Time bitcoin banks?

Recently, a rather remarkable event happened in the Bitcoin world. A block was obtained in which the bonus 12.5 BTC per unit turned out to be less than the bonus for the transaction 13.4 BTC . Of course, such situations happened before as a result of mistakes, generosity, or various experiments on Blockchain, but for the first time this situation was the result of a trend in the value of transactions.

Maybe Bitcoin requires banks or their analogues?

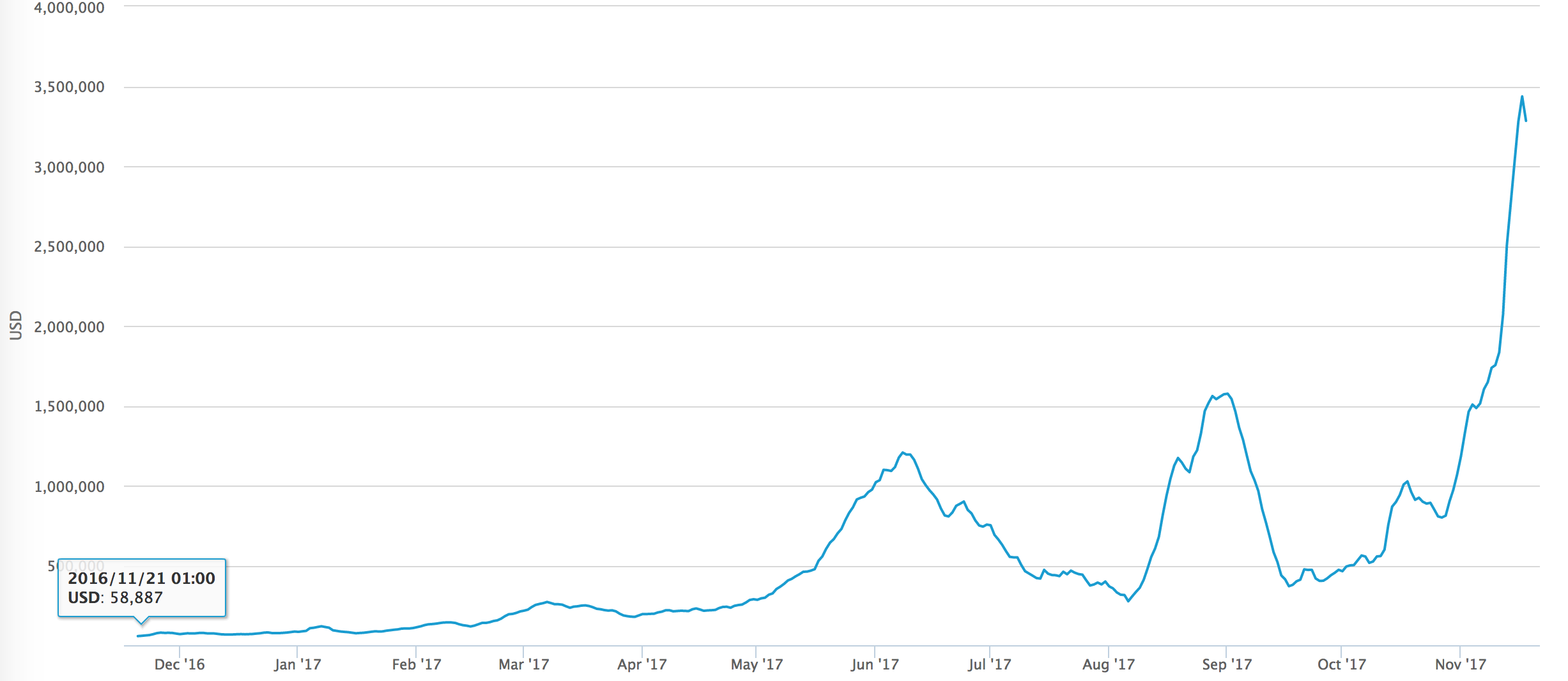

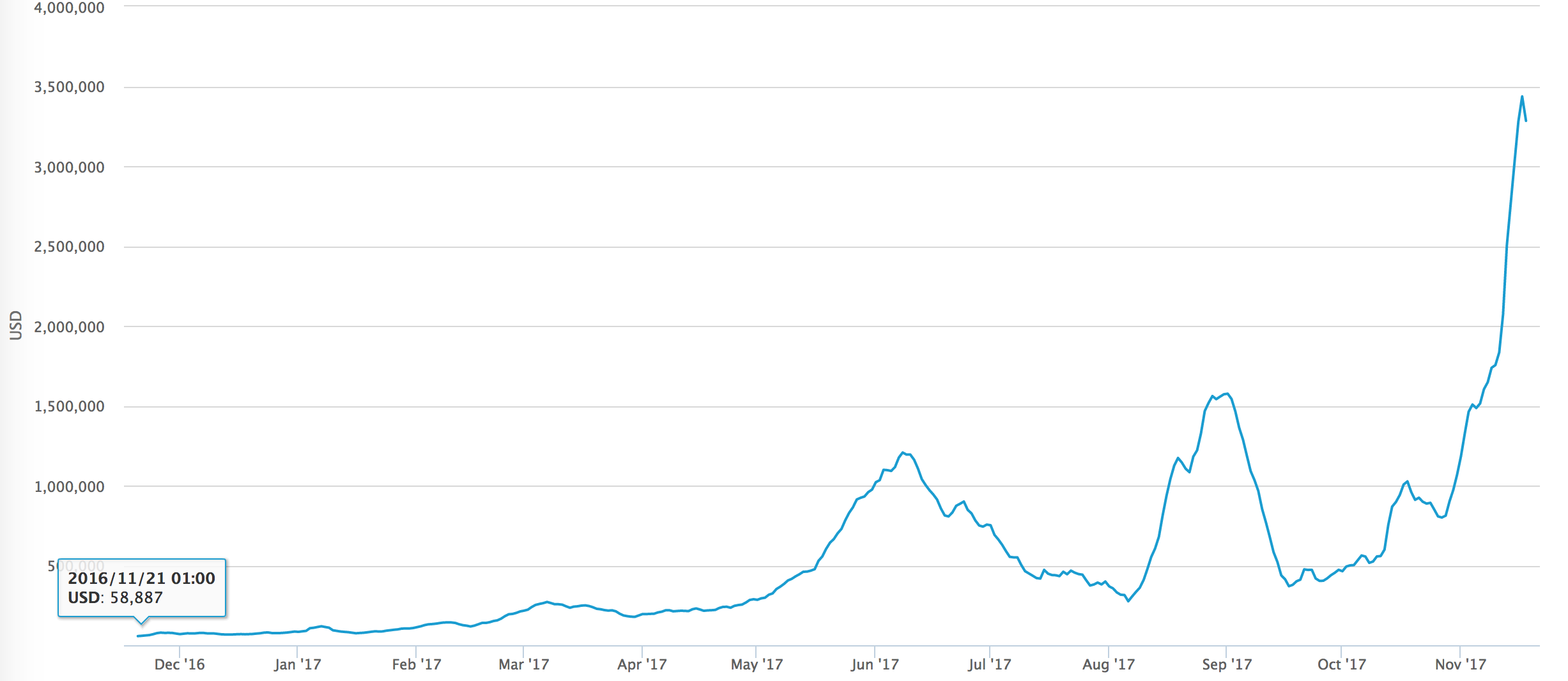

In 2016, it would seem, nothing foreshadowed trouble, transactions were cheap and cost $ 0.15 per transaction (50 satoshi per byte). Note: in bitcoin, the transaction volume in currency is not important, and only the size of the transaction is important, so a transfer of $ 1,000,000 costs the same as the $ 1-transfer . Some enthusiasts speculated, including myself, that the network should work without mining, when the transaction fee brings more than mining. This moment has come, but everything turned out not so brightly.

')

It is important that the main reason for the rise in transaction costs is not the rise in Bitcion cost, because comparing the blocks, we see that the price per byte increased in BTC, from 50 to 1250 Satoshi (during the rush). That is, if we take a 10-fold increase in Bitcoin in $, we get that the transaction price increased from $ 0.15 to $ 21.7. Obviously, this growth was speculative and there were those who could afford to pay such a price for the transaction. But what about those who expected to pay Bitcoin in a store or use for micropayments? Even those who would happily switch to other cryptocurrencies were trapped: in order to trade on the exchange, you will need to carry out at least 1 transaction.

We have long been accustomed to, working with large amounts - pay more tips. It is not strange for us that exchanges, banks, shops take a% of the volume of transactions. Then the truth is this% is governed by the "greed" of the organization. Bitcoin is not an organization, but a marketplace, a lively transaction market, and therefore miners include in the block exactly those transactions that are profitable. But people are still inclined to leave more tips for large amounts, thus, when large Bitcoin trades occur, the cost of 1 byte in Bitcoin rises sharply, which throws all small transactions overboard.

Consider the simplest payment transaction and think about where you can save.

The minimum size is about 220 bytes. Note that if we want to pay 1000 people at the same time, the size of “1 payment” tends to 38 bytes, which is 5 times more profitable. It is also important to try to avoid receiving money from many sources or, if possible, to combine them into one transaction. Combining 5000 Inputs = 1 MB, is a whole block, and costs about $ 50,000. The question of what to do with a store that accepts 1,000,000 payments per month and then settles with 100 suppliers remains open.

An interesting point is that the economy of Bitcoin transactions is closed: if you want to conduct a transaction, you pay a commission to Bitcoin. Therefore, it is worthwhile to study not the cost of a transaction in $, which depends on the market rate, but the cost in BTC. The cost in BTC is growing, 10 times in 1 year, because the volume of transactions increases.

The easiest way to reduce the cost of a byte in a block is to increase performance. Rumors that it is easy to scale Bitcoin and 100 ICO / Coin have already done so remain rumors. So far, no coin has approached 1 MB blocks, therefore the introduction of 2 MB Litecoin / DashCoin blocks is premature and the average need is about 100 KB. Even Bitcoin Cash with 8 MB generates an average of 100 KB blocks.

There are 3 obvious directions to increase productivity:

- Increase block size

- Increase block production speed

- Reduce transaction size

The first two directions are closely related to each other, because 1 MB can go from one minute to validation and more + more time is needed to distribute the block over the network to prevent fork from occurring. At the moment, work is underway to accelerate validation and distribution on the network, but the possible acceleration is only 2-4 times, given that Bitcoin already has 4 MB Segwit blocks.

Reduce the size of the transaction is the most promising piece. The principle of the Lightning Network is to exchange debt obligations offline, and fix them much less often. Unfortunately, this principle is applicable only if you constantly interact in the network with one agent. This principle has a beautiful mathematical basis, but in practice, if you perform a large number of transactions with someone, you can use similar approaches without the Lightning Network. The most successful approach would be if the cost of the transaction is going to 0. Because even the most minimal blockchain entry is already 65 bytes, considering Segwit it is 4-8 times more.

One of the solutions discussed is the use of other blockchains, the benefit is that there are enough people willing to conduct an ICO and sell tokens. In fact, the workload of Top 10 oins is <10%, that is, we can increase productivity by at least 100 times.

The main disadvantage is that people want to use Bitcoin, and this can only guarantee Bitcoin Blockchain. Exchange coin during a transaction leads to the fact that to carry out the transaction will still have to be in the Bitcoin system. You can try to raise money in Bitcoin, as Mastercoin did, and be an independent blockchain, fixing your transactions in a Bitcoin blockchain, but even here the growing transaction fee is fraught with great trouble.

Today, Plasma offers an interesting solution with a sub-blockchain and an arbitration system, but it also has some flaws.

If we put 1 Satoshi = 1 Cent, then 1 BTC = $ 1,000,000, which in theory is not so much because Market Cap BTC = $ 21 trillion, which is much lower than the global need for money. But, the cost of the transaction is likely to be $ 5-100, which is extremely much.

No one likes the word "bank" in cryptomere, because it is inevitably associated with fiat money and draconian loans. The most interesting thing is that in the real world, banks face similar scalability issues. Paying our money to the bank and using a plastic card for payments, the bank does not transfer money immediately to another bank, but issues a debt note and settles the balance later.

This scheme scales well, but we don’t want to apply directly to Bitcoin, of course. The main problem: if the bank does not converge with the credit debit and the bank expects a collapse, then we will not receive any Bitcoins from it. And this is exactly what we want to avoid using Bitcoin. Our money must remain with us and be safely stored.

In fact, we can eliminate this problem by issuing money to the bank in portions of $ 100-10000 weekly or monthly, depending on our trust in the bank. In this scheme, it is ideal to use the Lightning Network, since all the micropayments on our behalf are made by the bank and we pay only with the bank.

Probably everyone should have a choice on what account to receive a salary: on a bank or on a personal Bitcon account. When received on a personal account, the transaction fee will be deducted.

The “cash out” transaction is a transaction when you withdraw from a loan issued to a bank and transfer it to your Bitcoin account. Naturally, you have to pay a transaction fee, as well as when creating a loan.

Naturally, the scheme will not work if the sender and the payee do not belong to one bank or one network, because for this you have to record the transaction in the blockchain. Similar solutions already exist - these are international networks of banks, like Visa / Mastercard, and a crypto-analogue - Ripple. Therefore, the sender and the recipient are more likely to belong to the same banking network. Competition between banking networks can again improve the mechanisms of trust and reputation.

In fact, it is much more correct if this blockchain network is provided by the state, because this is the primary basis for calculating taxes: VAT, income tax, turnover tax. Of course, this is unlikely to happen, because in this case Bitcoin will be a supranational currency and literally an ideal offshore zone.

Oddly enough, but in the Bitcoin system of banks, the money belongs to you and, in order for the system to work, you will have to pay banks for using the system. The limitation, for example, is that sellers will not accept purchases from private customers (only from banks) unless they pay a high transaction cost.

In the network of banks, the most important thing is the reputation that some bank will be able to repay its debts to other banks, and we will have to pay for this, of course. Otherwise, any collapse of one bank will inevitably affect the balance of accounts of other banks.

PS I think that banks are not a relic of the old financial system, but also the engine of the new system. True, banks will have to go a long way to become a Bitcoin bank.

Maybe Bitcoin requires banks or their analogues?

Prehistory

In 2016, it would seem, nothing foreshadowed trouble, transactions were cheap and cost $ 0.15 per transaction (50 satoshi per byte). Note: in bitcoin, the transaction volume in currency is not important, and only the size of the transaction is important, so a transfer of $ 1,000,000 costs the same as the $ 1-transfer . Some enthusiasts speculated, including myself, that the network should work without mining, when the transaction fee brings more than mining. This moment has come, but everything turned out not so brightly.

')

It is important that the main reason for the rise in transaction costs is not the rise in Bitcion cost, because comparing the blocks, we see that the price per byte increased in BTC, from 50 to 1250 Satoshi (during the rush). That is, if we take a 10-fold increase in Bitcoin in $, we get that the transaction price increased from $ 0.15 to $ 21.7. Obviously, this growth was speculative and there were those who could afford to pay such a price for the transaction. But what about those who expected to pay Bitcoin in a store or use for micropayments? Even those who would happily switch to other cryptocurrencies were trapped: in order to trade on the exchange, you will need to carry out at least 1 transaction.

Transaction Size and Price

We have long been accustomed to, working with large amounts - pay more tips. It is not strange for us that exchanges, banks, shops take a% of the volume of transactions. Then the truth is this% is governed by the "greed" of the organization. Bitcoin is not an organization, but a marketplace, a lively transaction market, and therefore miners include in the block exactly those transactions that are profitable. But people are still inclined to leave more tips for large amounts, thus, when large Bitcoin trades occur, the cost of 1 byte in Bitcoin rises sharply, which throws all small transactions overboard.

Consider the simplest payment transaction and think about where you can save.

The minimum size is about 220 bytes. Note that if we want to pay 1000 people at the same time, the size of “1 payment” tends to 38 bytes, which is 5 times more profitable. It is also important to try to avoid receiving money from many sources or, if possible, to combine them into one transaction. Combining 5000 Inputs = 1 MB, is a whole block, and costs about $ 50,000. The question of what to do with a store that accepts 1,000,000 payments per month and then settles with 100 suppliers remains open.

An interesting point is that the economy of Bitcoin transactions is closed: if you want to conduct a transaction, you pay a commission to Bitcoin. Therefore, it is worthwhile to study not the cost of a transaction in $, which depends on the market rate, but the cost in BTC. The cost in BTC is growing, 10 times in 1 year, because the volume of transactions increases.

Bitcoin scalability

The easiest way to reduce the cost of a byte in a block is to increase performance. Rumors that it is easy to scale Bitcoin and 100 ICO / Coin have already done so remain rumors. So far, no coin has approached 1 MB blocks, therefore the introduction of 2 MB Litecoin / DashCoin blocks is premature and the average need is about 100 KB. Even Bitcoin Cash with 8 MB generates an average of 100 KB blocks.

There are 3 obvious directions to increase productivity:

- Increase block size

- Increase block production speed

- Reduce transaction size

The first two directions are closely related to each other, because 1 MB can go from one minute to validation and more + more time is needed to distribute the block over the network to prevent fork from occurring. At the moment, work is underway to accelerate validation and distribution on the network, but the possible acceleration is only 2-4 times, given that Bitcoin already has 4 MB Segwit blocks.

Reduce the size of the transaction is the most promising piece. The principle of the Lightning Network is to exchange debt obligations offline, and fix them much less often. Unfortunately, this principle is applicable only if you constantly interact in the network with one agent. This principle has a beautiful mathematical basis, but in practice, if you perform a large number of transactions with someone, you can use similar approaches without the Lightning Network. The most successful approach would be if the cost of the transaction is going to 0. Because even the most minimal blockchain entry is already 65 bytes, considering Segwit it is 4-8 times more.

Help other blockchains

One of the solutions discussed is the use of other blockchains, the benefit is that there are enough people willing to conduct an ICO and sell tokens. In fact, the workload of Top 10 oins is <10%, that is, we can increase productivity by at least 100 times.

The main disadvantage is that people want to use Bitcoin, and this can only guarantee Bitcoin Blockchain. Exchange coin during a transaction leads to the fact that to carry out the transaction will still have to be in the Bitcoin system. You can try to raise money in Bitcoin, as Mastercoin did, and be an independent blockchain, fixing your transactions in a Bitcoin blockchain, but even here the growing transaction fee is fraught with great trouble.

Today, Plasma offers an interesting solution with a sub-blockchain and an arbitration system, but it also has some flaws.

Time Bitcoin Banks?

If we put 1 Satoshi = 1 Cent, then 1 BTC = $ 1,000,000, which in theory is not so much because Market Cap BTC = $ 21 trillion, which is much lower than the global need for money. But, the cost of the transaction is likely to be $ 5-100, which is extremely much.

No one likes the word "bank" in cryptomere, because it is inevitably associated with fiat money and draconian loans. The most interesting thing is that in the real world, banks face similar scalability issues. Paying our money to the bank and using a plastic card for payments, the bank does not transfer money immediately to another bank, but issues a debt note and settles the balance later.

This scheme scales well, but we don’t want to apply directly to Bitcoin, of course. The main problem: if the bank does not converge with the credit debit and the bank expects a collapse, then we will not receive any Bitcoins from it. And this is exactly what we want to avoid using Bitcoin. Our money must remain with us and be safely stored.

Credit for operating expenses

In fact, we can eliminate this problem by issuing money to the bank in portions of $ 100-10000 weekly or monthly, depending on our trust in the bank. In this scheme, it is ideal to use the Lightning Network, since all the micropayments on our behalf are made by the bank and we pay only with the bank.

Cash withdrawal and receipt

Probably everyone should have a choice on what account to receive a salary: on a bank or on a personal Bitcon account. When received on a personal account, the transaction fee will be deducted.

The “cash out” transaction is a transaction when you withdraw from a loan issued to a bank and transfer it to your Bitcoin account. Naturally, you have to pay a transaction fee, as well as when creating a loan.

6-network networks

Naturally, the scheme will not work if the sender and the payee do not belong to one bank or one network, because for this you have to record the transaction in the blockchain. Similar solutions already exist - these are international networks of banks, like Visa / Mastercard, and a crypto-analogue - Ripple. Therefore, the sender and the recipient are more likely to belong to the same banking network. Competition between banking networks can again improve the mechanisms of trust and reputation.

In fact, it is much more correct if this blockchain network is provided by the state, because this is the primary basis for calculating taxes: VAT, income tax, turnover tax. Of course, this is unlikely to happen, because in this case Bitcoin will be a supranational currency and literally an ideal offshore zone.

Subscription fee

Oddly enough, but in the Bitcoin system of banks, the money belongs to you and, in order for the system to work, you will have to pay banks for using the system. The limitation, for example, is that sellers will not accept purchases from private customers (only from banks) unless they pay a high transaction cost.

In the network of banks, the most important thing is the reputation that some bank will be able to repay its debts to other banks, and we will have to pay for this, of course. Otherwise, any collapse of one bank will inevitably affect the balance of accounts of other banks.

PS I think that banks are not a relic of the old financial system, but also the engine of the new system. True, banks will have to go a long way to become a Bitcoin bank.

Source: https://habr.com/ru/post/342732/

All Articles