The Unified State Automated Information System is not as terrible as they are frightened: what will the unique DataMobile module of the Unified State Automated Information System help retail stores with?

Remember how the market plunged into a “state of shock” when in 2016 wholesalers and retailers were obliged to connect to the Unified State Automated Information System ? The first coped with the task perfectly well, but with the shops everything turned out to be more difficult. Now the situation has changed, but some outlets still have not connected to the “Unified System”, risking to give up to 150-200 thousand rubles. hard earned to pay the fine.

The hitch for many is not the desire to circumvent the law or to save. Some sellers and managers are frightened by the need to learn something new, to radically change the order of actions when accepting, inventorying, selling, writing off alcoholic beverages. Some merchants have no idea how to automate this process, especially if they are familiar with specialized software only by hearsay. In practice, this is easy to do, especially since there are already adapted software tools. We will tell about the most demanded of them.

What do we know about EGAIS

Since January 2016, the USAIS has not heard except the deaf owner of retail outlets for the sale of alcoholic beverages. The unified state automated information system controls the turnover of all alcohol-containing products - from acceptance to write-off. Of course, only in those outlets that have connected to the “ Unified System ” and have fulfilled all the requirements.

In theory, everything is simple: purchased the equipment, connect, work according to the law. But from theory to implementation, this is not one step: you need to find money for equipment, employee training, and set aside time to rebuild the goods flow system. Not everyone is ready for such changes: the habit, as you know, is second nature. Refuse and try to circumvent the procedure? The size of the fines for this is quite impressive, even for retail stores with a large turnover, not to mention the small market participants.

Acceptance of alcoholic beverages: "three happy days"

That is how much time the owners of retail outlets have in order to carry out in blot the entire volume of incoming alcoholic beverages. During these three days, the wholesaler bears responsibility for the alcoholic products that have come to you, after that - the trader. Is it a lot or a little to scan and check for legality the origin of the excise stamp of each unit? (Imagine a delivery of several thousand units of production per day) Enough, if you wish, trained and motivated employees, and most importantly - the right software.

With software, everything is clear: I bought DataMobile EGAIS and work. But the influence of the human factor on the workflow is unpredictable. If you, due to the fault of slow employees, did not meet within three days of scanning all the products received from the wholesaler, it will still automatically go to the store balance. What will happen next?

Simulate the situation. Another customer buys a bottle of alcohol from you, but the excise stamp does not pass the test at the Unified State Automated Information System , which will be signaled by the cash register software, where every sold mark is scanned during the sale. And this bottle is just from the party, which did not have time to scan in three days or even worse, the brand would be illegal. It is impossible to deceive the system, if only because now there are many applications on smartphones, where the regular buyer can check the legality of the sale, having read the QR code from the check issued to him, there is also a “Report” function to the Federal Service for RosAlkogolKulirovanie.

You feel guilty without guilt, because you are responsible for illegal alcohol before the regulatory authorities, not the supplier or manufacturer.

Alcohol inventory

Down and Out trouble started. Correctly take the goods - not all. The Unified State Automated Information System monitors that the amount of residues in the warehouse and in the hall matches the data in the system. The slightest discrepancy in fact means that the goods were at one time incorrectly credited or written off. Do not underestimate these shortcomings, even if we are talking about minimal differences. If it seems to you that a discrepancy of several bottles is trivial, then the EGAIS thinks differently: in the future, you will be fined - from 150 thousand rubles. for legal entity. Why not hedge up and take advantage of modern tools ?

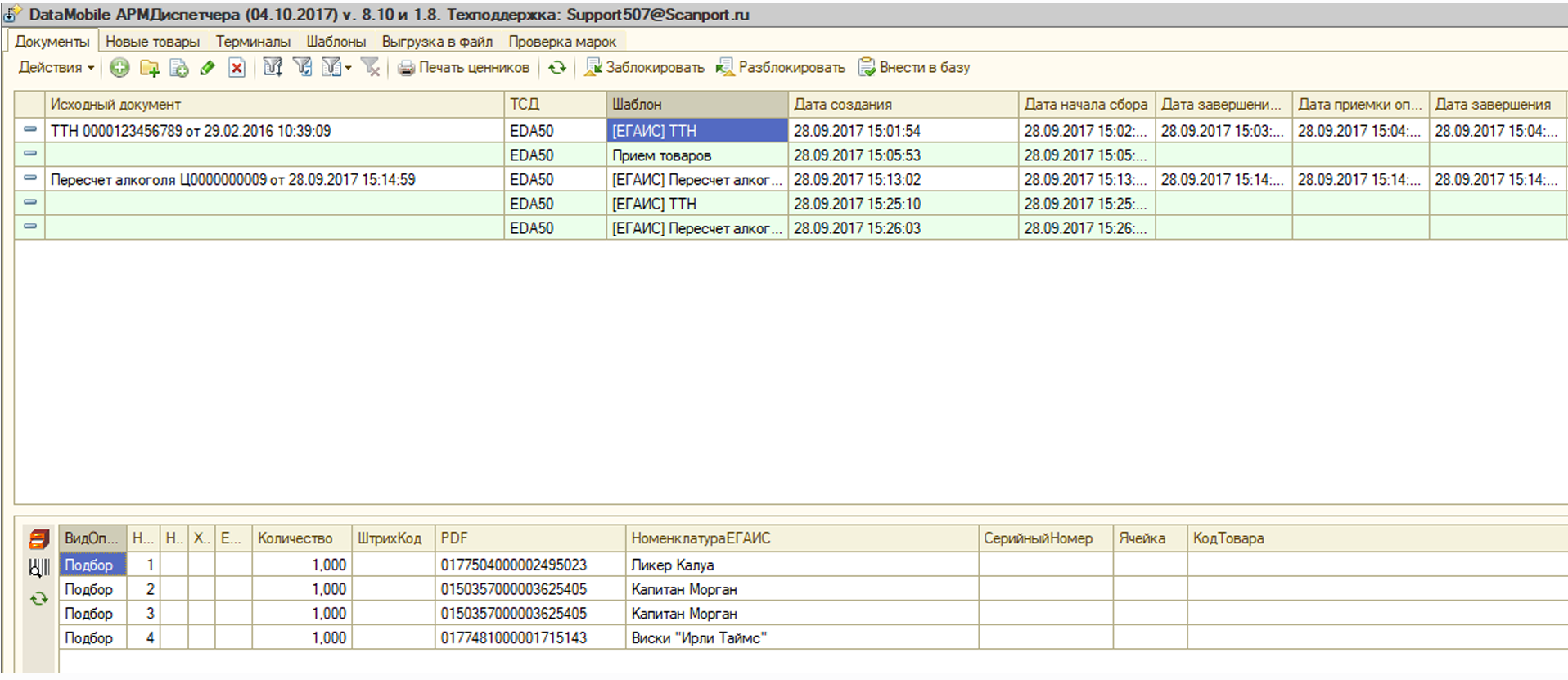

What can module DataMobile EGAIS

Specialized software, in our case, the module DataMobile is easy to install on any mobile device: smartphone, tablet or data collection terminal . With it you solve the problem of acceptance, accounting and inventory of alcoholic beverages. On the device comes TTN in the form of a task understandable for the user.

A mobile device (TSD) with this filling can:

• take alcohol to the balance, put on record - all in accordance with the requirements of the Law 182- ;

• control the movement of goods through the warehouse or trading floor;

• write off products, immediately form an act of cancellation and make changes to the system;

• to form at the shipment of goods ;

• check the validity of excise stamps on the server of the FS PAP ;

• perform blot inventory.

When accepting alcohol in large quantities, it is possible to scan each excise mark with a task verification from TTN, but without checking in the PAP file (checking each mark on the PAP servers can take from 3 seconds to an hour - how lucky). The data of all brands will go to the accounting system of the commercial enterprise, then in the background there will be a check of the stamps on the servers of the FS PAP , following which the merchandiser will decide whether to accept the TTP in whole or in part. This is a unique function of DataMobile EGAIS .

It often happens that the supplier delivers his goods on several invoices, but physically the goods lie in one machine, it will be difficult for the receiver to understand which goods belong to which invoice. To do this, a mechanism has been implemented for combining all TTH from one supplier, into one receiving invoice for TSD, and after checking on the instructions and unloading from the TSD back into the accounting system, the goods are automatically distributed to the original documents.

DataMobile with an open data exchange system is integrated into almost any product accounting system. The software is easy to install, provides uninterrupted data transfer online. Acceptance, authentication of excise stamps and other mandatory procedures under the control of such software and save the owners of shops selling alcohol from mistakes and heavy fines.

')

Source: https://habr.com/ru/post/339518/

All Articles