Startup cycle: how (in general) venture investment works

Hi, Habr! Recently I published a book on legal support of venture investments and IT business. I'm not going to sell the book, so I am happy to lay out one chapter for the members of the community.

The book "The law of a startup":

- Starter vs. entrepreneur

- Choose a form

- check in

- Corporate Governance

How is a company legally built? - Current work

Contracts and how they work

How to check an open source partner - Taxes

What does IT business pay in Russia? - Governmental support

- Startup cycle

How venture investment (in general) works - Venture transactions

- Venture funds

- Intellectual property

- Offshore and foreign trade

The advantages and pitfalls of offshore

At work (I am a lawyer and teacher), I often have to explain to students how venture investment works and why an investor to invest money in IT business, in fact, without getting anything in return. Therefore, I tried to explain the nature of the venture phenomenon. Of course, this is still a theory, in practice there are a lot of nuances and details, but as a general guide, I think it is appropriate. If something remains unclear, ask in the comments, I will explain as far as possible ;-)

Each startup has its own characteristics depending on the field of activity, which is its basis for intellectual property and even on the number of founders. However, if we expand the development of a startup into several milestones, they will be common: development of a prototype, market entry, rapid growth, scaling, transition to the stage of smooth growth.

')

What else unites startups?

A start-up differs from an “ordinary” business in that it is based on innovation - a special innovation that allows you to create new products, services, and business processes. Thanks to innovation, a real startup does not compete with other firms, but creates a new, completely open market.

As you remember, in 2007, Apple offered users a new mobile phone format - without a keyboard and with a touchscreen, as well as a special ecosystem for mobile applications that can be installed on the phone.

The iPhone was not an absolute competitor for the then dominant Nokia, Motorola, and other models with keyboards. He had certain drawbacks, but at the same time he offered much more extensive functionality, primarily as a mobile Internet surfing device. As a result, Apple created a new market, and push-button phones turned into a narrow (niche) product.

This is the essence of a startup: the innovation laid in its foundation opens up a new, not yet busy market. Thanks to innovation, a startup can grow extensively. In contrast, for example, from shawarma stalls, whose market is already established, the market for innovative goods has not yet been filled. Consequently, a startup can take it completely (as the Europeans occupied the market of American Indians with their axes, beads and blankets).

For this reason, a startup is growing very fast, in particular, in price. By investing in a “normal” business, the investor makes a profit; investing in a startup, primarily on the growth of the value of the share.

Timur from Zelenograd decided to open a pizzeria. He already had experience in the restaurant business and knew the recipes for a good pizza, but did not have the money for the initial rental of the premises and the purchase of equipment. Then Timur called his friend Arthur to join the project as an investor, that is, to invest money. Arthur offered Timur $ 5 million, and in return he wanted 75% in the company (and, accordingly, in its profit).Now let's see how investing in a real startup works.

Why did Arthur ask for such a large share? This is where the traditional valuation model works. For example, the average profit of a pizzeria of this size with proper management is $ 1 million per year. Taking into account that Arthur will not receive all the profit, as well as it will take some time to “promote”, the pizzeria will pay off in 7–8 years. So, in fact, Arthur will invest his money at 12-14% per year, and this is without taking into account the risks inherent in entrepreneurship. If the pizzeria goes bankrupt, Timur will not lose anything, but Arthur will lose $ 5 million.

Can Arthur count on what he earns by increasing the value of his share? No, because its share will grow only with the business itself. And in a year, and in five years, 75% of the pizzeria will cost about the same 5 million ₽. In addition, the institution will not be easy to sell, and it is difficult to scale it in Zelenograd, since there is plenty of pizzerias there.

Kohl invented a brilliant application that allows you to create beautiful pictures using neural networks. Pictures are a success - they look as if they were painted by a real artist. Kohl made the site, but because of a weak server, he manages to process only one image per minute. Users want to process much more.

Assessing the situation, Tanya - Colin's classmate and co-founder of the venture fund - offered investments: $ 5 million for a new server, a new website and advertising. In return, Tanya asked for 25% in Kolina company.

Why did Tanya ask for such a small share? The fact is that Colin business is promising. It can bring millions if you process a lot of pictures and take money for it. Consequently, the task is to maximize Kolin's service: buy servers and conduct an advertising campaign.

When the explosive growth slows down, Tanya will be able to put pressure on Kohl to introduce monetization mechanisms on the site: show ads, charge for new pictures, etc. Then the startup will turn into an ordinary business that brings good money. As an option, Tanya will be able to simply sell her share - unlike in a pizzeria, this business is much more profitable, and over time its share will cost more. If she gives the moment of sale (a little earlier than users lose interest in Colina’s technology), then she will be able to find the same avid investor and get maximum for her share.

As the startup grows

The development of a startup has traditionally been divided into several stages, which generally mean the path from a small company with innovation at the center to a large transnational corporation like Facebook. Of course, not every startup goes through all the stages: most of the projects go bankrupt before they reach the second.

Blame for all - the lack of funding, lack of experience or fundamental unrealizability of the project. In the middle stages of development, startups are absorbed by large competitors (to mutual benefit). All stages pass to the end only a few. Here is a graph illustrating the growth stages of a startup.

This graph is called “J-curve” (J curve), guess why?

Development

At an early stage, the entrepreneur creates a prototype and develops a business plan. Usually this stage is associated with going beyond the scope of primary financing (own money or money of relatives). Therefore, funds are needed to refine the investment product to the level of the applicable prototype.

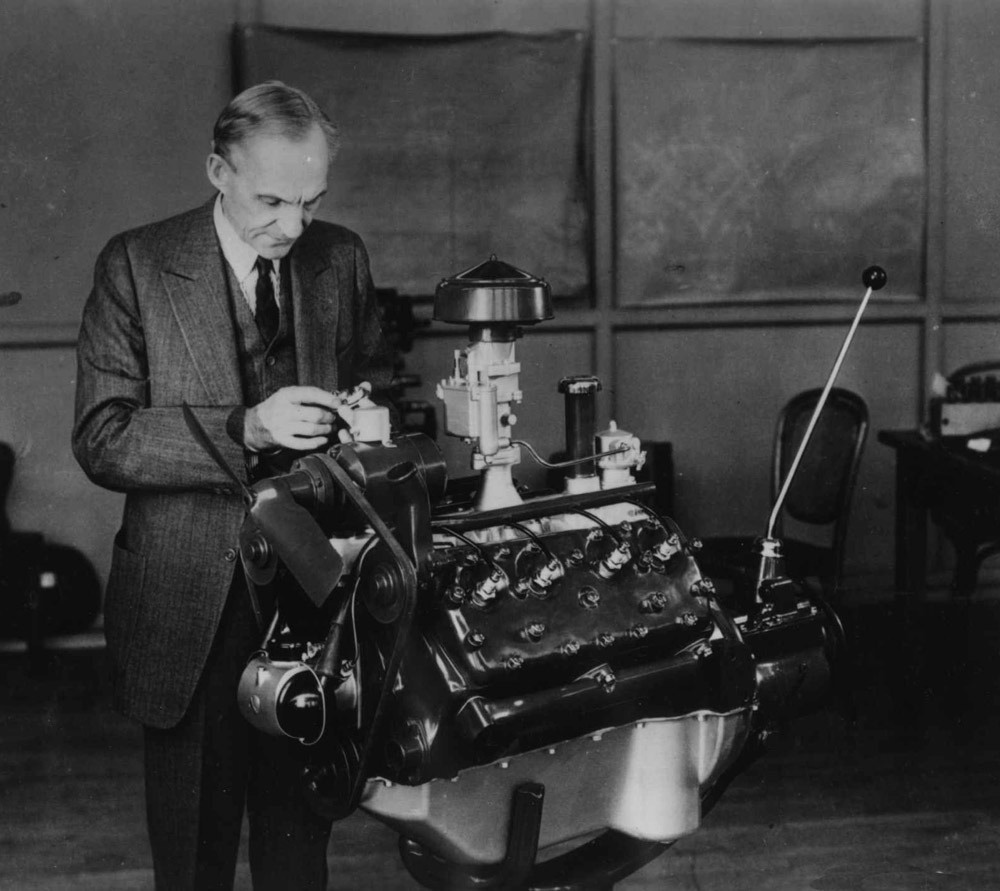

If the entrepreneur continues to develop the product at his own expense, the development stage may be delayed. This phenomenon is known as "garage business". For example, the "garage entrepreneur" was Henry Ford, who, working as chief engineer at the Edison plant, in his spare time from 1891 to 1901. worked on a prototype car.

The more development is delayed, the less the prospects for a startup - at any moment it will be occupied by someone more agile in the market niche. And vice versa, the faster a startup captures the market, the more substantial profit it will receive (and the more it grows in price). Such a pattern attracts venture investors like Tanya, who exchange money for shares in startups.

When a startup can attract investments depends on two factors. On the one hand, the earlier this happens, the more chances to occupy the market. Besides, investing at the initial stage means getting a larger share for the same money. On the other hand, the longer a startup exists, the clearer the technological perspectives of the innovation laid in its foundation. Early investment is accompanied by great risks, because the more conceptual an innovation is, the more difficult it is to assess its real applicability and usefulness.

Thus, investors are trying to achieve a balance between the risks of technological uncertainty of the project and the losses associated with the late entry of innovation to the market.

In the early stages, not all investors invest: they are usually seed funds, accelerators and business angels. Larger investors — venture capital funds and private equity funds — are waiting for the next stages, because in the early stages the transaction costs associated with evaluating, legal and accounting verification of a startup are too high relative to the price of the investment transaction itself.

Investment

When buying a stake, the investor cannot accurately assess the innovation underlying the startup. The very essence of innovation implies the absence of empirical data, on the basis of which its prospects can be assessed. Therefore, investing in a startup, investors get back not a fixed profit, but a share in the company, thus securing their remuneration depending on the overall growth of the startup.

An investor increases the return on his contribution by bringing a startup to the market as soon as possible. Due to the cost of extensive growth, a scalable and growing startup usually has no profit (there is a cash burn effect). Therefore, start-up investors do not receive dividends, but they are not needed: venture investors expect to make a profit not from dividends, but from the sale of their shares.

When does an investor sell his share? This moment depends on several factors. Ideally, when the market is fully embraced (the startup reaches the limits of scaling). In a number of cases, the investor sells his share earlier due to the requirements of the fund and internal restrictions (this will be discussed in the next chapter).

If a startup development strategy involves staged scaling (for example, entering a city / country / region market), venture financing can be attracted several times in ever increasing amounts. These investment rounds imply different amounts of investment, different financing conditions and different guarantees for investors.

Each arrival of a new investor is an important event for startup participants, because he has not yet become public and his shares cannot be sold on the stock exchange. If one of the participants wants to sell his share, then the easiest way to do this is with the arrival of a new investor.

If a startup has fully occupied the market and its development has stopped, then new investors are in no hurry to enter it, because their shares will not grow as fast as we would like. In this case, investors owning shares, can return their investments by:

- sales of shares to the founders, if those have enough money (LBO);

- absorption of a startup by a larger holding (M & A);

- public offer (placement on the stock exchange) startup shares (IPO).

After the venture investors exit, the startup turns into a “traditional” company with its market share, makes a profit and pays dividends. Investors are looking for the following startups.

Investor and startup

The relationship of the founder of a startup with an investor is a partnership, which in most cases leads to mutual benefit. However, we must not forget that the interests of partners differ. An investor seeks to maximize profits, and a start-up - to self-realize as the founder of a large company. This often causes conflicts between them.

For example, a conflict may arise when evaluating a company. At the heart of a startup is innovation - an asset that, in principle, cannot be accurately assessed, especially in the early stages. Therefore, an entrepreneur who buys a share in a startup always seeks to underestimate the value, and a startup person - to overestimate. Part of the problem is solved by post-investment share adjustment mechanisms (ratchet and convertible loan, we will discuss them a bit later).

Let me remind you once again that startups are non-public companies, their shares do not circulate on the exchange and do not have universal market value. In addition to problems with evaluation, this makes shares in a startup illiquid: the founder and investors of the early stages will not be able to get rid of the share if no one wants to buy it. At the same time, participation in a startup, albeit highly valued, does not bring profit by itself.

All together, it forms an “appraisal phenomenon”: a startup can be rated extremely high, up to billions of dollars. At the same time, the actual inflow of money into it will be an order of magnitude less, and the founders will receive nothing at all, since all investments will go “to growth”.

So, the most expensive startup in the world is considered to be the Uber service:

“Uber Technologies’s mobile taxi call service attracted $ 2.1 billion of investments in the next round of financing,” Bloomberg reported, citing sources familiar with the company's reporting.

American Forbes cites estimates of $ 68 billion: the publication was able to see a copy of the statements, from which it follows that in round G more than 43 million new shares were issued at a price of $ 48.77 per share. Thus, the service has strengthened the status of the most expensive startup in the world. ”

What happened? Uber needed new tools: for example, to enter the Singapore market or launch the development of an unmanned vehicle; in short, to do something that will increase the hypothetical expectations of future investors.

There were several investment (venture) funds that are willing to give the company money for these projects in exchange for a small share, which they will later resell. For Uber, these investments will be at least the seventh in a row (G is the seventh letter of the alphabet).

Uber issues 43 million shares and sells them to an investor for $ 48.77 per share. Accordingly, the assets of "Uber" increase by about $ 2.1 billion (48.77 x 43 million) - that is how much money the investors undertake to transfer.

“Investors estimate Uber at $ 68 billion” (in this case, it’s about post-money valuation, that is, after investing). This means that for purchased 43 million shares (for $ 2.1 billion) investors will receive a 3% stake in Uber:

Thus, the company's valuation is an extrapolation of the price that investors pay for a small percentage of the company, for 100% of its shares. The amount of $ 68 billion in question, "Uber" did not receive and most likely will never receive. This is a speculative sum, which is really confirmed only by 3%.

So, $ 68 billion is:

- not the amount for which Uber can be sold or bought;

- not the amount that Uber has or will ever have;

- not authorized capital "Uber".

A graph illustrating the difference between the Uber estimate and its real capitalization.

Another example to pin:

Vasya created a startup in the form of a joint stock company. Its authorized capital is 1 million shares with a nominal value of each 1 kopeck, for a total of 10 thousand rubles.

A week later, Vasya asked his father to invest $ 500 in a startup, offering one share for it. My father took pity on him and agreed: he bought one share for $ 500.

Now Vasya can honestly say to journalists:

- that investors valued his startup at $ 500 million (1 million shares x $ 500);

- that his startup for the week grew by about 3 million times (from 10 thousand to $ 500 million), which will give a result of 15.6 billion% per annum for future investors.

But we all know that, in fact, Vasya was simply presented with $ 500.

For those who do not want to wait for the publication of the remaining chapters on Habré - a link to the PDF of the full book is in my profile.

Source: https://habr.com/ru/post/333368/

All Articles