Fill in "Agreements, taxes and banking information" in iTunes connect for Russian LLC

How to place your application in the App Store, if you are a legal entity from Russia? Instructions for IP on the Internet can be found a lot. But if you are brave, dexterous, skillful, heard the name of your jungle (pun from the childhood of the 90s, if someone did not understand) and designed a fool LLC, then you will have a lot of difficulties on the way to conquer iTunes Connect. Therefore, having decided to interrupt this vicious circle of searching for answers to questions about how to fill out the unfortunate tax information for an LLC, I hasten to share my experience.

So, you already understood that you didn’t choose the best option by registering LLC for a developer account Apple. But the goal is set, not a step back. There are several ways:

It turned out that my small company is inhabited by missing people, and we went a third way, because, as practice proves, until you plunge into the fetid depths, you will not believe anyone that you shouldn't do that. In general, we are practicable, and not prudent theorists. B zababahali account for LLC.

')

I will not tell in detail how we got the DUNS number, this procedure is described by many. I will share only my life hacking: we managed to get it absolutely free . Having come across a resource , I simply drove in the name of my company on transliteration, and voila - I had my DUNS number.

Finally, the stage of filling in the section “Agreements, taxes and banking information” has arrived. Without it, you can not sell your application.

With a bank, in fact, everything is simple, if you have a current account, and if not, then you will still have to open it:

1. Choose a country (in our case, Russian Federation)

2. We drive in the bank's BIC, according to which the system determines the name of the bank.

3. We drive in the number of our current account and the name of the account holder - in our case this is the name of our legal entity.

4. Choose a currency - the Russian ruble.

5. Enter the TIN and the number of the correspondent account.

6. Confirm info.

Bank information is confirmed as soon as we fill out the tax form. Up to this point, it will hang in the status check.

We turn to the most important thing - fill in Tax Info .

Since we are a Russian LLC, we are not a US resident and do not have any assets in the US, click “No” in two questions and go directly to the form itself.

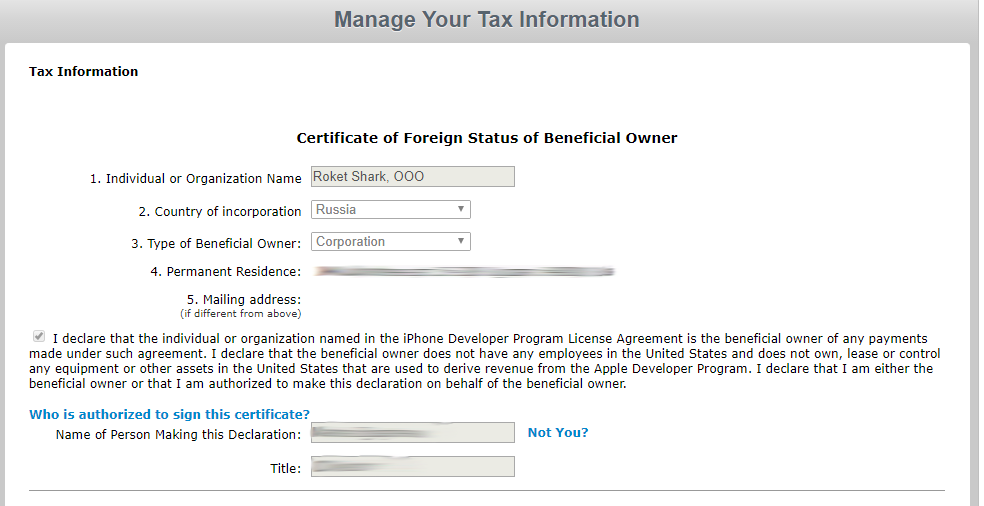

Put a checkbox, confirming that you do not have assets and business in the United States and that you are an authorized person of the company

We write our name and position in the company and go to Part I.

1. Points 1, 2, 3, 6, 7, I think, will not cause you questions.

2. Points 8, 9b and 10 are left blank.

1. We put a check in paragraph 14a, thereby confirming that you are a resident of Russia and within the framework of the agreement between Russia and the United States do not fall under double taxation. The remaining items in the 14th section are left blank.

2. In paragraph 15, set 0.00% and two checkboxes:

- Income from the sale of applications - income from the sale of the application.

- Other (please specify) - write In app purchases - income from in-game purchases.

Everything is simple here:

1. put a check in the paragraph "Under the penalties of perjury, I declare ..."

2. put a daw at the end of “I certify that I’ve identified a line of this form”.

3. Click Submit, check all the data again and finally confirm the completion of the form.

In theory, within 30 days you should be notified of any errors. But they should not be. Good luck!

So, you already understood that you didn’t choose the best option by registering LLC for a developer account Apple. But the goal is set, not a step back. There are several ways:

- To hammer on LLC and to be placed as the physicist (gemmor least), having paid one more annual subscription in $ 99.

- To score on a Russian legal entity and register a company in the United States (“Hemmor is, but can be treated,” - the advice of experienced large companies).

- Go through all the circles of hell and with a crippled psyche hoist the banner to the top of the iTunes Connect account.

It turned out that my small company is inhabited by missing people, and we went a third way, because, as practice proves, until you plunge into the fetid depths, you will not believe anyone that you shouldn't do that. In general, we are practicable, and not prudent theorists. B zababahali account for LLC.

')

I will not tell in detail how we got the DUNS number, this procedure is described by many. I will share only my life hacking: we managed to get it absolutely free . Having come across a resource , I simply drove in the name of my company on transliteration, and voila - I had my DUNS number.

Finally, the stage of filling in the section “Agreements, taxes and banking information” has arrived. Without it, you can not sell your application.

With a bank, in fact, everything is simple, if you have a current account, and if not, then you will still have to open it:

1. Choose a country (in our case, Russian Federation)

2. We drive in the bank's BIC, according to which the system determines the name of the bank.

3. We drive in the number of our current account and the name of the account holder - in our case this is the name of our legal entity.

4. Choose a currency - the Russian ruble.

5. Enter the TIN and the number of the correspondent account.

6. Confirm info.

Bank information is confirmed as soon as we fill out the tax form. Up to this point, it will hang in the status check.

We turn to the most important thing - fill in Tax Info .

Tax info

Since we are a Russian LLC, we are not a US resident and do not have any assets in the US, click “No” in two questions and go directly to the form itself.

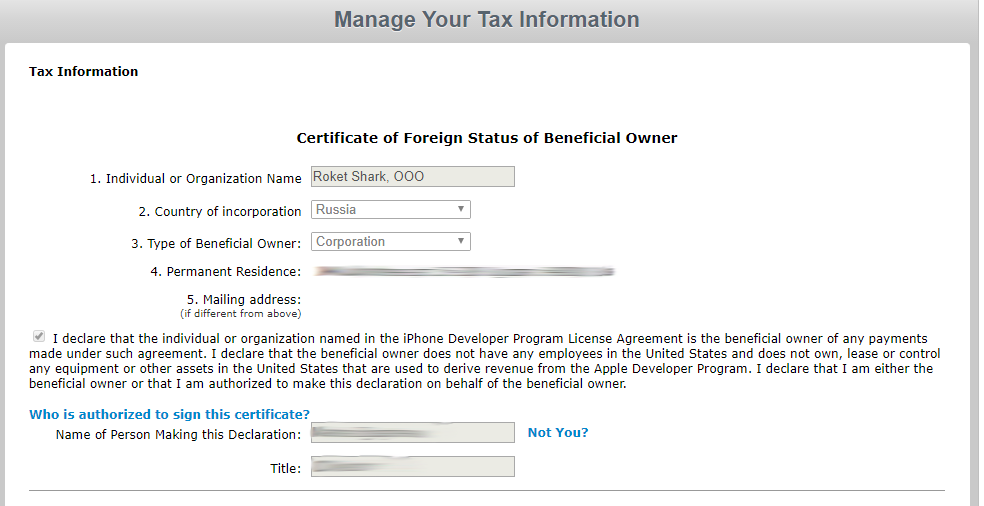

- Individual or Organization Name - this information is recorded automatically from the data of your DUNS - transliteration of the name of your LLC (transliteration may differ from the English name of your company, if you have it, of course. In our case, ROCKET SHARK is an English name, but in tax the information means Roket Shark. In D & B Russian support I was assured that there is nothing to worry about).

- Country of incorporation - Russia

- Type of Beneficial Owner. I put the Corporation. There are many discussions about the relevance of Russian forms of organizations and English-speaking. But in fact, Apple deeply does not care what you put here, the main thing is not to state-owned corporation.

- Permanent Residence. The legal address of your company. Filled as automatically.

- I put the address for the mail the same, daw "Coincides with the legal address."

Put a checkbox, confirming that you do not have assets and business in the United States and that you are an authorized person of the company

I’m hereby making this agreement. I declare ...

We write our name and position in the company and go to Part I.

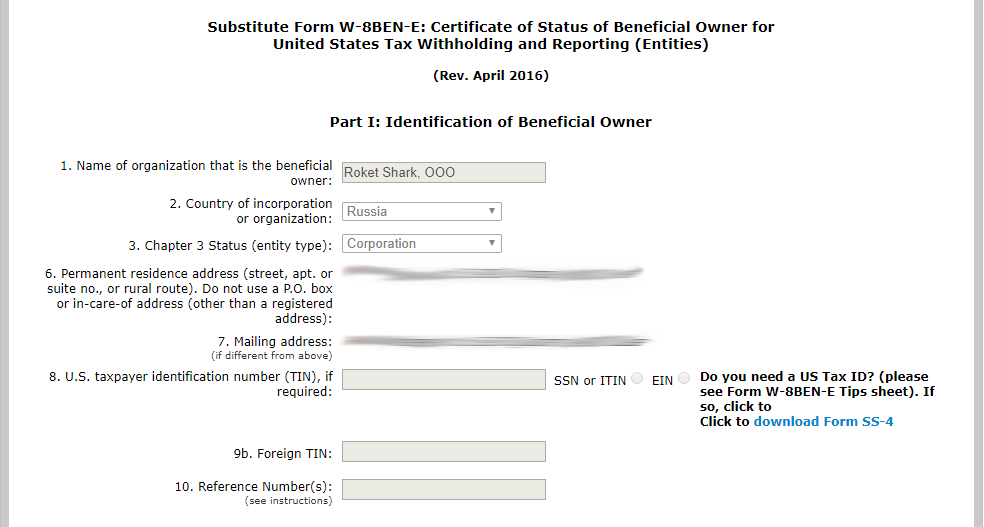

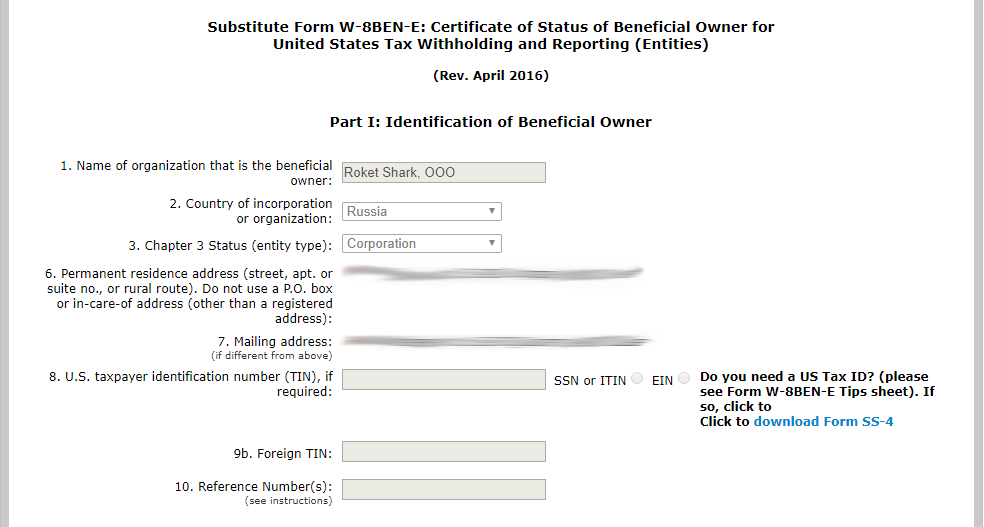

Part I.

1. Points 1, 2, 3, 6, 7, I think, will not cause you questions.

2. Points 8, 9b and 10 are left blank.

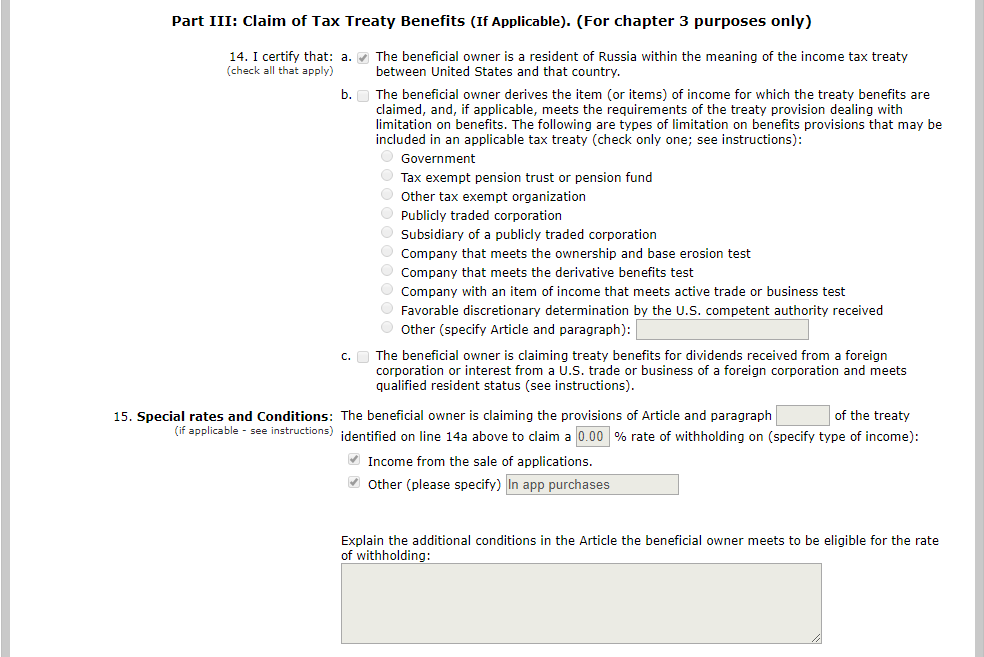

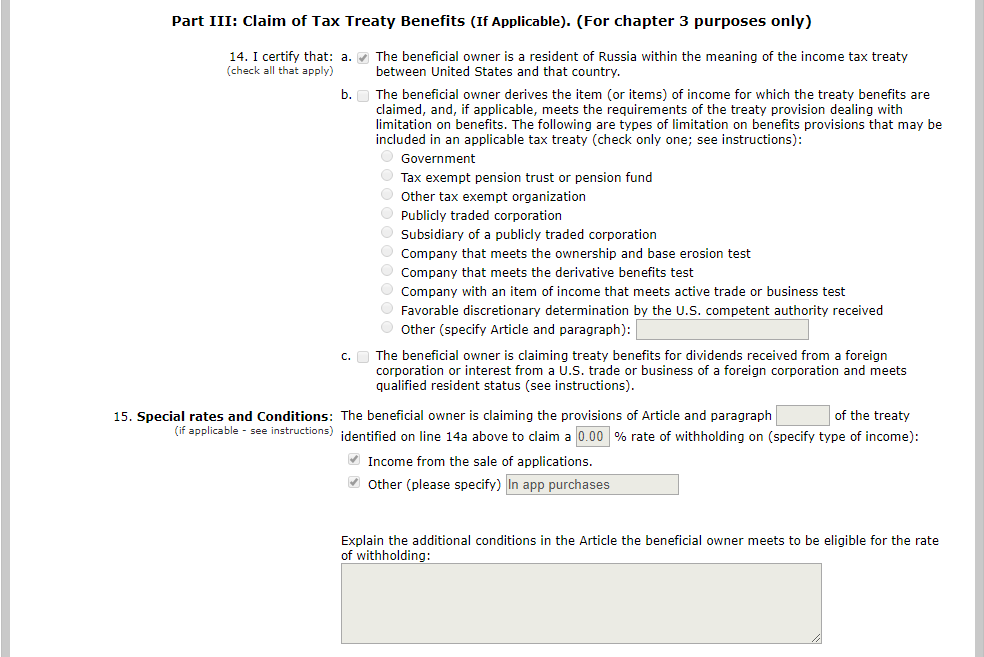

Part III

1. We put a check in paragraph 14a, thereby confirming that you are a resident of Russia and within the framework of the agreement between Russia and the United States do not fall under double taxation. The remaining items in the 14th section are left blank.

2. In paragraph 15, set 0.00% and two checkboxes:

- Income from the sale of applications - income from the sale of the application.

- Other (please specify) - write In app purchases - income from in-game purchases.

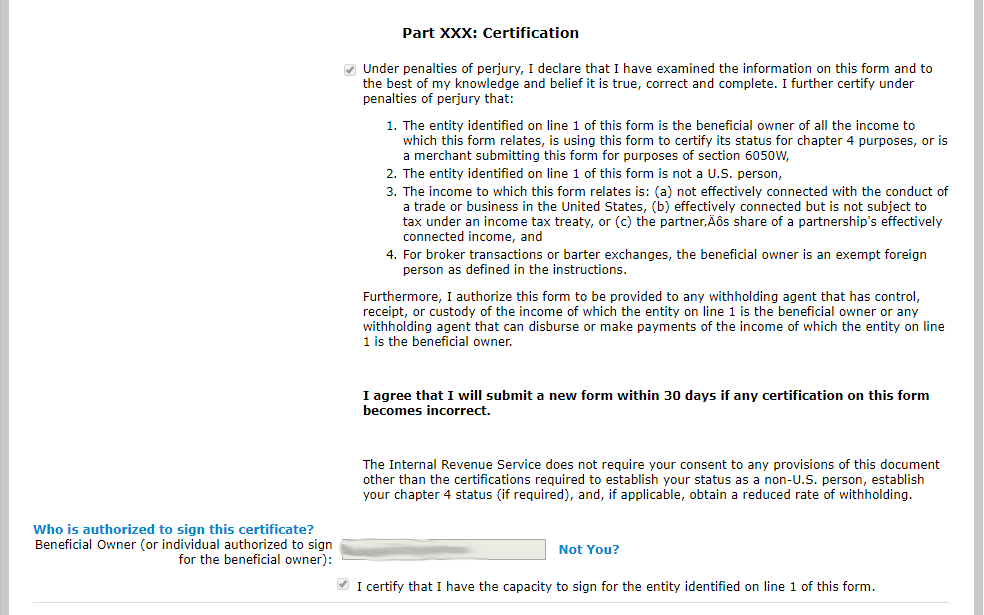

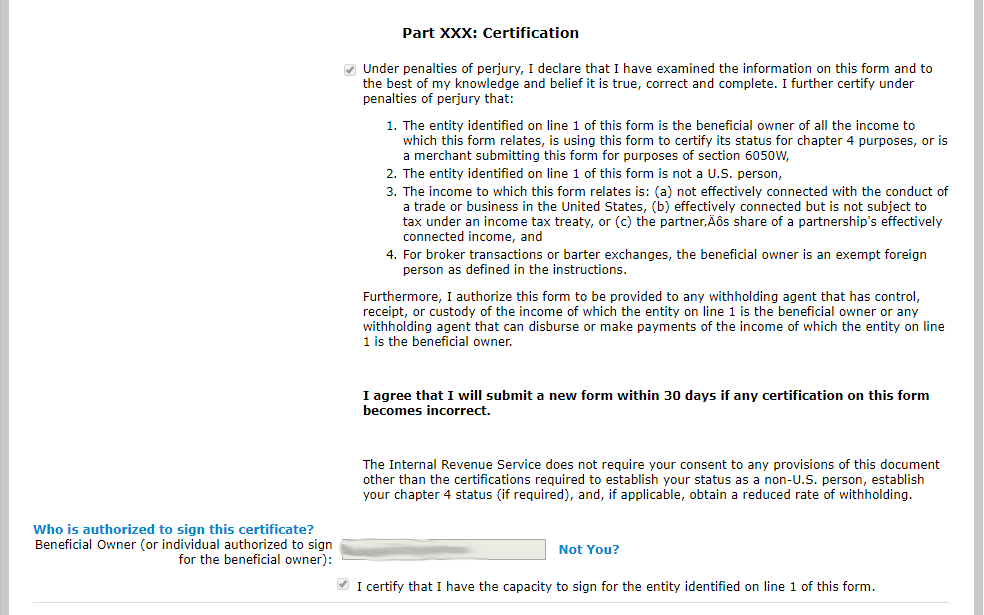

Part XXX: Certification

Everything is simple here:

1. put a check in the paragraph "Under the penalties of perjury, I declare ..."

2. put a daw at the end of “I certify that I’ve identified a line of this form”.

3. Click Submit, check all the data again and finally confirm the completion of the form.

In theory, within 30 days you should be notified of any errors. But they should not be. Good luck!

Source: https://habr.com/ru/post/336236/

All Articles