VAT and freelancers working with Upwork

The article outlined below considers only one of the aspects related to paying taxes when working with Upwork. At the moment there is a more complete guide - Legal withdrawal of funds from Upwork in the Russian Federation .

Those who withdraw funds from Upwork legally startled when Upwork offered a “simplified” workflow . First of all, because this document management meant the declaration of Upwork commissions and the payment of VAT from them.

Having responded to the flurry of perturbations, Upwork returned to the old workflow for an indefinite period. The tense wait for Upwork to stop working with the old contracts ended unexpectedly - on July 3, 2016, changes were made to the Tax Code, which came into force on January 1, 2017. From now on, to the law, what kind of contracts are used - now all you have to pay VAT. The problem is described in more detail in the article Tax Gus - 2 .

')

The debate on how to relate to all of this, toasting on the toaster, is still going on. But the update issued 3 days ago by the Elbe, it was necessary (at least from the point of view of the law) to pay almost all of the VAT.

If you use the services of Elba, have not yet paid the tax for the first quarter, this article will help you to do this in a manner most similar to the correct one (at least according to the author).

I emphasize that the current practice does not exist yet, I am not a lawyer and absolutely do not pretend to be the ultimate truth, and therefore, following the recommendations in this article , you take responsibility for all the associated risks.

In addition, I would not be in a hurry to file a declaration and pay the tax number at least until the 20th - you never know what other thoughts will come up in the bright minds discussing .

To pay VAT in Elba, you need to drive in all the expenses in the Documents section of the invoice:

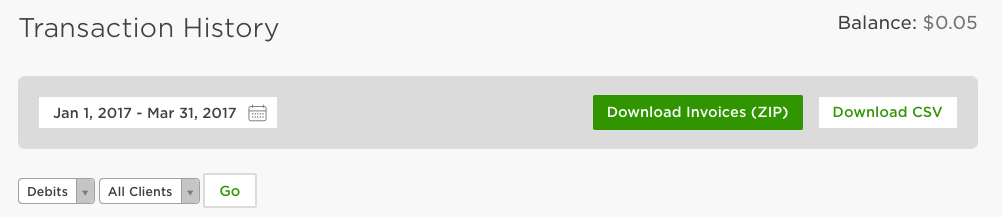

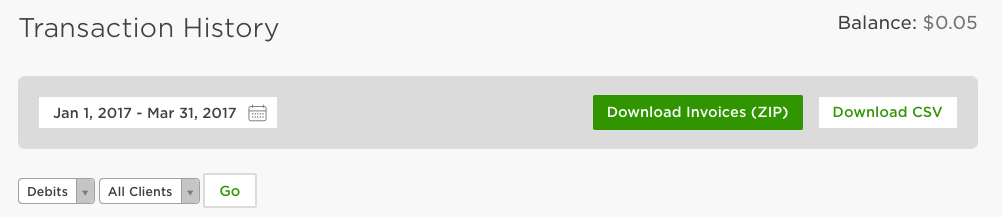

Until Elba learned to pull data with an Upwork machine and no one implemented the interaction between the Upwork API and the Elba API, you can significantly ease your task by exporting costs (Debits) in the Upwork section in CSV format:

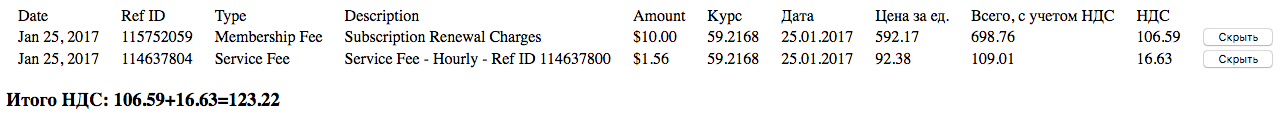

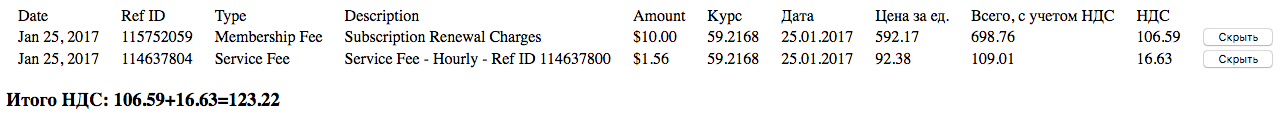

Or by feeding the contents of the received CSV to the next service . If it’s scary to feed your data to someone else’s service, you can pick it up at your own using the code on GitHub . The service will automatically convert expenses in dollars into expenses in rubles at the rate of the central bank on the day the expense is incurred, and prepare a date and description of the expense for copy-paste:

At the end of the quarter, on the basis of billed invoices, Elba will offer to declare VAT and pay tax on it:

UPD 07/19/2017 - Added a column with javascript to the script that fills the billing invoice form fields

UPD 11/13/2018 - Since January 2019 no VAT payment is required ( source )

Those who withdraw funds from Upwork legally startled when Upwork offered a “simplified” workflow . First of all, because this document management meant the declaration of Upwork commissions and the payment of VAT from them.

Having responded to the flurry of perturbations, Upwork returned to the old workflow for an indefinite period. The tense wait for Upwork to stop working with the old contracts ended unexpectedly - on July 3, 2016, changes were made to the Tax Code, which came into force on January 1, 2017. From now on, to the law, what kind of contracts are used - now all you have to pay VAT. The problem is described in more detail in the article Tax Gus - 2 .

')

The debate on how to relate to all of this, toasting on the toaster, is still going on. But the update issued 3 days ago by the Elbe, it was necessary (at least from the point of view of the law) to pay almost all of the VAT.

If you use the services of Elba, have not yet paid the tax for the first quarter, this article will help you to do this in a manner most similar to the correct one (at least according to the author).

I emphasize that the current practice does not exist yet, I am not a lawyer and absolutely do not pretend to be the ultimate truth, and therefore, following the recommendations in this article , you take responsibility for all the associated risks.

In addition, I would not be in a hurry to file a declaration and pay the tax number at least until the 20th - you never know what other thoughts will come up in the bright minds discussing .

To pay VAT in Elba, you need to drive in all the expenses in the Documents section of the invoice:

Until Elba learned to pull data with an Upwork machine and no one implemented the interaction between the Upwork API and the Elba API, you can significantly ease your task by exporting costs (Debits) in the Upwork section in CSV format:

Or by feeding the contents of the received CSV to the next service . If it’s scary to feed your data to someone else’s service, you can pick it up at your own using the code on GitHub . The service will automatically convert expenses in dollars into expenses in rubles at the rate of the central bank on the day the expense is incurred, and prepare a date and description of the expense for copy-paste:

At the end of the quarter, on the basis of billed invoices, Elba will offer to declare VAT and pay tax on it:

Some legal issues

- Responsibility for " Failure by a tax agent to transfer taxes " - 20% of the amount of underpaid tax (according to article 123 of the Tax Code of the Russian Federation)

- Responsibility for " gross violation of the rules for recording income and (or) expenses " in particular for

- " lack of invoices "

- " lack of primary documents "

- " systematic misrepresentation ... in tax accounting registers (for USN - KUDIR) ... cash "

- Unlike incomes, which need to be confirmed by acts of work performed, expenses (if you believe, including Elbe), do not need to be documented (of course, if you do not have a simplified tax system 15%), it is enough to declare them.

- If the tax question arises, why is the tax paid at the end of the quarter in one quarterly payment, and not because paragraph 2 of paragraph 4 of article 172 of the tax code requires it

In cases of sale of works (services), the place of sale of which is the territory of the Russian Federation, taxpayers are foreign persons who are not registered with tax authorities as taxpayers, tax is paid by tax agents simultaneously with payment (transfer) of funds to such taxpayers.

You can refer to the letter of the Ministry of Finance with explanations of 04/16/2010 N 03-07-08 / 116Note that if you acquire services from a foreign organization, the obligation to pay for which is terminated by netting, then the rule established by par. 2 p. 4 of Art. 174 of the Tax Code, is not valid. After all, you do not transfer funds to a foreign person. In this case, the VAT is paid in the same way as in the case of purchasing goods from foreign contractors.

- Withdrawal Fee does not participate in VAT if not in accordance with article 149 of the Tax Code of the Russian Federation

Non-taxable transactions (exempt from taxation)

then according to article 148 of the Tax Code

...

3) banking operations by banks (except for collection), including: ...You are a VAT tax agent in the event that the place of sales is our state of the Russian Federation (Article 148 of the Tax Code of the Russian Federation). The commission for bank transfer of a foreign bank is difficult to attribute to the service, which is implemented in the territory of the Russian Federation.

- Paying a tax from the funds that came to the p / c, or from the funds that came to the Upwork account is an open question (problems with the tax shine in both cases). Read more about the problem in the article tax gopher 1

- If you pay VAT at the end of the quarter, automatically creating a payment with the help of Elba, you recognize the fact of offsetting, i.e. underpayment of the simplified payment system, if you pay 6% from what fell on the p / s. If you pay within 5 days from the payment of the commission, you need to create each payment order in your hands at the bank.

- The assumption that 173-FZ prohibits the netting of a resident and non-resident refuted here

- There is an opinion that in many regions it is possible to significantly reduce the tax burden with the help of patent taxation (there’s no fussing around with paperwork). Opinion is being studied.

UPD 07/19/2017 - Added a column with javascript to the script that fills the billing invoice form fields

UPD 11/13/2018 - Since January 2019 no VAT payment is required ( source )

Source: https://habr.com/ru/post/325992/

All Articles