Big Data for car dealers and automakers: from idea to monetization

IHS Automotive predicts that by 2020 about 152 million "connected" machines will generate up to 30 terabytes of data per day. And a business that is able to competently take advantage of this wealth will obviously be "on horseback." Let's talk about what information can be used and what is needed for this.

Digital technology is changing the world. Objects cease to be just things - they turn into information and media centers that have access to the Internet, are combined in networks and are overgrown with new opportunities. In the automotive industry, it is connected cars.

The success of work in this direction depends not only on the characteristics of the modules installed in the machines, but on the services themselves, using these data, and analytical models that process and analyze what they have received, making useful business conclusions and forecasts.

')

The car allows you to collect information about its location and instantaneous speed, as well as analyze the data of the self-diagnostic system through OBD2. Based on only this information from one car, it is already possible to make a conclusion, for example, about the driver’s riding style or the mode of his movements (highway / city).

The analysis of such data "in bulk" is even more interesting. For example, by building a map of vehicles of a certain model, you can determine the target audience of this model and its “typical” habits. The horizon for the application of such information is quite wide. And business models for monetizing the collected unstructured data and formed on the basis of their analysis of the findings can be very diverse.

Data on the preferred speed, periods and frequency of acceleration and braking allow you to determine the driving style of the car owner and the degree of probability of an accident. This approach gives accurate drivers the opportunity to get a discount, for example, on insurance. A similar system is already used in a number of countries. Although, on the whole, the global volume of insurance premiums calculated using telematic data analysis is still small.

A similar story with loans - if a person drove carefully on a previous car, why not give him a loan for a new car with a reduced rate (the risks that the bank pledges at an interest rate will be slightly lower in this case).

Analysis of the telematic data makes it possible to create a kind of “electronic navigator” who will advise on which gas station it is more convenient to drive in, what route to choose to save fuel, time and, ultimately, money. The service can also report on maintenance in advance, and not only on the basis of the mileage data, but also on the results of the analysis of the service data of the machines of the same configuration from owners with similar operating conditions.

On the basis of data on all cars of a certain brand, descended from a single conveyor, one can predict the remaining useful life of a car (RUL) and the time to breakdown (TTF). And when comparing information about where and how the car was operated, with the data of visual inspection, the reasons for some breakdowns are clear.

Theoretically, if the driver from year to year demonstrates the same driving style, and then suddenly changes his habits, the system can fix the anomaly and signal it.

The cause of the anomaly can be as an emergency situation - hijacking, the disease - and quite an ordinary thing - teaching children to drive or update applications. Correct analysis of such anomalies will be possible only after analyzing huge amounts of data from a large number of cars - since it is necessary to identify patterns of behavior that would unequivocally indicate an emergency situation.

Information about where and how the car is operated, what difficulties arise and how well certain components function is also interesting for “sellers”. After analyzing it, automakers will be able to identify the "system problems" of the series or model and fix them in new versions. Dealers based on these data will be able to plan the purchase of spare parts or potential repairs.

In principle, such systems are already used by many dealers and are being tested by manufacturers. The latter are unlikely to spend a lot of time building processes - and, perhaps, soon we will see similar solutions in commercial operation.

Another area of application for “big car data” is working with “post-warranty” customers . Detailed information about the visitors to the car will allow you to identify patterns in their behavior, which, in turn, will give room for developing ways to keep them.

Additional information about the car owner and his movements allows you to target advertising aimed at the driver and his passengers. For example, if the collection of data from a large number of cars shows that mainly families with children pass by an advertising banner along the road (and you can find out by registering the regular parking of these cars near schools and other children's institutions), this will give a trump card to agency renting it out. Roughly speaking, ad targeting techniques that have long been used on the network will be available outside the Internet.

At the same time, it is possible to apply cross-marketing. Based on the client's previous interests, analyzed through the prism of information about his movements and riding style, dealers, gas station owners and other service providers will be able to create a personal package of offers from partner companies (shops, leisure centers, etc.).

All of the above is made possible by analyzing the data already collected. Imagine what opportunities will open up in front of the market if the car starts to “communicate” with the surrounding objects (other cars and road network elements), responding to their actions or collecting information about the driver's reaction.

Everything written above is very cool in theory, but so far on the scale of the entire traffic is not available in practice. And this is a simple explanation.

For the correct application of big data, three components are needed: a developed infrastructure, the readiness of industry representatives for innovations, and resources, including personnel, to put all ideas into practice. Let's see how things are now.

Technically, for the transition to the ideology of connected cars data everything is ready. Everywhere there is a mobile network with access to the Internet. Data exchange standards have already been developed that provide relatively easy integration of their supporting devices into the infrastructure of a potential system. There are ready-made and generally accepted solutions for analyzing and storing big data, such as Hadoop, Spark, Storm and others, as well as large cloud services (Amazon RedShift, Azure DataLake, Azure HDInsight).

It makes sense to speak about readiness for innovations in two planes: from the point of view of the market and from the side of ordinary motorists.

The market is theoretically ready. Already more than half of cars sold in the world belong to the category of connected. Visiongain believes that Big Data is one of the fastest growing segments of the automotive industry. This indicates the high demand for big data analysis. At the same time, automakers that are not yet taking initiatives are being pushed by investors and shareholders.

Nevertheless, the purely technical barrier still prevents the active movement in the direction of Big Data: the closed data exchange protocols inside the car do not allow you to easily and quickly collect all the information from all brands of cars on the market. Perhaps the situation will correct the appearance of a certain common standard, but for now this question is open.

It is difficult to judge the readiness of the mass user now. Like any innovation, services based on Big Data analysis have their supporters and opponents. For example, lovers of aggressive driving style is unlikely to enjoy a review of the scheme for calculating insurance. In forums and blogs, the very idea of collecting data from cars causes the same controversy as Google’s analysis of user behavior by devices and the Google search engine: one likes new functions, while others protest against “total surveillance” and tell horrors about the insecurity of accumulated data. But the flywheel is running.

Implementing Big Data analysis from scratch implies large intellectual and financial investments. Naturally, not everyone will pull them alone, but, like in other markets, they may well be divided between the interested parties. For example, we used this approach when creating Remoto: we took on research and development, and transferred the installation of equipment to automakers. So the device becomes an additional option of the car, due to which users get a number of necessary convenient functions.

With personnel capable of working effectively with Big Data, everything is somewhat more complicated, because globally this is a new market, to which the “right” approach has yet to be found. We have been forming our team for several years, focusing on active specialists with a creative approach to work, and are open to new contacts with people interested in this direction.

Right now we are looking for:

→ System Architect

→ System Analyst

→ Project Manager

One example of a service for working with large automotive data is the Remoto platform. It allows you to collect information about the car, manage part of its functions and communicate with the very "brain center" - the cloud - to transfer data. At the moment, Remoto works with cars Kia, Nissan, Infiniti, Toyota, Genesis, Honda. Technically, integration with the products of other auto concerns is also possible; to expand the list of supported models, small customization of software is required, which implies interaction with the manufacturer (and his agreement to introduce similar technologies).

The solution consists of several components:

A set of equipment in the car - a Remoto module with a SIM card - is installed directly by the manufacturer (as part of the standard configuration) or by a dealer (as an option). It is important that the installation does not violate the safety perimeter of the machine, since The solution can be integrated with the factory anti-theft system.

The task of the telematics device is receiving information from onboard systems, transferring raw data to the cloud, receiving commands and transmitting them to onboard systems. The frequency of sending data is determined by the system settings. For example, remote diagnostics is carried out two or three times a month.

The mobile application is available for Android and iOS (in limited mode - under Windows Phone). With it you can:

More than 50 services in total.

The server part is represented by the Microsoft Azure cloud and portals for dealers, automakers or insurance companies - i.e. for the main users of the collected driver data. An API is provided to integrate the portal with the client’s corporate systems.

Today in the world there are already more than 500 thousand mobile users of Remoto. This, in turn, is a good foundation for analyzing and monetizing Big Data. Even now, the Bright Box company, the brainchild of which Remoto is, helps car makers with business models, various marketing tricks are quite available - user activity cards with specific cars, refined customer profiles that prefer certain cars, etc.

Thus, for Big Data, there was a place even in the conservative automotive industry. The toolkit available today has opened ways for a fundamentally new interaction with the client, which makes it more likely that they will return in the future.

Digital technology is changing the world. Objects cease to be just things - they turn into information and media centers that have access to the Internet, are combined in networks and are overgrown with new opportunities. In the automotive industry, it is connected cars.

The success of work in this direction depends not only on the characteristics of the modules installed in the machines, but on the services themselves, using these data, and analytical models that process and analyze what they have received, making useful business conclusions and forecasts.

')

Big Data opportunities in the automotive market

The car allows you to collect information about its location and instantaneous speed, as well as analyze the data of the self-diagnostic system through OBD2. Based on only this information from one car, it is already possible to make a conclusion, for example, about the driver’s riding style or the mode of his movements (highway / city).

The analysis of such data "in bulk" is even more interesting. For example, by building a map of vehicles of a certain model, you can determine the target audience of this model and its “typical” habits. The horizon for the application of such information is quite wide. And business models for monetizing the collected unstructured data and formed on the basis of their analysis of the findings can be very diverse.

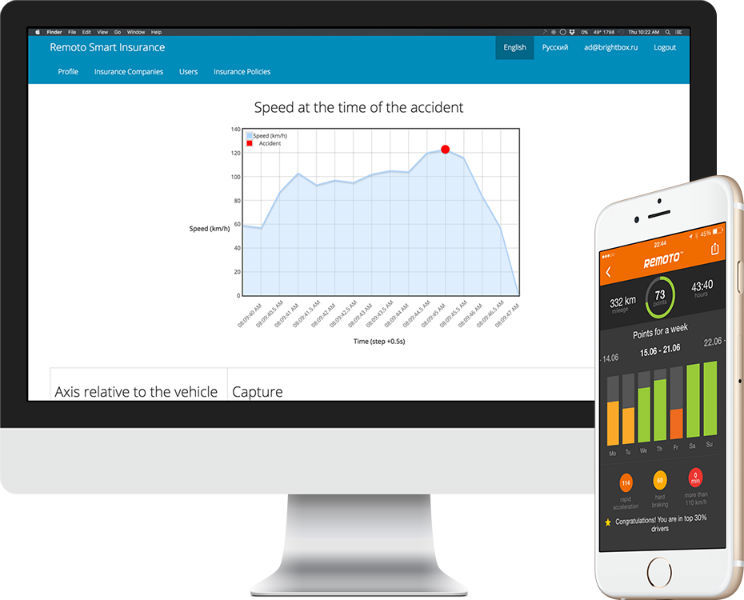

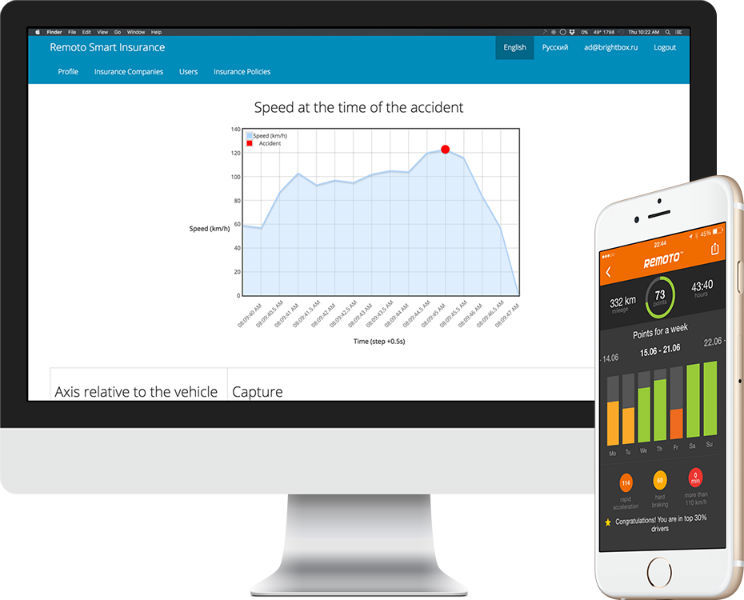

Usage-based insurance and lending

Data on the preferred speed, periods and frequency of acceleration and braking allow you to determine the driving style of the car owner and the degree of probability of an accident. This approach gives accurate drivers the opportunity to get a discount, for example, on insurance. A similar system is already used in a number of countries. Although, on the whole, the global volume of insurance premiums calculated using telematic data analysis is still small.

A similar story with loans - if a person drove carefully on a previous car, why not give him a loan for a new car with a reduced rate (the risks that the bank pledges at an interest rate will be slightly lower in this case).

Driver Information Services: Driving and Maintenance

Analysis of the telematic data makes it possible to create a kind of “electronic navigator” who will advise on which gas station it is more convenient to drive in, what route to choose to save fuel, time and, ultimately, money. The service can also report on maintenance in advance, and not only on the basis of the mileage data, but also on the results of the analysis of the service data of the machines of the same configuration from owners with similar operating conditions.

On the basis of data on all cars of a certain brand, descended from a single conveyor, one can predict the remaining useful life of a car (RUL) and the time to breakdown (TTF). And when comparing information about where and how the car was operated, with the data of visual inspection, the reasons for some breakdowns are clear.

Anomalies of behavior and emergency calls

Theoretically, if the driver from year to year demonstrates the same driving style, and then suddenly changes his habits, the system can fix the anomaly and signal it.

The cause of the anomaly can be as an emergency situation - hijacking, the disease - and quite an ordinary thing - teaching children to drive or update applications. Correct analysis of such anomalies will be possible only after analyzing huge amounts of data from a large number of cars - since it is necessary to identify patterns of behavior that would unequivocally indicate an emergency situation.

Current statistics automaker (dealer)

Information about where and how the car is operated, what difficulties arise and how well certain components function is also interesting for “sellers”. After analyzing it, automakers will be able to identify the "system problems" of the series or model and fix them in new versions. Dealers based on these data will be able to plan the purchase of spare parts or potential repairs.

In principle, such systems are already used by many dealers and are being tested by manufacturers. The latter are unlikely to spend a lot of time building processes - and, perhaps, soon we will see similar solutions in commercial operation.

Dealer customer retention

Another area of application for “big car data” is working with “post-warranty” customers . Detailed information about the visitors to the car will allow you to identify patterns in their behavior, which, in turn, will give room for developing ways to keep them.

Advertising

Additional information about the car owner and his movements allows you to target advertising aimed at the driver and his passengers. For example, if the collection of data from a large number of cars shows that mainly families with children pass by an advertising banner along the road (and you can find out by registering the regular parking of these cars near schools and other children's institutions), this will give a trump card to agency renting it out. Roughly speaking, ad targeting techniques that have long been used on the network will be available outside the Internet.

At the same time, it is possible to apply cross-marketing. Based on the client's previous interests, analyzed through the prism of information about his movements and riding style, dealers, gas station owners and other service providers will be able to create a personal package of offers from partner companies (shops, leisure centers, etc.).

All of the above is made possible by analyzing the data already collected. Imagine what opportunities will open up in front of the market if the car starts to “communicate” with the surrounding objects (other cars and road network elements), responding to their actions or collecting information about the driver's reaction.

There is an idea. And how to implement?

Everything written above is very cool in theory, but so far on the scale of the entire traffic is not available in practice. And this is a simple explanation.

For the correct application of big data, three components are needed: a developed infrastructure, the readiness of industry representatives for innovations, and resources, including personnel, to put all ideas into practice. Let's see how things are now.

Infrastructure

Technically, for the transition to the ideology of connected cars data everything is ready. Everywhere there is a mobile network with access to the Internet. Data exchange standards have already been developed that provide relatively easy integration of their supporting devices into the infrastructure of a potential system. There are ready-made and generally accepted solutions for analyzing and storing big data, such as Hadoop, Spark, Storm and others, as well as large cloud services (Amazon RedShift, Azure DataLake, Azure HDInsight).

Ready for innovation

It makes sense to speak about readiness for innovations in two planes: from the point of view of the market and from the side of ordinary motorists.

The market is theoretically ready. Already more than half of cars sold in the world belong to the category of connected. Visiongain believes that Big Data is one of the fastest growing segments of the automotive industry. This indicates the high demand for big data analysis. At the same time, automakers that are not yet taking initiatives are being pushed by investors and shareholders.

Nevertheless, the purely technical barrier still prevents the active movement in the direction of Big Data: the closed data exchange protocols inside the car do not allow you to easily and quickly collect all the information from all brands of cars on the market. Perhaps the situation will correct the appearance of a certain common standard, but for now this question is open.

It is difficult to judge the readiness of the mass user now. Like any innovation, services based on Big Data analysis have their supporters and opponents. For example, lovers of aggressive driving style is unlikely to enjoy a review of the scheme for calculating insurance. In forums and blogs, the very idea of collecting data from cars causes the same controversy as Google’s analysis of user behavior by devices and the Google search engine: one likes new functions, while others protest against “total surveillance” and tell horrors about the insecurity of accumulated data. But the flywheel is running.

Resources

Implementing Big Data analysis from scratch implies large intellectual and financial investments. Naturally, not everyone will pull them alone, but, like in other markets, they may well be divided between the interested parties. For example, we used this approach when creating Remoto: we took on research and development, and transferred the installation of equipment to automakers. So the device becomes an additional option of the car, due to which users get a number of necessary convenient functions.

With personnel capable of working effectively with Big Data, everything is somewhat more complicated, because globally this is a new market, to which the “right” approach has yet to be found. We have been forming our team for several years, focusing on active specialists with a creative approach to work, and are open to new contacts with people interested in this direction.

Right now we are looking for:

→ System Architect

→ System Analyst

→ Project Manager

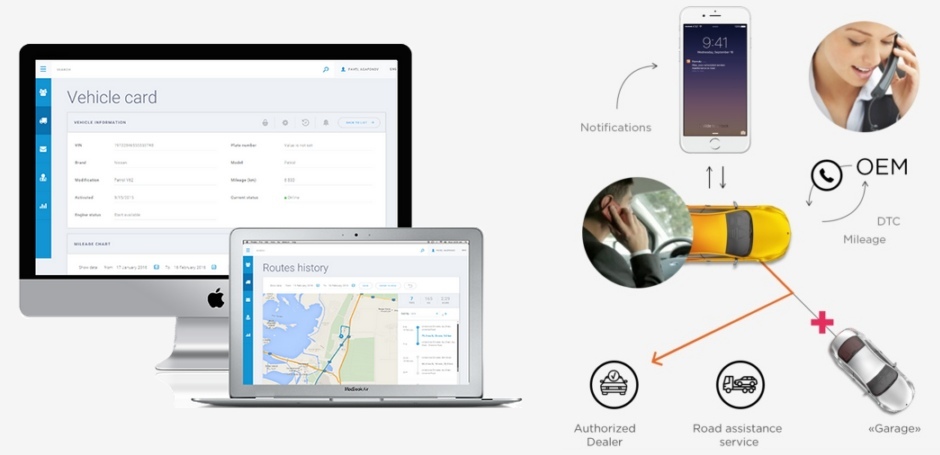

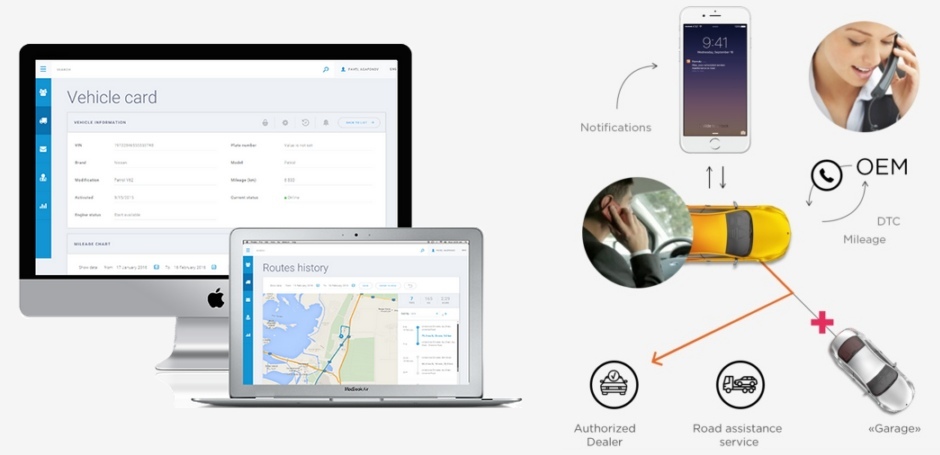

Remoto from the inside

One example of a service for working with large automotive data is the Remoto platform. It allows you to collect information about the car, manage part of its functions and communicate with the very "brain center" - the cloud - to transfer data. At the moment, Remoto works with cars Kia, Nissan, Infiniti, Toyota, Genesis, Honda. Technically, integration with the products of other auto concerns is also possible; to expand the list of supported models, small customization of software is required, which implies interaction with the manufacturer (and his agreement to introduce similar technologies).

The solution consists of several components:

- equipment installed in the car;

- mobile app;

- access portals for dealers and insurance companies;

- cloud infrastructure, responsible for storing and analyzing data.

A set of equipment in the car - a Remoto module with a SIM card - is installed directly by the manufacturer (as part of the standard configuration) or by a dealer (as an option). It is important that the installation does not violate the safety perimeter of the machine, since The solution can be integrated with the factory anti-theft system.

The task of the telematics device is receiving information from onboard systems, transferring raw data to the cloud, receiving commands and transmitting them to onboard systems. The frequency of sending data is determined by the system settings. For example, remote diagnostics is carried out two or three times a month.

The mobile application is available for Android and iOS (in limited mode - under Windows Phone). With it you can:

- remotely start the engine;

- set cooling or heating of the cabin on schedule;

- determine the location of the car and trace its route;

- track the impact on the car in the absence of the owner (hit above a certain level, evacuation when the engine is not started);

- remotely control the central lock (track the status of opening / closing doors and trunk).

More than 50 services in total.

The server part is represented by the Microsoft Azure cloud and portals for dealers, automakers or insurance companies - i.e. for the main users of the collected driver data. An API is provided to integrate the portal with the client’s corporate systems.

Today in the world there are already more than 500 thousand mobile users of Remoto. This, in turn, is a good foundation for analyzing and monetizing Big Data. Even now, the Bright Box company, the brainchild of which Remoto is, helps car makers with business models, various marketing tricks are quite available - user activity cards with specific cars, refined customer profiles that prefer certain cars, etc.

Thus, for Big Data, there was a place even in the conservative automotive industry. The toolkit available today has opened ways for a fundamentally new interaction with the client, which makes it more likely that they will return in the future.

Source: https://habr.com/ru/post/325718/

All Articles