Six myths about the blockchain and Bitcoin, or Why it is not such an effective technology

The author of the article is Alexey Malanov, an expert in the development of anti-virus technologies at Kaspersky Lab.

I have repeatedly heard the opinion that the blockchain is very cool, it is a breakthrough, the future is next. I hasten to disappoint you, if you suddenly believe in it.

Specification: in this post we will talk about the variant of implementation of the blockchain technology used in Bitcoin cryptocurrency. There are other applications and implementations of the blockchain, some of them have eliminated any shortcomings of the “blockchain classic”, but usually they are built on the same principles.

')

By itself, Bitcoin technology is considered revolutionary. Unfortunately, Bitcoin is used too often for criminal purposes, and I, as an information security specialist, don’t like it at all. But if we talk about technology, there is a breakthrough.

All components of the Bitcoin protocol and the ideas embodied in it, in general, were known until 2009, but it was the authors of Bitcoin who managed to make everything together and make it work in 2009. For almost 9 years, only one critical vulnerability was found in the implementation: on one account, the attacker received 92 billion bitcoins, the fix required a rollback of the entire financial history for a day. Nevertheless, only one vulnerability in such a period is a decent result, I take off my hat.

The authors of Bitcoin had a task: to make it work somehow, provided that there is no center and that no one trusts anyone. The authors have completed the task, the electronic money is functioning. But the decisions they made are monstrous in their inefficiency.

I’ll just say that the purpose of this post is not to discredit the blockchain. This is a useful technology that has already found and still will find many wonderful applications. Despite its shortcomings, it has unique advantages. However, in the pursuit of sensationalism and revolutionism, many are concentrating on the advantages of technology and often forget to soberly assess the real state of affairs, ignoring the minuses. Therefore, I consider it useful for diversity to consider precisely the shortcomings.

An example of a book in which the author places high hopes on the blockchain. Further in the text will be quotes from this book.

Quotation No. 1: "The blockchain can become an Occam's razor, the most effective, direct and natural means of coordinating all human and machine activity, corresponding to the natural desire for balance."

If you did not delve into the principles of the blockchain , and only heard reviews about this technology, you could get the impression that the blockchain is a kind of distributed computer that performs, respectively, distributed computing. They say that nodes around the world are collecting something more.

Such a representation is fundamentally wrong. In fact, all nodes serving the blockchain do exactly the same thing. Millions of computers:

No parallelization, no synergy, no mutual assistance. Only duplication, and immediately a million times. We will talk about why this is needed below, but, as you see, there is no effectiveness. Quite the contrary.

Quotation # 2: “With the spread of decentralized applications, organizations, corporations and societies, many new types of unpredictable and complex behavior, reminiscent of artificial intelligence (AI), may appear.”

Yes, indeed, as we found out, each full-fledged client of the network stores the entire history of all transactions, and more than 100 gigabytes of data has already come up. This is the total disk space of a cheap laptop or the most modern smartphone. And the more transactions in the Bitcoin network are performed, the faster the volume grows. Most have appeared in the last couple of years.

Growth blockchain volume. A source

And Bitcoin was still lucky - his competitor, the Ethereum network, in just two years after its launch and half a year of active use in the blockchain, 200 gigabytes has already run up. So, in current realities, the blockchain's eternity is limited to a dozen years - the increase in the capacity of hard drives definitely does not keep pace with the growth in the blockchain volume.

But besides the fact that it must be stored, it must also download. Anyone who tried to use a full-fledged local wallet for any cryptocurrency, was amazed to find that he could not make and receive payments until he had downloaded and verified the entire specified amount. You are lucky if this process takes only a couple of days.

You ask, is it possible not to keep it all, since this is the same thing on each node of the network? It is possible, but then, firstly, it will not be a peer-to-peer blockchain, but a traditional client-server architecture. And secondly, then the clients will have to trust the servers. That is, the idea of “not trusting anyone”, for the sake of which, including the blockchain, was invented, in this case disappears.

For a long time, Bitcoin users are divided into enthusiasts who “suffer” and download everything, and to ordinary people who use online wallets, trust the server and who, in general, don't care how it works there.

Quote number 3: “The combination of“ blockchain-technology + personal connection of the body ”will allow you to encode and make available all the thoughts of a person in a standardized compressed format. Data can be captured by scanning the cerebral cortex, EEG, brain-computer interfaces, cognitive nanorobots, etc. Thinking can be represented in the form of chains of blocks, writing down almost all of the human subjective experience and, possibly, his consciousness. After writing to the blockchain, various components of memories can be administered and transmitted — for example, to restore memory in case of diseases accompanied by amnesia. ”

If each network node does the same thing, then it is obvious that the bandwidth of the entire network is equal to the bandwidth of one network node. And you know what exactly it is equal to? Bitcoin can process a maximum of 7 transactions per second - at all.

In addition, in the Bitcoin blockchain transactions are recorded only once every 10 minutes. And after the recording appears, for reliability, it is customary to wait another 50 minutes, because the recordings regularly roll back spontaneously. Now imagine what you need to buy for bitcoin gum. Just an hour stand in the store, think.

Within the framework of the whole world, this is ridiculous now, when hardly every thousandth inhabitant of the Earth uses Bitcoin. And with such a speed of transactions significantly increase the number of active users and will not work. For comparison: Visa processes thousands of operations per second, and if necessary it will easily increase capacity, because classical banking technologies are just scalable.

Even if the usual money and die out, it is clearly not because they block the blockchain solutions.

Quotation # 4: "Autonomous enterprises in the cloud operating on the blockchain basis and operating on the basis of smart contracts could enter into electronic agreements with relevant organizations, for example, with governments, in order to register themselves under any jurisdiction under which they want to work."

You have probably heard about the miners, the giant mining farms that are built next to power plants. What are they doing? They burn electricity for 10 minutes, “shake” the blocks until they become “beautiful” and can be included in the blockchain ( we told about the “beautiful” blocks and why to “shake” them in the previous post ). This is necessary in order to rewrite financial history takes as much time as writing it (provided that you have the same total power).

Electricity is spent as much as the city consumes per 100,000 inhabitants. But add here also expensive equipment that is suitable solely for mining. The principle of mining (the so-called proof-of-work) is identical to the concept of “burning the resources of mankind”.

Blockchain optimists like to say that miners do not just do useless work, but ensure the stability and security of the Bitcoin network. This is true, the only problem is that miners protect Bitcoin from other miners .

If the miners were a thousand times smaller and would burn a thousand times less electricity, Bitcoin would function just as well - the same one block every 10 minutes, the same number of transactions, the same speed.

With regard to blockchain solutions, there is a risk of “ 51% attack ”. The essence of the attack is that if someone controls more than half of all mining capacities, he can secretly write an alternative financial history from everyone, in which he did not give his money to anyone. And then show everyone your version - and it will become a reality. Thus, he gets the opportunity to spend his money several times. Traditional payment systems are not subject to such an attack.

It turns out that Bitcoin became a hostage to its own ideology. “Superfluous” miners cannot stop mining, because then the probability that someone alone will control more than half of the remaining power will sharply increase. While profit is profitable, the network is stable, but if the situation changes (for example, because electricity will rise in price), the network may face massive “double spending”.

Quotation No. 5: “In order to become a full-fledged organization, a decentralized application must contain more complex functionality, for example, a constitution.”

It probably seems to you that, since the blockchain is stored on each node of the network, the special services will not be able to close Bitcoin if they wish, because it does not have some kind of central server or something like that - there is nobody to come to close. But this is an illusion.

In fact, all the “independent” miners are pooled (essentially cartels). They have to unite, because it is better to have a stable but small income than a huge one, but once in 1000 years.

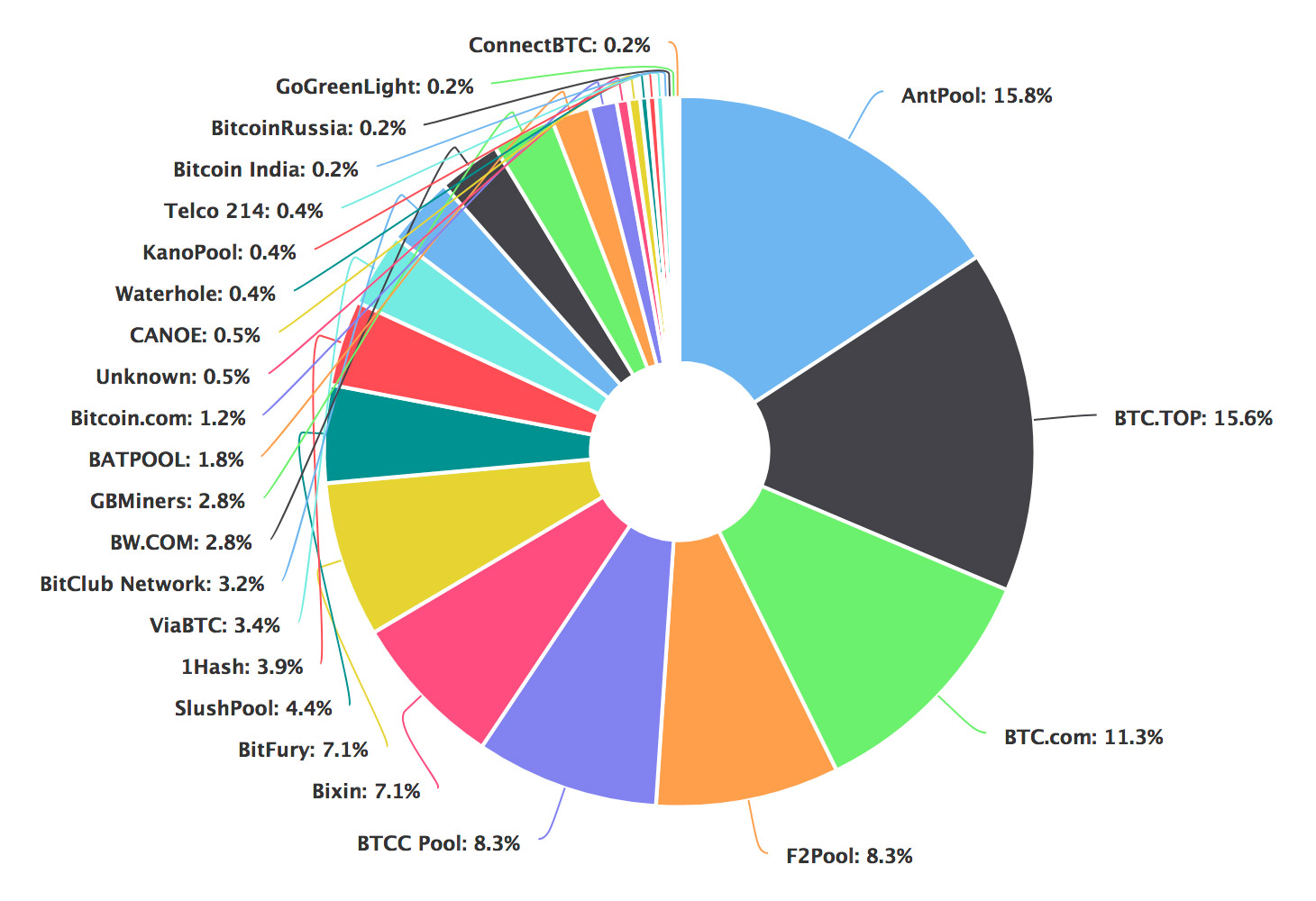

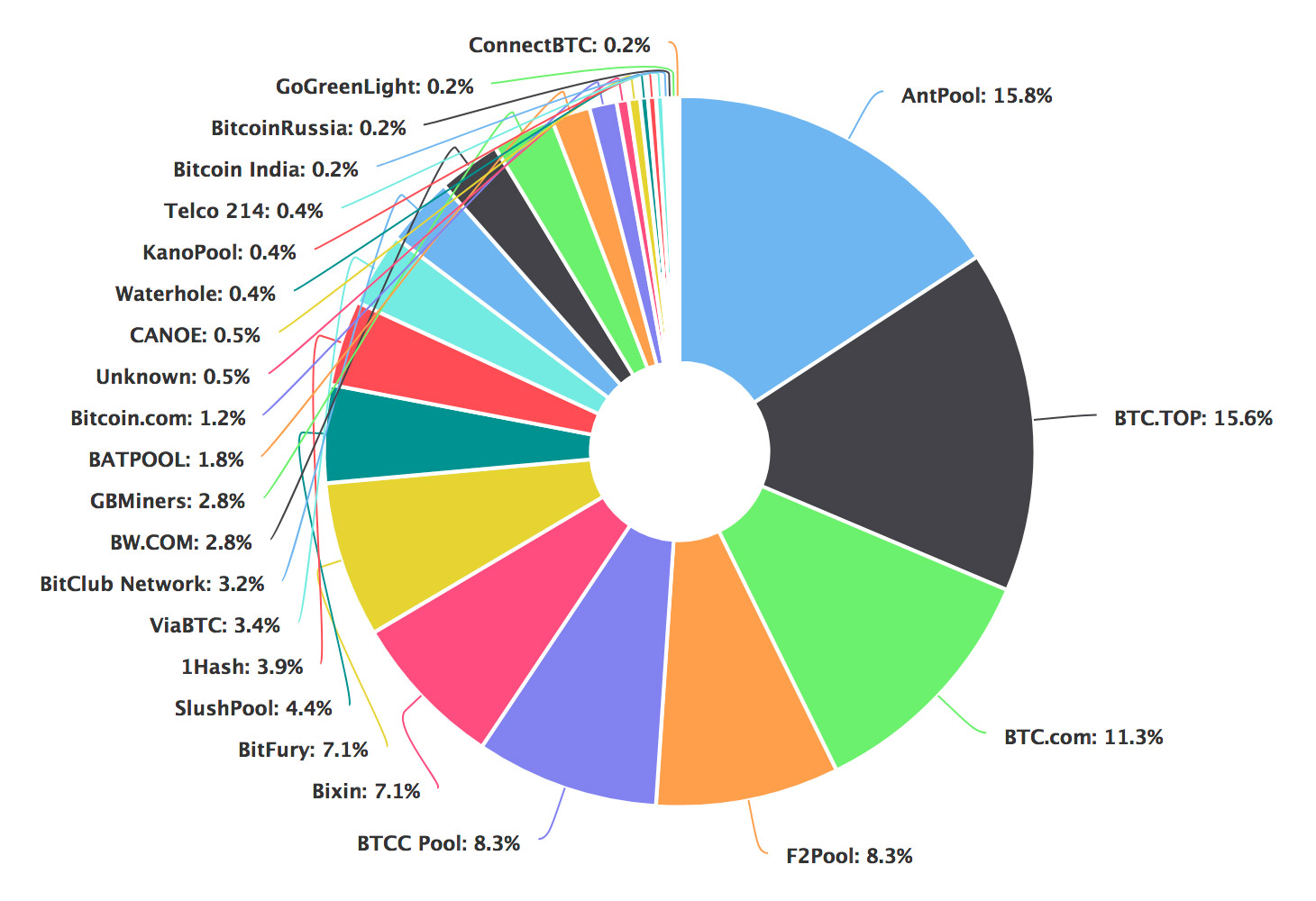

Bitcoin power distribution by pool. A source

As you can see on the diagram, large pools are about 20, and only 4 of them control more than 50% of the total capacity. It is enough to knock on four doors and get access to four control computers so that you have the opportunity to spend the same bitcoins more than once on your Bitcoin network. And, as you understand, such an opportunity will somewhat devalue bitcoin. And this task is quite feasible.

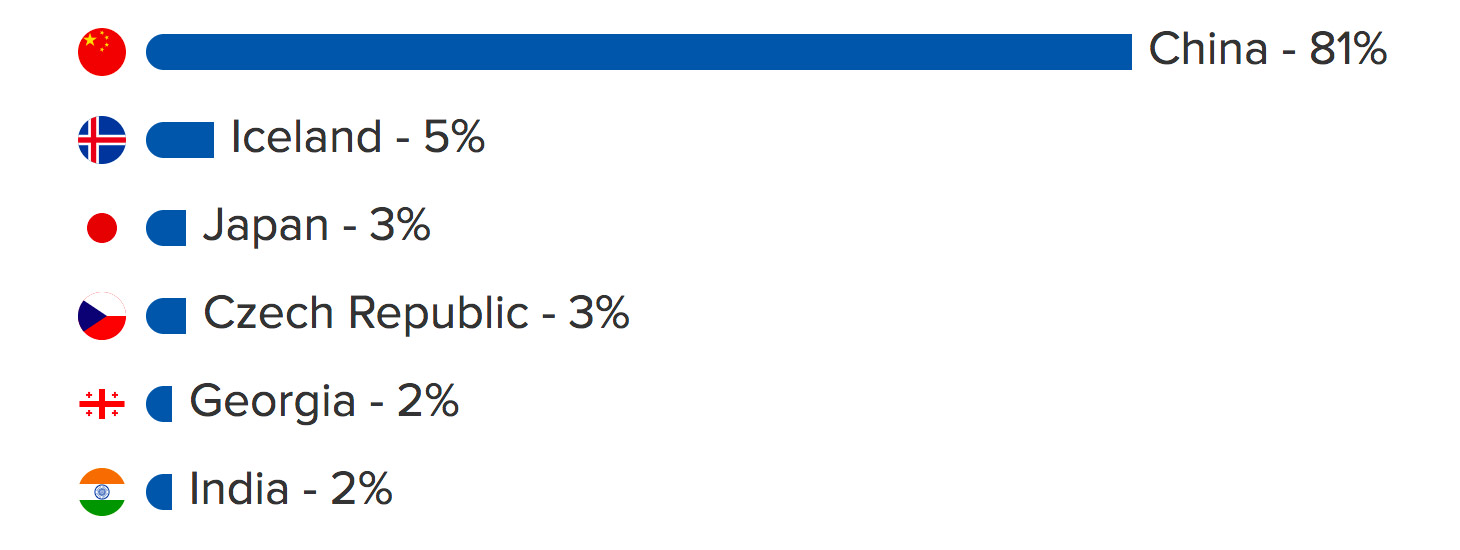

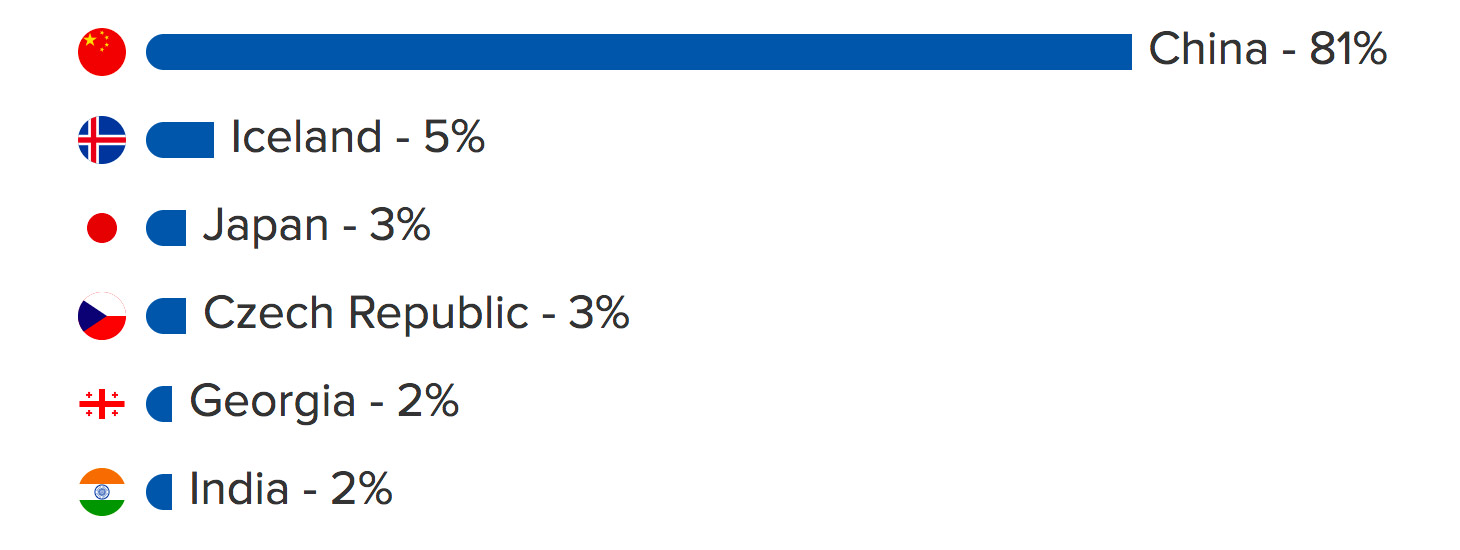

The distribution of mining by country. A source

But the threat is even more real. Most pools, along with their computing power, are in the same country, making it easier to take control of Bitcoin.

Quotation 6: “In the era of the blockchain, the traditional“ government 1.0 ”in many respects becomes an outdated model and there are opportunities for the transition from inherited structures to more personalized forms of government.”

The blockchain is open, everyone sees everything. So in Bitcoin there is no anonymity, he has “pseudonymity”. For example, if an attacker demands a ransom for a wallet, then everyone understands that the wallet belongs to the bad guy. And since anyone can follow the transactions from this wallet, then the fraudster will not be able to take advantage of the bitcoins received, because it is worth revealing the person somewhere, as he is immediately imprisoned. At almost all the exchanges, it is necessary to pass identification in order to exchange for ordinary money.

Therefore, attackers use the so-called "mixer". The mixer mixes dirty money with a lot of clean money, and thus "launders" them. The attacker pays a large commission for this and takes a lot of risks, because the mixer is either anonymous itself (and can run away with money), or already under the control of someone influential (and can be handed over to the authorities).

But let's leave the problems of criminals, what is the pseudonymity bad for honest users? Here is a simple example: I translate some bitcoins to my mother. After that, she knows:

Or if I returned my debt to a friend for lemonade, then he now knows everything about my finances. Do you think this is nonsense? Is it weak for everyone to open the financial history of their credit cards? Moreover, not only the past, but the whole future.

If for individuals this is still far away (well, you never know, someone wants to be "transparent"), then for companies it is deadly: all of their counterparties, purchases, sales, customers, volume of accounts, and generally everything, everything, everything becomes public. The openness of finance is perhaps one of the biggest flaws in Bitcoin.

Quotation No. 7: “It is possible that blockchain technology will have to become the top economic layer of the organically connected world of various computing devices, including wearable computing devices, sensors of the“ Internet of things ”.

I have listed six major complaints about Bitcoin and the version of the blockchain used in it. You ask, why did you hear about it from me, and not earlier from someone else? Does anyone see any problems?

Someone is blinded, someone simply does not understand how it works , and someone sees and realizes everything, but it is simply unprofitable for him to write about it. Think for yourself, many of those who bought bitcoins, begin to advertise and promote them. Such a pyramid comes out. Why write that technology has flaws if you are counting on a growth rate?

Yes, Bitcoin has competitors who have tried to solve certain problems. And although some ideas are very good, the blockchain is still the basis. Yes, there are other non-monetary uses of the blockchain technology, but the key drawbacks of the blockchain remain there.

Now, if someone tells you that the invention of the blockchain is comparable in importance to the invention of the Internet, treat this with a fair amount of skepticism.

I have repeatedly heard the opinion that the blockchain is very cool, it is a breakthrough, the future is next. I hasten to disappoint you, if you suddenly believe in it.

Specification: in this post we will talk about the variant of implementation of the blockchain technology used in Bitcoin cryptocurrency. There are other applications and implementations of the blockchain, some of them have eliminated any shortcomings of the “blockchain classic”, but usually they are built on the same principles.

')

About Bitcoin in general

By itself, Bitcoin technology is considered revolutionary. Unfortunately, Bitcoin is used too often for criminal purposes, and I, as an information security specialist, don’t like it at all. But if we talk about technology, there is a breakthrough.

All components of the Bitcoin protocol and the ideas embodied in it, in general, were known until 2009, but it was the authors of Bitcoin who managed to make everything together and make it work in 2009. For almost 9 years, only one critical vulnerability was found in the implementation: on one account, the attacker received 92 billion bitcoins, the fix required a rollback of the entire financial history for a day. Nevertheless, only one vulnerability in such a period is a decent result, I take off my hat.

The authors of Bitcoin had a task: to make it work somehow, provided that there is no center and that no one trusts anyone. The authors have completed the task, the electronic money is functioning. But the decisions they made are monstrous in their inefficiency.

I’ll just say that the purpose of this post is not to discredit the blockchain. This is a useful technology that has already found and still will find many wonderful applications. Despite its shortcomings, it has unique advantages. However, in the pursuit of sensationalism and revolutionism, many are concentrating on the advantages of technology and often forget to soberly assess the real state of affairs, ignoring the minuses. Therefore, I consider it useful for diversity to consider precisely the shortcomings.

An example of a book in which the author places high hopes on the blockchain. Further in the text will be quotes from this book.

Myth 1: Blockchain is a giant distributed computer

Quotation No. 1: "The blockchain can become an Occam's razor, the most effective, direct and natural means of coordinating all human and machine activity, corresponding to the natural desire for balance."

If you did not delve into the principles of the blockchain , and only heard reviews about this technology, you could get the impression that the blockchain is a kind of distributed computer that performs, respectively, distributed computing. They say that nodes around the world are collecting something more.

Such a representation is fundamentally wrong. In fact, all nodes serving the blockchain do exactly the same thing. Millions of computers:

- Check the same transaction by the same rules. Produce identical work.

- Write in the blockchain (if lucky and given the opportunity to write) the same thing.

- Keep the whole story for all the time, the same, one for all.

No parallelization, no synergy, no mutual assistance. Only duplication, and immediately a million times. We will talk about why this is needed below, but, as you see, there is no effectiveness. Quite the contrary.

Myth 2: Blockchain is forever. Everything written in it will remain forever

Quotation # 2: “With the spread of decentralized applications, organizations, corporations and societies, many new types of unpredictable and complex behavior, reminiscent of artificial intelligence (AI), may appear.”

Yes, indeed, as we found out, each full-fledged client of the network stores the entire history of all transactions, and more than 100 gigabytes of data has already come up. This is the total disk space of a cheap laptop or the most modern smartphone. And the more transactions in the Bitcoin network are performed, the faster the volume grows. Most have appeared in the last couple of years.

Growth blockchain volume. A source

And Bitcoin was still lucky - his competitor, the Ethereum network, in just two years after its launch and half a year of active use in the blockchain, 200 gigabytes has already run up. So, in current realities, the blockchain's eternity is limited to a dozen years - the increase in the capacity of hard drives definitely does not keep pace with the growth in the blockchain volume.

But besides the fact that it must be stored, it must also download. Anyone who tried to use a full-fledged local wallet for any cryptocurrency, was amazed to find that he could not make and receive payments until he had downloaded and verified the entire specified amount. You are lucky if this process takes only a couple of days.

You ask, is it possible not to keep it all, since this is the same thing on each node of the network? It is possible, but then, firstly, it will not be a peer-to-peer blockchain, but a traditional client-server architecture. And secondly, then the clients will have to trust the servers. That is, the idea of “not trusting anyone”, for the sake of which, including the blockchain, was invented, in this case disappears.

For a long time, Bitcoin users are divided into enthusiasts who “suffer” and download everything, and to ordinary people who use online wallets, trust the server and who, in general, don't care how it works there.

Myth 3: Blockchain is efficient and scalable, ordinary money will die

Quote number 3: “The combination of“ blockchain-technology + personal connection of the body ”will allow you to encode and make available all the thoughts of a person in a standardized compressed format. Data can be captured by scanning the cerebral cortex, EEG, brain-computer interfaces, cognitive nanorobots, etc. Thinking can be represented in the form of chains of blocks, writing down almost all of the human subjective experience and, possibly, his consciousness. After writing to the blockchain, various components of memories can be administered and transmitted — for example, to restore memory in case of diseases accompanied by amnesia. ”

If each network node does the same thing, then it is obvious that the bandwidth of the entire network is equal to the bandwidth of one network node. And you know what exactly it is equal to? Bitcoin can process a maximum of 7 transactions per second - at all.

In addition, in the Bitcoin blockchain transactions are recorded only once every 10 minutes. And after the recording appears, for reliability, it is customary to wait another 50 minutes, because the recordings regularly roll back spontaneously. Now imagine what you need to buy for bitcoin gum. Just an hour stand in the store, think.

Within the framework of the whole world, this is ridiculous now, when hardly every thousandth inhabitant of the Earth uses Bitcoin. And with such a speed of transactions significantly increase the number of active users and will not work. For comparison: Visa processes thousands of operations per second, and if necessary it will easily increase capacity, because classical banking technologies are just scalable.

Even if the usual money and die out, it is clearly not because they block the blockchain solutions.

Myth 4: Miners provide network security

Quotation # 4: "Autonomous enterprises in the cloud operating on the blockchain basis and operating on the basis of smart contracts could enter into electronic agreements with relevant organizations, for example, with governments, in order to register themselves under any jurisdiction under which they want to work."

You have probably heard about the miners, the giant mining farms that are built next to power plants. What are they doing? They burn electricity for 10 minutes, “shake” the blocks until they become “beautiful” and can be included in the blockchain ( we told about the “beautiful” blocks and why to “shake” them in the previous post ). This is necessary in order to rewrite financial history takes as much time as writing it (provided that you have the same total power).

Electricity is spent as much as the city consumes per 100,000 inhabitants. But add here also expensive equipment that is suitable solely for mining. The principle of mining (the so-called proof-of-work) is identical to the concept of “burning the resources of mankind”.

Blockchain optimists like to say that miners do not just do useless work, but ensure the stability and security of the Bitcoin network. This is true, the only problem is that miners protect Bitcoin from other miners .

If the miners were a thousand times smaller and would burn a thousand times less electricity, Bitcoin would function just as well - the same one block every 10 minutes, the same number of transactions, the same speed.

With regard to blockchain solutions, there is a risk of “ 51% attack ”. The essence of the attack is that if someone controls more than half of all mining capacities, he can secretly write an alternative financial history from everyone, in which he did not give his money to anyone. And then show everyone your version - and it will become a reality. Thus, he gets the opportunity to spend his money several times. Traditional payment systems are not subject to such an attack.

It turns out that Bitcoin became a hostage to its own ideology. “Superfluous” miners cannot stop mining, because then the probability that someone alone will control more than half of the remaining power will sharply increase. While profit is profitable, the network is stable, but if the situation changes (for example, because electricity will rise in price), the network may face massive “double spending”.

Myth 5: Blockchain is decentralized and therefore indestructible

Quotation No. 5: “In order to become a full-fledged organization, a decentralized application must contain more complex functionality, for example, a constitution.”

It probably seems to you that, since the blockchain is stored on each node of the network, the special services will not be able to close Bitcoin if they wish, because it does not have some kind of central server or something like that - there is nobody to come to close. But this is an illusion.

In fact, all the “independent” miners are pooled (essentially cartels). They have to unite, because it is better to have a stable but small income than a huge one, but once in 1000 years.

Bitcoin power distribution by pool. A source

As you can see on the diagram, large pools are about 20, and only 4 of them control more than 50% of the total capacity. It is enough to knock on four doors and get access to four control computers so that you have the opportunity to spend the same bitcoins more than once on your Bitcoin network. And, as you understand, such an opportunity will somewhat devalue bitcoin. And this task is quite feasible.

The distribution of mining by country. A source

But the threat is even more real. Most pools, along with their computing power, are in the same country, making it easier to take control of Bitcoin.

Myth 6: Blockchain anonymity and openness are good

Quotation 6: “In the era of the blockchain, the traditional“ government 1.0 ”in many respects becomes an outdated model and there are opportunities for the transition from inherited structures to more personalized forms of government.”

The blockchain is open, everyone sees everything. So in Bitcoin there is no anonymity, he has “pseudonymity”. For example, if an attacker demands a ransom for a wallet, then everyone understands that the wallet belongs to the bad guy. And since anyone can follow the transactions from this wallet, then the fraudster will not be able to take advantage of the bitcoins received, because it is worth revealing the person somewhere, as he is immediately imprisoned. At almost all the exchanges, it is necessary to pass identification in order to exchange for ordinary money.

Therefore, attackers use the so-called "mixer". The mixer mixes dirty money with a lot of clean money, and thus "launders" them. The attacker pays a large commission for this and takes a lot of risks, because the mixer is either anonymous itself (and can run away with money), or already under the control of someone influential (and can be handed over to the authorities).

But let's leave the problems of criminals, what is the pseudonymity bad for honest users? Here is a simple example: I translate some bitcoins to my mother. After that, she knows:

- How much money do I have at any given time?

- How much and, most importantly, what exactly did I spend them for all the time. What I bought, what roulette I played, what policy I supported “anonymously.”

Or if I returned my debt to a friend for lemonade, then he now knows everything about my finances. Do you think this is nonsense? Is it weak for everyone to open the financial history of their credit cards? Moreover, not only the past, but the whole future.

If for individuals this is still far away (well, you never know, someone wants to be "transparent"), then for companies it is deadly: all of their counterparties, purchases, sales, customers, volume of accounts, and generally everything, everything, everything becomes public. The openness of finance is perhaps one of the biggest flaws in Bitcoin.

Conclusion

Quotation No. 7: “It is possible that blockchain technology will have to become the top economic layer of the organically connected world of various computing devices, including wearable computing devices, sensors of the“ Internet of things ”.

I have listed six major complaints about Bitcoin and the version of the blockchain used in it. You ask, why did you hear about it from me, and not earlier from someone else? Does anyone see any problems?

Someone is blinded, someone simply does not understand how it works , and someone sees and realizes everything, but it is simply unprofitable for him to write about it. Think for yourself, many of those who bought bitcoins, begin to advertise and promote them. Such a pyramid comes out. Why write that technology has flaws if you are counting on a growth rate?

Yes, Bitcoin has competitors who have tried to solve certain problems. And although some ideas are very good, the blockchain is still the basis. Yes, there are other non-monetary uses of the blockchain technology, but the key drawbacks of the blockchain remain there.

Now, if someone tells you that the invention of the blockchain is comparable in importance to the invention of the Internet, treat this with a fair amount of skepticism.

Source: https://habr.com/ru/post/336036/

All Articles