IP and IT: the eternal dispute about the main thing

All authors have a goal of publications on Habré: mine is to convey to the community those problems that are not visible at first glance, but are of tremendous importance for the economy, social relations and, of course, technology development.

One of these topics that I tried to raise more than once is IP problems in IT.

Judging by the data received (and not only on Habré), there are two - opposite - positions: some say: “With this scheme, I’m talking about tax, and all I know is that I need to send a declaration there by mail, and deduct 6 times a quarter % Perhaps on other schemes some insurmountable difficulties, I do not know here. At the same time, I am happy to pay these 6%, they allow me to have a white income without hiding from anyone. ”

')

The second says that the tax itself is not a problem, but the bureaucracy (especially in the field), the lack of guarantees for all contributions (say, from the recent one - freezing pensions in the absence of freezing payments to the Pension Fund and other funds), and most importantly - corruption even “on the ground” is a misfortune that for it and the sectors associated with, say, e-commerce is much deeper than it seems at first glance.

Say, quite recently, 10 years ago, those who were selling a CD were called “pirates”, the problem is that: “the minor official won in the end. He opened next to the same kiosk with a pirate, only without paying rent, without a ticket office (no one checked it), m ... m may also pay, or maybe not. And we were fined for licensed products. It's a shame. Now I see a similar picture when the notorious AKIT comes onto the scene and throws small business with overt dirt, but gray phones, refrigerators and other household items of this color and their ilk do not disappear.

It would seem that such positions cannot get along. But get along: in one country, at the same time, with the same in general status of IP.

Before you say a few answers, thoughts - "easy" statistics.

"The number of small enterprises in Russia decreased by 69.8 thousand: according to Rosstat, in the first half of 2015 there were 242.6 thousand, and in the first half of 2016 it was 172.8 thousand. In fact, evaluate the development dynamics of small enterprises on the basis of statistics is now almost impossible ... "( Izvestia ).

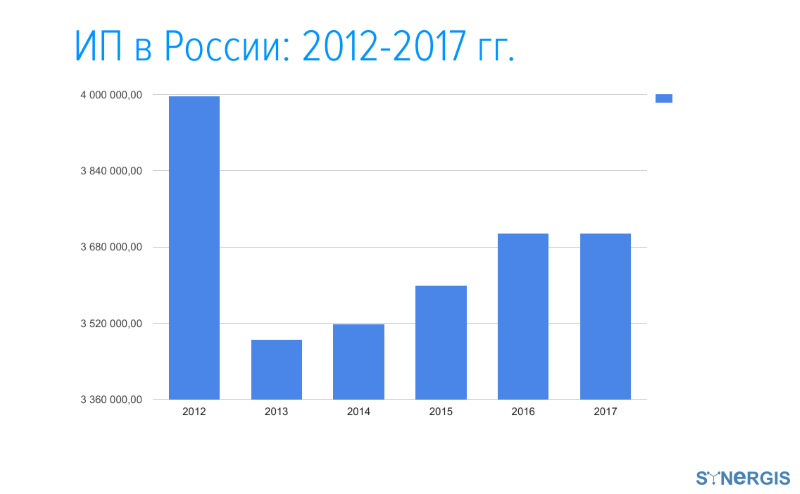

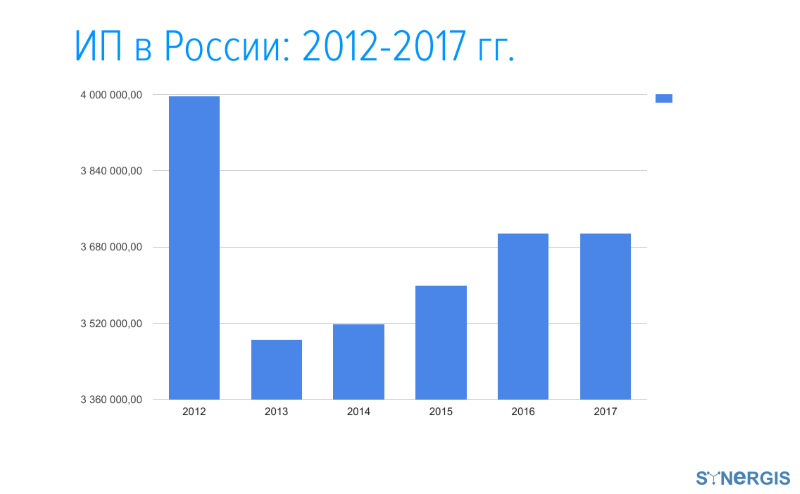

According to the site, from 2012 to 2017 the number of individual entrepreneurs changed as follows:

In 2013, many people think so, “dummies” are gone, because there was a sharp increase in payments to the FIU. Yes, there were arguments that “these are contributions to the future,” but after the expected reform of the pension and freezing of savings, many hopes faded away; Yes, there were arguments that “I counted - the pension issue is 40k / month and this payment is fully deducted”, etc. But the bottom line is that people who have had an IP and a cat. it was closed in 2013 and was not “empty cases”, for them simply “extra” 17 or more thousand, for which the mandatory contributions increased seemed an unnecessary burden.

I will cite a few examples that I personally met:

I do not condemn anyone and do not support: just the facts.

The question is different: IP for today is a form of business that is very disadvantageous for the existing system of (right-) relations.

I will cite a few points:

Again, I am not ready to evaluate these theses: they are just facts from practice. But the picture of the closed IP in the Russian Federation from 2012 to 2017.

Why did you remember this question now?

In connection with three trends:

So, to make it clearer: the UE at the simplified tax system 6% is an excellent, if not ideal for everyone, solution for freelancing . But government agencies are persistently insisting on the emergence of precisely “self-employed citizens” with an even greater (?) Simplification of the mini-business.

In 2015-2016 business has become shallow: the criteria for micro and small businesses have changed: few people associate it with entrepreneurship and it’s even more so, but if you think about it, an interesting tendency follows from this, which contradicts the trends of Skolkovo, Innopolis and their ilk. Is not it so?

Many (I cannot say exactly how much, since it is very difficult to count, but there is no open data) freelancers are increasingly mastering the Bitcoin and other cryptocurrency mines, and now the Ministry of Finance insists that digital money the money ( to the peak of electronic ) will be recognized as a financial instrument immediately after (or before) the significant event of 2018.

It turns out a very strange, in my opinion, and contradictory picture, where the pike is the desire of a number of communities to go into the non-state sphere of finance; Cancer - the desire of several government agencies for-to control any small business "from and to"; and the swan - technology that can not stand still. And to combine the three components so far it turns out only in the most secured part of the PI / LLC - freelancers with an income of 100+, in rubles, of course, and thousands of course. The rest, especially with employees, reminds everything of a film of an absurd reality: you can judge at least by blocking “Buttons” or, say, by the same type of mistakes in trying to regulate electronic and crypto-money; commodity aggregators, or even such a technological thing as a friend of Aristotle, the truth, as you know, which is more expensive.

So, this time the summary of the article will not be. There will be a question: “perhaps you should not create a lot of complex temporary forms, but the time has come for a global reboot and transfer to the area of simple forms?”.

Very soon I will tell the story of the creation of an IT company in the region and the difficulties of the first steps, I think this will be an excellent addition to this material, but for now, I would like to know from the Habra community what it knows and thinks about the described problems . Or, perhaps, for him they are, but only in quotes?

To finally dot the i or e, as you like, you can look at the figures of the Central Bank of Russia on loans :

The opinion is: “The reasons for the decline in small business lending was, along with the extremely high loan rate, also a decrease in the profitability of small businesses due to a decline in real incomes of the population, as well as a drop in investment.”

At the same time, the level of overdue loans for individual entrepreneurs in 2015 was about 12.3%, and in 2016 it was already 13.81% .

Give out less, give - also less. Dissonance. I also mentioned the main problem of IP in this aspect: responsibility . Unlike LLC - all property, except what is listed. Given the general debt load of the population - not the most rosy trend.

The essence of this aspect is that IP freelancers, as a rule, do not take loans, but IP, say, in e-commerce or similar areas - very much so. But IP freelancers without salespeople and those who “spin the market” cannot live: there are no customers - there is no capital flow. Of course, you can justify yourself that there is always offline, but still to create a site, promote it, for applications, etc. need online - a priori.

Perhaps the problem is not visible again. I admit: but it is still there.

I don’t know what conclusions everything will bring you, what was said above, but one of my friends commented on this dispute in the following way: “... there’s another aspect that very many self-employed people, especially creative people, don’t need millions, they are satisfied with the income from their creativity or activities the size of 20-50 k, so that they could do their favorite things and at the same time have enough food, but if they start to cooperate according to the rules of the state, then they will not survive, most of them will eat taxes, from which almost 0 and for the sake of what is all this, this is the main brake that scares great consistency of deal with these matters legally, plus add reporting and penalties and a bunch of parasites in the chain. " Someone agreed with him, some did not, but the numbers are a stubborn vector that says a lot .

UPD. The article was published, and the old problem was revealed again: briefly, about why contracts with individual entrepreneurs can be recognized as labor contracts. And how it threatens .

One of these topics that I tried to raise more than once is IP problems in IT.

Judging by the data received (and not only on Habré), there are two - opposite - positions: some say: “With this scheme, I’m talking about tax, and all I know is that I need to send a declaration there by mail, and deduct 6 times a quarter % Perhaps on other schemes some insurmountable difficulties, I do not know here. At the same time, I am happy to pay these 6%, they allow me to have a white income without hiding from anyone. ”

')

The second says that the tax itself is not a problem, but the bureaucracy (especially in the field), the lack of guarantees for all contributions (say, from the recent one - freezing pensions in the absence of freezing payments to the Pension Fund and other funds), and most importantly - corruption even “on the ground” is a misfortune that for it and the sectors associated with, say, e-commerce is much deeper than it seems at first glance.

Say, quite recently, 10 years ago, those who were selling a CD were called “pirates”, the problem is that: “the minor official won in the end. He opened next to the same kiosk with a pirate, only without paying rent, without a ticket office (no one checked it), m ... m may also pay, or maybe not. And we were fined for licensed products. It's a shame. Now I see a similar picture when the notorious AKIT comes onto the scene and throws small business with overt dirt, but gray phones, refrigerators and other household items of this color and their ilk do not disappear.

It would seem that such positions cannot get along. But get along: in one country, at the same time, with the same in general status of IP.

Before you say a few answers, thoughts - "easy" statistics.

"The number of small enterprises in Russia decreased by 69.8 thousand: according to Rosstat, in the first half of 2015 there were 242.6 thousand, and in the first half of 2016 it was 172.8 thousand. In fact, evaluate the development dynamics of small enterprises on the basis of statistics is now almost impossible ... "( Izvestia ).

According to the site, from 2012 to 2017 the number of individual entrepreneurs changed as follows:

In 2013, many people think so, “dummies” are gone, because there was a sharp increase in payments to the FIU. Yes, there were arguments that “these are contributions to the future,” but after the expected reform of the pension and freezing of savings, many hopes faded away; Yes, there were arguments that “I counted - the pension issue is 40k / month and this payment is fully deducted”, etc. But the bottom line is that people who have had an IP and a cat. it was closed in 2013 and was not “empty cases”, for them simply “extra” 17 or more thousand, for which the mandatory contributions increased seemed an unnecessary burden.

I will cite a few examples that I personally met:

- A freelance girl: she earns money by writing texts (mostly translations). Earnings are small - about 10,000 rubles. The IP was like “business for pleasure, but the extra zamorochki killed the desire to do it even according to the simplest scheme”;

- Two guys who used IP only in the “May-September” season: through the site they attracted tourists and made excursions in the eastern part of Baikal. They shut down the PI (it was with each of them), because “there was more demand, and work from a“ private trader ”brought more income”.

- More examples can be found in the discussions to the article .

I do not condemn anyone and do not support: just the facts.

The question is different: IP for today is a form of business that is very disadvantageous for the existing system of (right-) relations.

I will cite a few points:

- For individual entrepreneurs, personal funds and working capital are the same. Cash something - much easier than in the LLC. And most importantly - cheaper. This is not like the Central Bank (see the case of WebMoney, Qiwi, Robokassa).

- PI open and close - easy . Anyone can do it, and even online . Bankruptcy proceedings and many other things are not for individual entrepreneurs. If you don’t understand what I’m getting at, I strongly recommend watching the interesting interview of O. Tinkov and S. Galitsky. This issue will be especially acute for individual entrepreneurs after 2018 in connection with the discussed Federal Law 54 ( “On the online ticket offices” ).

- PI - always gives the budget less . Even, let's say, the penalties for LLC and IP are different: big ones in the direction of LLC.

Again, I am not ready to evaluate these theses: they are just facts from practice. But the picture of the closed IP in the Russian Federation from 2012 to 2017.

Why did you remember this question now?

In connection with three trends:

- The desire of public authorities to "legitimize" the sector of the so-called group of "self-employed citizens" (for IT, this is freelance in the first place);

- On-line cash registers, which are rightly noted by alex0nik : “Large networks have received significant savings. Private entrepreneurs, alas, are not. If at a minimum of 6 thousand FN + 3 thousand. OFD + 1.5 EDS = 10.5, in fact, what it was before for EKLZ + TEC. But the box office is more expensive. And the grids receive substantial discounts due to volumes on cash desks, on drives and on servicing at the OFD. ”

- Finally, in connection with the notorious fight against terrorism (in the light of recent events, it will obviously become tougher): as stated above, the IP for the FZ 115 and its “descendants” is the cornerstone.

So, to make it clearer: the UE at the simplified tax system 6% is an excellent, if not ideal for everyone, solution for freelancing . But government agencies are persistently insisting on the emergence of precisely “self-employed citizens” with an even greater (?) Simplification of the mini-business.

In 2015-2016 business has become shallow: the criteria for micro and small businesses have changed: few people associate it with entrepreneurship and it’s even more so, but if you think about it, an interesting tendency follows from this, which contradicts the trends of Skolkovo, Innopolis and their ilk. Is not it so?

Many (I cannot say exactly how much, since it is very difficult to count, but there is no open data) freelancers are increasingly mastering the Bitcoin and other cryptocurrency mines, and now the Ministry of Finance insists that digital money the money ( to the peak of electronic ) will be recognized as a financial instrument immediately after (or before) the significant event of 2018.

It turns out a very strange, in my opinion, and contradictory picture, where the pike is the desire of a number of communities to go into the non-state sphere of finance; Cancer - the desire of several government agencies for-to control any small business "from and to"; and the swan - technology that can not stand still. And to combine the three components so far it turns out only in the most secured part of the PI / LLC - freelancers with an income of 100+, in rubles, of course, and thousands of course. The rest, especially with employees, reminds everything of a film of an absurd reality: you can judge at least by blocking “Buttons” or, say, by the same type of mistakes in trying to regulate electronic and crypto-money; commodity aggregators, or even such a technological thing as a friend of Aristotle, the truth, as you know, which is more expensive.

So, this time the summary of the article will not be. There will be a question: “perhaps you should not create a lot of complex temporary forms, but the time has come for a global reboot and transfer to the area of simple forms?”.

Very soon I will tell the story of the creation of an IT company in the region and the difficulties of the first steps, I think this will be an excellent addition to this material, but for now, I would like to know from the Habra community what it knows and thinks about the described problems . Or, perhaps, for him they are, but only in quotes?

To finally dot the i or e, as you like, you can look at the figures of the Central Bank of Russia on loans :

- In 2012, out of 6,055,744 million rubles. PI accounted for 556,055;

- In 2017, out of 5,302,114 million rubles. on the IP already - 342 711;

- That is, in 2012 - 9.18%, and in 2017 - 6.46%.

The opinion is: “The reasons for the decline in small business lending was, along with the extremely high loan rate, also a decrease in the profitability of small businesses due to a decline in real incomes of the population, as well as a drop in investment.”

At the same time, the level of overdue loans for individual entrepreneurs in 2015 was about 12.3%, and in 2016 it was already 13.81% .

Give out less, give - also less. Dissonance. I also mentioned the main problem of IP in this aspect: responsibility . Unlike LLC - all property, except what is listed. Given the general debt load of the population - not the most rosy trend.

The essence of this aspect is that IP freelancers, as a rule, do not take loans, but IP, say, in e-commerce or similar areas - very much so. But IP freelancers without salespeople and those who “spin the market” cannot live: there are no customers - there is no capital flow. Of course, you can justify yourself that there is always offline, but still to create a site, promote it, for applications, etc. need online - a priori.

Perhaps the problem is not visible again. I admit: but it is still there.

I don’t know what conclusions everything will bring you, what was said above, but one of my friends commented on this dispute in the following way: “... there’s another aspect that very many self-employed people, especially creative people, don’t need millions, they are satisfied with the income from their creativity or activities the size of 20-50 k, so that they could do their favorite things and at the same time have enough food, but if they start to cooperate according to the rules of the state, then they will not survive, most of them will eat taxes, from which almost 0 and for the sake of what is all this, this is the main brake that scares great consistency of deal with these matters legally, plus add reporting and penalties and a bunch of parasites in the chain. " Someone agreed with him, some did not, but the numbers are a stubborn vector that says a lot .

UPD. The article was published, and the old problem was revealed again: briefly, about why contracts with individual entrepreneurs can be recognized as labor contracts. And how it threatens .

Source: https://habr.com/ru/post/326226/

All Articles