Banks and money through science fiction

While participants in our competition for banking services and applications are being registered, we decided to carefully study the well-known works of futurists to find out how the financial system of the future works in their presentation, and also how does this compare with the trends that are now forming in the industry.

There are two main concepts. The first is that in the distant future money and financial institutions will not play a special role, the heroes-discoverers of space will have more pressing problems and full wealth of resources. So, in the Star Trek series or the famous movie “2001: A Space Odyssey,” the characters don’t think at all about loans and paying bills.

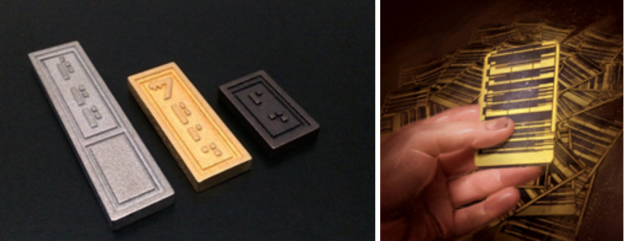

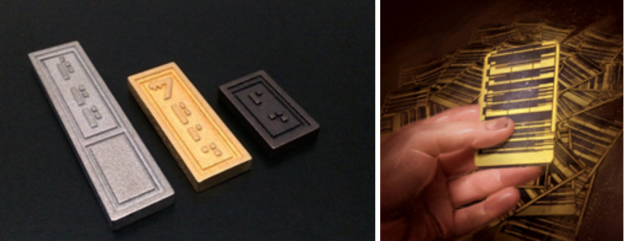

The second is that the money will be actively used, banks will control the world, but at the same time paper banknotes and all sorts of coins will remain in honor. In Star Wars, for example, the Intergalactic Banking Clan (MBC) is a huge force that has its own planets, manufactures, and armies. The Galactic Standard Credit is distributed throughout the galaxy, it is presented in the form of cash of the original rectangular shape and in the form of cashless transfers.

')

There is a third form on which to focus. This is money chips. You can load a different, but rather limited amount of money on the chip, they are not tied to the sender or recipient. When you pay the chip is given to the counterparty. Some Star Wars characters carry around a dozen of such chips, and smugglers like boxes in general.

In matters of financing, the IBC has been able to maintain neutrality and work on both fronts throughout the saga. At some point, the Chancellor received partial control over the credit department, and here we are almost the only time seeing an example of a banking application interface used by board members. Reminds modern BI-systems, is not it?

Issues of user interaction and the bank often remain behind the scenes. But this will not prevent us from making out the coolest ideas.

How will the people of the future access banking products? There will undoubtedly remain operational offices, where you can come for a consultation, visit your bank cell or open an account. In this case, the arrival of the client is a great opportunity for the bank to carry out the identification of a person. In the course are biometric sensors scan the iris and fingerprint. A good example is visiting the bank as the main hero of the “Recall All” film.

When you contact the clerk, the client allows you to scan your eye, all information is immediately displayed on the transparent glass of the booth, representing essentially a "personal account". The opening of the cell occurs on the fingerprint sensor, and the cell itself has a built-in computer capable of receiving coded messages.

Most often, people work in the offices of banks of the future, but there are exceptions. In "451 degrees Fahrenheit," for example, Montag went to the bank for money at night, and he was served by mechanical robots.

Away from offices, heroes of books and films use credit cards or a variety of communication devices. Mostly they are built on the basis of mobile phones, watches, arm-wear computers, which is pretty trite. For example, in the film “Dissenting Opinion” there are telephones in the course, and the transfer of money when buying an eye operation occurs through a wireless terminal for a credit card. But the hero "Recall All" has a keyboard implanted under the skin of the palm of your hand. Any information screen can be a display for him, just put your hand.

One-touch payment, without any authentication procedures, is a common place for all fantastic works. The maximum that may be required - to put a finger to the scanner. The example of the movie “Time” is indicative here. Money is the time left for a person to live, the current figure is always displayed on the outside of the forearm. To pay, just press your wrist to the scanner. There is a convenient way to transfer time from person to person - you need to take each other's wrists. That hand above is “pumping out” time from the one below.

It is interesting that in the film there is also an analogue of the “cache” - these are drives in the form of small boxes with a screen on which the downloaded capacity of minutes is indicated. You can take time off with them in parts, but you cannot replenish it anymore. The main treasure of the supervillain was just such a drive with a million years.

There are practically no scenes in films when the management of the financial routine is entrusted to artificial intelligence - personal assistants. Apparently, this is due to the fact that the ideal assistant does not distract the owner with such trifles as paying bills and repaying loans on time, but he silently and independently resolves these issues.

In the film “She”, the main character chats with artificial intelligence on general philosophical topics and plays novels, and only mentions letters at the mention of letters from the bank. At the same time, a fundamentally different channel is used for communication - sound, via a wireless headset, the dialogue is conducted in natural language. To display visual information and video transmission in the OS uses a tiny tablet the size of a pocket calendar.

Theoretically, besides voice control and visual interface, a neural interface will appear in the future. But so far there is no clear concept of how he will be able to work and what will happen to a person at the same time: the user will hear voices, see images, or everything will be limited to augmented reality glasses. The latter approach is visualized in such films as “Terminator 2” and “Back to the Future 2”.

Artificial intelligence in the banking applications of the future will have to take an active position. He should not just give the user something upon request, but actively actively report on the opportunities and dangers, propose solutions and plan the future. In the background, he will have to perform routine invoice payment and reporting operations, make purchases and arrange appointments.

Another function of AI built into the application is to counter information security threats. That he will have to identify a variety of attacks, to detect the atypical behavior of the owner. In a world with a developed AI component, the money will be different, they will begin to correspond to a certain amount of energy or computing power.

In the novel “2048” by Shelley Merci, for example, the original currency is denoted in Megawatts or Microfury. Banks are presented in the form of smart online offices - bankers. People are served by personal assistants - the Shaitans, who monitor the security and operation of the infrastructure, and on the Web, there are iskina - independent modules of artificial intelligence. It also describes an interesting format of "smart money" - somersaults. Kulbit is a small area of memory, half of which is free, and the second one contains a primitive version of Iskine - practically a virus that can perform simple calculations. Hundreds of somersault, united in a serious brain, capable of capturing computing power and hacking the protection of any Shaitan.

Banks offer dozens of financial services, but they are also quite difficult to combine within a single application without overloading the interface. In the future, the application must be associated with thousands of services. Through the standard API, he will have to interact with commercial structures, with state systems, and with advertising agents of producers of goods and services.

Collecting a digital user profile, such an application can negotiate discounts on goods required by a person, optimize the route, and offer profitable alternatives when choosing a hotel or restaurant. The application should warn you whether to transfer money to a specific person, choose the most profitable money transfer and conversion routes to other currencies.

At the same time, becoming a client of one bank, ideally, the user should be able to use the services of any other financial institution without re-identification. And this should not be decided within the framework of creating a centralized banking system! In order to preserve competition, transparency and reliability, decentralized systems will be created in the future, operating on fundamentally new transaction confirmation methods, for example, blockchain.

All industries in the modern world adapt to each other, and the banks of the future will be able to directly participate in this. For example, one of the trends is the replacement of the economy of owning the economy of use (sharing economy). So far, in terms of technology, it is represented by disparate applications that provide these services through subscription, but in the future we can expect that banks will assume the role of operators or even more likely aggregators of articles of human consumption and management of all joint financial relations of a person with the outside world could be realized through a single banking application.

Another concept of economics that is likely to experience some kind of “new rebirth” in the future is the economics of donation. Already, there are communities that practice this type of economy, such as the festival Burning Man. Banks, on the other hand, could take on the role of intermediaries who facilitate the donation process and provide more opportunities for this.

Another potential direction is the economy of trust. In a world where material goods are available or overprotected, trust could be the currency that people would value. Banks through client applications could help people build these chains of trust and assume the role of guarantor of one person’s trust over another, like the number of mutual friends on Facebook now.

Unfortunately, science fiction writers, creating their own worlds, do not pay enough attention to such fine details of everyday life. This work falls on the shoulders of Fintech developers who turn big ideas into practical solutions.

And how do you see the financial systems and banks of the future?

Those who know which mobile services will like the customers of banks and will be in demand in the near future, we are invited to participate in the Promotion contest .

There are two main concepts. The first is that in the distant future money and financial institutions will not play a special role, the heroes-discoverers of space will have more pressing problems and full wealth of resources. So, in the Star Trek series or the famous movie “2001: A Space Odyssey,” the characters don’t think at all about loans and paying bills.

The second is that the money will be actively used, banks will control the world, but at the same time paper banknotes and all sorts of coins will remain in honor. In Star Wars, for example, the Intergalactic Banking Clan (MBC) is a huge force that has its own planets, manufactures, and armies. The Galactic Standard Credit is distributed throughout the galaxy, it is presented in the form of cash of the original rectangular shape and in the form of cashless transfers.

')

There is a third form on which to focus. This is money chips. You can load a different, but rather limited amount of money on the chip, they are not tied to the sender or recipient. When you pay the chip is given to the counterparty. Some Star Wars characters carry around a dozen of such chips, and smugglers like boxes in general.

In matters of financing, the IBC has been able to maintain neutrality and work on both fronts throughout the saga. At some point, the Chancellor received partial control over the credit department, and here we are almost the only time seeing an example of a banking application interface used by board members. Reminds modern BI-systems, is not it?

Issues of user interaction and the bank often remain behind the scenes. But this will not prevent us from making out the coolest ideas.

Same interface

How will the people of the future access banking products? There will undoubtedly remain operational offices, where you can come for a consultation, visit your bank cell or open an account. In this case, the arrival of the client is a great opportunity for the bank to carry out the identification of a person. In the course are biometric sensors scan the iris and fingerprint. A good example is visiting the bank as the main hero of the “Recall All” film.

When you contact the clerk, the client allows you to scan your eye, all information is immediately displayed on the transparent glass of the booth, representing essentially a "personal account". The opening of the cell occurs on the fingerprint sensor, and the cell itself has a built-in computer capable of receiving coded messages.

Most often, people work in the offices of banks of the future, but there are exceptions. In "451 degrees Fahrenheit," for example, Montag went to the bank for money at night, and he was served by mechanical robots.

Away from offices, heroes of books and films use credit cards or a variety of communication devices. Mostly they are built on the basis of mobile phones, watches, arm-wear computers, which is pretty trite. For example, in the film “Dissenting Opinion” there are telephones in the course, and the transfer of money when buying an eye operation occurs through a wireless terminal for a credit card. But the hero "Recall All" has a keyboard implanted under the skin of the palm of your hand. Any information screen can be a display for him, just put your hand.

One-touch payment, without any authentication procedures, is a common place for all fantastic works. The maximum that may be required - to put a finger to the scanner. The example of the movie “Time” is indicative here. Money is the time left for a person to live, the current figure is always displayed on the outside of the forearm. To pay, just press your wrist to the scanner. There is a convenient way to transfer time from person to person - you need to take each other's wrists. That hand above is “pumping out” time from the one below.

It is interesting that in the film there is also an analogue of the “cache” - these are drives in the form of small boxes with a screen on which the downloaded capacity of minutes is indicated. You can take time off with them in parts, but you cannot replenish it anymore. The main treasure of the supervillain was just such a drive with a million years.

Personal agent

There are practically no scenes in films when the management of the financial routine is entrusted to artificial intelligence - personal assistants. Apparently, this is due to the fact that the ideal assistant does not distract the owner with such trifles as paying bills and repaying loans on time, but he silently and independently resolves these issues.

In the film “She”, the main character chats with artificial intelligence on general philosophical topics and plays novels, and only mentions letters at the mention of letters from the bank. At the same time, a fundamentally different channel is used for communication - sound, via a wireless headset, the dialogue is conducted in natural language. To display visual information and video transmission in the OS uses a tiny tablet the size of a pocket calendar.

Theoretically, besides voice control and visual interface, a neural interface will appear in the future. But so far there is no clear concept of how he will be able to work and what will happen to a person at the same time: the user will hear voices, see images, or everything will be limited to augmented reality glasses. The latter approach is visualized in such films as “Terminator 2” and “Back to the Future 2”.

Artificial intelligence in the banking applications of the future will have to take an active position. He should not just give the user something upon request, but actively actively report on the opportunities and dangers, propose solutions and plan the future. In the background, he will have to perform routine invoice payment and reporting operations, make purchases and arrange appointments.

Another function of AI built into the application is to counter information security threats. That he will have to identify a variety of attacks, to detect the atypical behavior of the owner. In a world with a developed AI component, the money will be different, they will begin to correspond to a certain amount of energy or computing power.

In the novel “2048” by Shelley Merci, for example, the original currency is denoted in Megawatts or Microfury. Banks are presented in the form of smart online offices - bankers. People are served by personal assistants - the Shaitans, who monitor the security and operation of the infrastructure, and on the Web, there are iskina - independent modules of artificial intelligence. It also describes an interesting format of "smart money" - somersaults. Kulbit is a small area of memory, half of which is free, and the second one contains a primitive version of Iskine - practically a virus that can perform simple calculations. Hundreds of somersault, united in a serious brain, capable of capturing computing power and hacking the protection of any Shaitan.

The reality may be cooler fiction

Thousands of services

Banks offer dozens of financial services, but they are also quite difficult to combine within a single application without overloading the interface. In the future, the application must be associated with thousands of services. Through the standard API, he will have to interact with commercial structures, with state systems, and with advertising agents of producers of goods and services.

Collecting a digital user profile, such an application can negotiate discounts on goods required by a person, optimize the route, and offer profitable alternatives when choosing a hotel or restaurant. The application should warn you whether to transfer money to a specific person, choose the most profitable money transfer and conversion routes to other currencies.

At the same time, becoming a client of one bank, ideally, the user should be able to use the services of any other financial institution without re-identification. And this should not be decided within the framework of creating a centralized banking system! In order to preserve competition, transparency and reliability, decentralized systems will be created in the future, operating on fundamentally new transaction confirmation methods, for example, blockchain.

Intermediary Bank

All industries in the modern world adapt to each other, and the banks of the future will be able to directly participate in this. For example, one of the trends is the replacement of the economy of owning the economy of use (sharing economy). So far, in terms of technology, it is represented by disparate applications that provide these services through subscription, but in the future we can expect that banks will assume the role of operators or even more likely aggregators of articles of human consumption and management of all joint financial relations of a person with the outside world could be realized through a single banking application.

Another concept of economics that is likely to experience some kind of “new rebirth” in the future is the economics of donation. Already, there are communities that practice this type of economy, such as the festival Burning Man. Banks, on the other hand, could take on the role of intermediaries who facilitate the donation process and provide more opportunities for this.

Another potential direction is the economy of trust. In a world where material goods are available or overprotected, trust could be the currency that people would value. Banks through client applications could help people build these chains of trust and assume the role of guarantor of one person’s trust over another, like the number of mutual friends on Facebook now.

Unfortunately, science fiction writers, creating their own worlds, do not pay enough attention to such fine details of everyday life. This work falls on the shoulders of Fintech developers who turn big ideas into practical solutions.

And how do you see the financial systems and banks of the future?

Those who know which mobile services will like the customers of banks and will be in demand in the near future, we are invited to participate in the Promotion contest .

Source: https://habr.com/ru/post/326862/

All Articles