Top 8 new fintech applications of the beginning of 2017

Thanks to fintech applications, lending, P2P, e-commerce, insurance services and non-banks became available for any smartphone user. In this material, we consider the eight most popular applications of 2017.

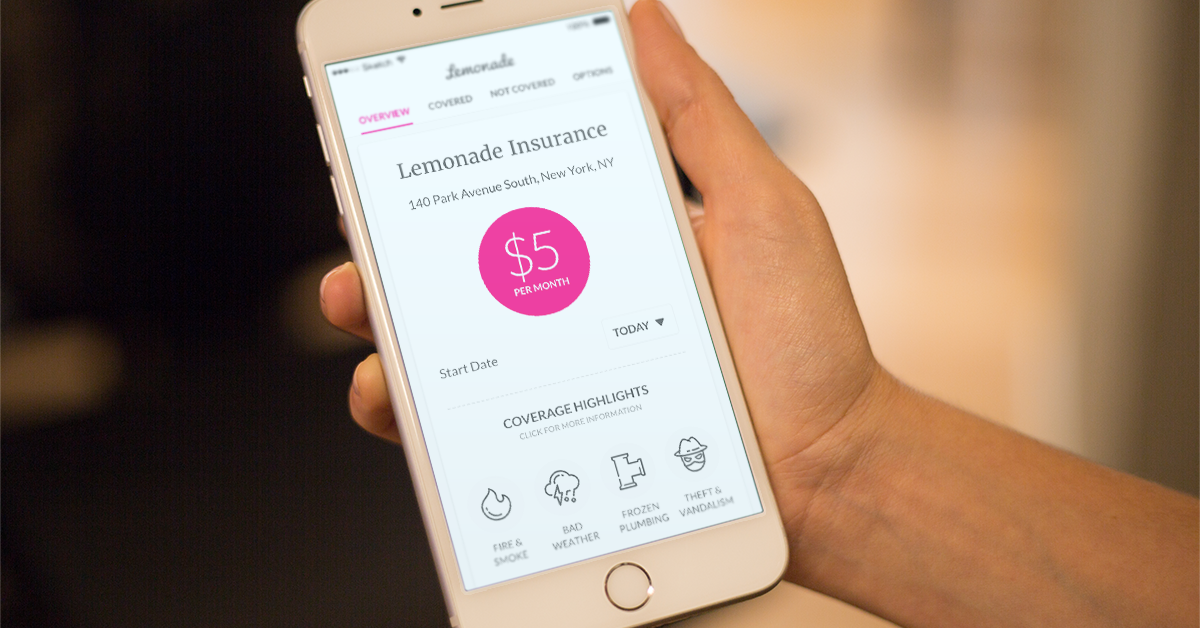

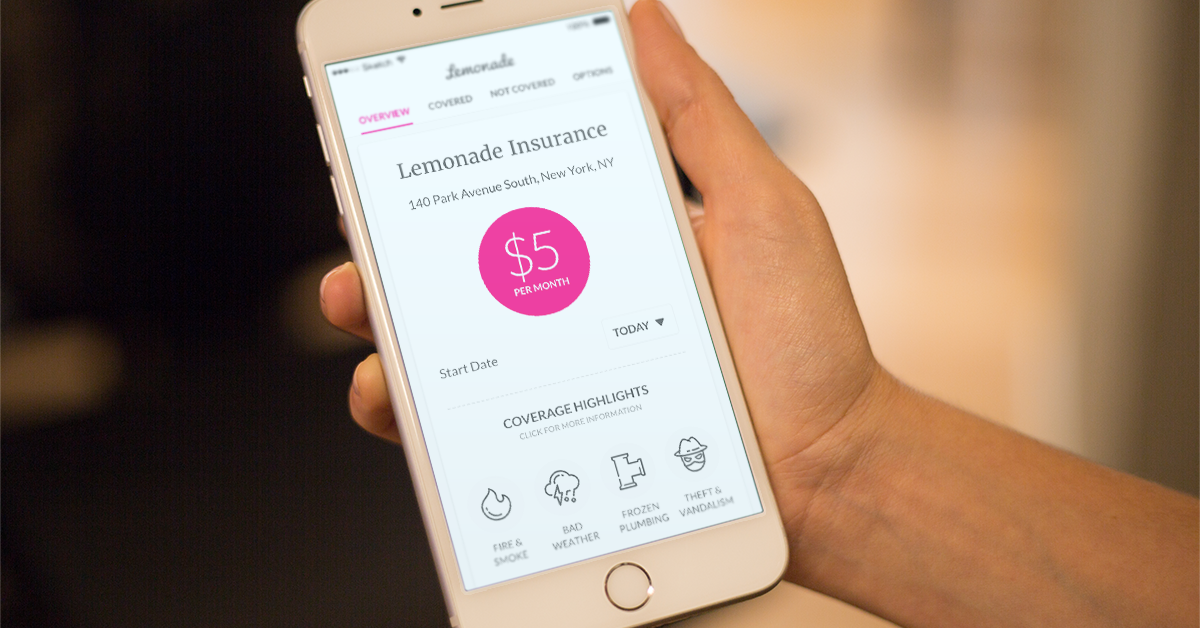

Startup Lemonade is going to change such a complex and confusing area as insurance, making it as simple as using any other mobile application. Founded in 2016, the company has set a goal: to reduce to a few minutes the time it takes to insure real estate or a car. For this, artificial intelligence technologies are used. They managed to set an absolute record of the insurance premium payment rate - only three seconds! Unfortunately, Lemonade services are currently available only in New York and Illinois.

')

We will tell a little more about how this is done. The user of the Lemonade mobile app indicates his place of residence and answers several questions. Instead of filling out forms, it is proposed to record a small video. According to the results of data processing, artificial intelligence selects a personal insurance offer.

If the user already has a contract with another insurance company, Lemonade offers to transfer the service to them on more favorable terms. It does not require filling out any paper documents, all procedures are carried out in digital form: using the application, you can report the occurrence of an insured event and immediately receive your insurance. The application also allows you to donate part of the money to charity.

Clarity Money refutes the widespread belief that in the area of personal finance management applications, everything has already been invented. Their application, which started in January 2017, has already managed to receive the prestigious award of the online industry, Webby Awards, to overcome the milestone of 100,000 active users and raise $ 14.5 million in two rounds of funding. Director Adam Dell says that they simply have no competitors in the market. After downloading the application, you will need to link it with your bank cards so that artificial intelligence can make clues. The application uses artificial intelligence and self-learning machines to reduce user costs. Also, the application allows you to create savings accounts.

Clarity Money has already helped save each user an average of $ 300 by analyzing spending over $ 10 billion. The application begins by cleaning outdated subscriptions that can withdraw money (for example, on Netflix and Apple Music), find ways to refinance existing loans, and save on bill payments. Also through the program, you can give a request for a discount from those online services, of which you are regular users.

Zelle is a P2P lending service that has partnerships with more than 20 banks, as well as an instant money transfer system. You can already use Zelle services, for example, from the Bank of America mobile application. To create a fast and reliable ecosystem of P2P lending, payments through Visa and Mastercard are supported. In 2016 alone, Zelle processed 170 million P2P payments, totaling $ 55 billion. To make a payment, a mobile phone number or email address is sufficient.

The closest competitors of the application are PayPal, Venmo and Square Cash, as Zelle allows you to instantly transfer money through a mobile phone. The banks that organized this enterprise believe that the Zelle user base will soon exceed 100 million people. By mid-2017, the possibility of transferring money through Zelle will appear in the mobile applications of the largest US banks. So this mobile application can be an alternative not only to checks, but also cash.

Starling Bank is one of English nebank. Thanks to this application, it becomes possible to receive banking services via a smartphone without contacting a bank branch. A unique feature is that banking services can be obtained using the Amazon Alexa “voice assistant”. The company also plans to add integration with Google Home, Siri and other similar services. In addition, another British FINTECH company, TransferWise, has entered into an agreement with Starling Bank to provide its customers with the possibility of international money transfers.

Starling Bank uses Faster Payments technology, which allows you to instantly transfer money and pay bills. Julian Sawyer, the executive director of Starling Bank is now engaged in obtaining permits from the government and the UK Civil Aviation Authority. He plans to deliver bank cards to customers using unmanned aerial vehicles (drones).

Amazon Cash is a fintech application from e-commerce leader Amazon. Amazon Cash is both a mobile wallet and a gift card that can be used on a mobile device. To start using Amazon Cash, you need to go to the site and get an SMS message with a barcode. The user then shows the barcode to the cashier of one of the stores participating in the program. After the cashier scans the code, the user balance in Amazon Cash is replenished by the amount that the buyer transfers to the cashier. At one time you can make an amount from 15 to 500 US dollars. At the same time, no commission is charged. There is no difference between the Amazon Cash balance and the gift card balance, since it’s the same thing: the amount you can use to make purchases on Amazon.com. Now for online purchases you do not need to enter your bank card details or buy a gift card. The barcode associated with the user account, it is enough to receive one time to continue to use it.

Amazon started to provide the service only in April of this year, but large retail chains have already become participants of the program: for example, CVS pharmacy pharmacies and Speedway gas stations.

Daily Change has been working since last December. This application for the smartphone in the form of a game teaches the savings of personal money. For example, the application will calculate how much you will save if you drink tap water instead of buying bottled water, or take lunch from home with you instead of ordering food in a cafe. The application also shows reminders about the payment of necessary payments and information about the status of savings accounts.

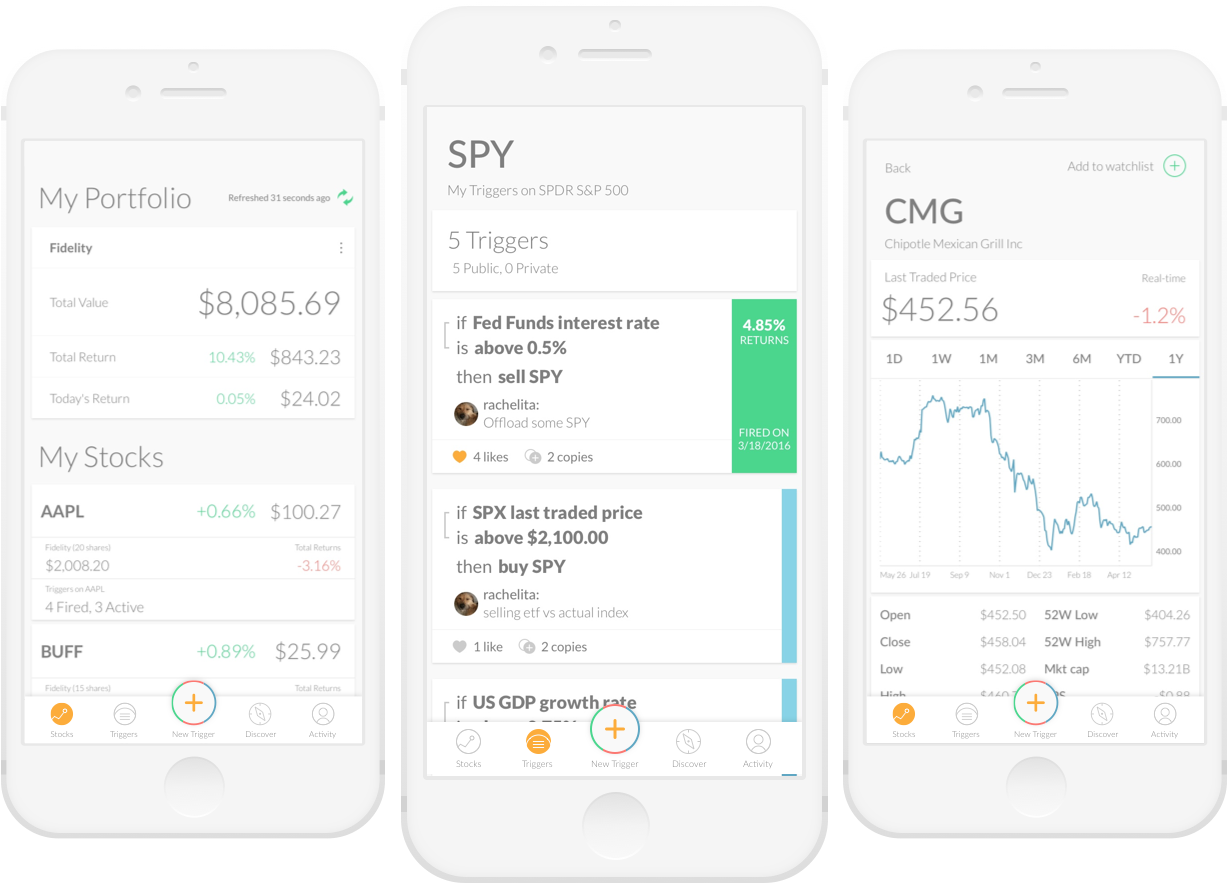

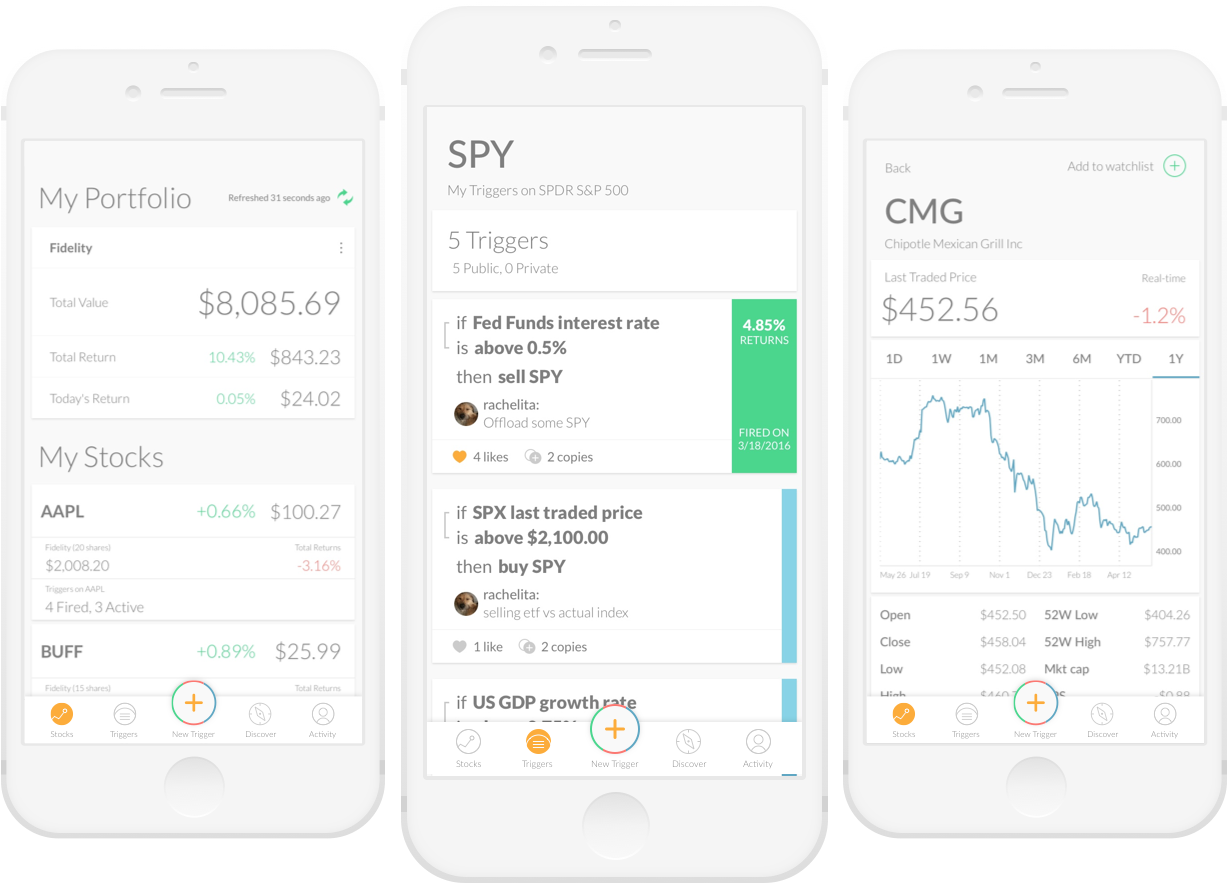

Trigger is a mobile platform that helps to get information about changes in the price of selected stocks, reports on profits, corporate events and even Twitter messages of famous people. Trigger has information similar to Twitter, and users can set up signals of interest. The Trigger app, released in 2015, gained much popularity after the recent presidential elections in the United States. Thanks to Trigger, the user finds out in real time when Trump writes on social networks, mentioning some joint-stock company. Markets immediately react to this by changing the stock price.

Jetty is the most recent financial application, which was launched only last week. While this is only an online platform, but soon there will be a mobile application. Jetty offers insurance services for tenants and rental owners. As stated on the company's twitter , "this is insurance against fire and theft, as well as from wasting time and money." Along with traditional insurance services, Jetty offers Jetty Passport, a service that replaces the guarantor or security deposit when renting real estate. The startup has already raised $ 4 million in funding from several investors, including Ribbit Capital. And it seems that the founders of Ribbit Capital have high hopes for this service.

Lemonade

Startup Lemonade is going to change such a complex and confusing area as insurance, making it as simple as using any other mobile application. Founded in 2016, the company has set a goal: to reduce to a few minutes the time it takes to insure real estate or a car. For this, artificial intelligence technologies are used. They managed to set an absolute record of the insurance premium payment rate - only three seconds! Unfortunately, Lemonade services are currently available only in New York and Illinois.

')

We will tell a little more about how this is done. The user of the Lemonade mobile app indicates his place of residence and answers several questions. Instead of filling out forms, it is proposed to record a small video. According to the results of data processing, artificial intelligence selects a personal insurance offer.

If the user already has a contract with another insurance company, Lemonade offers to transfer the service to them on more favorable terms. It does not require filling out any paper documents, all procedures are carried out in digital form: using the application, you can report the occurrence of an insured event and immediately receive your insurance. The application also allows you to donate part of the money to charity.

Clarity Money

Clarity Money refutes the widespread belief that in the area of personal finance management applications, everything has already been invented. Their application, which started in January 2017, has already managed to receive the prestigious award of the online industry, Webby Awards, to overcome the milestone of 100,000 active users and raise $ 14.5 million in two rounds of funding. Director Adam Dell says that they simply have no competitors in the market. After downloading the application, you will need to link it with your bank cards so that artificial intelligence can make clues. The application uses artificial intelligence and self-learning machines to reduce user costs. Also, the application allows you to create savings accounts.

Clarity Money has already helped save each user an average of $ 300 by analyzing spending over $ 10 billion. The application begins by cleaning outdated subscriptions that can withdraw money (for example, on Netflix and Apple Music), find ways to refinance existing loans, and save on bill payments. Also through the program, you can give a request for a discount from those online services, of which you are regular users.

Zelle

Zelle is a P2P lending service that has partnerships with more than 20 banks, as well as an instant money transfer system. You can already use Zelle services, for example, from the Bank of America mobile application. To create a fast and reliable ecosystem of P2P lending, payments through Visa and Mastercard are supported. In 2016 alone, Zelle processed 170 million P2P payments, totaling $ 55 billion. To make a payment, a mobile phone number or email address is sufficient.

The closest competitors of the application are PayPal, Venmo and Square Cash, as Zelle allows you to instantly transfer money through a mobile phone. The banks that organized this enterprise believe that the Zelle user base will soon exceed 100 million people. By mid-2017, the possibility of transferring money through Zelle will appear in the mobile applications of the largest US banks. So this mobile application can be an alternative not only to checks, but also cash.

Starling bank

Starling Bank is one of English nebank. Thanks to this application, it becomes possible to receive banking services via a smartphone without contacting a bank branch. A unique feature is that banking services can be obtained using the Amazon Alexa “voice assistant”. The company also plans to add integration with Google Home, Siri and other similar services. In addition, another British FINTECH company, TransferWise, has entered into an agreement with Starling Bank to provide its customers with the possibility of international money transfers.

Starling Bank uses Faster Payments technology, which allows you to instantly transfer money and pay bills. Julian Sawyer, the executive director of Starling Bank is now engaged in obtaining permits from the government and the UK Civil Aviation Authority. He plans to deliver bank cards to customers using unmanned aerial vehicles (drones).

Amazon Cash

Amazon Cash is a fintech application from e-commerce leader Amazon. Amazon Cash is both a mobile wallet and a gift card that can be used on a mobile device. To start using Amazon Cash, you need to go to the site and get an SMS message with a barcode. The user then shows the barcode to the cashier of one of the stores participating in the program. After the cashier scans the code, the user balance in Amazon Cash is replenished by the amount that the buyer transfers to the cashier. At one time you can make an amount from 15 to 500 US dollars. At the same time, no commission is charged. There is no difference between the Amazon Cash balance and the gift card balance, since it’s the same thing: the amount you can use to make purchases on Amazon.com. Now for online purchases you do not need to enter your bank card details or buy a gift card. The barcode associated with the user account, it is enough to receive one time to continue to use it.

Amazon started to provide the service only in April of this year, but large retail chains have already become participants of the program: for example, CVS pharmacy pharmacies and Speedway gas stations.

Daily Change

Daily Change has been working since last December. This application for the smartphone in the form of a game teaches the savings of personal money. For example, the application will calculate how much you will save if you drink tap water instead of buying bottled water, or take lunch from home with you instead of ordering food in a cafe. The application also shows reminders about the payment of necessary payments and information about the status of savings accounts.

Trigger

Trigger is a mobile platform that helps to get information about changes in the price of selected stocks, reports on profits, corporate events and even Twitter messages of famous people. Trigger has information similar to Twitter, and users can set up signals of interest. The Trigger app, released in 2015, gained much popularity after the recent presidential elections in the United States. Thanks to Trigger, the user finds out in real time when Trump writes on social networks, mentioning some joint-stock company. Markets immediately react to this by changing the stock price.

Jetty

Jetty is the most recent financial application, which was launched only last week. While this is only an online platform, but soon there will be a mobile application. Jetty offers insurance services for tenants and rental owners. As stated on the company's twitter , "this is insurance against fire and theft, as well as from wasting time and money." Along with traditional insurance services, Jetty offers Jetty Passport, a service that replaces the guarantor or security deposit when renting real estate. The startup has already raised $ 4 million in funding from several investors, including Ribbit Capital. And it seems that the founders of Ribbit Capital have high hopes for this service.

Source: https://habr.com/ru/post/325532/

All Articles