Payment pages and solutions (or through thorns to the stars - and through many pictures)

TLDR for the impatient - in principle, you can close the article

It so happened that I took part in the creation / management / negotiations with a large number of banks and payment systems that provide online acquiring services in Russia. This happened on a number of mini-projects with completely different providers, but that's not the point.

I work more in this area, but I want to share three aspects of online payments: i) business and market situation for 2016-2017 (guide for the manager) ii) technical integration details (CTO) iii) customer behavior / design / layout payment page (design, layout, testing).

')

All this experience was not gained immediately - in about 1.5 - 2 years of active picking in this area. If you are not interested in business experience, but are only interested in design materials, feel free to skip the first spoilers .

List of main sections

Spoiler header

- What is the difference between acquirers, how to “read” their marketing materials correctly?

- What kind of behavioral features of people need to be considered first of all when creating their payment pages + log and panopticum of our efforts in this area;

- As far as we finally managed to increase the conversion and reduce the rate for all this time, indicating the real interest;

- Features of negotiating with banks and payment decisions and how to beat back chargebacks;

- Features of technological integration, pros and cons, our experience and stuffed bumps;

- The main myths or simply collected results of our AB tests in 1 place;

- A few words about scammers in this area;

What is the difference between acquirers, how to “read” their marketing materials?

Spoiler header

Acquiring is, on the one hand, a technically difficult business, where you need to have an IPA, a personal account, integration with banks or services providing processing (I do not fully understand the entire value chain in this area, but it looks like this : VISA / MASTERCARD - processing - an online equatoring service , and any “combinations” are possible in which a bank, such as Sberbank, tries to eat the whole chain through its or white-label software. The fewer mouths in the chain, the more profitable the rate.

At rates:

Also, if the service is an integrator, then any complication of the chain is possible, since the system becomes mononye-to-many). On the other hand, it is a business where there is a very high fraud and responsibility for each ruble transferred . Think if your real final commission is in the region of 0.1-0.5% maximum, and your turnover is measured in millions of rubles, then the loss or protest of one transaction that will accuse you is a huge loss of revenue. Approximately for this reason, banks / services (services that have lost market share - we will not give names) are always trying to outweigh transactions against the merchant (system user, store).

All sections about business need to be read only by those whose marginality is much lower than 10% - in such a situation the difference between 4% and 2% is quite noticeable.

Also note that the Russian market is very isolated from the world one because of the isolation of the banking system. For this reason, there are much more advanced services and much more freedom and less monopoly. Contrary to. This is partly a consequence of the huge cashing market, which began to be cut only in 2014-2015. As cashing in, acquiring and electronic money are connected - these are all alternative payment methods. When I read about mPesa in Africa , the electronic money boom in Russia in the mid-2000s immediately comes to mind.

At rates:

- Aggregator services that target a mass customer typically offer a rate of 3-4%;

- Bank acquaintances can usually be played at a bet, because they can influence their internal pricing. For example, if your turnover is millions or tens of millions of rubles a month, then you can qualify for a rate of 2 - 2.5%;

- If your turnover is closer to 100 million rubles a month - then you can already talk about a rate of 1.5 - 2% through banks;

- The minimum possible rate if you do not sell tickets or do not belong to the low-risk category according to banks and VISA and MasterCard ~ 1.5%;

- There are lower categories with a low risk, where on a large turnover one can get closer to 1.1%. All digital services here are usually NOT ;

- If your turnover is much higher, then you should rather be PCI DSS certified and accept payments on your side, but more on that later;

- If you are offered a preferential rate for the first X turnover or time period, then this most likely will not work and some of the services just try to change their share of the pie. But it will not work, because such any integration project is a long game, and quickly, as a rule, nothing starts;

Also, if the service is an integrator, then any complication of the chain is possible, since the system becomes mononye-to-many). On the other hand, it is a business where there is a very high fraud and responsibility for each ruble transferred . Think if your real final commission is in the region of 0.1-0.5% maximum, and your turnover is measured in millions of rubles, then the loss or protest of one transaction that will accuse you is a huge loss of revenue. Approximately for this reason, banks / services (services that have lost market share - we will not give names) are always trying to outweigh transactions against the merchant (system user, store).

All sections about business need to be read only by those whose marginality is much lower than 10% - in such a situation the difference between 4% and 2% is quite noticeable.

Also note that the Russian market is very isolated from the world one because of the isolation of the banking system. For this reason, there are much more advanced services and much more freedom and less monopoly. Contrary to. This is partly a consequence of the huge cashing market, which began to be cut only in 2014-2015. As cashing in, acquiring and electronic money are connected - these are all alternative payment methods. When I read about mPesa in Africa , the electronic money boom in Russia in the mid-2000s immediately comes to mind.

Primary Payment Service Clusters

Spoiler header

- While-label banking services , usually running on the RBS system. They are characterized by slow changes, a lower rate, the availability of RBS technical support, a very good basic service (you have to pervert to make candy). The documentation is readable, but cool. Accept only cards. As a rule, new attempts to introduce new in such combinations are not obtained. Also, the bank branch, which is responsible for the service and the service means that the protest you will communicate with the bank;

- Uniteller . Another service provides aggregator, moderate rates. Positions itself as a more advanced version of RBS + a number of technological features + aggregator. In practice, they provide customization options that are out of date for 3-5 years from state-of-the-art (which is already outdated at the time of this writing). Well, there are pretty girls working as managers (to whom is a plus, and who is not);

- New services or aggregators that master the money of investors. Great API and documentation, high stakes and zero guarantees that money will come to you tomorrow. I would not advise;

- Yandex.Cassa (service of the Yandex.Money company - a joint venture of Yandex and Sberbank), Yandex seems to have sold them to Sberbank, but the brand has remained). Very adequate people, quality managers (oddly enough). Their existence is the reason why I would not recommend using clause 3. The stakes are moderately high, you can bargain a little if you have a large amount, but due to the large number of mouths, the rate will never be lower than 2% most likely. Yandex also has sister services - Yandex money, a massive collection of donations, and so on. Everything develops and the documentation is even readable;

- Robokassa - were the de facto leader, before the Yandex-money for the year fully occupied this niche (2016). Publicly - due to misunderstandings with their bank and concessions on KYC procedures. In practice, in 2015 - 2016, they began a policy of shifting all fines to the merchant. It also has a strange ambition to collect data from your customers. For this reason, working with them is not recommended;

- Paypal is a high rate, they want to enter the market, a very outdated API, you need to fill in a ton of fields for a client, etc., etc. It is good to do joint marketing with them, or to have them as a backup acquiring and / or international solution. As the main method - hardly;

- All the other more or less large services , it seemed to me, either abruptly lose their share, or do not develop or have no real advantages over those described above;

- Banks, RBS and Uniteller have options for accepting payments from abroad, but they are usually focused on minimizing risks , rather than maximizing revenue;

What behavioral features of people need to be considered first of all when creating their payment pages? Chronicle of our efforts

A person, especially online, where almost the entire population is already, (!!!) is a fearful, cautious and understanding (!!!) creature (people have come to leave money for you). Therefore, if you want to build a mental model of its behavior, follow these principles:

- Think about the fact that it is not clear to the typical user on the payment page or order form;

- Imagine that you are a shop assistant who uses the Internet for the first time and wants to use your service;

- Each is not the most logical or just a working button - minus 50% to the conversion;

- Any hangup or JS that does not work as some type of device - minus 50% -100% to conversion on this type of device;

- Any additional manual transition to another page from the order form - minus 90% to the conversion;

- Users trust more to go to the bank site than to enter card data on a site without HTTPS and with low trust FOR THE TOTAL POPULATION on average. This means that if your business is white and fluffy, but less than 1-5% of the population knows about it, then people will not want (statistically, of course) to enter data on your side;

- Convenience, adaptability, readability on all devices in a convenient form, correctly made inputs in the form of filling for any type of device (if you bother so much, I will describe these details further in point 5);

- Correct and beautiful flow from your site (application) to the payment page, approximately similar design, lack of visual garbage;

- Follow the principle of reducing "friction" - in simple language - the less hemorrhoids the client needs to undergo - the better (details also in section 5);

- In secret, running ahead, FIELD OWNER OF THE CARD IS NOT NEEDED TO MAKE A PAYMENT ;

These principles sound rather dry, but let me illustrate from the actual payment pages. If you also need, then here:

- Link to a folder on Google disk with mockups and test logs (video);

- Link to the archive on the Google disk with all the HTML payment pages described below (there are problems with setting up scripts for each acquirer, but everything should be opened either in a browser or on a simple web server);

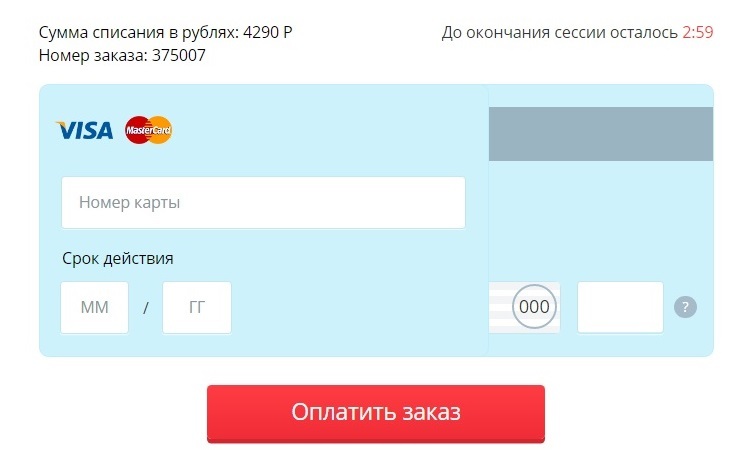

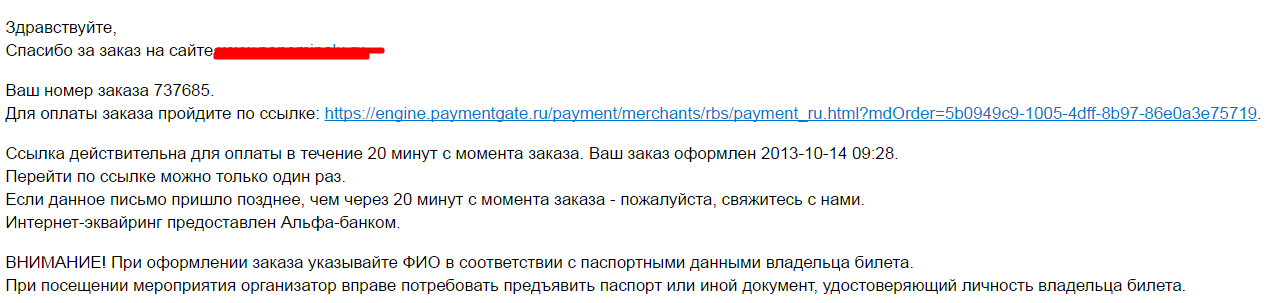

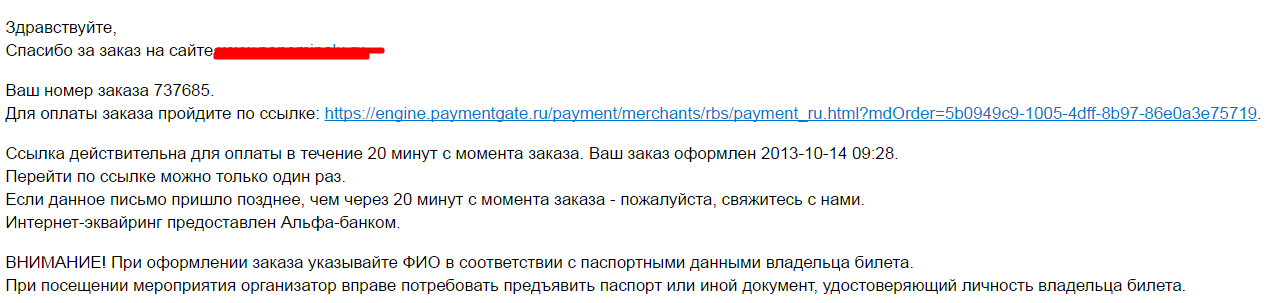

Initially, the client received such a letter. It is easy to guess that problems with the opening, delivery of the letter has a very negative impact on the conversion

Picture

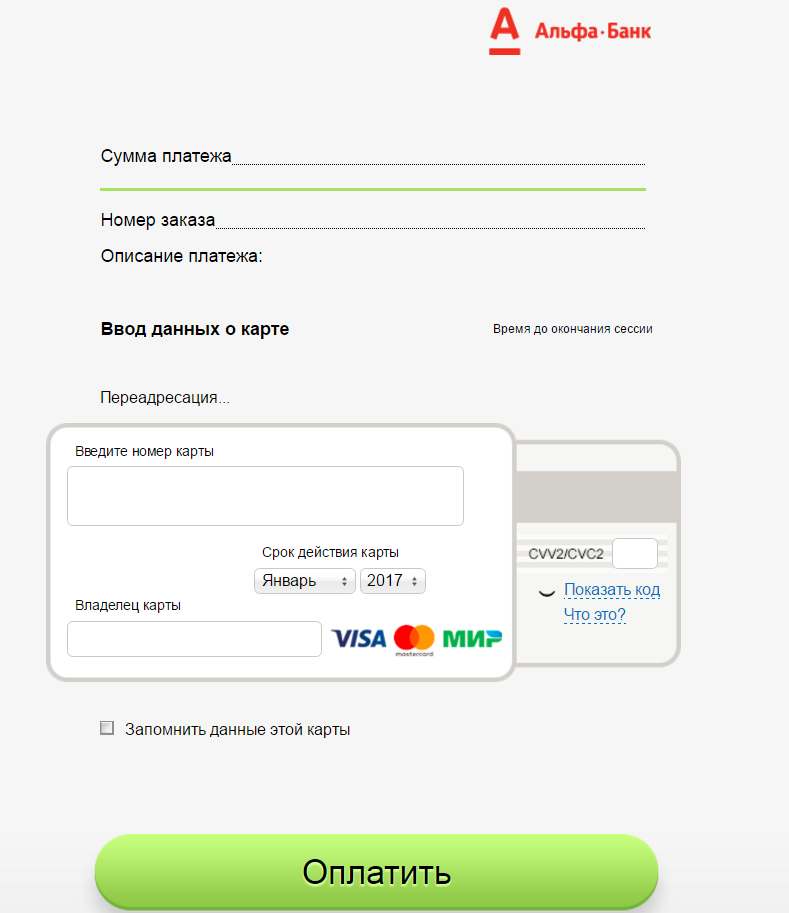

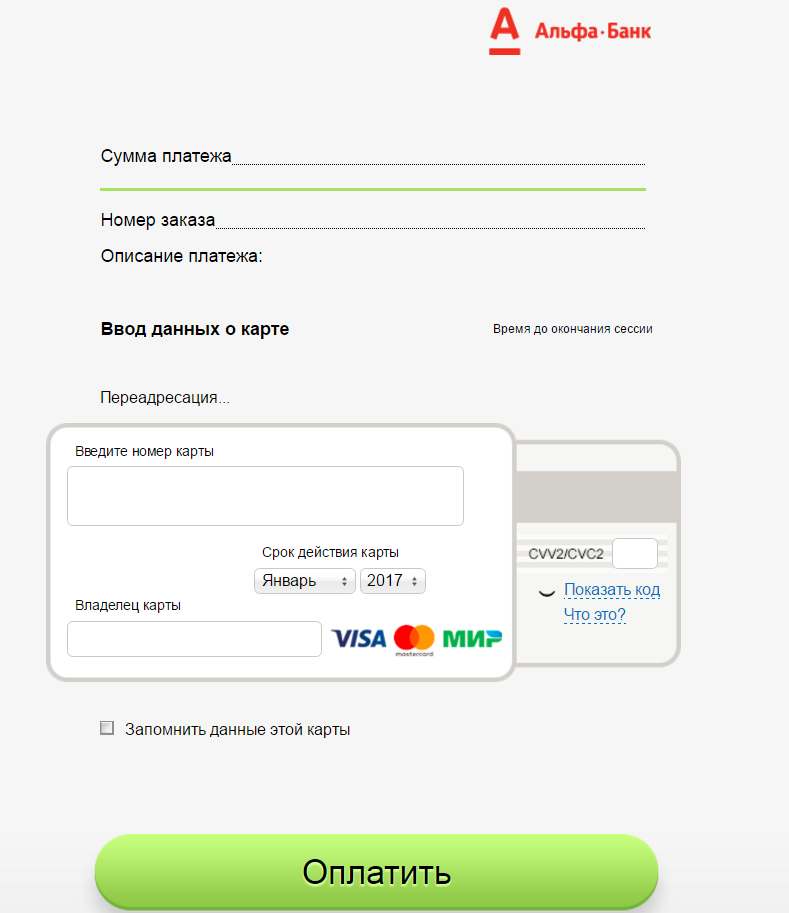

The letter led to a form that is not a fountain either. It is huge, not adaptive, it can not be embedded in the i-frame, etc. etc. As you know - stock form from Alfa Bank. She is terrible.

Picture

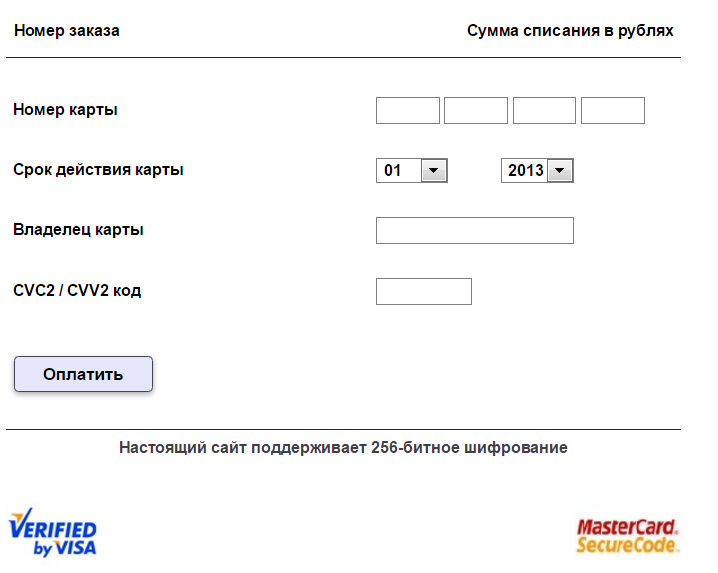

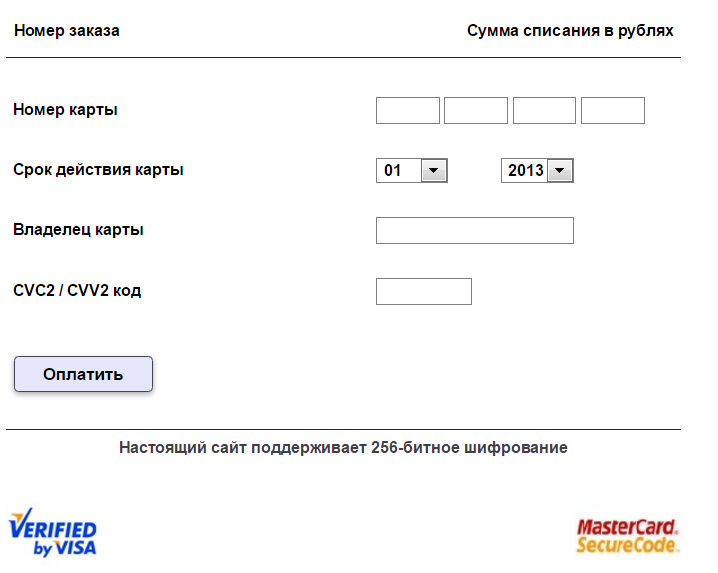

And this is the following standard form of the next acquirer. It is good and simple, but not adaptive and looks awful on mobile devices.

Picture

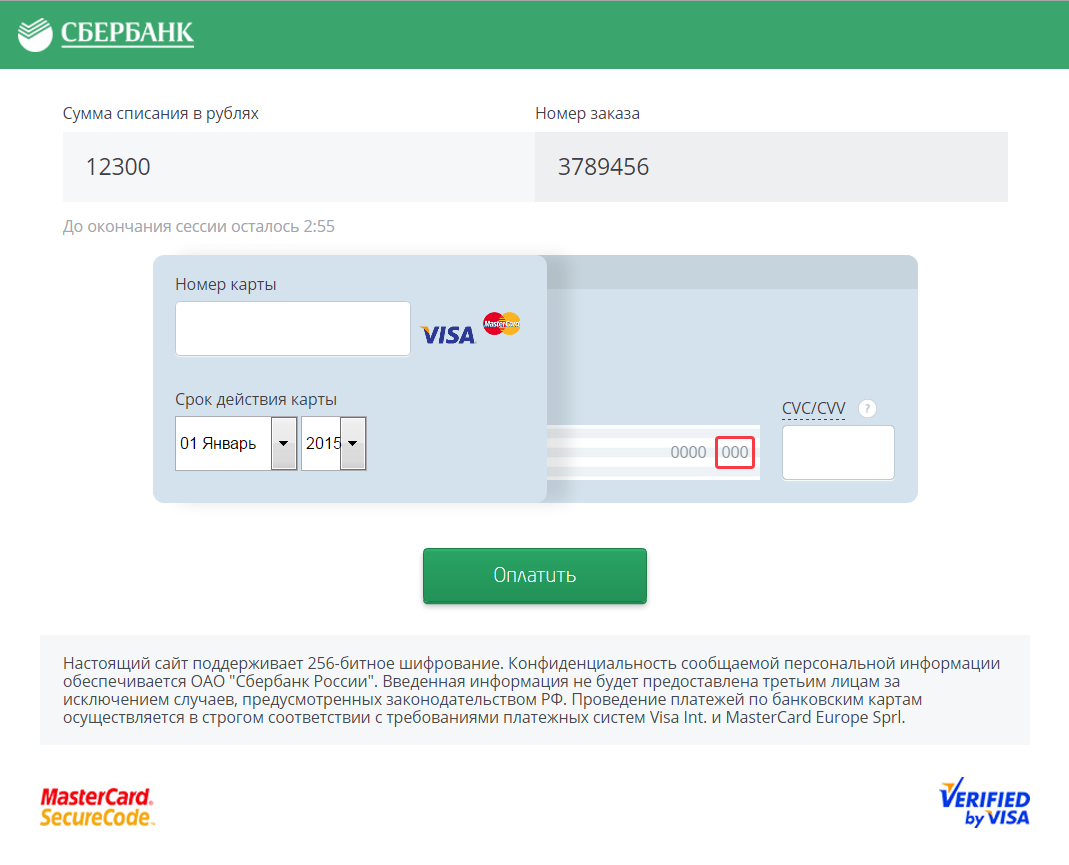

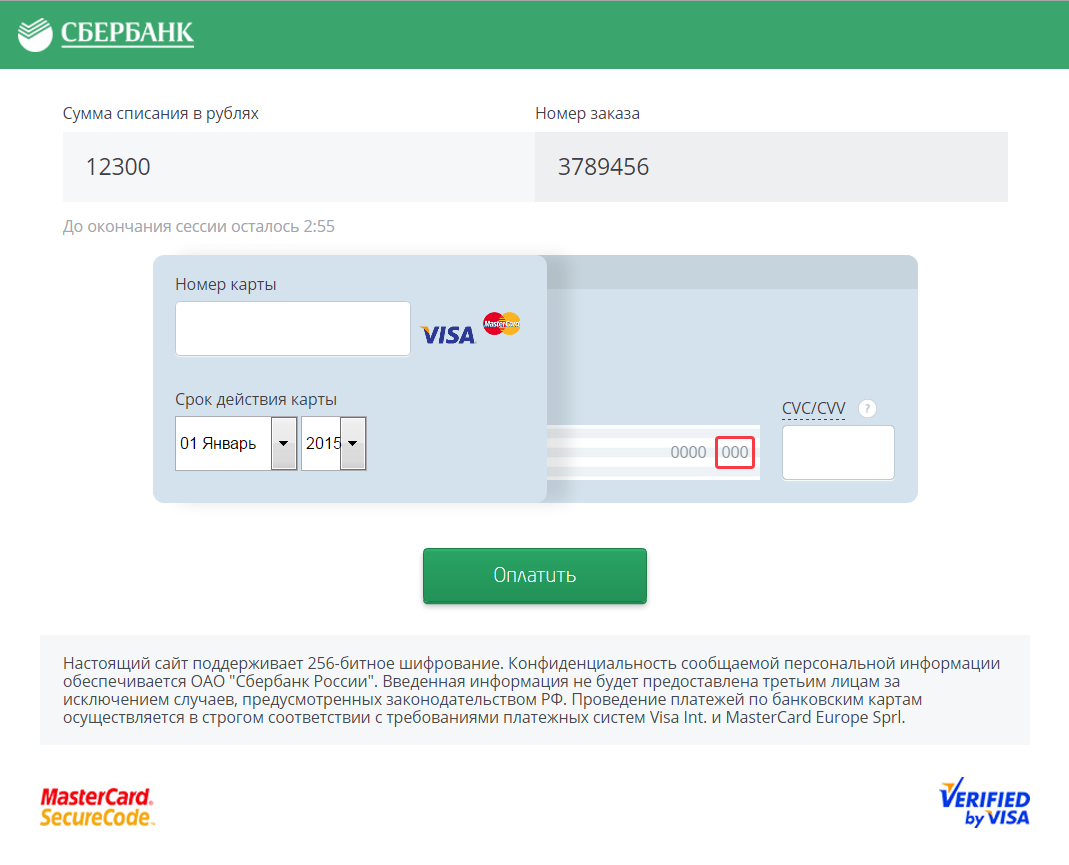

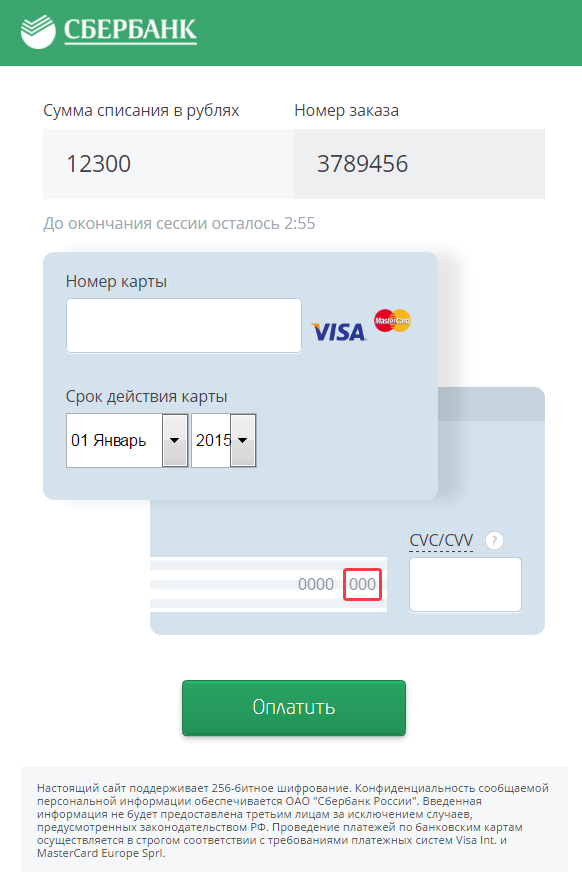

After a series of efforts, the form began to look like this. Obviously, we changed the acquirer to the one who allowed us to play with the form. So far there is a lot of garbage on the form, plus a couple of customers called the call center, thinking that the payment was accepted by Sberbank and not by us. Well, you understand.

Picture

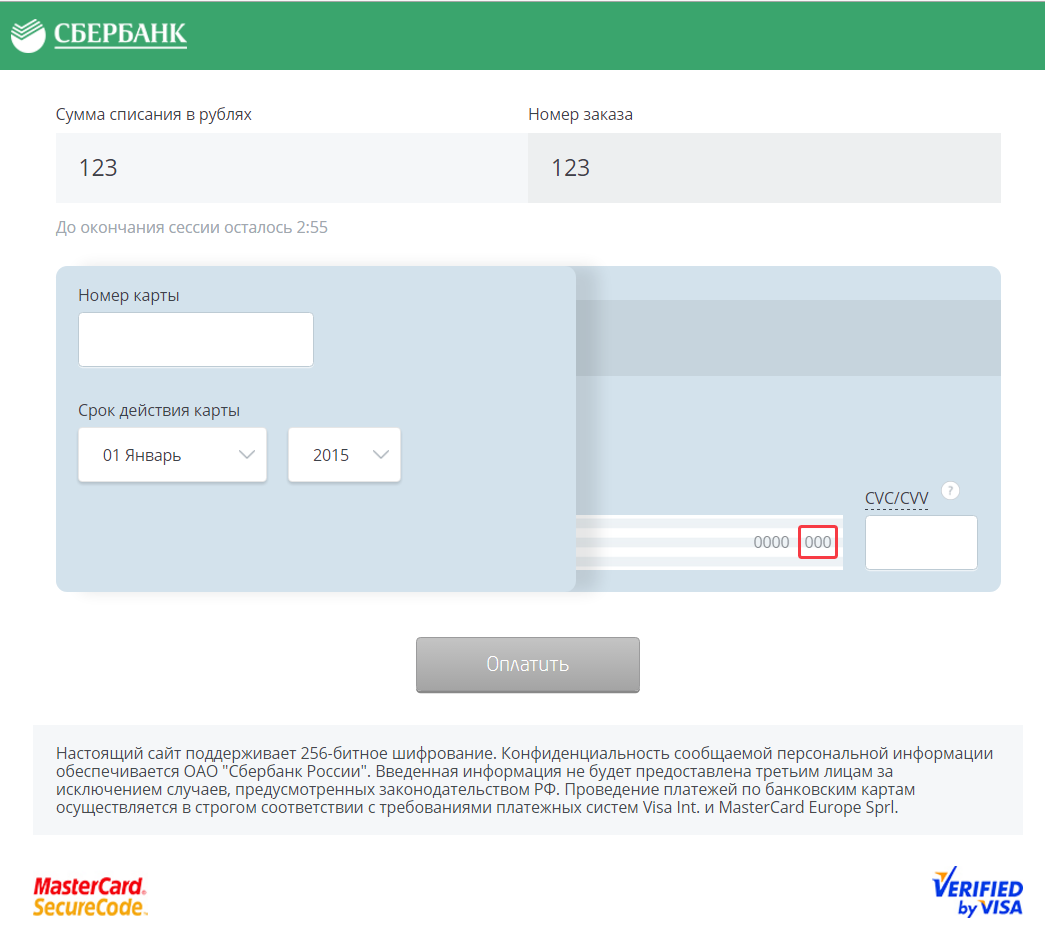

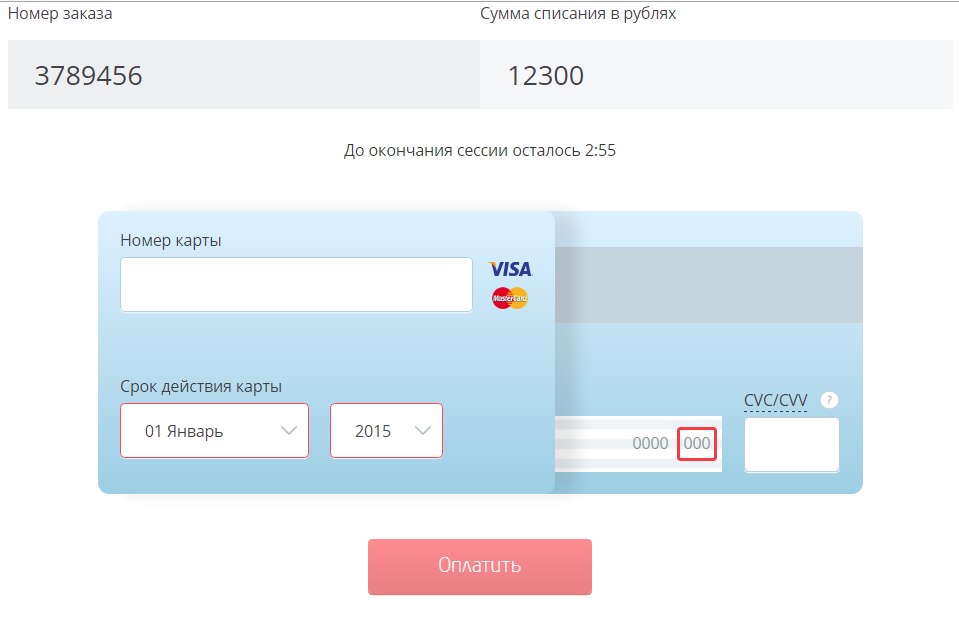

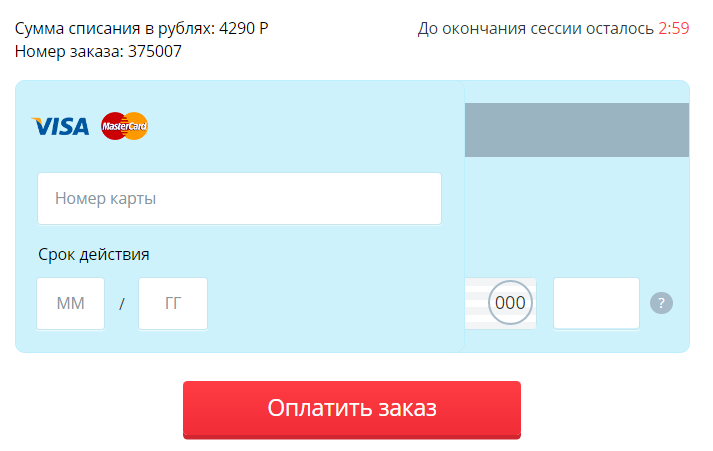

Slightly less miserable variation of the past form. I can’t convey this here, but a lot of work has been done to make the fields easier to enter, so that the “cursor doesn’t jump once again”, so that the fields are displayed on all types of devices correctly and conveniently. So that on all types of devices the input forms are displayed natively.

Picture

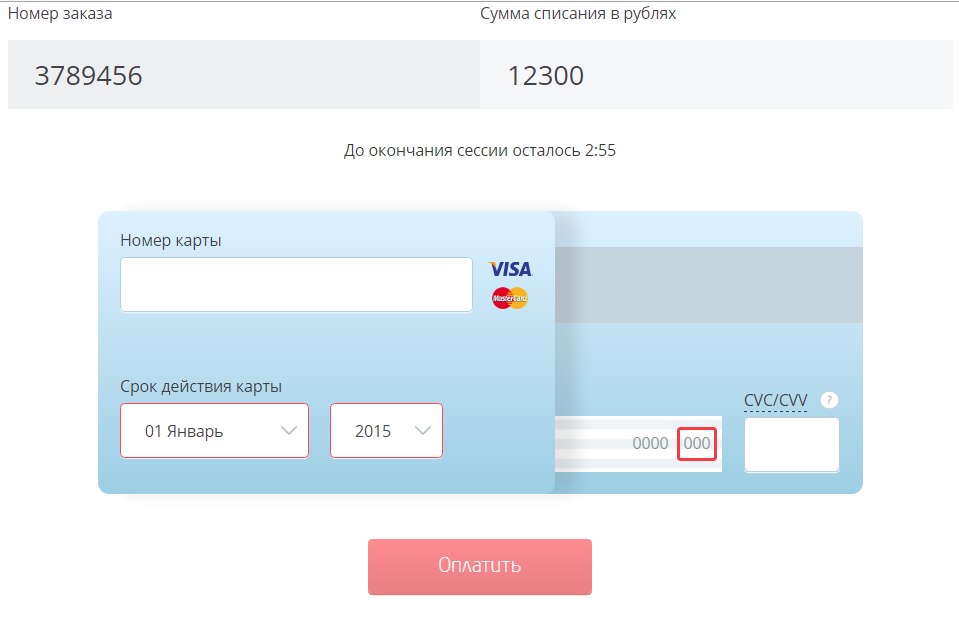

Adaptive display of past form. Note that there is still a large amount of visual trash.

Picture

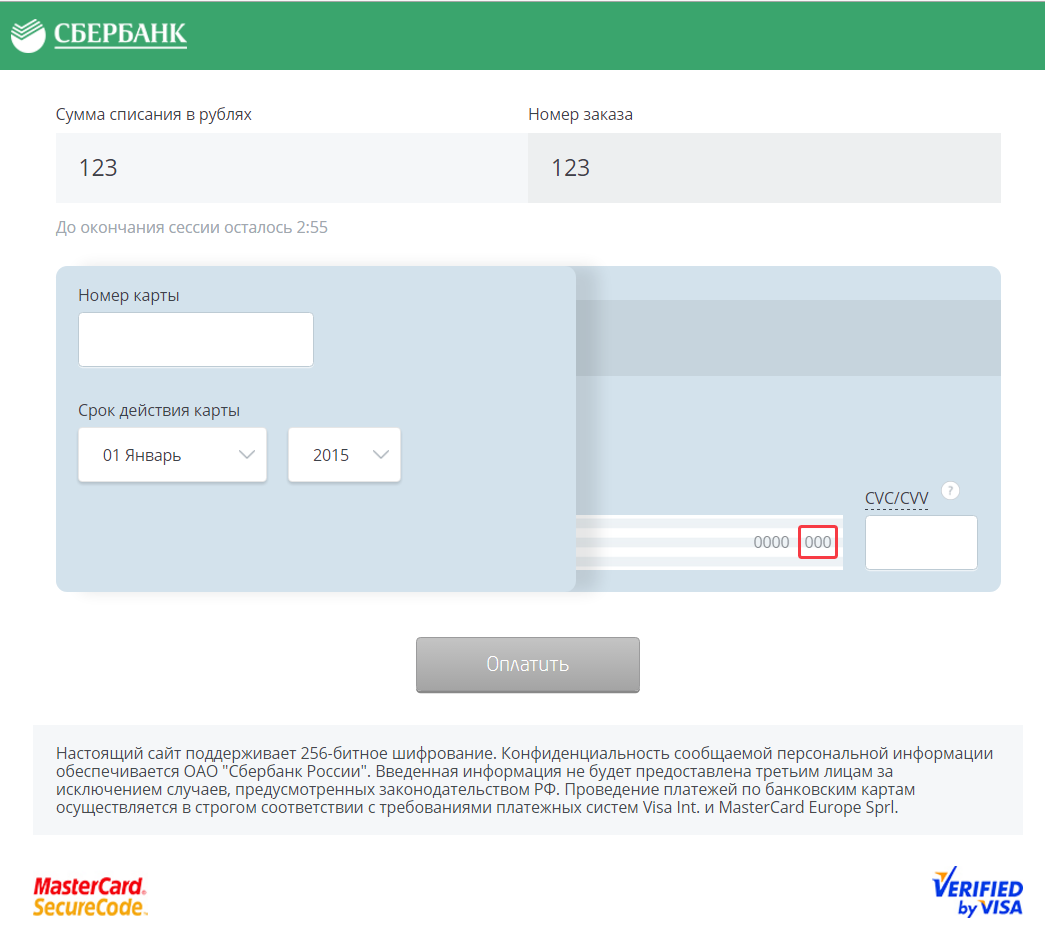

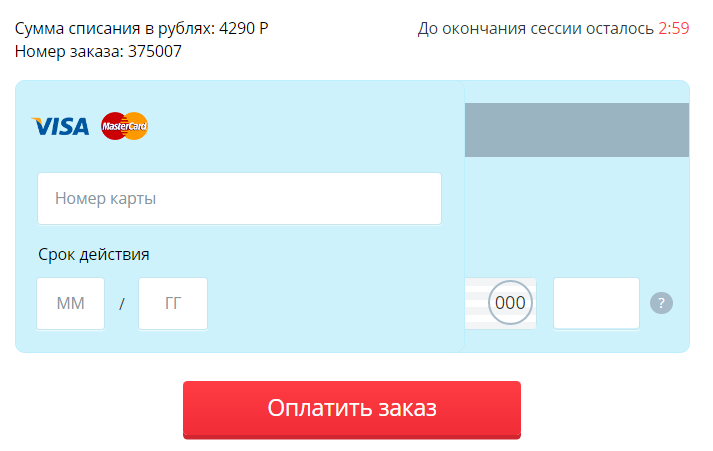

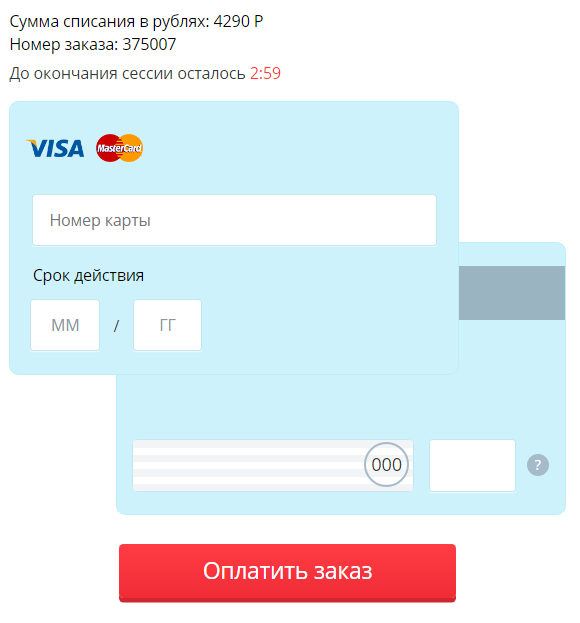

The next iteration of the form - note that there is no longer any “visual trash”, unnecessary words, a palette in the style of the company. Less - more.

Picture

Naturally, this iteration is also mobile and adaptive. Also a lot of work on forms.

Picture

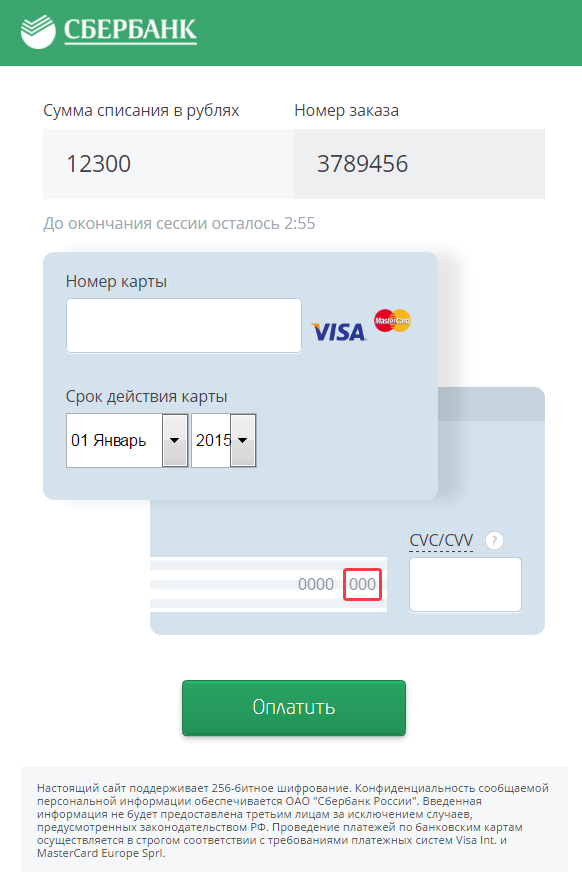

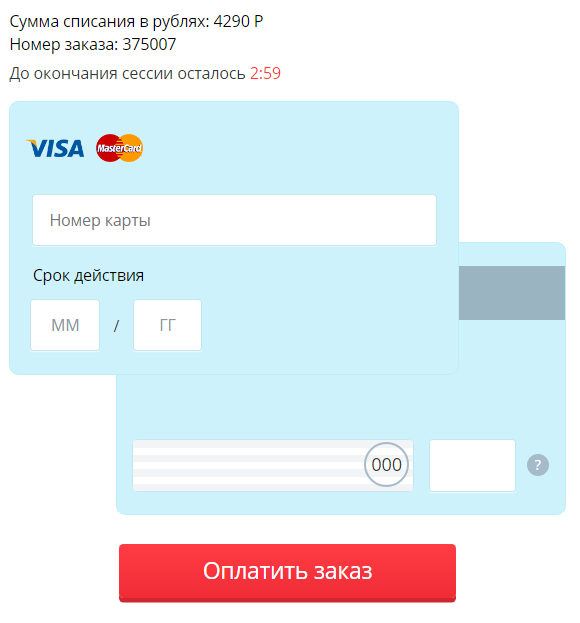

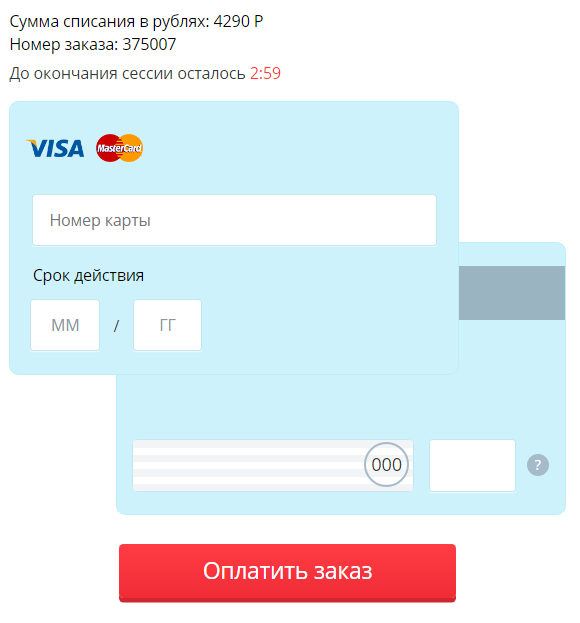

And this is the final version of the form.

Picture

Naturally, it is completely mobile and adaptive.

Picture

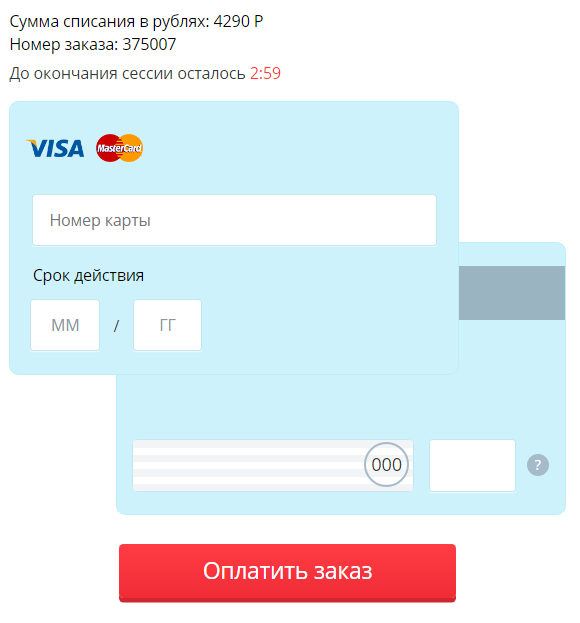

The same form, but for another acquirer (how much pain it cost) and with the option of saving the card.

Picture

Important information for those who do not have a big budget for a mobile application

- If your payment form is adaptive and adapts to the frame, then you can open it in the web-view in your mobile application;

- This allows you to save money on 3DS and make as if you do not need to follow the link from the application to the browser in your phone;

Features of technological integration, pros and cons, our experience and stuffed bumps

If you are not going to get certified for PCI-DSS (it can cost relatively a lot of money), then the probability is high that the form of payment will open on the side of the bank or the payment service (on its domain). What does this mean from a practical point of view?

- In a very sad case, if you have no technical ability to influence the behavior of the frontend of your site or you sell a single product, the form of payment will be in the form of a link in an email. The link will lead to the bank / payment service page. The openness / lossability of email multiplied by the inattention of customers (if the client received two links) and your “curved hands” and moments related to the fact that the transition does not always work out, lead to the fact that this solution has a conversion rate of 50%. It is clear that those who really want to buy something will try again, but this is wrong;

- In a more advanced case, the payment will work as a redirect on the web with the inability to have a counter, cookie or JS script on the side of the payment page;

- How correctly advanced JS scripts and media requests can be prohibited on the bank side. Everything needs to be solved only through HTML and CSS;

- If you make a custom payment page and try to coordinate it with the payment service, then:

- Most likely there will be restrictions on client validation scripts ( Luna formula );

- Restriction on the visual component of HTML input;

- You will have to prove to the bank that the new HTML tags that are needed to make the fields look good on the cell phone are really needed;

- The only information you can get about customer behavior on the bank side is the response of the API of the payment service / bank;

- At Sberbank, card issuance periodically drops and payments stop working online and offline. This happens on average once a month;

- On mobile frontends, you need to pay close attention to how the page behaves and is displayed on the main types of devices (iPhone, Android);

- You need to test the page once at least on every type of device popular with your company's customers;

- If you are advanced enough to open a page in the i-frame or web-view, then closely follow the conversion, it may not grow from the introduction of the iframe - customers may be frightened;

- Carefully read the list of fields that your acquiring service wants, really need to make a payment card ONLY (everything else is either legacy or they collect information about your customers):

- We really need - the card number (at the time of writing, the article may have already changed, but due to the introduction of new cards, the field was 4 + 4 + 4 + 4-7 characters - banks are not very well informed about such changes);

- Really needed - expiration date (look carefully at the documentation, it is necessary to configure it as simple as possible for the client)

- Really need - security code (CVV / CVC 3-5 characters);

- The payment service will open the frame itself / redirect to the page with 3DS if it is enabled;

Turn off 3DS

As a rule, it is not recommended, because:

Spoiler header

- The bank / service will shift the responsibility on you;

- On the Internet, a high fraud level;

- The presence of fraudsters and customers who play in the "double" chargeback - appeal to you and the bank to protest the transaction;

- For some types of cards of Russian issuers, in principle, you cannot pay on the Internet without 3DS. In particular, for Sberbank cards. This means that if you disable it, the transaction will be rejected by default;

There is still one very subtle and important point associated with tracking the time of “swelling” of the form:

Spoiler header

- Most of the payment services have a timeout of 20 minutes (configured when requesting an API) for payment, which starts to go ... at the moment of TRANSITION to the bank / service side, NOT at the MOMENT sending the request to the API service;

- If you have a so-called time-to-live of your product or service, then it is likely from 5 minutes to a day (someone calls it a reservation time, someone else somehow);

- In practice, this means that if you have at least 1000 orders per month and / or you send duplicate links to an e-mail, you will definitely find a client who either:

- Pay after your time-to-live expires;

- Will try to pay at the second attempt;

- All such cases are essentially hemorrhoids for your customer service (if not, then personally for you);

- The real solution to this problem I have only seen in Uniteller. Of course, there is an even simpler solution - to set up time-to-live on your system in about 20 minutes, but if your order can also be taken offline, this may not be possible;

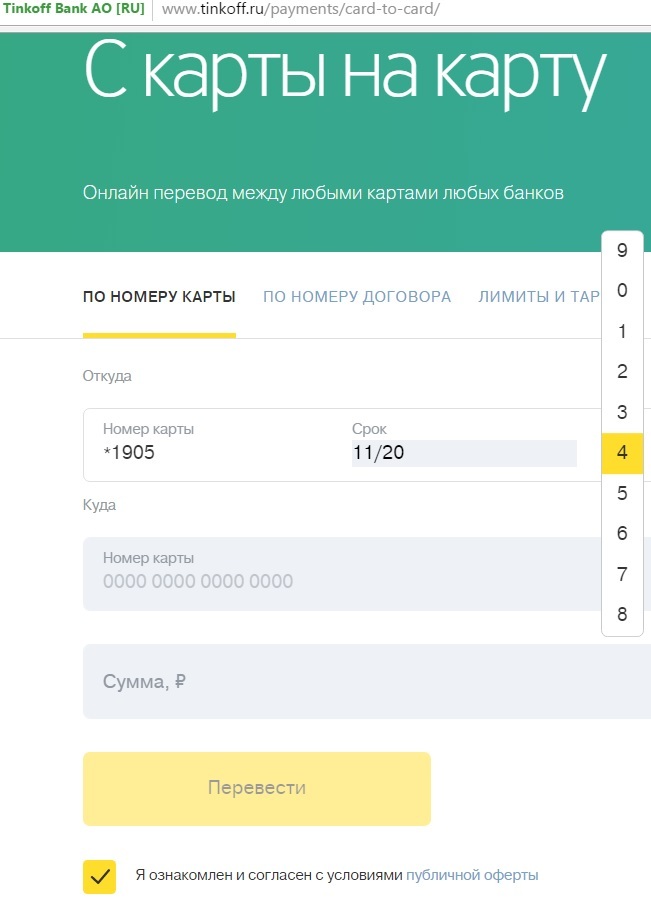

An example of an almost perfect UX from tinkoff bank. I do not fully understand why there is a need for a “drum” for a CVV code (it infuriates) - perhaps to protect against such fraud .

Just in case, here is the link:

- Link to a folder on Google disk with mockups and test logs (video);

- Link to the archive on the Google disk with all the HTML payment pages described below (there are problems with setting up scripts for each acquirer, but everything should be opened either in a browser or on a simple web server);

How much did we eventually manage to increase the conversion rate and reduce the rate for all this time, indicating the real interest

The figures are indicative, because it’s really difficult to track the full conversion funnel. But it is easy to see what proportion of invoices for payment is paid, and what is not.

When reading this table, know what the percentage differs from the percentage point. If the conversion was 50%, and it became 55%, then it changed by 5 percentage points

| Used payment page | Approximate Observed Payment Gateway Conversion |

|---|---|

| 1. Email + link to Alfa-Bank website | ~ 50% + there were a lot of problems on our side |

| 2. Redirection to the RBS website (white label from Sberbank) and email to secure | ~ 60% -65% (raised by 10-15 pp) |

| 3. Redirect to the RBS website (white label from Sberbank) with a new payment page | ~ 65% -70% (raised by 5 pp) |

| 4. Redirect to the RBS website (white label from Sberbank) with the final version of the payment page | ~ 75% (raised by another 5-10 pp) |

| 5. Redirect to the Uniteller website (white label from Sberbank) with the final version of the payment page | ~ 70% - the conversion is lower than that of Sberbank + RBS |

| 6. Point 5 + opening in iframe without HTTPS | ~ 70% (minus 5 pp against paragraph 5) |

| 7. Point 5 + Opening in the iframe with HTTPS | did not have time to test |

| 8. Opening in the web-view in mobile platforms | about the same as on the desktop |

The main influencing factors that we identified as a result of AB tests (conditionally):

- The less fields and noise - the better. Consider that each field is minus 5pp to conversion;

- Each block that attracts the attention of the client - minus 5pp conversion;

- Each logo, picture or inscription that is not logically associated with your business - minus 5-10 pp for conversion;

- Technological advancement is necessary and important, but only if the CUSTOMER trusts such technology or your brand ;

In theory, there are still badges, locks and other paraphernalia - but thank God, I did not have time to test it, because first you need to solve technological problems).

Features of negotiating with banks and payment decisions and how to beat back chargebacks

Spoiler header

- Banks will not change their processes for you;

- KYC processes with tightening the screws in the economy are more and more anal - some services ask for all EQUAL to the beneficiaries;

- In the worst case, a bank / service will simply write money from you (hi, Paypal, but I personally beat off these chargebacks for a lot of money) without a right to challenge in the case of chargeback;

- If the bank / service has a protest process, then as a rule, if you provide proof that the service is provided in the form of a note with the signature of the manager, which will show that the service is being provided, you can recapture chargeback;

A few words about scammers in this area

Now, when the country is in recession - I began to notice that the scammers intensified to such a level that I began to encounter them even in spite of the firewall in the perception of shit sites, advertising and teasers.

Spoiler header

- This scheme is simply brilliant . No words. In fact, auto substitution from a fake server for buying tickets in the form of card-2-card. PHP script takes a page;

- Scammers are commonplace - they bought a digital product, asked to return the money immediately and you and the bank. The digital product itself was immediately resold while the bank was thinking;

- Brilliant scammers with avito - we really want to buy your sofa, just tell us your card number. And the code from SMS. They know how the web banking of a number of large banks works and try to play on it. If you tell them that their phone is listed as spammers and a statement is written to the police, they are offended and no longer answer the phone;

- In Western banks, which are more backward, this also happens;

Source: https://habr.com/ru/post/328828/

All Articles