We remove and deposit cash at an ATM using a smartphone. World's first

Hi, Habr! The guys and I thought and decided that since everyone is starting to actively use all sorts of Pay-e (Apple Pay, Samsung Pay, Android Pay, and a couple of vendors are just around the corner), why not give users the opportunity not only to pay using a smartphone at the store's checkout, but also withdraw money from an ATM.

No sooner said than done.

')

Thoughts that it would be nice to gradually transfer payment processes to non-contact, came to us even during the first Alfa Future People festival. Then this idea fit well into the concept that there should be no cash on the territory of the festival. It was offered to pay with a bracelet.

The guest of the festival at the entrance received a bracelet and a card tied to it (MasterCard). A smart card was built into the bracelet, which allowed you to pay with a touch on the outlets of the festival. Thus, both the festival pass and the wallet were obtained.

It was 2014, and then the possibility of depositing or withdrawing cash from an ATM was extended from the bracelets to our MasterCard PayPass cards, after which they finalized VISA.

A new stage in the development of payments by touch was asked when vendors were actively involved in the business. Apple on September 9, 2014 presented Apple Pay, which not only proved its viability, but also set another trend. Samsung decided to keep up, as a result of which the world saw Samsung Pay, and now Android Pay is also working in Russia.

Users who appreciated the convenience of such payment at the box office, could not help asking questions about the possibility of interaction between a smartphone and an ATM.

We talked to the guys from Apple and explained to them what and how we want to do. The idea was received with enthusiasm.

On Apple Pay, all processing improvements were run in, so after the release of Samsung Pay and Android Pay, there were no technical difficulties, and in fact the entire connection of the new system to ATMs depended only on the success of negotiations with the vendor.

When you do something with the intention of launching the first in the world, the speed of work will play a rather important role. In the majority view, all processes related to banking and the introduction of something new should be quite unhurried - here both the specificity of the banking sector, its inherent bureaucracy, and many other factors, each of which in one way or another hampers the progress of work.

In our case, everything happened so quickly that we first did something, implemented and tested, and then wrote all the necessary documentation and made possible corrections from the vendor.

Here we must pay tribute to our contractor, BPC Banking Technologies, which did its part of the work as quickly as possible.

As a result, everything about everything in the case of connecting Apple Pay has left us a month. In April 2017, we are going to Apple, and already in early May we conduct the first live tests on ATMs.

The answer to both of these questions is, in fact, simple - it all depends on the vendor’s payment system itself.

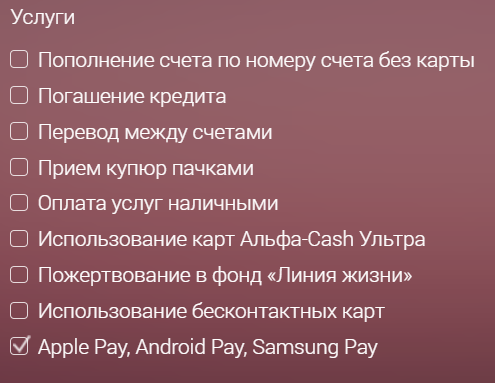

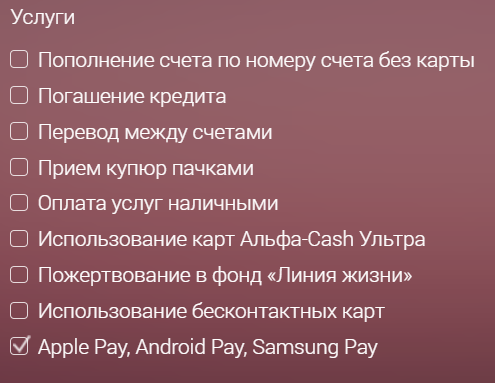

That is, if your smartphone supports Apple Pay, Samsung Pay or Android Pay, then you can withdraw or deposit cash at one of our new ATMs using a smartphone. If the payment on the pinpad in the store works with the help of hours - then you will be able to use them with an ATM.

The same applies to security - everything related to the safe storage of a bank card token on a device is provided by the vendor itself.

Additional protection against unauthorized access to your account by the ATM is the need to enter a PIN code from the corresponding card during any operation. For example, if in a cafe you can pay for a cup of coffee with a simple touch, without a pin code, then interaction with an ATM will require entering a code even if you want to withdraw 100 rubles from the account.

At the beginning of July in Moscow, we still have 20 such terminals installed, in Russia a total of 300. The priority in the installation is given to Alfa-Bank branches, but ATMs are also placed in business centers.

In order to find such an ATM on the map, we made an additional filter on the site. Soon it should appear in mobile applications.

These ATMs will be allocated visually with the help of special stickers, it will also be noticeable that a reader is installed under the slot for the card.

It does not go without curiosities, because people get used to the appearance of ATMs, and begin to suspect something, if suddenly some additional detail appears on their favorite device. Whether it’s a reader or an anti-Chinese measure, for the user it’s still something new, which means it’s suspicious. We have already been called a couple of times about the fact that "someone has installed some strange garbage on an ATM, which will now precisely withdraw money from all my cards". In fact, it is even good that users are vigilant and call us, because the cases are different.

By the end of 2017, we plan to bring the number of such ATMs to 700. The restructuring of the ATM network itself is carried out in two ways - this is the installation of the latest models of ATMs, and the upgrade of the current ones (corresponding software + reader). In this case, in the case of an upgrade, the cost of such a revision is approximately 5% of the price of a new ATM.

Now a couple of weeks have passed since the official launch, so it will be difficult to show some detailed statistics on the use of this function, but general information makes it clear that they are beginning to use it more and more actively. And not so much in the test mode “Let me try to take a thousand with a smartphone”, but for quite large amounts - there were withdrawals of about 100,000 rubles using Apple Pay. While we tend to believe that this particular Pay will become the most popular with users, but only time will tell.

There are plans to enter the so-called topless ATMs in the ATM park. Contrary to expectations, such an ATM will not have a nice assistant next to it to help you withdraw or deposit cash, it’s just an ATM without a top (no screen and no keyboard). Similar ATMs are already in use in some selected countries.

How it works - all operations (the choice of the desired action, a specific amount and other things) are carried out on the smartphone screen through the bank application. After clarifying all the details it remains only to bring the smartphone to the ATM reader and receive or deposit cash. The ATM itself is a rectangular box that has only a reader and a compartment for receiving and issuing bills.

This, by the way, gives a small plus in terms of security. If earlier cameras could be installed above a keyboard at a specific angle, recording your pincode for an attacker (or even using a fake keyboard for the same purpose), then entering a pincode and other data from the screen of your smartphone eliminates such a vulnerability. Like the problem of skimmers - there is no slot for cards = no one clones the magnetic stripe of your card.

Of course, there is a non-zero probability that with time and the growing popularity of contactless miniature NFC skimmers will appear, this is inevitable, as the eternal confrontation between the sword and the shield. But, frankly, the level of data protection in the token and in the magnetic strip is very different.

Of course, we expect the appearance of similar ATMs and our colleagues in banking.

But about the spread of this in the world while the following trend is observed. ATMs are most developed in Asia. Some new functions and experiments often appear there (but in the case of replenishment and withdrawal via smartphone, we were the first in the world).

The West, despite the fact that ATMs first appeared there, progresses not so actively in terms of ATMs. For the most part, this is due to the fact that their ATM fleet went through all stages of evolution, from the first ATMs that processed checks (which they invented for this purpose) to ATMs that you can see in the USA now.

Barclays Bank, 1967, photo - AP.

This thing was the first automatic cash dispenser in the world. The user inserted a check into the slot and got cash. The cash in this case was limited to 10 pounds, because at that time it was not possible to check how much money the client had on the account in principle. But already at that time they were struggling with fakes, and these checks, which were issued by the bank, were marked with carbon-14 isotope. For a person, the isotope is fairly harmless, but an ATM could understand, a correct check was inserted into it, or someone decided to get rich at the expense of the bank in an unlawful way.

Now in the US, the situation is such that most of the cards used are with magnetic stripes, not with chips, not to mention contactless. By the way, for this reason, the cloned maps are being taken to the Obl from the Russian Federation to the USA. Suppose you have a card with a chip. Somehow, in the ATM, which was not installed in the most reliable place, you got on skimmers, which counted the magnetic stripe and pin-code, after which the attacker made a clone of your card using a pig.

So, the use of this clone in the Russian Federation will be useless - banks have data that the card is also protected by a chip, so it will not work to withdraw money from a clone through an ATM. But you can take a clone to the United States and cash it there, without checking for a chip.

Now the ATM network in the USA is so huge that a huge amount of time and money will be spent on its modernization. Together with a certain conservatism, we have what we have - a noticeable lag behind the rest of the world in working with maps.

Why we are more fortunate - because in our country, ATMs began to actively appear in the 90s of the last century. We started with fairly normal technologies that we managed to develop in accordance with the needs of users and our ideas.

Therefore, it is now much easier for us to introduce something new.

What we are trying to do.

PS By the way, if you want to take part in the development of such solutions, we recently opened several new vacancies , perhaps we need you.

No sooner said than done.

')

How it all began

Thoughts that it would be nice to gradually transfer payment processes to non-contact, came to us even during the first Alfa Future People festival. Then this idea fit well into the concept that there should be no cash on the territory of the festival. It was offered to pay with a bracelet.

The guest of the festival at the entrance received a bracelet and a card tied to it (MasterCard). A smart card was built into the bracelet, which allowed you to pay with a touch on the outlets of the festival. Thus, both the festival pass and the wallet were obtained.

It was 2014, and then the possibility of depositing or withdrawing cash from an ATM was extended from the bracelets to our MasterCard PayPass cards, after which they finalized VISA.

A new stage in the development of payments by touch was asked when vendors were actively involved in the business. Apple on September 9, 2014 presented Apple Pay, which not only proved its viability, but also set another trend. Samsung decided to keep up, as a result of which the world saw Samsung Pay, and now Android Pay is also working in Russia.

Users who appreciated the convenience of such payment at the box office, could not help asking questions about the possibility of interaction between a smartphone and an ATM.

Conversation

We talked to the guys from Apple and explained to them what and how we want to do. The idea was received with enthusiasm.

On Apple Pay, all processing improvements were run in, so after the release of Samsung Pay and Android Pay, there were no technical difficulties, and in fact the entire connection of the new system to ATMs depended only on the success of negotiations with the vendor.

When you do something with the intention of launching the first in the world, the speed of work will play a rather important role. In the majority view, all processes related to banking and the introduction of something new should be quite unhurried - here both the specificity of the banking sector, its inherent bureaucracy, and many other factors, each of which in one way or another hampers the progress of work.

In our case, everything happened so quickly that we first did something, implemented and tested, and then wrote all the necessary documentation and made possible corrections from the vendor.

Here we must pay tribute to our contractor, BPC Banking Technologies, which did its part of the work as quickly as possible.

As a result, everything about everything in the case of connecting Apple Pay has left us a month. In April 2017, we are going to Apple, and already in early May we conduct the first live tests on ATMs.

What smartphones does it work and how safe is it?

The answer to both of these questions is, in fact, simple - it all depends on the vendor’s payment system itself.

That is, if your smartphone supports Apple Pay, Samsung Pay or Android Pay, then you can withdraw or deposit cash at one of our new ATMs using a smartphone. If the payment on the pinpad in the store works with the help of hours - then you will be able to use them with an ATM.

The same applies to security - everything related to the safe storage of a bank card token on a device is provided by the vendor itself.

Additional protection against unauthorized access to your account by the ATM is the need to enter a PIN code from the corresponding card during any operation. For example, if in a cafe you can pay for a cup of coffee with a simple touch, without a pin code, then interaction with an ATM will require entering a code even if you want to withdraw 100 rubles from the account.

Where can I try in action

At the beginning of July in Moscow, we still have 20 such terminals installed, in Russia a total of 300. The priority in the installation is given to Alfa-Bank branches, but ATMs are also placed in business centers.

In order to find such an ATM on the map, we made an additional filter on the site. Soon it should appear in mobile applications.

These ATMs will be allocated visually with the help of special stickers, it will also be noticeable that a reader is installed under the slot for the card.

It does not go without curiosities, because people get used to the appearance of ATMs, and begin to suspect something, if suddenly some additional detail appears on their favorite device. Whether it’s a reader or an anti-Chinese measure, for the user it’s still something new, which means it’s suspicious. We have already been called a couple of times about the fact that "someone has installed some strange garbage on an ATM, which will now precisely withdraw money from all my cards". In fact, it is even good that users are vigilant and call us, because the cases are different.

By the end of 2017, we plan to bring the number of such ATMs to 700. The restructuring of the ATM network itself is carried out in two ways - this is the installation of the latest models of ATMs, and the upgrade of the current ones (corresponding software + reader). In this case, in the case of an upgrade, the cost of such a revision is approximately 5% of the price of a new ATM.

Now a couple of weeks have passed since the official launch, so it will be difficult to show some detailed statistics on the use of this function, but general information makes it clear that they are beginning to use it more and more actively. And not so much in the test mode “Let me try to take a thousand with a smartphone”, but for quite large amounts - there were withdrawals of about 100,000 rubles using Apple Pay. While we tend to believe that this particular Pay will become the most popular with users, but only time will tell.

What's next

There are plans to enter the so-called topless ATMs in the ATM park. Contrary to expectations, such an ATM will not have a nice assistant next to it to help you withdraw or deposit cash, it’s just an ATM without a top (no screen and no keyboard). Similar ATMs are already in use in some selected countries.

How it works - all operations (the choice of the desired action, a specific amount and other things) are carried out on the smartphone screen through the bank application. After clarifying all the details it remains only to bring the smartphone to the ATM reader and receive or deposit cash. The ATM itself is a rectangular box that has only a reader and a compartment for receiving and issuing bills.

This, by the way, gives a small plus in terms of security. If earlier cameras could be installed above a keyboard at a specific angle, recording your pincode for an attacker (or even using a fake keyboard for the same purpose), then entering a pincode and other data from the screen of your smartphone eliminates such a vulnerability. Like the problem of skimmers - there is no slot for cards = no one clones the magnetic stripe of your card.

Of course, there is a non-zero probability that with time and the growing popularity of contactless miniature NFC skimmers will appear, this is inevitable, as the eternal confrontation between the sword and the shield. But, frankly, the level of data protection in the token and in the magnetic strip is very different.

Of course, we expect the appearance of similar ATMs and our colleagues in banking.

But about the spread of this in the world while the following trend is observed. ATMs are most developed in Asia. Some new functions and experiments often appear there (but in the case of replenishment and withdrawal via smartphone, we were the first in the world).

The West, despite the fact that ATMs first appeared there, progresses not so actively in terms of ATMs. For the most part, this is due to the fact that their ATM fleet went through all stages of evolution, from the first ATMs that processed checks (which they invented for this purpose) to ATMs that you can see in the USA now.

Barclays Bank, 1967, photo - AP.

This thing was the first automatic cash dispenser in the world. The user inserted a check into the slot and got cash. The cash in this case was limited to 10 pounds, because at that time it was not possible to check how much money the client had on the account in principle. But already at that time they were struggling with fakes, and these checks, which were issued by the bank, were marked with carbon-14 isotope. For a person, the isotope is fairly harmless, but an ATM could understand, a correct check was inserted into it, or someone decided to get rich at the expense of the bank in an unlawful way.

Now in the US, the situation is such that most of the cards used are with magnetic stripes, not with chips, not to mention contactless. By the way, for this reason, the cloned maps are being taken to the Obl from the Russian Federation to the USA. Suppose you have a card with a chip. Somehow, in the ATM, which was not installed in the most reliable place, you got on skimmers, which counted the magnetic stripe and pin-code, after which the attacker made a clone of your card using a pig.

So, the use of this clone in the Russian Federation will be useless - banks have data that the card is also protected by a chip, so it will not work to withdraw money from a clone through an ATM. But you can take a clone to the United States and cash it there, without checking for a chip.

Now the ATM network in the USA is so huge that a huge amount of time and money will be spent on its modernization. Together with a certain conservatism, we have what we have - a noticeable lag behind the rest of the world in working with maps.

Why we are more fortunate - because in our country, ATMs began to actively appear in the 90s of the last century. We started with fairly normal technologies that we managed to develop in accordance with the needs of users and our ideas.

Therefore, it is now much easier for us to introduce something new.

What we are trying to do.

PS By the way, if you want to take part in the development of such solutions, we recently opened several new vacancies , perhaps we need you.

Source: https://habr.com/ru/post/332596/

All Articles