The economics of tokens: why are ICOs so popular?

HYIP-father and insanity-mother in Russia created a crypto-growth not righteous ...

Today I would like to continue (see the list below) publications about ICO. There are three reasons for this:

- Few people write about this not from the side of “like-dislike” ratings or general instructions of the “step-by-step” format;

- Of the coming projects, only 1-2 out of 10 understand why it is generally necessary to prescribe the economy of tokens and what it is, and in the meantime, this is the financial basis of the project;

- And most importantly: the states - the USA, China, Russia, Hong Kong, Yu. Korea ... they are peering more and more closely at this area , which means - expect trouble and even small and medium businesses.

So, first about what is and can be. About models.

In total, there are three. The rest is their combination to one degree or another:

')

- The inflationary model - in this case, we will understand the approach in which the number of tokens is not limited in emissions and price growth depends only on a steady increase in demand (Ethereum now);

- The stagnation model - in a specific aspect means binding to any fiat currency (dollar, euro, etc.) or other asset (most often gold, like GBG in Golos.io) and usually in conjunction with limited emissions;

- Deflationary model - here we will talk about a limited number of tokens, which creates an artificially limited offer and provides, subject to the interest of the buyout, price increases in the medium and long term (Bitcoin for today).

I understand that from an academic point of view - there is something to argue about. But Habr is not the Russian Academy of Sciences, and the main thing is that the disputes will no longer be about the content, but the form, as practice has shown, is what interests me first and not the second.

Accordingly, the selected model (or alloy thereof) will strongly depend on what is commonly called the legal status of the token. I will give a few examples:

- Internal, or club, currency : another applicable analogue is play money. These are peculiar tokens that rotate within a specific service / system / platform and are tied to a certain economic entity. For example, FileCoin and Storj offer payments with their tokens for leased disk space. Or XPR - a cryptocurrency created to protect the network from DDoS (therefore, Ripple is sometimes forced to restrain and even bring down the course, however, after large investments and this has ended).

- Token-bonus (option - token discount ) : in this case, for any active action (remember the Howie test and why the action is important), the user receives a reward. Sometimes, all this is combined with the first item: for example, the same DsPlus make payments on geo-tags, and also use PlusCoin as an internal unit of payment.

- The token as a prepayment for a service, a product : usually the very first one also receives a discount. Now, in the second wave of the ICO , this has become super-popular, because the real sector is entering the arena (again, in a specific aspect, this means a running business and a business tied to offline).

You can continue to list, but for now - no need: there will still be a post to talk in more detail.

At the moment, I’ll dwell on this: I’ve already shown how ICO / ITO / TGE speculators are earning money. And I do not recommend doing so: all the same, almost nothing gives the project a positive course.

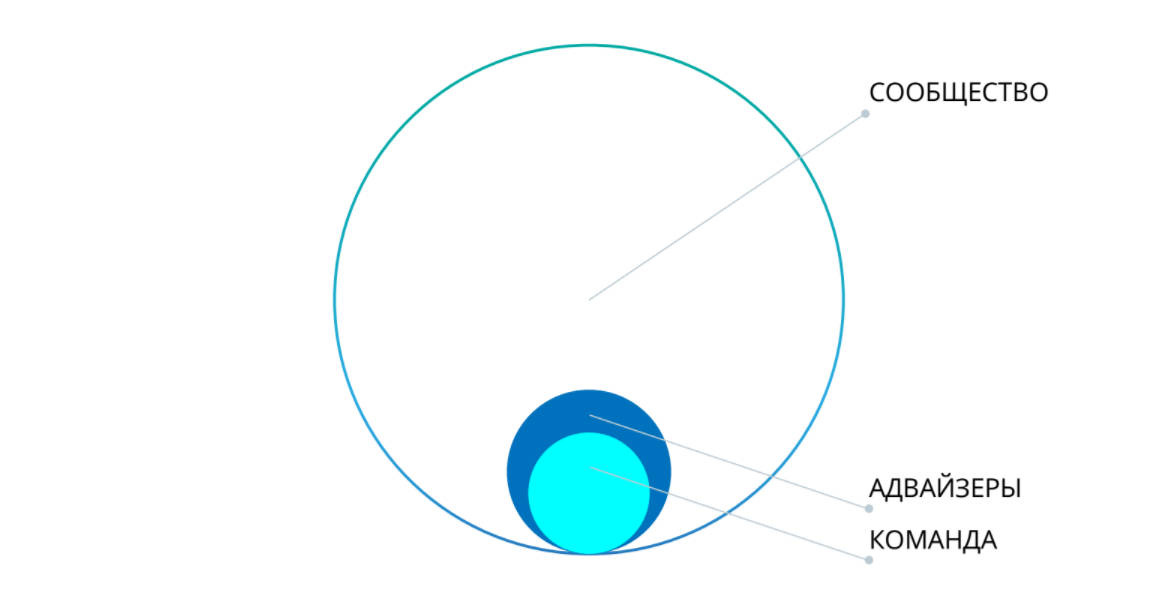

But the most important thing is that this is opposition. After carefully studying the WP of the same https://descrow.org/ (you can find it here , and analyzing the project’s primary link and golos ), I found the following point: “The number of DEST tokens takes about 4-5% of the total campaigns . At the time of the transition of early investors to DES with a 50% bonus, the share of primary investors will be about 6% -7.5% ... 2. For team work and operating activities, we reserve 10% of tokens ... 3. To reward advisors, advisors and people who assist the project at the stage of preparation and launch, we reserve 10% of tokens. 4. The rest (more than 70%) of tokens will be sold as part of ICO. Thus, the team will own only 10% of the project. ” You can see it below:

Such an approach is very often used in classical investing: when not the whole company is bought out (usually this is characteristic only of mergers / acquisitions), but only part of it speaks of the value of the whole company, based on the value of the purchased share. In general, it is a normal market mechanism, but it is only used to manipulate it too often: in particular, the theory of the Big Fool is the very case . In addition, this can often be found at IPO.

Therefore, the summary is the following: as a protective mechanism, such a scheme can be used, and sometimes even necessary. But as soon as it falls into bad hands, the market immediately starts shaking from unicorns, the price of which is one and a half broken pennies.

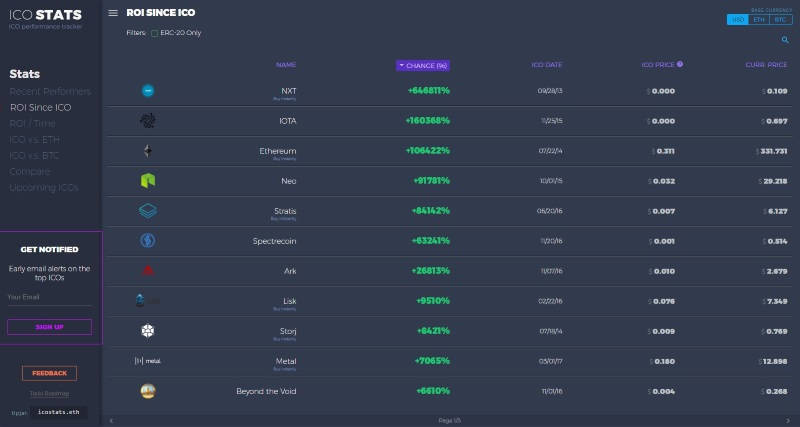

However, I can do without moralizing: everyone is free to choose himself. Just leave a small pivot table for ICO yield: be surprised.

To make it clearer: the first indicator gives almost 650 000% ROI, the second - more than 160 000%, and the third - more than 106 000%.

Very often, novice investors (if you can call them that: they usually still look for speculations) look at these numbers and think that by investing $ 2 they will get a million or even more. The problem is that the market always comes to collapse as a result: investment steroids are short-lived. And the main thing is that every year the cycle diminishes everything, and the effect increases, I think that the crypto bubble will lead to very, very terrible consequences among those who enter it at the very end, i.e. at the peak, as it was 08/08/08 in the Russian Federation and earlier.

And every time in this place one has to write a message that the market itself should start regulating: the state is not an assistant here. Bans do not give anything: remember 2013 and the prohibition of anonymous centralized systems (in fact). And open the Bitcoin chart. Everything will fall into place (and yes, I will not give references again: it is not difficult to find them, the question is who needs this).

Therefore, if your startup starts ICO / ITO / TGE, study at least three important aspects :

- Token model. Why will one be profitable and the other not profitable? The better their union? Etc.

- Should I put ALL tokens on the market or limit their circulation to 5-10%? If so, why? Do you need to buy a token by speculators? How to resist it (a few words - below)?

- Finally, the legal status of the token is what determines the jurisdiction, the organizational structure of the company, etc. Remember this.

As promised, I’ll add a few words about the opposition to speculators (why and when it is needed, read in the last publication ).

First, you need to understand that the speculators need the fast money: as soon as the token goes to the stock exchange, they start pamping (raise in price), and then they sell it sharply and a lot. Therefore, the easiest way is not to withdraw a token to the exchange quickly. At the same time - limited output will not do anything except fall, since even small amounts of the same players will be able to manipulate the price of your asset.

Secondly, according to the scheme described above, it is possible to add a predetermined number of tokens to the market (it’s better if it is wired into a smart contract with a certain factor, which can be tied to both the price and the number of participants and other parameters - something similar is Bitcoin is called complexity in the network, although this mechanism plays the role of self-regulation on another level). This is how this mechanism was described by the well-known blockchain enthusiast from Kaliningrad - Pavel Didkovsky: "... to exclude the speculative variable purely technically, so as to minimize arbitration and resale schemes. There are several solutions ... first thing that comes to mind is the transfer of a small amount of reputation with in case of frequent transfers, make the decrease in reputation exponential and add a relationship between reputation and the number of transactions. Plus, you can add a transaction pre-order system that will best match the P2P logic . "

Thirdly, it is also possible to introduce a countdown mechanism, that is, the price of a token rises in price over time and therefore selling it at the very first stage is simply not profitable (Waves has something similar).

Fourthly, it is possible to create stablockcoins and / or stablocktoken, attached, as indicated at the beginning, to some existing asset. Gold and oil in favor. On the second place are dollars (something similar, a creed dollar, is for example on the famous Polonix). But the problem is that such an approach means a departure from the p2p paradigm and, in fact, is an ersatz.

I think that experts will add these aspects, for me it’s important that every beginner founder (ICO organizers are called so) understood that token economics is not an empty phrase, not an excuse to pay for calculations, but the basis of foundations, without which any project collapse in 2-3 years. The maximum (if there is a lot of money and there will be no additional rounds of investment) is 5-7 years. The e-commerce market in the Russian Federation is the best confirmation of this. And not only he, and not only in Russia.

Therefore, very often, when I see projects that collect more than necessary, I understand that they still have much to understand : in particular, a large amount of money within the system is not a positive factor for development, but, on the contrary, a purely negative factor. There are, of course, examples when the money received above is spent as it should, but there are only a handful of them, but examples of the opposite, the collapse of which has yet to be contemplated by all of us, is becoming more and more: and soon out of hundreds they will come out in the thousands.

Therefore: do ICO. Do not listen to anyone. But remember that you do not create anything new in numbers: only in action and ideas. So be careful with the calculations!

PS ICO Compilation:

- The first part of the first book on ICO

- The second part of the second book on ICO

- On the legal status of cryptocurrency in the Russian Federation book

- On the legal status of digital money in the Russian Federation article: opinion of the Central Bank

- About the normal approach to ICO

- How earn on ICO, and how to do it is not necessary

- Legalize ICO funds

- About the project, which will make communication with crypto better and itself goes for it to ITO

- Jurisdictions for ICO (no changes on innovations)

- Translation of Hong Kong's opinion on ICO (September 2017)

- The first modular ICO about voting

- About ICO figures in Russia

About counteracting evil in ICO and blockchain projects in general:

- Recognize scam

- Warning on the main risks of ICO

- An example of a scam (?) Format "in a hurry"

- Bypass scam at the technical level

- Why does greed ruin everyone?

- About scams on the other hand

- Identify scam

PPS If you do not understand why ICO is so popular, the answer is simple: less paper, less responsibility, more opportunities, cheaper money. Simply - this must be properly used. But this is already understood by a few.

Source: https://habr.com/ru/post/337416/

All Articles