ICO: legalization of funds received. Part I

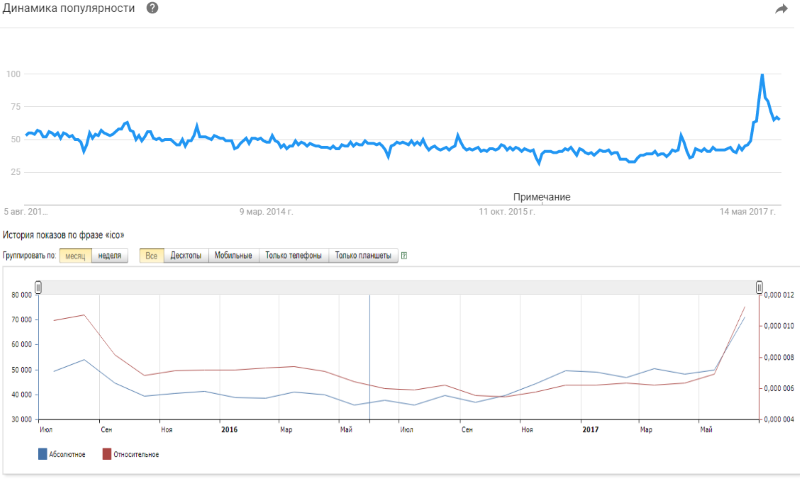

ICO , it’s also the primary placement of tokens, is gaining enormous popularity: the market has exceeded $ 1,000,000,000 in six months, the growth of requests can be seen below ... but at the same time there are no clear jurisdictions with intelligible regulation, not so much.

But for the beginning - all the same indicators:

')

And now - already schemes which can quite exist today.

№1. Ico = donation

This year I have twice managed to meet and talk with an interesting person from the blockchain environment - Sergey Sergienko (Chronobank, CEO). In addition - we are in constant correspondence telegram & facebook.

And, as I understood, his project - Chronobank approached the essence of token (although in fact there are several types), precisely as a donation.

Art. 582 of the Civil Code of the Russian Federation (similar, by the way, can be found in the Civil Code of other countries ) states: “donation is a gift of a thing or right for generally useful purposes. Donations can be made to citizens ... organizations. ”

Thus, donation is a gift. In general, if you take cryptoactive assets as property rights or some kind of property (itsynergis team is in the first position, the Ministry of Finance is in the second position), then the approach itself is correct.

But you need to understand that donation - again, you can compare the approaches of different countries - according to Art. 572 of the Civil Code of the Russian Federation is a contract according to which: "... one party (donor) donates or undertakes to transfer to another party (to the donee) a property or property right (requirement) to itself or to a third party or exempts or undertakes to release it from property obligations to yourself or to a third party. "

In the case of tokens, we often have:

- The actual distribution of profits (income)

- Bonuses, discounts

- Exchange specs on tokens

- Possible repurchase

- Other counter actions

All items must be read through the disjunction. In addition - the list, as we see, is not closed.

It is reasonable that the state authorities immediately ask the question: “is it a sham transaction then is all this?” Actually, let us turn again to the original source - to art. 170 of the Civil Code of the Russian Federation: “A sham transaction, that is, a transaction that was made in order to cover up another transaction, including a transaction on other terms, is void . For the transaction, which the parties really had in mind, taking into account the substance and content of the transaction, the rules relating to it apply. ”

Therefore, donations, in my opinion, should be donations, and such campaigns are quite possible for themselves, but this should be a) explicitly stated in the White Paper (or better - in a special agreement on the distribution of tokens) and b) understand that investors will other than in return status, let's call it so, tokens.

№2. R & D - terrible abbreviation, efficient scheme

For starters, the norm is again: “Under the contract for research works, the contractor undertakes to carry out scientific research , determined by the technical task of the customer, and under the contract for development and technological works, develop a sample of a new product , design documentation for it or a new technology , and the customer undertakes to accept the work and pay for it. " This is article 769 of the Civil Code.

If we turn to the analysis of blockchain projects, we will see that the necessary parameters, say, innovative technology, are present: even the controversial Golem , SONM, the same interesting, but incredibly complex Sergey Time Bank, which brought together millions of Brave and hundreds of other projects are sharpened on what they create, what is not yet, or what is, but done without decentralization.

The scheme works as follows: an individual organizes an ICO. It does not matter on which platform and how. The main thing is that it is the recipient of funds. Then this person enters into a contract with developers and other artists (designers, engineers - anyone). In this case, the contract can be mixed according to Art. 421 of the Civil Code of the Russian Federation: at first glance there is “exchange + compensated provision of services”, but, as indicated by the Presidium of the Supreme Arbitration Court of the Russian Federation in paragraph 1 of the “Review of the practice of resolving disputes related to the exchange agreement”, which was in turn secured by an information letter from September 24, 2002 N 69, I quote: “bilateral transactions involving the exchange of goods for equivalent in value services do not apply to barter”. And, thus, the court comes to the conclusion that it is necessary to use a bundle of "purchase and sale + compensated provision of services." True, in the case of crypto, we will not have rubles and in general - currencies in the understanding of the law, but this is another question, which is ready to be answered in a separate article.

The essence of the scheme is that the individual, the issuer of tokens, then concludes an R & D agreement with a legal entity. And, in order to get Fiat to be less problematic, the terms of payment for each stage are specified in the agreement.

“Contributors” to such an ICO receive several guarantees at once:

- Transfer of funds for each next stage, if the previous one is completed only

- Minimal risks when withdrawing funds to Fiat

- Understandable process monitoring scheme

There are risks, among which, the undisputed leader is trust in a particular individual. For enhancement, you can use already developed escrow, multi-signature, etc. mechanisms.

A legal entity, receiving funds from a specific individual, also has transparency for the bank, controlling structures and counterparties.

Conceptually it looks like this. Nuances are the devil, and their analysis can take forever, but if we don’t start, then instead of eternity we will get a cycle of meaningless iterations, which in itself sounds an unnecessary absurdity.

Number 3. Incorporation into share capital

The beginning of the scheme is similar to the previous one, but the main thing here is that the received funds are paid into the authorized capital of a legal entity: that is, an individual — let's call it “token issuer” —fire for cryptocurrency, EHT, BTC, Waves, etc., fiat money (they are also rubles).

There remains the unanswered question of how to cash out $ 1,000,000 or more , but let us leave room for discussion: the more so since I have a couple of answers ready ...

Further it will be necessary to make one more contract - assignment of the right to claim. From an individual - legal: under this agreement, a return purchase of tokens from “investors” should take place (I don’t see meanings to introduce new concepts, you can use a longer one - tokens recipients).

Thus, the scheme looks, for example, so: the loan agreement between physical. by persons (or otherwise, if the percentage of profitability is not set) - receiving Fiat from crypto - entering into the company's authorized capital - concluding an assignment agreement for an individual and a legal entity to pay off the original loan agreement (other agreement) between the issuer and the recipients of tokens.

I think that colleagues who have figured out the scheme, as well as observant readers, will have questions at this place and far beyond two or three. But we will carry out them for brackets of comments.

№4. Some more concept schemes

Habr is an interesting place , but here I am writing primarily to a) popularize the blockchain, which is now simply torn from the ICO hyip and unnecessary emission of cryptoactive assets, as well as from the notorious speculations; b) give a general development vector to blockchain startups; and c) find solutions beyond the prohibitive policy of the Russian state apparatus, which has been imposed since 2014 in this industry (and not only).

Therefore - at the end - a few more options for discussion:

- If tokens are some kind of property or property rights, you can even try to put all this on the balance: your accountant will be extremely happy about it, and the tax one, judging by the last letter, is a bit shocked, but the fact is that no one has canceled this scheme. By the way, I am already trying with two very advanced accountants, because I have little sense in accounting, to build a “debit-credit” scheme for such things, but for now this is just an announcement.

- Tokens can be a kind of discount on products (Kolionovo, Mashkino have such), then you can recall loyalty programs and tie everything to just such a component as a marketing tool. Yes, there is no special law here, but, as the main thing shows, practice proves: it is not needed here.

- A number of my colleagues , in the broadest sense of the word, of course, have already identified certificate tokens,

that is, “this type of token certifies the owner’s right to the tangible asset with which the digital token is provided. As a result, the token certificate is the digital equivalent of such an asset. This facilitates the turnover of the underlying asset - tokens easily replace the owner, without the need to move the underlying asset. To implement the token requirement, it can be sent to the issuer in exchange for the asset itself. ” And this is also a working version. Moreover,

for example, WebMoney has managed to work with this scheme since 1998.

Thus, even within this part of the study, we can offer a dozen (especially if we understand that the schemes can be combined) of working models that do not need special regulation, if by this we mean some special NLA for such and strict instructions. in the format: "only that which is expressly stated in the law is allowed."

Yes, there is something to work on regarding boo. accounting and taxes, the harmony of the scheme in terms of legal completion, you can hone the legal technique and engage in the training of specialists, but it is NOT necessary:

- Reshape and so young and fragile market

- To change the existing rules again, due to the instability of which the economy just storms

- Come up with some vague definitions, as it was with the Federal Law №161, or as it is in the framework of other laws now

- And most importantly - it is not necessary to embroil business and power 1001 times

I hope my appeals will not be in vain, as was the case with the Federal Law on messengers, VPNs and commodity aggregators , as well as the very 161m - “On the National Payment System”.

And at the end I will answer three popular questions:

- Am I afraid to share such valuable, according to some, information openly ?

No, I am not afraid, since I sincerely believe that a different approach is a violation of the very essence of the blockchain environment, which I am promoting. Secondly, no, because last year the blockchain and ICO were 1-2, less often 3-5 applications per week , and today it is 10-15 per day . And even a team of 20 people at an outsource with such a flow can not cope. In addition, the level of services currently offered, except, of course, only for the market’s luminaries, is very low and this is another factor in the early collapse of the ICO bubble and cryptoactive assets in general. Me and the same team is not profitable. Finally, the third - there are always nuances: and it is they who separate professionals from all others and they, we and the team, are also ready to share, but at the level of b2b interactions, since in a different way this is not possible in principle. - Why are there always more questions in my articles than answers? There are two points here: firstly, thanks to the questions, the person learns, comprehends the new and thereby develops; secondly, the sphere is painfully young and without open questions it is simply impossible to build a discussion in it, and without the latter it is impossible to build a normal dialogue, including with the authorities.

- Why do I defend ICO if I know that it is a bubble? The answer is simple - I do not defend ICO: for me, relations in the style of p2p are important, and ICO is only one of many ways to develop these relations. But I can’t ignore the problems of the initial allocation of tokens, as I understand

otherwise it will all end very, very bad.

I hope my position is clear. Thank you for the time spent on the passage of lines and I hope for questions.

Source: https://habr.com/ru/post/334974/

All Articles