Will high-frequency trading disappear?

Economist Preslav Raykov posted on The Market Mogul's blog about the prospects for high-frequency trading. We chose the most interesting thoughts of the expert.

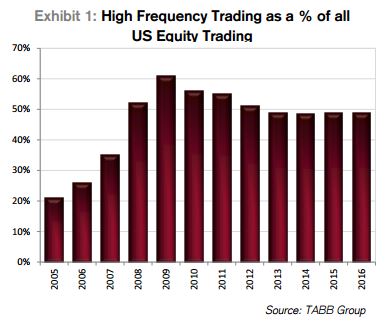

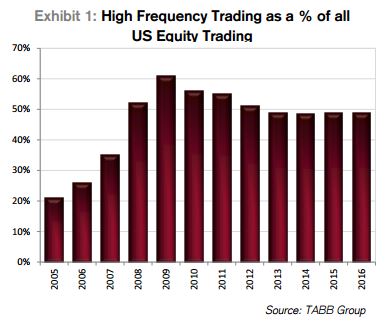

High-frequency trading (HFT) has existed for a long time and in recent years has encountered a number of problems: physical boundaries, rising infrastructure costs, competition, lower profits, and increased regulation. Because of all this, the share of HFT in total trade has been steadily declining in the western market. However, high-frequency trading still accounts for more than half of all transactions in the United States and Europe.

')

But after almost 10 years of rapid technology development, dozens of cases of market collapse and increased trading speed, high-frequency trading can be viewed as a natural result of attempts to make financial markets more efficient, bring them closer to theoretical purity and enable them to immediately reflect any new information.

HFT is a game with an infinite number of conditions that can be added to an already existing set of steps. When the algorithms are developed and the initial parameters are established, the technology of high-frequency trading seems surprising because it accommodates human judgments and reactions, emotions, fears and hopes in the framework of microsecond transactions.

In relation to HFT, the financial world is divided into two camps: those who think that the stock market has benefited from this technology, and those who argue that high-frequency trading benefits only a handful of academics supported by venture funds, and trading platforms that have taken advantage of retail by investors.

The impact of high-frequency trading was wide and probably lasting. HFT infrastructure and practices can become mandatory attributes for the financial industry of the future, as high-frequency trading improves the quality of markets, not only for institutional investors, but also for retail ones.

It is believed that, like everything that is very complex, dynamic and difficult to learn, HFT has a double impact on the stock market. Algorithms for high-frequency trading are focused on speed, mainly because most of them use arbitrage or passive investment strategies to generate their income.

Higher trading volumes and liquidity are the most significant, long-lasting, and noticeable impact on stock markets today. The total volume of trading in stocks in the United States has doubled since the advent of high-frequency trading.

Ultra-high trading volume does not leave any options for players who are looking for tiny profits from millions of transactions, so the growth in volumes has significantly changed the balance of power in the market. This means that HFT algorithms increase liquidity due to passive market-making.

This feature of high-speed traders plays an important role when there is a significant outflow of liquidity from conventional suppliers during market turmoil caused by important macroeconomic news, political events or natural disasters.

The profits of most HFT players require extremely high levels of preferred asset volatility. On the other hand, the volatility of stock prices is the main building block of the market. Therefore, high volatility is undesirable for large institutional investors and companies. It can lead to an increase in the perceived risk of the company's shares, and hence an increase in the weighted average cost of capital - the cost of providing each source of financing for the company.

Super high trading volumes resulting from high-frequency trading affect the price movement dynamics during the trading day and can reduce stock volatility, since HFT players provide liquidity in the market and allow large traders to make their transactions without significantly affecting stock prices, indirectly reducing price deviations .

Arguments that this liquidity is a kind of fake can be refuted by the fact that strategies in the high-frequency trading market do not benefit from the movement of stock prices. They create revenues from the difference in the purchase / sale price and the discounts provided by the electronic system for making purchase and sale transactions (ECN).

High-frequency traders reveal the largest and most liquid assets, constantly provide liquidity and actually form the market, so you can say that HFT reduces the difference in purchase / sale prices for companies with large capitalization and contributes to faster pricing in the market.

The effect of increased liquidity can allow traditional institutional investors to more easily adjust their portfolios to reflect their fundamental views on company performance. Thus, HFT can reduce transaction costs faced by institutional investors, and helps bring market prices closer to their fundamental value.

High-frequency trading is not popular with everyone, but it clears the market of irrational investors. Because of the HFT, they are unable to resist lightning-fast price changes.

Since the 2000s, the financial markets have undergone significant changes, especially in the field of algorithmic and HFT transactions. Since this environment has changed by the beginning of 2010 and enough time has passed, it is possible to estimate the impact of high-frequency trading on the market.

There will always be two points of view on the HFT, but it must be taken into account that in 5-7 years high-frequency trading will be closely associated with artificial intelligence and machine learning. Recent improvements in high-frequency trading have significantly changed the course of trading processes in the markets, but it is not clear whether this impact will be positive or negative.

High-frequency trading (HFT) has existed for a long time and in recent years has encountered a number of problems: physical boundaries, rising infrastructure costs, competition, lower profits, and increased regulation. Because of all this, the share of HFT in total trade has been steadily declining in the western market. However, high-frequency trading still accounts for more than half of all transactions in the United States and Europe.

')

But after almost 10 years of rapid technology development, dozens of cases of market collapse and increased trading speed, high-frequency trading can be viewed as a natural result of attempts to make financial markets more efficient, bring them closer to theoretical purity and enable them to immediately reflect any new information.

HFT is a game with an infinite number of conditions that can be added to an already existing set of steps. When the algorithms are developed and the initial parameters are established, the technology of high-frequency trading seems surprising because it accommodates human judgments and reactions, emotions, fears and hopes in the framework of microsecond transactions.

In relation to HFT, the financial world is divided into two camps: those who think that the stock market has benefited from this technology, and those who argue that high-frequency trading benefits only a handful of academics supported by venture funds, and trading platforms that have taken advantage of retail by investors.

The impact of high-frequency trading was wide and probably lasting. HFT infrastructure and practices can become mandatory attributes for the financial industry of the future, as high-frequency trading improves the quality of markets, not only for institutional investors, but also for retail ones.

High-frequency trading and market quality

It is believed that, like everything that is very complex, dynamic and difficult to learn, HFT has a double impact on the stock market. Algorithms for high-frequency trading are focused on speed, mainly because most of them use arbitrage or passive investment strategies to generate their income.

Higher trading volumes and liquidity are the most significant, long-lasting, and noticeable impact on stock markets today. The total volume of trading in stocks in the United States has doubled since the advent of high-frequency trading.

Ultra-high trading volume does not leave any options for players who are looking for tiny profits from millions of transactions, so the growth in volumes has significantly changed the balance of power in the market. This means that HFT algorithms increase liquidity due to passive market-making.

This feature of high-speed traders plays an important role when there is a significant outflow of liquidity from conventional suppliers during market turmoil caused by important macroeconomic news, political events or natural disasters.

Impact of volatility

The profits of most HFT players require extremely high levels of preferred asset volatility. On the other hand, the volatility of stock prices is the main building block of the market. Therefore, high volatility is undesirable for large institutional investors and companies. It can lead to an increase in the perceived risk of the company's shares, and hence an increase in the weighted average cost of capital - the cost of providing each source of financing for the company.

Super high trading volumes resulting from high-frequency trading affect the price movement dynamics during the trading day and can reduce stock volatility, since HFT players provide liquidity in the market and allow large traders to make their transactions without significantly affecting stock prices, indirectly reducing price deviations .

Arguments that this liquidity is a kind of fake can be refuted by the fact that strategies in the high-frequency trading market do not benefit from the movement of stock prices. They create revenues from the difference in the purchase / sale price and the discounts provided by the electronic system for making purchase and sale transactions (ECN).

Spreads and Transaction Costs

High-frequency traders reveal the largest and most liquid assets, constantly provide liquidity and actually form the market, so you can say that HFT reduces the difference in purchase / sale prices for companies with large capitalization and contributes to faster pricing in the market.

The effect of increased liquidity can allow traditional institutional investors to more easily adjust their portfolios to reflect their fundamental views on company performance. Thus, HFT can reduce transaction costs faced by institutional investors, and helps bring market prices closer to their fundamental value.

High-frequency trading is not popular with everyone, but it clears the market of irrational investors. Because of the HFT, they are unable to resist lightning-fast price changes.

Conclusion

Since the 2000s, the financial markets have undergone significant changes, especially in the field of algorithmic and HFT transactions. Since this environment has changed by the beginning of 2010 and enough time has passed, it is possible to estimate the impact of high-frequency trading on the market.

There will always be two points of view on the HFT, but it must be taken into account that in 5-7 years high-frequency trading will be closely associated with artificial intelligence and machine learning. Recent improvements in high-frequency trading have significantly changed the course of trading processes in the markets, but it is not clear whether this impact will be positive or negative.

Other materials on finance and stock market from ITinvest :

- ITinvest educational resources

- Analytics and market reviews

- Futures, indices and IPOs: how exchanges really work and why they are needed

- Top 10 books to understand the stock market device

- Futures, indices and IPOs: how exchanges really work and why they are needed

- Infrastructure of the Russian securities market (brief educational program)

- How-to: robots and brokerage trading system APIs

Source: https://habr.com/ru/post/339548/

All Articles