ICO - the dawn of a decentralized business model

Inspired by thoughts from the blog co-founder Coinbase Fred Ehrsam

What's the matter? What happened?

Strange events began to occur literally 4-5 months ago. Until that time, during the last three years, venture capitalists and funds invested about $ 1 billion in cryptocurrency startups, but just in recent months several blockchain projects have collected more than $ 250 million, and no venture money has been invested in any of them. What is the matter?

')

Let's look at some examples:

The SONM project is a decentralized global cloud computing supercomputer. As with Bitcoin or Ethereum, they do not have a centralized owner and network operator. The project attracted funding of $ 42 million, selling SNM tokens for bitcoins and ethers. Token allows you to buy and sell computing power. If you have earned or bought SNM, then you can buy, for example, the miners' computing power or keep them as an asset. If you think that they are more expensive, you can exchange them for any other currency (1 SNM costs about $ 0.068 today)

Gnosis is a market for forecasts, where you can buy and sell forecasts for the outcome of an event, where participants are paid to confirm the event as oracles. The project collected the planned amount of $ 12.5 million in just 10 minutes.

Steem or Golos is a decentralized reddit where people get paid to contribute to news and content.

Clearance Tokens

All these projects made crowdfunding on the blockchain, and in order to raise money, they emitted and sold their own tokens. If you saw in this process just a new way to raise money, just as a company sells stocks, then take a closer look and you will see how far it all goes beyond simply raising money.

In all major projects, tokens have several key components:

- The currency that is used in the application itself.

- Contributors (investors) of the application directly buy tokens from the creators.

- Cryptocurrencies (tokens) are easily converted into any crypto or fiat currency.

All these projects create their own crypto-economic ecosystems, and in fact, we say that this is a completely new decentralized business model that is just being created and tried. The essence of this model is the creation of a network in which there is no central controlling company. Network ownership is shared among all participants, which is a unique business model. It became possible thanks to the combination of new cryptocurrency features and the Internet. It is these facts that suggest that the phenomenon goes beyond the usual new way of collecting money.

In these “projects” or “applications” we can notice one more thing: they really are decentralized software protocols. Protocols are a modern technical term, standard languages that allow people on the Internet to work together on specific problems.

Here are popular Internet protocols that have been used for a long time:

HTTP is the primary protocol that determines how information is transmitted over the Internet.

SMTP is a protocol for sending and receiving email used by your email application.

SSL - secure data transfer protocol used, including by your browser

One of the founders of Union Square Ventures, venture capitalist Albert Wenger, writes in his blog : “Historically, it is very difficult to stimulate the creation of new protocols.” This is due to the fact that it was not possible to monetize the creation and maintenance of these protocols. It is very difficult to get a new protocol because of the “chicken and egg” problem. For example, to create an SMTP e-mail protocol, there was no direct monetary incentive. Much later after its creation, companies such as Outlook, Hotmail and Gmail made a real business on top of it. As a result, we see very successful protocols, which are usually quite old.

The new business model has a great way to stimulate creators. Now you can create a protocol, create a token of this protocol, save part of the token yourself for future development and, if your protocol is successful, the token will grow in value. Moreover, since such platforms are always open source, then if the creators suddenly become too greedy and leave too many tokens for themselves, anyone can simply fork the system and run the same network, but with better conditions.

That tokens can help solve the problem of "chicken and eggs", which occurs when creating network projects. To understand this problem, let's look at several well-known projects: Twitter, Facebook, Reddit. The value of being the first customers in these networks was very low. Few people used them, so there was no content. Now millions of people use these applications, and people find great value in them. In other words, the value of the network grows when more people join it.

Give value to people and you will create a new network.

To attract people to join the network, decentralized platforms give token buyers partial ownership of the network. They pay tokens to their investors, and the owners of tokens are hoping for its growth potential in the future (this is how to be the first Bitcoin miners). Well, this can be compared to buying a stock in a startup. The earlier you buy them, the more property at lower prices you get.

These incentives are awesome, they compensate and complement each other. There are much more incentives for clients and contributors to join your network, even if it is still sparsely populated, it is already becoming useful. Such models have been used for many years by startups to attract employees. Now decentralized platforms and applications use it to encourage all potential users from around the world to join the network at an early stage.

All this greatly simplifies the very creation and launch of the network. Network projects tried all possible things to solve the chicken and egg problem, for example Reddit created its own content until users filled the platform with their own content, and Facebook used the Harvard Student Catalog to fill its network.

Bitcoin and Ethereum were the first to use the decentralized model. They used it to fill customers with networks for currency exchange or transactions. Currently, this model is used by dozens of decentralized applications to create their own networks.

Imagine what would have happened if this model had been used from the very beginning for projects such as Twitter, Wikipedia, Facebook, Reddit, or Uber. Instead of the main company owning the network and earning money by extracting the rent from the network they created, the program protocol would replace the centralized operator, and all the creators and participants of the network would mutually own it. Network distributors (for example, Uber drivers) would not be working bees, but would be more like co-owners of a network in which they themselves create value.

Decentralized protocol - this is the network operator

Such a decentralized business model can be described, for example, as Uber, without the need for Uber as a company that controls drivers and passengers, or as Reddit, without the need for Reddit, as centralized hosting, or Facebook, without Facebook itself. Of course, there will be companies that support these networks through any value-added services, for example, checking cars in Uber or auto financing, it just will not be one company that owns the entire network.

It may be too early to talk about this, but tokens and a new decentralized model may mean a whole series of global changes for the world:

If the project builds decentralization first, then it doesn’t matter where it is located: in Africa, in China or in Silicon Valley. It is located in the same global blockchain network. The investment market and access to project financing are becoming more equal, where anyone can become the creator of the project and receive funding. On the other hand, anyone can become a venture investor and get the opportunity to invest in any project. Thus, at first, the blockchain technology gave us Internet money, now it gives us Internet assets.

Most likely, it will be similar to the processes in the late 90s to create websites, or processes to create mobile applications in the 2000s.

Projects like BITSHARES, Steem and some more have their own blockchains. Others were created on top of the major large platforms Colored Coins on Bitcoin, Augur on Ethereum, but all these facts and phenomena work independently of the platform and protocol of the blockchain.

I believe that most often we will see that tokens will be built on basic blockchains, such as Ethereum, as well as most of the tools for web developers, libraries and examples created, focused on platforms such as Ruby on Rails or Django. Many web applications were created on them, as they greatly simplified the deployment of websites. At the same time, there are still a lot of important infrastructure projects to be done in order for decentralized applications and tokens to be created as easy as a website for a modern developer.

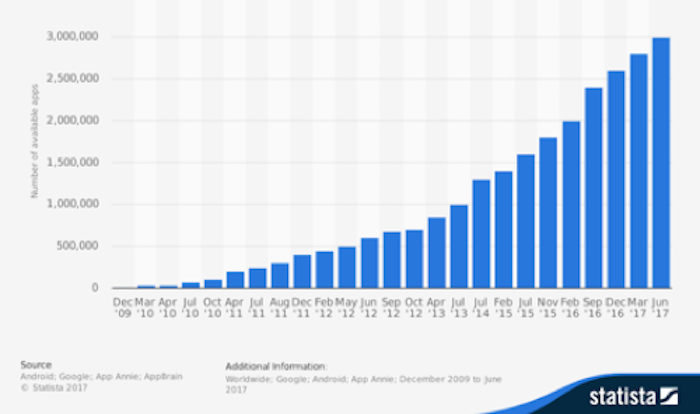

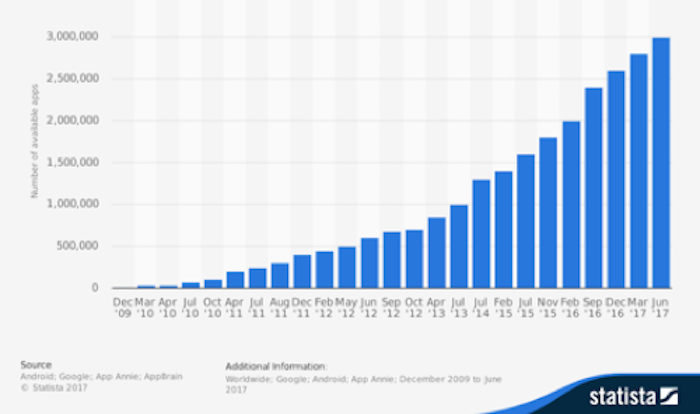

The growth in the number of tokens is likely to be similar to the growth in the number of applications in the App Store and Google Play, it will start slowly and then grow exponentially.

Just like web and mobile applications, at first there will be thousands, then millions, many of them will not be needed by anybody, some will be in demand, and some will become super hits. There will be many problems, painful lessons, hacks like DAO, quite a few large projects can fall. Some people will focus only on the financial side of this wave, such as Wall Street 2.0, and until they see the whole phenomenon. This is the biggest and most important trend that we will observe in the world of digital currencies in the next few years. Most likely, this will be the basis for the first monster applications that, as they say, come forever.

Today we have only a few basic protocols, but look at how much they make for our lives: HTTP gives us data via the Internet, SMTP gives us email, SSL gives us secure data transmission on the Internet.

The decentralized protocols and the tokens on which they work are the beginning of a mechanism for creating a huge number of such protocols, which means global equality of opportunities to have joint digital ownership in networks that we can buy and sell. This is what leads to great innovations and better opportunities for consumers, as well as businesses all over the world.

Regulators such as the SEC will certainly want to know more and somehow enter this big game, but hopefully they will see that tokens have fundamentally different properties than securities, that the token not only grows on the stock exchange, but also helps grow program protocol. By working in this way, tokens allow the use of innovations in these protocols, which will become an additional force for the Internet economy.

For many decentralized applications, protocols, and tokens, most of the basic concepts are still true, but there is too little time to gain full conviction in trends. Fundamental basic protocols should be as modular as possible. And I think that we will see decentralized applications that are built on many different protocols, when one application has one token and will be built on a series of basic protocols.

What's the matter? What happened?

Strange events began to occur literally 4-5 months ago. Until that time, during the last three years, venture capitalists and funds invested about $ 1 billion in cryptocurrency startups, but just in recent months several blockchain projects have collected more than $ 250 million, and no venture money has been invested in any of them. What is the matter?

')

Let's look at some examples:

The SONM project is a decentralized global cloud computing supercomputer. As with Bitcoin or Ethereum, they do not have a centralized owner and network operator. The project attracted funding of $ 42 million, selling SNM tokens for bitcoins and ethers. Token allows you to buy and sell computing power. If you have earned or bought SNM, then you can buy, for example, the miners' computing power or keep them as an asset. If you think that they are more expensive, you can exchange them for any other currency (1 SNM costs about $ 0.068 today)

Gnosis is a market for forecasts, where you can buy and sell forecasts for the outcome of an event, where participants are paid to confirm the event as oracles. The project collected the planned amount of $ 12.5 million in just 10 minutes.

Steem or Golos is a decentralized reddit where people get paid to contribute to news and content.

Clearance Tokens

All these projects made crowdfunding on the blockchain, and in order to raise money, they emitted and sold their own tokens. If you saw in this process just a new way to raise money, just as a company sells stocks, then take a closer look and you will see how far it all goes beyond simply raising money.

In all major projects, tokens have several key components:

- The currency that is used in the application itself.

- Contributors (investors) of the application directly buy tokens from the creators.

- Cryptocurrencies (tokens) are easily converted into any crypto or fiat currency.

All these projects create their own crypto-economic ecosystems, and in fact, we say that this is a completely new decentralized business model that is just being created and tried. The essence of this model is the creation of a network in which there is no central controlling company. Network ownership is shared among all participants, which is a unique business model. It became possible thanks to the combination of new cryptocurrency features and the Internet. It is these facts that suggest that the phenomenon goes beyond the usual new way of collecting money.

In these “projects” or “applications” we can notice one more thing: they really are decentralized software protocols. Protocols are a modern technical term, standard languages that allow people on the Internet to work together on specific problems.

Here are popular Internet protocols that have been used for a long time:

HTTP is the primary protocol that determines how information is transmitted over the Internet.

SMTP is a protocol for sending and receiving email used by your email application.

SSL - secure data transfer protocol used, including by your browser

One of the founders of Union Square Ventures, venture capitalist Albert Wenger, writes in his blog : “Historically, it is very difficult to stimulate the creation of new protocols.” This is due to the fact that it was not possible to monetize the creation and maintenance of these protocols. It is very difficult to get a new protocol because of the “chicken and egg” problem. For example, to create an SMTP e-mail protocol, there was no direct monetary incentive. Much later after its creation, companies such as Outlook, Hotmail and Gmail made a real business on top of it. As a result, we see very successful protocols, which are usually quite old.

The new business model has a great way to stimulate creators. Now you can create a protocol, create a token of this protocol, save part of the token yourself for future development and, if your protocol is successful, the token will grow in value. Moreover, since such platforms are always open source, then if the creators suddenly become too greedy and leave too many tokens for themselves, anyone can simply fork the system and run the same network, but with better conditions.

That tokens can help solve the problem of "chicken and eggs", which occurs when creating network projects. To understand this problem, let's look at several well-known projects: Twitter, Facebook, Reddit. The value of being the first customers in these networks was very low. Few people used them, so there was no content. Now millions of people use these applications, and people find great value in them. In other words, the value of the network grows when more people join it.

Give value to people and you will create a new network.

To attract people to join the network, decentralized platforms give token buyers partial ownership of the network. They pay tokens to their investors, and the owners of tokens are hoping for its growth potential in the future (this is how to be the first Bitcoin miners). Well, this can be compared to buying a stock in a startup. The earlier you buy them, the more property at lower prices you get.

These incentives are awesome, they compensate and complement each other. There are much more incentives for clients and contributors to join your network, even if it is still sparsely populated, it is already becoming useful. Such models have been used for many years by startups to attract employees. Now decentralized platforms and applications use it to encourage all potential users from around the world to join the network at an early stage.

All this greatly simplifies the very creation and launch of the network. Network projects tried all possible things to solve the chicken and egg problem, for example Reddit created its own content until users filled the platform with their own content, and Facebook used the Harvard Student Catalog to fill its network.

Bitcoin and Ethereum were the first to use the decentralized model. They used it to fill customers with networks for currency exchange or transactions. Currently, this model is used by dozens of decentralized applications to create their own networks.

Imagine what would have happened if this model had been used from the very beginning for projects such as Twitter, Wikipedia, Facebook, Reddit, or Uber. Instead of the main company owning the network and earning money by extracting the rent from the network they created, the program protocol would replace the centralized operator, and all the creators and participants of the network would mutually own it. Network distributors (for example, Uber drivers) would not be working bees, but would be more like co-owners of a network in which they themselves create value.

Decentralized protocol - this is the network operator

Such a decentralized business model can be described, for example, as Uber, without the need for Uber as a company that controls drivers and passengers, or as Reddit, without the need for Reddit, as centralized hosting, or Facebook, without Facebook itself. Of course, there will be companies that support these networks through any value-added services, for example, checking cars in Uber or auto financing, it just will not be one company that owns the entire network.

It may be too early to talk about this, but tokens and a new decentralized model may mean a whole series of global changes for the world:

If the project builds decentralization first, then it doesn’t matter where it is located: in Africa, in China or in Silicon Valley. It is located in the same global blockchain network. The investment market and access to project financing are becoming more equal, where anyone can become the creator of the project and receive funding. On the other hand, anyone can become a venture investor and get the opportunity to invest in any project. Thus, at first, the blockchain technology gave us Internet money, now it gives us Internet assets.

Most likely, it will be similar to the processes in the late 90s to create websites, or processes to create mobile applications in the 2000s.

Projects like BITSHARES, Steem and some more have their own blockchains. Others were created on top of the major large platforms Colored Coins on Bitcoin, Augur on Ethereum, but all these facts and phenomena work independently of the platform and protocol of the blockchain.

I believe that most often we will see that tokens will be built on basic blockchains, such as Ethereum, as well as most of the tools for web developers, libraries and examples created, focused on platforms such as Ruby on Rails or Django. Many web applications were created on them, as they greatly simplified the deployment of websites. At the same time, there are still a lot of important infrastructure projects to be done in order for decentralized applications and tokens to be created as easy as a website for a modern developer.

The growth in the number of tokens is likely to be similar to the growth in the number of applications in the App Store and Google Play, it will start slowly and then grow exponentially.

Just like web and mobile applications, at first there will be thousands, then millions, many of them will not be needed by anybody, some will be in demand, and some will become super hits. There will be many problems, painful lessons, hacks like DAO, quite a few large projects can fall. Some people will focus only on the financial side of this wave, such as Wall Street 2.0, and until they see the whole phenomenon. This is the biggest and most important trend that we will observe in the world of digital currencies in the next few years. Most likely, this will be the basis for the first monster applications that, as they say, come forever.

Today we have only a few basic protocols, but look at how much they make for our lives: HTTP gives us data via the Internet, SMTP gives us email, SSL gives us secure data transmission on the Internet.

The decentralized protocols and the tokens on which they work are the beginning of a mechanism for creating a huge number of such protocols, which means global equality of opportunities to have joint digital ownership in networks that we can buy and sell. This is what leads to great innovations and better opportunities for consumers, as well as businesses all over the world.

Regulators such as the SEC will certainly want to know more and somehow enter this big game, but hopefully they will see that tokens have fundamentally different properties than securities, that the token not only grows on the stock exchange, but also helps grow program protocol. By working in this way, tokens allow the use of innovations in these protocols, which will become an additional force for the Internet economy.

For many decentralized applications, protocols, and tokens, most of the basic concepts are still true, but there is too little time to gain full conviction in trends. Fundamental basic protocols should be as modular as possible. And I think that we will see decentralized applications that are built on many different protocols, when one application has one token and will be built on a series of basic protocols.

Source: https://habr.com/ru/post/337152/

All Articles