Amazon, Apple, and Microsoft Shares Equal to Due to Technical Failure

Last Monday, traders who followed market events through Google Finance, Yahoo Finance, as well as Bloomberg and Thomson Reuters trading terminals, noticed a sharp jump in share prices of a number of large companies. Some of them, for example, Amazon and Apple, have significantly lost in value, while others, on the contrary, have grown.

However, there were no significant changes at that moment in the market; the trading platforms simply provided incorrect information. The cause of the error could be incorrect data from third-party providers.

')

What happened

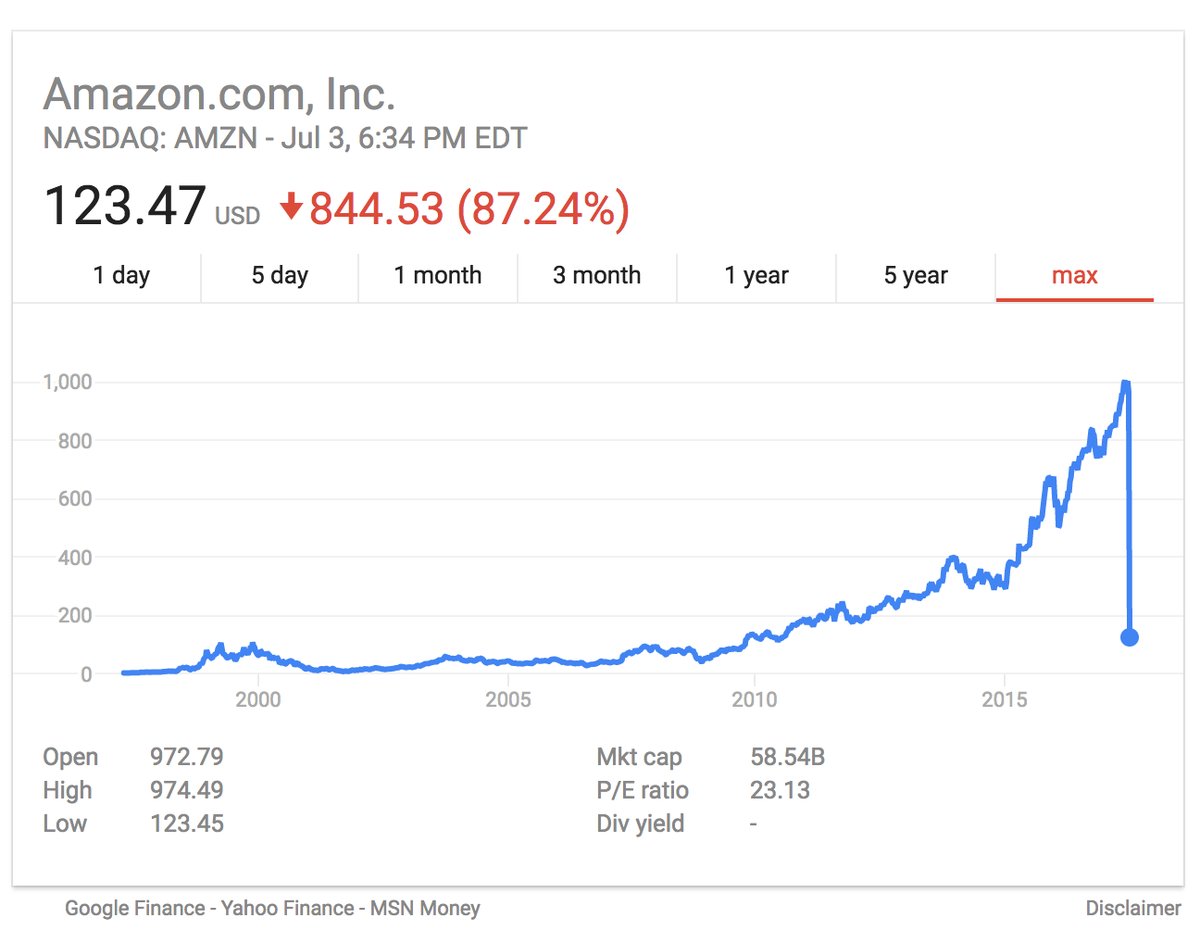

The incident occurred on US trading floors on Monday, July 3. By 11 o'clock in the evening, EST, Amazon’s share price fell by 87% to $ 123.47. Such data provided the marketplace Google Finance. Shortly before, Yahoo Finance showed that Amazon shares fell 74% and traded at $ 248.49. In reality, by the end of the day, the company's securities lost only 1.5% (the price was $ 953.66), and after the close of trading they grew by 0.1%.

Apple was in a similar situation. According to Google and Yahoo Finance, the value of its shares fell by 14% to $ 123.47. In fact, by the end of trading, the shares lost only 0.4% and were worth $ 143.50.

Curiously, the stock price of both Amazon and Apple was $ 123.47. This indicator has become common for most other companies. But if for the aforementioned Amazon and Apple, this meant a collapse, then for the rest - a rapid growth. For example, the value of eBay shares rose by 253%, Mattel Inc. - 473%, Microsoft Corp. - 79%.

If the mentioned price hikes were real, this would have enormous consequences for companies, reports The Wall Street Journal. In particular, the capitalization of Apple and Amazon would have decreased by $ 104 billion and $ 369 billion, respectively. Microsoft, on the other hand, would add $ 415 billion.

Who is guilty

The cause of the incident was that so-called test data was published on Google Finance, Yahoo Finance and Bloomberg. But the question of who exactly provided the wrong information remains open. According to RBC, journalists were asked to send to Bloomberg all questions about what happened in the Nasdaq. Google also said that incorrect data was obtained from the exchange, although through third parties.

In turn, Nasdaq does not see its fault in what happened. The representative of the organization, John Kristinat, said that the mistake was made by third-party providers whose services are used by trading platforms. The speaker said: "This is a supplier problem, not a Nasdaq problem."

The MarketWatch edition cites similar words from a Nasdaq representative, although without mentioning specific names: “UTP creates test data, and this is part of the normal workflow. The problem occurs when third parties mistakenly distribute this data. Nasdaq is working with third-party vendors to resolve the issue. ”

It is worth noting that after 11 pm on Monday North American Eastern Time, Yahoo Finance and Bloomberg began to show correct information, but test data was still hanging on Google Finance. Their companies are supplied by Swiss SIX Financial Information (shows prices by the end of the day) and New York-based Interactive Data Real-Time Services, Inc. (prices during the day). New York data providers did not respond to the MarketWatch request. But the Swiss hurried to disown all charges. According to their representatives, the company checked the data provided and did not find any errors or distortions in them.

The Nasdaq believes that confusion could arise from the early close of trading on Monday. Independence Day is celebrated in the US on July 4th, so on the eve of trading on the Nasdaq, it stopped at 1.00 pm EST. After the closing of the official session, the securities on the exchange, as a rule, are traded for another four hours.

Implications for Traders and the Exchange

On the pre-holiday day, Nasdaq notified traders of the early closing of trades and asked to consider any information that extends after 17.16 EST. Perhaps that is why the failure did not lead to serious consequences. RBC reports that no real transaction error in the data has not affected.

The failure was resolved promptly, the very next day, Nasdaq reported that all systems were working normally. However, according to the agency of economic information PRIME, not all stock quotes are reliable. In particular, the cost of Amgen Inc. shares was incorrectly displayed on Google Finance. It is reported that on Tuesday morning she fell 28% to $ 123.4. On the eve, these shares closed at $ 172.8.

Sudden collapses have occurred on the Nasdaq and earlier. So, at the end of June 2017, the shares of Facebook, Apple, Microsoft, Amazon, Alphabet and other large IT-companies fell in price by 3-4%. According to financiers , this was an adjustment after a long increase.

Financial companies are developing their own tools that help minimize the consequences of such failures. Errors in the work of exchange systems can lead not only to incorrect display of trade data, but also to incorrect calculation of the collateral to hold the position, which can even lead to premature closing of the transaction.

In order to minimize possible damage, brokerage companies are developing various systems to protect customers. How this protection is implemented in the ITinvest MatriX trading system can be found here .

Source: https://habr.com/ru/post/332522/

All Articles