Overview of important legal requirements of the Facebook platform

On the Internet there is a lot of information about the legal requirements of such sites as Google Play or the AppStore, but there is no good analysis of the legal requirements of the Facebook site.

Based on this fact, the idea arose to consolidate the requirements for application and game developers on Facebook in this article. In addition, there are a number of controversial points that have a desire to share.

# Developers and payments

Despite the fact that Facebook does not imperatively indicate who can be a developer, a legal entity or just an individual, you can receive payments in applications (using the Facebook payment system) to the account of a legal entity or an individual entrepreneur.

')

If we are read by developers from Ukraine, then in Ukrainian local legislation, unlike the laws of Russia or the Republic of Belarus, the term “individual entrepreneur” is synonymous with the term “individual entrepreneur”

# Commissions and currency

Facebook charges for its services in the amount of 30% of the developer’s revenue, as well as all applicable sales taxes or VAT (VAT) automatically. All revenue is converted into US dollars.

# Withdrawals

Facebook pays developer revenues automatically, twice a month. There are two options: a bank account or a PayPal account.

# Verification of bank account or PayPal account

The list of bank countries where Facebook does not require additional verification for payment:

Austria, Belgium, Canada, Czech Republic, Denmark, Finland, France, Germany, Hong Kong, Hungary, Ireland, Italy, Luxembourg, Netherlands, New Zealand, Poland, Portugal, Singapore, Slovakia, Spain, South Korea, Sweden, United Kingdom, United States.

Unfortunately, the CIS countries were not included in this list.

Developers with bank accounts in other countries are required to pass verification by submitting additional documents.

# Documents for account verification {for legal entities}

1. Certificate of Registration.

2. The document, which will clearly indicate the total number of shares of the company, the percentage distribution of shares of the company and the name of each shareholder. If the applicant entity is part of a larger group of companies or has a multi-level ownership structure, a similar document will be required for each entity that is part of the ownership and management structure.

In addition, it will be necessary to disclose the ownership and management structure of the company (to the final beneficiary)

4. Bank statement or letter from the bank where the account is kept (not older than 6 months). This only applies if you want to receive payments to a bank account, not PayPal.

If you chose the latter, then a screenshot of the PayPal account, on which the beneficiary is indicated, the email associated with the account and the payer ID.

5. Identity cards: Everything is simple, for all owners of the company who have more than 10% of the shares must submit scans of a passport or driver's license.

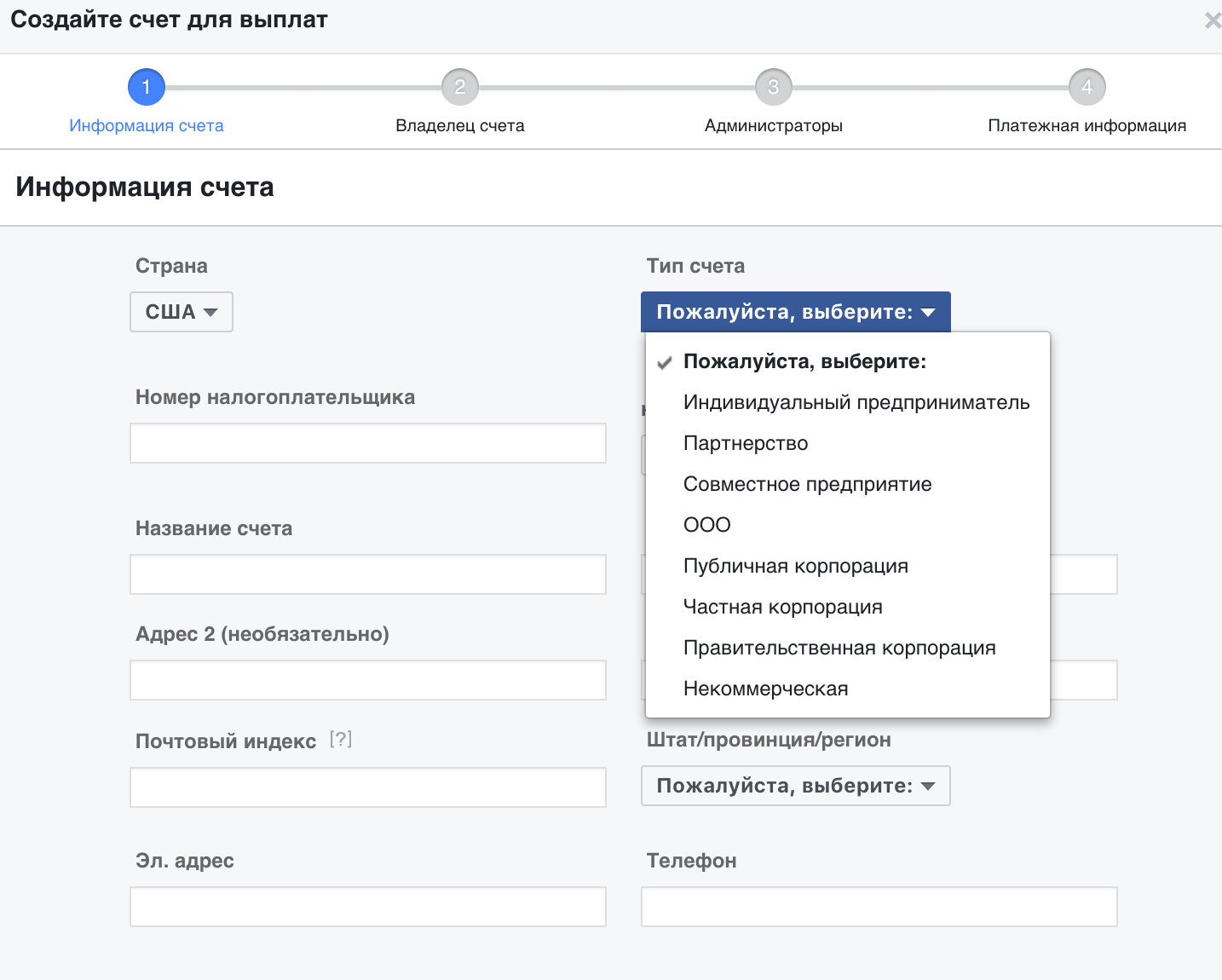

# Place of company registration {if you plan to accept payments via Facebook}

The developer may operate as an individual entrepreneur, but, for example, if there are valid claims from the user, proved in court, the developer will be liable to the user with all his capital and property. Responsibility of the company (form of LLC) is limited.

You can register a company in your own country (be it Russia, Belarus, Ukraine, Kazakhstan, etc.), or you can follow the path of registering a company abroad.

#Risk

There is an opportunity to make a company for residents of the CIS abroad, for example, a bunch of “Hong Kong + account in the Baltic States”, and not to pay income tax at the company level, which is quite profitable (such companies can be officially exempt from taxation in Hong Kong).

But, for example, Google Play requires that a company and a bank account be in the same country. (eg Cyprus company with a bank account in Cyprus)

Due to the fact that tax-free options for opening a company and a bank account in one country are not enough, and they are not very convenient, it became interesting what requirements Facebook puts forward and whether the above-mentioned link with Hong Kong can be applied to it.

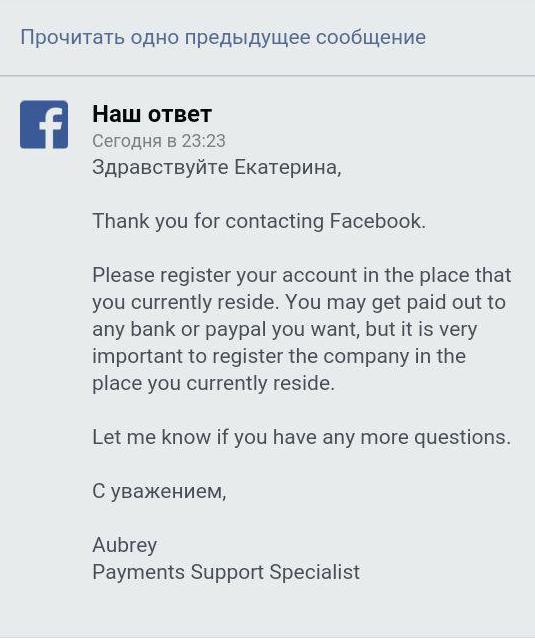

There is no clearly identified requirement in the Facebook documentation that the company and the account must be in the same country, but the opposite is not stated. After addressing this question to the support service, an answer was received:

They argue that a bank account can be anywhere, but the company must be open in the place where the developer lives.

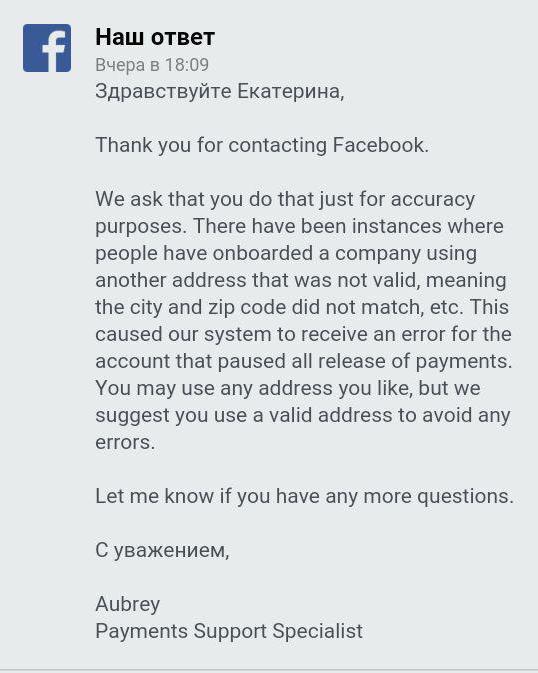

To the question (not literally) “Why?” Answered the following:

The answer is absolutely ambiguous. It seems as possible that the address of residence does not coincide with the address of the company, but at the same time the payment may be rejected.

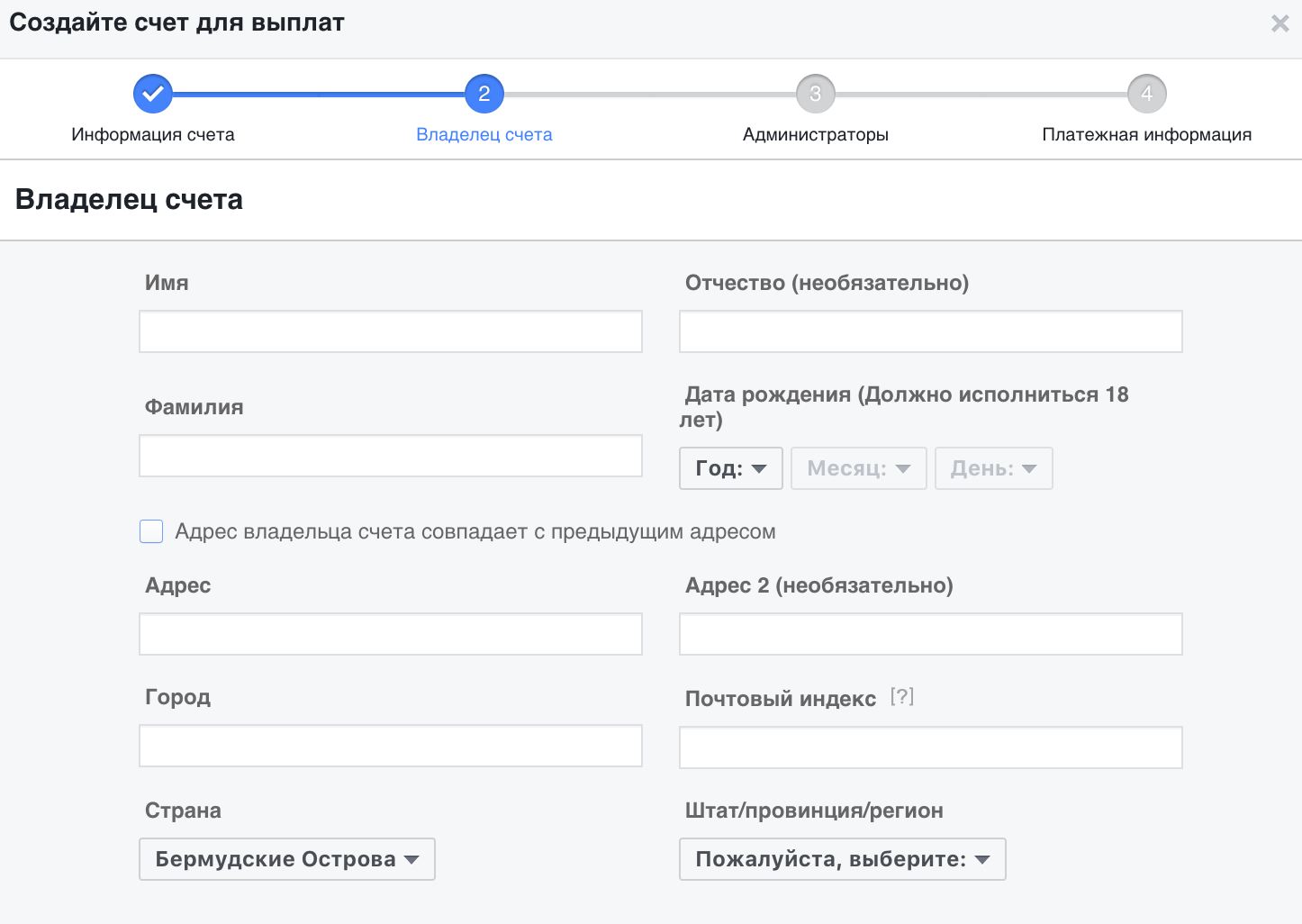

An interesting observation: the registration form allows you to indicate that the address of the beneficiary’s account is different from the address of the company's registration.

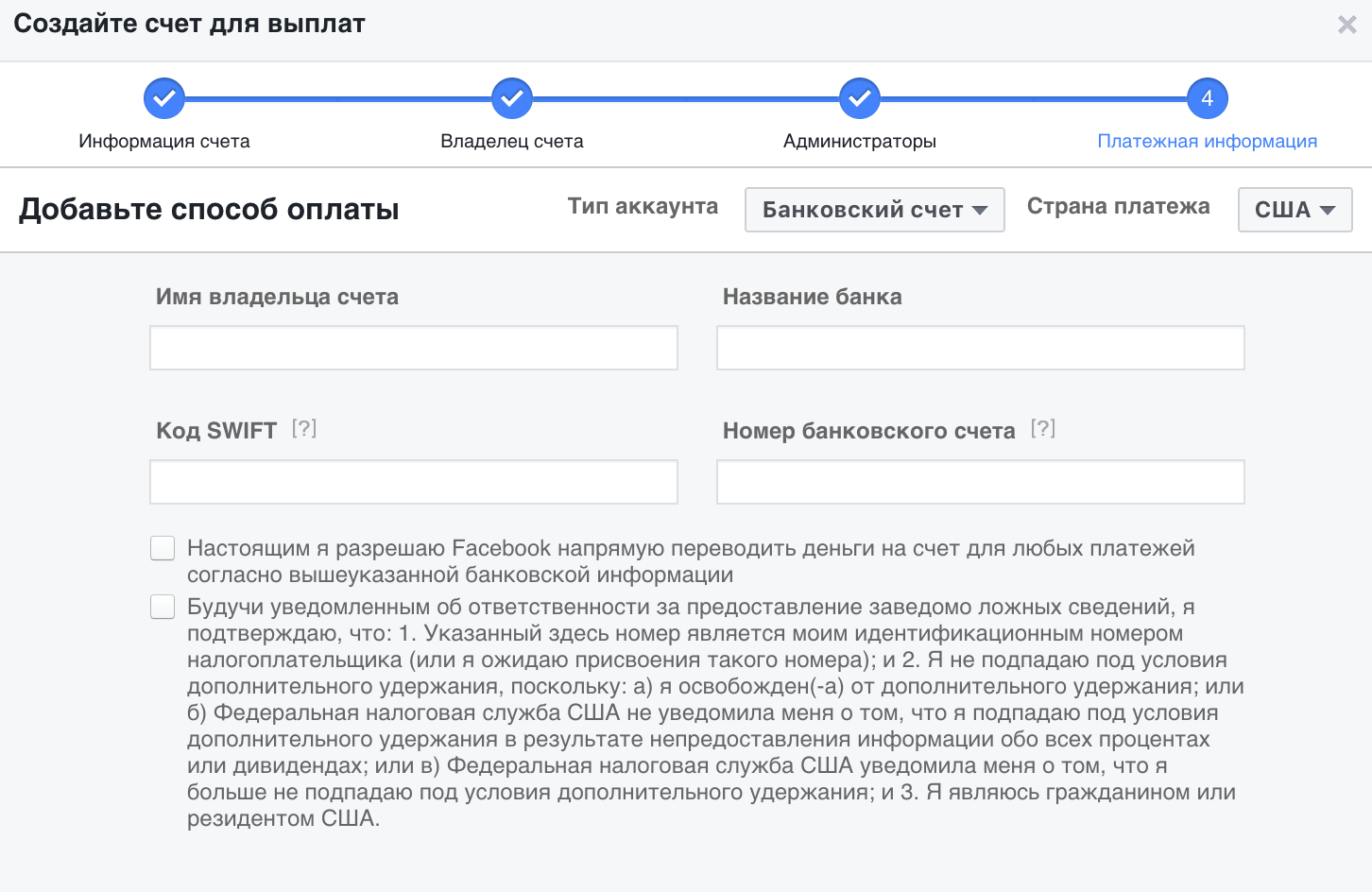

It’s hard to make a withdrawal , as we are lawyers and are used to basing on documents, not on registration forms or support service responses, but it seems that the beneficiary’s home address for the company’s account, the company’s registration address and the country of the bank account may differ , and the link with Hong Kong works . By the way, the screenshot with the form on the bank account below:

# Taxes.

Profit tax developers pay themselves and Facebook does not take responsibility for this.

With respect to VAT, the following rules apply:

Facebook deducts from the amount of payments to the developer in connection with sales to users located in European Union member states of VAT (VAT) depending on the location of the user and lists it to the appropriate tax authorities.

From January 1, 2017, Facebook deducts the current VAT or tax on goods and services depending on the location of the user and transfers it to the appropriate tax authorities in the following countries: New Zealand, Russia and South Korea. From July 1, 2017, Facebook will perform such actions for Australia.

# Paid subscriptions.

Here Facebook is quite logical and loyal, and this problem rarely arises.

When a developer uses the function of a paid subscription to an application (or a specific functionality of the application), it is forbidden to cancel the subscription of a user before the end of the period for which the user made a payment without returning money for an unused period.

Soon, Facebook will tell in detail about payments through Messenger and we will prepare a legal analysis, adding to this article, or creating the following.

Thanks for attention!

Source: https://habr.com/ru/post/343646/

All Articles