Now Wall Street: How Amazon, Alibaba, and Rakuten Will Change Finance (McKinsey Report)

Image: Nate , CC BY-NC 2.0

The next big area that will significantly change under the influence of technology companies is finance. Such a conclusion is contained in the 52-page report of McKinsey analysts . We present to your attention the main points of this document.

')

What analysts predict

According to the report, the total profitability of companies in the financial industry may reach 9.3% by 2025, while maintaining the current market conditions. However, experts are not sure that such a preservation is possible - if users switch to financial products of digital companies, then the overall profitability of traditional financial business will also increase by only 5.2% in 2025.

Two scenarios for the development of the financial industry by McKinsey

In this case, “digital companies” means not new FINTECH start-ups. On the contrary, analysts are convinced that technology giants like Amazon, Alibaba, Tencent and Rakuten will change everything.

Platform Companies

The prospects of technology giants are determined by the fact that they provide users with large-scale integrated platforms. This allows you to build extremely strong ties with customers. The essence of this approach in the report is explained on the example of one of the largest online marketplace in Asia, Rakuten:

- The loyalty program of the service involves charging users with points or internal money that can be used to make purchases.

- Company members can arrange and credit cards for shopping.

- The company produces financial products and services from mortgages to brokerage services.

- She owns one of the largest travel portals in Japan.

- And also - Viber messenger, which is used by approximately 800 million people in the world.

And this picture is observed not only in Asia - in the United States, Amazon has long been a favorite application of the millennials, and 73% of them would prefer using financial services from Google, Amazon or PayPal to interact with their usual bank.

What does this mean for financial companies

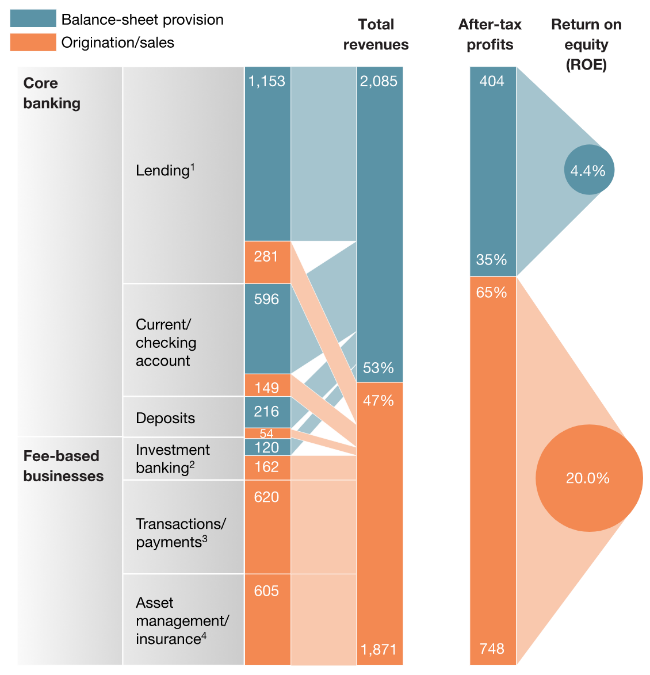

According to analysts at McKinsey, the “nuclear” business of banks - issuing loans, deposits, etc. - generates 53% of the total revenue of the industry, with a profit of 35% and a ROE of 4.4%. In turn, the “distribution” of these services brought 47% of revenue and 65% of profit from ROE at 20%. And this particular piece of cake can be taken away from the financiers by technology companies that have long learned to distribute and package services.

What will all this lead to?

Under pressure from technology companies that have accustomed users to the convenience and high level of service, financial market players are also forced to follow this path. A few years ago, it was scary to look at the websites and applications of any bank, today users have access to convenient applications, various calculators of mortgage payments and interest on deposits that have not been available recently.

In addition, McKinsey analysts suggest that in the future, some financial institutions will prefer to become partners of platform companies in order to deal only with basic services themselves, and distribute distribution issues to those who know better about it.

“Today, many banks are considering this opportunity. The main problem here is pricing. If banks stop interacting directly with the user [giving it away to a conditional Amazon], will they be able to set prices high enough for their services to make money anyway? And in many cases the answer is "yes."

Other materials on finance and stock market from ITI Capital :

Source: https://habr.com/ru/post/342350/

All Articles