FinWin-2017: competition fintech projects and the latest trends in the banking sector

On 22 June, the annual forum-exhibition of ecosystems and marketplaces for the financial and related industries FinWin 2017 was held for the second time in Moscow at the Digital October center.

The event brought together top managers of major banks, financial organizations, representatives of companies interested in partnership, and the press. The topic of discussions, as a year ago, was about banking ecosystems and the possibilities of expanding the list of proposals at the expense of collaboration with advanced fintech projects.

Despite the seriousness of the topics discussed, the forum was held in the format of "bankers without ties". The atmosphere of the event pleased with its ease: many performances were accompanied by jokes, and discussions were conducted in an informal way.

')

Photo source: FutureBanking's official Facebook group .

One of the most intriguing events of the FinWin forum was a project competition. The aim of the competition was the selection of several of the most promising projects with significant potential for cooperation with banks. The jury included leading fintech experts from Russia's largest banks - Otkritie, Raiffeisenbank, Tinkoff, Alfa-Bank, Sberbank and VTB-24. The participants presented their projects, revealing the benefits of services that could contribute to the development of banking ecosystems.

The winners were the projects “My Capital”, “My Broker”, “iQ Channels” and “Altkraft”. Let us dwell on the presentations of the winning companies in more detail:

Photo source: FutureBanking's official Facebook group.

My Capital

The project “My Capital” is a mobile marketplace of financial instruments. The ecosystem consists of more than 10 mobile and desktop applications implemented for iOS, Android, Windows and Mac operating systems.

The creators of "My Capital" is a full-cycle company from Novosibirsk, which has many years of experience in creating and promoting applications, which is undoubtedly a strong point of the project. The team came to the idea of its product, simply putting itself in the place of the consumer - a regular user who wants to have a simple answer to a direct question in the spirit of “Siri, where should I invest 300 thousand rubles?”. This is the standard to which, according to the speaker, it is worth striving. In words, it is easy to implement something like this, but at the moment there are no solutions on the market that would carry out an automated and yet personalized selection of financial proposals for a potential investor.

By the way, the My Capital team includes not only developers and marketers, but also financiers and scientists from the Novosibirsk Academgorodok. Together they are developing an adaptable intellectual system based on neural networks, which, according to their forecasts, will help to bring such a scheme to life.

Developers, attracting organic traffic from mobile markets, plan to collect the necessary data on the user's investment desires through applications in order to provide the specific person with the most relevant proposals for the compilation of an investment portfolio. One of the applications, bearing the same name as the project, offers the consumer assistance in selecting the optimal bank offer for deposits, the other helps to deal with the stock market, the third - to master IIS and so on.

Photo source: Future Banking's official Facebook group.

The company offers banks the opportunity to promote services through an ecosystem of investment applications. The fact that the user is ready to take an additional step - installing an application to select a suitable product - is a guarantee for banks to receive a highly motivated client. The integration conditions are negotiated by the creators of “My Capital” with financial institutions on an individual basis, which provides the customer with the most convenient format of implementation.

The project is very young, only six months old, but, as the jury’s decision showed, it is very promising. Currently, developers are working hard to develop a recommender system to increase the relevance of search results and the development of predictive modules to clarify user needs.

Video report

My Broker

The first winner is followed by another winner, a product long established in the market from a veteran in the financial sector, BCS, an intellectual application called “My Broker” , which is positioned by the creators as the “exchange in a smartphone”. Unlike the project “My Capital”, it is not exactly an ecosystem of applications, but rather a single product with the maximum opportunities for investing on the stock exchange.

The project arose as a response to the need for a novice broker in some simple and convenient tool for working with the stock market. The target audience of the product is, first of all, people who are not particularly knowledgeable in the field of finance, but are interested in finding options for investment. The preliminary survey showed that respondents are primarily afraid of the seeming complexity of interaction with exchanges and the ambiguity of the first steps.

“My broker” allows you to sell and buy stocks, bonds and other securities. An application using an intelligent system creates an individual investment plan for the user. There is also a lot of informative tabs of the “Quotes” and “Currency exchange” section with the most profitable offers. Opening a brokerage account is carried out directly from the application.

BCS analysts online can offer ready-made solutions for investment or advise the user. User-created personal financial portfolio is a kind of widget with illustrative growth indicators. Developers guarantee the security of all financial transactions.

An application originally created for private investors may be an interesting option for financial institutions. “My Broker” is an open API and infrastructure ready for integration that banks can use for their projects as part of the task of expanding the investment opportunities of their clients and the marketplace of banking services.

Video report

Altkraft

The Altkraft company specializes in creating products in the field of digital marketing. The guys were the only representatives of this trend in the competition. The project, presented at the exhibition, is a synthesized platform for marketing automation and communication in digital channels. Data security is provided by the client firewall: the platform is positioned as on-premise software. The platform is installed on the client's equipment, which allows to fulfill the requirement of the Law “On Personal Data” No. 152-.

The creators of the project promise a comprehensive solution to the following tasks: automating regular communications with the client, split testing, analytics (more than 30 campaign slices), saving money by reducing SMS and overall centralization of marketing and communications for all branches within a single platform valuable for banks).

The project will allow banks to build a unified marketing strategy in all digital channels - email, push notifications, instant messengers, SMS, email, etc., to collect a history of user actions. Developers guarantee seamless integration with partner sites.

To summarize, interaction with Altkraft provides banks with a number of advantages: quick implementation, a unified marketing strategy, collecting and accumulating user data and their interests for further, more accurate targeting, and the possibility of partner schemes to attract customers.

Video report

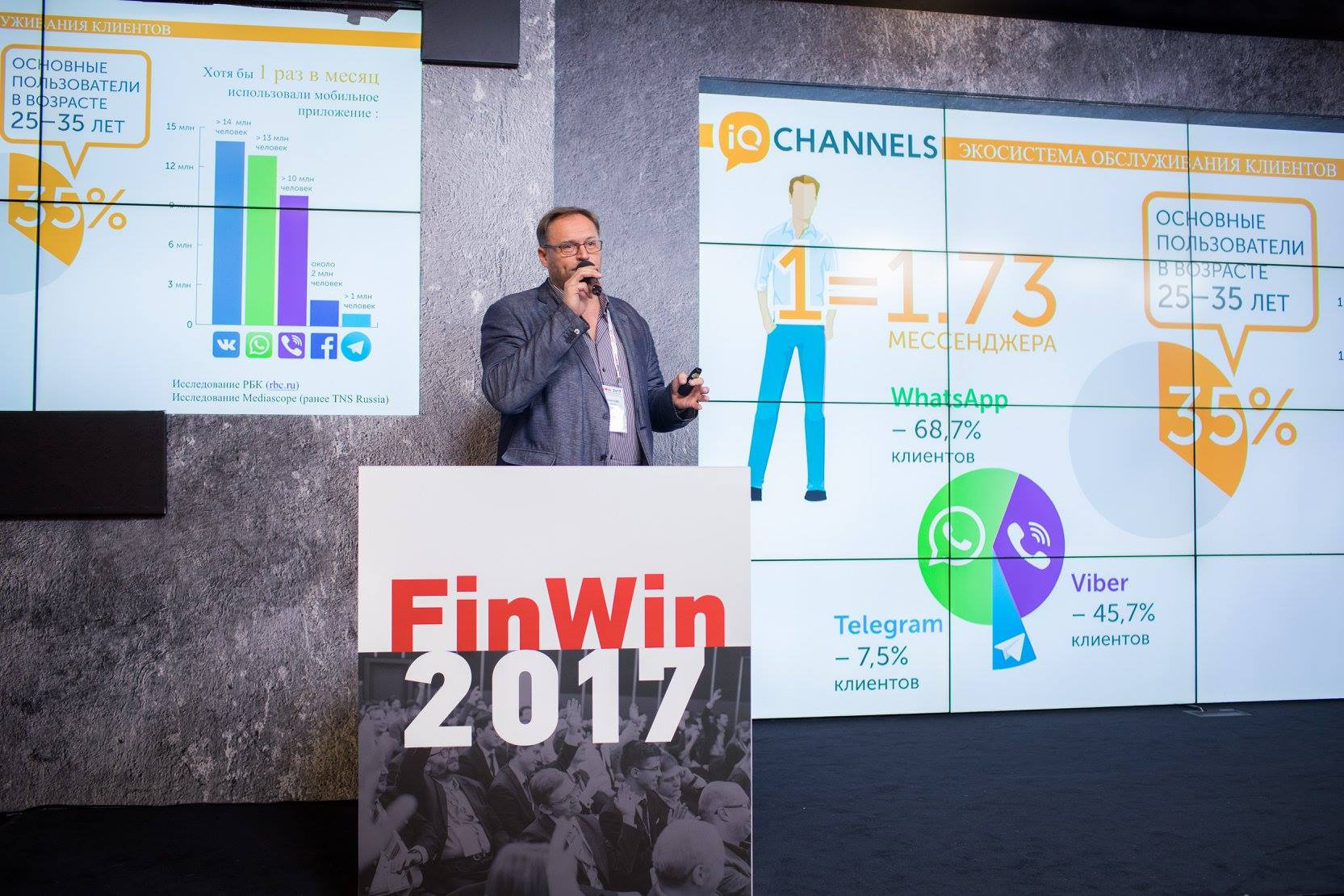

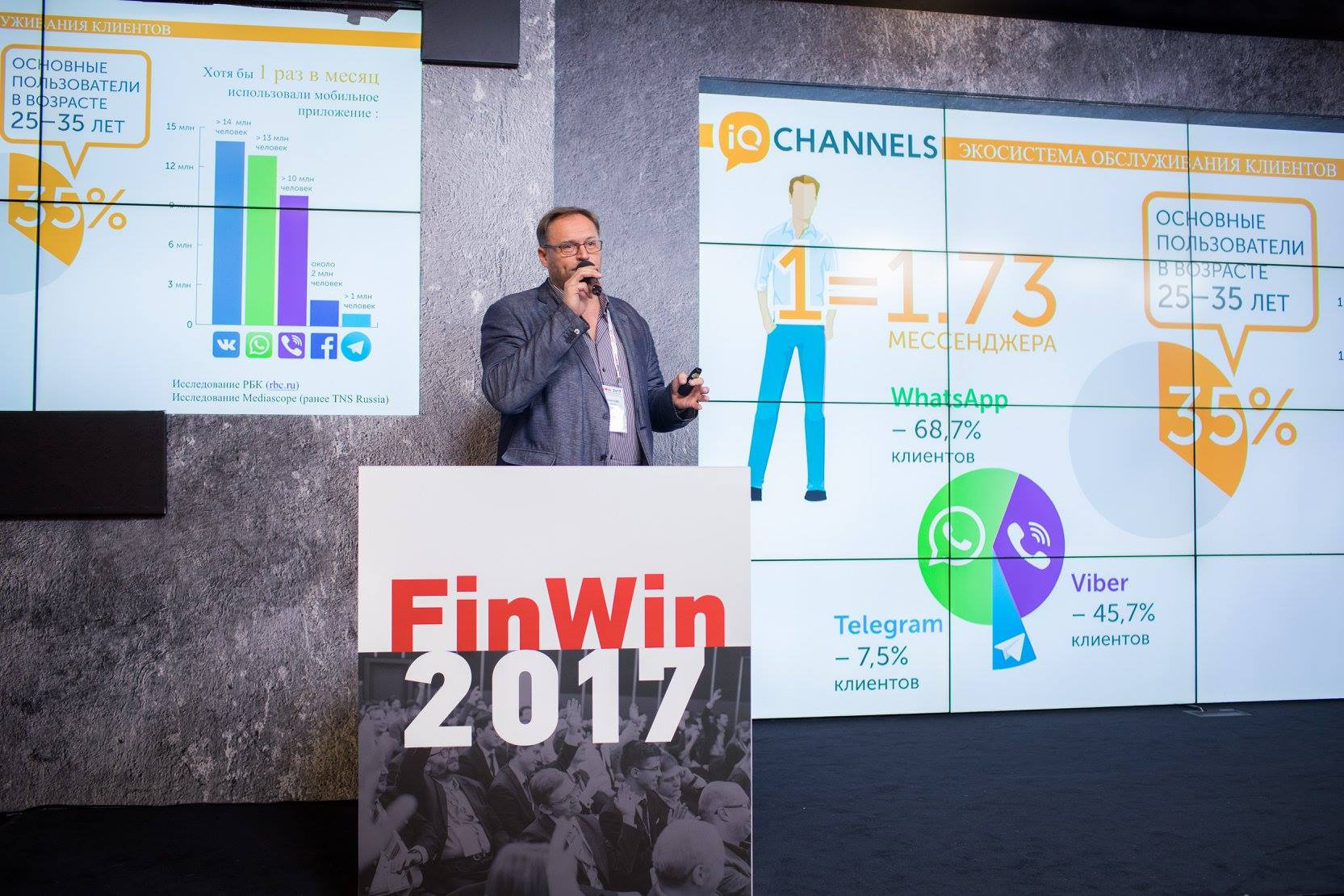

iQChannels

The list of winners closes the project of the company iQStore - an ecosystem of tools for business interaction with the customer called iQChannels.

The product is an omnichannel solution for customer support service that supports interaction with the client: in chat format via the website, the Internet and mobile bank, instant messengers; video calls, e-mail, SMS. The implementation of the ecosystem will allow to reduce various channels into a single network, organize and systematize customer service and help to collect communication history in various channels in one place.

Such experience helps not only to systematize customer data, but also to increase the loyalty of consumers of banking services.

Video report

Photo source: FutureBanking's official Facebook group.

In addition to the four projects presented, Tekhnosoft, Art-Bank, Freedom24.ru, BrainySoft, 7 Seconds, Credit Application Operator, Money in Business, VentureClub also took part in the competition. Each of the decisions aroused the interest of the audience and the jury. For example, experts from BrainySoft have created an aggregator of added value for different types of financial organizations: online stores, banks, microfinance organizations. The platform provides an extensive set of ready-made integrations for the provision of loans for the purchase of goods in real time and subsequent work with clients.

As for the program, FinWin 2017 consisted of three sessions under the code names “Experience of Ecosystem Leaders”, “Ecosystem for Small and Medium Business” and “Banks are looking for partners”, as well as two panel discussions on the topic “How to build a better ecosystem for the user” and “ What services do the entrepreneur need. ”

Surprisingly, the cryptocurrency was never discussed: the forum was a kind of "middle ground". There were no noisy advanced technologies, however, it was still about the future of banks and modern solutions.

During the discussion about the content of the concepts of “marketplace” and “ecosystem”, the participants quite quickly reached a consensus: banks understand the term “marketplace” as some related services that they can offer their customers. The ecosystem in this context implies a certain bundle of tools, platforms and services, where the most favorable environment for the client is created.

Today, most banks come to the conclusion that in a highly competitive environment, in order to retain the customer, you need to be able to offer the consumer as many “buns” as possible, creating marketplays for related non-banking services. In fact, these additional opportunities can be of any kind: from paying utility bills, fines and taxes to buying tickets for a concert or a plane. The main thing that the user saw in them convenience for themselves.

Such measures allow banks to:

Photo source: FutureBanking's official Facebook group.

During the sessions, domestic and foreign top managers of banks and high-class FINTECH specialists spoke. For example, Mikhail Lomtadze, representative of the board of the Kazakh bank Kaspi, member of the board of directors of Binbank Alexander Filatov, project manager of Tarantool Data Grid Mail.ru Group Denis Anikin, head of department of the Center for Technological Innovations of Sberbank Andrey Aristarkhov and others. A detailed overview of the presentations is presented in the article "In the bank as in the store, or what customers want . "

Let's stop on some records of performances which, can interest readers of a habr.

Interesting both in content and in the format of the presentation was the report of Nikolai Adeev, representative of Artsofte on the topic “Misconceptions in the formation of marketplaces or how the ecosystem begins.”

Nicholas immediately made a reservation that the term "ecosystem" he understands a certain set of front-end product environments that are somehow connected with each other, and that which end users encounter. He singled out three theses of ecosystem: the seamlessness and uniformity of the interface, a single method of identification, a comfortable way of moving between these environments in a single window system. The list of typical misconceptions includes the following beliefs:

Watch the video presentation is , as for the information content of the report, and for the charisma of the speaker, who informal style of presentation was able to capture and engage the audience.

The joint report of a member of the Board of Directors of Binbank, Alexander Filatov, and the Business Development Director of Binbank Digital, Igor Gaydarzhi, dealt with both management issues and technological nuances. The presentation included advice on how to eat 10 banks and not become clumsy, how to redraw the entire control system (spoiler: it was not without Gref), and, of course, the ubiquitous Agile was not deprived of attention.

And, finally, Sberbank. The head of the Sberbank Center for Technological Innovations, Andrei Aristarkhov, spoke about the private experience of using open API for the development of the organization. Implementing an open API is a phased process. In general, it occurs according to the following scheme: the emergence of the open API stimulates an influx of external developers with fresh ideas from FINTECH products and then applications executed by their forces (the formation of marketplaces occurs just at this, a mature stage of the project’s development), which, in its queue leads to business expansion. To secure data and company reputations, Sberbank distributes partners working with the Open API into several levels of trust, each of which has its own pool of rights and privileges.

In general, FinWin 2017 was fruitful for enterprises interested in partnership, and provided a lot of interesting material for examination. During the discussions, it became obvious that the trends that were discussed at the previous forum for the year consolidated and linger for a long time. Banks are trying to diversify their services and get additional value for customers, gradually turning into marketplace financial and non-financial offers. This trend stimulates interest in finding solutions for expanding the list of services and integrating with them. From the latest trends of the last year we can note more attention to additional services for legal entities.

According to experts, at the moment, existing offers on the market for individuals fully meet the needs of clients and expand the list of solutions needed primarily for legal entities. Offering additional opportunities in addition to standard banking services (for example, modern accounting platform or hosting) banks will be able to generate additional interest of legal entities and encourage them to make decisions about cooperation.

The event brought together top managers of major banks, financial organizations, representatives of companies interested in partnership, and the press. The topic of discussions, as a year ago, was about banking ecosystems and the possibilities of expanding the list of proposals at the expense of collaboration with advanced fintech projects.

Despite the seriousness of the topics discussed, the forum was held in the format of "bankers without ties". The atmosphere of the event pleased with its ease: many performances were accompanied by jokes, and discussions were conducted in an informal way.

')

Photo source: FutureBanking's official Facebook group .

Project competition

One of the most intriguing events of the FinWin forum was a project competition. The aim of the competition was the selection of several of the most promising projects with significant potential for cooperation with banks. The jury included leading fintech experts from Russia's largest banks - Otkritie, Raiffeisenbank, Tinkoff, Alfa-Bank, Sberbank and VTB-24. The participants presented their projects, revealing the benefits of services that could contribute to the development of banking ecosystems.

The winners were the projects “My Capital”, “My Broker”, “iQ Channels” and “Altkraft”. Let us dwell on the presentations of the winning companies in more detail:

Photo source: FutureBanking's official Facebook group.

My Capital

The project “My Capital” is a mobile marketplace of financial instruments. The ecosystem consists of more than 10 mobile and desktop applications implemented for iOS, Android, Windows and Mac operating systems.

The creators of "My Capital" is a full-cycle company from Novosibirsk, which has many years of experience in creating and promoting applications, which is undoubtedly a strong point of the project. The team came to the idea of its product, simply putting itself in the place of the consumer - a regular user who wants to have a simple answer to a direct question in the spirit of “Siri, where should I invest 300 thousand rubles?”. This is the standard to which, according to the speaker, it is worth striving. In words, it is easy to implement something like this, but at the moment there are no solutions on the market that would carry out an automated and yet personalized selection of financial proposals for a potential investor.

By the way, the My Capital team includes not only developers and marketers, but also financiers and scientists from the Novosibirsk Academgorodok. Together they are developing an adaptable intellectual system based on neural networks, which, according to their forecasts, will help to bring such a scheme to life.

Developers, attracting organic traffic from mobile markets, plan to collect the necessary data on the user's investment desires through applications in order to provide the specific person with the most relevant proposals for the compilation of an investment portfolio. One of the applications, bearing the same name as the project, offers the consumer assistance in selecting the optimal bank offer for deposits, the other helps to deal with the stock market, the third - to master IIS and so on.

Photo source: Future Banking's official Facebook group.

The company offers banks the opportunity to promote services through an ecosystem of investment applications. The fact that the user is ready to take an additional step - installing an application to select a suitable product - is a guarantee for banks to receive a highly motivated client. The integration conditions are negotiated by the creators of “My Capital” with financial institutions on an individual basis, which provides the customer with the most convenient format of implementation.

The project is very young, only six months old, but, as the jury’s decision showed, it is very promising. Currently, developers are working hard to develop a recommender system to increase the relevance of search results and the development of predictive modules to clarify user needs.

Video report

My Broker

The first winner is followed by another winner, a product long established in the market from a veteran in the financial sector, BCS, an intellectual application called “My Broker” , which is positioned by the creators as the “exchange in a smartphone”. Unlike the project “My Capital”, it is not exactly an ecosystem of applications, but rather a single product with the maximum opportunities for investing on the stock exchange.

The project arose as a response to the need for a novice broker in some simple and convenient tool for working with the stock market. The target audience of the product is, first of all, people who are not particularly knowledgeable in the field of finance, but are interested in finding options for investment. The preliminary survey showed that respondents are primarily afraid of the seeming complexity of interaction with exchanges and the ambiguity of the first steps.

“My broker” allows you to sell and buy stocks, bonds and other securities. An application using an intelligent system creates an individual investment plan for the user. There is also a lot of informative tabs of the “Quotes” and “Currency exchange” section with the most profitable offers. Opening a brokerage account is carried out directly from the application.

BCS analysts online can offer ready-made solutions for investment or advise the user. User-created personal financial portfolio is a kind of widget with illustrative growth indicators. Developers guarantee the security of all financial transactions.

An application originally created for private investors may be an interesting option for financial institutions. “My Broker” is an open API and infrastructure ready for integration that banks can use for their projects as part of the task of expanding the investment opportunities of their clients and the marketplace of banking services.

Video report

Altkraft

The Altkraft company specializes in creating products in the field of digital marketing. The guys were the only representatives of this trend in the competition. The project, presented at the exhibition, is a synthesized platform for marketing automation and communication in digital channels. Data security is provided by the client firewall: the platform is positioned as on-premise software. The platform is installed on the client's equipment, which allows to fulfill the requirement of the Law “On Personal Data” No. 152-.

The creators of the project promise a comprehensive solution to the following tasks: automating regular communications with the client, split testing, analytics (more than 30 campaign slices), saving money by reducing SMS and overall centralization of marketing and communications for all branches within a single platform valuable for banks).

The project will allow banks to build a unified marketing strategy in all digital channels - email, push notifications, instant messengers, SMS, email, etc., to collect a history of user actions. Developers guarantee seamless integration with partner sites.

To summarize, interaction with Altkraft provides banks with a number of advantages: quick implementation, a unified marketing strategy, collecting and accumulating user data and their interests for further, more accurate targeting, and the possibility of partner schemes to attract customers.

Video report

iQChannels

The list of winners closes the project of the company iQStore - an ecosystem of tools for business interaction with the customer called iQChannels.

The product is an omnichannel solution for customer support service that supports interaction with the client: in chat format via the website, the Internet and mobile bank, instant messengers; video calls, e-mail, SMS. The implementation of the ecosystem will allow to reduce various channels into a single network, organize and systematize customer service and help to collect communication history in various channels in one place.

Such experience helps not only to systematize customer data, but also to increase the loyalty of consumers of banking services.

Video report

Photo source: FutureBanking's official Facebook group.

In addition to the four projects presented, Tekhnosoft, Art-Bank, Freedom24.ru, BrainySoft, 7 Seconds, Credit Application Operator, Money in Business, VentureClub also took part in the competition. Each of the decisions aroused the interest of the audience and the jury. For example, experts from BrainySoft have created an aggregator of added value for different types of financial organizations: online stores, banks, microfinance organizations. The platform provides an extensive set of ready-made integrations for the provision of loans for the purchase of goods in real time and subsequent work with clients.

Actually conference

As for the program, FinWin 2017 consisted of three sessions under the code names “Experience of Ecosystem Leaders”, “Ecosystem for Small and Medium Business” and “Banks are looking for partners”, as well as two panel discussions on the topic “How to build a better ecosystem for the user” and “ What services do the entrepreneur need. ”

Surprisingly, the cryptocurrency was never discussed: the forum was a kind of "middle ground". There were no noisy advanced technologies, however, it was still about the future of banks and modern solutions.

During the discussion about the content of the concepts of “marketplace” and “ecosystem”, the participants quite quickly reached a consensus: banks understand the term “marketplace” as some related services that they can offer their customers. The ecosystem in this context implies a certain bundle of tools, platforms and services, where the most favorable environment for the client is created.

Today, most banks come to the conclusion that in a highly competitive environment, in order to retain the customer, you need to be able to offer the consumer as many “buns” as possible, creating marketplays for related non-banking services. In fact, these additional opportunities can be of any kind: from paying utility bills, fines and taxes to buying tickets for a concert or a plane. The main thing that the user saw in them convenience for themselves.

Such measures allow banks to:

- Increase customer loyalty;

- to invade the territory of retail and marketplaces like Yandex Market;

- receive additional income through commissions.

Photo source: FutureBanking's official Facebook group.

During the sessions, domestic and foreign top managers of banks and high-class FINTECH specialists spoke. For example, Mikhail Lomtadze, representative of the board of the Kazakh bank Kaspi, member of the board of directors of Binbank Alexander Filatov, project manager of Tarantool Data Grid Mail.ru Group Denis Anikin, head of department of the Center for Technological Innovations of Sberbank Andrey Aristarkhov and others. A detailed overview of the presentations is presented in the article "In the bank as in the store, or what customers want . "

Let's stop on some records of performances which, can interest readers of a habr.

Interesting both in content and in the format of the presentation was the report of Nikolai Adeev, representative of Artsofte on the topic “Misconceptions in the formation of marketplaces or how the ecosystem begins.”

Nicholas immediately made a reservation that the term "ecosystem" he understands a certain set of front-end product environments that are somehow connected with each other, and that which end users encounter. He singled out three theses of ecosystem: the seamlessness and uniformity of the interface, a single method of identification, a comfortable way of moving between these environments in a single window system. The list of typical misconceptions includes the following beliefs:

- The conviction of banks that they "own" customers and can easily sell them anything.

- Understanding of marketplace as an analogue of a separate portal / showcase / e-commerce.

- The conviction that the sites should be engaged in marketing and advertising, RBS - IT-specialists, while the marketplaces personify the business itself.

Watch the video presentation is , as for the information content of the report, and for the charisma of the speaker, who informal style of presentation was able to capture and engage the audience.

The joint report of a member of the Board of Directors of Binbank, Alexander Filatov, and the Business Development Director of Binbank Digital, Igor Gaydarzhi, dealt with both management issues and technological nuances. The presentation included advice on how to eat 10 banks and not become clumsy, how to redraw the entire control system (spoiler: it was not without Gref), and, of course, the ubiquitous Agile was not deprived of attention.

And, finally, Sberbank. The head of the Sberbank Center for Technological Innovations, Andrei Aristarkhov, spoke about the private experience of using open API for the development of the organization. Implementing an open API is a phased process. In general, it occurs according to the following scheme: the emergence of the open API stimulates an influx of external developers with fresh ideas from FINTECH products and then applications executed by their forces (the formation of marketplaces occurs just at this, a mature stage of the project’s development), which, in its queue leads to business expansion. To secure data and company reputations, Sberbank distributes partners working with the Open API into several levels of trust, each of which has its own pool of rights and privileges.

In general, FinWin 2017 was fruitful for enterprises interested in partnership, and provided a lot of interesting material for examination. During the discussions, it became obvious that the trends that were discussed at the previous forum for the year consolidated and linger for a long time. Banks are trying to diversify their services and get additional value for customers, gradually turning into marketplace financial and non-financial offers. This trend stimulates interest in finding solutions for expanding the list of services and integrating with them. From the latest trends of the last year we can note more attention to additional services for legal entities.

According to experts, at the moment, existing offers on the market for individuals fully meet the needs of clients and expand the list of solutions needed primarily for legal entities. Offering additional opportunities in addition to standard banking services (for example, modern accounting platform or hosting) banks will be able to generate additional interest of legal entities and encourage them to make decisions about cooperation.

Source: https://habr.com/ru/post/332162/

All Articles