ICO: Basic Jurisdictions and Issues

About a year ago I began to study the topic of ICO (who does not know, this is the primary placement of tokens : the analogy is taken from the abbreviation IPO): as it turned out, it was not for nothing. Today, the ICO market is out (already out - and the year is not over yet) for 1,000,000,000 dollars . At the same time, the crypto market in volume went beyond 100,000,000,000 (but now it fluctuates around the figure of 85 billion ). This, of course, is not trillions, but seriously.

In this post I would like to answer three questions:

')

- Is ICO a bubble or not?

- In which jurisdictions and why are those who conduct an ICO registered?

- Does ICO have a future and what is it?

The answer to the first question is simple: yes. Yes, ICO is a bubble and there are several reasons for this:

- Most of the services (currently closely analyzed - 54, just viewed - 117) do not have a clear technological basis and sometimes even a well-developed concept: the creators confine themselves to the White Book and the Roadmap, knocking money for development and marketing on ICO;

- The speculator is too strong , because the market is very small and it is very easy to manipulate the price (below are a few examples).

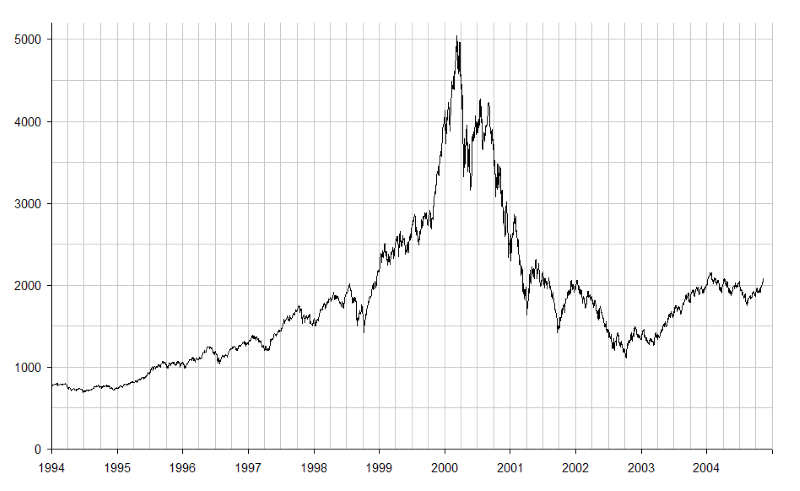

- If you compare dot-coms or tulip-mania with ICO, then there is a lot in common: a large amount of what is growing; huge speculations on this; the belief is that it will never end, etc.

- The teams that go to the ICO are very young and this seems to be a positive factor at the launch, but when operational difficulties arise, the difficulties increase threefold. And I’m not even talking about Matchpool and others like him when someone steals money, but that team coordination is not a factor that can be neglected. In the blockchain, perhaps even more, he shows himself, so the sphere is built as super-technological, which means that the risk from the human factor only increases, paradoxically: I think the example of The DAO is familiar to everyone.

Of course, this is not all: but even these criteria in the assessment will be enough to understand the instability of the primary accumulation of capital in the ICO. Moreover, now (in 2017, in the sense of), this tool has become just HYIP: money from banks, investors and the same IPO are not a little, but money from crowdfunding (we will not go into detailed analysis now, since the phenomena explaining ICO - several: it all depends on the legal status of the token ).

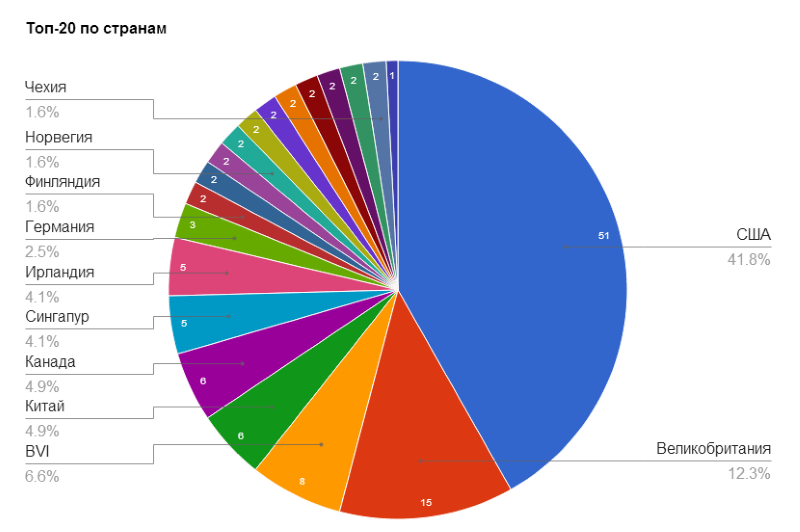

The answer to the second question is not so simple: in 2014, bitnovosti also conducted research on this market. And what a picture drew:

To make the study completely “pure”, I’ll note that it’s still in the material that was primarily about bitcoin startups. But what the situation looks like today (I took my own work for the basis, statistics can also be collected from the sources listed below) in TOP-30:

I will add that for consideration I took only those projects in which:

- It was precisely the ICO (for example, Bitcoin and Ripple did not have it - although for various reasons, it was not);

- The data on the companies are not closed: there is in the White Paper and / or on the website: and this time I deliberately did not dig deep to take the place of an ordinary user and see the company's data, if you do not need to make some creepy requests in the format SPARK;

- Capitalization allows to draw general conclusions.

- According to the coinmarketcap list, I reached 41 places , but did not include: btc, ltc (although this coin has the Litecoin Association from the USA, and the Litecoin Foundation from Singapore), monero; EOS, because the company was already organized earlier, as, say, Ardor (derived from NXT); Byteball - because the platform does not imply ICO in principle;

- In addition, I did not touch the Chinese projects either, since you need to be a very ... unexpected investor in order to create a company under ICO in the Middle Kingdom.

Of course, quite a bit of surfing the Web you can find data from other projects: Waves , Golem (Golem Factory GmbH is a Swiss LLC established in 2017.) and so on.

The question is that few still do it.

Therefore, before depositing funds into the account of the next ICO project, I recommend studying the following material:

- How do crypto assets understand in different countries of the world?

- General description in ICO evaluation

- ICO from the point of view of a lawyer

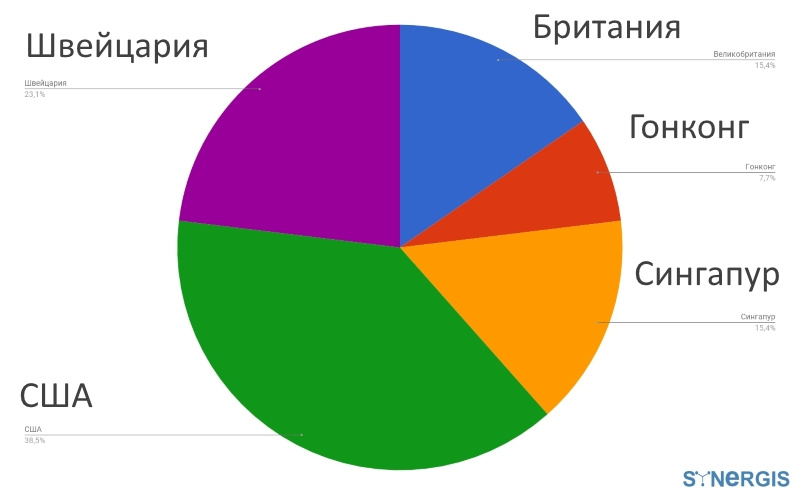

The registration in Singapore (one more recent project, SONM, by the way, is also explainable): for 6000-10,000 dollars you get a company in a technologically developed country, where the Government is friendly (read more here ) is generally set to blockchain startups. Besides, the withdrawal of Fiat funds received at the ICO is not comparable here, say, with Russia (if it is appropriate to compare something with this jurisdiction in this aspect). In this regard, Hong Kong is a completely logical alternative to Singapore: you can read more about the attitude to the “crypt” in the book , I can only say that in both countries it is neutral-positive.

The United States is the birthplace of startups, so projects originating there do not change jurisdiction. Switzerland, and more specifically - Zug , is considered to be Cryptodolina (Ethereum V. Buterin "is to blame" in the first place). Great Britain in this sense is good for Russian startups.

It seems to be all logical? Yes, but you need to understand that these jurisdictions are not initially sharpened by a (and sometimes well-advanced) small business.

In summary, it sounds like this:

- England, Scotland - about 1000-1500 dollars

- Singapore - (see above) about 10,000

- Hong Kong - 2,000

- Switzerland - 11,000 - 15,000

But these figures may seem reasonable to many people on Habré: another question is transaction costs. For example, in the same Hong Kong and Scotland for failure to submit reports followed by penalties. However, even this does not stop many: nevertheless, the ICO collect millions, at least hundreds of thousands of dollars.

But what is allowed to Jupiter, but the bull is allowed: access to the ICO is not unique services, all sorts of projects from the real sector or projects without a huge marketing budget (and it is from 100,000 to 500,000 evergreens and even more from TOP ICOs).

In addition, fans of HYIP and transaction costs, which cannot be called direct financial, do not take into account: for example, if you need to withdraw funds to Fiat (it’s elementary to pay developers, managers ... or even worse, to partners), then the question of certification is immediately raised, and this can be done not in all cities. Moscow and St. Petersburg - do not count, it is about regional projects. Let's say, in our region there was only one notary who is ready to assure translation of documents and one who agreed to a number of notarial actions. Plus - apostille.

Another common question is taxes, but here it’s simpler:

By the way, the attentive reader noticed for sure that I missed above the USA? So, the United States for non-residents of this country is a big fear and risk: besides, it is there (in the EU, however, too) that there is a risk of recognizing tokens as securities with everything that is not the most pleasant, flowing.

To make it clear - I remind you: Ripple - a company that was originally tied to the United States, was fined 700,000 dead presidents at one time, because "... Ripple Labs was unable to register as a financial services company, but nonetheless sold XRP, a digital means for making payments on the Ripple network." Again, there are examples in the book on ICO .

Therefore, the USA is a good jurisdiction, but: 1) only at first glance; 2) for US residents first.

Finally, to answer the last question, I will say the following: the ICO has a future, but a fall is inevitable. And for a number of reasons:

- Tightening government regulation

- Disappointment in projects after not exiting alpha-beta versions

- Absolute (and this will be a separate material) unpreparedness of projects from a legal point of view: this thunder will be one of the most audible;

- Technological imperfection .

Locally this is already visible in the markets:

Or on the brightest example - on Ethereum:

However, the latter problem is now connected not only with speculation (format: “Acne died - we all die), but also with very important things, when launching the next ICO puts

Thus, in my opinion, the choice of jurisdiction is only one of the steps to optimize risks. And it will not help at all, or even harm, if the project does not just shoot, but “something goes completely wrong”.

In particular, I can declare with full responsibility that the legal status of tokens is worked out only for 20%, and a complete description of the scheme for transferring ownership (or individual rights to possession, use, order) is less than total. And that means collisions are inevitable. Especially due to the fact that the technology of smart contracts is far from ideal: however, this is for sure - a whole different story.

And yes: the schedule is a reminder ...

PS I ask to participate in the survey: you need a cut of opinions on jurisdiction.

UPD. About ICO and Scams

Source: https://habr.com/ru/post/333748/

All Articles