How to pay taxes and fees of individual entrepreneurs or why we made a bot-accountant in Telegram

This article is for freelancers who work as an entrepreneur or are just planning to become entrepreneurs. We will tell you how to save the maximum on the tax on the USN and how our bot accountant in Telegram will help with this (and why ordinary online accounting is not suitable for this).

But before we start, let's see how much businessmen pay for the USN.

Insurance premiums PI

All entrepreneurs annually pay for themselves compulsory insurance contributions to the PFR and FFOMS. And regardless of whether they have income and on which tax system they are located.

Contributions are calculated on the basis of the minimum wage, which rises from time to time (for example, the minimum wage is 7500 rubles, and from July 1 it will increase to 7800 rubles). Therefore, if this year the entrepreneur must pay a minimum of 27,990 rubles, then the next - 29 109.60 rubles.

If the incomes of individual entrepreneurs for the year exceed 300 thousand rubles, then in the Pension Fund you must additionally pay 1% of the excess amount. If the SP is registered for less than a year, the amount of contributions decreases proportionally from the date of SP registration until the end of the year. (The exact amount of contributions can be calculated using the insurance premium calculator on our website.)

Contributions to the FIU, including a fixed part and an additional 1%, may not exceed the amount calculated on the basis of an 8-fold minimum wage. Therefore, the maximum amount of contributions to the FIU and the FFOMS in 2017 is 191,790 rubles.

The fixed portion of contributions must be paid by December 31, an additional 1% to the PFR - by April 1 of the following year. But insurance premiums are better paid in installments over the course of a year; we’ll tell about this below.

Advance payments and tax on USN

USN is of two types: income 6% or income minus expenses 15% (rates in different regions may vary). For IT freelancers, it is more suitable for USN revenues of 6%. Therefore, in this article we will talk about the calculation of the tax for individual entrepreneurs at the USN income without employees.

After the entrepreneur has income, he needs to pay advance payments and tax on the simplified tax system. Advance payments are paid during the year for each quarter (until April 25, July 25, October 25). The tax is paid following the results of the tax period - until April 30 of the following year.

The advance payments and the tax on the simplified tax system are calculated in the same way - it is 6% of the income received. This amount can be reduced by insurance premiums paid in the same period, as well as previous advance payments.

Reduced tax on the simplified tax system

So, there are several ways to reduce the tax on the simplified tax system. The first is to pay insurance premiums during the year (and not a single amount at the end). The second is to pay advance payments on time. If instead of advance payments to pay the full amount of tax at the end of the year, after the filing of the tax declaration you may be charged penalties for their late payment. If you don’t need to pay tax at all (for example, in December you paid insurance premiums and completely reduced the tax on USN), then the tax may still require you to pay advance payments, and then write them off from the account. How to avoid this situation, we will write further.

To understand how the tax on the simplified tax system is reduced, consider its formula.

H = D × 6% - B - C , where

H is an advance payment (for 1 quarter, half year, 9 months) or a tax on the simplified tax system for the year,

D is the amount of income for the period (cumulative from the beginning of the year),

B - these are insurance premiums paid in the same period,

is the sum of advance payments for the previous reporting periods.

For example, if an entrepreneur earned 250 thousand rubles in the first quarter, then the advance payment on the simplified tax system would amount to 15 thousand rubles:

250,000 × 6% = 15,000

If for the 2nd quarter he earns another 250 thousand rubles. and pay insurance premiums of 10 thousand rubles., the advance payment for the half year will be 5 thousand rubles .:

500,000 × 6% - 10,000 - 15,000 = 5000

In order to reduce the tax on USN insurance premiums, it is important that they be paid before the end of the quarter. For example, the advance payment for the 1st quarter can be reduced by insurance premiums paid from January 1 to March 31, the advance payment for the half-year can be reduced by contributions paid from January 1 to June 30, etc. This may be a fixed part of contributions, and additional 1% in the FIU. That is why it is important, if you have income, to pay contributions during the year, despite the fact that the deadline has not yet arrived.

If you have paid the debt on insurance premiums for the previous year, you can also reduce the tax on the simplified tax system for this amount.

The consequences of not paying taxes and fees

For non-payment of insurance premiums and advance payments (tax) under the simplified tax system may be charged penalties in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay (approximately 12% per annum).

For failure to pay tax on the simplified tax system may also be fined in the amount of from 20 to 40% of the unpaid amount.

What if you didn’t pay advance payments during the year?

As we have already written, this may result in the fact that after submitting the tax return, the tax amount will be debited from the current account, despite the fact that you do not have a tax debt. For example, if you paid insurance premiums in December and completely reduced the tax on the simplified tax system.

The fact is that tax reduction in the FTS program will occur only after the expiration of the deadline for filing a declaration (for the IP - April 30). Until that time, you will be in arrears in advance payments, and the tax may put a claim on you, and in the event of non-fulfillment, you will write off this amount from the settlement account. To avoid this, we recommend filing a declaration closer to the end of the term.

Online Accounting

Now let's see how premiums are considered popular online accounting. We do not take other functions (they are able to do a lot of useful things), only the calculation of contributions.

Input data: for the 1st and 2nd quarter of 2017 the individual entrepreneur earned 250 thousand rubles each. Insurance premiums and advance payments have not yet paid.

Total income is 500 thousand rubles. Tax on the simplified tax system - 30 000 rubles.

Amount of accrued insurance premiums:

- fixed part in the Pension Fund - 23 400 rubles.,

- fixed part in the FFOMS - 4590 rubles,

- additional 1% in the Pension Fund - 2000 rubles.

My business

My business offers to pay a fixed part of insurance premiums in equal parts during the year (1/4 per quarter), and an additional 1% only in the next year. For example, for our IP for the 2nd quarter, the service calculated in the Pension Fund of Russia - 11,700 rubles, in the FFOMS - 2,295 rubles.

Thus, the advance payment on the simplified taxation system for the 2nd quarter the entrepreneur will be able to reduce only by 13,995 rubles. and he will have to pay another 16 005 rubles .:

500,000 × 6% - 13,995 = 16,005

Suppose there is no more income from an IP. Until the end of the year, he will have to pay 11,700 rubles to the Pension Fund of Russia, 2295 rubles to the FFOMS, and 1% to 2,000 rubles before April 1 of the next year. That is, in just a year with My case, he will pay 45,995 rubles:

- in the Pension Fund - 23 400 rubles.,

- in FFOMS - 4590 rubles,

- in the PFR 1% - 2000 rubles,

- tax on the simplified tax system - 16 005 rubles.

Under the tax on the simplified tax system he will have an overpayment of 13,995 rubles, as he paid both insurance premiums and tax on the simplified tax system. Overpayment can be refunded or credited against future payments. But for this you must apply to the tax.

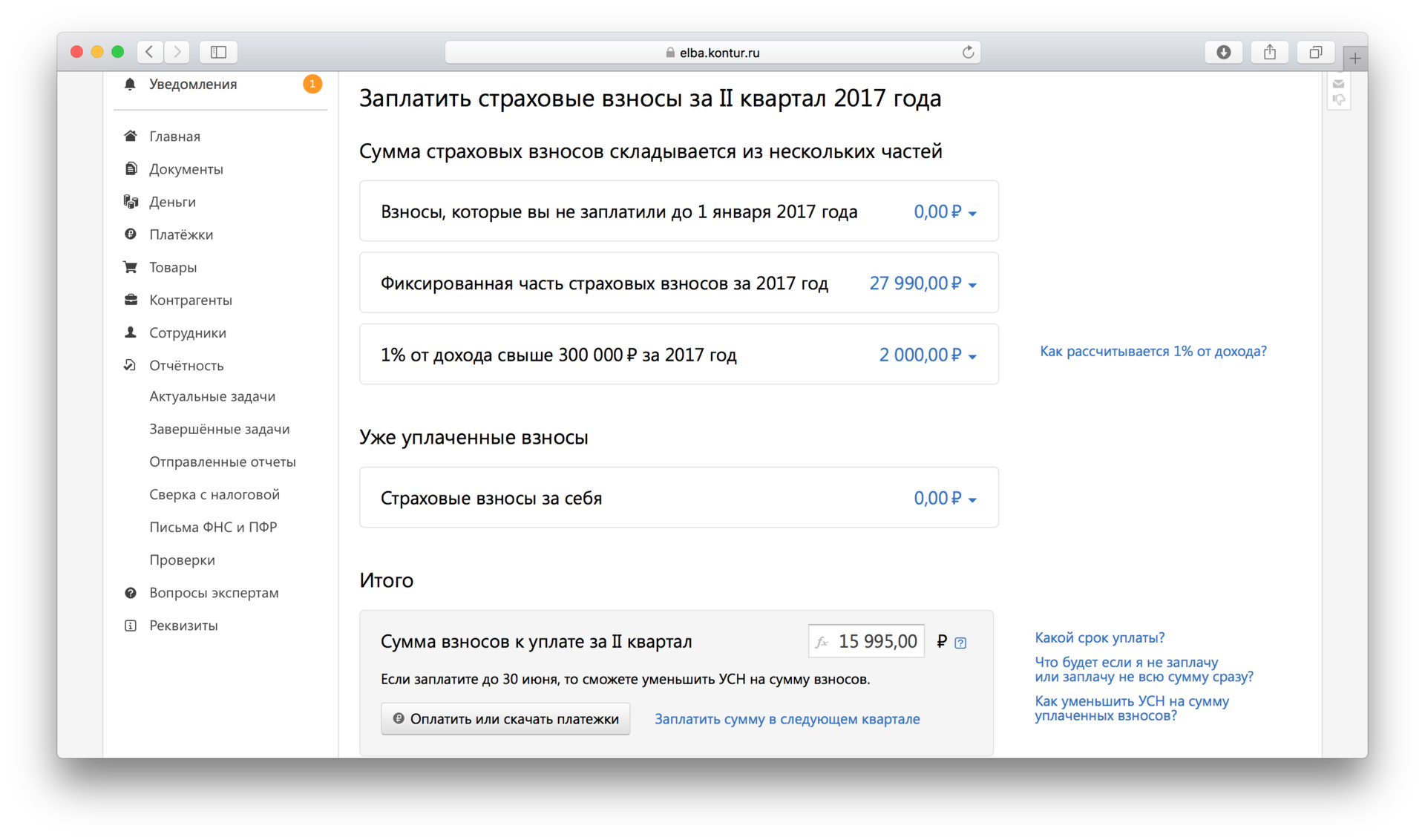

Elba

Elba also proposes to pay a fixed part of insurance premiums in equal parts during the year (1/4 per quarter) + an additional 1% to the PFR. For our IP, the service calculated in the PFR - 11,700 rubles, in the FFOMS - 2,295 rubles, in the PFR 1% - 2,000 rubles, a total of 15,995 rubles.

Advance payment under the simplified taxation system for the 2nd quarter will be 14,005 rubles:

500,000 × 6% - 15,995 = 14,005

If the individual entrepreneur has no more income, then he will also have to pay 11,700 rubles to the PFR by the end of the year. and in the FFOMS - 2295 rubles. In total for the year with the Elbe, he will pay 43 995 rubles, while the tax on the simplified tax system will be an overpayment of 13 995 rubles:

- in the Pension Fund - 23 400 rubles.,

- in FFOMS - 4590 rubles,

- in the PFR 1% - 2000 rubles,

- tax on the simplified tax system - 14 005 rubles.

1C

1C considers insurance premiums as Elba. That is, the entrepreneur will have to pay 43 995 rubles for the year. with overpayment on the simplified tax system 13 995 rubles.

Conclusion

Online accounting offers to pay insurance fees evenly throughout the year, not taking into account your real income, so you have to pay the tax on the simplified tax system, and insurance premiums. Thus, at the end of the year there will be an overpayment on the tax of the simplified tax system. It can be returned or credited against future payments, but this is a lengthy procedure that requires the entrepreneur to apply to the tax.

That is why we made a free accountant bot in Telegram.

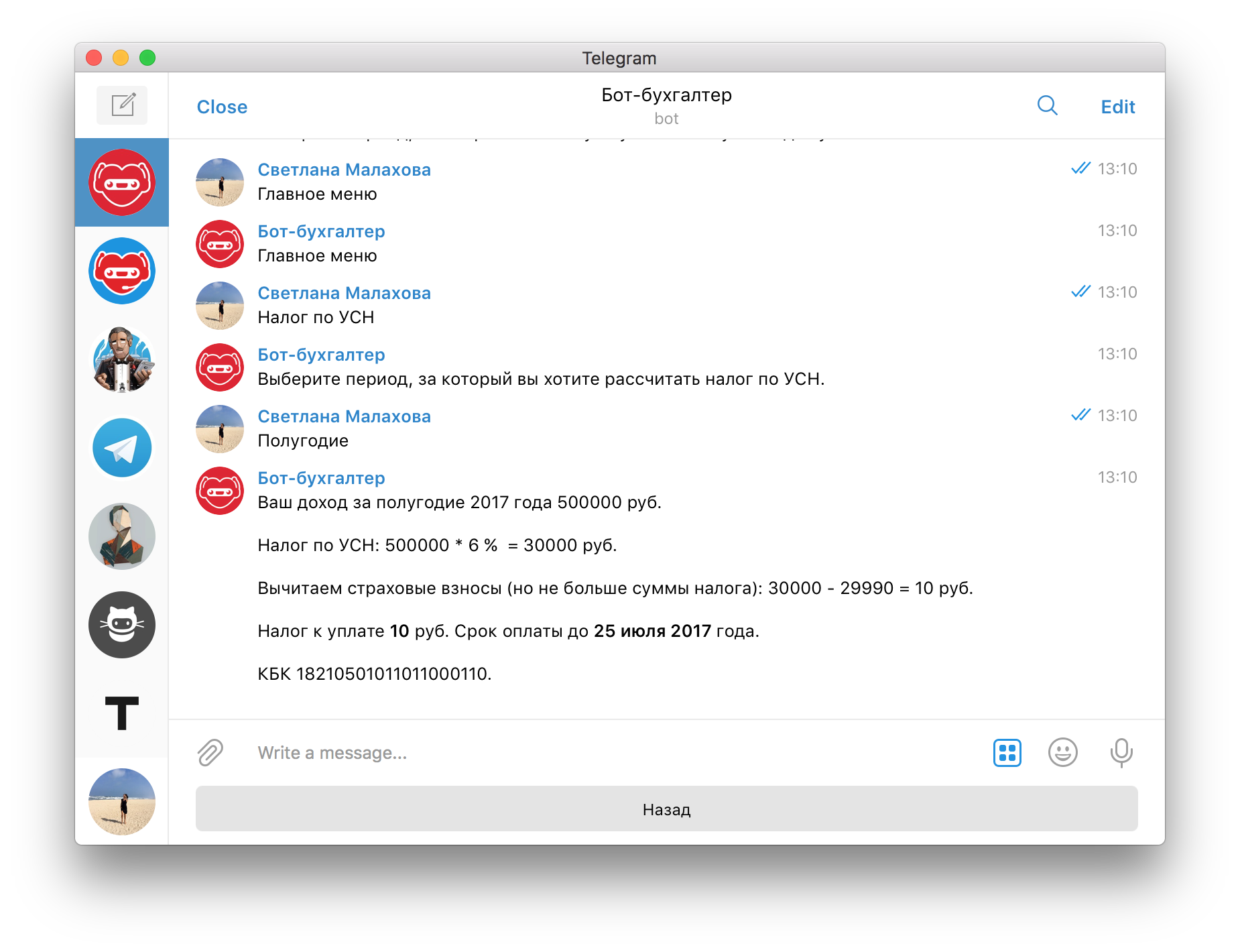

Bot Accountant

The bot accountant will calculate insurance premiums in such a way as to minimize the tax on the simplified tax system and not to overpay. If you have incomes, then at the end of the quarter, the bot will offer you to pay insurance premiums in the amount of tax on the simplified tax system and automatically divide this amount for each fund.

For example, before June 30, our entrepreneur has to pay 23,400 rubles to the Pension Fund of Russia, 4590 rubles to the Federal Fund for Medical Insurance Fund, 2,000 rubles to the Pension Fund of Russia, only 29,990 rubles.

Then until July 25, he will have to pay an advance payment on the USN - 10 rubles.

In the absence of income until the end of the year nothing more to pay. In total for the year with a bot-accountant the entrepreneur will pay 30,000 rubles:

- in the Pension Fund - 23 400 rubles.,

- in FFOMS - 4590 rubles,

- in the PFR 1% - 2000 rubles,

- tax on the simplified tax system - 10 rubles.

In this case, no overpayments, which then need to be returned from the tax, he will not.

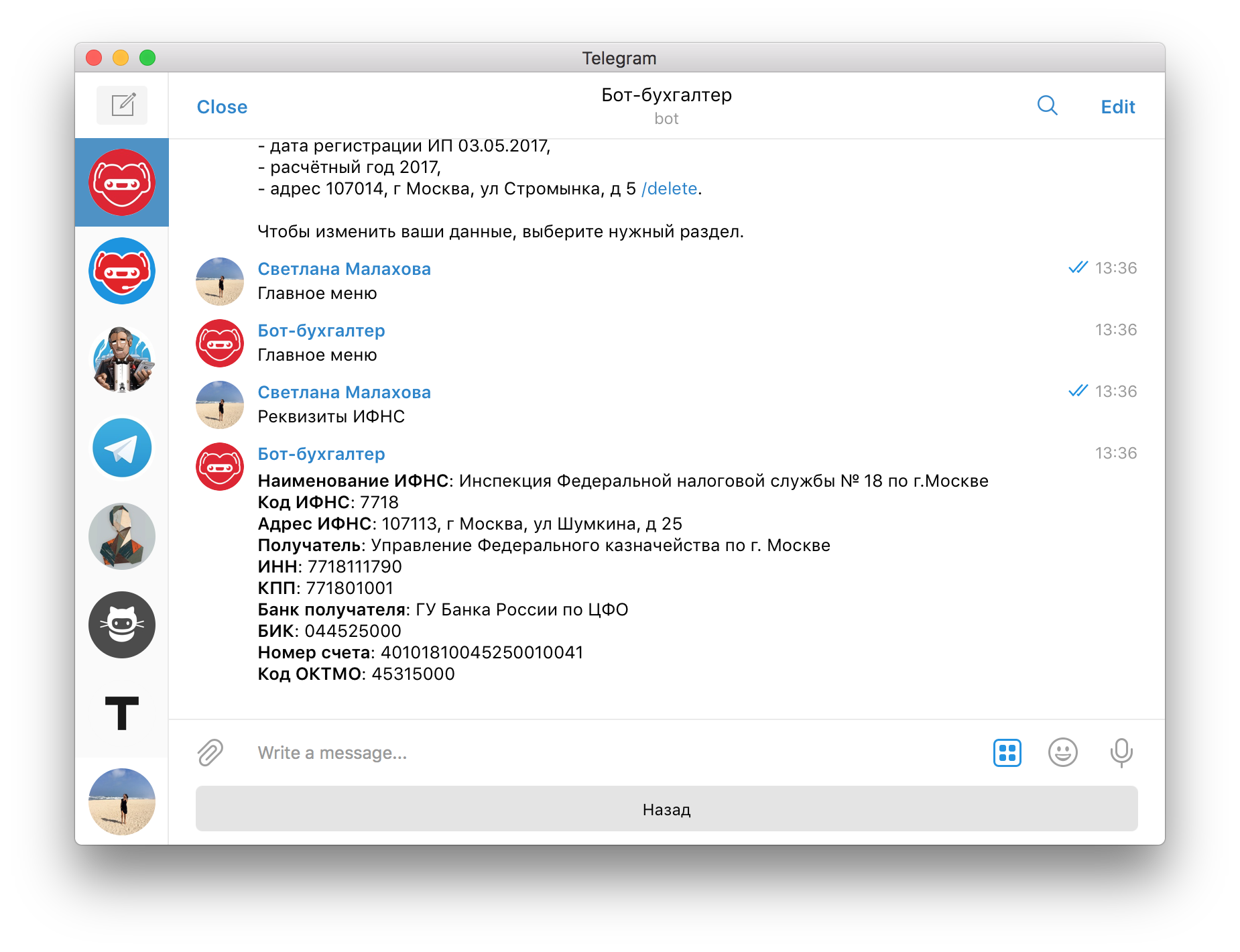

What else can a bot accountant

The bot will calculate the insurance premiums of the individual entrepreneur, help reduce the tax on the simplified tax system, remind you about upcoming payments and filing reports. He will also tell you the BCC for each payment and the current details of your tax office.

We hope that the bot will be useful and help you save on taxes. By the end of the year, we plan to add import of bank statements and export of payment orders to pay tax and contributions, as well as the preparation of a declaration on the simplified tax system.

If you have any questions, write in the comments.

')

Source: https://habr.com/ru/post/331828/

All Articles