Service Desk - quick start. 4 part. Asset accounting

In the continuation of the series of articles about building Service ServiceDesk.

I remind you that in the previous three articles ( 1 , 2 , 3 ) we came to the conclusion that we really need a ServiceDesk, we decided on a service portfolio and a single entry point. Today we talk about asset accounting. Who is interested in this topic - please under the cat.

According to the ITIL methodology, asset accounting is included in the process of managing service assets and configurations.

')

The purpose of this process is to ensure that:

Basic concepts :

Configuration is a generic term used to describe a group of KEs that function together to provide an IT service, or a part of it, also used to denote settings for the parameters of one or several KEs.

Configuration baseline — the baseline for the configuration that was formally agreed and controlled

The change management process is used as the basis for future builds,

releases and changes

Configuration item (CI), configuration item (CI) - any component or other service asset that must be managed in order to provide an IT service

Information about KE is registered in the configuration management system and is supported by the current process of management of service assets and configurations.

CIs include not only hardware, but also IT services, software, buildings, people, and documents (for example, process documentation and SLA)

Important! Asset accounting is additional overhead. And technical experts are very reluctant to do this work. As a result, we needed a separate person who prepared all the incoming documents, documents for moving, etc.

Immediately decide for yourself whether you want to link treatment with equipment. Ie when registering the application, will you indicate the problem KE. This requires additional time when registering the application. But in the future gives a significant plus, because You see the whole story of KE, what were the problems with it. And in the future will be able to make more informed conclusions about the feasibility of repair or replacement.

If you do not plan to link the treatment with configuration units, then I highly recommend to ask how the company keeps records of assets in principle. And maybe the current system is completely fine with you. It will only be necessary to get access to it and teach employees to use it. Although it is not consistent with the methodology of ITIL.

If you still decide to consider everything yourself, then here are a few practical tips on metering technology:

As soon as you have made the decision to keep records of assets and made the initial settings of the system, prohibit any movements of equipment without taking into account in the database. If the asset is not listed - put on the account, mark and only then issue / move. This greatly slows down the work at the beginning, but will allow to achieve data integrity. Otherwise, you will never finish initial registration of assets.

Well, immediately begin to conduct the initial registration. Where, how much and what lies.

After that you will have a complete picture of the equipment. What does she give you?

Having adjusted the accounting process, you will show the business that you care about its property. That you have a picture of the current equipment, do preventive maintenance to extend the life of the equipment and clearly know what equipment reserve you have. This contributes to increasing trust both in the department as a whole and in you as the person responsible for the process.

Duplicate contract scans only if the company does not have a centralized repository. Otherwise, it's just a waste of time. You should have only the most necessary information in the database.

If it is a contract for communication - the number, the object of the service, the provider, the speed, the amount of the monthly payment, technical support contacts.

On the one hand, the information should be enough for your specialists to contact the technical support of the provider in the event of an accident without your participation and leave a request.

On the other hand, you should be ready at any time to present the current state of affairs through communication channels and their costs.

Similarly, on purchases and refills - think ahead for what you are entering information. What reports you want to build in a year.

Important! Keep all passwords from personal accounts, etc. separately. In protected form. For tomorrow your management will like your base and two more departments will start working in it. Those who know the passwords from corporate hosting are not at all necessary.

The same applies to the instructions. Never write passwords in the instructions. We had cases when our instructions got into public access without our participation. And the policy of storing separate passwords has justified itself.

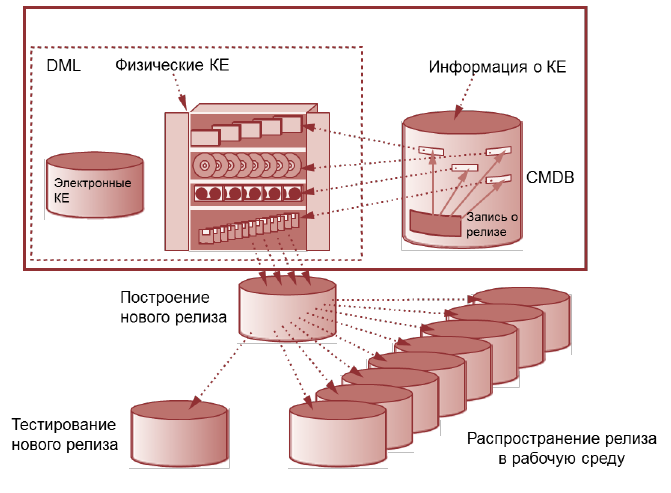

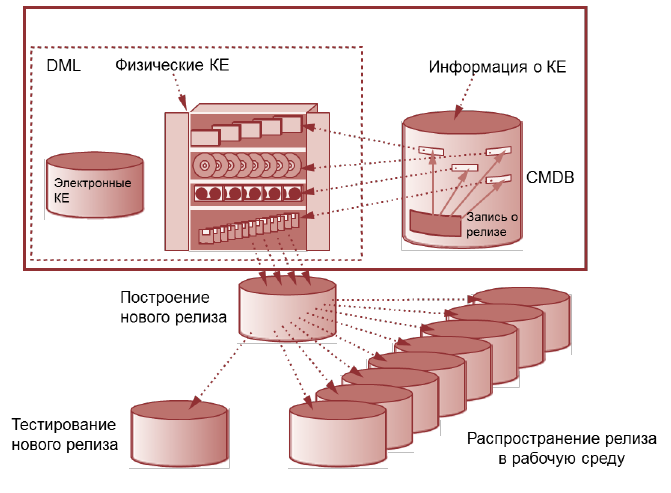

A reference software library (definitive media library, DML) - one or more secure repositories that contain full and authorized versions of all CIs related to DML software may also contain related CIs, such as licenses and documentation

The library is a logically unified repository, even if physically distributed storage locations are DML controlled by the service assets and configuration management process and is part of the configuration management system.

What does it mean - get a single repository of reference distributions. All software should be taken only from there. Computers roll out with reference images. So that there is no situation when each specialist has his own personal collection of favorite programs and he makes installations from it. This will ensure the homogeneity of the environment, which at one time reduces the cost of maintenance.

If you have a zoo from the distributions of ZverCD and their analogues, this will complicate support.

Well, consider the license. To not accidentally become a pirate. Where what programs are delivered when they were bought. Here, accounting is similar with technology.

No license - no installation. We cannot issue an unbought monitor, we cannot deliver an unbought program. The topic of licensing and knocking out money for the purchase of licenses is a separate big topic.

I emphasize again - keeping records will take time away from specialists. Carefully weigh whether you are ready for this additional load or not. Otherwise, the account will be kept once and there will be not much sense from it. “Sell” the idea of accounting, not only to management, but also to specialists. So that they see all the advantages.

Internet does not work? Immediately in one place you can find the contract and the phone provider.

On the fifth floor out of the printer toner? On the base we look at which cartridge to carry. Etc.

In this article, I do not pretend to 100% disclosure of the topic of accounting, but only want to give a general idea of the process. And to warn about those rakes, on which we stumbled.

I remind you that in the previous three articles ( 1 , 2 , 3 ) we came to the conclusion that we really need a ServiceDesk, we decided on a service portfolio and a single entry point. Today we talk about asset accounting. Who is interested in this topic - please under the cat.

According to the ITIL methodology, asset accounting is included in the process of managing service assets and configurations.

')

The purpose of this process is to ensure that:

- Service assets required to provide services are properly controlled. Accurate and reliable information on these assets is available on demand at the right place at the right time. This information includes all the details about the configuration of the assets and the relationships between them.

Basic concepts :

Configuration is a generic term used to describe a group of KEs that function together to provide an IT service, or a part of it, also used to denote settings for the parameters of one or several KEs.

Configuration baseline — the baseline for the configuration that was formally agreed and controlled

The change management process is used as the basis for future builds,

releases and changes

Configuration item (CI), configuration item (CI) - any component or other service asset that must be managed in order to provide an IT service

Information about KE is registered in the configuration management system and is supported by the current process of management of service assets and configurations.

CIs include not only hardware, but also IT services, software, buildings, people, and documents (for example, process documentation and SLA)

Important! Asset accounting is additional overhead. And technical experts are very reluctant to do this work. As a result, we needed a separate person who prepared all the incoming documents, documents for moving, etc.

Accounting equipment

Immediately decide for yourself whether you want to link treatment with equipment. Ie when registering the application, will you indicate the problem KE. This requires additional time when registering the application. But in the future gives a significant plus, because You see the whole story of KE, what were the problems with it. And in the future will be able to make more informed conclusions about the feasibility of repair or replacement.

If you do not plan to link the treatment with configuration units, then I highly recommend to ask how the company keeps records of assets in principle. And maybe the current system is completely fine with you. It will only be necessary to get access to it and teach employees to use it. Although it is not consistent with the methodology of ITIL.

If you still decide to consider everything yourself, then here are a few practical tips on metering technology:

- Decide what you consider individually, and what piece by piece. In our case, we considered individually only large and / or expensive objects. Sistemnik, monitors, printer. Each was assigned an individual number and it was possible to trace its history. Cartridges, mice, keyboards and other trifles were considered individually. Bought 5 pieces, gave 2 pieces, in stock there are 3 pieces left.

- Decide what equipment parameters are important to you and which are not. We had a great desire to describe in detail each piece of metal. And the serial number and model and how many ports and photos ... It all took a lot of time. Just imagine what you want to see in a year. And only these parameters and make. For example - With what diagonal monitors in your office. What power processors, etc.

- Be sure to fill in the purchase data - the date, which legal entity from which you bought, the invoice number, price. This will help in case of warranty. You may change the legal entity, or the supplier. Without this information it will be more difficult to understand.

- Consider the labeling technique. That she was in an easily accessible place, not wiped, did not come off. Desirable in two places. Thermal labels did not justify themselves, very quickly faded. The most reliable was a piece of paper under the tape with a printed number. Or use factory serial numbers for accounting.

As soon as you have made the decision to keep records of assets and made the initial settings of the system, prohibit any movements of equipment without taking into account in the database. If the asset is not listed - put on the account, mark and only then issue / move. This greatly slows down the work at the beginning, but will allow to achieve data integrity. Otherwise, you will never finish initial registration of assets.

Well, immediately begin to conduct the initial registration. Where, how much and what lies.

After that you will have a complete picture of the equipment. What does she give you?

- You will be able to identify frequently faulty equipment. The larger the park and the more specialists, the more difficult it is to track it manually.

- Track equipment obsolescence and plan new purchases in advance.

- Organize maintenance work to extend the life of the equipment

- Detect abnormal consumption of consumables (cartridges, paper).

Having adjusted the accounting process, you will show the business that you care about its property. That you have a picture of the current equipment, do preventive maintenance to extend the life of the equipment and clearly know what equipment reserve you have. This contributes to increasing trust both in the department as a whole and in you as the person responsible for the process.

Accounting contracts

Duplicate contract scans only if the company does not have a centralized repository. Otherwise, it's just a waste of time. You should have only the most necessary information in the database.

If it is a contract for communication - the number, the object of the service, the provider, the speed, the amount of the monthly payment, technical support contacts.

On the one hand, the information should be enough for your specialists to contact the technical support of the provider in the event of an accident without your participation and leave a request.

On the other hand, you should be ready at any time to present the current state of affairs through communication channels and their costs.

Similarly, on purchases and refills - think ahead for what you are entering information. What reports you want to build in a year.

Important! Keep all passwords from personal accounts, etc. separately. In protected form. For tomorrow your management will like your base and two more departments will start working in it. Those who know the passwords from corporate hosting are not at all necessary.

The same applies to the instructions. Never write passwords in the instructions. We had cases when our instructions got into public access without our participation. And the policy of storing separate passwords has justified itself.

Accounting software

A reference software library (definitive media library, DML) - one or more secure repositories that contain full and authorized versions of all CIs related to DML software may also contain related CIs, such as licenses and documentation

The library is a logically unified repository, even if physically distributed storage locations are DML controlled by the service assets and configuration management process and is part of the configuration management system.

What does it mean - get a single repository of reference distributions. All software should be taken only from there. Computers roll out with reference images. So that there is no situation when each specialist has his own personal collection of favorite programs and he makes installations from it. This will ensure the homogeneity of the environment, which at one time reduces the cost of maintenance.

If you have a zoo from the distributions of ZverCD and their analogues, this will complicate support.

Well, consider the license. To not accidentally become a pirate. Where what programs are delivered when they were bought. Here, accounting is similar with technology.

No license - no installation. We cannot issue an unbought monitor, we cannot deliver an unbought program. The topic of licensing and knocking out money for the purchase of licenses is a separate big topic.

Conclusion

I emphasize again - keeping records will take time away from specialists. Carefully weigh whether you are ready for this additional load or not. Otherwise, the account will be kept once and there will be not much sense from it. “Sell” the idea of accounting, not only to management, but also to specialists. So that they see all the advantages.

Internet does not work? Immediately in one place you can find the contract and the phone provider.

On the fifth floor out of the printer toner? On the base we look at which cartridge to carry. Etc.

In this article, I do not pretend to 100% disclosure of the topic of accounting, but only want to give a general idea of the process. And to warn about those rakes, on which we stumbled.

Source: https://habr.com/ru/post/344020/

All Articles