Financial Management: How to estimate the cost of the services provided

The IT department in any organization is a consumer of the budget and a source of income at the same time. The budget for information technology every year signs for several dozen items of expenditure, but incomes often turn out to be unstructured, so it is difficult to assess their role in achieving business goals. Understanding the scale, characteristics and costs of classified services provides better infrastructure management and control over IT as a whole. Therefore, in today's material we would like to talk about how the cost of services is calculated and what financial management tools are offered by the ServiceNow platform.

/ Flickr / GotCredit / CC

/ Flickr / GotCredit / CC

The purpose of financial management for IT services is to maintain an acceptable level of funding for the design, development and delivery of services that meet the business strategy of the organization. It also allows you to achieve transparency in operations and provide the service provider with new opportunities for making decisions.

')

Financial Management for IT services is part of building an ITIL service strategy and contains three processes: budgeting, accounting, and charging.

Budgeting is the process of planning income and expenses in an organization with the definition of a range of services. Planning is carried out periodically (usually once a year), and gives the company the ability to track where the funds are spent. The next process is effective cash accounting. It allows you to find areas in which you can improve financial efficiency, that is, save. This takes into account several components of the cost:

As for charging, this is the process required to deliver services, and is responsible for determining how much customers must pay for the service (pricing) and receiving compensation (invoicing).

Thus, the main tasks of the Financial Management process are: determining the IT services provided by the department, developing a methodology for calculating the cost, monitoring the work of the IT department and, finally, drawing up a budget taking into account all factors. Therefore, we will move on to the issue of financial management of IT and determining the cost of services.

According to the book ITIL Service Delivery, two approaches are used to estimate the cost of service: cost accounting by cost centers and cost accounting for activities or services. In the first case, all costs are distributed to customers, and the total total cost is divided equally between them. In the second, all costs are allocated to the services: if you calculate all the costs of the service, you can determine the cost unit and use it as a tool to calculate the consumption of services by each customer.

Since the IT Guild company is actively implementing and using the service management model, we will consider the option of calculating the costs of services. To do this, all services must be defined and published in the service catalog and specified in the client account in accordance with SLA (Service Level Agreement) and CMDB (for CI). The figure below shows how the principles of direct, indirect and overhead costs form a complete picture of the calculation of the costs of the service.

When establishing indirect or overhead costs, one should consider such an element as component services. Component service is a fully priced service that is not explicitly stated in user accounts or cost recovery mechanisms. Therefore, such services should be considered additionally. An example of a component service could be a data transfer service over a network if an organization decides to consider its costs as overhead or indirect.

The process of calculating service costs consists of several steps: defining IT services and IT systems, classifying services and modeling services and systems in the CMDB, selecting services and systems specified in user accounts, defining a cost allocation methodology for component IT services and, finally, the definition of a unit of costs for services visible to the subscriber based on the way they are used.

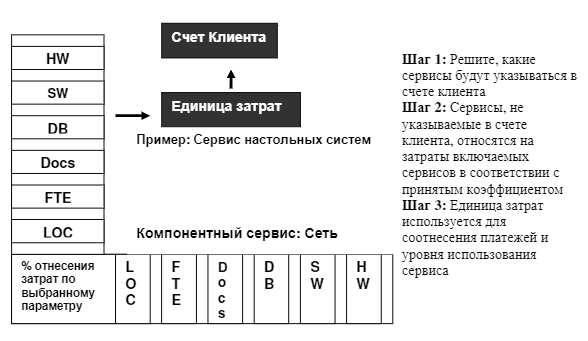

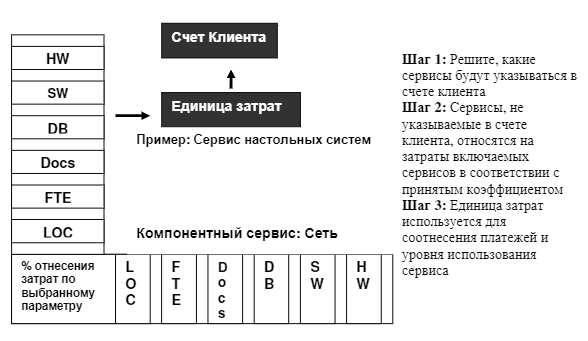

An example of the calculation of IT-service is shown in the diagram below. Here, HW is hardware, SW is software, DB is databases, Docs are documents, contracts, licenses, FTE is dedicated human resources, and LOC are buildings.

Calculation of service costs ( source )

Calculation of service costs ( source )

The above diagram shows two fully priced IT services, one of which (desktop systems) is included in the customer’s account, and the other is treated as a component service (network). A percentage of the cost of the latter is included in the total cost of service of desktop systems.

Consider the example of the process of forming the cost of service, but with some assumptions. Of course, it includes the cost of licenses of the application, which provides this service 100%. This is followed by the license for the database that our application uses. Suppose that we need 1 of 5 licenses for the database, so we will consider only 20% of the total cost. Further, we will take into account the server itself, on which the application is running, but there is another similar application on it, so only 50% of its cost will be included in the cost of the service.

We will also consider the cost of server support by an external organization. If it supports 4 servers (and costs are distributed evenly), then we need only a quarter of the cost of support. But only 10% of them will participate in the formation of the cost of one service and 50% of the cost of another service. Total we get: 15% = 2.5% (10% from 1/4) + 12.5% (50% from 1/4).

It is also necessary to take into account the cost of the work on the ServiceDesk service, we will consider it in a uniform breakdown by services (the total number of which, say, 20), that is, equal to 5%. Add here and related operational services, for example, network support - this is also 5%, assuming that costs are evenly divided by services.

We also give a general formula for calculating the cost of owning a service for the required period. It looks like this:

COService = 100% Sla + 50% Ss2 + 20% Sdb + 10% Ss1 + 15% Ssup + 5% Ssd + 5% Snet

In the above formula: Ss1 is the cost of equipment (Server 1), Ss2 is the cost of equipment (Server 2), Sla is the cost of application licenses, Sdb is the cost of database licenses, Ssup is the cost of server support, Ssd is the cost of supporting SD, Snet is the cost system service network support.

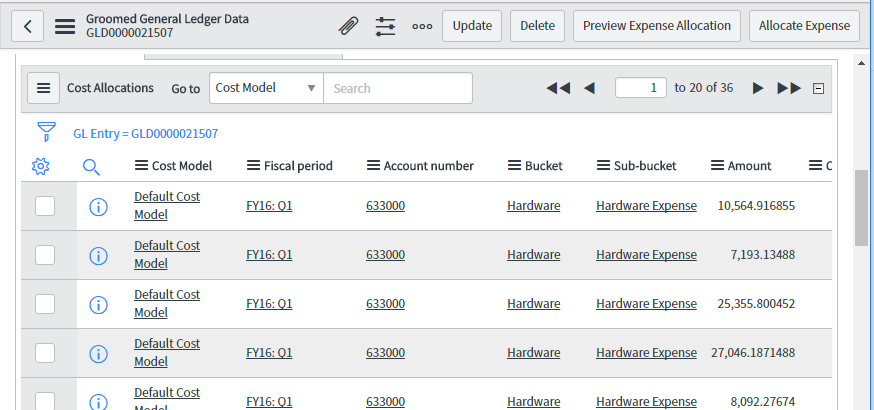

Financial Management is done according to the type of incident management, so that IT professionals and managers are more comfortable with operations in a familiar interface. ServiceNow uses several processes to calculate the cost of Financial Management services. Here are the main ones, for each of which the platform provides ready-made tools:

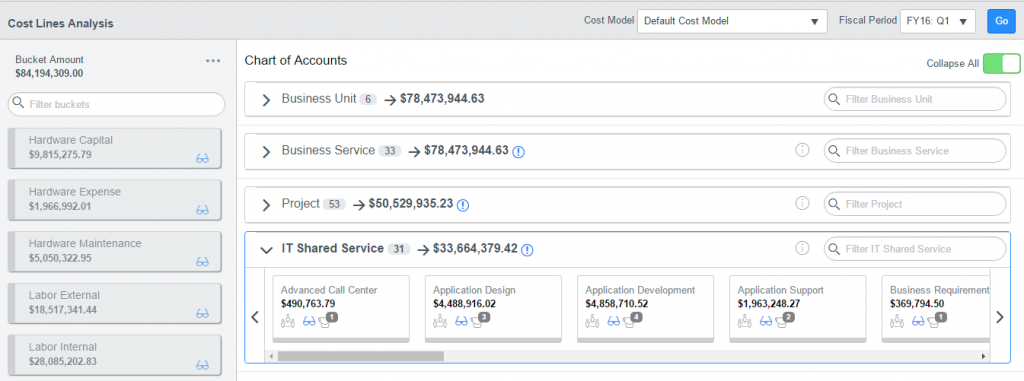

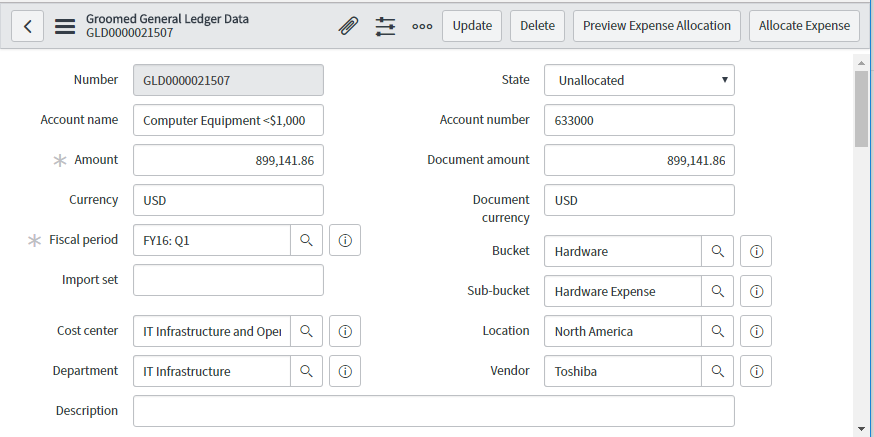

ServiceNow allows you to set budgets and set amounts for a specific period. Cost centers can be tied to budgets to show the actual total cost of all related expenses. In the ServiceNow console, you can perform an analysis of executable budgets and costs incurred.

For each cost item, you can get extended information, as well as cost details.

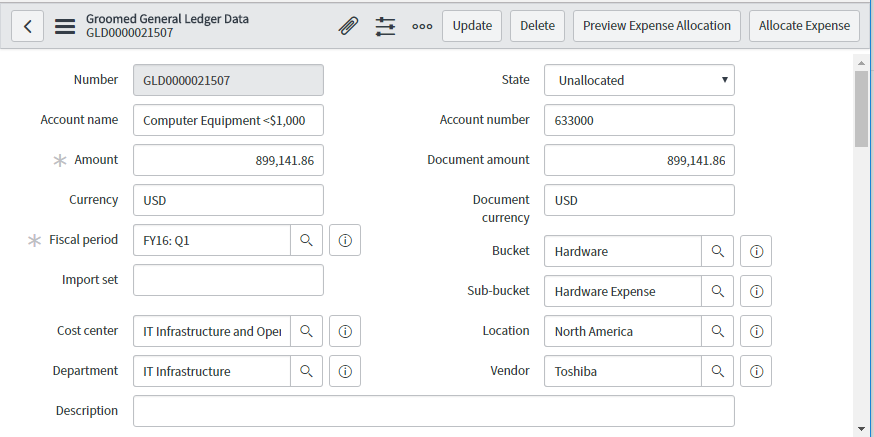

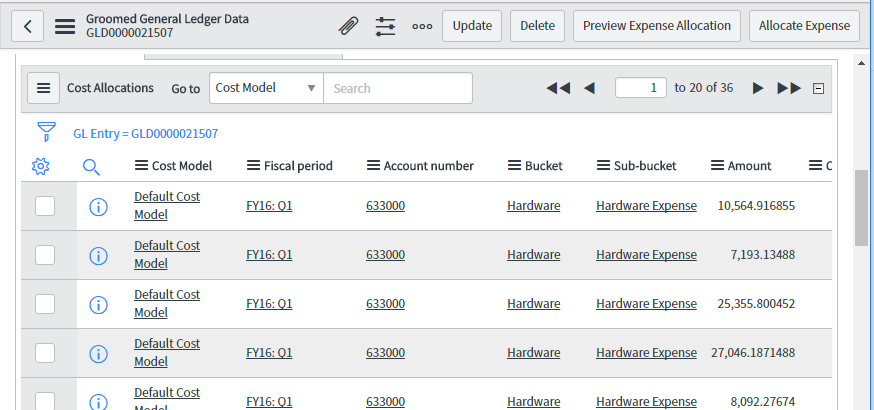

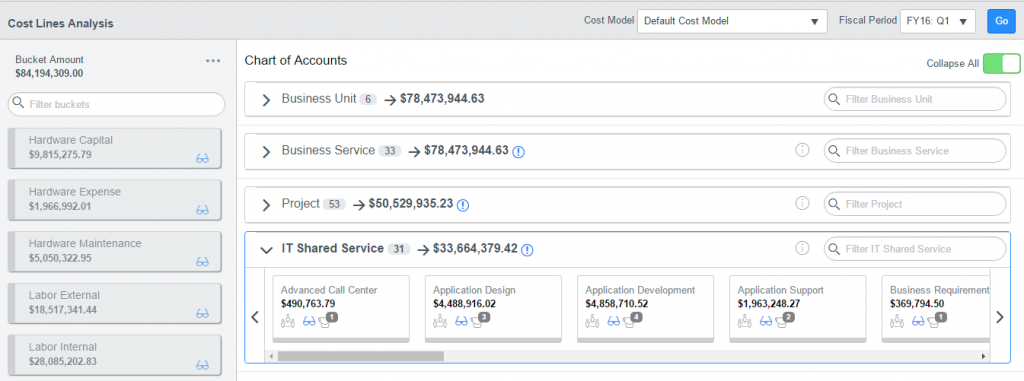

Cost lines are used to indicate costs for various activities. They can be created manually, imported into the system or generated automatically when a user requests a service. A set of cost lines can be used to bill a customer for the services he uses.

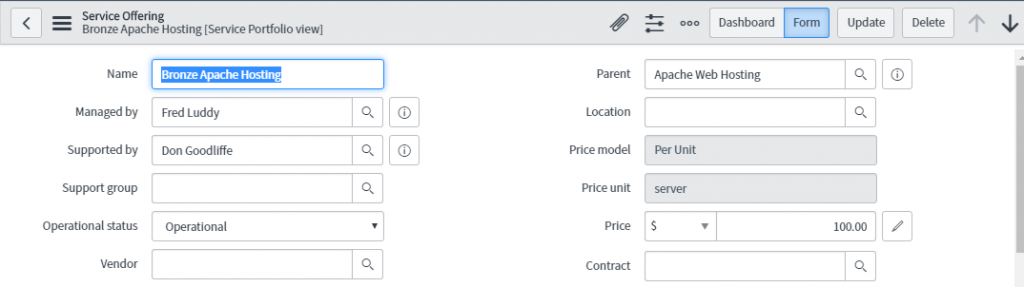

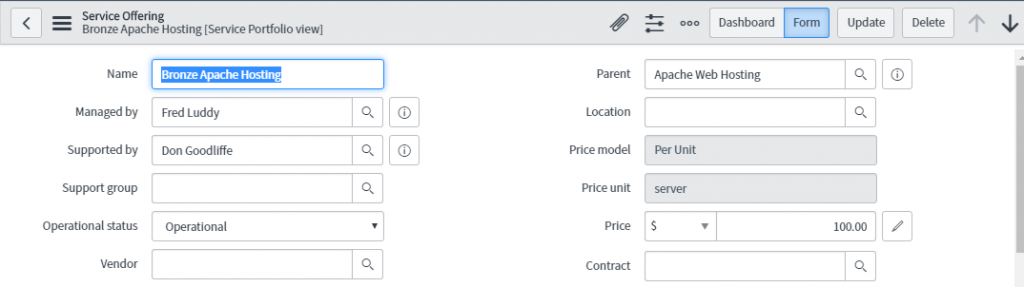

Here you can set the price for using the services provided. When creating a configuration unit, cost lines are created automatically.

The body of knowledge on the calculation of service costs and ServiceNow tools allow the IT division to effectively plan and use the budget, as well as to obtain high profits from the services provided. These are just the main processes provided by Financial Management ServiceNow. For more information about its functions, installation, configuration and use, you can find out in the ServiceNow documentation library or contact the specialists of IT Guild, the official certified partner of ServiceNow.

PS A few more materials on the topic from the blog "IT Guild":

/ Flickr / GotCredit / CC

/ Flickr / GotCredit / CCThe purpose of financial management for IT services is to maintain an acceptable level of funding for the design, development and delivery of services that meet the business strategy of the organization. It also allows you to achieve transparency in operations and provide the service provider with new opportunities for making decisions.

')

Financial Management for IT services is part of building an ITIL service strategy and contains three processes: budgeting, accounting, and charging.

Budgeting is the process of planning income and expenses in an organization with the definition of a range of services. Planning is carried out periodically (usually once a year), and gives the company the ability to track where the funds are spent. The next process is effective cash accounting. It allows you to find areas in which you can improve financial efficiency, that is, save. This takes into account several components of the cost:

- Capital costs are the purchase of what will become a financial asset, such as a server.

- Operational costs - the cost of ensuring the work of services - electricity, staff salaries, etc.

- Direct costs are the costs of providing IT services that can be attributed to a specific customer, project, etc. For example, the cost of operating dedicated servers or purchasing software licenses.

- Indirect costs - the cost of providing IT services that can not be fully attributed to a specific customer, such as the purchase of a common server.

- Fixed costs - costs, the value of which does not change with an increase (decrease) in the intensity of use of the service.

- Variable costs are costs, the value of which varies depending on the intensity of use of the service.

As for charging, this is the process required to deliver services, and is responsible for determining how much customers must pay for the service (pricing) and receiving compensation (invoicing).

Thus, the main tasks of the Financial Management process are: determining the IT services provided by the department, developing a methodology for calculating the cost, monitoring the work of the IT department and, finally, drawing up a budget taking into account all factors. Therefore, we will move on to the issue of financial management of IT and determining the cost of services.

Calculating the cost of service

According to the book ITIL Service Delivery, two approaches are used to estimate the cost of service: cost accounting by cost centers and cost accounting for activities or services. In the first case, all costs are distributed to customers, and the total total cost is divided equally between them. In the second, all costs are allocated to the services: if you calculate all the costs of the service, you can determine the cost unit and use it as a tool to calculate the consumption of services by each customer.

Since the IT Guild company is actively implementing and using the service management model, we will consider the option of calculating the costs of services. To do this, all services must be defined and published in the service catalog and specified in the client account in accordance with SLA (Service Level Agreement) and CMDB (for CI). The figure below shows how the principles of direct, indirect and overhead costs form a complete picture of the calculation of the costs of the service.

When establishing indirect or overhead costs, one should consider such an element as component services. Component service is a fully priced service that is not explicitly stated in user accounts or cost recovery mechanisms. Therefore, such services should be considered additionally. An example of a component service could be a data transfer service over a network if an organization decides to consider its costs as overhead or indirect.

The process of calculating service costs consists of several steps: defining IT services and IT systems, classifying services and modeling services and systems in the CMDB, selecting services and systems specified in user accounts, defining a cost allocation methodology for component IT services and, finally, the definition of a unit of costs for services visible to the subscriber based on the way they are used.

An example of the calculation of IT-service is shown in the diagram below. Here, HW is hardware, SW is software, DB is databases, Docs are documents, contracts, licenses, FTE is dedicated human resources, and LOC are buildings.

The above diagram shows two fully priced IT services, one of which (desktop systems) is included in the customer’s account, and the other is treated as a component service (network). A percentage of the cost of the latter is included in the total cost of service of desktop systems.

Consider the example of the process of forming the cost of service, but with some assumptions. Of course, it includes the cost of licenses of the application, which provides this service 100%. This is followed by the license for the database that our application uses. Suppose that we need 1 of 5 licenses for the database, so we will consider only 20% of the total cost. Further, we will take into account the server itself, on which the application is running, but there is another similar application on it, so only 50% of its cost will be included in the cost of the service.

We will also consider the cost of server support by an external organization. If it supports 4 servers (and costs are distributed evenly), then we need only a quarter of the cost of support. But only 10% of them will participate in the formation of the cost of one service and 50% of the cost of another service. Total we get: 15% = 2.5% (10% from 1/4) + 12.5% (50% from 1/4).

It is also necessary to take into account the cost of the work on the ServiceDesk service, we will consider it in a uniform breakdown by services (the total number of which, say, 20), that is, equal to 5%. Add here and related operational services, for example, network support - this is also 5%, assuming that costs are evenly divided by services.

We also give a general formula for calculating the cost of owning a service for the required period. It looks like this:

COService = 100% Sla + 50% Ss2 + 20% Sdb + 10% Ss1 + 15% Ssup + 5% Ssd + 5% Snet

In the above formula: Ss1 is the cost of equipment (Server 1), Ss2 is the cost of equipment (Server 2), Sla is the cost of application licenses, Sdb is the cost of database licenses, Ssup is the cost of server support, Ssd is the cost of supporting SD, Snet is the cost system service network support.

Tools for calculating the cost of services in ServiceNow

Financial Management is done according to the type of incident management, so that IT professionals and managers are more comfortable with operations in a familiar interface. ServiceNow uses several processes to calculate the cost of Financial Management services. Here are the main ones, for each of which the platform provides ready-made tools:

- Budgeting is the process of forecasting and controlling revenues / expenditures within an organization.

- Cost accounting is a process that allows the IT division of a company to keep track of expenditures.

- Charges are the process of invoicing customers for the services they used.

- Pricing is the process of determining the price for a service that a company provides to its customers.

Budgeting in ServiceNow

ServiceNow allows you to set budgets and set amounts for a specific period. Cost centers can be tied to budgets to show the actual total cost of all related expenses. In the ServiceNow console, you can perform an analysis of executable budgets and costs incurred.

For each cost item, you can get extended information, as well as cost details.

Accounting and Charges

Cost lines are used to indicate costs for various activities. They can be created manually, imported into the system or generated automatically when a user requests a service. A set of cost lines can be used to bill a customer for the services he uses.

Pricing

Here you can set the price for using the services provided. When creating a configuration unit, cost lines are created automatically.

The body of knowledge on the calculation of service costs and ServiceNow tools allow the IT division to effectively plan and use the budget, as well as to obtain high profits from the services provided. These are just the main processes provided by Financial Management ServiceNow. For more information about its functions, installation, configuration and use, you can find out in the ServiceNow documentation library or contact the specialists of IT Guild, the official certified partner of ServiceNow.

PS A few more materials on the topic from the blog "IT Guild":

- 5 human resources for successful implementation of ServiceNow

- IT Operations Management - IT Infrastructure Management

- How to implement a configuration management process (Configuration Management). Part 1

- How to implement a configuration management process (Configuration Management). Part 2

- What is Project Portfolio Management?

Source: https://habr.com/ru/post/331380/

All Articles