How to apply “big data” in insurance: ITMO University projects

According to the IDC analytical agency, in just 3 years the market volume of specialized software working with Big Data could reach $ 203 billion. Now it is estimated at 130 billion, but the demand from the banking sector, insurance and telecommunications companies is only growing.

Today we will talk about what analytical tasks at the junction of insurance and “big data” areas are solved by projects of the ITMO University.

Flickr / Richard Masoner / CC

Flickr / Richard Masoner / CC

')

The main interest of companies and their customers is effective risk management and cost optimization. There is nothing new in the direction itself - the risks and the desire to preserve this or that property, financial assets or other valuables are central elements of the entire insurance industry.

Forecasting and evaluation are an integral part of the risk management process. Compared with the times when the first insurance companies were created (for example, following the Great Fire in London in 1666), the degree of complexity of assessment methods and the volume of data analyzed increased many times over.

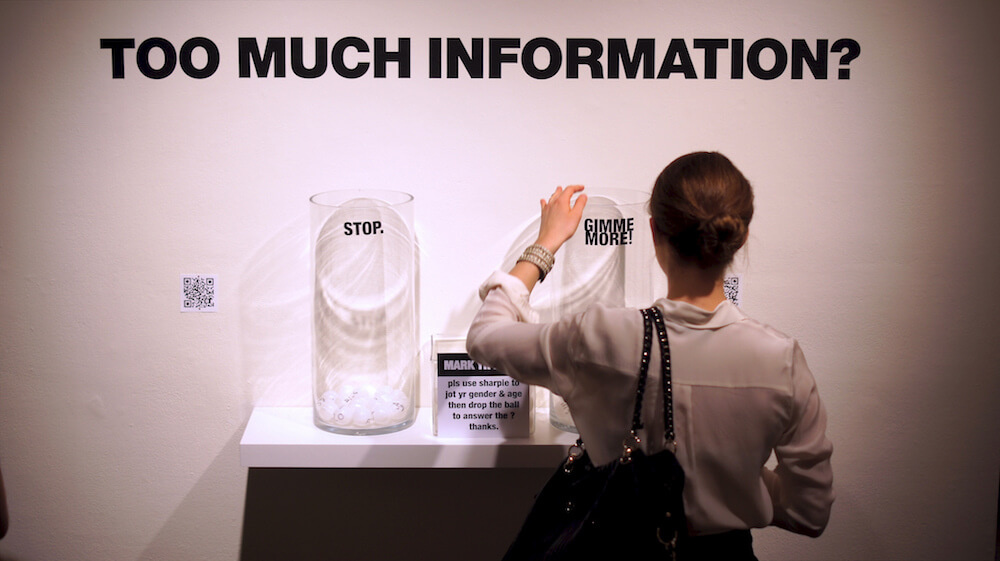

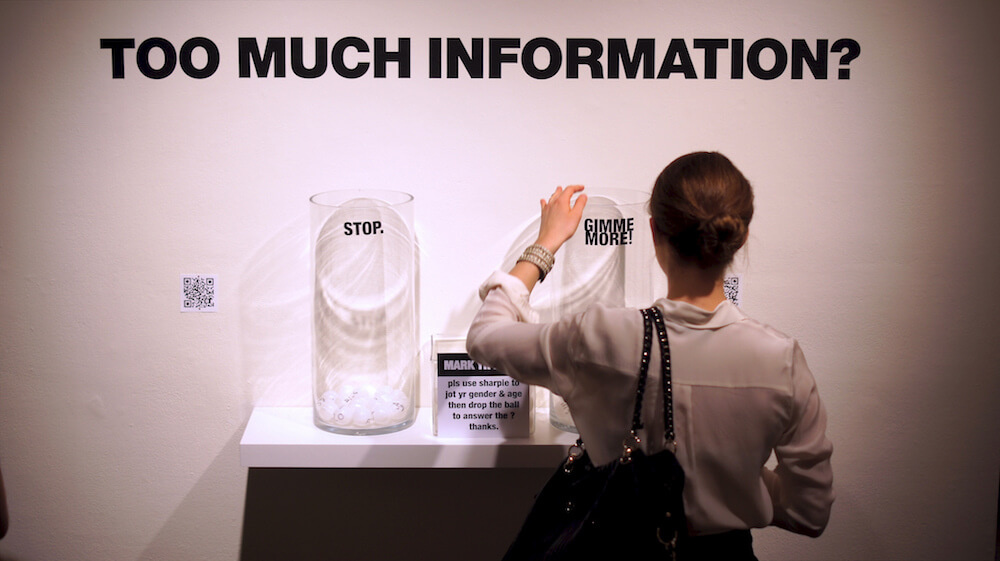

The emergence of "smart devices" and new opportunities to work with huge amounts of data, transforms the tasks facing the analytical departments of insurance companies. Starting with the modernization of the existing infrastructure for the collection and analysis of information and to the revision of the main approaches to customer service. All this is necessary not only to reduce the cost of insurance, but also to increase the transparency of data collection processes - the client’s understanding of what information he provides and what he receives in return.

To discuss such problems, ITMO University uses such platforms as the iDealMachine accelerator. One of the iDoMa accelerator projects involves monthly seminars for anyone interested in a startup industry. As part of one of these events, we held a meeting with representatives of leading insurance companies, with whom the seminar participants discussed the lack of start-ups in the field of insurance.

As one of the main reasons for this phenomenon, the experts highlighted the overly emphasized bias of insurance companies in favor of their subsidiaries. Today's startups in this area are mostly spin-offs of large insurance companies that don’t want to position such projects as a separate business. On the other hand, the interest of insurance companies to work in the in-house format can attract those who are willing to sell their project or make it part of a corporation.

In 2008, Nature magazine published one of the first definitions of Big Data, which suggested the presence of special methods and tools for processing huge amounts of information. The current reputation of Big Data is largely corrupted by false expectations and the search for a universal solution that will allow you to move to a completely different technological level.

The problem lies not so much in the popularity of the term “Big Data”, but in the not entirely accurate statement of the tasks and choice of tools to solve them. The bulk of the projects that deal with Big Data, comes to "big disappointments" only because it can not formulate the exact purpose of such work. Anyway, many are still convinced that “Big Data” is nothing more than a marketing ploy.

Flickr / Ted Eytan / CC

The situation is similar in the insurance industry. To be more precise, in auto insurance - in the field of application of telematics devices to track driving style and assess the risk of occurrence of an insurance event. Our market boasts only 50,000 personalized offers that have been implemented by insurance companies over the past few years using telematics. Statistics show that these sales are no more than 1% of the total number of all CASCO policies.

There can be many reasons: from the reluctance to change the driving style to a less aggressive, to fears about the unfair use of personal data (almost all motorists are faced with this). The main problem here is that there is no specialized legal framework in Russia that could standardize such systems and the way they work with them for insurance companies. Nevertheless, insurers do not lose hope and are working on various options for technological solutions that will allow the market to be interested in real results, and not serve only as a marketing lure.

Another area of insurance in which the use of Big Data is slowly but surely gaining momentum is property insurance. The built-in sensors help to reduce the risks here, which allow detecting unauthorized penetration into the room, gas leakage, breakthrough of one or another component of the water supply system or fire in time. Such devices are of interest not only from the point of view of minimizing losses (when something went wrong according to plan), but also serve as the basis for the formation of a more profitable insurance offer in combination with statistics and the accumulated history of insured events.

The life and health insurance segment is developing in a similar way - there are some approaches to tracking the status of the insured. Some of the advanced offers from insurance companies take into account not only the client’s medical history, but also data from wearable devices. Thus, the client receives substantial exchange discounts for data that is accumulated in the bases of the insurance company for further processing. Nevertheless, it is telematics that is in the lead by the degree of distribution among insurers - and most of the projects on the analysis of data in insurance are somehow connected with cars.

One of our students took advantage of the interest of insurance companies in innovative developments and adapted their research work to the format of the annual competition of the company Ingosstrakh. In his competitive work “Big Data in Insurance - Applications”, Yaroslav Polin, a student at the ITMO University Software Systems Department, highlighted the most promising anti-fraud approaches and methods for personalizing OSAGO policy prices using the features provided by Big Data.

Yaroslav analyzed the current fraudulent situations and determined the parameters that allow tracking suspicious messages from customers. This approach is much like the methods that financial organizations use to search for suspicious transactions online.

Telematics providers are also guided by this logic and find their benefits in working with Big Data. The authors of one of these projects - Maxim Savelyev and Samuel Gorelik. In short, we are talking about a software and hardware system that allows you to track various characteristics of vehicles. On the basis of these data, it is possible to assess the quality of driving, which can not but arouse the interest of transport companies (control of the fleet and the work of employees) and insurance companies (providing discounts for accurate driving).

The main purpose of telematics systems is to provide basic data for creating personalized insurance offers. Here take into account such parameters as: vehicle speed, acceleration, braking, fuel consumption and other nuances that allow you to build a "profile" of the driver.

The developers of this vehicle monitoring system have designed not only "hardware", but also special software - the complex is currently being tested on several buses of the St. Petersburg State Unitary Enterprise "Passenger Transport". Subsequently, such a system for assessing the quality of traffic may become part of the “smart” transport network of any city. Research in this area and in the field of road quality assessment is also conducted by staff at ITMO University.

Today we will talk about what analytical tasks at the junction of insurance and “big data” areas are solved by projects of the ITMO University.

Flickr / Richard Masoner / CC

Flickr / Richard Masoner / CC')

What are we talking about

The main interest of companies and their customers is effective risk management and cost optimization. There is nothing new in the direction itself - the risks and the desire to preserve this or that property, financial assets or other valuables are central elements of the entire insurance industry.

Forecasting and evaluation are an integral part of the risk management process. Compared with the times when the first insurance companies were created (for example, following the Great Fire in London in 1666), the degree of complexity of assessment methods and the volume of data analyzed increased many times over.

The emergence of "smart devices" and new opportunities to work with huge amounts of data, transforms the tasks facing the analytical departments of insurance companies. Starting with the modernization of the existing infrastructure for the collection and analysis of information and to the revision of the main approaches to customer service. All this is necessary not only to reduce the cost of insurance, but also to increase the transparency of data collection processes - the client’s understanding of what information he provides and what he receives in return.

To discuss such problems, ITMO University uses such platforms as the iDealMachine accelerator. One of the iDoMa accelerator projects involves monthly seminars for anyone interested in a startup industry. As part of one of these events, we held a meeting with representatives of leading insurance companies, with whom the seminar participants discussed the lack of start-ups in the field of insurance.

As one of the main reasons for this phenomenon, the experts highlighted the overly emphasized bias of insurance companies in favor of their subsidiaries. Today's startups in this area are mostly spin-offs of large insurance companies that don’t want to position such projects as a separate business. On the other hand, the interest of insurance companies to work in the in-house format can attract those who are willing to sell their project or make it part of a corporation.

More criticism

In 2008, Nature magazine published one of the first definitions of Big Data, which suggested the presence of special methods and tools for processing huge amounts of information. The current reputation of Big Data is largely corrupted by false expectations and the search for a universal solution that will allow you to move to a completely different technological level.

The problem lies not so much in the popularity of the term “Big Data”, but in the not entirely accurate statement of the tasks and choice of tools to solve them. The bulk of the projects that deal with Big Data, comes to "big disappointments" only because it can not formulate the exact purpose of such work. Anyway, many are still convinced that “Big Data” is nothing more than a marketing ploy.

Flickr / Ted Eytan / CC

The situation is similar in the insurance industry. To be more precise, in auto insurance - in the field of application of telematics devices to track driving style and assess the risk of occurrence of an insurance event. Our market boasts only 50,000 personalized offers that have been implemented by insurance companies over the past few years using telematics. Statistics show that these sales are no more than 1% of the total number of all CASCO policies.

There can be many reasons: from the reluctance to change the driving style to a less aggressive, to fears about the unfair use of personal data (almost all motorists are faced with this). The main problem here is that there is no specialized legal framework in Russia that could standardize such systems and the way they work with them for insurance companies. Nevertheless, insurers do not lose hope and are working on various options for technological solutions that will allow the market to be interested in real results, and not serve only as a marketing lure.

Another area of insurance in which the use of Big Data is slowly but surely gaining momentum is property insurance. The built-in sensors help to reduce the risks here, which allow detecting unauthorized penetration into the room, gas leakage, breakthrough of one or another component of the water supply system or fire in time. Such devices are of interest not only from the point of view of minimizing losses (when something went wrong according to plan), but also serve as the basis for the formation of a more profitable insurance offer in combination with statistics and the accumulated history of insured events.

The life and health insurance segment is developing in a similar way - there are some approaches to tracking the status of the insured. Some of the advanced offers from insurance companies take into account not only the client’s medical history, but also data from wearable devices. Thus, the client receives substantial exchange discounts for data that is accumulated in the bases of the insurance company for further processing. Nevertheless, it is telematics that is in the lead by the degree of distribution among insurers - and most of the projects on the analysis of data in insurance are somehow connected with cars.

What makes ITMO University

One of our students took advantage of the interest of insurance companies in innovative developments and adapted their research work to the format of the annual competition of the company Ingosstrakh. In his competitive work “Big Data in Insurance - Applications”, Yaroslav Polin, a student at the ITMO University Software Systems Department, highlighted the most promising anti-fraud approaches and methods for personalizing OSAGO policy prices using the features provided by Big Data.

Yaroslav analyzed the current fraudulent situations and determined the parameters that allow tracking suspicious messages from customers. This approach is much like the methods that financial organizations use to search for suspicious transactions online.

Telematics providers are also guided by this logic and find their benefits in working with Big Data. The authors of one of these projects - Maxim Savelyev and Samuel Gorelik. In short, we are talking about a software and hardware system that allows you to track various characteristics of vehicles. On the basis of these data, it is possible to assess the quality of driving, which can not but arouse the interest of transport companies (control of the fleet and the work of employees) and insurance companies (providing discounts for accurate driving).

The main purpose of telematics systems is to provide basic data for creating personalized insurance offers. Here take into account such parameters as: vehicle speed, acceleration, braking, fuel consumption and other nuances that allow you to build a "profile" of the driver.

The developers of this vehicle monitoring system have designed not only "hardware", but also special software - the complex is currently being tested on several buses of the St. Petersburg State Unitary Enterprise "Passenger Transport". Subsequently, such a system for assessing the quality of traffic may become part of the “smart” transport network of any city. Research in this area and in the field of road quality assessment is also conducted by staff at ITMO University.

Source: https://habr.com/ru/post/329762/

All Articles