Taxes on IT-business in Russia

Hi, Habr! I continue to publish my book on the legal aspects of IT business. Today - about taxes and related issues. Considering that in Russia the tax system is poorly differentiated by type of business, the material is quite suitable for “ordinary”, that is, non-technological entrepreneurship.

The book "The law of a startup":

')

The state exists primarily due to taxes (and secondly, due to duties, excise taxes and privatization of state enterprises). Accordingly, it establishes taxes and ensures that citizens and organizations pay them.

Controlling cash payments is not easy: bills are easy to hide and impossible to track. Therefore, the state is interested in transferring all to non-cash payments (I wrote about this in the previous chapter). Before the advent of non-cash payments and secure cash desks, it was necessary to get out - so that in order to tax the illiterate population, in the Russian Empire excise taxes were levied on sugar, matches, yeast, kerosene and other essential goods.

Excise is an indirect tax, the value of which is laid in terms of unit of production and is confirmed by a special excise stamp - in short, a tax on a specific product. Excise taxes still exist (primarily for alcohol, tobacco and gasoline) and bring about 5% of budget revenues to the state (far from its main part).

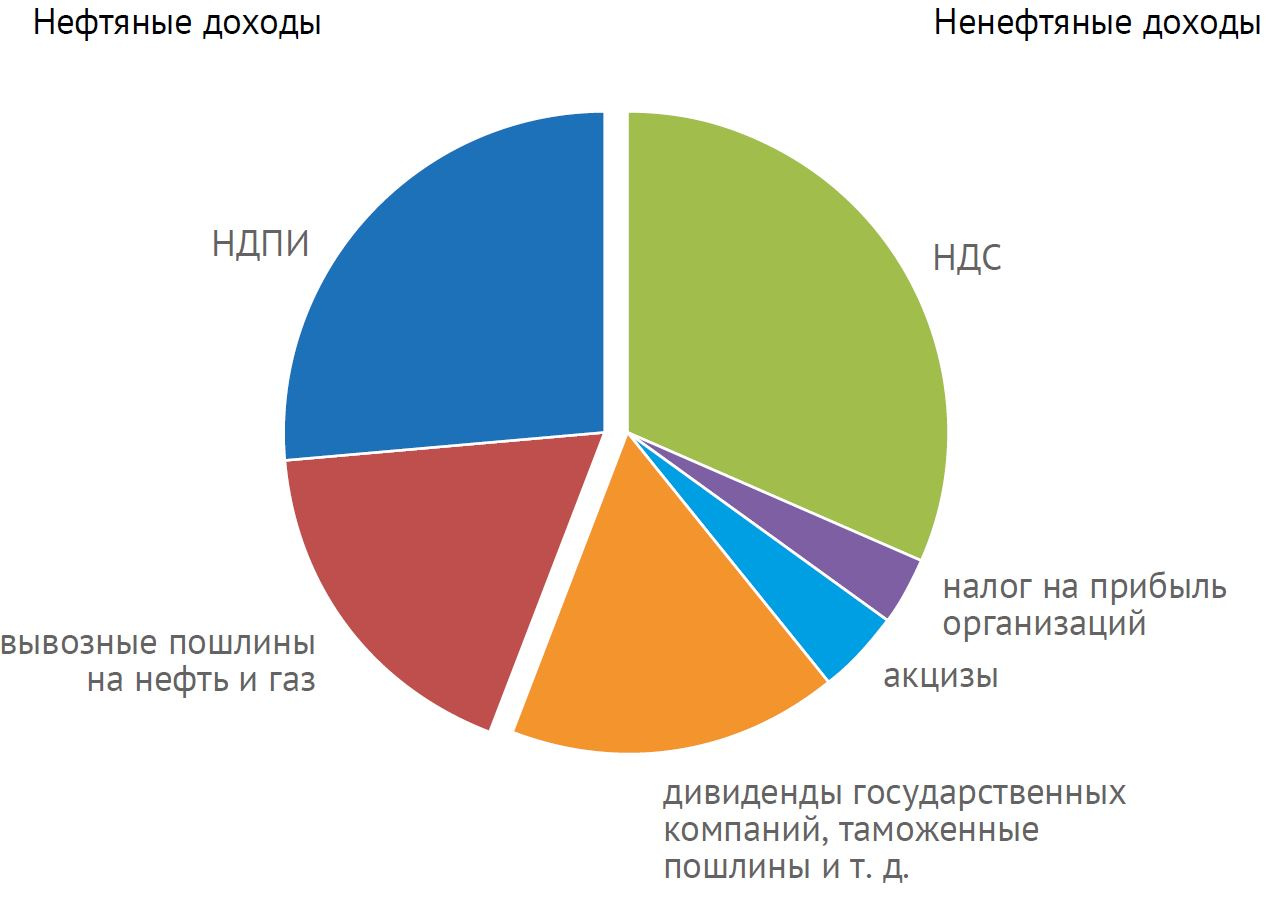

The main source of incomes of the federal budget are taxes on minerals. These are the mineral extraction tax (MET) and the export duty on a number of natural resources, primarily oil (export duty) . That is why the Russian budget depends on oil prices: after all, it receives almost half of the revenues (from 40 to 50% depending on the prices on the world market) due to the seizure of oil and gas super-profits of mining companies.

In addition to the income from the sale of raw materials, a substantial part of the money goes to the state budget from value added tax (VAT) , and to the budget of subjects - from corporate profit tax (NGO) . Both of these taxes are paid by entrepreneurs using a common tax system (OSN, sometimes reduced as ESS).

Entrepreneurs can choose other tax systems. In addition to DOS, they are available:

For various reasons, these three “non-general” tax systems use mainly small business, and they do not bring large revenues to budgets.

Ordinary individuals cannot choose between several tax systems and pay only the personal income tax (PIT) , the basic rate for which is 13%.

On average, the rate on "business" taxes is lower than on personal income tax, but they must be paid, unlike the "semi-voluntary" taxes that citizens pay on declarations. Why? Because entrepreneurs create special accounts in banks (settlement accounts). Such an account is controlled by the tax, and you can not open it without showing the state the movement of funds on it.

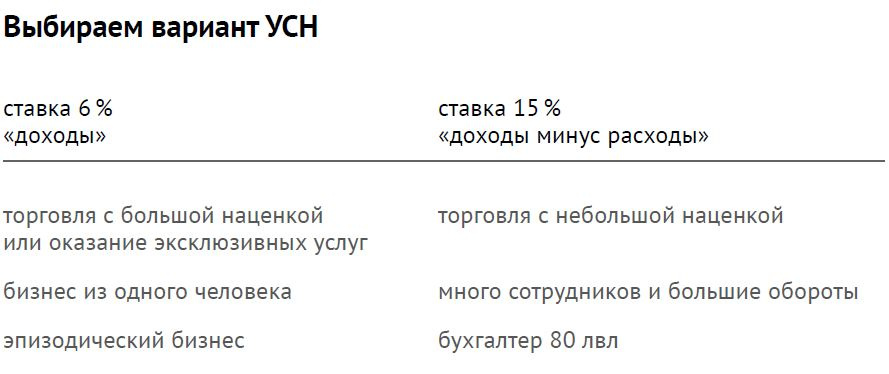

It is so called because it is really simpler than the general system. We analyzed the simplified tax system in the previous chapter; You, of course, remember that in it, unlike the whole range of taxes of the OCH, only the income tax or the profit tax (optional) is paid.

The table shows which option will be approximately profitable:

In order for the simplified tax system not to apply large business, several thresholds have been established. First, the restrictions on turnover (from 2017, this amount increased to 150 million ₽ per year) and the number of employees (no more than 100 people). There is a restriction for subsidiaries: if more than 25% of the company's participants are legal entities, it is no longer possible to use the simplified tax system. There are other restrictions associated mainly with certain types of activities (banks, insurers, etc.)

The general system is applied to all by default, but in fact it is used by a business that is not subject to the simplified system of taxation (primarily medium and large). DOS includes not one but several taxes. The main ones are:

As you can see, the longer the chain of sales of goods, the greater the percentage charged from the final price. As a result, it turns out that the more complex and technological the product is, the more (in percent) the state levies taxes. Of course, this is wrong, because in this way the state discourages manufacturers of technological goods and, in the end, slows down technical progress.

As we see, the total percentage of the value of the goods is stable and does not depend on the number of intermediaries. It is important to understand that VAT works only when it is paid by all links in the chain.

That is why the buyer acting under the simplified taxation system can, without fear, purchase goods with VAT for their own needs - the seller does not lose anything. But if he buys for resale, then there are few people willing to buy his goods, because for them such a purchase will result in unnecessary tax expenses. It means that for a company engaged in trade or b2b services, the main taxation system with VAT is preferable to the simplified tax system.

Perhaps you have been to Europe and, returning from there, received payments through the “Tax free” system. This is the return of VAT (VAT, Value Added Tax) to exporters, it is only there that stimulates not only entrepreneurs, but also individual consumers.

It turns out that VAT is better than a simple sales tax: it always constitutes a fixed percentage of the total price of the goods and helps stimulate exports.

I am sure that accountants are already scratching their hands to write an angry message to me. Yes, gentlemen, I admit - I have very simplified the scheme for paying VAT. In fact, a more realistic chain looks like this:

In general, you understand: in fact, VAT transactions are a complicated thing, trust them only to a qualified accountant, because it is very easy to “get lost” in the calculation of interest, declarations, refunds. It is because of this that the DOS allows not to pay VAT at all at a profit of less than 2 million ₽ per quarter - so that a small business, for some reason not falling under the USN, will not go bankrupt in accounting.

What taxes do non-entrepreneurs pay? Strangely enough, this question matters for the entrepreneur. Since citizens are rarely forced to fill out income declarations and are very reluctant to do this, the state helps them by obliging employers to pay personal income tax for their employees.

The main tax that in Russia is paid by non-entrepreneurial individuals from their income is the personal income tax, abbreviated as PIT.

In contrast to the same corporate income tax, personal income tax is paid not from profit, but from income. This means that if a citizen earned 500 000 ₽ for the year, then, regardless of the amount of expenses, he will pay taxes on all income at the standard rate of 13%, that is 65,000 ₽.

Quite a cruel deal: what if you spent most of your income, for example, on studying? In this regard, the state compensates for some expenses (for treatment, study, first purchase of real estate) by deductions. With the income spent on these needs, the state returns the paid personal income tax.

Conclusion: the deduction can not be more than the tax paid (otherwise it will not be a deduction, but some kind of grant!)

Taxes for citizens, as a rule, are paid by their employers. If an individual has an employment contract (similarly, a civil law contract, service contract, etc.), the organization must retain 13% of personal income tax from his salary specified in the contract and transfer this amount to the budget.

If a person works by himself (for example, a tutor) or rents an apartment, then he does not have an employer. In this case, the tax is calculated on the basis of a declaration - a written statement of the taxpayer about his income. The taxpayer declares, that is, declares how much he earned and, accordingly, what tax from this amount he must pay.

What will happen if a citizen provides false information in the declaration? Of course, to verify the accuracy of this information is very difficult, but in some cases it is possible. For example, a citizen sold an apartment for one amount, and indicated another in the declaration, understated, but the buyer, deciding to receive a deduction, indicated in the statement the true (full) cost of the apartment ...

Consider that 13% of personal income tax is not all that the employer pays for its employee. In fact, for an employee who receives "clean" 87 000 ₽, he gives another 43,000 ₽ (if he does not apply preferential rates). What is the sum of this sum?

Our pension, as well as part of health insurance and benefits are paid not from the state budget, but from the money that the citizens “set aside themselves”. More precisely, employers do it for them voluntarily-compulsively.

There are state funds that “insure” us (citizens) from old age, illness or accident. For the fact that with each salary a certain amount is sent to the insurance fund, the victim receives compensation when an insured event occurs. If you get into an accident, according to OSAGO, the culprit will partially compensate the damage. Similarly, when you grow old (an insured event occurs), the pension fund will pay you a pension (of course, the pension will be less than your salary, but, as in the case of CTP, it is better than nothing).

In practice, such funds are unprofitable, therefore citizens are chronically short of money for pensions. There are more and more pensioners (due to the increase in life expectancy), and fewer workers (due to the demographic gap of the 1990s.) The burden on working citizens is increasing, and they increasingly go into the shadows, hiding their salaries and not paying contributions.

In an ideal social state, you can build a pension system in which the money paid by current workers, taking into account interest, will be enough to cover pensions, but for this to happen, the population must be young, not old. In any case, such a system will not be one hundred percent fair, because in it even those who have not worked a single day receive the minimum guaranteed pensions. If you earned millions and paid interest to the pension fund, your pension will still be limited to the upper threshold.

However, the best system in Russia is still not invented. The pension fund is chronically short of money, but any increase in contributions is a shudarit business. At the same time, citizens are inclined to agree to “wages in envelopes” (without paying contributions), because after the devaluation of pensions in the 90s, confidence in the state pension system has fallen dramatically.

In practice, it will be even more profitable: you can apply a number of special deductions and benefits. Even in the most general case, an IE without workers can reduce the tax on the amount of paid contributions. In Tannin case, it will save about 30 thousand rubles and pay for its costs for a qualified accountant or for the course Microsoft Excel.

The creation of such schemes is called tax optimization. This is not against the law: you can work as an individual, you can do the same work as an individual entrepreneur - the only difference is that individual entrepreneurs pay less taxes, file reports and are responsible for it, and also receive a lower old-age pension. However, the majority of our fellow citizens will skeptically say that they still need to live to old age.

For those who do not want to wait for the publication of the remaining chapters on Habré - a link to the PDF of the full book is in my profile.

The book "The law of a startup":

')

- Starter vs. entrepreneur

- Choose a form

- check in

- Corporate Governance

How is a company legally built? - Current work

Contracts and how they work

How to check an open source partner - Taxes

What does IT business pay in Russia? - Governmental support

- Startup cycle

How venture investment (in general) works - Venture transactions

- Venture funds

- Intellectual property

- Offshore and foreign trade

The advantages and pitfalls of offshore

Features of the national budget

The state exists primarily due to taxes (and secondly, due to duties, excise taxes and privatization of state enterprises). Accordingly, it establishes taxes and ensures that citizens and organizations pay them.

Controlling cash payments is not easy: bills are easy to hide and impossible to track. Therefore, the state is interested in transferring all to non-cash payments (I wrote about this in the previous chapter). Before the advent of non-cash payments and secure cash desks, it was necessary to get out - so that in order to tax the illiterate population, in the Russian Empire excise taxes were levied on sugar, matches, yeast, kerosene and other essential goods.

Excise is an indirect tax, the value of which is laid in terms of unit of production and is confirmed by a special excise stamp - in short, a tax on a specific product. Excise taxes still exist (primarily for alcohol, tobacco and gasoline) and bring about 5% of budget revenues to the state (far from its main part).

The main source of incomes of the federal budget are taxes on minerals. These are the mineral extraction tax (MET) and the export duty on a number of natural resources, primarily oil (export duty) . That is why the Russian budget depends on oil prices: after all, it receives almost half of the revenues (from 40 to 50% depending on the prices on the world market) due to the seizure of oil and gas super-profits of mining companies.

Revenues of the federal budget in 2016

In addition to the income from the sale of raw materials, a substantial part of the money goes to the state budget from value added tax (VAT) , and to the budget of subjects - from corporate profit tax (NGO) . Both of these taxes are paid by entrepreneurs using a common tax system (OSN, sometimes reduced as ESS).

Entrepreneurs can choose other tax systems. In addition to DOS, they are available:

- simplified taxation system (simplified tax system);

- patent taxation system (SPE);

- single tax on imputed income (UTII).

For various reasons, these three “non-general” tax systems use mainly small business, and they do not bring large revenues to budgets.

Ordinary individuals cannot choose between several tax systems and pay only the personal income tax (PIT) , the basic rate for which is 13%.

On average, the rate on "business" taxes is lower than on personal income tax, but they must be paid, unlike the "semi-voluntary" taxes that citizens pay on declarations. Why? Because entrepreneurs create special accounts in banks (settlement accounts). Such an account is controlled by the tax, and you can not open it without showing the state the movement of funds on it.

Simplified taxation system

It is so called because it is really simpler than the general system. We analyzed the simplified tax system in the previous chapter; You, of course, remember that in it, unlike the whole range of taxes of the OCH, only the income tax or the profit tax (optional) is paid.

The table shows which option will be approximately profitable:

In order for the simplified tax system not to apply large business, several thresholds have been established. First, the restrictions on turnover (from 2017, this amount increased to 150 million ₽ per year) and the number of employees (no more than 100 people). There is a restriction for subsidiaries: if more than 25% of the company's participants are legal entities, it is no longer possible to use the simplified tax system. There are other restrictions associated mainly with certain types of activities (banks, insurers, etc.)

General taxation system

The general system is applied to all by default, but in fact it is used by a business that is not subject to the simplified system of taxation (primarily medium and large). DOS includes not one but several taxes. The main ones are:

- The tax on the profit of an organization is a tax that is considered on the same principle as the simplified tax system “Income minus expenses”. The normal income tax rate is 20%, which is more than the USN at a rate of 15%. However, the income tax involves a number of differentiated rates for different types of enterprises. Accordingly, if you are doing the right thing from the point of view of the state, you can count on a reduced rate.

Please note: The individual entrepreneur, which operates under the DOS, instead of the corporate income tax pays income tax (PIT) of 13%. However, in contrast to the “ordinary” personal income tax (about it later), a number of professional tax deductions are applied here, which allows IP on DOS to actually pay 13% not from income, but from profit. - Property tax at a rate of up to 2.2%.

- Value Added Tax (VAT) - 18% from each sale of a product, work or service. Do not confuse VAT and sales tax (which, for example, is valid in the United States): the value-added tax is not paid on the entire cost of selling goods, but only on its value added, that is, on the supplier’s mark-up. Why is this necessary, and how is such a tax considered?

Imagine that we pay 18% from each sale of goods (sales tax). Apply this hypothetical tax to the chain of transactions.

- The lumberjack rented a plot, raised a pine tree on it and cut it down. He sold the log to a sawmill for $ 100, while giving it $ 18 to the state as VAT.

- The owner of the sawmill made boards from a log and sold them to a furniture factory for $ 400. From this sum he paid the state 72 tax;

- The furniture maker made chairs from the boards and sold them to the store for $ 1,000, paying the state $ 180 tax.

As a result, the tree passed a chain of four participants: the lumberjack >> the sawmill >> the furniture maker >> the shop. The total amount of tax paid was: 18 + 72 + 180 = 270 ₽ (27% of the total value of the goods).

As you can see, the longer the chain of sales of goods, the greater the percentage charged from the final price. As a result, it turns out that the more complex and technological the product is, the more (in percent) the state levies taxes. Of course, this is wrong, because in this way the state discourages manufacturers of technological goods and, in the end, slows down technical progress.

Now imagine that taxpayers do not pay tax on the entire value of their goods, but only on the added value (from their own extra charge):

- A logger sold a log to a sawmill for $ 100, while giving it $ 18 to the state as a tax; (its margin is equal to the price of the goods).

- The owner of the sawmill made boards from a log and sold them to a furniture factory for $ 400. From this sum he paid to the state (400 - 100) 18 = 54 ₽ of tax, since his margin amounted to 300 ₽ (and he paid $ 100 to the logger).

- The furniture maker made chairs from the boards and sold them to the store for $ 1,000, paying the state (1,000 - 400) x 18 = $ 108 tax (surcharge 600 ₽).

As a result, the tree passed a chain of four participants: the lumberjack >> the sawmill >> the furniture maker >> the shop. The total amount of tax paid was: 18 + 54 + 108 = 180 ₽ (18% of the total value of the goods).

As we see, the total percentage of the value of the goods is stable and does not depend on the number of intermediaries. It is important to understand that VAT works only when it is paid by all links in the chain.

For example, if the sawmill will operate under the simplified taxation system “Incomes” (generally not involving VAT), the chain will be interrupted:

- A lumberjack sold a log to a sawmill for $ 100, while giving it $ 18 to the state as a tax.

- The owner of the sawmill made boards from a log and sold them to a furniture factory for $ 400. From this amount, he paid the state 6% of the USN "income", that is, $ 24 tax.

- The furniture maker made chairs from the boards and sold them to the store for $ 1,000, paying the state 1,000 x 18% = 180 rubles of tax. The chain was interrupted and the mark-up cannot be determined: from the point of view of the state, it is equal to 1 000 ₽.

As a result:

- the total amount of VAT paid was: 18 + 180 = 198 ₽ (19.8% of the total value of the goods);

- the logger did not lose anything by selling the goods to an entrepreneur working on the simplified taxation system;

- the sawmill saved at the expense of the USN - paid $ 24 in taxes instead of $ 54;

- the furniture maker lost $ 72 by paying extra VAT (67% more than he should have).

That is why the buyer acting under the simplified taxation system can, without fear, purchase goods with VAT for their own needs - the seller does not lose anything. But if he buys for resale, then there are few people willing to buy his goods, because for them such a purchase will result in unnecessary tax expenses. It means that for a company engaged in trade or b2b services, the main taxation system with VAT is preferable to the simplified tax system.

With the help of VAT, you can also stimulate exporters by setting the export VAT at 0% (our state does just that):

- The furniture maker made chairs from the boards and sold them to the store for $ 1,000, paying the state (1,000 - 400) 18 = 108 rubles. tax (surcharge 600 ₽).

- Shop sold chairs abroad for 2 000 ₽. Export VAT is zero. This means that the store overpaid the tax of $ 108, which was included in the price of the chairs by the previous participants in the chain. He has the right to take them from the treasury and thus, in addition to the profit of 1 000 rubles, earn another 108 rubles.

Perhaps you have been to Europe and, returning from there, received payments through the “Tax free” system. This is the return of VAT (VAT, Value Added Tax) to exporters, it is only there that stimulates not only entrepreneurs, but also individual consumers.

It turns out that VAT is better than a simple sales tax: it always constitutes a fixed percentage of the total price of the goods and helps stimulate exports.

Disclaimer for professionals

I am sure that accountants are already scratching their hands to write an angry message to me. Yes, gentlemen, I admit - I have very simplified the scheme for paying VAT. In fact, a more realistic chain looks like this:

- A logger sold a log to a sawmill for $ 118 ($ 100 added value + $ 18 VAT). At the same time, he transferred 18 ₽ to the state and gave an invoice to the sawmill.

- The owner of the sawmill made boards from a log and sold them to a furniture factory for $ 472. He must pay the state 72 USD, but applied to the deduction 18 USD paid upon purchase (based on the invoice from the logger). As a result, the VAT paid by the owner of the sawmill was $ 54 ($ 72 - $ 18).

- Furniture factory shipped chairs for export for $ 2,000. VAT is 0%. The factory declared a VAT refund of 72 ₽ (472 ₽ x 18%). To do this, she had to go through a desk audit for the quarter in which the return was announced ...

In general, you understand: in fact, VAT transactions are a complicated thing, trust them only to a qualified accountant, because it is very easy to “get lost” in the calculation of interest, declarations, refunds. It is because of this that the DOS allows not to pay VAT at all at a profit of less than 2 million ₽ per quarter - so that a small business, for some reason not falling under the USN, will not go bankrupt in accounting.

Tax on personal income

What taxes do non-entrepreneurs pay? Strangely enough, this question matters for the entrepreneur. Since citizens are rarely forced to fill out income declarations and are very reluctant to do this, the state helps them by obliging employers to pay personal income tax for their employees.

The main tax that in Russia is paid by non-entrepreneurial individuals from their income is the personal income tax, abbreviated as PIT.

In contrast to the same corporate income tax, personal income tax is paid not from profit, but from income. This means that if a citizen earned 500 000 ₽ for the year, then, regardless of the amount of expenses, he will pay taxes on all income at the standard rate of 13%, that is 65,000 ₽.

Quite a cruel deal: what if you spent most of your income, for example, on studying? In this regard, the state compensates for some expenses (for treatment, study, first purchase of real estate) by deductions. With the income spent on these needs, the state returns the paid personal income tax.

Masha earned 500 000 ₽ for the year, working as an accountant in the Edelweiss company, and paid, respectively, 65 000 tax. During the year she spent $ 120,000 on gold crowns for teeth. Masha collected checks and issued herself a tax deduction, which amounted to 120 000 ₽ x 13% = 15 600 ₽. This money came to her card.

A student, Kostya, earned $ 10,000 in a year, by making a summer courier in a small company. At the same time during the year he paid 80 000 ₽ for his studies at the faculty of public administration. Kostya filed a deduction, but was able to get only 1,300 ₽ - this is the entire personal income tax, which he paid to the state (10,000 ₽ x 13%).

Conclusion: the deduction can not be more than the tax paid (otherwise it will not be a deduction, but some kind of grant!)

The burden of the employer

Taxes for citizens, as a rule, are paid by their employers. If an individual has an employment contract (similarly, a civil law contract, service contract, etc.), the organization must retain 13% of personal income tax from his salary specified in the contract and transfer this amount to the budget.

Marina has a labor contract with a salary stamp of $ 100,000, but she gets her hands on $ 87,000 a month. It is assumed that Marina earns a salary of 13 000 ₽, immediately through the employer “gives” to the state. Nevertheless, it is her money, even though she does not have time to take possession of them.

If a person works by himself (for example, a tutor) or rents an apartment, then he does not have an employer. In this case, the tax is calculated on the basis of a declaration - a written statement of the taxpayer about his income. The taxpayer declares, that is, declares how much he earned and, accordingly, what tax from this amount he must pay.

What will happen if a citizen provides false information in the declaration? Of course, to verify the accuracy of this information is very difficult, but in some cases it is possible. For example, a citizen sold an apartment for one amount, and indicated another in the declaration, understated, but the buyer, deciding to receive a deduction, indicated in the statement the true (full) cost of the apartment ...

Contributions

Consider that 13% of personal income tax is not all that the employer pays for its employee. In fact, for an employee who receives "clean" 87 000 ₽, he gives another 43,000 ₽ (if he does not apply preferential rates). What is the sum of this sum?

Our pension, as well as part of health insurance and benefits are paid not from the state budget, but from the money that the citizens “set aside themselves”. More precisely, employers do it for them voluntarily-compulsively.

There are state funds that “insure” us (citizens) from old age, illness or accident. For the fact that with each salary a certain amount is sent to the insurance fund, the victim receives compensation when an insured event occurs. If you get into an accident, according to OSAGO, the culprit will partially compensate the damage. Similarly, when you grow old (an insured event occurs), the pension fund will pay you a pension (of course, the pension will be less than your salary, but, as in the case of CTP, it is better than nothing).

In practice, such funds are unprofitable, therefore citizens are chronically short of money for pensions. There are more and more pensioners (due to the increase in life expectancy), and fewer workers (due to the demographic gap of the 1990s.) The burden on working citizens is increasing, and they increasingly go into the shadows, hiding their salaries and not paying contributions.

In an ideal social state, you can build a pension system in which the money paid by current workers, taking into account interest, will be enough to cover pensions, but for this to happen, the population must be young, not old. In any case, such a system will not be one hundred percent fair, because in it even those who have not worked a single day receive the minimum guaranteed pensions. If you earned millions and paid interest to the pension fund, your pension will still be limited to the upper threshold.

However, the best system in Russia is still not invented. The pension fund is chronically short of money, but any increase in contributions is a shudarit business. At the same time, citizens are inclined to agree to “wages in envelopes” (without paying contributions), because after the devaluation of pensions in the 90s, confidence in the state pension system has fallen dramatically.

Examples from practice

Tanya is a designer. It is not profitable for legal entities to work with it, because it is an individual, which means that by transferring to it a card fee, you will have to withhold personal income tax and contributions. So, for every paid to Tania “clean” 100 ₽ the customer will pay “dirty” 114.95 ₽ (100 ₽ / 0.87).

You will also have to pay contributions for Tanya: 31.15 rubles from every 114.95 rubles (114.95 rubles x 27.1%) The rate of contributions to the Pension Fund of Russia; 22% - in the MHIF - 5.1%, and contributions to the FSS (2.9%) under civil law contracts are usually not paid).

Tanya wants to attract more large customers. For this, she registers the PI. Without planning to make “official” expenses, Tanya chooses a rate of 6%. Also, as an individual entrepreneur, she will pay fixed fees (more on this in the second chapter): 27 990 ₽ per year + 1% of turnover exceeding 300 thousand ₽.

Imagine that Tanya received “clean” for the year 1 million ₽. Without the IE, it will cost the employer: 1 460 919,54 ₽ (1 000 000 ₽: 0.87 x 1.271).

With SP Tania it will cost the customer:

The main amount: (1 000 000 ₽ +27 990 ₽): 0.94 = 1 093 606 ₽ +

+ contributions from turnover in excess of 300 000 ≈ 1 100 000 ₽, that is, 25% more than in the previous version. This benefit Tanya and the employer will be able to share among themselves.

In practice, it will be even more profitable: you can apply a number of special deductions and benefits. Even in the most general case, an IE without workers can reduce the tax on the amount of paid contributions. In Tannin case, it will save about 30 thousand rubles and pay for its costs for a qualified accountant or for the course Microsoft Excel.

Iskender opened LLC to conduct business with partners. Director, he appointed his friend Renata.

If Renat works under an employment contract, in order to receive $ 50,000 in hands, Iskender will have to pay $ 74,712.64 ($ 50,000 / 0.87 + 30% of contributions to three funds).

However, Iskender had a good accountant who suggested: Renat could open an IP and get a job in the company as an external manager. In this case, in order for Renat to receive his $ 50,000 per month, Iskender will have to pay him only $ 55,774 under a management agreement (not counting deductions, which will allow him to save even more).

The creation of such schemes is called tax optimization. This is not against the law: you can work as an individual, you can do the same work as an individual entrepreneur - the only difference is that individual entrepreneurs pay less taxes, file reports and are responsible for it, and also receive a lower old-age pension. However, the majority of our fellow citizens will skeptically say that they still need to live to old age.

For those who do not want to wait for the publication of the remaining chapters on Habré - a link to the PDF of the full book is in my profile.

Source: https://habr.com/ru/post/335850/

All Articles