9 minutes on ICO: Overview of IPO for Business Alternatives

Read the original article in the DTI Blog .

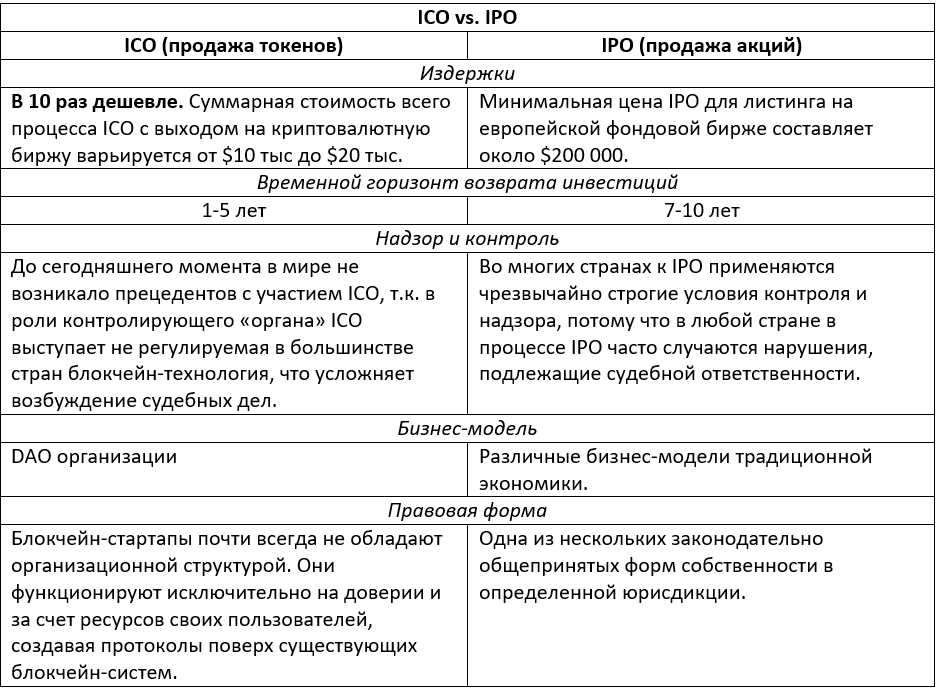

Today we will look at how to attract primary capital for a company using cryptocurrency. It has quite a lot of advantages over a standard IPO: it allows you to attract more funds, spending 10+ times less on it than with the standard procedure for placing shares on the stock exchange. This method is called crowdsale, or ICO (Inicial Coin Offering).

ICO instead of IPO

By and large, ICO can be considered as an analogue of the initial public offering of shares (IPO, Initial Public Offering). The difference is that during an IPO, the investor receives real shares, and in the case of ICO - the so-called crypto shares - cryptographic tokens , which are not actually shares, but allow the investor to receive part of the company's profits. In addition, IPOs are usually regulated by national legislation (as opposed to ICO).

')

For example, in the United States for public offerings of shares, the issuer (a company necessarily incorporated as a joint-stock company) must be registered with the SEC (Securities and Exchange Commission). The registration process itself is complex and lengthy .

At the same time, the company needs to disclose a sufficiently large amount of information (including financial statements). At the same time, each stock exchange sets its own requirements for the issuer to undergo the listing procedure (inclusion of securities in the exchange list). Thus, the exchange can determine the required number of shareholders, the size of the company's income for the last year, or the value of assets , etc.

Below is a comparative table of ICO and IPO.

ICO exit process

The token pre-sale mechanism (ICO) is directly dependent on the type of tokens . There are two main types:

- Application Tokens

- Tokens

The difference between them is primarily in the presence / absence of the source code from the company.

Important! The company, depending on its needs, independently determines the combination of tokens. It can only be application tokens, only stock tokens, or their mix. All this is prescribed in the White Paper and in the ICO environment (for example, https://goo.gl/YTHmRA ).

The company has source code >> Application Tokens

Application Tokens / Appcoins - a form of currency necessary for users to receive services provided by a decentralized network. Their counterpart is a token to visit the attraction , the investor does not have any rights, only the opportunity to use the application.

Tokens-tokens can be freely bought / sold for any cryptocurrency on crypto-exchanges, as well as earned by creating values in the corresponding network (bounty program).

Earnings options: mining / subscribing to news / likes and subscriptions in social networks / translation of campaign materials into other languages and moderation / publication of content. An example of such a program: https://goo.gl/g9PNwJ

The sequence of command actions for ICO (application tokens):

- White paper publication, as well as key and technical information about the project: goal, ICO time frame, team, site development roadmap, project features and other details) in cryptocurrency investor communities ( Bitcoin Talk , Reddit , etc.)

- The announcement of the upcoming ICO and the publication of the source code before the generation of the first token.

- Network deployment and token token generation using mining. It is possible to reserve part of the tokens for the founders, as a reward for the idea and development of the network.

- Advertising of ICO and sale of tokens-tokens to everyone (accepted currencies are set by the company: there can be only dollar / euro / etc, only cryptocurrency, or their mix).

- Next, the team is working on the development of the project as planned: creating a network effect, creating applications and supporting the network. As the network grows, the demand for tokens increases, which leads to an increase in the cost of user tokens.

The company has no source code >> Tokens-shares

Tokens shares are used to finance development and build a network . To access the company's services they are not needed. In fact, they can be considered as crypto shares of the company. In exchange for investments, the holders of tokens shares receive dividends in the form of interest on income or part of the fees for transactions in the network.

In many cases, share tokens are shares in organizations of type DAO (we will tell about them below). In addition to receiving remuneration, the holders of DAO token-shares also vote on the investment proposals of companies. The number of votes is proportional to the package of token shares.

The sequence of actions of the team with ICO (stock tokens):

- White paper publication, as well as key and technical information about the project: goal, ICO time frame, team, site development roadmap, project features and other details) in cryptocurrency investor communities ( Bitcoin Talk , Reddit , etc.)

- Creating a smart contract with a number of token shares reserved for the founders of the network.

- Creation of a provider company that will develop a network for a fee.

- Advertising and promotion of the upcoming ICO and sale of tokens-shares to everyone. From the money received, payment is made to the provider company.

- Next, the team is working on the development of the project according to the plan: expands the network, collects and distributes remuneration for using the network.

There are still credit tokens - they can be considered as a short-term loan to the network, in exchange for interest income on the loan amount. There have been no cases of their separate use in the ICO process as long as they are paired with one of the above-mentioned tokens. One of the first networks using credit tokens ( Steem Dollar (SD)) was the Steemit network.

Interestingly, some states are seriously considering the possibility of issuing government crypto bonds, Australia has already begun to implement.

DAO organizations

As we wrote above, in many cases, tokens are shares in DAO organizations. These organizations represent a new business model: common features with a legal entity that exists in digital form on the blockchain, with code instead of statutory documents, lack of centralized management, where decisions are made by holders of tokens of shares by voting. The model involves the overall contribution and responsibility of all participants, without a central management company. This business model works with a combination of internet and cryptocurrency.

Bitcoin and Ethereum were the first to use this decentralized model, and they used it to load a network of currencies / transactions. The same model is currently used to load other networks ( Steem / Augur / Waves / Wings / Antshares / Golem /, etc.).

If we discard all the buzzwords, the DAO consists of a set of independently functioning applications that, without human participation, carry out tasks for the work of the organization.

How to create : some projects have created their own blockchain (for example, DAO Steem). Others were created on one of the digital currency protocols (for example, Golem, Augur on Ethereum).

We share with you a tutorial on how to create a DAO - organization on Ethereum: https://www.ethereum.org/dao#the- shareholder-association

How the operating model of DAO functions can be found here - read .

Legal status of ICO and crowdsale

ICO can not be called both legal and illegal way to attract investment in the project. Its legal status, procedure and requirements for companies that are going to raise funds in this way are not currently defined in any country in the world. There are no informal rules for their conduct, which could be found on a generally recognized resource and with which most of the crypto-community agree.

In fact, cryptocurrency activities are carried out in the informal sector of the economy, and the status of the cryptocurrency itself is in a legal vacuum (the so-called “gray zone”). In addition, it is difficult to determine the legal nature of the relations arising during an ICO or a crowdsale, since it is difficult to call them classic relations of financing. Obviously, this is the case when the law does not keep pace with the development of technology.

Currently, the SEC is developing a number of clarifications to the legislation, which will allow to regulate the blockchain as a transfer agent.

Consider a few case studies.

Case 1

The pre-sale of the broadcast (Ethereum platform cryptocurrency) was conducted by Ethereum Foundation, a non-profit organization registered in Switzerland. The sole declared purpose of the Fund is to manage the proceeds from the sale of the ether and the development of the Ethereum ecosystem. In order for US citizens to buy air without the permission of the SEC, the Foundation issued a preliminary sale of the broadcast (ETH) as a sale of "cryptotopliva" necessary for the operation of applications developed on Ethereum. The development of the program code was carried out by Ethereum Switzerland GmbH, based in Switzerland.

Case 2

Another experimental approach uses Singular-DTV - a blockchain-based entertainment studio. CODE - an abbreviation, a combination of two elements:

CO (Central Organized) - control component in the form of a Swiss GmbH

DE (Decentralized Entity) - a decentralized ecosystem based on the Ethereum network.

The GmbH is responsible for the expenditure of the air collected during the pre-sale of tokens through DE. The goal of the project is to create media projects to collect revenues from them. The CODE model is assumed to comply with regulatory and tax laws, protecting tokens owners from possible liability.

Case 3

Token emission and network support occur independently of the creator of the system. Tokens are emitted by means of a computer algorithm, in which there is no public key to receive the proceeds. The creator of the system receives its share of tokens from mining, since it is the first miner in the finished network. This approach applies the network Steemit and its creator - the company Delaware C Corp.

The listed ways to build new companies are only the first attempts to adapt a new business model to existing legislation. As the crypto space develops, new rules of the game will be developed.

The continuation of the analytical note is available at the link: blog.dti.team

Source: https://habr.com/ru/post/338348/

All Articles