to send a letter, telephone operator services - to call someone who lived far away, and publisher services, to bring their stories and ideas to the world . Today, bitcoin does the same thing - it gives us the opportunity to transfer funds to each other instantly, at the global level and without securing anyone’s consent.

Just as the value of money is not determined by what material they are made of, the value of Bitcoin is not in the tokens that we exchange, but in the system that allows this exchange to take place.

From all that you can learn about Bitcoin, his course is of the least interest. Its value is that it solves the tasks that were set for it, and it does it better than others. Only with the understanding of the blockchain technology comes the realization of what it really is worth.

Crypto-Renaissance: The Financial Revolution

More than a third trillion dollars is how much the total market value of cryptocurrency is. 165 million of this amount accounts for one bitcoin, which shows how dominant the network effect can be. Using Bitcoin technology, every person on the planet now has the opportunity to create and exchange currency - now it is no longer the prerogative of rulers and oligarchs. In the information sphere, a printing press produced a similar revolution in terms of creation and exchange, which opened up the Renaissance and paved the way for the industrial revolution. It is as if we are rediscovering for ourselves why money was invented.

Huge wealth is created before our eyes, but everything happens so fast that most people simply do not notice this. I remember as a child I loved reading the Guinness Book of Records, and one of the most interesting articles for me was the one that spoke of the richest people in the world. From the late 80s to the early 90s, this title was firmly held by the Sultan of Brunei , who had a golden throne, 200 Ferrari and sheathed with gold plates of Rolls-Royce.

But then, in the late 90s , Bill Gates and other geeks suddenly found themselves in the first positions . Where did they come from? How could a bunch of zadrotov who write code, go to sneakers and work in the garages to get around the Sultan with furniture made of pure gold? Why did this happen?

Because in the global system, which allows people to store and transmit information, much more value than in the brilliant yellow pebbles and underground sources of fossil fuels.

The same processes are now unfolding in cryptomir. Suddenly geeks, who for years built the Bitcoin system voluntarily and without any return, begin to receive payment for their work from the very technology that they created. Traders who believed in these projects and, in addition to the time and effort to create them, have also invested their small funds in them, now they see an increase of 1,000 to 30,000%. Pioneers are paving the way for a new generation of financial applications that will attract billions of new users to the Internet economy. Some of them are already approaching the status of billionaires, and over time such people will only become more.

Creating wealth is, in fact, not bad, and there is nothing terrible about the concentration of wealth. The main thing here is how it is acquired - honestly or not. Bitcoin is honest money. The pioneers in cryptocurrency did not need any coercion, no unfair advantages, no abuse of power and violation of labor rights to make a fortune. That is why those who inherited trust funds and “spent decades on the exchanges” do not digest Bitcoin - they cannot accept the fact that geeks who decided to take risks and became early followers of the new technology are now richer than they are. I suppose that the same type on the golden throne, to whom the very idea was ridiculous that some boom in the garage could become richer than he, argued in the same way.

Bitcoin and other cryptocurrencies will give many financial independence, and that's great. Millions of people who have never had access to capital will be able to achieve their goals and, perhaps, create something that will benefit all of humanity.

One Bitcoin developer was once asked (paraphrasing): “If you work on a voluntary basis, then who pays you? Why are you doing all this? ” He replied: "Bitcoin pays me, and in return I give him time and work."

Separation of state and money

Bitcoin is now in eighth place by capitalization among all the currencies of the world. It took him only eight years to reach this position, despite the fact that only 0.1% of the world's population uses this currency or has it in possession.

So, perhaps, this cryptocurrency will turn out before our eyes one of the largest financial "soap bubbles" in history. On the other hand, there is a serious likelihood that we are witnessing something extremely remarkable - a return to the autonomy of money from state bodies.

People want to be part of the financial world. The world of investment and financial exchange, which was once a fenced platform, where rich and powerful people - mediators and brokers, institutions and organizations - frolicked to thousands of ordinary people of free and open nature, which reports to the blockchain financial operations. These are people who cannot afford to get support from the current system, are eliminated on checks and find themselves at an impasse. They view Bitcoin and other cryptocurrencies as an opportunity to enter the global economic market, bypassing all instances and doing away with mouse fuss. They invest their earnings, a few bucks to and fro, hoping to get an honest profit and are willing to risk money, if only they would not stay at the mercy of consumerism and inflation.

And it works. Young people from different sectors of society and nations, from Kazakhstan to the Philippines, do not spare the time and effort to study the blockchain technology and the fundamentals of crypto trading, find work in this area, earn money, and then teach and encourage others to do the same.

Children who were born in 2009 or later will live in a world where cryptocurrencies have always existed and are perceived as the norm, and not a new trend. They will never be able to understand why they should wait for “3-5 business days” to get the money through, stand in queues at banks, pay 10% commission. Of course, you can say that I wishful thinking, but do not forget: the Internet was also once called the fashion fad. But now we don’t go online - we live on the Internet.

Tomorrow's technologies, such as robotics, artificial intelligence, unmanned vehicles, and the Internet of things, will not use credit cards, which were never intended for online payments, but blockchain and cryptocurrency, and Bitcoin will act as a global reserve. The probability that it will be so, almost one hundred percent.

Will there be a period of slump on crypto market? Probably. Just as almost six trillion dollars burned down on the dotcom bubble in 2000, Bitcoin and other cryptocurrencies will also go through such incidents in their cyclical movement. The bursting bubbles help to identify the main players in the market and to separate those who came quickly to cut the money. The main thing is that this technology is a reality and will not go anywhere from us.

Future of money

What will be next? Rigorous growth of Bitcoin begins to look logical, if you understand those multi-layered technologies that underlie it. Add to this thousands and thousands of people who, based on their own financial interests, are willing to work hard and fight to the last to keep the blockchain afloat - to build a system, protect the system, become part of the system - and you will get the irresistible power of innovation and value pushes us to the next stage of the evolution of the monetary system.

Although, if you answer strictly to the question: it is impossible to predict exactly what will happen.

We are talking only about hypothetical scenarios that I and other authors are considering. It would be naive to say that we know exactly what this growth trend will lead to. Therefore, the work never stops, and we try to set the direction of movement, and not just move where it leads. By publishing this article, I contribute to the formation of a positive feedback loop and to the self-reinforcing trend that bitcoin set to continue to develop and strengthen without stopping until it leads us to a radically new global paradigm of value transfer.

The future of money will be in the hands of those who use them - people, independent individuals, not the authorities. Money, in fact, is a means of communication. They broadcast information about how much value someone gave to someone. Thanks to the Bitcoin protocol, we finally understood how to use the most powerful of our communication channels - the Internet - to share values with anyone, anywhere, anytime, without external approval and other difficulties, with complete freedom.

We live in a world of the future, where bitcoin gave freedom to money.

Source: https://habr.com/ru/post/344494/

All Articles