Startup of the day (October 2017)

Continuing the “Startup of the Day” series of digests, today I present the most interesting projects for October. If you want to get acquainted with the others, then please in my blog. Entries are available on Facebook , ICQ and Telegram .

Via

A lot of investments are being poured on market-taxi projects all over the world, but Via stands out even against this background. In 2015, he received a round of 27 million, in 2016 - 100 million, the other day - 250 million, a total of almost 400. Despite such generous funding, Via launches one new city a year and works now only in New York, Chicago and Washington, and even in them to call the car can only be in the most popular areas within the Garden Ring in Moscow concepts.

Monstrous money is going to turn a taxi into a kind of bus - this is the final point of the future evolution of UberPOOL. The user calls the car, indicates the place of landing and disembarking. Clever algorithms of Via are looking for a suitable combination of routes and transfer landing within a quarter, or even two. The car arrives at the indicated place, other passengers are already sitting in it, but to everyone along the way, and they almost did not lose time - the new one didn’t go to the neighboring quarter for nothing. For those who do not want or can not walk with heavy suitcases, Via has a normal taxi mode, but this is a by-product, they will not kill Uber anyway.

Naturally, a joint trip is several times cheaper than an individual one. The service at the same time can earn more - depending on how many people manage to cram into one machine. The driver receives a rate per hour, not for the trip, and is obliged to accurately follow the orders of the program - both on the route and on the selection of all potential passengers.

Such an economy is dramatically dependent on the density of travel. For an ordinary taxi, reducing the number of passengers and drivers by half means only a half increase in the time of filing - sometimes it is noticeable, sometimes not, but not a disaster. For Via, the absolute number of users immediately affects the number of close routes, which means that the occupancy rate of the vehicle, and thus the profitability. In the struggle for travel density, a natural option is to subscribe, and, to encourage customers to drive more often, Via sells almost unlimited travel cards. In different cities, a startup offers different conditions, the best option is available in Washington - $ 85 per month with no limit on the number of trips.

Whether such a model will survive, no one knows. It looks very interesting, users love cheap, but they need so much to make the economy converge. While Via continues to develop its three cities and is preparing to leave for London.

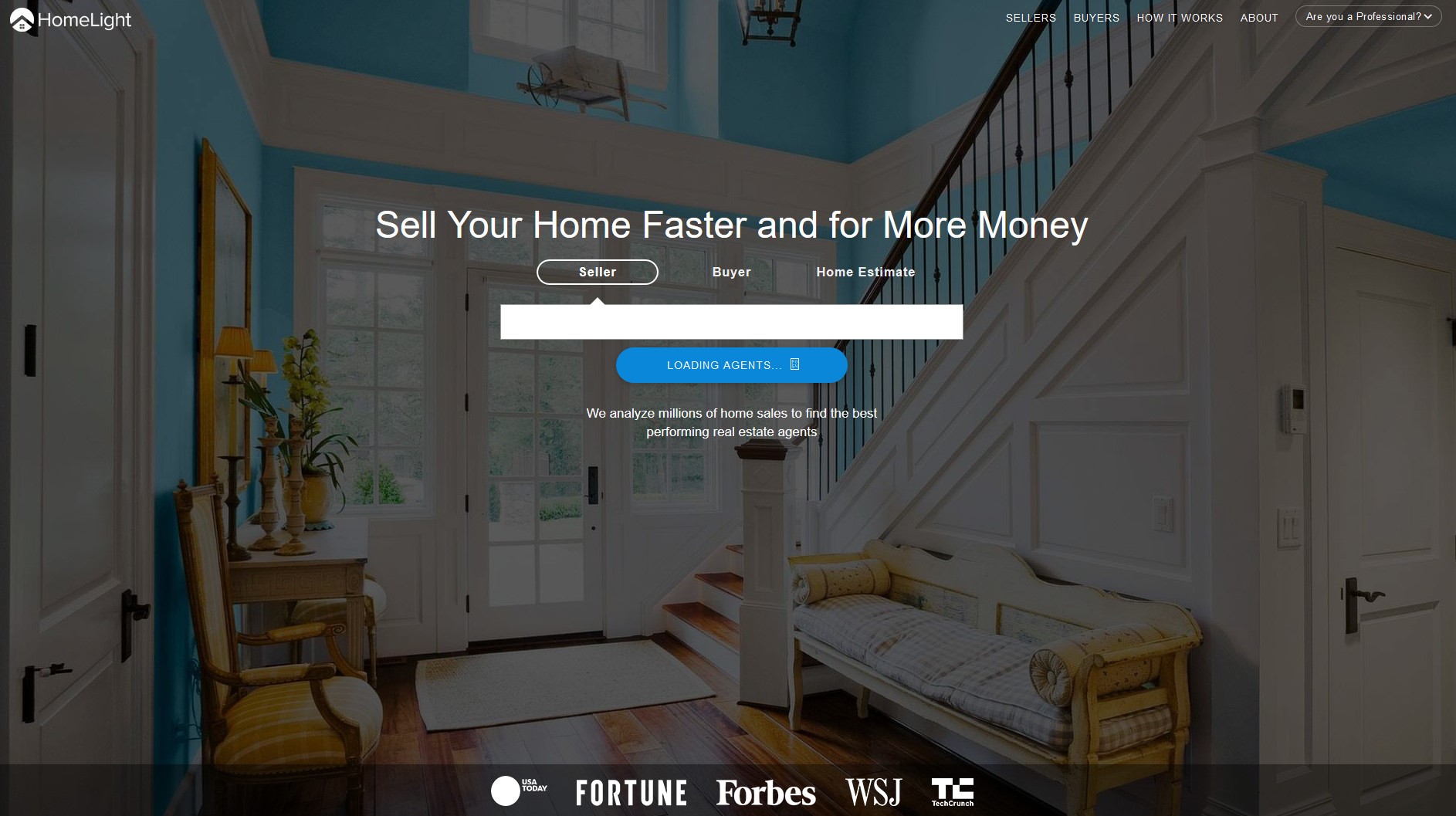

Homelight

Marketplays often claim that all their performers are good, and make the choice themselves. For example, taxi aggregators do this. Or they can, on the contrary, fill up the user with countless sentences - like Airbnb or CIAN. HomeLight went the third way. He collected statistics on transactions with American real estate, isolated from there the participation of realtors and now claims that he offers only the best.

A potential seller or buyer of the house enters data about their situation, Smart Algorithms creak with gears and give out five agents that are suitable for the user. He contacts any of the candidates. And then, when the transaction is completed, the agent pays HomeLight from his commission.

In principle, the idea is convincing. A realtor in the States is more or less necessary, one cannot do without it, and it is obvious that they are not twin brothers and differ from each other. 1-2% of the effectiveness in a transaction is ten thousand dollars: an amount worth thinking about. It is clear that a person cannot distinguish a good agent from a bad one, in principle, even after the fact. Yes - polite, yes - he arrived on time, yes - he did not mess up with the papers. But did he miss the client? Did you advertise the house well? Could bargain more effectively? No answer. HomeLight says that the answer is in statistics: we compare the prices of transactions with the prices of ads, we average, so we see who trades better. And if you compare not the prices, but the dates, then we will find out who finds customers faster. They, of course, more difficult to explain, Machine Learning, Big Data, AI, but the essence of this does not get any worse.

Does this approach really work, or can one throw a coin in terms of effectiveness? Nobody knows: it’s impossible to evaluate a realtor. But how the business itself, HomeLight works well, says it has grown in turn five times in 16 months between rounds and is going to help sell homes by 1.5 billion this year. The standard commission of the agent is 3%, HomeLight takes, say, one-tenth, the revenue is $ 5 million — a bit, but do not forget about the insane growth rate. The startup investment received 50 million, 40 of them in the last round.

x.ai

Very offensive business correspondence pattern - “Let's meet at 14:00”, “No, I'm busy, come tomorrow at 15:30”, “And if it's Thursday at 11?”, “Then next Monday at 12”. Two busy people who do not have a free minute spend time writing letters that a robot could write.

Actually, he already does it. X.ai sells the services of an electronic personal assistant, which is included in such dialogues and finds a convenient meeting time for all. To activate it, you do not need to launch the application or enter the site; it is enough to put the postal address of the robot in a copy of one of the letters, then he will do everything himself. In Amy's correspondence or, if the user prefers male secretaries, Andrew pretends to be a living human assistant and does not require a special relationship. All communication takes place in a normal, natural language. The interviewee does not even suspect that she is communicating with the program.

Subscription to the service costs $ 40 per month. With savings of, say, five minutes for one meeting and two meetings on a working day, $ 12 per hour is released — a great deal for white-collar workers from Silicon Valley. On the other hand, for such money it is possible to recruit living people in India, the quality of the service would only improve. Evil tongues claim that x.ai does just that; last year there was a huge scandal when one of the former employees told reporters how he himself responded to complex letters, helped collect statistics for robots. Many naturally read it as “AI is not any, people are responsible for pennies”. However, the case failed to hush up.

An investment startup raised $ 45 million, it’s hardly an idea to return this money at the expense of a paid subscription - the service is really a niche and yet not fundamentally high-quality. With the manager, you need to be softer, with an obsessive promoter - it's harder, such nuances are poorly automated, and the concept of “no one knows that this is a robot” does not allow for condescension to treat errors. But the algorithms and the accumulated database of correspondence can be sold to the developers of universal assistants. Siri or Cortana, sooner or later, will want to embed this to themselves.

Chongchong

In China, the new fashion - power bank rental services. WeChat and other applications devour the battery mercilessly, until the evening the smartphone in the hands of the millennial does not survive, additional energy is regularly needed. Xiaodian, which I wrote about in the summer, rescues in this difficult situation with the help of charging stations located around the city in shops and cafes. ChongChong and several analogs solve the same problem in a slightly different way. Instead of a box, distributing electricity for money, they constructed a box, issuing power bank for money.

Instead of sitting and waiting, when at least 30% of the charge appears, the ChongChong user runs into the store for 15 seconds, scans the QR code, grabs the battery and runs farther, the phone is charging on the go. The fee for this is a visit to another point in order to hand over the power bank, but the larger the network of vending at a startup, the more often they are found along the way, the approach for the user looks better.

Worse it is for monetization. Xiaodian creates value for the partners who installed its equipment, it attracts people who are waiting for charging and are buying something from boredom. A typical ChongChong user does not buy anything, he came running, took or gave away a power bank and ran away. The price of charging remains almost symbolic, and users will not pay much for this. How a startup will become profitable in such conditions is incomprehensible perfectly, promotional materials tell about future trade in geodata, but it looks extremely unconvincing.

On the other hand, the service turned out to be convenient: people use it, the audience is growing. In modern China, this is enough for investors to stand in line, a round in this market follows the round. The record holder is just ChongChong, he received 75 million dollars.

Chegg

The company has long held an IPO, worth more than a half billion, but its history is interesting, there is no Russian analogue, and it hasn’t yet turned a profit, so consider Chegg. Back in 2007, then a startup was launched as a local ad site, a kind of Yula in the pre-smartphone era. The audience for the project was mostly student, and, watching it, the founders noticed one completely unexpected pattern.

It turns out (who would have thought), every year, students of a huge number of colleges switch to a new course and buy new textbooks, and at the end of the year they want to get rid of them. Having made such an amazing discovery, Chegg immediately rushed to solve this headache and pivotnulsya in a specialized service for working with textbooks. The product is standardized, the nomenclature is relatively small, the startup has set fixed purchase prices for each edition and the status of the book. Buys used textbooks Chegg at its own warehouse, and then either resells or rents. Naturally, the filing does not happen - no one is obliged to buy everything, at any moment the publication is excluded from the list of interest.

The pros and cons of such a business are clear: the audience is surprisingly loyal, every student buys, sells or rents dozens of books for years before graduation, but the check for each transaction is small, and it’s a lot like any physical goods. In addition, the market share is immediately occupied by normal libraries, and the other part is gradually devoured by electronic textbooks. “To be or not to be” in this situation is not obvious in advance, Netflix has a similar business model, investors believe that Chegg will succeed, invested aggressively - 30 million in 2008, 75 million in 2010. Alas, did not work. However, Netflix also made pivots.

Chegg decided not to turn sharply, but to grow in breadth: to become a portal. The exchange and resale of textbooks attract a student audience, and for monetization the company develops and buys new services - there was a lot of investment, there is something to spend on M & A. The most successful new products have become an online solver for questions from problem books and a subscription to access to live teachers for quick consultations, but there are still a dozen of them - right up to help in career planning.

IPO happened in the middle of the portal process, but the company did not affect, in fact, it was another round of investments, and not a long-awaited way out and universal happiness. Already in public status, Chegg continues to raise investments, bring losses and wait for a bright future. This year, the financial reports have become a little better, maybe the future is near.

')

Source: https://habr.com/ru/post/341634/

All Articles