Click, trade, deposit. Our online tools for corporate clients

In the modern world of high technology, banks are striving to offer their customers new high-tech services that expand opportunities and increase usability while using banking services. The VTB Bank team is no exception. How to make currency exchange faster and more convenient? How to quickly place funds when the day is closing? Read under the cut.

The market situation may change significantly during the day, which leads to fluctuations in the prices of banking products. With large volumes of transactions, a slight difference in price can lead to a significant change in the total amount - consider for example, FX for corporate clients.

Typical service involves contacting the bank and fixing the exchange rate by phone with the subsequent sending of supporting documents for legal processing of the transaction. If it is necessary to exchange a large amount, customers can contact the bank for a quote several times before concluding a transaction in anticipation of a course that suits them.

')

With strong market movements, the rate can change very quickly, literally within seconds, with the result that customers face two problems:

To solve these problems, we have developed the Click & Trade service, through which customers can conclude currency purchase / sale transactions online without having to contact the bank.

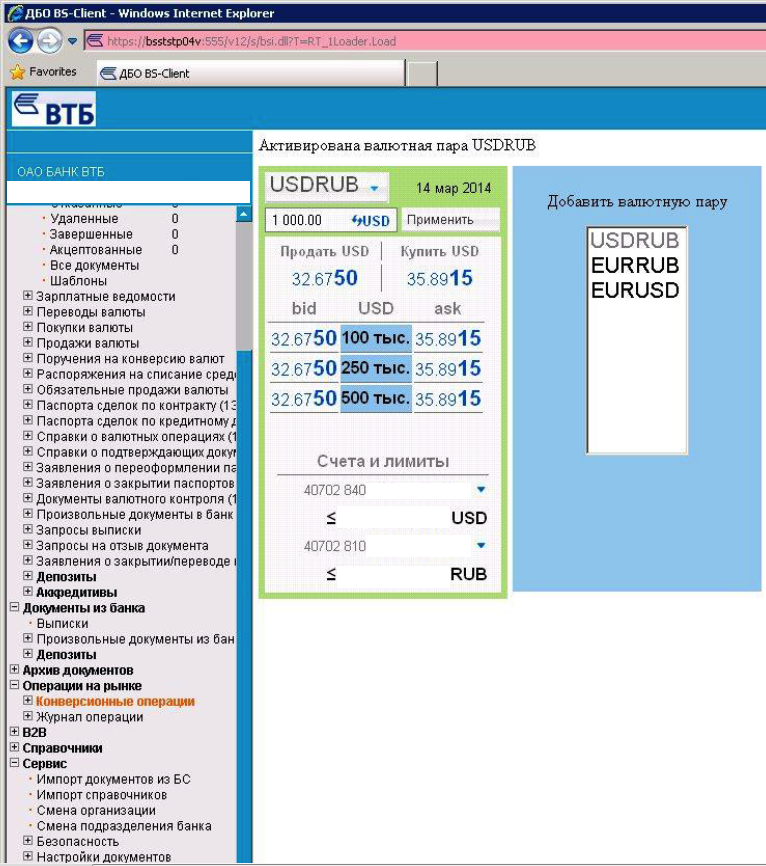

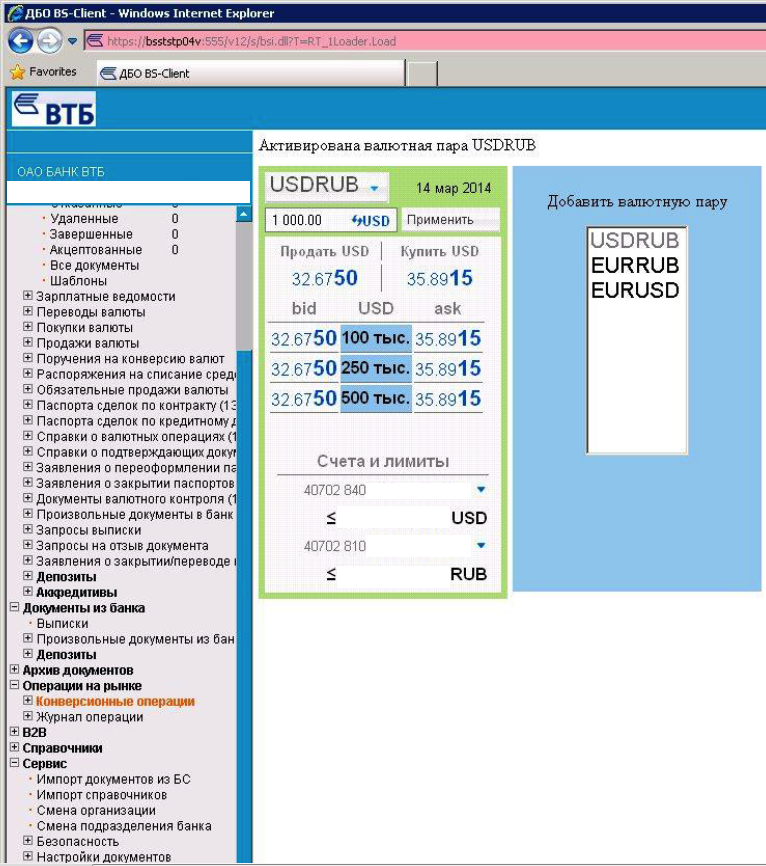

How did we do it? As part of the existing Internet client DBO (remote banking service), a special interface has been developed that allows you to view current bank quotes. Quotes change online after the market and are calculated automatically, which allows keeping spreads low.

The quotes are not indicative, the bank is ready to make a deal according to these quotes - just press one button and the deal will be concluded. In this case, the bank will receive a confirmation of the transaction, which is legally binding (since the service is “embedded” in the RBS), which frees the client from the subsequent forwarding of documents.

Thus, the client can follow the current quotes during the day in anticipation of the “necessary” market movement and conclude transactions without calling the bank and sending documents, simply by clicking on the appropriate quotation - quickly and conveniently.

A similar service was developed for placing deposits by corporate clients. In the case of deposits, the attraction rates do not change as often as currency rates, but the online interface significantly saves time on contacting the bank for a deal.

The client only needs to enter the desired parameters of the transaction in the special interface of the Internet client DBO, and the machine will calculate the rate at which the bank is ready to accept the deposit. One click - and the transaction will be concluded, the bank will go to the necessary documents for processing the transaction (again having legal force, since the service is "embedded" in the RBS). The client will only replenish the deposit account.

The speed of execution of the transaction is of particular importance when in the evening funds are received in the company’s accounts that must be placed before the end of the day. Having implemented an online service, the bank saves the time of the client, which was previously allotted for paperwork.

Online quotes and paperwork are technology application points that improve service. Customer experience demonstrates the relevance of such services, in the future the bank plans to increase the number of products offered in online services.

FX: Click and Trade

The market situation may change significantly during the day, which leads to fluctuations in the prices of banking products. With large volumes of transactions, a slight difference in price can lead to a significant change in the total amount - consider for example, FX for corporate clients.

Typical service involves contacting the bank and fixing the exchange rate by phone with the subsequent sending of supporting documents for legal processing of the transaction. If it is necessary to exchange a large amount, customers can contact the bank for a quote several times before concluding a transaction in anticipation of a course that suits them.

')

With strong market movements, the rate can change very quickly, literally within seconds, with the result that customers face two problems:

- Spread increase

- Delays in making a deal due to an avalanche-like flow of calls to the bank.

To solve these problems, we have developed the Click & Trade service, through which customers can conclude currency purchase / sale transactions online without having to contact the bank.

How did we do it? As part of the existing Internet client DBO (remote banking service), a special interface has been developed that allows you to view current bank quotes. Quotes change online after the market and are calculated automatically, which allows keeping spreads low.

The quotes are not indicative, the bank is ready to make a deal according to these quotes - just press one button and the deal will be concluded. In this case, the bank will receive a confirmation of the transaction, which is legally binding (since the service is “embedded” in the RBS), which frees the client from the subsequent forwarding of documents.

Thus, the client can follow the current quotes during the day in anticipation of the “necessary” market movement and conclude transactions without calling the bank and sending documents, simply by clicking on the appropriate quotation - quickly and conveniently.

Deposits: Click and Deposit

A similar service was developed for placing deposits by corporate clients. In the case of deposits, the attraction rates do not change as often as currency rates, but the online interface significantly saves time on contacting the bank for a deal.

The client only needs to enter the desired parameters of the transaction in the special interface of the Internet client DBO, and the machine will calculate the rate at which the bank is ready to accept the deposit. One click - and the transaction will be concluded, the bank will go to the necessary documents for processing the transaction (again having legal force, since the service is "embedded" in the RBS). The client will only replenish the deposit account.

The speed of execution of the transaction is of particular importance when in the evening funds are received in the company’s accounts that must be placed before the end of the day. Having implemented an online service, the bank saves the time of the client, which was previously allotted for paperwork.

Online quotes and paperwork are technology application points that improve service. Customer experience demonstrates the relevance of such services, in the future the bank plans to increase the number of products offered in online services.

Source: https://habr.com/ru/post/344484/

All Articles