How to earn on ICO? And how to do it is not necessary

“If you can do without a token, then an ICO is not necessary,” V. Buterin

So, the ICO theme is gaining momentum, and Habr, meanwhile, is deaf to it. And this is wonderful, because unexplored opportunities - not just the sea, but the ocean, I would even say the ocean-planet. Today we will talk about how to earn an ICO and why you should not do that ...

Scheme number 1. Primitive: speculation

Speculators are not those who develop the market, as many people think: no, in the short-term analysis, this is precisely how it looks. But then we have another, not long-awaited, crisis and deplorable results.

')

We go to a well-known site (by the way, if you don’t know about it: DO NOT even think about climbing into any ICO!) And see:

Example for the number of times - IOTA (TOP 10)

Example number two - NEO (TOP 20)

Example number three - Golem (TOP 30)

So the pattern is obvious? If not, then I tell you: take on preICO, preferably the earliest, tokens with a discount of 10% to 50% and then wait for the exit on the stock exchanges or, in general, for the opportunity to trade. And sell when you achieve the desired growth (and it is already included in the discount).

Speculation. Nothing else.

For projects, this actually means a lot of unpleasant things, here are a few basic ones:

- Speculators sell tokens. And take the assets into the crypt. It seems to be all right. But the question that few people ask themselves: “and who, in fact, buys tokens?” Clearly, people of different qualifications, knowledge and understanding. Demand creates supply? A good slogan, but it usually works exactly the opposite: supply creates demand. Nothing like ?

- By itself, trading on a small capitalization leads to the scheme: “But now let us, in small volumes, pampam this token, and then we will merge everything according to the very same theory?”. And so it can continue as in MMM: the nth number of times.

- However, surprisingly :), but capitalization in most cases decreases proportionally. But capitalization is what projects are fighting for? Or not? Then why wait for 105%, 120, 300, 400%, etc.? percent of the maximum amount? Then, the team gets the agreed profit of the total amount of funds raised: the higher it is, the higher the team's profit. Of course, everybody pretends that they are afraid of “whales”, when at the upper limit everyone is bought by large investors, but are all large ones (however, even quotes are relevant here) are interesting projects, say, up to 10,000,000?

The second scheme is almost honest.

Very often the teams that come to us (and surprisingly many teams come to us and 90% of them believe that almost no one comes to us, because they came to us first, because the selection criteria in our market are not easy hard, and the most severe), start with questions about the economy of tokens. In 90% of cases, this means that a) or the guys do not have a clear business plan, at least in their heads, or b) there is something wrong with the project.

But this is a separate question. Let's talk about it another time.

Now about the point: in many documents the team takes most of the funds in one way or another. On marketing, on organizational needs, on expansion, etc. Sometimes this is justified, but more often it is not.

Why?

The goal of ICO is to create an end product. And therefore it is important that the funds will be used specifically for the development, testing, release to release. It is clear that I want to sit in a beautiful office, have breakfast in the Maldives and have a dinner at the% select-place-% themselves, but the question remains: “how effective is it in terms of creating the final product?”.

Now the world is overflowing with ICO-millionaires, which in fact are not: firstly, the money received by the project and the team is usually different money (the difference is up to 10 times or more); secondly, to say that everything is fair and millions worked out - you need a finished product, which, moreover, is demanded by the community, that is, it turned out just the way investors and users were waiting for it. Are there many now? Suppose: Waves, Golos / Steem, Ethereum ... And even here there are those who will say a word against (and will be right in its own way). In addition, many successful ICOs enter new ICOs: by doing so, their area of responsibility increases. It is necessary to raise not one, but 2, 3 or even 10 projects, and participation in each will not be the same. In addition, the trip also takes a lot of time.

However, what is it about me: it should only concern investors, is not it?

The third scheme - combined

Actually, I will not speak for long here - everything is simple: people get their legitimate 1-10% as a team and develop a product. The rest is spent on development, marketing, community development, etc. Everything, as written in WP. In addition, they can make money on the course of tokens in the medium or long term (a kind of option - if you take an analogue from the classic it-business).

Moreover, when a product fires already in a release, they profit from it. And a good, note profit. And not one year.

The scheme is beautiful. There is one “but” in it: ... I will not write about him: if you can NOT fill this three-point, do not go to the ICO.

Fourth scheme - scam

I write a lot about scams, often and wherever possible, for this is Pure Evil and we must always fight against it. Therefore - just compiling links:

The fifth scheme - fraudsters

They break everything that is possible, using everything that is impossible: from banal phishing and SPAM to DNS cache poisoning (seen on blockchain.info). Through admins computers, through holes in smart contracts, through social engineering. In general, everything is as usual: error digests are sometimes released on Golos.io.

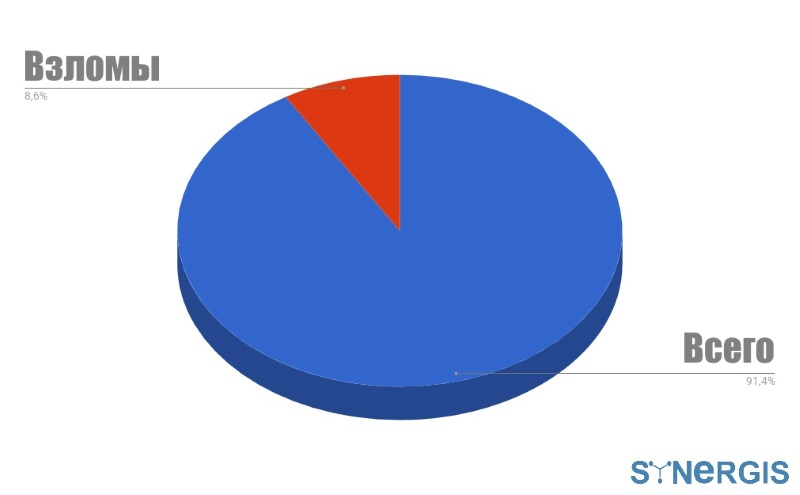

The most important thing is the numbers. Here they are (data from the Forklog from Chainalysis are linked to ItSynergis):

I will quote: “Since the beginning of 2017, investors have invested $ 1.6 billion in ICO, of which $ 150 million went to fraudsters.” Not bad? More precisely, this is just very bad: just for now, very few people realize it.

10% is taken immediately. And from the remaining 90% - 90% -95% will go to the bottom of the story: so what is this, blockchain, better world than the old one? The same philosophy, the same rake, the same horses, kings, and so on, and so forth.

The sixth scheme - guarantors

I will say right away that there are several types of guarantors:

- Technical - through smart contracts, for example, the project https://descrow.org/ , which I was offered to investigate and which will be the first note right today;

- Classical, or economic, banks or other institutions that guarantee some financial obligations under the transaction (for example, Hronobank has an interesting example);

- Personal - this is the so-called escrow agents (advisors). Usually these are people who have already achieved some success in a particular industry (banking, gaming, etc.)

or inside the blockchain-society (Sergey Sergienko, Alexander Ivanov, Vitalik Buterin, etc.);

Actually, there is nothing bad in the scheme itself: yes, there is an agent, but it’s not just a parasitic, but it performs a quite useful function, and therefore - here, rather, a symbiosis. Another question is if the guarantor leaves, for example, immediately after the closure of the ICO. It is very similar to the tactics of "locomotives" in the political reality.

It is not right. Perfectly.

In my opinion, the advisor should conduct the project from and to (from preICO to release, and possibly further) in order to monitor its state, development, implementation of stated goals, etc. at each stage. However, for the time being this is not very necessary for anyone: the wonderful COSS project or an interesting project from Irkutsk (to which it could not fail to pay attention ) just attract attention by introducing guarantor advisers into their ranks. Coss did a great job: I have never seen so much anywhere.

The problem with advisors at this stage is that: a) many of them take on too many projects, as mentioned above; b) not everyone does the analysis of products for which they vouch; c) they are not interested in the actual formation of the service, the production of goods, etc., but only in the collection of funds for ICO.

I think that this model will fix the global reputation system.

Scheme of the seventh - accompaniment

I’ll definitely write about this separate and large article with names, names, sites and locations, but for now I’ll say this: Internet publishers, law firms, marketers (especially marketers), programmers, analysts and many more people earn money topic. "

In this, too, there is not even a score of any negative, except for three aspects:

- When, instead of a product, we get only a beautiful product wrapper;

- When people inflate prices by 2-10-15, etc. time;

- When blockchain and ICO are introduced for the sake of p. 2 or money in general.

For the rest - I have not seen such a rapid growth of the industry for a long time: and this is wonderful!

It remains to wait for the anti-boom and test the strength of those who call themselves crypto-enthusiasts, blockchain-evangelists, crypto-anarchists (all concepts are written separately consciously): I remember, in an unconfirmed story there was already a student who denied the teacher three times in one evening . I hope in our community there will be the minimum number.

Write what other ways you know what you think about all this and how you see the evolution of the industry as a whole.

PS For those who are in the tank or behind the wall, I answer the question: “why is it for me?”, I answer again: “then that I don’t want to leave this ship”. If it happens, I will be the last to leave: out of respect for the ideas that were developed by those who call themselves supporters of freedom, and not such things . Besides: not everything is so bad .

Source: https://habr.com/ru/post/336810/

All Articles