Mobile market in numbers

Alexey Vvestsky ( App Annie ), speaker of the 6th International Mobile Business Conference MBLT17 .

Analysis of indicators for downloads and revenues of non-gaming applications in the App Store and Google Play allows us to draw conclusions about the trends in the development of the mobile market in Russia and around the world, as well as understand which categories of applications are beneficial to monetize through in-app purchases.

This review does not take into account advertising revenue, but considers the number of first paid installations, embedded purchases and subscriptions.

')

The number of smartphones in the world will double in the next 3-4 years and amount to more than 6 billion devices. This will increase the capacity of emerging markets and their attractiveness to publishers.

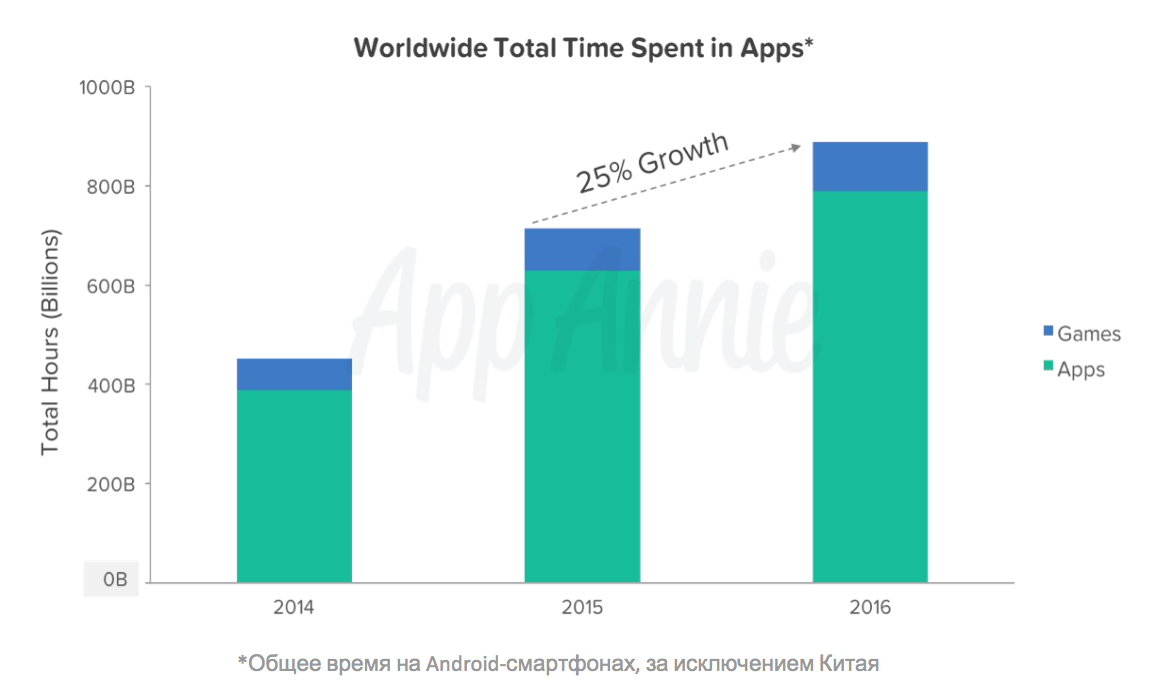

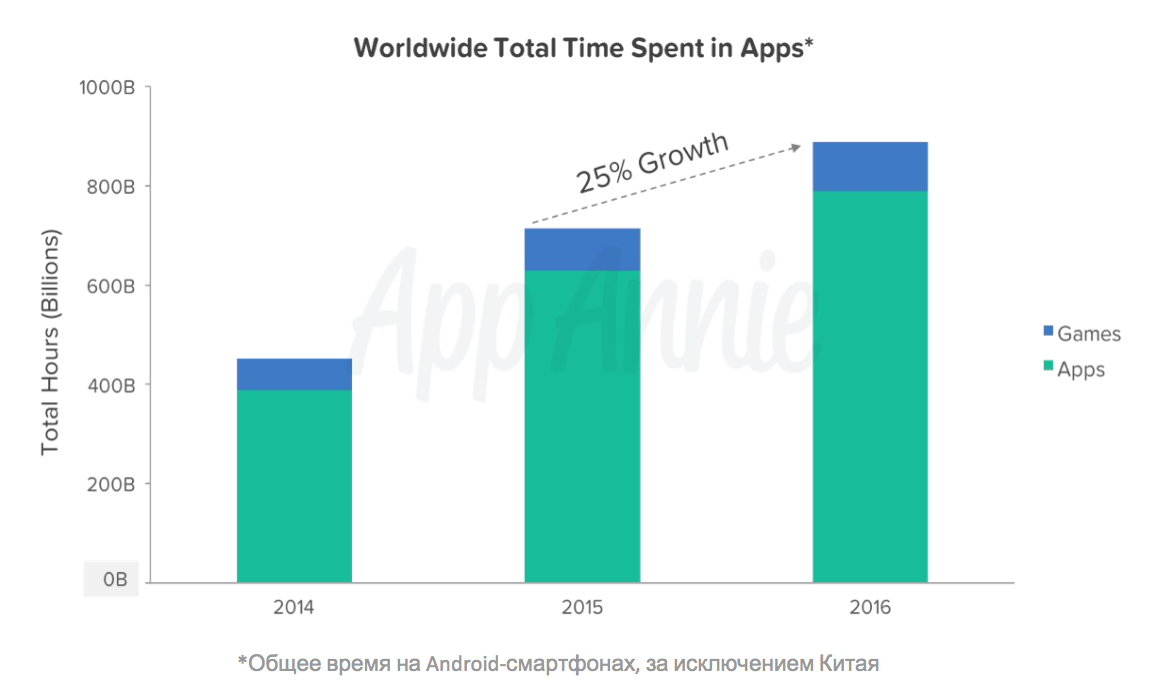

Revenues will continue to grow at the expense of developed countries, as users in these countries spend more time in applications. For example, the increase in 2016 by 2015 on this indicator was 25% (App Annie's own data on Android devices).

The time spent in certain categories and income in these categories is growing. Among the leaders in terms of growth rates in 2016 are Travel, Maps & Navigation, Shopping, Finance, Entertainment. Lifestyle and Communication, although they slowed down the growth rates in 2016, they actively grew in previous years.

Mobile and digital-first applications tend to grow faster than offline player applications. This is particularly evident in the example of retail applications. The average monthly number of sessions of initially digital retail applications in Germany, the UK and France increased in 2016 compared to 2015 by 30-70%, while this indicator for companies combining online and offline trade grew by only 10- 15% in these three countries.

The emergence of many fintech applications and more attention of banks to the mobile strategy spurred growth in the category of Finance. In the UK, Germany, France and Spain, the number of sessions for the top 10 retail banking applications doubled on average between 2014 and 2016.

The Russian market for mobile non-gaming applications continues to show steady growth in downloads. Monthly downloads figures from January 2012 to January 2017 increased more than 4 times. Clearly visible seasonality. Peaks fall in the middle of winter, downturns - in June. The main growth factors, as in many other developing countries, are the increasing availability of smartphones and the growth of their number in the market.

There are developing countries that are ahead of Russia in terms of download growth rates - India, China, Indonesia. However, with the exception of these three countries, if we consider markets that are comparable in terms of load volumes, the rest of the countries either grow more slowly (Brazil, Turkey), or even reach a plateau (Mexico, most developed countries).

By the number of downloads, Russia is still in 5th place (it will soon cede to Indonesia), behind the United States, China, India and Brazil.

The easiest way to find out the top 13 countries in terms of income is to look at the top 13 countries in terms of GDP according to the IMF and replace India on Taiwan in this list. The locations of specific countries in these two ratings will differ slightly, but you will get a general idea.

Russian applications dominate the local market for non-gaming applications: they account for about half of downloads and more than 60% of revenues. France, Germany, India and Brazil are much more open to international publishers. Only Asian markets are superior to Russia in terms of closeness.

For comparison, the Russian mobile gaming market is extremely open: only one local company is in the top 10 game publishers in terms of revenue in the iOS App Store and Google Play in April 2017. The most advanced Russian game studios have long been guided not by the local, but by the world market. This explains their international success. For example, the company Playrix from Vologda recently entered the top 20 publishers in the world in terms of revenue. Achievement that will not be subdued for a long time to Russian non-gaming publishers.

Unlike gaming, non-gaming companies can not boast of comparable international success. In the top 100 publishers of income in the United States (the largest market), only one Russian publisher - Ultimate Guitar. But there are two Belarusian publishers - Apalon and Red Rock Apps (Grinasys). Both are in the top 40 publishers on iOS in April, ahead of Ultimate Guitar.

It makes no sense to limit oneself to one’s own market: application revenue (excluding games) in four English-speaking countries — the USA, the United Kingdom, Canada, Australia — is more than 30 times more than the income in Russia.

Creating applications for the international market, it is useful to know in which categories users are accustomed to pay, and in which - not.

Top categories in English-speaking countries by average income (subscriptions, in-app purchases and paid first installs) to download: Music, Health & Fitness, Entertainment, Lifestyle, Education, Social. Moreover, all these same 6 categories are among the most monetary, not only in Western but also in Eastern countries.

This does not mean that other categories are worse. There are applications that can be monetized only through advertising or through bank card transactions. Just in those applications / categories that had the opportunity to try different business models, subscriptions and in-app purchases turned out to be the most effective.

Analysis of indicators for downloads and revenues of non-gaming applications in the App Store and Google Play allows us to draw conclusions about the trends in the development of the mobile market in Russia and around the world, as well as understand which categories of applications are beneficial to monetize through in-app purchases.

This review does not take into account advertising revenue, but considers the number of first paid installations, embedded purchases and subscriptions.

')

1. The app market is growing and will continue to grow.

The number of smartphones in the world will double in the next 3-4 years and amount to more than 6 billion devices. This will increase the capacity of emerging markets and their attractiveness to publishers.

Revenues will continue to grow at the expense of developed countries, as users in these countries spend more time in applications. For example, the increase in 2016 by 2015 on this indicator was 25% (App Annie's own data on Android devices).

2. The growth of the market as a whole leads to the growth of certain categories

The time spent in certain categories and income in these categories is growing. Among the leaders in terms of growth rates in 2016 are Travel, Maps & Navigation, Shopping, Finance, Entertainment. Lifestyle and Communication, although they slowed down the growth rates in 2016, they actively grew in previous years.

Mobile and digital-first applications tend to grow faster than offline player applications. This is particularly evident in the example of retail applications. The average monthly number of sessions of initially digital retail applications in Germany, the UK and France increased in 2016 compared to 2015 by 30-70%, while this indicator for companies combining online and offline trade grew by only 10- 15% in these three countries.

The emergence of many fintech applications and more attention of banks to the mobile strategy spurred growth in the category of Finance. In the UK, Germany, France and Spain, the number of sessions for the top 10 retail banking applications doubled on average between 2014 and 2016.

3. The Russian market is no exception.

The Russian market for mobile non-gaming applications continues to show steady growth in downloads. Monthly downloads figures from January 2012 to January 2017 increased more than 4 times. Clearly visible seasonality. Peaks fall in the middle of winter, downturns - in June. The main growth factors, as in many other developing countries, are the increasing availability of smartphones and the growth of their number in the market.

4. Growth of the Russian market in the international context

There are developing countries that are ahead of Russia in terms of download growth rates - India, China, Indonesia. However, with the exception of these three countries, if we consider markets that are comparable in terms of load volumes, the rest of the countries either grow more slowly (Brazil, Turkey), or even reach a plateau (Mexico, most developed countries).

By the number of downloads, Russia is still in 5th place (it will soon cede to Indonesia), behind the United States, China, India and Brazil.

The easiest way to find out the top 13 countries in terms of income is to look at the top 13 countries in terms of GDP according to the IMF and replace India on Taiwan in this list. The locations of specific countries in these two ratings will differ slightly, but you will get a general idea.

5. The Russian non-gaming market is much closer in closeness to the Asian

Russian applications dominate the local market for non-gaming applications: they account for about half of downloads and more than 60% of revenues. France, Germany, India and Brazil are much more open to international publishers. Only Asian markets are superior to Russia in terms of closeness.

For comparison, the Russian mobile gaming market is extremely open: only one local company is in the top 10 game publishers in terms of revenue in the iOS App Store and Google Play in April 2017. The most advanced Russian game studios have long been guided not by the local, but by the world market. This explains their international success. For example, the company Playrix from Vologda recently entered the top 20 publishers in the world in terms of revenue. Achievement that will not be subdued for a long time to Russian non-gaming publishers.

6. Closeness of the market does not give advantages

Unlike gaming, non-gaming companies can not boast of comparable international success. In the top 100 publishers of income in the United States (the largest market), only one Russian publisher - Ultimate Guitar. But there are two Belarusian publishers - Apalon and Red Rock Apps (Grinasys). Both are in the top 40 publishers on iOS in April, ahead of Ultimate Guitar.

It makes no sense to limit oneself to one’s own market: application revenue (excluding games) in four English-speaking countries — the USA, the United Kingdom, Canada, Australia — is more than 30 times more than the income in Russia.

7. Six categories that are beneficial to monetize through in-app purchases

Creating applications for the international market, it is useful to know in which categories users are accustomed to pay, and in which - not.

Top categories in English-speaking countries by average income (subscriptions, in-app purchases and paid first installs) to download: Music, Health & Fitness, Entertainment, Lifestyle, Education, Social. Moreover, all these same 6 categories are among the most monetary, not only in Western but also in Eastern countries.

This does not mean that other categories are worse. There are applications that can be monetized only through advertising or through bank card transactions. Just in those applications / categories that had the opportunity to try different business models, subscriptions and in-app purchases turned out to be the most effective.

Source: https://habr.com/ru/post/329374/

All Articles