How cheat traders on cryptocurrency exchanges: the investigation of Business Insider

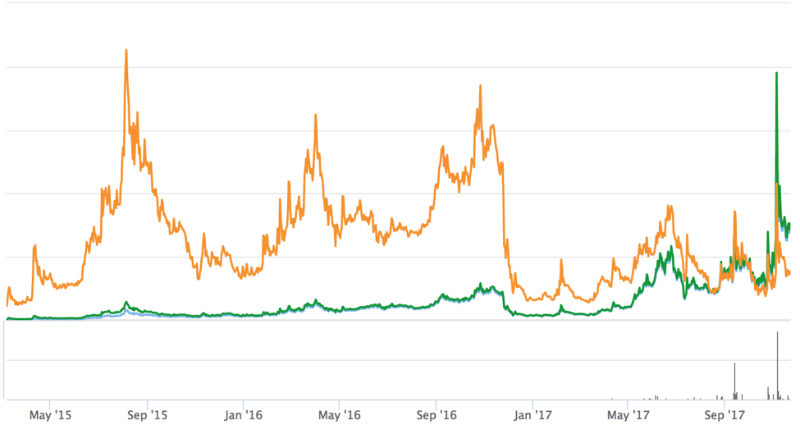

Vcash cryptocurrency trading schedule manipulated by unscrupulous traders

The publication Business Insider has published a large investigation of altcoin price manipulation schemes on some cryptocurrency exchanges that are similar to the operations performed by the hero of the film “The Wolf of Wall Street”. We list the main facts from this article.

')

What are we talking about

A cryptocurrency manipulation scheme called “pump and dump” is common on the stock exchanges - it involves the collusion of a number of traders who buy a certain cryptocurrency, and then begin an advertising campaign coordinated through the chats in Telegram, designed to unleash the coin they have chosen.

On forums and subject groups in social networks, they talk about the prospects for the currency, when third-party traders who believe them begin to buy it - the price rises. When it increases enough, the traders who have colluded sell their coins and stop the advertising campaign. As a result, the price quickly falls to the original, and investors of the “second wave”, who believe in the prospects for the purchased cryptocurrency, are at a loss.

Journalists have discovered pump and dump schemes for the promotion of cryptocurrencies UBQ, VCash, Chill Coin, Magi Coin and Indorse - this is only for the previous two weeks. All manipulations were carried out on two exchanges - Russian Yobit and Bittrex located in Las Vegas.

It was the Pump and dump circuit that was realized by Jordan Belford, who became the prototype for the main character of the film “The Wolf from Wall Street” with Leonardo DiCaprio. It is worth noting that Pump and dump schemes are prohibited on conventional exchanges regulated by the state, such as the Nasdaq, the London Stock Exchange or the Moscow Exchange. However, in the case of cryptocurrency exchanges, such transactions may be legal precisely because of the absence of most laws regulating the trade in cryptocurrencies.

Detailed fraud scheme

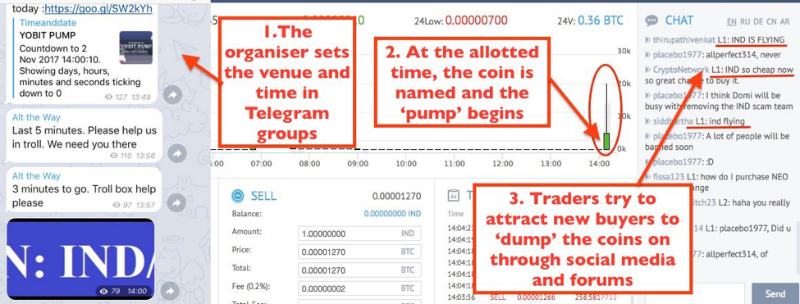

First, in the specialized Telegram channels, coordinated buying of a specific cryptocurrency is discussed:

The announcement of scam in the community of PumpKings - after the manipulation, a report was published on how much it was possible to raise the price of altcoin and the volume of trading with it. Image: Business Insider

Then the traders involved in the manipulation begin to spin the selected coin - they enter into discussions on forums, in social networks, write about the prospects of currency on Reddit, etc. The task is to convince third-party investors that the rise in the value of the coin is justified and will continue in the future. At the same time, a goal is set in advance - how much the cryptocurrency price should increase. Upon its achievement, the participants in the manipulation sell the purchased altcoins and stop the promotion activities. As a result, the price very quickly returns to the initial level.

Fraud scheme: discussion in the chat, at the appointed time, the currency is announced for the coordinated buying, its price immediately rises, then the traders try to attract the attention of outside investors. Image: Business Insider

It is not known how many traders participate in such manipulations, however the number of subscribers of the Pump King community alone is ~ 15 thousand. It is also difficult to calculate how much the traders taking part in it can earn as a result of such fraud. One thing is clear for sure - at the moment, the hands of the organizers of such scams are untied due to the practical absence of regulation. And on the contrary, anyone who organizes such a scheme on the “ordinary” stock exchange will very quickly face problems with the law.

Other materials on finance and stock market from ITI Capital :

Source: https://habr.com/ru/post/343164/

All Articles