In simple words: smart contracts, Ethereum, ICO

The author of the article is Alexey Malanov, an expert in the development of anti-virus technologies at Kaspersky Lab.

Many have heard about Bitcoin, which is not surprising - this cryptocurrency was the first and still remains the most popular and largest. The success of Bitcoin inspired a bunch of people to the exploits, so over the past couple of years, different cryptocurrencies - the so-called Alt-Coins - created so much horror, more than 1000.

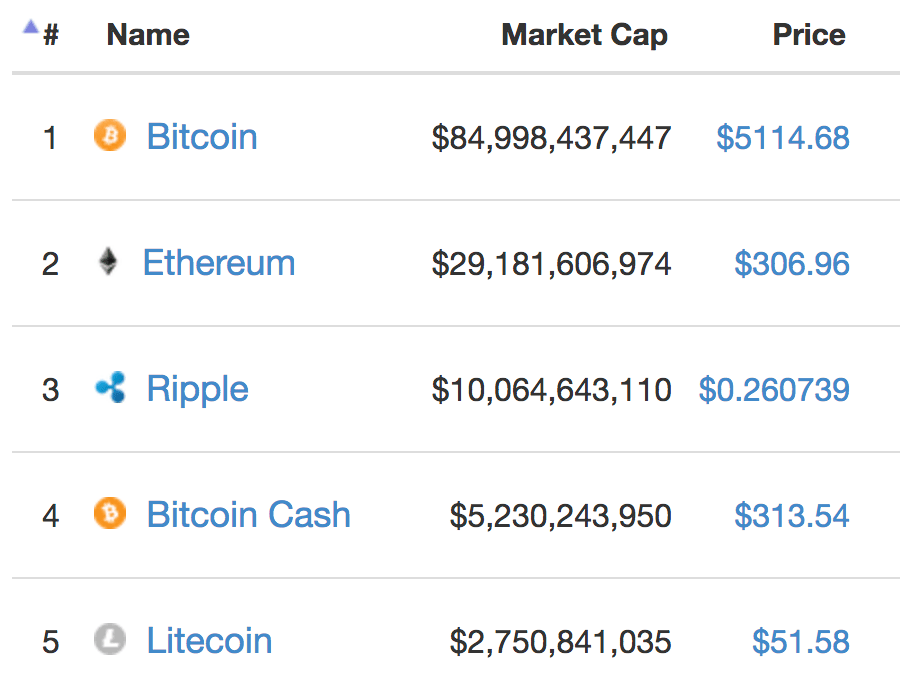

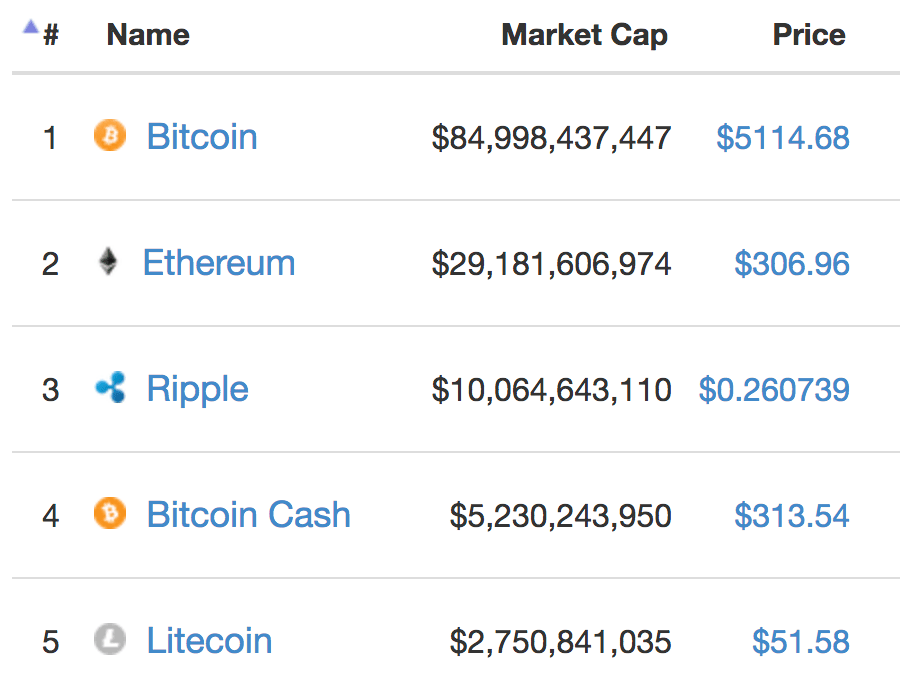

So, Bitcoin - at the moment is definitely number one. Do you know which cryptocurrency is in second place? Ethereum. When we talk about places, we mean capitalization, that is, the total value of all coins of a currency.

')

Capitalization and prices of TOP-5 cryptocurrency. A source

As you can see, Ethereum is far ahead of other “Altcoins”, and in June 2017 it was almost overtaken by Bitcoin, “the great and terrible”. Let's see what is so special about Ethereum and why the vast majority of ICOs this year use it.

Ethereum was launched quite recently, on July 30, 2015. One of its creators was now known in the blockchain party and, not afraid of the word, influential Vitalik Buterin. He was born in Russia, but from the age of six he lived in Canada. At that time, when he outlined his ideas, which ultimately formed the basis of the Ethereum network, he was 19 years old.

So, what's the idea? On the Bitcoin network, from the user's point of view, everything is pretty simple. There are wallets, you can transfer money from one purse to another or to several at once. The network is built on very ingenious principles, allowing you to do without a single center, but the tasks are solved quite classic. The usual payment system, by and large: people, money, transfers - everything, nothing more.

But you can go further and create a payment network that allows you to write programs that would work with wallets, take money from wallets, decide who to send as much and so on. With an important condition: for all users, each such program will work according to well-known principles, predictably, equally, transparently, and so that no one can change it.

Actually, the creators of Ethereum just added to the basic functionality of cryptocurrency the ability to create such programs. All wallets in Ethereum are divided into two types: those that are controlled by people, and those that are managed autonomously by programs.

Programs — they are called smart contracts — are written to the blockchain. Thus, this program is remembered forever, all network participants have a copy of it (the blockchain is the same for everyone), respectively, and the smart contract is fulfilled for all is also identical.

And this innovation has significantly expanded the scope of blockchain-currencies.

What programs can I write? Yes, whatever. For example, the financial pyramid. To do this, it is enough to create a smart contract on the Ethereum network with the following rules:

Or you can arrange an auction. We write the program:

There are a million more uses: wallets with several owners, financial instruments, self-fulfilling betting, voting, lotteries, games, casinos, notaries, and more.

Recall the advantage: it is a blockchain - everyone is sure that no one cheats, everyone sees the text of the program and understands that it works exactly as it says. The program is not a person. It will not go away with money, it will not go bankrupt, and so on. Unless, of course, there are no bugs or "unexpected behavior."

But there are significant limitations, here are some of them:

In other words, as in other areas, much depends on the professionalism of the authors of the contracts.

Simple smart contract Ethereum. An error allows you to steal all the money, who found - well done

Pyramids, voting, casino, lottery - it's all great. But what turned out to be really convenient to do with the help of smart contracts isto inflate bubbles to collect money for your startup.

After all, with the help of a smart contract, you can automate all the “accounting”: the contract itself will remember from whom and how much money came, he will accrue “shares”, and will also enable each participant to transfer and sell these shares. You do not need any fuss with mail addresses, credit cards, checking cards, authorization of investors and the like. In addition, everyone sees how many shares were issued and how they were distributed among the participants. From the hidden pre-printing of shares and the sale of one share several times protects the blockchain.

After all, with the help of a smart contract, you can automate all the “accounting”: the contract itself will remember from whom and how much money came, he will accrue “shares”, and will also enable each participant to transfer and sell these shares. You do not need any fuss with mail addresses, credit cards, checking cards, authorization of investors and the like. In addition, everyone sees how many shares were issued and how they were distributed among the participants. From the hidden pre-printing of shares and the sale of one share several times protects the blockchain.

Smart contracts have given a million "cryptoinvestors" the opportunity to "throw money at the monitor."

I didn’t find this niche for Ethereum right away. As of January 1, 2017, the cost of one broadcast was $ 8, and its peak (at least, so far) at $ 400 reached the rate by June. All thanks to the large number of ongoing ICOs - the initial offer of start-ups. The desire to invest the air in any project stimulates the demand for air. And these projects are now darkness.

Ethereum cost chart. A source

Let's discuss ICO in more detail. A typical cryptostartap scheme is:

The amount is usually 10-20 million dollars and is collected in just a few minutes, sometimes days. As a rule, ICO is limited in time or amount collected - and this forms a stir.

Comes to comic cases. For example, during the ICO of one of the projects, $ 35 million was collected in 24 seconds. And to get into the number of “lucky participants”, project fans paid up to $ 6,600 transaction fees. Ethereum's high demand and low bandwidth makes it necessary to increase commissions in order to send money and participate, rather than stay behind in the queue.

What happens next with the tokens issued to investors depends on the project. Someone promises to pay dividends from future profits, someone plans to accept these tokens for payment of services implemented by the project, someone promises nothing.

As a rule, the tokens themselves are displayed on a cryptobirth, and the bidding opens. Those who did not have time to participate in the ICO, can buy them already on the stock exchange - most likely, more expensive. Those who participated in the ICO, then to resell more expensive, can sell them on the exchange.

Sometimes the former are so much larger that the price is growing rapidly, and the project’s capitalization swells to a billion dollars. With that, he hasno profit, no product, there is only an idea, a plan and, at best, a team.

Since the author of the project has collected a lot of money, he has the opportunity to buy out his tokens on the stock exchange, warming up the price of the token even more. On ordinary stock exchanges with ordinary shares, this behavior is prohibited, but there are no regulators in the crypto industry.

In 2017 (by September), various projects for ICO have already collected about 1.7 billion dollars. Little is heard about successful projects, but investors are not losing optimism.

Many have heard about Bitcoin, which is not surprising - this cryptocurrency was the first and still remains the most popular and largest. The success of Bitcoin inspired a bunch of people to the exploits, so over the past couple of years, different cryptocurrencies - the so-called Alt-Coins - created so much horror, more than 1000.

So, Bitcoin - at the moment is definitely number one. Do you know which cryptocurrency is in second place? Ethereum. When we talk about places, we mean capitalization, that is, the total value of all coins of a currency.

')

Capitalization and prices of TOP-5 cryptocurrency. A source

As you can see, Ethereum is far ahead of other “Altcoins”, and in June 2017 it was almost overtaken by Bitcoin, “the great and terrible”. Let's see what is so special about Ethereum and why the vast majority of ICOs this year use it.

Ethereum idea

Ethereum was launched quite recently, on July 30, 2015. One of its creators was now known in the blockchain party and, not afraid of the word, influential Vitalik Buterin. He was born in Russia, but from the age of six he lived in Canada. At that time, when he outlined his ideas, which ultimately formed the basis of the Ethereum network, he was 19 years old.

So, what's the idea? On the Bitcoin network, from the user's point of view, everything is pretty simple. There are wallets, you can transfer money from one purse to another or to several at once. The network is built on very ingenious principles, allowing you to do without a single center, but the tasks are solved quite classic. The usual payment system, by and large: people, money, transfers - everything, nothing more.

But you can go further and create a payment network that allows you to write programs that would work with wallets, take money from wallets, decide who to send as much and so on. With an important condition: for all users, each such program will work according to well-known principles, predictably, equally, transparently, and so that no one can change it.

Actually, the creators of Ethereum just added to the basic functionality of cryptocurrency the ability to create such programs. All wallets in Ethereum are divided into two types: those that are controlled by people, and those that are managed autonomously by programs.

Programs — they are called smart contracts — are written to the blockchain. Thus, this program is remembered forever, all network participants have a copy of it (the blockchain is the same for everyone), respectively, and the smart contract is fulfilled for all is also identical.

And this innovation has significantly expanded the scope of blockchain-currencies.

Smart Contract Examples

What programs can I write? Yes, whatever. For example, the financial pyramid. To do this, it is enough to create a smart contract on the Ethereum network with the following rules:

- If the sum of X came from the address of the wallet A, remember this in the plate of debts.

- If after this, the sum Y> 2 * X came from address B, send 2 * X money to address A, remember the debt to participant B.

- And so on for each member.

- Optional: send 5% of all incoming money to the author of a smart contract.

Or you can arrange an auction. We write the program:

- If the auction is not over, remember the sender addresses and the bid amounts of each participant.

- When the auction is over, choose the maximum bid, declare the winner, send back all other bids.

- Optionally: we send the won lot if Ethereum has an idea what it is.

There are a million more uses: wallets with several owners, financial instruments, self-fulfilling betting, voting, lotteries, games, casinos, notaries, and more.

Recall the advantage: it is a blockchain - everyone is sure that no one cheats, everyone sees the text of the program and understands that it works exactly as it says. The program is not a person. It will not go away with money, it will not go bankrupt, and so on. Unless, of course, there are no bugs or "unexpected behavior."

Smart Contract Restrictions

But there are significant limitations, here are some of them:

- The program is very difficult to obtain random numbers and other uncertainties. In some lotteries, clever participants manage to “match” the jackpot.

- It’s not so easy to “hide” some information. For example, a list of bidders or their bids.

- If the contract requires information that is not in the blockchain (for example, the current exchange rate of any currency), then someone trusted must add this information to the blockchain.

- To interact with contracts, users need to broadcast - this is the internal currency of Ethereum. You can not arrange a vote among those who do not have wallets with money.

- Smart contracts are pretty slow. For the whole world, you can perform 3-5 transactions per second.

- Smart contracts themselves usually perform few actions, because in the blockchain, every miner will have to repeat these actions and verify the result. Suddenly he will have a slow computer.

- If there are mistakes in the smart contract, then it is forever. The only way to correct the error is to switch to another smart contract, but only if the possibility of withdrawing money and such a transition was provided for in the program initially. As a rule, very few people provide for this.

- Smart contracts may hang or even work differently than everyone expected, because they did not understand the program code.

In other words, as in other areas, much depends on the professionalism of the authors of the contracts.

The main use of smart contracts

Simple smart contract Ethereum. An error allows you to steal all the money, who found - well done

Pyramids, voting, casino, lottery - it's all great. But what turned out to be really convenient to do with the help of smart contracts is

After all, with the help of a smart contract, you can automate all the “accounting”: the contract itself will remember from whom and how much money came, he will accrue “shares”, and will also enable each participant to transfer and sell these shares. You do not need any fuss with mail addresses, credit cards, checking cards, authorization of investors and the like. In addition, everyone sees how many shares were issued and how they were distributed among the participants. From the hidden pre-printing of shares and the sale of one share several times protects the blockchain.

After all, with the help of a smart contract, you can automate all the “accounting”: the contract itself will remember from whom and how much money came, he will accrue “shares”, and will also enable each participant to transfer and sell these shares. You do not need any fuss with mail addresses, credit cards, checking cards, authorization of investors and the like. In addition, everyone sees how many shares were issued and how they were distributed among the participants. From the hidden pre-printing of shares and the sale of one share several times protects the blockchain.Smart contracts have given a million "cryptoinvestors" the opportunity to "throw money at the monitor."

ICO - Initial Coin Offering

I didn’t find this niche for Ethereum right away. As of January 1, 2017, the cost of one broadcast was $ 8, and its peak (at least, so far) at $ 400 reached the rate by June. All thanks to the large number of ongoing ICOs - the initial offer of start-ups. The desire to invest the air in any project stimulates the demand for air. And these projects are now darkness.

Ethereum cost chart. A source

Let's discuss ICO in more detail. A typical cryptostartap scheme is:

- You have an idea. Usually it is somehow related to cryptocurrency or blockchain.

- For its implementation and launch you need money.

- You announce to everyone that you are receiving the broadcast, and in return, issue shares / tokens / candy wrappers using a smart contract.

- You advertise your project and collect the required amount.

The amount is usually 10-20 million dollars and is collected in just a few minutes, sometimes days. As a rule, ICO is limited in time or amount collected - and this forms a stir.

Comes to comic cases. For example, during the ICO of one of the projects, $ 35 million was collected in 24 seconds. And to get into the number of “lucky participants”, project fans paid up to $ 6,600 transaction fees. Ethereum's high demand and low bandwidth makes it necessary to increase commissions in order to send money and participate, rather than stay behind in the queue.

Payback cryptoinvestment

What happens next with the tokens issued to investors depends on the project. Someone promises to pay dividends from future profits, someone plans to accept these tokens for payment of services implemented by the project, someone promises nothing.

As a rule, the tokens themselves are displayed on a cryptobirth, and the bidding opens. Those who did not have time to participate in the ICO, can buy them already on the stock exchange - most likely, more expensive. Those who participated in the ICO, then to resell more expensive, can sell them on the exchange.

Sometimes the former are so much larger that the price is growing rapidly, and the project’s capitalization swells to a billion dollars. With that, he has

Since the author of the project has collected a lot of money, he has the opportunity to buy out his tokens on the stock exchange, warming up the price of the token even more. On ordinary stock exchanges with ordinary shares, this behavior is prohibited, but there are no regulators in the crypto industry.

In 2017 (by September), various projects for ICO have already collected about 1.7 billion dollars. Little is heard about successful projects, but investors are not losing optimism.

Source: https://habr.com/ru/post/340250/

All Articles