Online cash vs blockchain: you did not know this, but thought about it?

Usually, mini-studies come in two types: more similar to technical analysis — with beautiful graphs, lots of numbers, and other wonders of statistics; or those that are close to the analysis of the fundamental: a description of the principles of the formation of the phenomenon being studied, the disclosure of essential relationships, etc.

The second approach is close to me, but due to popularity, one often has to resort to the first one in some way or another.

As always - at the end there is an abstract of what is stated in the article, but for now - several important observations on the omnipresent Federal Law No. 54 (it is figuratively called “On the online ticket offices”, although in fact it has a much more prosaic name: “On the application of control - cash equipment in the implementation of cash payments and (or) payments using electronic means of payment ").

')

I had to wait for quite a long time when an article appeared on Habré, after which the main questions would disappear. Here it is .

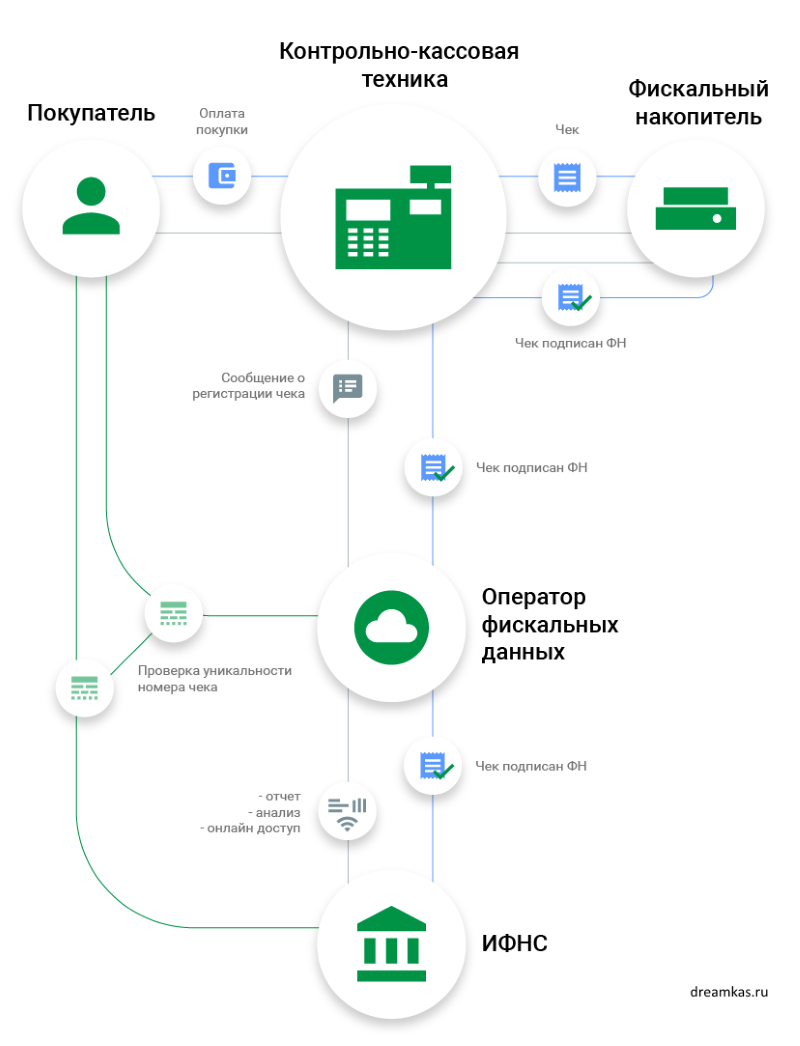

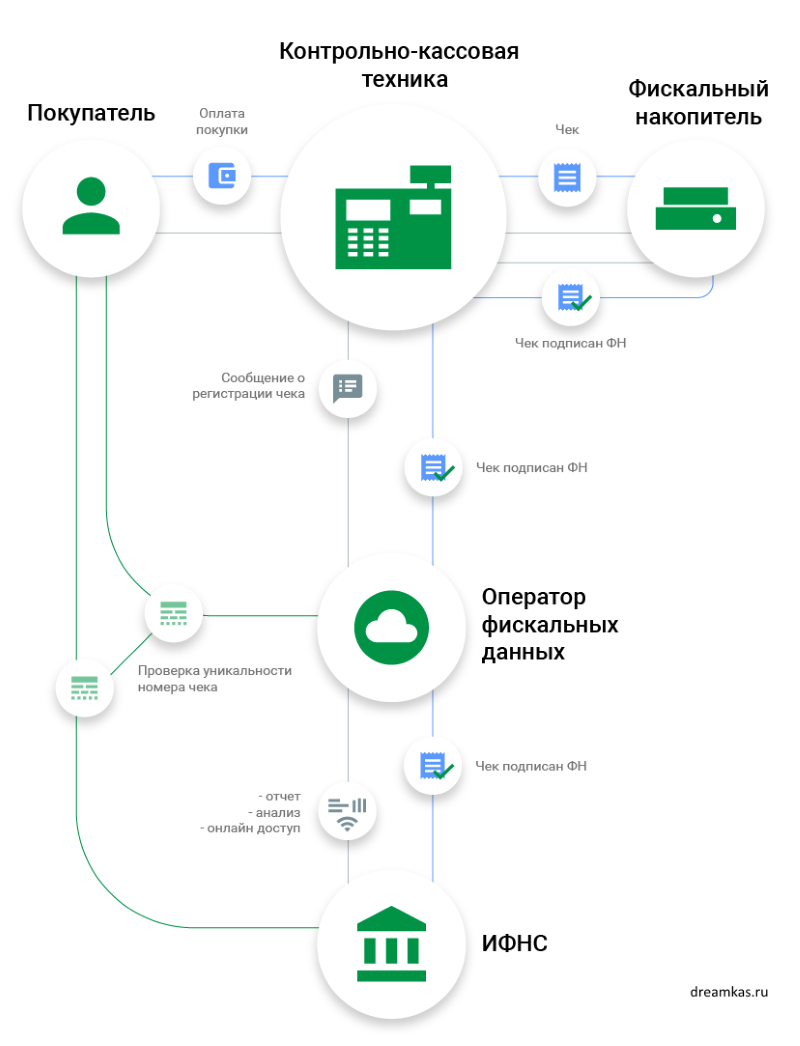

For those who love the graphical presentation - a good photo on the CCP work scheme from 2017.

Peer at this photo-schedule: I do not want to say with 100% probability, but for me it reminds too much of the blockchain.

However, here are some important notes.

In the Russian Federation, the possibilities of cryptocurrency and block chains were discussed in many different ways:

But then a reasonable question arises: "Why do we need online ticket offices?" .

Let's look at what lawyers call innovations:

I don’t know if it’s just me, but a logical question arises: “ Why complicate things again? ”.

You can, of course, use the now-popular weapon of exposure , but still Habr is about something else .

Therefore, I am interested in a purely organizational-economic question: the blockchain, without any intermediaries, allows recording any information (especially since the speed of electronic checks is not as critical as, say, for arbitrage on the stock exchange or “instant” money transfers). Objections to hardware solutions are accepted, but to be honest, I don’t see them.

And now - the numbers.

In Russia, 3,854,688 legal entities and 3,708,450 individual entrepreneurs . Total, 7 563 138. Let only half of the UL (I think that much more, but not important for the order of numbers) and 90% of the individual entrepreneurs (because the individual entrepreneur is always a particular person and if I, say, have participation in three LLCs, the IP will still be only one thing: to close - it is possible, but only) will use online cash registers through the CRF.

In a year according to the law - no more than 3,000 rubles . Until.

In this case, we obtain: 5,782,032,000 rubles per year for the LE and 10,012,815,000 rubles. for sp.

Total - more than 15 000 000 000 according to my most modest calculations . Let something wrong, even erroneous. Let be. To understand the order of numbers, believe me, it does not matter. But there will still be maintenance, configuration, one-time registration, etc. And, I think, for sure, over time, additional, not free, but necessary services will appear.

Billions of rubles out of the blue. Although until 2018, the blockchain community has quite a supply of time and strength, which means it could be made easier and cheaper . The only question is that it is not necessary, is not it?

So, the point of this mini-study is to ask questions:

Yes, I understand (and understood 10 years ago ) that fees are a unique opportunity with the help of the Constitutional Court (for example, here and now ) or without it to increase the amount of state budget revenues by legitimate (but for many, not legitimate) methods.

The question for Habr is still different : not so long ago (in 2011), Federal Law No. 161 “On the national payment system” was adopted, which I mentioned more than once. And not even two. This law is essentially the legal nature of electronic money destroyed and brought them to the level of one of the types of cashless payments.

How did it turn out? The fact that after the advent of cryptocurrency, the Central Bank desperately began to promote the untenable theory of money substitutes , which completely killed the desire not only from exchangers, aggregators, but even retailers to engage in "digital money": including such giants (# 2 in TOP 100 from 2016 years) as Yulmart.

Although, let me remind you that the same WebMoney appeared back in 1998, when another “local” crisis raged in the world (yes, it was not only in the Russian Federation): there was enough time to turn such tools as Qiwi terminals, unique (no matter how badly I personally treated) the mechanism of WMR, WMZ, and other wallets. As a result: the market of electronic payments became 100% banking; the banking segment, in turn, is bursting at the seams of eternal license reviews (Masterbank and its successors have been told more than once); and the cryptosphere, despite a whole special law with complex terminology, remains unregulated. Moreover: cryptoresources continue to be blocked, and therefore money flows in a deep river from the budget (btc-e, localbitcoins, exmo are only the first, but not the only examples ).

So it turns out that from a legal, organizational and economic point of view, FZ 54 is another, super-illogical decision that introduces temporary measures where it is possible and necessary to carry out global and systemic changes: or is everything simpler? ..

Before the summary of the article - an opinion that literally met today at one of the stormy discussions: “undoubtedly, the introduction of online cash registers will cause a massive reduction in the IP, as in the situation with raising insurance premiums in 2013. Probably, our legislator does not even suspect what the “ridiculous incomes” of most individual entrepreneurs who use UTII and PSN and even the simplified tax system, especially take a province where there is simply no work. People sometimes become individual entrepreneurs and continue to be just to be registered as an unemployed citizen. ” I don’t try to judge him - I leave it as it is: however, one question still remains - “will this generate a new, local black market?” .

So, the article discusses:

PS And yes, this article is not about cryptocurrencies, but about the phenomenon of online cash registers, therefore it is located here, and not on GT.

The second approach is close to me, but due to popularity, one often has to resort to the first one in some way or another.

As always - at the end there is an abstract of what is stated in the article, but for now - several important observations on the omnipresent Federal Law No. 54 (it is figuratively called “On the online ticket offices”, although in fact it has a much more prosaic name: “On the application of control - cash equipment in the implementation of cash payments and (or) payments using electronic means of payment ").

')

I had to wait for quite a long time when an article appeared on Habré, after which the main questions would disappear. Here it is .

For those who love the graphical presentation - a good photo on the CCP work scheme from 2017.

Peer at this photo-schedule: I do not want to say with 100% probability, but for me it reminds too much of the blockchain.

However, here are some important notes.

In the Russian Federation, the possibilities of cryptocurrency and block chains were discussed in many different ways:

- Pension funds want to implement a system without a single center;

- Masterchain tested back in 2016;

- The Central Bank in general began to advocate for the blockchain: “in terms of means of payment, we have something to use, and here, perhaps, the blockchain will give a reserve that will allow the banking system to translate into a new quality”;

- Qiwi wanted to create a “crypto-ruble” at all, but the Central Bank made it clear that for the time being it was “more about blockchain than about digital money”.

But then a reasonable question arises: "Why do we need online ticket offices?" .

Let's look at what lawyers call innovations:

- “By and large, the only innovation of the law is that customers can now demand that the store send an electronic copy of the check to their email or phone” (this is just from the article above);

- In fact, still unknown subjects appeared - CRFs (fiscal data operators);

- In addition, from 2018, online cash registers will in fact become a universal phenomenon for business, i.e. they should be applied (practically) by everyone.

I don’t know if it’s just me, but a logical question arises: “ Why complicate things again? ”.

You can, of course, use the now-popular weapon of exposure , but still Habr is about something else .

Therefore, I am interested in a purely organizational-economic question: the blockchain, without any intermediaries, allows recording any information (especially since the speed of electronic checks is not as critical as, say, for arbitrage on the stock exchange or “instant” money transfers). Objections to hardware solutions are accepted, but to be honest, I don’t see them.

And now - the numbers.

In Russia, 3,854,688 legal entities and 3,708,450 individual entrepreneurs . Total, 7 563 138. Let only half of the UL (I think that much more, but not important for the order of numbers) and 90% of the individual entrepreneurs (because the individual entrepreneur is always a particular person and if I, say, have participation in three LLCs, the IP will still be only one thing: to close - it is possible, but only) will use online cash registers through the CRF.

In a year according to the law - no more than 3,000 rubles . Until.

In this case, we obtain: 5,782,032,000 rubles per year for the LE and 10,012,815,000 rubles. for sp.

Total - more than 15 000 000 000 according to my most modest calculations . Let something wrong, even erroneous. Let be. To understand the order of numbers, believe me, it does not matter. But there will still be maintenance, configuration, one-time registration, etc. And, I think, for sure, over time, additional, not free, but necessary services will appear.

Billions of rubles out of the blue. Although until 2018, the blockchain community has quite a supply of time and strength, which means it could be made easier and cheaper . The only question is that it is not necessary, is not it?

So, the point of this mini-study is to ask questions:

- Software and hardware developers - how much better is it really than blockchain-based solutions? And not even in the context of 2017, but, say, the next 3 years.

- To state bodies and officials : isn't the system that was originally created as an “open book for recording necessary events” transparent?

- Habro-community : Isn't it logical to start using the first in the world that in 5-10 years many will use ( judging by Japan and not only )?

Yes, I understand (

The question for Habr is still different : not so long ago (in 2011), Federal Law No. 161 “On the national payment system” was adopted, which I mentioned more than once. And not even two. This law is essentially the legal nature of electronic money destroyed and brought them to the level of one of the types of cashless payments.

How did it turn out? The fact that after the advent of cryptocurrency, the Central Bank desperately began to promote the untenable theory of money substitutes , which completely killed the desire not only from exchangers, aggregators, but even retailers to engage in "digital money": including such giants (# 2 in TOP 100 from 2016 years) as Yulmart.

Although, let me remind you that the same WebMoney appeared back in 1998, when another “local” crisis raged in the world (yes, it was not only in the Russian Federation): there was enough time to turn such tools as Qiwi terminals, unique (no matter how badly I personally treated) the mechanism of WMR, WMZ, and other wallets. As a result: the market of electronic payments became 100% banking; the banking segment, in turn, is bursting at the seams of eternal license reviews (Masterbank and its successors have been told more than once); and the cryptosphere, despite a whole special law with complex terminology, remains unregulated. Moreover: cryptoresources continue to be blocked, and therefore money flows in a deep river from the budget (btc-e, localbitcoins, exmo are only the first, but not the only examples ).

So it turns out that from a legal, organizational and economic point of view, FZ 54 is another, super-illogical decision that introduces temporary measures where it is possible and necessary to carry out global and systemic changes: or is everything simpler? ..

Before the summary of the article - an opinion that literally met today at one of the stormy discussions: “undoubtedly, the introduction of online cash registers will cause a massive reduction in the IP, as in the situation with raising insurance premiums in 2013. Probably, our legislator does not even suspect what the “ridiculous incomes” of most individual entrepreneurs who use UTII and PSN and even the simplified tax system, especially take a province where there is simply no work. People sometimes become individual entrepreneurs and continue to be just to be registered as an unemployed citizen. ” I don’t try to judge him - I leave it as it is: however, one question still remains - “will this generate a new, local black market?” .

So, the article discusses:

- Federal Law 54 in terms of the strategic tasks facing the economy of the Russian Federation;

- Questions are posed to the IT community about what is wrong with the blockchain, if the Federal Law 54 is so necessary?

- Finally, the facts are cited that the Federal Law 54 is another temporary solution for obtaining income items by the budget of the Russian Federation, which, however, in the long run will lead to the next problems with private capital.

PS And yes, this article is not about cryptocurrencies, but about the phenomenon of online cash registers, therefore it is located here, and not on GT.

Source: https://habr.com/ru/post/326102/

All Articles