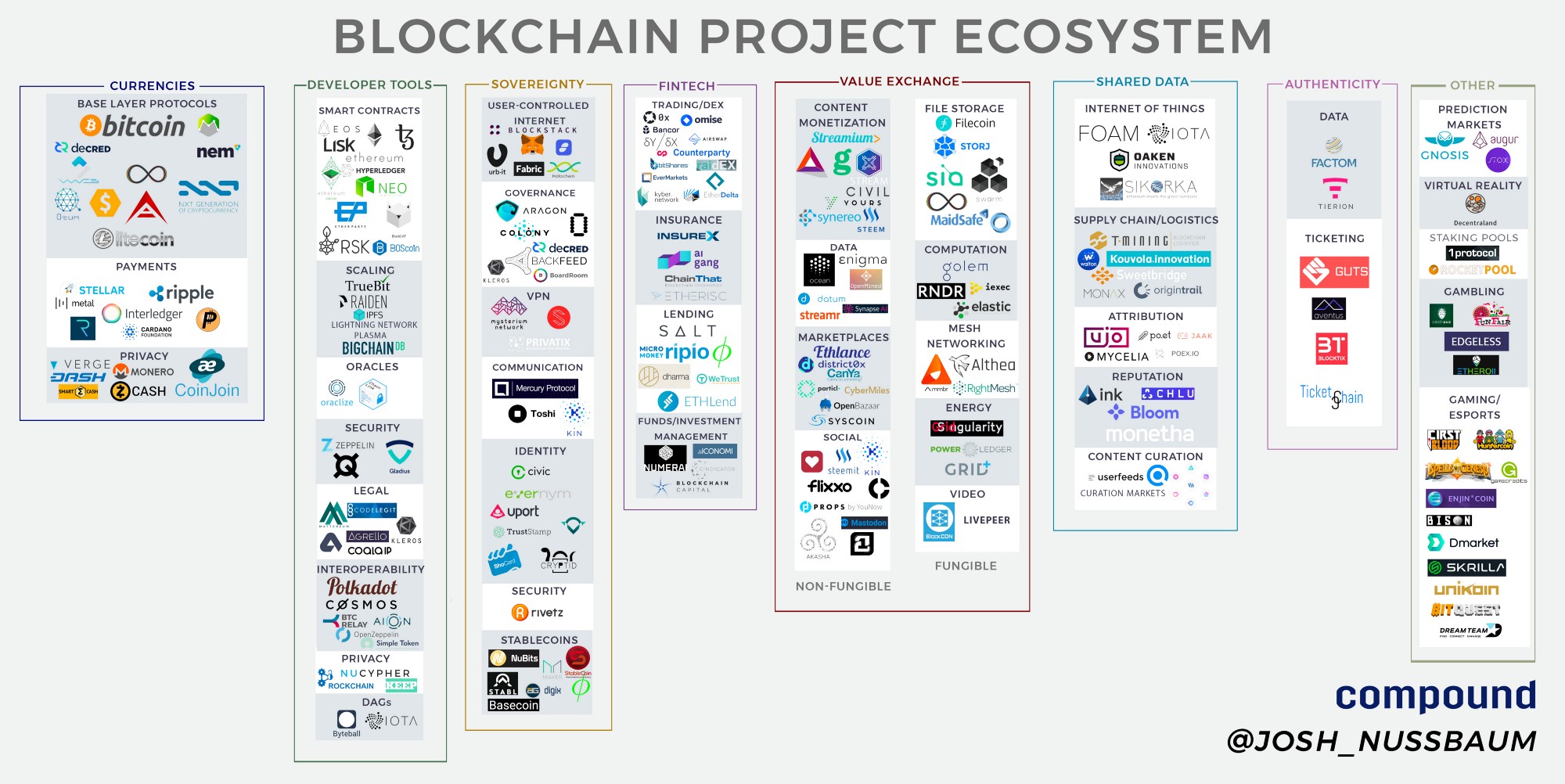

Ecosystem blockchain projects

As I wrote in my article on ICO, blockchain technology, cryptocurrency, and token sales are now at their peak of popularity. I have been working in the venture industry for over five years and have not yet come across technologies that would develop with such breakneck speed, generating new companies and projects. Not so long ago, founders and venture investors dealt primarily with centralized exchanges, private blockchain solutions, wallets and some other startup ideas that dominated the market from 2012 to 2016.

However, as I said several months ago, the growing popularity of Ethereum with its full Turing scripting language and the ability for developers to state the state in each block, created the conditions for developing smart contracts. This led to the fact that more and more teams are embarking on decentralized projects in pursuit of the main advantage, which gives the blockchain - the opportunity to develop a single truth, with which everyone agrees, without the help of intermediaries or the central government.

Now there are many interesting developments on the market that improve both the functionality of existing blockchain solutions and the user experience. But considering the frequency with which new projects come out, it is becoming increasingly difficult for me to track each of them and figure out what place it occupies in the ecosystem. In addition, the risk of not seeing the trees behind the forest increases, if we do not have a comprehensive idea of what this forest looks like. Such reasoning pushed me to compile a list of all decentralized blockchain projects that I follow, including also those that I managed to find information about myself or on a tip from friends who are familiar with the ecosystem. This ecosystem map is a summary of this work.

A small caveat: many projects were difficult to attribute to one category, but I tried to identify the main purpose or unique value of each and distribute them accordingly. Of course, quite a few projects fall into the “gray zone”: they can be equally well written into several different categories. The most difficult case is the fat protocols, the functionality of which affects a number of areas.

')

Below I give an overview of all the selected major categories and briefly touch on the subcategories of which they are composed.

Currencies

Base Layer Protocols - Payments - Privacy

For the most part, these projects were created as an advanced type of currency for a particular use case; each represents a store of value, a medium of exchange, or a unit of account. Bitcoin has become the first and largest player in this category, but many projects aim to refine some aspects of its protocol or adapt them to certain conditions. The Privacy subcategory could be merged with Payments or Base Layer Protocols, but I decided to write them separately, because anonymous, untraceable cryptocurrency is very important for users who want to hide a transaction so as not to advertise some kind of purchase for one reason or another, or for companies that do not want to disclose trade secrets.

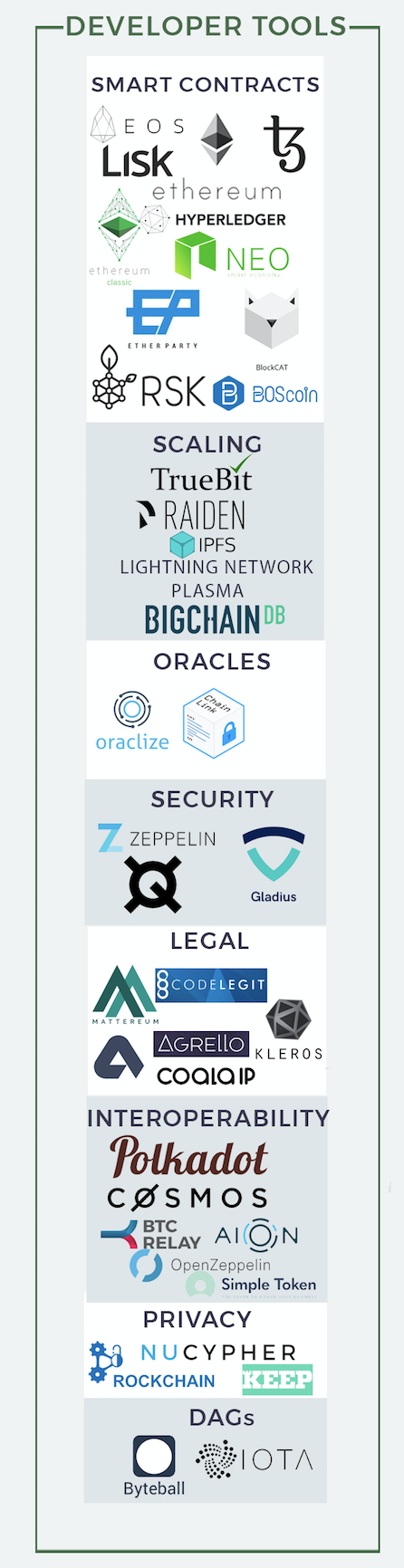

Developer Tools

Smart Contracts - Scaling - Oracles - Security - Jurisprudence - Compatibility - Privacy - DAG Technology

Projects in this category are mostly used by developers as building blocks for decentralized applications. To allow users to directly interact with the protocols through the application interface (for other tasks than financial ones), many of the current products listed here need to be refined to be implemented on a wider scale. The scale and compatibility of the protocols are those areas of research that will play a big role in shaping the technology stack for Web3.

In my opinion, at the moment it is one of the most entertaining categories, both in terms of theoretical interest, and from the perspective of an investor. In order for many applications of the blockchain, which were predicted to us (for example, completely decentralized anonymous organizations or an alternative to Facebook, which gives the user complete control over personal data) to see the light, the basic scalable infrastructure must grow and develop. Many of these projects set such a goal for themselves.

Also, for this product cut-off, the principle of “only one will win!” Does not work, unlike, say, cryptocurrencies that perform the function of an accumulation tool. For example, to create a decentralized data marketplace, you may need tools from various subcategories: Ethereum for smart contracts, Truebit for accelerated calculations, NuCypher for re-encryption through a proxy, ZeppelinOS for security and Mattereum for enforcing legal contracts to protect the interests of the client in the event of a dispute. Since they are protocols and not isolated data stores, they are able to interact with each other. Such compatibility creates new applications due to the exchange of data and functionality between several protocols as part of a single application. Preethi Kasireddy explains this process very clearly in his article .

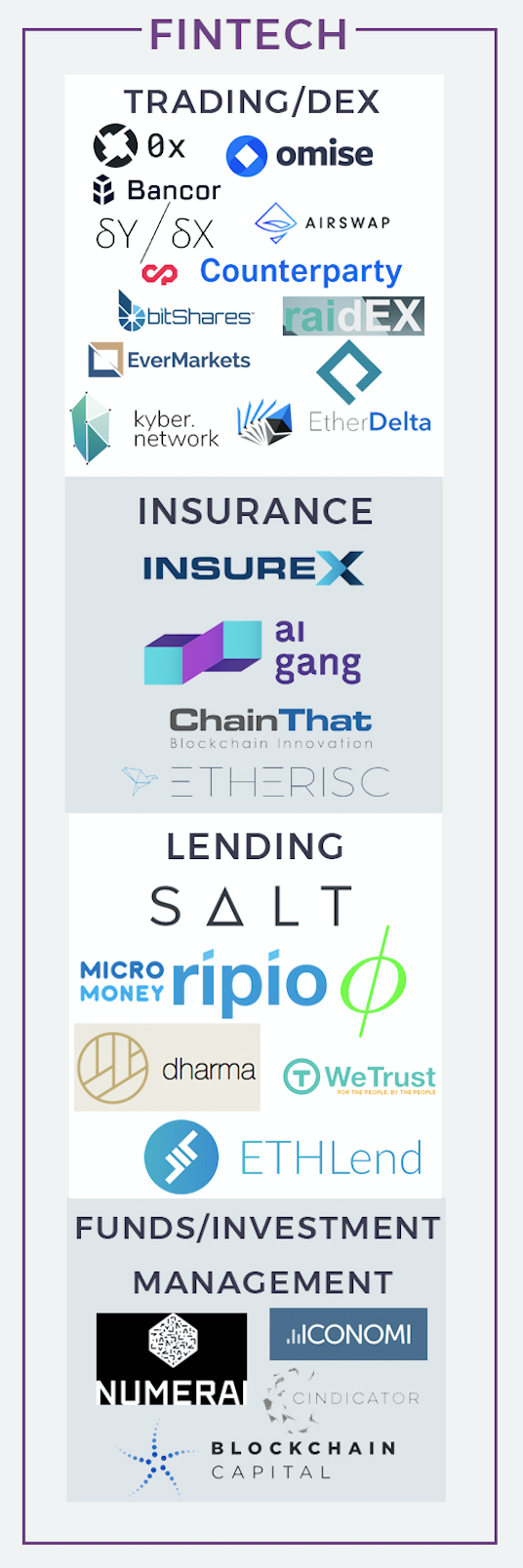

Fintech

Commerce - Insurance - Loans - Investment Management

Here everything is quite transparent. When you use a large number of different protocols and applications (as in the example above), many of them may have their own cryptocurrency; as a result, a number of new economies are emerging. Any economy that operates with multiple currencies needs the tools to convert one unit to another, to make it easier to make loans, take investments, and so on.

The DEX (Decentralized Exchange) subcategory could be referred to as Developer Tools. Many projects are already beginning to implement the 0x protocol , and I assume that this trend will only increase in the near future. In a world where you can potentially make as many tokens as you want, the wide distribution of applications using several tokens of different types will be possible only if all the difficulties associated with converting them are eliminated. This advantage gives decentralized exchange.

Products from subcategories Loans and Insurance use economies of scale by risk aggregation. By making the relevant markets open and allowing people to be assessed in the context of a wider base or on an individual, differentiated basis (according to their personal risk characteristics), it is possible to reduce the prices of services — accordingly, customers should theoretically be the winners. The blockchain remembers and keeps state unchanged; Since records of all previous interactions are stored in a chain, users can be sure that no one will distort the data that makes up their personal history.

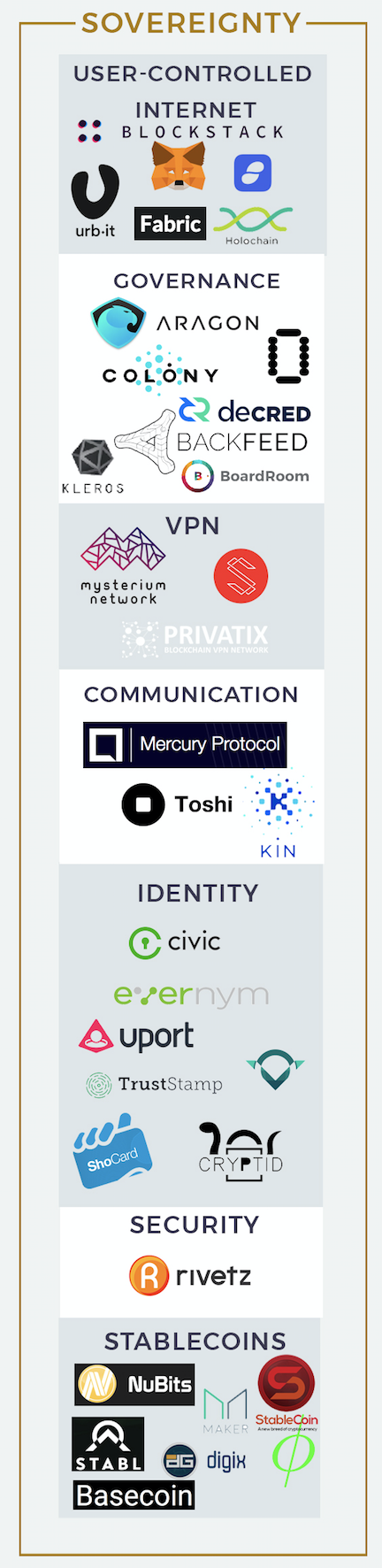

Autonomy

Internet with user control - Management - VPN - Communication - Identification - Security - Stablecoins

The Blockstack team writes about it like this:

“In the past ten years, we have seen a transition from desktop applications (which run locally) to cloud applications that store user data on remote servers. Such centralized services are a favorite target of hackers, they are often hacked. ”

Autonomy is another area that is of the most lively interest to me today. Blockchain still suffers from problems with scaling and performance, but when it comes to confidential information that we now have to trust a third party, the value of its trustless architecture more than pays for these shortcomings. Thanks to cryptoeconomics, users do not have to trust any person or organization — only theories that people will act rationally if they are given the right incentive.

Projects from this category provide the functionality needed in a world where the client must believe not in the integrity of people and organizations, but in the incentives that are implemented through cryptography and the economy.

Value exchange

Non-Interchangeable: Content Monetization - Data - Marketplace - Social Services

Interchangeable: File storage - Calculations - Mesh-networks - Energy - Video

The main feature of the Bitcoin protocol is that several different participants can trust each other without the need to build trusting relationships outside the blockchain. Participants can conduct transactions and exchange data in such a way that information about them will be stored unchanged. It is considered a generally accepted fact that people unite into firms when the coordination of the production process on the market begins to cost more than within a separate organization. But what if even those who have no reason to trust each other could unite in such "firms"? Through the blockchain and cryptoeconomics, the time and effort spent on establishing trust relationships are reduced to zero, which allows more people to take part in this kind of cooperation and receive a portion of the profits, and the traditional hierarchical structure of the company is not necessary.

Now intermediaries and other rent-oriented people are an inevitable evil that allows you to maintain order, maintain safety and ensure compliance with the rules on the P2P market. But in many areas, cryptoeconomic systems can replace trusting relationships, so that the need for intermediaries will disappear. At the expense of saving on payment for their services, users will be able to provide each other with goods and services at significantly lower prices.

Projects in this category can be divided into two main groups according to the same basic feature - whether the products they work with are interchangeable. Markets that allow users to exchange interchangeable goods and services, commoditize things like storage, computing, Internet connection, traffic, energy, and so on. Now the competition among companies that provide these goods and services is based on the effect of scale - this paradigm can only be replaced by an economy where scale economies are becoming even more substantial. To achieve this, it is easy if you turn to hidden resources and make the market open to all; marginal costs in this situation begin to tend to zero.

Markets working with non-interchangeable goods do not receive such advantages. However, they allow the supplier to take the full value of their goods or services, and not what the intermediary will leave them.

Data exchange

Internet of Things - Supply Chain / Logistics - Attribution - Reputation - Content Management

The public data layer can be compared with the global distribution system used by airlines. This system provides a centralized data repository to which all airlines send their registries so that it is easier to coordinate all the information about available flights, including routes and prices. This allows companies such as Kayak and others to push out classic travel agents - it’s enough just to build a front-end component to this system so that users can perform operations themselves. Usually such intermediary aggregators attract those markets where there is a barrier to direct competition, but technical progress gives the intermediary the opportunity to combine the functions of employees, the necessary metadata and user preferences (as it happened with the SDS).

Using the example of financial initiatives that carry out blockchain projects, we observe in action the most powerful technological catalyst that will push the boundaries of a multitude of markets - only the profit will now go to not the intermediary, but those individuals and organizations that provide data.

In 2015, Hunter Walk wrote that one of the biggest missed opportunities of the last decade was the refusal of eBay to open its third-party reputation system, which would make the company the center of P2P commerce. I would put it even more categorically: the most valuable thing about eBay is the reputation data that has been collected for a long time. This is what makes users loyal and gives eBay the opportunity to take an impressive tax on them for the fact that they can make transactions with peace of mind, knowing that they are dealing with a trustworthy person. In blockchain protocols with open data, users can transfer such information from the application to the application, as the latter are connected to common protocols. As a result, increased competition leads to a more rapid pace of innovation.

Another example on which you can analyze the principle of operation of a publicly accessible data layer is centralized companies, such as Premise Data . The staff of Premise Data contains a whole network of employees who collect various kinds of information about more than 30 countries - from the volume of consumption of a product to the materials used in production in a specific location. The company processes this information using machine learning and sells the resulting databases to a wide range of customers. Instead of looking for and hiring people to gather materials, you can start a project where anyone can search and add information, annotate the collected data and create different models to draw conclusions based on them. Participants will have the opportunity to earn tokens, which will gradually increase in price, as companies will pay them for the processed data and calculations based on them. Theoretically, as a result, we should receive a growing number of participants in the project and more accurate conclusions - a certain rate per unit of information will be established on the market and any contribution will be paid accordingly.

Many other similar possibilities can be listed: the “open data platform” became a popular concept for startups several years ago, and several companies even managed to achieve great success with it. Problems, according to my forecasts, will arise mainly with sales and business development. Most companies sell databases to larger organizations; It will be interesting to see how they will manage their decentralized projects. Also, separate private enterprises now have additional opportunities, which until now were unprofitable or impossible for them.

Authentication

Data - Ticket Distribution

In essence, cryptocurrencies are simply digital assets belonging to a specific block chain. Products in this category use these digital assets to identify products in real life (for example, tickets to an event) or data. The constancy of the chain, even in public access, gives participants confidence that the data they receive is not touched and that they will be available even after a long time. That is why confidential information and those markets in which fraud is common, the introduction of the blockchain is a good way to convince the user that everything is done honestly.

Conclusion

Innovative solutions can be found in all these categories, but I personally have the most enthusiasm for young projects that contribute to the development of the technology stack for web3: provide functionality that will be useful in various usage scenarios, give the user independence in managing their own data and contribute purchase and sale of interchangeable goods and services. So far, we can talk about cryptocurrency among the masses only in theory, but it is logical to assume that the infrastructure and application options that provide users with benefit, privacy or security in particularly sensitive issues (for example, identification, credit balance or VPN, among others), most can count on success.

If we talk about a more distant future, there are also interest in projects that strengthen the ecosystem as a whole due to the exchange of data and bootstrapping of the system (that is, the exchange of non-interchangeable assets). I’m sure there are other areas that I’m still considering from the wrong perspective, or I can’t imagine at all! If you are working on something that fits these descriptions, or want to clarify or object something, I, as always, will be glad to hear from you.

Jesse Walden , Larry Sukernik , Brendan Bernstein , Kevin Kwok , Mike Dempsey , Julian Moncada , Jake Perlman-Garr , Angela Tran Kingyens and Mike Karnjanaprakorn also took part in the compilation of the map and explanations for it.

Source: https://habr.com/ru/post/341436/

All Articles