Futures, indices and IPOs: how exchanges really work and why they are needed

In our blog, we write a lot about exchange technologies, IPOs of well-known companies and interesting news, but for a long time we haven’t stopped at length on the general structure of the financial market. Therefore, today we will explain in simple language why we need exchanges at all, what futures, options and stock indices are, and why companies are holding an IPO.

How does the exchange

The Exchange is the most convenient place for conducting operations with securities. She should be composed of:

')

- The trading system, where buy and sell orders are accumulated, is “mated” in the event of a price match, i.e. registration of transactions with various instruments and records in the relevant accounting registers (eg).

- The clearing house, which keeps records of participants ’funds, delivers money for each transaction to paper sellers and deducts money from buyers’ accounts, and carries out external and internal cash transfers.

- The Depositary Center, which, similarly to the Clearing House, keeps records of securities of participants in trades, delivers securities to buyers 'accounts, writes off securities from sellers' accounts, clears securities according to the results of trading in authorized depositories.

All these operations are performed automatically. Another important role played by an organized exchange platform is to ensure the liquidity of securities.

Liquidity is the ability to quickly or without significant overhead costs to sell or buy a security.

Due to the large number of bidders and a large number of securities, both sold and bought at the same time, liquidity can be quite high. The exchange provides liquidity conditions for each specific paper in two ways: a reasonable tariff policy, which attracts private investors, and the creation of an institution of market makers.

A market maker is a bidder who, by agreement with the exchange, is obliged to maintain the difference between purchase and sale prices within certain limits. For this, he receives certain benefits from the stock exchange - for example, the ability to conduct operations with securities, which the market maker supports with reduced commissions or without them at all.

Why do you need it

Securities are a form of capital existence and are traded on the stock market. All this carries a number of functions.

First, securities redistribute cash:

- Between countries and territories.

- Between industries and sectors of the economy.

- Between individual enterprises within the same sector.

It is necessary to understand that the market is arranged in such a way that money flows to where it can bring the greatest effect from its use. This principle is manifested in the redistribution of capital, always and everywhere - no matter whether we are talking about private companies or entire countries.

Secondly, thanks to the securities, there is a redistribution of investments in each specific enterprise between large, medium and small investors. This process affects almost every citizen of the country, even if he is not aware of this. Thus, a conditional man in the street who has a deposit in a bank may not know and not think that a bank, using its money, could buy, for example, corporate bonds - this is how a particular person, unaware of it, becomes a source of development funds specific enterprise and the economy as a whole.

The third important function of securities is that they serve to fix the rights of the owners to a share of the debt or ownership of enterprises (in the case of company securities) or on the share of debt of the whole state (in the case of government securities).

Depending on the type of securities and the specific issuer, the income that the securities bring may vary from the loss itself to astronomical amounts. Naturally, there is always a risk of losing money - for example, in the event of the bankruptcy of an enterprise that issued securities, but on large time horizons - from 15 to 30 years on average - securities generate income corresponding to or exceeding economic growth.

At the same time, it is important to understand that the laws of physics do not apply in the stock market - in particular, the force of gravity. Often, many believe that once stocks have grown significantly in a short period of time, they will certainly be waiting for a fall. This is not necessarily the case.

Example : Over the course of 10 years, Berkshire Hathaway’s shares rose from $ 6,000 to $ 10,000. At this point, many decided that growth was already quite significant, and missed the opportunity to earn huge money on a price that in the following 6 years rose to $ 70,000 and even higher.

As a risk payment that carries such financing of the economy, the owners of securities receive additional income: coupons, interest payments in the case of debt securities, dividends and a rise in the market value in the case of equity securities.

About why the stock market and state-regulated exchanges have nothing to do with the so-called forex kitchens can be read in this our material .

Derivatives: futures, options and more

The functioning of any exchange platform is difficult to imagine without the so-called derivatives or “secondary securities”. Conventionally, they can be divided into the following classes:

- Depositary receipts;

- Securities warrants;

- Futures contracts;

- Forward contracts;

- Option contracts.

Depositary receipts

Inherently closest to ordinary shares. It often happens that some foreign company (conditional Rostelecom) wants to place its shares in the depositary of Bank of New York and concludes an agreement with it. The bank for these shares further releases for free circulation certificates of securities - American Depositary Receipts (ADRs). One ADR can correspond to one or several shares. ADRs are denominated in US dollars and are freely traded on US exchanges. What is important is that the market value of ADRs in terms of one share and the rate of national currency of the country of the company issuing the shares corresponds to the exchange (market) value of the shares underlying such ADRs.

Warrants to securities

The term "warrant" is derived from the English word warranty. Warrant is the right to redeem a certain number of shares of an enterprise in a rather distant future (from one to five years).

The owner of a warrant is guaranteed the right to redeem a certain number of shares at a certain price in the future, therefore the holder of the warrant is insured against dilution of his stake in the company (and, for example, from his withdrawal from her management). Warrants do not bargain on the stock exchange, but circulate, which is logical, on the over-the-counter market. Most often, they are used by shareholders who want to protect their stake in the company, in the event of additional share issues, during mergers and acquisitions of companies.

Futures contracts

Futures (from English futures) is an obligation to buy or sell a certain asset (it is called basic) at a certain price on a certain date in the future. In addition, each futures contract is characterized by the number of the underlying asset (eg shares), the date of execution of the contract (expiration date) and, in fact, the price (strike price), according to which the buyer agrees to buy the underlying asset and the owner to sell.

Futures contract schedule from the SmartX terminal

Thus, the seller undertakes to sell a certain amount of the underlying asset in the future at a certain price, and the buyer upon the occurrence of this time to buy it at the agreed price. The guarantor of the transaction is the stock exchange, which takes insurance deposits from both parties to the transaction. The basic asset may be the shares themselves, stock indices, currency, commodities and interest rates.

The history of the emergence of futures and a detailed description of the principles of their work can be found in this material .

Forward contracts

“Forwards” is an obligation to buy or sell a certain product on a certain date in the future at a predetermined price. At first glance, everything is very similar to futures, but there is a significant difference.

- Forward contracts are concluded only on the over-the-counter market between two specific counterparties - they also bear the risk of non-compliance with the terms of the contract (in the case of futures, this risk lies on the exchange).

- Such a contract can be concluded on an arbitrary date in the future, unlike a futures contract that has a standard settlement date.

- As a underlying asset, a forward contract can be anything, and not just assets that allow exchange standardization.

- Such contracts, as a rule, do not require guaranteed deposits, and there is no variation margin charged on them.

Options

This is the right to buy or sell a certain underlying asset in the future at a certain price. Not an obligation, as in the case of futures, when, upon the arrival of a specified date, the transaction will necessarily take place under certain conditions. In the case of an option, its exercise is the choice of the buyer, he may use his right, or he may not realize it.

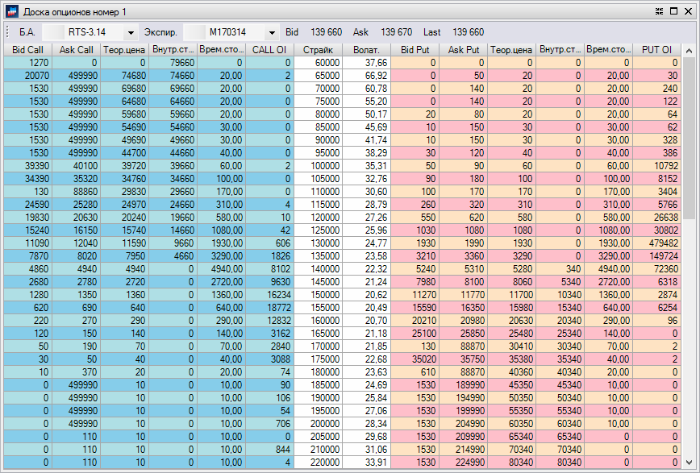

SmartX Terminal Option Board

Options are traded on the same stock exchanges and the same sections as futures contracts. They also have a specification, which includes the concept of the underlying asset. Interestingly, futures can also be used as the underlying asset. Options have expiration date. There are variations on when an option can be exercised. The so-called American options can be exercised at any time before the expiration date, European - only on this date.

More details about the options and history of this financial instrument we told here .

What are stock indices and why are they needed?

The stock index is an indicator of price changes for a certain group of securities. You can imagine the stock index as a "basket" of the shares combined on any basis.

Most importantly, when studying the index, it is from what stocks or bonds it is formed. The set of securities included in the list, on the basis of which the index is calculated, determines what information can be obtained by observing the dynamics of this index. In general, the main purpose of stock index compilation is to create an indicator with the help of which investors could characterize the general direction and “speed” of movement of stock quotes of companies in a particular industry.

Studying the dynamics of the indices helps the participants in exchange trades to understand the impact on the quotes of certain events - if, for example, oil prices rise, then it is logical to expect growth in the quotes of all oil companies. However, stocks of different companies are growing at different speeds (and some may not grow at all) - the index helps to understand the general trend of the market segment movement without the need to assess the position of many disparate companies. Comparing the indices to each other gives an understanding of how different sectors of the economy trade in the market compared to each other.

Indices can be “agency” when they are calculated by special agencies (for example, Standard & Poor’s S & P indices). The second option - stock indexes, created, in fact, by stock exchanges. In the US, this is NASDAQ, and in Russia, the two main stock indices were calculated by the MICEX and RTS exchanges, which are now merged into a single Moscow Exchange.

In addition, the index compiler can be a brokerage company. For example, ITinvest calculates its own indices , among which are, for example, correlation indices (futures on the RTS index and the MICEX index, futures on the RTS index and S & P 500 index), which are used to trade futures on the RTS index, “glued” futures and other indicators.

You can read more about index families and their use here .

IPO: why it is needed, pros and cons

Of course, in the course of talking about modern stock exchanges one cannot overlook the topic of IPO - so often can one hear this abbreviation in various media.

When a company wants to offer its shares to the general public, it holds an IPO (Initial Public Offering - IPO). Accordingly, the status of the organization changes - instead of private (anyone can not become a shareholder), it becomes public (anyone can become a shareholder).

Private companies may have shareholders, but there are not so many of them, and such companies are faced with the requirements of regulatory bodies other than those that apply to public ones. The process of preparing an initial public offering of IPOs takes from several months to a year and costs the company quite substantial funds.

It's all about the money - the company wants to raise funds. After receiving this money can be used for business development or, for example, reinvestment in infrastructure.

Another advantage of the presence of publicly traded shares of the company is the ability to offer options to top managers, enticing the best specialists. In addition, the shares can be used in mergers and acquisitions, covering part of the payment - with the purchase of Facebook WhatsApp, the founders of the messenger received a significant portion of $ 19 billion shares of the social network, which has already entered the stock exchange. Getting listed on the world's largest stock exchanges — the NYSE or NASDAQ — is simply prestigious.

Private investors can not buy shares of the company before the official start of trading. Often, in the first days of trading, stocks of new companies are subject to strong fluctuations, so analysts usually advise not to rush into making deals, and wait until the price is established at a more or less stable level.

The fact of an IPO for a company is usually positive, because it means that it has grown enough to qualify for raising capital in a similar way - it is used only when you really need a lot of money for large-scale expansion. In addition, public companies attract much more attention, which makes it easier for them to hire staff and the marketing process.

Among the shortcomings of the IPO, it is possible to note the increasing attention to the company from the regulatory authorities after the exit to the stock exchange - there are a large number of requirements of both the state and the exchange platforms themselves, which companies trading in them must fulfill. In particular, this concerns the issuance of financial statements. In addition, the founders of the company are not always able to immediately sell their shares after an IPO and become millionaires, as this can lower their rate and capitalize their business.

Conclusion: useful links and materials for studying the stock market

Source: https://habr.com/ru/post/338318/

All Articles