Unicorn technology companies are revalued by an average of 48%: research by scientists from Stanford

Image: TED Conference , CC BY-NC 2.0

In April 2017, an article by Will Gornall from the University of British Columbia and Ilya Strebulayev from Stanford was published under the title “Making Venture Values of Business Come True”. In it, scientists analyzed the estimates of more than a hundred world-famous companies (including technology companies) with an estimate of a billion dollars or more (the so-called "unicorns").

')

It turned out that these estimates far from always correspond to reality and can be repeatedly overestimated. We publish the main findings of this study.

What is the problem

Venture capital is an important driver of economic growth and an important financial tool. For example, from the end of the 1970s, 43% of US companies that were listed on the stock exchange were financed by venture investors before their IPO.

Historically, the most successful companies with venture financing went to the stock exchange for a period of 3 to 8 years from the moment of attracting the first money. However, over time the situation has changed, and now more and more of these companies prefer to remain private, and can grow to enormous sizes without going public - among them, for example, Uber, AirBnB and Pinterest, estimated at tens of billions of dollars.

The growth of such companies gave rise to the term “unicorn” - the so-called venture financing companies whose valuation exceeds $ 1 billion. The term was supposed to reflect the rarity of such a phenomenon, but at the beginning of 2017 there were already 200 unicorns in the world, and 113 such companies were located in USA.

Despite the growing importance and availability of venture financing, the assessment of unicorn companies is still a black box. This is partly due to the natural difficulty of evaluating fast-growing, liquid companies. However, this is largely due to the complexity of the financial structures of companies attracting venture capital financing. It is sometimes difficult to understand this, not only to external observers, but also to insiders who are as close as possible to business. Therefore, scientists from Stanford and the University of British Columbia decided to develop their own methodology for evaluating unicorns, which could show their real value.

Research methodology

As Ilya Strebulayev told the Republic publication, the pricing model is based on the option pricing model. The researchers took into account the amount of recent investment and valuation of companies, as well as financial contracts.

As a result, 116 companies were analyzed, including Airbnb, Lyft, Magic Leap, Snap, WhatsApp, Uber and many others. And so, what conclusions did the scientists come to.

Unicorns overestimated, on average, by 48%

According to the results of the evaluation based on the developed model, it turned out that the average revaluation of unicorn companies is 48% - the average rating of companies from the list was kept at $ 3.5 billion, while its “fair” value should not exceed $ 2.7 billion.

The figure shows the distribution of the revaluation of the value of companies. Overvalued ∆V is defined as the percentage by which the company's current valuation exceeds its “fair” value, calculated according to the financial model of scientists

As a result, 52 of the 116 unicorn companies would have lost their status if their assessment led to real numbers.

Thirteen unicorns from the list are overvalued by more than 100%

A number of listed companies have been overvalued by more than 100%. Among them:

- SolarCity - Ilona Musk’s company in March 2012 was overvalued by 178% ($ 1.9 billion)

- Square - Twitter creator Jack Dorsey's service in September 2014 was estimated at $ 6 billion, which is 169% higher than his fair price;

- Box - in July 2014 cost $ 2.6 billion, while the real price should not exceed $ 800 million, the final revaluation at the level of 200%;

- CloudFlare - service in June 2015 was estimated at $ 3.2 billion - which is 103% higher than the fair price.

There are unicorns with an almost honest assessment.

In spite of everything, the scientists managed to find out the companies whose assessments almost correspond to their real value. Among such projects, for example, the AirBnB service, which in 2015 was estimated at $ 30 billion, which is “only” 15% higher than the fair price. Also here, scientists mention Uber - with a capitalization of $ 68 billion (May 2016), the excess of fair value was only 8%.

Conclusion

The US Securities and Exchange Commission (SEC) is not in awe of the situation with the exorbitantly inflated estimates of technology companies, unicorns. As SEC chairman Mary Joe White said: “We are afraid that here the tail is wagging a dog - that is, there are fears that in the pursuit of prestige, they are trying to present themselves as a more valuable asset than it really is.”

To illustrate the words of the functionary, the authors of the study give an example of the company Ilona Mask SpaceX. In 2008, the company raised money for the development of a satellite launch program and the development of space travel services. Despite the fact that this was in the midst of the financial crisis, and the NASDAQ index was then seriously declining, the company managed to conduct a round of investments and raise money at a price of $ 3.88 per share, and a few months earlier in the previous round in March 2007 the price of one share was defined in $ 3.

Since then, SpaceX has successfully developed, has become a successful company, and recently attracted another round of investment at a price of $ 77.46 per share. However, in 2008, its shares were rated higher only because its leadership wanted to show its importance to new investors, and this increase in price was not determined by anything, scientists believe.

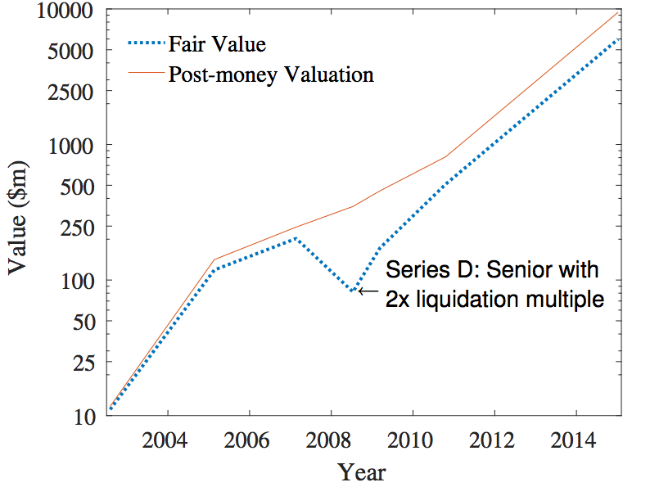

The ratio of the assessment and the real price (blue dotted line) of the company SpaceX - in 2008 there is a serious discrepancy

Ultimately, as stated by study co-author Ilya Strebulayev in his interview: “Both investors and entrepreneurs need to pay more attention to the conditions in which the market is located. It is very important to consider exactly which securities are offered to you. There are many of them in the world of venture capital investments, and each of them involves different cash flows and a level of control. ”

Other materials on finance and stock market from ITinvest :

- ITinvest educational resources

- Analytics and market reviews

- How to determine the best time for a transaction in the stock market: Trend following algorithms

- How Big Data is Used to Analyze the Stock Market

- Finding inefficiencies: What you need to know about creating strategies for trading on the exchange

- Experiment: Using Google Trends to predict stock market crashes

Source: https://habr.com/ru/post/337916/

All Articles