Basics of contractual work in IT: contractors and employees

Hi, Habr! I continue to publish my book on the legal aspects of IT business. Today - about current activities (contracts, registration of employees). This material is quite relevant for the "ordinary", that is, non-technological entrepreneurship.

The current work of a startup is based on contracts. The contract is not just a formality, but an important document that fixes your obligations to the counterparty (the other party to the contract).

')

Not uncommon - situations where you have a completely different idea of the obligations under the transaction, sufficient remuneration, the quality of the goods, etc. The contract is a document in which your agreed intentions, agreed will are expressed. That is why the contract is concluded in several identical copies for each party and is sealed with their signatures.

Most contracts are in simple writing . This means that a notary is not needed for their conclusion, and the form itself can be any (even a pen on a napkin). Moreover, the signed agreements can be exchanged by mail or by email, the main thing is to take into account the risks of an atypical form of the agreement; for example, the contract concluded in the Telegram, it will be difficult to confirm in court. Therefore, while optimists exchange contracts by e-mail, realists demand that each page be signed.

From the point of view of a lawyer, the conclusion of a contract is not one action, but several interrelated:

Any contract establishes certain rights and obligations of the parties. Accordingly, at least one of them will be obliged to do something in favor of the other side. However, a contract is only a condition for future actions. The fact of the execution of the contract is confirmed by other documents, which in everyday life are called closing.

The fact of execution of the contract must be confirmed in order to:

The fact of payment of the contract , if such payment was carried out in a non-cash manner (from the current account), is not necessary to confirm: if necessary, the bank will issue an account statement. But the fact of delivery of goods, provision of services or performance of work is confirmed by individual papers - the invoice and acts, respectively. They must be stored.

We are accustomed to cash payments (credit cards from the majority of our fellow citizens have recently appeared), while the business has long been working on non-cash payments using special checking accounts. When you need to pay the bill, the entrepreneur gives his bank an order to make a payment. To do this, you need to know the name of the counterparty, its twenty-digit current account and the bank in which it is opened. The money will go from one account to another within a few hours, less often - the next day.

Unlike Western Union transfers and other similar systems, transfers between settlement accounts are carried out through the Bank of Russia payment system or through mutual (correspondent) accounts of banks from each other: of course, physically, money “does not go anywhere”.

The state is interested in businessmen exchanging money in a non-cash order: at the same time, all movements in the account are recorded and subsequently they can be easily raised (for example, when checking). Simply put, cashless settlement is +15 to the whiteness of the business.

Cash gives much more opportunities for unscrupulous entrepreneurs. If cash comes into the company without taking into account (for example, from individuals), then the entrepreneur is tempted not to deposit them in the current account and, accordingly, do not take it into account when paying taxes.

Understanding this, the state is trying to close the loopholes for common machinations that lead to unaccounted cash. Most often, cash registers with fiscal checks, which are stored in the memory of the machine or in the cloud, become a barrier to cash. Thus, the tax (remotely or during a physical inspection) can always see how much money has passed through a particular cash register. The main thing is not to allow sales past the cashier’s office (from the same series, all offers like: “You were not given a check — purchase is free”).

There is a fairly well-developed shadow cashing transfer business. A large number of one-day firms are created in order to transfer taxable non-cash receipts to unrecorded banknotes. It is better not to get involved in such things: firstly, this is in itself unlawful.

Money laundering, in fact, is the opposite of cashing: in order not to attract the attention of law enforcement agencies, criminals create the appearance of legal origin for their income. To this end, “dirty money” is transferred to companies that receive large cash receipts, ostensibly as part of payment for legal services. In the days of Al Capone, "laundering" was accomplished with the help of small b2c-enterprises like laundry. Such institutions reported inadequately large profits, because the gangsters made their illegal income through them. Formally, there was practically nothing to complain about.

And now a business with a large cash turnover (for example, a network of minibuses) is often associated with shadow circles. Contacting such "entrepreneurs", it is easy to get a real criminal sentence.

In Russian law, there are two classes of contracts: under labor law and civil law. In some cases (for example, when an entrepreneur hires a contractor - an individual to perform work) this can be formalized both as a labor contract and as a civil law contract.

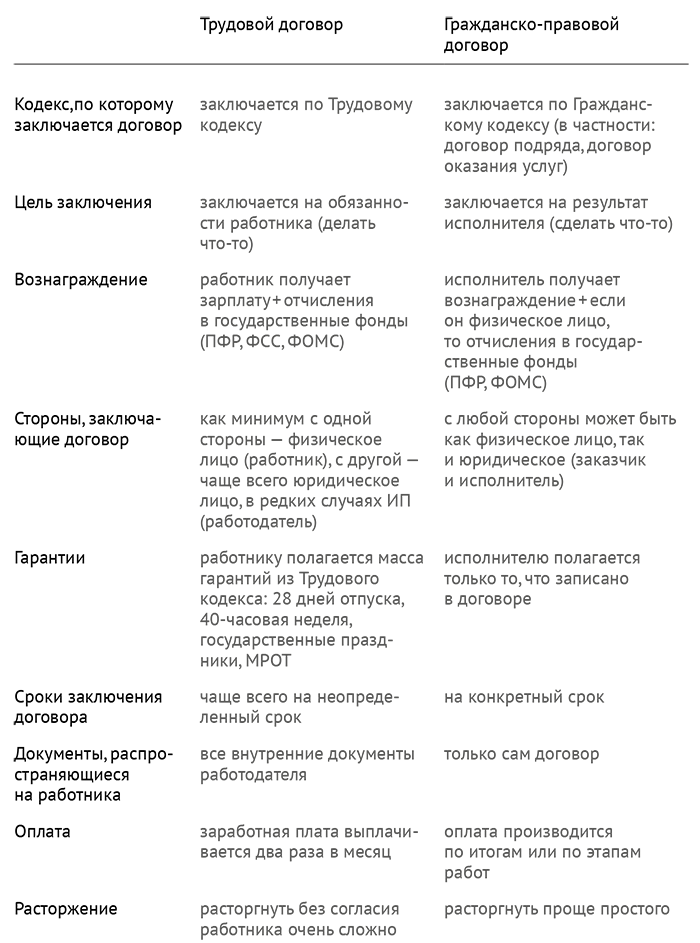

Comparison of employment and civil contract

From the point of view of payment under both contracts, approximately the same amount will be released (contributions to the FSS are small), but it is not easier to terminate a civil contract. Therefore, employers prefer to use it in order not to bind themselves with restrictions of the Labor Code. However, in this case the rule applies: if the relations regulated by a civil law contract are in fact an employment relationship, the rules of labor law apply to them. Therefore, it is important, entering into a civil contract, to ensure that it includes the result of the work, as well as be urgent. It is necessary to take into account the other signs.

The most obvious guarantees relate to dismissal. If in American films the boss can simply say: “You are fired” - and the employee goes to pack things in a box, then in Russia it is almost impossible to do this against the will of the employee. Even if he directly violates the contract (works poorly, is late), you will have to collect a whole commission in order to prove it, and then still give such an employee a second chance. There are other paradoxes.

Usually, dismissal occurs in one of three scenarios:

In addition to the employment contract, several other documents appear in the employment relationship, and above all - the employment record. All employers are recorded in this relic of the Soviet system - this is how the book confirms experience and competence of work. Now there is not much sense in it: the labor history is still recorded in the Pension Fund, and anyone can get at least a million labor records. Many have them in several pieces for simultaneous work in different firms.

However, organizations are still required to keep employment records. Moreover, the documents regulating their storage, clearly give mothballs:

The overwhelming majority of these documents have been on computer for a long time (in Excel or in accounting software). However, by law, a huge amount of paper must be duplicated in paper form. Compliance with these requirements is monitored by a special service - Rostrud. Previously, she checked organizations at will, now she does it mainly on complaints of employees.

Fortunately, we are gradually moving away from archaic demands. There are no mandatory forms of labor documents, and since 2017. microenterprises (with up to 15 employees) in general can be limited to standard employment contracts - if only they pay contributions to extra-budgetary funds. I want to believe that someday and labor books will sink into oblivion.

Employers usually assume that the rights to content created by full-time employees belong to the organization by default. In fact, this is absolutely not the case. Neither what is created on the employer's equipment, nor what is done during working hours, does not automatically become the property of the employer.

There is also an important condition for the transfer of the code to the employer - remuneration (and wages are not considered appropriate remuneration). In itself, the lack of remuneration does not lead to the return of the IP employee, but he has reason to file a lawsuit for compensation.

If not all conditions are met, the employee will have the opportunity to retain intellectual property. In this case, he may not swear with the employer, but go to a competitor, taking all the results with him.

In some cases, it is difficult to fully comply with the requirements of the legislation. For example, a company is engaged in development, employees work on tickets and upload updated code to a common repository; duplicate this acts and listing, of course, strange. Therefore, the intellectual property regime in an organization is a balance: on the one hand, to close the main risks, on the other - to preserve adequacy in the eyes of employees.

For example, the source code can be protected as NDA know-how; you can transfer to CD / DVD-R and sign for them; You can specify in detail the order of loading into the external reference repository from personal accounts. Alternatively, you can take all the relations on intellectual property in separate (copyright) contracts that are much easier to write, sign and translate into English for investors.

After Silicon Valley, many Russian start-ups began to offer employees options - incentives in the form of shares or shares of a startup. By endowing employees with shares (or the right to buy a share at par after a certain period of work), the employer saves on salaries and increases the motivation of employees. The faster the company develops, the more expensive the option becomes with it.

However, not all so simple.

Taking into account these factors, I do not advise getting involved in the distribution of options to employees in the early stages, without enlisting the support of investors. If for some reason the use of the option is unavoidable, it is better to use the “phantom option” - in fact, an agreement on an additional bonus to the employee for the performance of the established KPIs. Once transferred to the share in a startup is very difficult to return, and a large number of owners is always worse than one.

For those who do not want to wait for the publication of the remaining chapters on Habré - a link to the PDF of the full book is in my profile.

- Starter vs. entrepreneur

- Choose a form

- check in

- Corporate Governance

How is a company legally built? - Current work

Contracts and how they work

How to check an open source partner - Taxes

What does IT business pay in Russia? - Governmental support

- Startup cycle

How venture investment (in general) works - Venture transactions

- Venture funds

- Intellectual property

- Offshore and foreign trade

The advantages and pitfalls of offshore

Offer and acceptance

The current work of a startup is based on contracts. The contract is not just a formality, but an important document that fixes your obligations to the counterparty (the other party to the contract).

')

Not uncommon - situations where you have a completely different idea of the obligations under the transaction, sufficient remuneration, the quality of the goods, etc. The contract is a document in which your agreed intentions, agreed will are expressed. That is why the contract is concluded in several identical copies for each party and is sealed with their signatures.

Most contracts are in simple writing . This means that a notary is not needed for their conclusion, and the form itself can be any (even a pen on a napkin). Moreover, the signed agreements can be exchanged by mail or by email, the main thing is to take into account the risks of an atypical form of the agreement; for example, the contract concluded in the Telegram, it will be difficult to confirm in court. Therefore, while optimists exchange contracts by e-mail, realists demand that each page be signed.

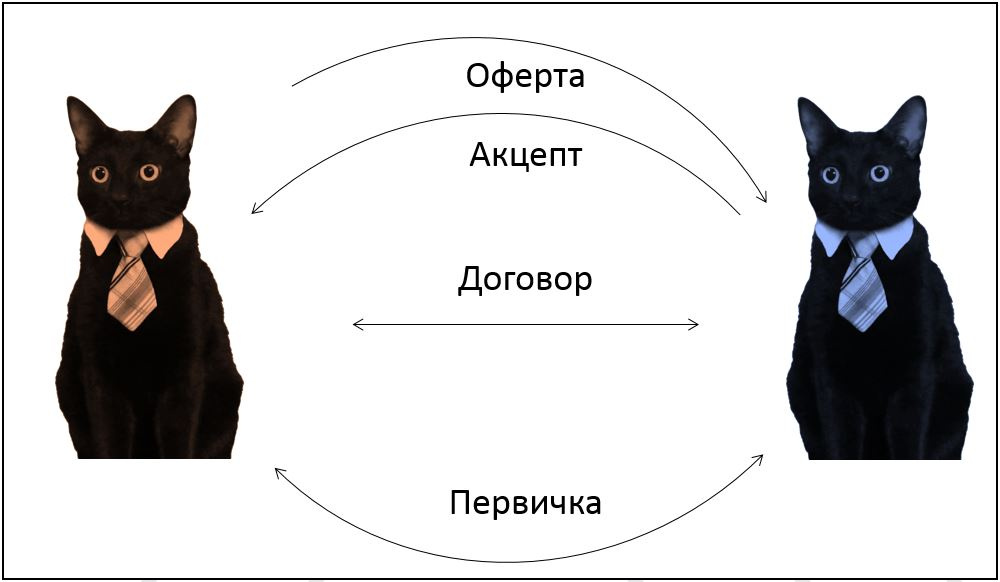

From the point of view of a lawyer, the conclusion of a contract is not one action, but several interrelated:

- one party sends an offer to the other party - a proposal to conclude a contract;

- the recipient of the offer can accept it, that is, make an acceptance ,

- or, in turn, he can start bargaining: send the conditions (counter offer) to the one who sent it, after which the whole process will start over from the beginning.

IP Petrova sent IP Kruzhkov an offer for the supply (a type of sale and purchase) of tomatoes. According to its conditions, Petrova supplied Kruzhkova a ton of tomatoes for 15 thousand ₽. Kruzhkov sent a counter offer with a proposal to put tomatoes for 12 thousand ₽. Petrova accepted the counter offer. Now she must put tomatoes for 12 thousand ₽.This process of “offer-acceptance” is very important for proving the fact and the moment of the conclusion of the contract. For example, if you take goods from the supermarket shelf, then accept the offer (price tag). Even if at the checkout they tell you that the price was indicated incorrectly and the goods are more expensive, you can demand to sell at the price on the price tag - because you have already accepted the offer and the store cannot play the situation back.

An offer that is not addressed to a specific person, but is aimed at everyone at once, is called a public offer.If the parties sign a contract in person, this moment is the acceptance of the offer. Consequently, according to Article 191 of the Civil Code, all terms specified in the contract begin to run from the day after it is signed . It is more difficult to determine the beginning of the time when exchanging signed contracts: in this case, the moment of conclusion of the contract is the moment when the party that submitted the offer received acceptance (the contract signed by the other party).

IP Kruzhkov offered IP Petrova a delivery of tomatoes within a month. He sent Petrova a copy of the contract signed on his part with the date of signing (March 1). Petrova did not return the contract for a long time, referring to illness and employment; as a result, she returned the contract with her signature only on March 23, and on April 10 she sent Kruzhkov a claim for delay.What are the legal consequences of the acceptance of the offer, that is, the conclusion of the contract?

In this situation, there is no delay: the contract is concluded from the moment when Kruzhkov received acceptance, that is, from March 23. This means that the delivery time lasts until April 23, regardless of the date of signing the contract.

Any contract establishes certain rights and obligations of the parties. Accordingly, at least one of them will be obliged to do something in favor of the other side. However, a contract is only a condition for future actions. The fact of the execution of the contract is confirmed by other documents, which in everyday life are called closing.

The fact of execution of the contract must be confirmed in order to:

- the counterparty could not declare (for example, in court) that you did not fulfill or poorly executed the contract concluded with him;

- confirm expenses incurred before the tax authorities and other inspectors.

The fact of payment of the contract , if such payment was carried out in a non-cash manner (from the current account), is not necessary to confirm: if necessary, the bank will issue an account statement. But the fact of delivery of goods, provision of services or performance of work is confirmed by individual papers - the invoice and acts, respectively. They must be stored.

IP Petrova delivered IP Kruzhkovu cucumbers for 12 thousand ₽ prepaid. The driver who brought cucumbers did not sign any documents with Kruzhkov. A month later, Kruzhkov filed a lawsuit demanding the return of money for an allegedly unfulfilled contract, claiming that cucumbers had not been delivered. Petrova was forced to prove the delivery on the basis of indirect evidence (the testimony of the driver, records from the DVR on the machine).

IP Kruzhkov bought a ton of tomatoes for his restaurant for 12 thousand ₽. The driver who delivered the tomatoes handed him the invoice, but Kruzhkov lost it. A year later, the restaurant was faced with a tax audit. Kruzhkov was unable to confirm the costs of tomatoes (12 thousand rubles), because he did not keep the closing documents. He was charged arrears, penalties and fines.

Settlement and cashing

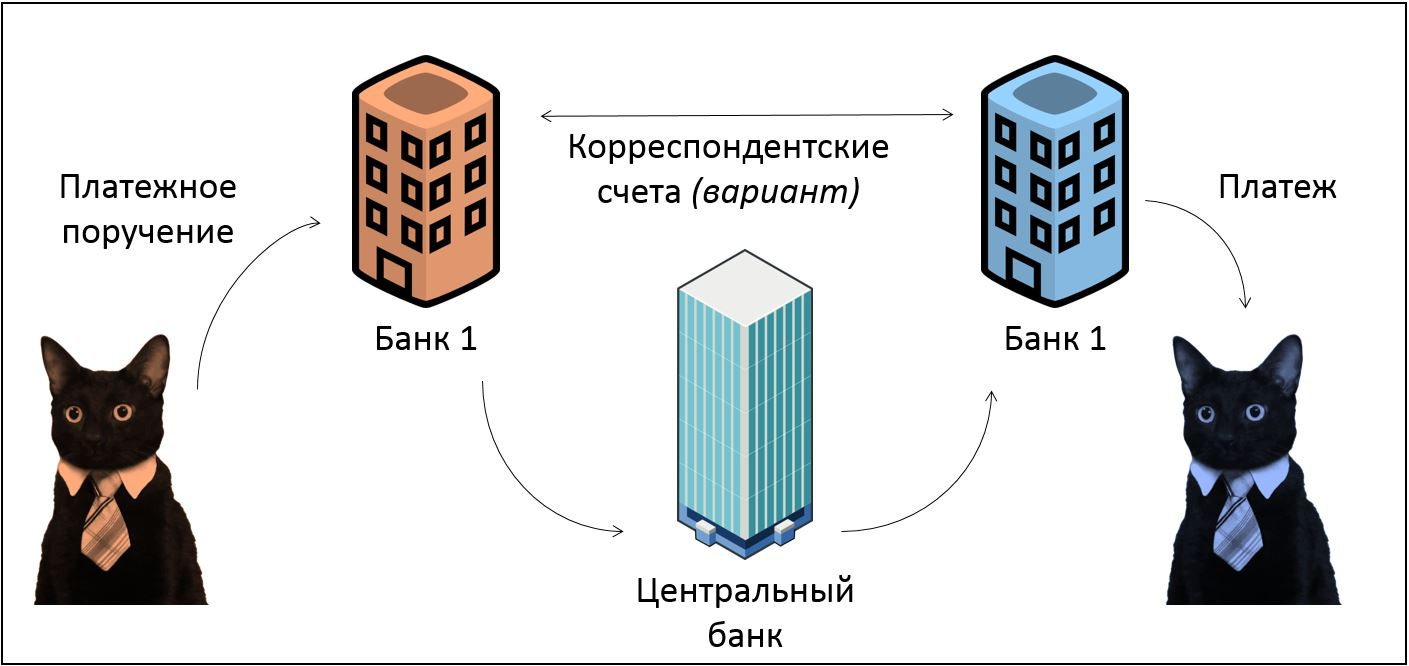

We are accustomed to cash payments (credit cards from the majority of our fellow citizens have recently appeared), while the business has long been working on non-cash payments using special checking accounts. When you need to pay the bill, the entrepreneur gives his bank an order to make a payment. To do this, you need to know the name of the counterparty, its twenty-digit current account and the bank in which it is opened. The money will go from one account to another within a few hours, less often - the next day.

Unlike Western Union transfers and other similar systems, transfers between settlement accounts are carried out through the Bank of Russia payment system or through mutual (correspondent) accounts of banks from each other: of course, physically, money “does not go anywhere”.

The state is interested in businessmen exchanging money in a non-cash order: at the same time, all movements in the account are recorded and subsequently they can be easily raised (for example, when checking). Simply put, cashless settlement is +15 to the whiteness of the business.

Cash gives much more opportunities for unscrupulous entrepreneurs. If cash comes into the company without taking into account (for example, from individuals), then the entrepreneur is tempted not to deposit them in the current account and, accordingly, do not take it into account when paying taxes.

Understanding this, the state is trying to close the loopholes for common machinations that lead to unaccounted cash. Most often, cash registers with fiscal checks, which are stored in the memory of the machine or in the cloud, become a barrier to cash. Thus, the tax (remotely or during a physical inspection) can always see how much money has passed through a particular cash register. The main thing is not to allow sales past the cashier’s office (from the same series, all offers like: “You were not given a check — purchase is free”).

There is a fairly well-developed shadow cashing transfer business. A large number of one-day firms are created in order to transfer taxable non-cash receipts to unrecorded banknotes. It is better not to get involved in such things: firstly, this is in itself unlawful.

Kruzhkov, the sole founder and director of Aleichem LLC, decided to reduce taxation and receive cash not through the withdrawal of dividends, but through cash withdrawal and save a few percent on the payment of personal income tax. Kruzhkov found Lobion LLC, the manager of which offered him to transfer a cashless deposit into cash at a commission of 8%.Secondly, firms like Lobion LLC are often engaged not only in cashing but also in money laundering (in terms of our legislation, “legalization of funds obtained by criminal means”). Consequently, your business will be associated with criminal organizations.

As it turned out later, Lobion LLC was engaged in cashing activities throughout the region. A year later, the manager and his colleagues were prosecuted under art. 172 of the Criminal Code (illegal banking) and Art. 173 (pseudo-enterprise). The transactions from Aleichem LLC were studied, Kruzhkova was brought to the case as a witness. He was charged with tax arrears and a fine, and during the investigation, all computers were removed from his office for a year and a half.

Money laundering, in fact, is the opposite of cashing: in order not to attract the attention of law enforcement agencies, criminals create the appearance of legal origin for their income. To this end, “dirty money” is transferred to companies that receive large cash receipts, ostensibly as part of payment for legal services. In the days of Al Capone, "laundering" was accomplished with the help of small b2c-enterprises like laundry. Such institutions reported inadequately large profits, because the gangsters made their illegal income through them. Formally, there was practically nothing to complain about.

And now a business with a large cash turnover (for example, a network of minibuses) is often associated with shadow circles. Contacting such "entrepreneurs", it is easy to get a real criminal sentence.

Labor Relations

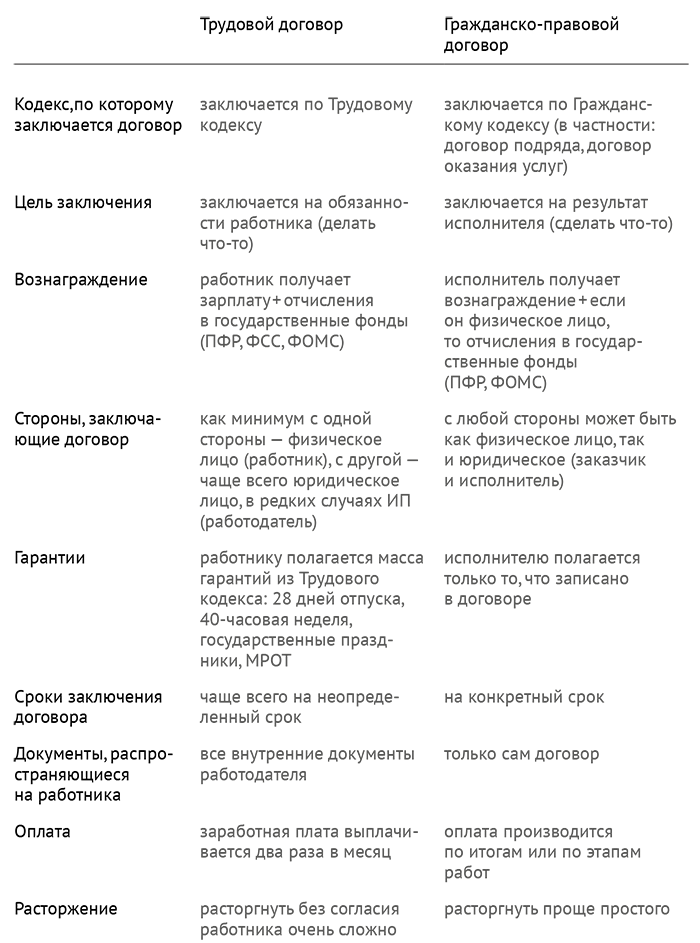

In Russian law, there are two classes of contracts: under labor law and civil law. In some cases (for example, when an entrepreneur hires a contractor - an individual to perform work) this can be formalized both as a labor contract and as a civil law contract.

Comparison of employment and civil contract

From the point of view of payment under both contracts, approximately the same amount will be released (contributions to the FSS are small), but it is not easier to terminate a civil contract. Therefore, employers prefer to use it in order not to bind themselves with restrictions of the Labor Code. However, in this case the rule applies: if the relations regulated by a civil law contract are in fact an employment relationship, the rules of labor law apply to them. Therefore, it is important, entering into a civil contract, to ensure that it includes the result of the work, as well as be urgent. It is necessary to take into account the other signs.

The director of Edelweiss LLC Ibragimov concluded an agreement for the provision of cleaning services with Tokhtarov. The contract stipulated that Tokhtarov comes to the office by 8 am, washes the floors and wipes dust, cleans the tracks from the snow in winter. Payment was recorded monthly.Why employers do not like to enter into employment contracts? The fact is that our Labor Code, inheriting documents from the era of the victorious proletariat, gives the worker a lot of guarantees.

Six months later, Ibragimov fired Tokhtarov. He appealed to the court, where it was recognized that in fact it was about labor relations. Ibragimov was obliged to conclude an employment contract with Tokhtarov under the same conditions, and also to pay him wages for the entire period from the moment of his dismissal.

The most obvious guarantees relate to dismissal. If in American films the boss can simply say: “You are fired” - and the employee goes to pack things in a box, then in Russia it is almost impossible to do this against the will of the employee. Even if he directly violates the contract (works poorly, is late), you will have to collect a whole commission in order to prove it, and then still give such an employee a second chance. There are other paradoxes.

Usually, dismissal occurs in one of three scenarios:

- For violations (under the article). If a worker came drunk or absent, you need to draw up a corresponding act with several signatures. If he simply does not work well, he will have to do a certification. In general, any violations have to be reasoned in detail, therefore, they are rarely dismissed for them. More often, an employee is offered to resign voluntarily. In this case, the employer will make less effort, and the employee will receive a workbook without unpleasant details.

- At their own request. This is the most conflict-free option. In this case, the employee must work for two weeks (by agreement with the employer, it is possible even less). Then he will receive the final payment (including payment of unused vacation) and documents in his hands - if, of course, he does not change his mind about leaving.

- By agreement of the parties. If the employee is stubborn, the employer may try to negotiate with him for additional compensation, subject to dismissal. This is called dismissal by agreement of the parties: in fact, this is a deal “you quit — I pay compensation.”

In addition to the employment contract, several other documents appear in the employment relationship, and above all - the employment record. All employers are recorded in this relic of the Soviet system - this is how the book confirms experience and competence of work. Now there is not much sense in it: the labor history is still recorded in the Pension Fund, and anyone can get at least a million labor records. Many have them in several pieces for simultaneous work in different firms.

However, organizations are still required to keep employment records. Moreover, the documents regulating their storage, clearly give mothballs:

"The receipt and expenditure book on the accounting of the workbook forms and the insert into it and the account book of the movement of the workbooks and inserts in them must be numbered, strung together, signed by the head of the organization, and also sealed with a wax seal ..."In addition to workbooks, organizations must maintain a mass of personnel documents (personnel documents). And not only to lead, but also to store from 50 to 75 years! Such documents, for example, are:

(from the Government Decree "On workbooks") .

- The staff list is a table where all the rates (positions) of the company are listed. To accept an employee, an employer must open a bid with such a salary;

- employee's personal card - something like a personal file with information about an employee: where he served, what university he graduated from, what language he knows. Before 1997, there were “party spirit and nationality” columns;

- timesheet - a table that indicates which employees have come to work and when.

The overwhelming majority of these documents have been on computer for a long time (in Excel or in accounting software). However, by law, a huge amount of paper must be duplicated in paper form. Compliance with these requirements is monitored by a special service - Rostrud. Previously, she checked organizations at will, now she does it mainly on complaints of employees.

Fortunately, we are gradually moving away from archaic demands. There are no mandatory forms of labor documents, and since 2017. microenterprises (with up to 15 employees) in general can be limited to standard employment contracts - if only they pay contributions to extra-budgetary funds. I want to believe that someday and labor books will sink into oblivion.

Employees and Content Rights

Employers usually assume that the rights to content created by full-time employees belong to the organization by default. In fact, this is absolutely not the case. Neither what is created on the employer's equipment, nor what is done during working hours, does not automatically become the property of the employer.

Turner Peter in his shift, instead of doing his job, machined on the factory machine a brilliant mechanism. The plant demanded to give him all the rights to it. Does he have that right? No, because the worker acted outside his work duties. Everything that is created outside the employment contract belongs only to the employee.In fact, intellectual property passes to the employer while simultaneously observing the following conditions.

- Creation of the work was part of the labor function of the employee, his job duties (Art. 1370 of the Civil Code). Employment duties can be specified in the employment contract or, if the employment contract is written in general terms, in the additional job description. Remember the chapter on routine? The employee is subject to all internal documents adopted by the employer.

Masha wrote the code and refused to transfer it to the employer. In the contract concluded with her, it is not stipulated that Masha “writes the code in C #”, so she has the right to say that she acted outside her work obligations.

The employer showed a job description, which indicated the obligation to “write code in C #”, as well as an order that Masha was assigned to write a specific algorithm. However, Masha said that she had never seen these documents and, accordingly, would not sign them. In this situation, Masha is right: the employer can hardly prove that Masha knew about the existence of these documents. - The result of the assignment is transmitted and recorded - ideally, by an act or official note containing the result (screenshots, decryption, etc.). Otherwise, the employee can always say that he did not fulfill the task and, accordingly, could not pass the result to anyone.

Masha worked as a programmer at Koder LLC. One day she sold part of her code to competitors from V Production. The boss found out about it and called her on the carpet, but Masha didn’t lose her head and said that the code transferred to competitors wrote at home during off hours. Until the head had any proof of what code Masha wrote for Koder LLC, stop the leak will be impossible.

There is also an important condition for the transfer of the code to the employer - remuneration (and wages are not considered appropriate remuneration). In itself, the lack of remuneration does not lead to the return of the IP employee, but he has reason to file a lawsuit for compensation.

If not all conditions are met, the employee will have the opportunity to retain intellectual property. In this case, he may not swear with the employer, but go to a competitor, taking all the results with him.

In some cases, it is difficult to fully comply with the requirements of the legislation. For example, a company is engaged in development, employees work on tickets and upload updated code to a common repository; duplicate this acts and listing, of course, strange. Therefore, the intellectual property regime in an organization is a balance: on the one hand, to close the main risks, on the other - to preserve adequacy in the eyes of employees.

For example, the source code can be protected as NDA know-how; you can transfer to CD / DVD-R and sign for them; You can specify in detail the order of loading into the external reference repository from personal accounts. Alternatively, you can take all the relations on intellectual property in separate (copyright) contracts that are much easier to write, sign and translate into English for investors.

Options

After Silicon Valley, many Russian start-ups began to offer employees options - incentives in the form of shares or shares of a startup. By endowing employees with shares (or the right to buy a share at par after a certain period of work), the employer saves on salaries and increases the motivation of employees. The faster the company develops, the more expensive the option becomes with it.

However, not all so simple.

- wisely organize an option is difficult. A competent organization means that the employee is confident that he will receive the option, and the employer is confident that the employee will not interfere in the management of the company. Unqualified lawyers organize options in two ways (both wrong):

- Employees receive a promise from the employer to transfer a share to them - in this case, under Russian law, the employer is not obliged to do anything with them and can always take back their promise;

- employees immediately get a share in the company - this makes them full-fledged members of the company, including the right to a part of its profits, as well as the opportunity to participate in management and block unfavorable decisions. This creates problems for large participants in the company, primarily investors. - options are transferred to employees without a system and without established performance indicators (KPI). As a result, at best, nothing changes, and at worst - employees are too much involved with the new status and just stop working.

- An option in itself does not give the employee additional profit. In order to convert a share in the company into profit, it must be sold, and who needs a minority share in a loss-making enterprise? Without the condition of joining an investment transaction (tag-along) or the option of buying a company by an employee, an employee can wait for the option to be exercised for years.

Taking into account these factors, I do not advise getting involved in the distribution of options to employees in the early stages, without enlisting the support of investors. If for some reason the use of the option is unavoidable, it is better to use the “phantom option” - in fact, an agreement on an additional bonus to the employee for the performance of the established KPIs. Once transferred to the share in a startup is very difficult to return, and a large number of owners is always worse than one.

For those who do not want to wait for the publication of the remaining chapters on Habré - a link to the PDF of the full book is in my profile.

Source: https://habr.com/ru/post/336316/

All Articles