Chronobank: we sell time, we “buy” people

Recently, I posted two posts about the blockchain project Golos - and was somewhat surprised: it turned out that not many people at Habré know about this interesting and promising resource.

In addition, in addition to Bitcoin and a number of other cryptocurrencies, they know about the “chain of blocks” on Habro sites as well, and there are not so many of them outside. Yes, the blockchain has problems , but there are also very interesting and promising areas of development.

So, today we will talk about Chronobank: and, recalling past articles, I will say a few words what kind of project it is.

')

First, the materials:

To briefly describe Chronobank.io, I will quote: “Chronobank is an innovative platform based on the blockchain technology, which is designed to modernize the current infrastructure of the labor market and the format of relationships between employers and employees, as well as level intermediaries in the form of employment agencies .”

And now - the actual translation of the White Book .

CHRONOBANK-PHASE 1: NON-VOLATILE DIGITAL TOKEN, PROVIDED BY WORKING FORCE

TEAM CHRONOBANK

CHRONOBANK.IO

INFO@CHRONOBANK.IO

Summary This white paper describes the basic principles of a system designed for the production of tokens endowed with labor (Labor-Hour Tokens, LHT) using blockchain technology. ChronoBank - the proposed implementation of the described system, which can be deployed in various economic spaces. The proposed system uses smart contracts to automate the process in which a LHT token of a specific country can be redeemed in real working time using traditional contracts with recruitment companies. The proposed implementation of the so-called. “Stable currency” (stable coin) is an electronic payment system without inflation and volatility.

1. Introduction

With the advent of cryptocurrency, almost instant low-cost money transfers have become a reality. The blockchain technology, which is used by most cryptocurrencies, has recently been used to solve a wide variety of problems. Currently, the most common implementation of this technology is the Bitcoin payment system [1]. The unit of account in this system is 1 bitcoin (BTC). Since its inception in 2009, the rate of this token has been subject to sharp fluctuations, which prevented its use as a global currency.

Many attempts have been made to take advantage of blockchain technology, while reducing the risks associated with cryptocurrency volatility. For this purpose, many projects introduce the concept of a stable coin, in which each token in the system has an equivalent equivalent that is stored in a non-digital, tangible form in the “real world”.

Below are two examples of the implementation of the stable coin idea :

USDT of Tether Company [2]:

Each USDT token corresponds to an equivalent amount in US dollars stored in the bank account of Tether Limited.

Digix [3]:

Each token is provided with an equivalent amount of gold, which is saved in the vaults by a specialized company.

In both examples, the owner of the token can always redeem this token by its equivalent, thereby ensuring the stability of the currency.

Another notable example of a stable coin is Bitshares [4], which attempts to decentralize the entire system using electronic CFD contracts [Contract For Differences, CFD] [5]. The purpose of the system presented in this document is not to achieve decentralization, but to eliminate some of the shortcomings of existing centralized stable coins. These shortcomings are associated with the difficulty of storing physical or economic goods and the growing likelihood of attacks, since a single organization consolidates all the system’s assets. Typical stable coins are also subject to volatility of the underlying asset. Although these fluctuations are usually very small compared to traditional cryptocurrencies, they are still significant. For example, USDT is subject to a devaluation of the US dollar due to inflation.

In this document, we propose a stable cryptocurrency system that does not have the aforementioned drawbacks of the existing “stable” cryptocurrencies. In particular, we propose a new type of token that does not rely on existing fiatnie currency or physical values, instead, the token is provided with legal obligations of companies to provide labor. Thus, the system and its control body are not responsible for centralized storage and asset management. In addition, the cost of an hour of unskilled labor in a certain geographic region is naturally regulated in accordance with economic conditions, such as inflation, thereby preserving the long-term internal stability of cryptocurrency.

This document is organized as follows: before discussing the technical details of the system components and the processes taking place in it, we give an overview of the system as a whole in section 2. Section 3 briefly summarizes the economic considerations regarding the actual deployment of the system and its feasibility. Finally, section 4 discusses the future directions for the development of the ChronoBank system. The appendix contains explanations of some of the concepts found in the document. Appendices B and C list the variables that are used in the operation of the system. These variables are also listed in table 1.

2. ChronoBank System

Like existing stable coins (such as USDT and Digix), we propose to create a centralized authority that coordinates the creation, redemption and destruction of LHT tokens. We call it ChronoBank Entity (CBE).

He is responsible for concluding and negotiating contracts for labor, in addition to the mining and distribution of LHT tokens. Ultimately, the role of CBE is to ensure the stability of the LHT system through careful management of the underlying processes.

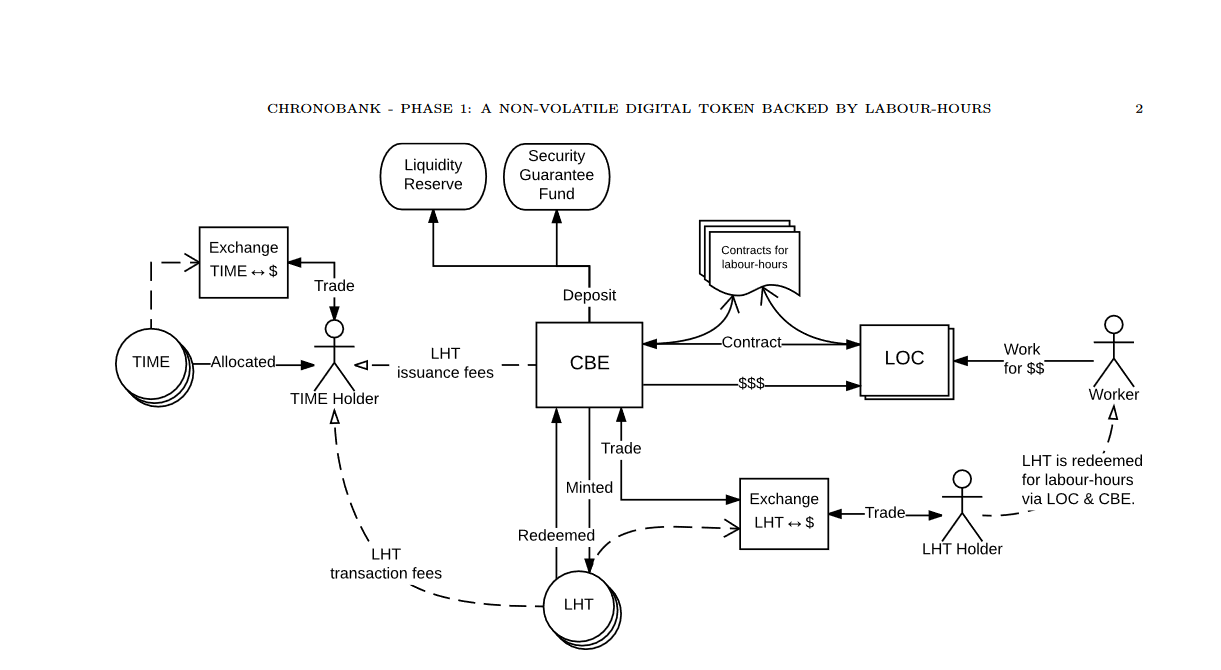

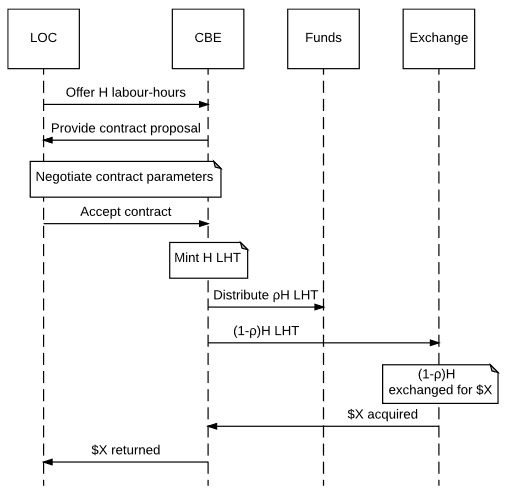

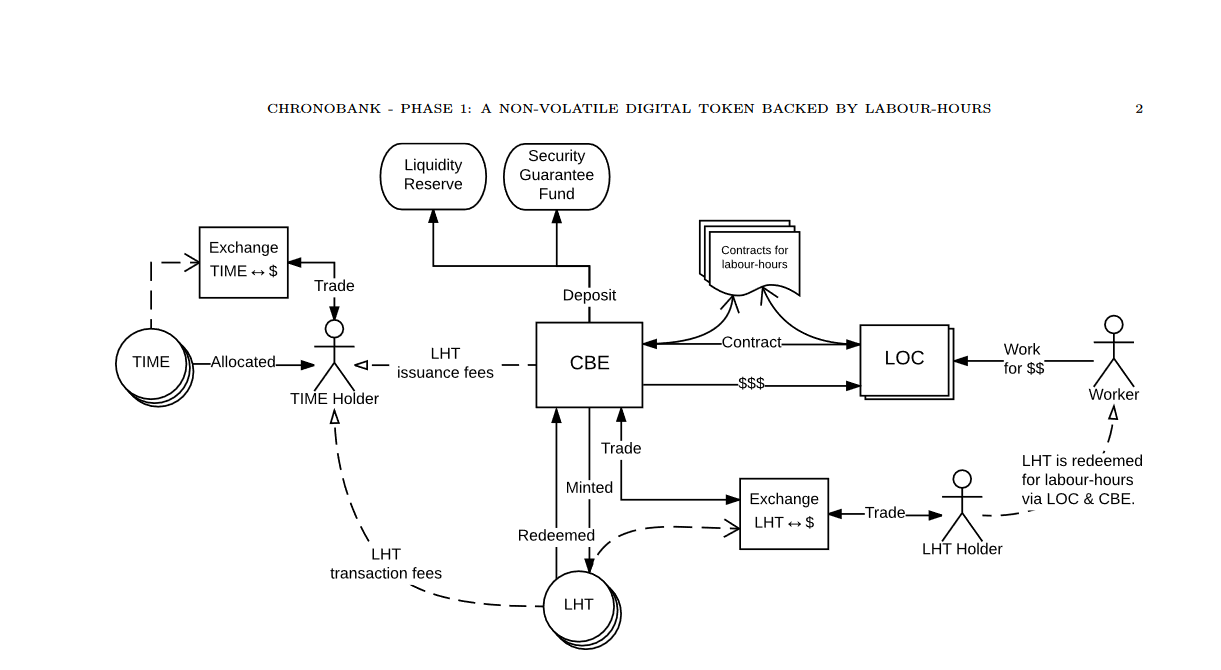

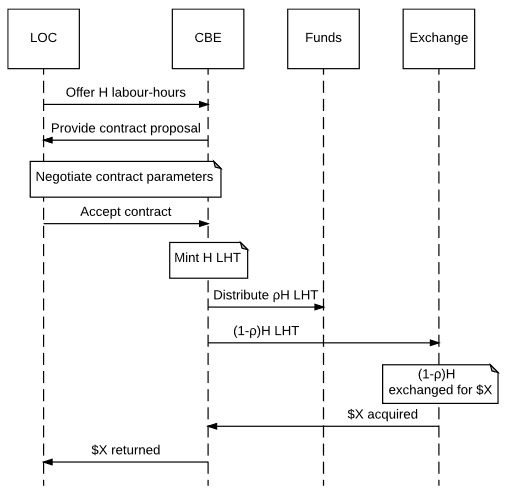

Scheme 1 . General view of the ChronoBank system. This diagram shows the components of the system and their interaction. CBE (ChronoBank Entity) - the central body, LOC (Labor-Offering Companies) - companies offering labor, LHT (Labor-Hour Tokens) - tokens provided with labor, TIME - tokens sold at crowdsale.

This section will provide detailed information on all activities and operations carried out by the CBE and its partners. An overview of the functions of the components of the ChronoBank system is shown in Figure 1.

The system as a whole is designed for one-time deployment in each separate economic region. For example, the system can be deployed once in Australia using the cost per working hour in the Australian economy, measured in Australian dollars. Since this document is a general description of the system, there is no description of the implementation specific for each region, but there are general system parameters that need to be adapted for each region. With a few exceptions, all the processes and structures described in this document may have small differences in different regions where ChronoBank is applied.

The initial implementation of CBE will use the Ethereum blockchain [6]; However, in future implementations, tokens may be issued on the basis of other blockchain systems (for example, Waves [7], Bitcoin [1]), when deemed appropriate.

CBE carries economic benefits for both the environment where it is deployed and for system participants who help the CBE by providing initial working capital. Unlike the region-specific deployment of a CBE system, only one group of CBE participants (so-called TIME token holders) exists at the global level. These system participants provide CBE with initial operating capital in the form of Fiat and cryptocurrency in exchange for a portion of the future earnings of CBE.

2.1. System members and TIME tokens

In order to finance the development and operation of the ChronoBank system, a fundraising phase, in other words, a crowdsale, will be conducted. During a crowdsale, individuals can acquire TIME tokens at a fixed price, which gives the token owner the right to receive a share of the system’s profits. In addition to the right to make a profit from the work of the system, TIME token holders will also have the right to vote on important issues related to the ChronoBank system.

TIME tokens will be released using the Ethereum ecosystem, in particular, using the ERC20 standard [8]. The ERC20 specification will be supplemented to enable voting and distribution of rewards; This will be discussed further in sections 2.1.3 and 2.1.2.

2.1.1. Crowdsale

During the crowdsale, TIME tokens will be created as needed and sold at a fixed price of 100 tokens for 1 bitcoin (BTC). There are no restrictions on the number of TIME tokens generated during crowdsal; however, no additional TIME tokens will be issued after this phase.

Ρ Total Percentage of LHTs Received by CBE

Fc Commission charged by CBE for mining (aka minting is our note) tokens.

Fr Commission charged by CBE to pay for tokens

Fi emission fee (taken during mining)

S Percentage of LHT issued, sent to the Guarantee Fund (Security Guarantee Fund or SGF).

LT Percentage of LHT issued, sent to Liquidity Reserve (Liquidity Reserve or LR)

L0 Percentage of LHT issued for labor insurance companies (Labor-Offering Companies or LOC).

M Number of months before the transfer of funds from the sub-fund L0 to SGF

L Percentage of LHT tokens intended for LOC insurance.

P The interval between the payment of remuneration for time-tokens.

Table 1. List of used variables and constants. Additional information in the application.

All TIME tokens sold on the crowdsale will be 88% of the total number of tokens generated when the ChronoBank system is started. 10% will be distributed to members of the ChronoBank.io team (for current research and development), and the remaining 2% will be used to reward advisers and early members of the system.

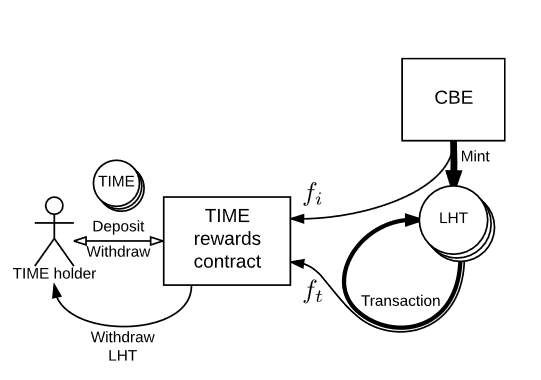

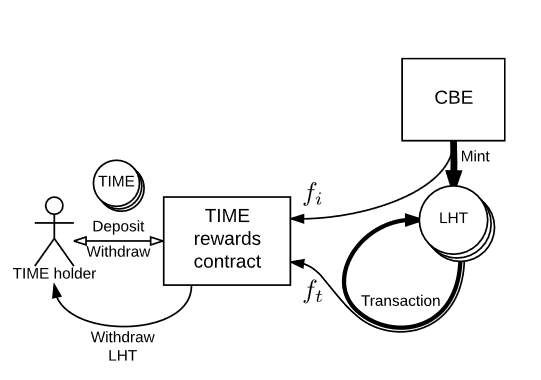

Scheme 2. The issue fee (fi) and transaction fee (ft) are deposited in a smart contract. Owners of TIME tokens can withdraw a part of the LHT after each snapshot if their TIME tokens are deposited in the contract.

2.1.2. Reward for TIME tokens

For the use of LHT users will be charged a fixed commission of ft = 0.15% for all transactions. In addition to the transaction fee, when issuing tokens, there will be an emission fee (fi) (more in section 2.2.1). The emission fee will be 3% during the first year of operation, 2% in the second year, and from the third year it will be fixed at 1%.

Transaction fees and issuance fees will be charged automatically and sent to the smart contract on the Ethereum blockchain, as shown in Figure 2. The smart contract is designed so that the holders of TIME tokens can freely withdraw their remuneration (i.e. A specific token is not tracked) and changed on exchanges.

A smart contract will allow TIME token owners to receive their remuneration regularly at intervals (P). At any stage, TIME owners can add their tokens to the contract. With the onset of the time of payment, a snapshot of deposited tokens TIME and the current balance of the smart contract will be made 1. Remuneration will be equally accrued for each TIME token that was deposited at the time of the snapshot. Holders of tokens can withdraw their reward before the next payment. With the next payment, a snapshot is also made, and all unclaimed remuneration will be withdrawn and added to the total balance of the snapshot. Scheme 3 illustrates this concept; it shows the construction of the balance of a smart contract over time. We also want to note that we assume that the value of the variable (P) will be within a few months.

Holders of TIME can deposit and withdraw their tokens at any stage, however, only those who deposited tokens until the time of the snapshot can apply for a reward. Removing TIME tokens from the contract also deprives the contributor of remuneration. TIME holders also have the right to keep their tokens indefinitely, in a smart contract, periodically requesting remuneration.

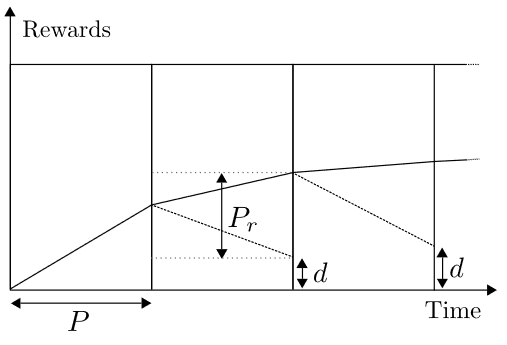

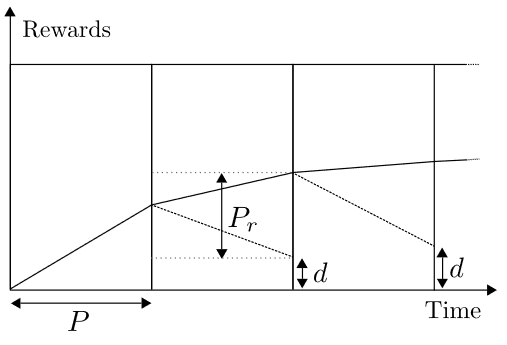

Scheme 3. The smart contract receives a reward (Pr) at each interval (P) (in our example, Pr is fixed). In each snapshot, the unclaimed part of the reward is indicated by (d). Unclaimed remuneration, is transferred to the next payment (P). The dotted line shows the balance intended for the payment of rewards, which decreases as the owners of TIME withdraw their reward.

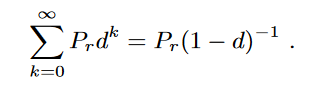

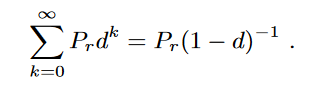

This remuneration system gives an upper limit to the amount of remuneration that can be in a contract at any time, with some reasonable assumptions. The total amount of remuneration received from the collected commissions for a certain period between payments (P) is indicated by a variable (Pr). If we proceed from the constant amount of collected commissions and fees for each period between payments (ie, Pr is fixed) and take into account the average percentage of holders of TIME tokens who constantly store their tokens in contract (d), we can calculate the upper limit of the stored LHT -tokenov in the smart contract according to the following formula * 2:

(one)

(one)

For greater clarity, let's adhere to a conservative estimate that 90% of all TIME token holders do not withdraw their reward. In this case, a reward of no more than 10Pr will be stored in the smart contract at any time. A less conservative estimate, based on the fact that 50% of TIME holders withdraw their remuneration after each payment, will ensure at any time the availability in the contract no more than 2Pr. Thanks to the careful (and possibly dynamic) choice of the parameter (P), we can find a balance between practicality (frequency of withdrawal of rewards) and security (safe level of assets in a smart contract).

2.1.3. TIME tokens. Voting

Periodically, the CBE may vote in Ethereum to obtain an opinion from TIME token holders. The voting results will be taken into account by the CBE when considering financial or technical issues, as well as on the implementation of the Chronobank system.

1 Anyone can initiate this operation, but as a rule, it is carried out by the CBE.

2 It is assumed that 0 ≤ d <1.

Only valid holders of TIME tokens are active participants in the CBE system, and only they are eligible to vote.

2.2. Labor-Hour Tokens

LHT tokens are the basic unit in the ChronoBank system. The task of these tokens is to provide a non-volatile, non-inflationary currency based on various blockchains. In the future, we plan to use these tokens in systems such as LaborX (a brief description in section 4).

LHT will be issued based on the standard Ethereum ERC20 token and will be available for exchange on all major exchanges. ChronoBank system guarantees that 1 LHT token will always be equal to 1 hour of work under contracts with various LOC companies. Thus, the owners of tokens can at any time repay their labor. This section describes the various processes that support the relationship between LH tokens and working hours at 1: 1, and ensure the economic stability of the ChronoBank system.

2.2.1. Mining (minting)

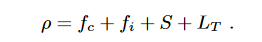

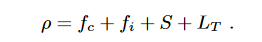

Mining occurs when LOC decides to enter into a contract with CBE. Then the CBE performs a thorough check (its principles are described in the business plan [9]) for those who wish to participate in the LOC system. As soon as the LOC passes, CBE and LOC negotiate on various issues (see Appendix B), then a contract is concluded whereby the LOC undertakes to pay off LHT (or their equivalent in Fiat) with labor. CBE will then publish the contract hash in Ethereum and keep it in a decentralized storage system, such as IPFS [10] or SWARM [11]. So A public registry is created that details the current provision of LHT workforce in detail. Exact mining mechanisms are non-trivial, and we refer our reader to schemes 4 and 5 for further consideration of this process. When LOC and CBE agreed on conditions, CBE releases LHT in accordance with the number of hours offered by LOC, in a 1: 1 ratio. During mining, CBE retains a portion of tokens (ρ) 3, and transfers the rest (1 - ρ) of the LOC company . In practice, CBE can sell LOC tokens on exchanges and transfer LOC fiat currency if they don’t want to deal with cryptocurrencies. The percentage (ρ) held by the CBE will be immediately divided in the following proportions (see diagram 5).

• fc ∈ [0, 0.01] - commission charged by CBE for minting

• fi - the issue fee, which will be transferred to the smart contract for TIME token holders (see section 2.1.2).

S is the part to be sent to the SGF Guarantee Fund (see Section 2.3.2).

• LT - sent to the Liquidity Reserve LR (see section 2.3.1).

This fund is divided in the ratio (l) into two parts: the sub-fund LI (LOC insurance) and L0 (liquidity provision) (for details see section 2.3.1).

For greater clarity, here’s the following formula (example):

(2)

(2)

We expect that the system will maintain fixed commissions, but will vary the parameters S, l and LT (and, consequently, ρ) individually to ensure the stability and viability of the ChronoBank ecosystem. The purpose of the LR Reserve and the SGF Guarantee Fund is described in detail in the Funds section (2.3), and a brief discussion of the economic viability of this system is given in Section 3.

Scheme 4. Overview of the processes during mining in Chronobank

Scheme 5. Distribution of issued LHT

2.2.2. Redemption

Since LHTs are provided with real labor, holders can redeem their tokens at any time. To do this, holders will deposit their LHT in a special smart contract for Ethereum. Along with the deposit, the holders of tokens will indicate related data regarding their redemption request: type of work, place of work, date / time of work, contact information, etc.

3 All percentages presented in this document should be read as decimal fractions. Therefore, (1 - ρ) ≥ 0.

CBE then looks for relevant LOC companies.

If there are any, CBE provides a list of LOC companies most satisfying to the request.In order to avoid recurring requests and reward CBE for the service provided, CBE takes a small fee of fr ∈ [0, 0.01] from the amount of deposited tokens. The number of working hours matching the request will be less than or equal to the number of deposited LHT tokens, minus the CBE commission. Any unsuccessful requests or unused working hours can be withdrawn from the smart contract. Moreover, a term will be set in the smart contract, after which holders can withdraw their LHTs. This will protect depositors from failing or lacking suitable offers in the CBE.

When the CBE has selected a list of suitable LOCs, the holder may accept or reject the proposed companies. In case of deviation, the holder can withdraw their LHT tokens minus the CBE service fee. If accepted, the CBE will transmit all associated request details to the selected LOC. The smart contract will store the LHT until the work is completed and the token holder is satisfied with the work. To ensure the performance of work in accordance with the request may use the dispute resolution system. Once the job is done and the holder is satisfied with it, the deposited LHTs will be destroyed, again providing a 1: 1 LHT ratio with the corresponding labor hours.

2.2.3. Intrinsic value

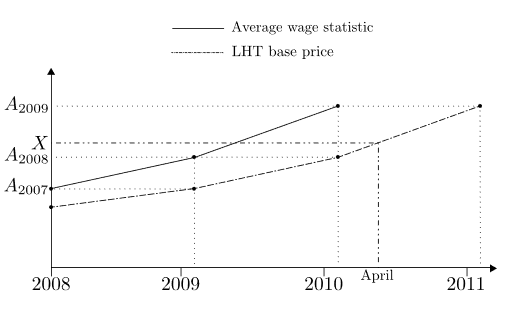

So far, we have ensured only the correspondence between the LHT and the working hours 1 to 1, but have not yet determined their value. The internal cost of one LHT and, therefore, one working hour depends on the region. Although you can choose any arbitrary value for practical reasons, we believe that the cost of one LHT should be equal to the average hourly wage in the region.

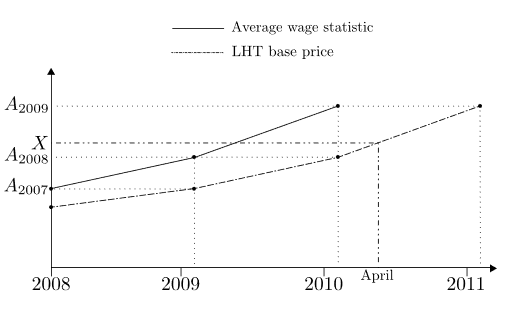

The average hourly wage in the region will be determined by the official statistical body of the specific region. Soif the LHT was corrected in accordance with the latest statistical data of a particular region, the price of the LHT would change stepwise from that point on. Usually, such statistics are published annually, and in such cases there would be an abrupt change in the LHT price every year. To realize a smooth price change, we suggest interpolating the LHT price between the new and the old value linearly. This requires that the LHT price lags behind the latest statistics by at least 1 year.

We illustrate this with a clear example, as shown in Figure 6. Let us determine the LHT price for April 2010 in the region where the statistical body publishes data in January of each year. This data shows the average salary in the region over the previous year. The price will be calculated on the basis of two values: A2008 (average salary in 2008; publication in January 2009) and A2009 (average salary in 2009; publication in January 2010). We do a linear interpolation between these two points to find the LHT price for April 2010. This will give us an approximate average salary of 4 April 2008. This example shows that the price of LHT in April 2010 will be equal to the approximate average wage in April 2008, thus demonstrating the lag of the price of LHT from the current actual average wage.It should be noted that this does not affect in any way any aspects related to the supply or redemption of labor. The cost of the proposed or canceled labor force does not depend on the price of the LHT token. However, this value will be measured in accordance with the fixed price of the LHT.

Scheme 6. The base price of one LHT token in April 2010, (X), can be calculated as a linear interpolation between the average wage in 2008 and 2009. (A2008 and A2009).

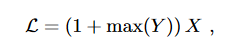

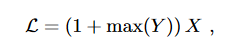

In any region, there are usually subregions that have additional costs associated with the provision of labor. We want to integrate these costs into the cost of our LHT token. To do this, we take the maximum level of costs in the subregion and add it to the region’s average wage, and we get the base price of LHT. In particular, we have (3):

(3)

(3)

where X is the linearly interpolated function of average wages and Y is the subregional costs as a percentage of the work performed. (L), as defined in equation (3), is the price of the LHT for each individual region. This value will vary linearly during each year in a transparent and predictable way.

2.3. Funds

The uniqueness of securing a digital token with “contract debt” requires various guarantees so that smart contracts are always protected and the likelihood of defaults are taken into account (as possible - our comment). There are a number of adverse scenarios that may arise in a debt-based system. The solutions we propose involve careful maintenance of the operation of two funds: the LR Liquidity Reserve and the SGF Guarantee Fund. In this section we will describe in detail the work of these funds and how they help to solve some problems that may arise in the system.

2.3.1. Liquidity reserve Liquidity

reserve is an offline LHT repository controlled by the CBE. He receives a certain percentage (LT) of new LHT tokens during the minting (section 2.2.1). LR performs two functions:

4 This is a rough calculation, suggesting a linear increase in salary during the year.

(1) Reducing the risks of LOC companies - during mining, LOC will receive payment in the amount of (1 - ρ) LHT for the working hours that they have agreed to provide. Therefore, LOC essentially carries some risk in the form of immediate redemption of all tokens. To reduce this risk, the CBE stores a portion of the issued LHT, in the LI sub-fund (see Section 2.2.1) for each LOC, to reimburse it for costs if the LHT is redeemed for an amount greater than (1-ρ) H. LI will cover all redundant (that is, all that is greater (1 - ρ)) quenched tokens until it is exhausted.

In the form of a formula, this can be represented as follows (where Lm is the tokens from the LI sub-fund):

(four)

where E is the excess LHT that the LOC must repay. The formula for calculating E is:

(five)

however, R is the total percentage of redeemed LHTs.

The sub-fund LI is not constant, it is gradually transferred to the SGF (see section 2.3.2). The rate of transfer of funds from this fund is determined by the parameter (M), which determines the total number of months until the funds are fully transferred. This parameter is consistent in the process of mining. LI tokens are translated monthly in equal parts (LI / M).

In the future, this procedure allows CBE with minting to statistically select the parameters ρ, LT and M, taking into account the level of risk and the reputation of a particular LOC. For example, ρ, LT and M can be chosen so that, with a confidence level of 95%, a LOC company at a certain point in time loses no more (ρ - ζ) LHT 5. Here ζ is the number that determines the risk level LOC- the company. This degree of freedom allows CBE to work with LOC companies while controlling risks.

(2) LHT Liquidity - The price of LHT will ultimately be determined by the price at which CBE buys and sells these tokens 6. The funds used for this are kept in the Liquidity Reserve. The tokens of the L0 subfund are taken into account in the general balance of the LR of the fund (see section 2.2.1). CBE stabilizes the LHT price and ensures its liquidity in various markets by buying and selling LHT at the base price (section 2.2.3.)

The parameter (l), previously set in the contract between the CBE and the LOC, determines the percentage of LHT that goes into the LI subfund (tokens used for LOC insurance, gradually transferred to the Guarantee Fund) and the L0 subfund (constantly used to ensure liquidity). With careful monitoring of the parameter (l), the CBE can maintain the desired amount of funds in the Liquidity Reserve. Since this fund will contain both LHT and traditional currencies, it is necessary to monitor its volume, due to the potential volatility of the currency it contains.

Single use of this fund will occur during the initial setup of the system. When the first LOC companies become part of the system, the newly issued LHTs will need to be sold in order to transfer the funds received to the LOC. Initially, the demand for LHT will be low, and funds from the Liquidity Reserve will be used to enhance this process. In this regard, part of the funds raised by the ICO will be directed to the LR.

2.3.2. Guarantee fund

One of the main drawbacks of the monetary system secured by debt obligations is the probability of bankruptcy of companies providing such obligations (LOC in our case). Despite minting inspections of LOC companies, we anticipate the likelihood that some companies may go bankrupt. The main purpose of SGF is to provide a safety reserve fund to protect against such situations. In practice, this fund will destroy the LHT tokens contained in it for an amount equal to the amount of default.

It is necessary to calculate the probability of default of LOC-companies. This will determine the number of LHTs that need to be stored in the SGF. The amount stored in the SGF will be proportional to the amount of the debt and, therefore, proportional to the amount of LHT in circulation (since each LHT token is provided with an hour of working time). The required number of tokens in the SFG can be installed and maintained by selecting the minting variables S, l and LT.

3. Economic considerations

In this section, we briefly describe some of the interesting properties and immediate economic implications of using the Chronobank system.

3.1. Economic incentives

First of all, the system should be designed in such a way that there are economic incentives for both LOC companies and LHT holders. For LOC, an incentive for participation in the ChronoBank system is an interest-free loan.

When the LOC agrees to participate in the system and provide working hours, the company actually receives an interest-free loan, which must be returned when their contract expires. In order for this to be interesting to a LOC company, it is necessary that it pay less for our services for the duration of the contract than if she took a loan, for example, from a local bank.

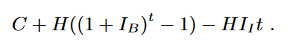

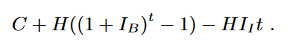

Consider a simple example that demonstrates the feasibility of such a scenario. Note that the bank each year to the loan amount accrues interest (IB), this loan has an initial value ©, and the total amount is equal to (H). Over a period of time (t), provided that the borrower does not make regular payments to the bank 7, the borrower (ie, LOC) loses on this:

5 This can occur because LOC assets increase over time due to the received external investment.

6 Considering that one LHT has a base intrinsic value of one hour of work time.

7 In this example, we use a loan without regular payments to clarify the analogy with our system and eliminate some mathematical complexity that can make our point of view less clear.

(6)

The first element corresponds to the initial cost of the loan, the second - the total interest accrued at time (t), the last element is the potential interest income from external investments. Here we have determined the average annual interest income from foreign investments (II).

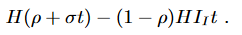

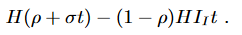

On the other hand, the LOC may not apply to the local bank, but to the ChronoBank system. If the LOC offers (H) business hours, it will receive H (1 - ρ) LHT tokens in return and will have to return (1 + σt) H tokens upon expiration of the contract (at time t). Here σ is the percentage representing the average annual increase in the price of LHT 8. It quantifies the price of LHT taking into account inflation, in connection with the expected increase in the average wage for the contract period. Thus, in the ChronoBank LOC system loses:

(7)

The first element here comes from the original amount taken by ChronoBank (Hρ) and from the LHT fluctuations over time. The second element is derived from the potential return on foreign investment in obtaining (1-ρ) H LHT tokens.

In this example, the LOC will be economically profitable to participate in the ChronoBank system if the ChronoBank commissions are less than the amount of bank interest on the loan, namely:

(eight)

Here (σ + ρII) is the average annual fluctuation of the LHT in combination with (ρ) the percentage of the average expected return on investment. With a reasonable assumption that this value is less than the interest rate of a bank loan (IB), equation (8) is always true for a certain period of time (t) if all other variables are fixed.

In fact, the longer the duration of the contract, the more advantageous it is for LOC. Thus, in this example, we see that the system encourages VOCs to participate in the ChronoBank system on a long-term basis 9.

Moreover, CBE and LOC can adjust both (H) and (ρ) when agreeing on a contract, which allows strengthening economic incentives in less favorable economic regions / scenarios.

As for the LHT holders, their economic incentive is more obvious. LHT, in comparison with its predecessors from the stable coin series, is non-inflationary. Therefore, holders have an economic incentive to use LHT, as its value will increase relative to local fiat inflation currencies. It should be noted that the purchase and possession of LHT for investment purposes (which consequently reduces the token’s liquidity) is not in the interests of the holder, since the gain in this is often less than external investment strategies.

3.2. System stability

This section is devoted to the ability of ChronoBank to overcome various economic obstacles, which we consider to be its stability.

The stability of the ChronoBank system depends on how well the CBE controls the mining. Through the minting, two funds are monitored and maintained: a liquidity reserve and a guarantee fund.

As the system grows, funds will flow into both the LR and SGF. Tokens from SGF are displayed only if LOC defaults. LR is reduced only if the traditional currency it contains loses in value. Thus, both funds must grow as the system develops. As the funds reach a sustainable level, the percentage of LHT entering these funds during the minting (ρ) can be reduced, which will further strengthen the economic incentives for more LOCs to join the system. A larger number of participating LOC companies will mean a greater amount of LHT in circulation and a larger amount of funds accumulated in SGF and LR. The stability of the system will depend directly on the amount of funds in SGF and LR, and therefore we expect the system to be more stable as it develops.

3.3. Possible difficulties

A number of difficulties may arise during the operation of the system. In this section, we briefly outline the main and most obvious ones along with the proposed solutions.

• LOC defaults on the provision of working hours. As already mentioned, SGF will be used in this situation. The CBE will destroy the required LHT from the SGF to maintain the 1: 1 ratio of LHT to business hours.

• High demand / supply causing price fluctuations. This can be solved with a sufficiently large LR, which will provide demand in periods of high supply and vice versa. Initially funds from the crowdsale will be placed in the LR, and as the system grows, the LR will be maintained at the necessary safe level that will solve this problem.

• Repayment of all LHT tokens. LHT at any time will always be supported by contractual working hours in the ratio of 1 to 1. Thus, this scenario is possible, and the system will continue to function in this case. However, the risk in this case lies with the participating LOC companies that will be required to repay the LHT with labor. SGF (Section 2.3.1) can also cover a portion of the cost of this development. At the discretion of the CBE, it will be decided whether to use SGF in this very unlikely scenario.

• Increased demand after the expiration of the contract. Upon expiration of the contract, the LOC will be required to purchase the appropriate amount of LHT in exchange for the under-provided labor. This could potentially create periods of high demand for tokens. In such cases, we will counteract the increase in demand with the help of LR and, if necessary, SGF.

8 It is also possible that the price will fall.

9 Calculation taking into account regular payments on bank loans complicates this example, and although this reduces the size of the right side of equation (8), this does not change our final result.

4. Further work

Economic models. The key to the success of the ChronoBank system is a conscious choice of the above-mentioned economic parameters. It is important to conduct further analysis to determine how changing parameters affects the feasibility and sustainability of the system in a wider context. This will certainly be done before the actual use of the system.

LaborX. The electronic money transfer system described in this document is proposed as the first step towards a larger decentralized labor system. LHT is the base currency for a decentralized labor exchange called LaborX.

The purpose of LaborX is to provide a direct exchange of labor hours for LHT, thereby reducing the centralization of the ChronoBank system. LaborX will include a rating system whereby LHT owners can determine the integrity of a transaction by studying the quality and / or specialization of the labor supplier, given its history on the platform. By providing a direct exchange of LHT for labor, the system’s dependence on contracts with LOC companies is significantly reduced. This should theoretically reduce costs and increase the stability of the system as a whole.

5. Conclusion

This document proposes an electronic system of electronic transfers without inflation and volatility. This innovative system is made possible by recent advances in blockchain and cryptography. Using these technologies, the system presents contractual obligations in such a way that it can be economically feasible and very practical for digital platforms such as LaborX. The intrinsic value of the proposed token reflects the average value of the hourly rate of human labor, which is the most fundamental unit of economic value.

Links

[1] Satoshi Nakamoto. Bitcoin: A peer-to-peer electronic cash system. 2008

[2] Tether.to. Tether: Fiat currencies on the bitcoin blockchain. 2014.

[3] Anthony C. Eufemio Kai C. Chng Shaun Djie. Digix's whitepaper: The gold standard in crypto-assets. 2016.

[4] Fabian Schuh Daniel Larimer. Bitshares 2.0: Financial smart contract platform. 2015.

[5] Investopedia. Contract for difference.

[6] Gavin Wood. Ethereum: A secure decentralized generalized transaction ledger. Ethereum Project Yellow Paper, 2014.

[7] Sasha Ivanov. Waves whitepaper. 2016.

[8] Ethereum Request for Comments (ERC) 20.

[9] The ChronoBank Team. ChronoBank: Business Outline.

[10] IPFS: A peer-to-peer hypermedia protocol to make the web faster, safer, and more open.

[11] Viktor Tron Aron Fisher, Daniel A. Nagy. SWARM.

CHRONOBANK-PHASE 1: SUSTAINABLE DIGITAL TOKEN PROVIDED BY WORKING FORCE

Appendix A. Terms The

following is a list of terms used in the document.

• CBE (ChronoBank Entity) - the central body of the ChronoBank system

• LHT (Labor-Hour Token) - labor-provided token

• LOC (Labor-Offering Company) - labor-providing company

• SGF (Security Guarantee Fund) - Guarantee Fund

Appendix B . the contract options on mining

There are a number of parameters that must be agreed in the process of mining. For greater clarity, here are the variables that the CBE should set when mining:

• S is the percentage of tokens issued that should be stored in the Guarantee Fund

• LT is the total percentage of tokens to be stored in LR

• l is the percentage of LT determining how much of the LR fund will be used in the LI sub-fund as insurance for LOC companies. The remaining funds will be stored in the sub-fund L0.

• M is the total number of months before the transfer of funds from LI to SFG.

This determines the speed of the transfer of funds, i.e. LI / M per month.

• Term - the term of the contract, in accordance with which the LOC must redeem issued LHT.

By setting the above variables, the CBE will individually record (ρ), the total percentage is subtracted from the LOC, initially through the relation (2).

Appendix C. Commissions

ChronoBank Tariffs can be summarized as follows:

• fc - commission charged by the CBE to issue tokens. Estimated value fc ∈ [0, 0.01].

• fi - an emission fee, which is charged during the mining and is entered into a smart contract with the holders of TIME-tokens. The emission fee will be 3% during the first year of operation, 2% in the second year, and from the third year it will be fixed at 1%.

• ft - transaction fee, which is deposited in a smart contract with holders of TIME-tokens. The commission is 0.15%.

• fr - CBE is charged when redeeming tokens as a CBE reward for the service provided and in order to avoid recurrent requests. The expected value is fc ∈ [0, 0.01].

PS I hope the material will be useful and discuss, because I personally like the Chronobank system to be quite sympathetic and I believe that despite the possible flaws, there is great potential in it.

In addition, in addition to Bitcoin and a number of other cryptocurrencies, they know about the “chain of blocks” on Habro sites as well, and there are not so many of them outside. Yes, the blockchain has problems , but there are also very interesting and promising areas of development.

So, today we will talk about Chronobank: and, recalling past articles, I will say a few words what kind of project it is.

')

First, the materials:

- Official video in Russian

- Actually, the site

- White paper , the translation of which is presented below.

- Project analysis from ICO rating

- Conceptual description of the project in Russian

To briefly describe Chronobank.io, I will quote: “Chronobank is an innovative platform based on the blockchain technology, which is designed to modernize the current infrastructure of the labor market and the format of relationships between employers and employees, as well as level intermediaries in the form of employment agencies .”

And now - the actual translation of the White Book .

CHRONOBANK-PHASE 1: NON-VOLATILE DIGITAL TOKEN, PROVIDED BY WORKING FORCE

TEAM CHRONOBANK

CHRONOBANK.IO

INFO@CHRONOBANK.IO

Summary This white paper describes the basic principles of a system designed for the production of tokens endowed with labor (Labor-Hour Tokens, LHT) using blockchain technology. ChronoBank - the proposed implementation of the described system, which can be deployed in various economic spaces. The proposed system uses smart contracts to automate the process in which a LHT token of a specific country can be redeemed in real working time using traditional contracts with recruitment companies. The proposed implementation of the so-called. “Stable currency” (stable coin) is an electronic payment system without inflation and volatility.

1. Introduction

With the advent of cryptocurrency, almost instant low-cost money transfers have become a reality. The blockchain technology, which is used by most cryptocurrencies, has recently been used to solve a wide variety of problems. Currently, the most common implementation of this technology is the Bitcoin payment system [1]. The unit of account in this system is 1 bitcoin (BTC). Since its inception in 2009, the rate of this token has been subject to sharp fluctuations, which prevented its use as a global currency.

Many attempts have been made to take advantage of blockchain technology, while reducing the risks associated with cryptocurrency volatility. For this purpose, many projects introduce the concept of a stable coin, in which each token in the system has an equivalent equivalent that is stored in a non-digital, tangible form in the “real world”.

Below are two examples of the implementation of the stable coin idea :

USDT of Tether Company [2]:

Each USDT token corresponds to an equivalent amount in US dollars stored in the bank account of Tether Limited.

Digix [3]:

Each token is provided with an equivalent amount of gold, which is saved in the vaults by a specialized company.

In both examples, the owner of the token can always redeem this token by its equivalent, thereby ensuring the stability of the currency.

Another notable example of a stable coin is Bitshares [4], which attempts to decentralize the entire system using electronic CFD contracts [Contract For Differences, CFD] [5]. The purpose of the system presented in this document is not to achieve decentralization, but to eliminate some of the shortcomings of existing centralized stable coins. These shortcomings are associated with the difficulty of storing physical or economic goods and the growing likelihood of attacks, since a single organization consolidates all the system’s assets. Typical stable coins are also subject to volatility of the underlying asset. Although these fluctuations are usually very small compared to traditional cryptocurrencies, they are still significant. For example, USDT is subject to a devaluation of the US dollar due to inflation.

In this document, we propose a stable cryptocurrency system that does not have the aforementioned drawbacks of the existing “stable” cryptocurrencies. In particular, we propose a new type of token that does not rely on existing fiatnie currency or physical values, instead, the token is provided with legal obligations of companies to provide labor. Thus, the system and its control body are not responsible for centralized storage and asset management. In addition, the cost of an hour of unskilled labor in a certain geographic region is naturally regulated in accordance with economic conditions, such as inflation, thereby preserving the long-term internal stability of cryptocurrency.

This document is organized as follows: before discussing the technical details of the system components and the processes taking place in it, we give an overview of the system as a whole in section 2. Section 3 briefly summarizes the economic considerations regarding the actual deployment of the system and its feasibility. Finally, section 4 discusses the future directions for the development of the ChronoBank system. The appendix contains explanations of some of the concepts found in the document. Appendices B and C list the variables that are used in the operation of the system. These variables are also listed in table 1.

2. ChronoBank System

Like existing stable coins (such as USDT and Digix), we propose to create a centralized authority that coordinates the creation, redemption and destruction of LHT tokens. We call it ChronoBank Entity (CBE).

He is responsible for concluding and negotiating contracts for labor, in addition to the mining and distribution of LHT tokens. Ultimately, the role of CBE is to ensure the stability of the LHT system through careful management of the underlying processes.

Scheme 1 . General view of the ChronoBank system. This diagram shows the components of the system and their interaction. CBE (ChronoBank Entity) - the central body, LOC (Labor-Offering Companies) - companies offering labor, LHT (Labor-Hour Tokens) - tokens provided with labor, TIME - tokens sold at crowdsale.

This section will provide detailed information on all activities and operations carried out by the CBE and its partners. An overview of the functions of the components of the ChronoBank system is shown in Figure 1.

The system as a whole is designed for one-time deployment in each separate economic region. For example, the system can be deployed once in Australia using the cost per working hour in the Australian economy, measured in Australian dollars. Since this document is a general description of the system, there is no description of the implementation specific for each region, but there are general system parameters that need to be adapted for each region. With a few exceptions, all the processes and structures described in this document may have small differences in different regions where ChronoBank is applied.

The initial implementation of CBE will use the Ethereum blockchain [6]; However, in future implementations, tokens may be issued on the basis of other blockchain systems (for example, Waves [7], Bitcoin [1]), when deemed appropriate.

CBE carries economic benefits for both the environment where it is deployed and for system participants who help the CBE by providing initial working capital. Unlike the region-specific deployment of a CBE system, only one group of CBE participants (so-called TIME token holders) exists at the global level. These system participants provide CBE with initial operating capital in the form of Fiat and cryptocurrency in exchange for a portion of the future earnings of CBE.

2.1. System members and TIME tokens

In order to finance the development and operation of the ChronoBank system, a fundraising phase, in other words, a crowdsale, will be conducted. During a crowdsale, individuals can acquire TIME tokens at a fixed price, which gives the token owner the right to receive a share of the system’s profits. In addition to the right to make a profit from the work of the system, TIME token holders will also have the right to vote on important issues related to the ChronoBank system.

TIME tokens will be released using the Ethereum ecosystem, in particular, using the ERC20 standard [8]. The ERC20 specification will be supplemented to enable voting and distribution of rewards; This will be discussed further in sections 2.1.3 and 2.1.2.

2.1.1. Crowdsale

During the crowdsale, TIME tokens will be created as needed and sold at a fixed price of 100 tokens for 1 bitcoin (BTC). There are no restrictions on the number of TIME tokens generated during crowdsal; however, no additional TIME tokens will be issued after this phase.

Ρ Total Percentage of LHTs Received by CBE

Fc Commission charged by CBE for mining (aka minting is our note) tokens.

Fr Commission charged by CBE to pay for tokens

Fi emission fee (taken during mining)

S Percentage of LHT issued, sent to the Guarantee Fund (Security Guarantee Fund or SGF).

LT Percentage of LHT issued, sent to Liquidity Reserve (Liquidity Reserve or LR)

L0 Percentage of LHT issued for labor insurance companies (Labor-Offering Companies or LOC).

M Number of months before the transfer of funds from the sub-fund L0 to SGF

L Percentage of LHT tokens intended for LOC insurance.

P The interval between the payment of remuneration for time-tokens.

Table 1. List of used variables and constants. Additional information in the application.

All TIME tokens sold on the crowdsale will be 88% of the total number of tokens generated when the ChronoBank system is started. 10% will be distributed to members of the ChronoBank.io team (for current research and development), and the remaining 2% will be used to reward advisers and early members of the system.

Scheme 2. The issue fee (fi) and transaction fee (ft) are deposited in a smart contract. Owners of TIME tokens can withdraw a part of the LHT after each snapshot if their TIME tokens are deposited in the contract.

2.1.2. Reward for TIME tokens

For the use of LHT users will be charged a fixed commission of ft = 0.15% for all transactions. In addition to the transaction fee, when issuing tokens, there will be an emission fee (fi) (more in section 2.2.1). The emission fee will be 3% during the first year of operation, 2% in the second year, and from the third year it will be fixed at 1%.

Transaction fees and issuance fees will be charged automatically and sent to the smart contract on the Ethereum blockchain, as shown in Figure 2. The smart contract is designed so that the holders of TIME tokens can freely withdraw their remuneration (i.e. A specific token is not tracked) and changed on exchanges.

A smart contract will allow TIME token owners to receive their remuneration regularly at intervals (P). At any stage, TIME owners can add their tokens to the contract. With the onset of the time of payment, a snapshot of deposited tokens TIME and the current balance of the smart contract will be made 1. Remuneration will be equally accrued for each TIME token that was deposited at the time of the snapshot. Holders of tokens can withdraw their reward before the next payment. With the next payment, a snapshot is also made, and all unclaimed remuneration will be withdrawn and added to the total balance of the snapshot. Scheme 3 illustrates this concept; it shows the construction of the balance of a smart contract over time. We also want to note that we assume that the value of the variable (P) will be within a few months.

Holders of TIME can deposit and withdraw their tokens at any stage, however, only those who deposited tokens until the time of the snapshot can apply for a reward. Removing TIME tokens from the contract also deprives the contributor of remuneration. TIME holders also have the right to keep their tokens indefinitely, in a smart contract, periodically requesting remuneration.

Scheme 3. The smart contract receives a reward (Pr) at each interval (P) (in our example, Pr is fixed). In each snapshot, the unclaimed part of the reward is indicated by (d). Unclaimed remuneration, is transferred to the next payment (P). The dotted line shows the balance intended for the payment of rewards, which decreases as the owners of TIME withdraw their reward.

This remuneration system gives an upper limit to the amount of remuneration that can be in a contract at any time, with some reasonable assumptions. The total amount of remuneration received from the collected commissions for a certain period between payments (P) is indicated by a variable (Pr). If we proceed from the constant amount of collected commissions and fees for each period between payments (ie, Pr is fixed) and take into account the average percentage of holders of TIME tokens who constantly store their tokens in contract (d), we can calculate the upper limit of the stored LHT -tokenov in the smart contract according to the following formula * 2:

(one)

(one)For greater clarity, let's adhere to a conservative estimate that 90% of all TIME token holders do not withdraw their reward. In this case, a reward of no more than 10Pr will be stored in the smart contract at any time. A less conservative estimate, based on the fact that 50% of TIME holders withdraw their remuneration after each payment, will ensure at any time the availability in the contract no more than 2Pr. Thanks to the careful (and possibly dynamic) choice of the parameter (P), we can find a balance between practicality (frequency of withdrawal of rewards) and security (safe level of assets in a smart contract).

2.1.3. TIME tokens. Voting

Periodically, the CBE may vote in Ethereum to obtain an opinion from TIME token holders. The voting results will be taken into account by the CBE when considering financial or technical issues, as well as on the implementation of the Chronobank system.

1 Anyone can initiate this operation, but as a rule, it is carried out by the CBE.

2 It is assumed that 0 ≤ d <1.

Only valid holders of TIME tokens are active participants in the CBE system, and only they are eligible to vote.

2.2. Labor-Hour Tokens

LHT tokens are the basic unit in the ChronoBank system. The task of these tokens is to provide a non-volatile, non-inflationary currency based on various blockchains. In the future, we plan to use these tokens in systems such as LaborX (a brief description in section 4).

LHT will be issued based on the standard Ethereum ERC20 token and will be available for exchange on all major exchanges. ChronoBank system guarantees that 1 LHT token will always be equal to 1 hour of work under contracts with various LOC companies. Thus, the owners of tokens can at any time repay their labor. This section describes the various processes that support the relationship between LH tokens and working hours at 1: 1, and ensure the economic stability of the ChronoBank system.

2.2.1. Mining (minting)

Mining occurs when LOC decides to enter into a contract with CBE. Then the CBE performs a thorough check (its principles are described in the business plan [9]) for those who wish to participate in the LOC system. As soon as the LOC passes, CBE and LOC negotiate on various issues (see Appendix B), then a contract is concluded whereby the LOC undertakes to pay off LHT (or their equivalent in Fiat) with labor. CBE will then publish the contract hash in Ethereum and keep it in a decentralized storage system, such as IPFS [10] or SWARM [11]. So A public registry is created that details the current provision of LHT workforce in detail. Exact mining mechanisms are non-trivial, and we refer our reader to schemes 4 and 5 for further consideration of this process. When LOC and CBE agreed on conditions, CBE releases LHT in accordance with the number of hours offered by LOC, in a 1: 1 ratio. During mining, CBE retains a portion of tokens (ρ) 3, and transfers the rest (1 - ρ) of the LOC company . In practice, CBE can sell LOC tokens on exchanges and transfer LOC fiat currency if they don’t want to deal with cryptocurrencies. The percentage (ρ) held by the CBE will be immediately divided in the following proportions (see diagram 5).

• fc ∈ [0, 0.01] - commission charged by CBE for minting

• fi - the issue fee, which will be transferred to the smart contract for TIME token holders (see section 2.1.2).

S is the part to be sent to the SGF Guarantee Fund (see Section 2.3.2).

• LT - sent to the Liquidity Reserve LR (see section 2.3.1).

This fund is divided in the ratio (l) into two parts: the sub-fund LI (LOC insurance) and L0 (liquidity provision) (for details see section 2.3.1).

For greater clarity, here’s the following formula (example):

(2)

(2)We expect that the system will maintain fixed commissions, but will vary the parameters S, l and LT (and, consequently, ρ) individually to ensure the stability and viability of the ChronoBank ecosystem. The purpose of the LR Reserve and the SGF Guarantee Fund is described in detail in the Funds section (2.3), and a brief discussion of the economic viability of this system is given in Section 3.

Scheme 4. Overview of the processes during mining in Chronobank

Scheme 5. Distribution of issued LHT

2.2.2. Redemption

Since LHTs are provided with real labor, holders can redeem their tokens at any time. To do this, holders will deposit their LHT in a special smart contract for Ethereum. Along with the deposit, the holders of tokens will indicate related data regarding their redemption request: type of work, place of work, date / time of work, contact information, etc.

3 All percentages presented in this document should be read as decimal fractions. Therefore, (1 - ρ) ≥ 0.

CBE then looks for relevant LOC companies.

If there are any, CBE provides a list of LOC companies most satisfying to the request.In order to avoid recurring requests and reward CBE for the service provided, CBE takes a small fee of fr ∈ [0, 0.01] from the amount of deposited tokens. The number of working hours matching the request will be less than or equal to the number of deposited LHT tokens, minus the CBE commission. Any unsuccessful requests or unused working hours can be withdrawn from the smart contract. Moreover, a term will be set in the smart contract, after which holders can withdraw their LHTs. This will protect depositors from failing or lacking suitable offers in the CBE.

When the CBE has selected a list of suitable LOCs, the holder may accept or reject the proposed companies. In case of deviation, the holder can withdraw their LHT tokens minus the CBE service fee. If accepted, the CBE will transmit all associated request details to the selected LOC. The smart contract will store the LHT until the work is completed and the token holder is satisfied with the work. To ensure the performance of work in accordance with the request may use the dispute resolution system. Once the job is done and the holder is satisfied with it, the deposited LHTs will be destroyed, again providing a 1: 1 LHT ratio with the corresponding labor hours.

2.2.3. Intrinsic value

So far, we have ensured only the correspondence between the LHT and the working hours 1 to 1, but have not yet determined their value. The internal cost of one LHT and, therefore, one working hour depends on the region. Although you can choose any arbitrary value for practical reasons, we believe that the cost of one LHT should be equal to the average hourly wage in the region.

The average hourly wage in the region will be determined by the official statistical body of the specific region. Soif the LHT was corrected in accordance with the latest statistical data of a particular region, the price of the LHT would change stepwise from that point on. Usually, such statistics are published annually, and in such cases there would be an abrupt change in the LHT price every year. To realize a smooth price change, we suggest interpolating the LHT price between the new and the old value linearly. This requires that the LHT price lags behind the latest statistics by at least 1 year.

We illustrate this with a clear example, as shown in Figure 6. Let us determine the LHT price for April 2010 in the region where the statistical body publishes data in January of each year. This data shows the average salary in the region over the previous year. The price will be calculated on the basis of two values: A2008 (average salary in 2008; publication in January 2009) and A2009 (average salary in 2009; publication in January 2010). We do a linear interpolation between these two points to find the LHT price for April 2010. This will give us an approximate average salary of 4 April 2008. This example shows that the price of LHT in April 2010 will be equal to the approximate average wage in April 2008, thus demonstrating the lag of the price of LHT from the current actual average wage.It should be noted that this does not affect in any way any aspects related to the supply or redemption of labor. The cost of the proposed or canceled labor force does not depend on the price of the LHT token. However, this value will be measured in accordance with the fixed price of the LHT.

Scheme 6. The base price of one LHT token in April 2010, (X), can be calculated as a linear interpolation between the average wage in 2008 and 2009. (A2008 and A2009).

In any region, there are usually subregions that have additional costs associated with the provision of labor. We want to integrate these costs into the cost of our LHT token. To do this, we take the maximum level of costs in the subregion and add it to the region’s average wage, and we get the base price of LHT. In particular, we have (3):

(3)

(3)where X is the linearly interpolated function of average wages and Y is the subregional costs as a percentage of the work performed. (L), as defined in equation (3), is the price of the LHT for each individual region. This value will vary linearly during each year in a transparent and predictable way.

2.3. Funds

The uniqueness of securing a digital token with “contract debt” requires various guarantees so that smart contracts are always protected and the likelihood of defaults are taken into account (as possible - our comment). There are a number of adverse scenarios that may arise in a debt-based system. The solutions we propose involve careful maintenance of the operation of two funds: the LR Liquidity Reserve and the SGF Guarantee Fund. In this section we will describe in detail the work of these funds and how they help to solve some problems that may arise in the system.

2.3.1. Liquidity reserve Liquidity

reserve is an offline LHT repository controlled by the CBE. He receives a certain percentage (LT) of new LHT tokens during the minting (section 2.2.1). LR performs two functions:

4 This is a rough calculation, suggesting a linear increase in salary during the year.

(1) Reducing the risks of LOC companies - during mining, LOC will receive payment in the amount of (1 - ρ) LHT for the working hours that they have agreed to provide. Therefore, LOC essentially carries some risk in the form of immediate redemption of all tokens. To reduce this risk, the CBE stores a portion of the issued LHT, in the LI sub-fund (see Section 2.2.1) for each LOC, to reimburse it for costs if the LHT is redeemed for an amount greater than (1-ρ) H. LI will cover all redundant (that is, all that is greater (1 - ρ)) quenched tokens until it is exhausted.

In the form of a formula, this can be represented as follows (where Lm is the tokens from the LI sub-fund):

(four)

where E is the excess LHT that the LOC must repay. The formula for calculating E is:

(five)

however, R is the total percentage of redeemed LHTs.

The sub-fund LI is not constant, it is gradually transferred to the SGF (see section 2.3.2). The rate of transfer of funds from this fund is determined by the parameter (M), which determines the total number of months until the funds are fully transferred. This parameter is consistent in the process of mining. LI tokens are translated monthly in equal parts (LI / M).

In the future, this procedure allows CBE with minting to statistically select the parameters ρ, LT and M, taking into account the level of risk and the reputation of a particular LOC. For example, ρ, LT and M can be chosen so that, with a confidence level of 95%, a LOC company at a certain point in time loses no more (ρ - ζ) LHT 5. Here ζ is the number that determines the risk level LOC- the company. This degree of freedom allows CBE to work with LOC companies while controlling risks.

(2) LHT Liquidity - The price of LHT will ultimately be determined by the price at which CBE buys and sells these tokens 6. The funds used for this are kept in the Liquidity Reserve. The tokens of the L0 subfund are taken into account in the general balance of the LR of the fund (see section 2.2.1). CBE stabilizes the LHT price and ensures its liquidity in various markets by buying and selling LHT at the base price (section 2.2.3.)

The parameter (l), previously set in the contract between the CBE and the LOC, determines the percentage of LHT that goes into the LI subfund (tokens used for LOC insurance, gradually transferred to the Guarantee Fund) and the L0 subfund (constantly used to ensure liquidity). With careful monitoring of the parameter (l), the CBE can maintain the desired amount of funds in the Liquidity Reserve. Since this fund will contain both LHT and traditional currencies, it is necessary to monitor its volume, due to the potential volatility of the currency it contains.

Single use of this fund will occur during the initial setup of the system. When the first LOC companies become part of the system, the newly issued LHTs will need to be sold in order to transfer the funds received to the LOC. Initially, the demand for LHT will be low, and funds from the Liquidity Reserve will be used to enhance this process. In this regard, part of the funds raised by the ICO will be directed to the LR.

2.3.2. Guarantee fund

One of the main drawbacks of the monetary system secured by debt obligations is the probability of bankruptcy of companies providing such obligations (LOC in our case). Despite minting inspections of LOC companies, we anticipate the likelihood that some companies may go bankrupt. The main purpose of SGF is to provide a safety reserve fund to protect against such situations. In practice, this fund will destroy the LHT tokens contained in it for an amount equal to the amount of default.

It is necessary to calculate the probability of default of LOC-companies. This will determine the number of LHTs that need to be stored in the SGF. The amount stored in the SGF will be proportional to the amount of the debt and, therefore, proportional to the amount of LHT in circulation (since each LHT token is provided with an hour of working time). The required number of tokens in the SFG can be installed and maintained by selecting the minting variables S, l and LT.

3. Economic considerations

In this section, we briefly describe some of the interesting properties and immediate economic implications of using the Chronobank system.

3.1. Economic incentives

First of all, the system should be designed in such a way that there are economic incentives for both LOC companies and LHT holders. For LOC, an incentive for participation in the ChronoBank system is an interest-free loan.

When the LOC agrees to participate in the system and provide working hours, the company actually receives an interest-free loan, which must be returned when their contract expires. In order for this to be interesting to a LOC company, it is necessary that it pay less for our services for the duration of the contract than if she took a loan, for example, from a local bank.

Consider a simple example that demonstrates the feasibility of such a scenario. Note that the bank each year to the loan amount accrues interest (IB), this loan has an initial value ©, and the total amount is equal to (H). Over a period of time (t), provided that the borrower does not make regular payments to the bank 7, the borrower (ie, LOC) loses on this:

5 This can occur because LOC assets increase over time due to the received external investment.

6 Considering that one LHT has a base intrinsic value of one hour of work time.

7 In this example, we use a loan without regular payments to clarify the analogy with our system and eliminate some mathematical complexity that can make our point of view less clear.

(6)

The first element corresponds to the initial cost of the loan, the second - the total interest accrued at time (t), the last element is the potential interest income from external investments. Here we have determined the average annual interest income from foreign investments (II).

On the other hand, the LOC may not apply to the local bank, but to the ChronoBank system. If the LOC offers (H) business hours, it will receive H (1 - ρ) LHT tokens in return and will have to return (1 + σt) H tokens upon expiration of the contract (at time t). Here σ is the percentage representing the average annual increase in the price of LHT 8. It quantifies the price of LHT taking into account inflation, in connection with the expected increase in the average wage for the contract period. Thus, in the ChronoBank LOC system loses:

(7)

The first element here comes from the original amount taken by ChronoBank (Hρ) and from the LHT fluctuations over time. The second element is derived from the potential return on foreign investment in obtaining (1-ρ) H LHT tokens.

In this example, the LOC will be economically profitable to participate in the ChronoBank system if the ChronoBank commissions are less than the amount of bank interest on the loan, namely:

(eight)

Here (σ + ρII) is the average annual fluctuation of the LHT in combination with (ρ) the percentage of the average expected return on investment. With a reasonable assumption that this value is less than the interest rate of a bank loan (IB), equation (8) is always true for a certain period of time (t) if all other variables are fixed.

In fact, the longer the duration of the contract, the more advantageous it is for LOC. Thus, in this example, we see that the system encourages VOCs to participate in the ChronoBank system on a long-term basis 9.

Moreover, CBE and LOC can adjust both (H) and (ρ) when agreeing on a contract, which allows strengthening economic incentives in less favorable economic regions / scenarios.

As for the LHT holders, their economic incentive is more obvious. LHT, in comparison with its predecessors from the stable coin series, is non-inflationary. Therefore, holders have an economic incentive to use LHT, as its value will increase relative to local fiat inflation currencies. It should be noted that the purchase and possession of LHT for investment purposes (which consequently reduces the token’s liquidity) is not in the interests of the holder, since the gain in this is often less than external investment strategies.

3.2. System stability

This section is devoted to the ability of ChronoBank to overcome various economic obstacles, which we consider to be its stability.

The stability of the ChronoBank system depends on how well the CBE controls the mining. Through the minting, two funds are monitored and maintained: a liquidity reserve and a guarantee fund.

As the system grows, funds will flow into both the LR and SGF. Tokens from SGF are displayed only if LOC defaults. LR is reduced only if the traditional currency it contains loses in value. Thus, both funds must grow as the system develops. As the funds reach a sustainable level, the percentage of LHT entering these funds during the minting (ρ) can be reduced, which will further strengthen the economic incentives for more LOCs to join the system. A larger number of participating LOC companies will mean a greater amount of LHT in circulation and a larger amount of funds accumulated in SGF and LR. The stability of the system will depend directly on the amount of funds in SGF and LR, and therefore we expect the system to be more stable as it develops.

3.3. Possible difficulties

A number of difficulties may arise during the operation of the system. In this section, we briefly outline the main and most obvious ones along with the proposed solutions.

• LOC defaults on the provision of working hours. As already mentioned, SGF will be used in this situation. The CBE will destroy the required LHT from the SGF to maintain the 1: 1 ratio of LHT to business hours.

• High demand / supply causing price fluctuations. This can be solved with a sufficiently large LR, which will provide demand in periods of high supply and vice versa. Initially funds from the crowdsale will be placed in the LR, and as the system grows, the LR will be maintained at the necessary safe level that will solve this problem.

• Repayment of all LHT tokens. LHT at any time will always be supported by contractual working hours in the ratio of 1 to 1. Thus, this scenario is possible, and the system will continue to function in this case. However, the risk in this case lies with the participating LOC companies that will be required to repay the LHT with labor. SGF (Section 2.3.1) can also cover a portion of the cost of this development. At the discretion of the CBE, it will be decided whether to use SGF in this very unlikely scenario.

• Increased demand after the expiration of the contract. Upon expiration of the contract, the LOC will be required to purchase the appropriate amount of LHT in exchange for the under-provided labor. This could potentially create periods of high demand for tokens. In such cases, we will counteract the increase in demand with the help of LR and, if necessary, SGF.

8 It is also possible that the price will fall.

9 Calculation taking into account regular payments on bank loans complicates this example, and although this reduces the size of the right side of equation (8), this does not change our final result.

4. Further work

Economic models. The key to the success of the ChronoBank system is a conscious choice of the above-mentioned economic parameters. It is important to conduct further analysis to determine how changing parameters affects the feasibility and sustainability of the system in a wider context. This will certainly be done before the actual use of the system.

LaborX. The electronic money transfer system described in this document is proposed as the first step towards a larger decentralized labor system. LHT is the base currency for a decentralized labor exchange called LaborX.

The purpose of LaborX is to provide a direct exchange of labor hours for LHT, thereby reducing the centralization of the ChronoBank system. LaborX will include a rating system whereby LHT owners can determine the integrity of a transaction by studying the quality and / or specialization of the labor supplier, given its history on the platform. By providing a direct exchange of LHT for labor, the system’s dependence on contracts with LOC companies is significantly reduced. This should theoretically reduce costs and increase the stability of the system as a whole.

5. Conclusion

This document proposes an electronic system of electronic transfers without inflation and volatility. This innovative system is made possible by recent advances in blockchain and cryptography. Using these technologies, the system presents contractual obligations in such a way that it can be economically feasible and very practical for digital platforms such as LaborX. The intrinsic value of the proposed token reflects the average value of the hourly rate of human labor, which is the most fundamental unit of economic value.

Links

[1] Satoshi Nakamoto. Bitcoin: A peer-to-peer electronic cash system. 2008

[2] Tether.to. Tether: Fiat currencies on the bitcoin blockchain. 2014.

[3] Anthony C. Eufemio Kai C. Chng Shaun Djie. Digix's whitepaper: The gold standard in crypto-assets. 2016.

[4] Fabian Schuh Daniel Larimer. Bitshares 2.0: Financial smart contract platform. 2015.

[5] Investopedia. Contract for difference.

[6] Gavin Wood. Ethereum: A secure decentralized generalized transaction ledger. Ethereum Project Yellow Paper, 2014.

[7] Sasha Ivanov. Waves whitepaper. 2016.

[8] Ethereum Request for Comments (ERC) 20.

[9] The ChronoBank Team. ChronoBank: Business Outline.

[10] IPFS: A peer-to-peer hypermedia protocol to make the web faster, safer, and more open.

[11] Viktor Tron Aron Fisher, Daniel A. Nagy. SWARM.

CHRONOBANK-PHASE 1: SUSTAINABLE DIGITAL TOKEN PROVIDED BY WORKING FORCE

Appendix A. Terms The

following is a list of terms used in the document.

• CBE (ChronoBank Entity) - the central body of the ChronoBank system

• LHT (Labor-Hour Token) - labor-provided token

• LOC (Labor-Offering Company) - labor-providing company

• SGF (Security Guarantee Fund) - Guarantee Fund

Appendix B . the contract options on mining

There are a number of parameters that must be agreed in the process of mining. For greater clarity, here are the variables that the CBE should set when mining:

• S is the percentage of tokens issued that should be stored in the Guarantee Fund

• LT is the total percentage of tokens to be stored in LR

• l is the percentage of LT determining how much of the LR fund will be used in the LI sub-fund as insurance for LOC companies. The remaining funds will be stored in the sub-fund L0.

• M is the total number of months before the transfer of funds from LI to SFG.

This determines the speed of the transfer of funds, i.e. LI / M per month.

• Term - the term of the contract, in accordance with which the LOC must redeem issued LHT.

By setting the above variables, the CBE will individually record (ρ), the total percentage is subtracted from the LOC, initially through the relation (2).

Appendix C. Commissions

ChronoBank Tariffs can be summarized as follows:

• fc - commission charged by the CBE to issue tokens. Estimated value fc ∈ [0, 0.01].

• fi - an emission fee, which is charged during the mining and is entered into a smart contract with the holders of TIME-tokens. The emission fee will be 3% during the first year of operation, 2% in the second year, and from the third year it will be fixed at 1%.

• ft - transaction fee, which is deposited in a smart contract with holders of TIME-tokens. The commission is 0.15%.

• fr - CBE is charged when redeeming tokens as a CBE reward for the service provided and in order to avoid recurrent requests. The expected value is fc ∈ [0, 0.01].

PS I hope the material will be useful and discuss, because I personally like the Chronobank system to be quite sympathetic and I believe that despite the possible flaws, there is great potential in it.

Source: https://habr.com/ru/post/329738/

All Articles