3D Blockchain. Face Proof (PoF)

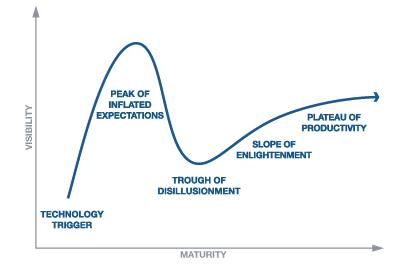

My tendency is to question everything and the blockchain [1] was no exception. Let's take a look at the Gartner Hype Cycles technology cycle. Where do you find Blockchain? Naturally, everyone will determine for himself his presence on one or another cycle, which is characteristic of the project at one of the development stages. Someone is developing the business application to the full and sees future horizons, while others are just starting their acquaintance. But if you look wider? Blockchain indisputably stuck in thought and showed great potential for transforming many segments of human relationships. But I still have some doubt about some of the current principles of its work. As a result, I see this stage somewhere at the peak of high expectations (Peak of inflated expectations) - public excitement with excessive enthusiasm and unrealistic expectations. Which means, there is still to wait for such cycles as: Getting rid of illusions, Overcoming shortcomings, Plateau of productivity.

My tendency is to question everything and the blockchain [1] was no exception. Let's take a look at the Gartner Hype Cycles technology cycle. Where do you find Blockchain? Naturally, everyone will determine for himself his presence on one or another cycle, which is characteristic of the project at one of the development stages. Someone is developing the business application to the full and sees future horizons, while others are just starting their acquaintance. But if you look wider? Blockchain indisputably stuck in thought and showed great potential for transforming many segments of human relationships. But I still have some doubt about some of the current principles of its work. As a result, I see this stage somewhere at the peak of high expectations (Peak of inflated expectations) - public excitement with excessive enthusiasm and unrealistic expectations. Which means, there is still to wait for such cycles as: Getting rid of illusions, Overcoming shortcomings, Plateau of productivity.

Therefore, if you are interested in the criticism and the assumption of a different approach in determining a consensus, then welcome under cat.

Turn to Bitcoin [2]. This is a peer-to-peer monetary system in which electronic transactions are made directly by participants, bypassing financial institutions (trustee / intermediary). Where protection against double spending is achieved by consensus in a peer-to-peer network based on evidence of the work done (Proof of Work [3]). As an incentive to maintain the system, a cryptocurrency is issued and charged together with the commission to miners who do this work. A natural question arises, are they not intermediaries? Yes, the principle of trust was removed from them, as a result of which the responsibility is gone (no one will be blamed), but they are the third party that the transaction participants pay for the service provided (reliability assurance). Moreover, a huge part of the remuneration is now due to the issue, which means that those who are now acquiring cryptocurrency, without knowing it (or suspect?), Pay for the transactions already made by their predecessors. For example, this question was raised at point 9 from Gartner. In the future, when the issue ceases, the amount derived from this earlier will be distributed as a commission, which will significantly increase the transaction cost. On the technical side, this issue can be solved by increasing the block size or by other solutions such as SegWit [4] (just how long will it be decided?). But the economic side still suffers. Reliability is ensured when the number of miners is huge, because it meant "one processor - one vote." But in the end they will fall into the competitive environment, where the only amount in the re-tightening of the blanket will be the size of the commission, in general, someone will grow and remain afloat, and someone will leave, or be absorbed. And from here there is a consequence - the cost of the transaction. The more decentralized the system, the higher the cost of transactions. The more centralized it is, the lower it is. These are ordinary economic realities, a similar thought has already been, only in relation to energy efficiency, for example, here .

The next point is that even though it is a monetary system, it is closed in itself, in other words, the blockchain interacts with the world through an environment based on trust. Also, any blockchain depends on its own cryptocurrency, providing incentives for the reliability of the network and the implementation of transactions. Accordingly, on the one hand, this is a single settlement unit, which is good, on the other hand, it is a direct dependence on the functioning of applications (not already related to money, but using this blockchain) on the fate of its cryptocurrency and transaction costs. Additionally, the closure effect raises the question, according to what rule does it emit? After all, there is already someone who is ready for something: someone restricts, someone does not, and someone applies the principle of burning altogether, such as in the Proof of Burn (proof of burning).

Let us turn to Ethereum [5]. It is noteworthy that the need for its own cryptocurrency in Ethereum is more justified, since necessary for the implementation of smart contracts and applications. The issue here is not limited, but over time tends to zero. As a result, the economic side in relation to the miners here is the same. But how much does this emission method have flexibility regarding economic processes? After all, the level of money supply is one of the main elements of the functioning of the monetary system and the economy as a whole. On the other hand, if we assume that the whole world has switched to the blockchain, for example, an infinite issue that will be tied to a transaction intensity, then the economy will show its acceleration, and when the number of transactions drops, on the contrary, the emission rate decreases, the model seems viable.

Let us return to the blockchain - this is a chain of blocks with records of transactions that are formed continuously, security is provided by cryptography. Each block contains information about the previous block. The blockchain is a distributed data registry, a complete copy of which or its part is simultaneously stored on multiple computers. The formation of new blocks is carried out according to a certain consensus algorithm, as described above, for example, based on the proof of the work done (Proof of Work) or others. At the same time, branching of the chain is a frequent occurrence; this is when several new blocks are being formed at the same time, each of which is considered the same block as the previous one. The branch will stop as soon as a new block is found that continues any of the branches. All nodes will switch to the circuit that has the longest version and continue to work on extending it. Those. blockchain seems to be linear. Now imagine how much such a blockchain is overloaded with unnecessary work? The full current version of the chain is stored on special nodes of the network, called full nodes, the other nodes (light wallets used by users) refer to the full ones, if necessary, to check something. Anyone can download the full version of the blockchain. But given the fact that the blockchain is developing not only for transactions, but also as a registry of various events, it also allows various applications to work. But in graphic form the blockchain seems to be linear, how much will the size of such a chain increase in the future? After all, the huge size will lead to the risk of centralization. Only units will be able to keep a complete node of TB calculated, which means units will be able to collude and impose rules.

Consider the Proof of Stake [3]. Proof of share is the second most well-known consensus algorithm, which is an alternative to Proof of Work. The argument in favor of PoS is the lack of need for huge calculations and provides a small input threshold. In the original PoS, the idea is that instead of computing power as in PoW (costly), the probability of creating a new unit is proportional to the share of ownership (cryptocurrency) of the user in the system. Accordingly, in order to violate this system, significant funds will be required and at the same time breaking the stability of the blockchain itself will suffer. But such an approach leads to the same centralization results as in PoW, only faster. Because it gives the same motivation of accumulating funds in one hand. As a result, PoS variations appeared, these are: Proof of Activity (proof of activity - a hybrid scheme of PoW and PoS); Delegated Proof of Stake (delegated share confirmation) and Leased Proof of Stake (leased share confirmation). DPoS is based on the fact that a share owner, by voting in proportion to his share, delegates responsibility to a certain number of delegates who take turns in randomly generating blocks. LPoS is based on the fact that users can rent (instead of voice as on DPoS) their balance to nodes (nodes), thereby obtaining a portion of the profits. The number of nodes is limited to improve the performance characteristics of the blockchain. As a result, in fact, in general, the PoS resembles a banking system that has only transformed. With the same success, it was possible to create a blockchain among banks, where everyone who has a license must be fully aware and participate in block generation (depending on depositors) and do it among themselves to optimize business processes, and then provide various IT solutions for applications.

3D Blockchain. Face Proof (PoF)

In general, one can continue to argue about the correctness or incorrectness of a particular principle. Definitely problems exist and there will undoubtedly be solutions. But starting from the old paradigms, there will be only the imposition of different solutions on each other and as a result we will see only the complication of the system, and the eternal opposition will remain. In other words, as long as the blockchain is based on incentives with means to ensure reliability, there will be a simultaneous incentive for the system to centralize.

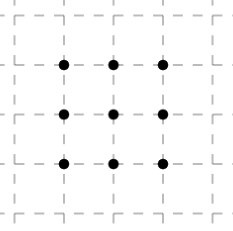

Take a look at the drawing, this is the task. It is necessary to connect all 9 points with four lines running continuously one after the other. This task demonstrates the principles of going beyond thinking. Perhaps this is applicable to the blockchain and not to build on the old paradigms because it goes beyond monetary transactions? Since the blockchain does not need to prove to everyone about its need, potential, and it has long since distanced itself from ordinary transactions, and provided opportunities such as a distributed data registry, the implementation of smart contracts, decentralized applications, and the holding of ICOs. Then is a blockchain possible without miners ensuring reliability? And without the main cryptocurrency, which is necessary first of all to stimulate this reliability? The cryptocurrency itself is of course necessary for the implementation of cash transactions, just the blockchain itself will be independent of it, and other actions not related to cash transactions will proceed separately. In this case, who will ensure the reliability of the system? Who already has an incentive to do this for free, but with the same degree of protection?

Take a look at the drawing, this is the task. It is necessary to connect all 9 points with four lines running continuously one after the other. This task demonstrates the principles of going beyond thinking. Perhaps this is applicable to the blockchain and not to build on the old paradigms because it goes beyond monetary transactions? Since the blockchain does not need to prove to everyone about its need, potential, and it has long since distanced itself from ordinary transactions, and provided opportunities such as a distributed data registry, the implementation of smart contracts, decentralized applications, and the holding of ICOs. Then is a blockchain possible without miners ensuring reliability? And without the main cryptocurrency, which is necessary first of all to stimulate this reliability? The cryptocurrency itself is of course necessary for the implementation of cash transactions, just the blockchain itself will be independent of it, and other actions not related to cash transactions will proceed separately. In this case, who will ensure the reliability of the system? Who already has an incentive to do this for free, but with the same degree of protection?

Let us turn again to the article by Satoshi Nakamoto [2]. It said that if one vote is an IP address, then such a scheme can be compromised. As a result, added "complexity" to the scheme was a different "one processor - one vote." Those. the binding goes to the physical world. Then, perhaps in the physical world, find a replacement processor. Or perhaps, that the processor acted from someone's face?

Let's call cryptocurrency as a service and turn to the blockchain participants (besides the miners):

- There is a cryptocurrency as a service for the implementation of cash transactions and smart contracts, in terms of which is also prescribed the implementation of these transactions.

- There are services that provide certain IT solutions (medical card, digital dentistry , real estate registry, voting systems, Internet of things, insurance and other solutions not related to monetary transactions, but including one solution or another where it is possible and necessary to use a distributed data registry), those. decentralized applications.

- There are customers of these services. They can be both physical persons and legal entities (group of persons). Which carry out transactions in these services.

We already know the blockchain on cryptocurrency, the blockchain on applications - although there will be a large number of them, but they have a common drawback - an economic incentive to conquer the market. But here are the customers, these are the participants on which we pay attention. The whole point of the blockchain is to ensure that customers make transactions online without trust and without a third party, which should reduce transaction costs and efficiency. But as we have seen above, this is not quite the case. In this case, I came to the conclusion that it is the customers who, in making their transactions (transactions), implement the blockchain consensus. Because their need to complete transactions is an incentive . Moreover, it is the customers who have the greatest number, which means they are able to realize the most maximum effect of decentralization. As a result, there will be a “one person - one voice” scheme, such a scheme cannot be compromised, it is impossible to persuade a huge number of people to take harmful actions. Any transaction sent to the network will be carried out by a person or group of persons through a computer (smartphone, computer, terminal, and other equipment).

The only thing that is required for this is the verification of the client (person) by means of biometrics, which will serve as a private key . It will be impossible to lose, steal, disable (the client himself is the owner of the blockchain, and information on biometrics is not stored anywhere ).

Incorrect interpretation, which is misleading. I recommend to read the comment.

Take a look at the block formation scheme.

Suppose conventionally that X, A, B, C, C, D, D, E are users. The word transaction also means a transaction. Let us analyze an example with user B.

- User B sends the transaction to user C. This transaction is called TB and is in pending status.

- Its validity and writing to the open block is performed by someone else's confirmed transaction, in this case Ta.

- In the open block, already belonging to the transaction TB, the information of its validator is also recorded - the transaction Ta.

- The transaction Tx, which is the validator of the transaction Ta, checks the chain of blocks belonging to user B, and relating to the service in which the transaction TB was performed, on:

- The presence of another open block, where the same transaction TB, but another validator (not Ta). In this case, the block is canceled in which the presence time from the moment of sending the validator transaction is the smallest.

- The presence of another open block, where another transaction of user B in this service. In this case, the adequacy of funds is checked (if it is a cash transaction) during the execution of transactions, time is also taken into account and a decision is made to cancel any open block or, on the contrary, leave it.

- The presence of other sent transactions, in case one of them went offline.

- If everything is normal, the transaction Tx, confirming the validity of the transaction TB, writes its information in the transaction block TB.

- Since in regards to TB, everything is fine; Transaction TB checks the validity of its first validator - transaction Ta. If everything is normal, the transaction information TB is recorded in the block belonging to the transaction Ta.

- The Ta transaction closes the validator block ... (for more details, by analogy in paragraph 10, using the example of closing the Tx block).

- Further, the TB transaction opens a new block, but not for the blockchain of user B, but for a random transaction of another user who sent a transaction that is in the waiting status. In this case, this is Tv, user V.

- Repeats the process in relation to the transaction TV (from 2 to 6 points).

- From the moment Tv enrolled in the TB transaction block. TB closes the transaction block Tx. At the same time, TB and TV also check transaction Tx.

- Processes are repeated and as a result, sooner or later, the blocks of Ta, TB, TV, etc. transactions are closed (but perhaps disbanded).

The complexity of this approach lies in the fact that in the block of a Tb transaction, all 5 transactions of validators must confirm Tb. Imagine that in the block of transaction TV, at the time of its closure, Te rejected the validity of TV. This is a weighty "statement", but as you can see, Te has already been confirmed by the transactions Tg and Td, and moreover, they are enclosed in a block. Tr and Td are also validators of Tv. In this case, Te also verifies Ta and TB transactions. If it is not confirmed, Those is rejected and the Transaction Block TD is looking for another transaction from waiting. If Te is valid, then T will be re-checked by all transactions and if it is rejected again by Te or another transaction, the Tv block is canceled. TV is recognized not valid. In consequence of this, the closed blocks Tx, Ta and TB contain irrelevant information, i.e. Lying. To fix this, the reverse process is needed - the block is decaying.

If TV turned out to be invalid, then a small decay occurs in the Tx block. This is the most minimal damage, the correction of which is possible due to a different unit with a small decay. They are able to exchange main transactions and close blocks to each other. In the Ta and TB blocks, a partial decomposition (semi decay) occurs before a valid transaction, then the processes are repeated.

As a result, it can be concluded that, with the likelihood of such a scenario, the user must be limited in his ability to send the next transaction in a particular service until the previous one closes completely, including closing its validator blocks. Naturally, this will not benefit the speed of transactions. But at the same time, imagine what the likelihood of such a scenario? It is minimal and possible only when attacking. Attacks are also unlikely, because such a user will compromise itself and will be known not only in virtual spaces, but also in real ones. Another approach is possible when using different status channels, or other methods that facilitate sending several transactions simultaneously in one service. All these are technical issues that are resolved along the way.

Now we will present this blockchain graphically. We have different services (X axis) on the blockchain (different cryptocurrencies - state or not, smart contract platforms, applications, etc.), which provide the capabilities (services and products) to clients (Y axis), which are as physical . Persons and legal entities faces. As well as customer transactions (Z axis). As a result, it turns out that one person has his own blockchain in different services, but at the same time is connected together with the rest. In other words, if user B registers with service 1 (for example, a cryptocurrency of the Central Bank), then all transactions generated by user B in this service will be recorded sequentially in his (user) blockchain chain associated with this service. At the same time, service 1 will also maintain the sequence of the chain, but alternating transactions from all users of the service (that is, it will be a node that sequentially records blocks generated by users of this service), but it is not the main keeper of the chain, but only appears to be a reserve. This is due to the fact that, based on the block formation scheme, each transaction generated by user B is also recorded in blocks of six other participants (in their blockchain), this is the accepting transaction (user C) and five validators (Ta, Tx, TV, Tr, Td each of which could be carried out in another service). Surprisingly, it coincided with the theory of six handshakes . If you believe that, then making all participants in the transaction will be conditionally connected to each other as one unit. This means that if someone wants to change the information in his block, then this person will need to be persuaded to change it by six more participants, who, in turn, have their own and further to the end.

Now we will present this blockchain graphically. We have different services (X axis) on the blockchain (different cryptocurrencies - state or not, smart contract platforms, applications, etc.), which provide the capabilities (services and products) to clients (Y axis), which are as physical . Persons and legal entities faces. As well as customer transactions (Z axis). As a result, it turns out that one person has his own blockchain in different services, but at the same time is connected together with the rest. In other words, if user B registers with service 1 (for example, a cryptocurrency of the Central Bank), then all transactions generated by user B in this service will be recorded sequentially in his (user) blockchain chain associated with this service. At the same time, service 1 will also maintain the sequence of the chain, but alternating transactions from all users of the service (that is, it will be a node that sequentially records blocks generated by users of this service), but it is not the main keeper of the chain, but only appears to be a reserve. This is due to the fact that, based on the block formation scheme, each transaction generated by user B is also recorded in blocks of six other participants (in their blockchain), this is the accepting transaction (user C) and five validators (Ta, Tx, TV, Tr, Td each of which could be carried out in another service). Surprisingly, it coincided with the theory of six handshakes . If you believe that, then making all participants in the transaction will be conditionally connected to each other as one unit. This means that if someone wants to change the information in his block, then this person will need to be persuaded to change it by six more participants, who, in turn, have their own and further to the end.

When the user is registered in any of the services, the genesis of the block is generated. As a result, there are two ways to generate the first transaction blocks:

- The two genesis of a block opens a block of someone else's transaction, thereby becoming its validator.

- One genesis block is able to open two blocks of different transactions, where each of the transaction will later act as the second validator.

Further, all according to the block formation scheme.

Conclusion

Undoubtedly, many can be repelled by a similar approach of proof to the face (Proof of Face), since its implementation requires verification of the user, including biometrics, but which will serve as a kind of private key. (note, biometrics in PoF should not be stored electronically anywhere, it is only the private key for generating a public one). But on the other hand, all countries (including various organizations) are now working on verification through biometrics, and sooner or later there will be a transition from a paper passport to a digital one. And his information will either be centralized (which is hardly possible), or it will be in the blockchain, which will most likely work on the Proof of Stake with a cryptocurrency from the Central Bank, where banks will be full nodes. Accordingly, not only monetary transactions, but also any transactions will go through them. In general, and in general, all of this is purely the consequences described above, it is the dependence on the blockchain cryptocurrency, the dependence on the cost of transactions, and the likelihood of control (by the operators - full nodes) due to the tendency to centralize in favor of economic / political interests.

Then the approach based on Proof of Face, which will allow users to be the owners of their blockchain in each service separately, looks more acceptable. The ultimate impossibility of centralization will allow anyone to stay online, since a scenario where millions of people choose not to accept transactions from a particular person at the same time is excluded. Free simple transactions as it happens in the real world when transferring cash from hand to hand. The lack of a fee for the operation of applications that will really reduce the costs of implementing the service. The independence of the blockchain from the fate of one or another cryptocurrency . The small size of the chain of blocks , because each chain is formed for each user personal and separately for each service, which will positively affect the speed of validation. Accordingly, the transaction rate will theoretically be higher than in the current blockchains. The safety of data chains is provided in the devices of the users themselves, where each user block is synchronized with 6 more participants. And also in the nodes that write blocks of their users. Apply now the principles of critique to the formation of blocks and the sequence of formation of chains, which together will ensure, in addition to the security and integrity of information, confidentiality . After all, it is not necessary to save all the information on each validator in each block, but only part of it can be applied, for example, using the Merkle tree.

In general, the main message is that the users themselves who carry out transactions should implement the consensus, which is their incentive. How, I suggested the above approach. The implementation of such a blockchain can be in three ways:

- At the state level, when moving from a paper passport to a digital one.

- As an open source project of a separate blockchain.

- As Sidechain.

In the first case, it is fast and legal (when the transformation process happens together in all areas and levels). Will not meet resistance. But at the beginning of the path will develop within a single state. There is a risk of excessive control.

In the second case, the registration of users will occur from the service (commercial organizations). Thus, it will be implemented as an alternative to existing databases.

The third method implies that the current blockchains are services within the framework of this approach, providing various IT solutions for specific tasks. And the PoF consensus will allow to unite them and generate a complete interconnection.

There is truth more true than another truth, but there is truth better, because what is useful is true.

PS At the time of writing, unfortunately I was not familiar with solutions based on DAG (directed acyclic graph) implemented in Byteball and IOTA. But the essence of the above does not change. Probably, using DAG, it is possible to exclude such a property as block decay and block creation in general, leaving only the schema, at the same time solving the problem with simultaneous sending of several transactions.

Bibliography

[1] Blockchain

[2] Translation of Satoshi Nakomoto's article. Bitcoin: a digital peer-to-peer cash system

[3] What is Proof-of-Work and Proof-of-Stake

[4] What is Segregated Witness

[5] White Paper Ethereum translation

')

Source: https://habr.com/ru/post/333708/

All Articles