“It is expensive for us” - retail about acquiring

This article is EXCLUSIVELY PERSONAL OPINION of its author, and is based on his personal experience!

For several months now, I have been watching drama in a row, as our retail complains to the Federal Anti-Monopoly Service ( FAS) , or somewhere else, that Internet acquiring has become dear to them. I was wondering if the retails also lead themselves with their suppliers? And it turned out more like - which was to be expected. Let us and we will help retail calculate the interest.

Alas, Igor Korolev from cnews does not care about acquiring. For example, only Sberbank can give a rate of 1.4% - and it will be lower than the cost price. In general, Sberbank often works in acquiring minus, i.e. if the bank gave acquiring, for example, to Alfa-Bank, then Sber would have earned more on the interchange . Although maybe now something has changed. But there is no interchange in the size of 0.5% in Russia.

')

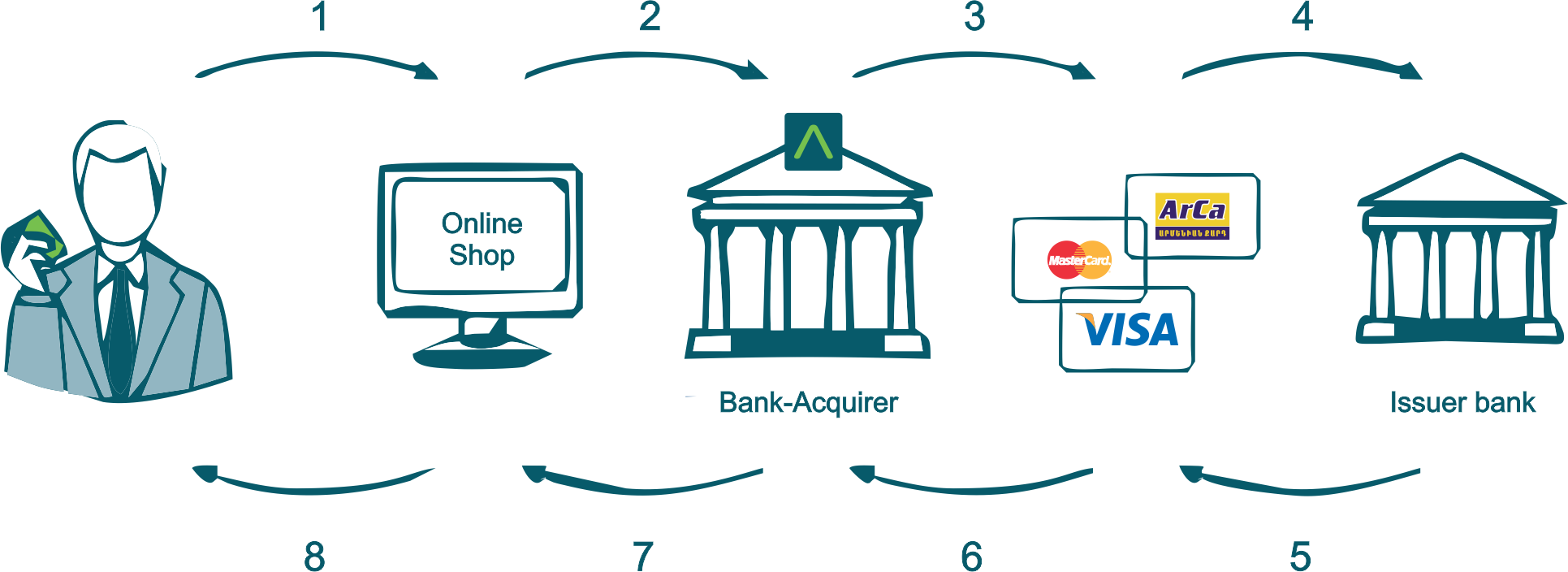

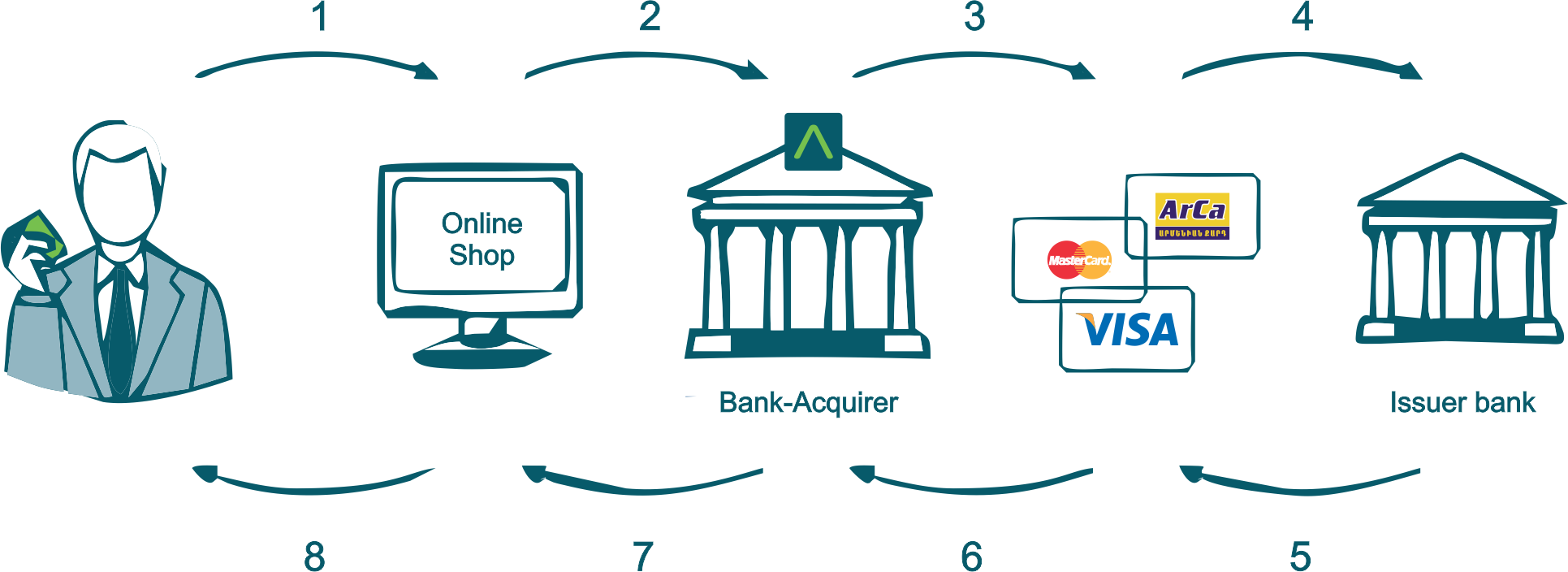

Let's try to figure out where the feet grow from and how expensive it is for them.

Figuratively speaking, the situation looks like this: you collect cars, the cost of your spare parts is 850 thousand rubles, the cost of assembly is 100 thousand rubles. Sell for 1 million rubles, i.e. net profit from the 1st car - 50 thousand rubles. And then consumers are starting to complain to you in the FAS that they want to buy these cars at a price of 900 thousand rubles. Your cars - your price, which primarily relies on the cost of work and spare parts.

Of course, the size of the interchange (the commission that the acquirer pays the issuer) is determined by the Russian banks themselves. But the benefit of banks from reducing interchange is not obvious. The financial model of retail - to buy goods (for example, in China, where most of the goods are produced) to put their mark-up, which will cover the overhead (including card commission). How in such a model can retail become expensive? If the goods cost 997 or 998 rubles - the buyer will not notice the difference.

Someone from particularly clever financiers decided that the acquiring commission is a local where you can cut costs, increase your own margin, curry favor with the management and get a bonus. In principle, these people are paid for fighting “dear to us”.

I still work in the field of Internet acquiring, so let's look at an example in the field of Internet acquiring. How much does one transaction really cost?

And so, the average interchange for Visa / MasterCard is 1.53%. (Of course, provided that almost no one pays Platinum MasterCards or higher).

Visa commission for transaction clearing is $ 0.0061, MasterCard is $ 0.009.

The total cost, with the distribution of 60/40 and 3 thousand of the average check, ~ 0.015% - takes itself MPS.

→ Tariffs Visa

→ MasterCard Fees

By the way, for the Krosborder transaction, the cost of clearing increases tenfold - hence fixes appear for European acquirers working in the Russian market (for an online gambling note).

But this is not all. MPS requires the availability of insurance deposits. Of course the original documents for us are closed NDA with the participants. But NSPK kindly copied the rules for the formation of insurance funds and put them in open access .

So, the acquirer must keep in the insurance fund 5 days of turnover, which he pays towards the issuers (for example, interchange - but this is a rather insignificant amount). This is especially true for those acquirers who make payments to cards or return funds. So, 30% of returns from a five-day turnover are money that does not work. At the refinancing rate of the Central Bank, this will add 0.04%, although of course the bank could issue this money on credit and make a profit twice as high. I believe that experts from banks can name hundreds more of any payments (such as an annual audit) that the bank has to pay. But we are not a bank, so we can not say for sure.

Let's make it easier, let's calculate that four large customers need 1 seller, 1 support person (of course, support is round-the-clock and works in shifts) and 1 programmer. Salaries of 90, 70 and 120, respectively. And this will be another ~ 0.07%.

Total total rate (excluding audit, promotional costs, etc.) ~ 1.655%

So, if someone offers a rate of 1.7% for Internet acquiring, then there are only two options: either he just does not know how to count, or he is Sberbank.

By the way, from the super “cool” ideas of the same retail (in particular, AKIT) - to introduce taxes / duties on purchases in foreign online stores. Yes, protectionism existed in Europe / USA even 150-200 years ago, only he defended his production. But when one retail trade in Chinese goods requires another retail trade in Chinese goods to be levied, this already, IMHO, seems to be ascam for non-market methods of economic struggle.

Although of course that “other retail” (the enemy of all Russian retail is aliexpress) is good. It violates the same rules of the IPU with Yandex Money - here it is miscoding (a false indication of the type of payment: the MCC of the electronic wallet, instead of the outlet) and the connection of non-residents. Moreover, the Central Bank, named by the regulator in 161 FZ, does not seem to notice this, just as it does not notice a large flow of money leaving the NPO not directly to the resident - and this is clearly not 5% of the turnover.

For several months now, I have been watching drama in a row, as our retail complains to the Federal Anti-Monopoly Service ( FAS) , or somewhere else, that Internet acquiring has become dear to them. I was wondering if the retails also lead themselves with their suppliers? And it turned out more like - which was to be expected. Let us and we will help retail calculate the interest.

Alas, Igor Korolev from cnews does not care about acquiring. For example, only Sberbank can give a rate of 1.4% - and it will be lower than the cost price. In general, Sberbank often works in acquiring minus, i.e. if the bank gave acquiring, for example, to Alfa-Bank, then Sber would have earned more on the interchange . Although maybe now something has changed. But there is no interchange in the size of 0.5% in Russia.

')

Let's try to figure out where the feet grow from and how expensive it is for them.

Figuratively speaking, the situation looks like this: you collect cars, the cost of your spare parts is 850 thousand rubles, the cost of assembly is 100 thousand rubles. Sell for 1 million rubles, i.e. net profit from the 1st car - 50 thousand rubles. And then consumers are starting to complain to you in the FAS that they want to buy these cars at a price of 900 thousand rubles. Your cars - your price, which primarily relies on the cost of work and spare parts.

Of course, the size of the interchange (the commission that the acquirer pays the issuer) is determined by the Russian banks themselves. But the benefit of banks from reducing interchange is not obvious. The financial model of retail - to buy goods (for example, in China, where most of the goods are produced) to put their mark-up, which will cover the overhead (including card commission). How in such a model can retail become expensive? If the goods cost 997 or 998 rubles - the buyer will not notice the difference.

Someone from particularly clever financiers decided that the acquiring commission is a local where you can cut costs, increase your own margin, curry favor with the management and get a bonus. In principle, these people are paid for fighting “dear to us”.

I still work in the field of Internet acquiring, so let's look at an example in the field of Internet acquiring. How much does one transaction really cost?

And so, the average interchange for Visa / MasterCard is 1.53%. (Of course, provided that almost no one pays Platinum MasterCards or higher).

Visa commission for transaction clearing is $ 0.0061, MasterCard is $ 0.009.

The total cost, with the distribution of 60/40 and 3 thousand of the average check, ~ 0.015% - takes itself MPS.

→ Tariffs Visa

→ MasterCard Fees

By the way, for the Krosborder transaction, the cost of clearing increases tenfold - hence fixes appear for European acquirers working in the Russian market (for an online gambling note).

But this is not all. MPS requires the availability of insurance deposits. Of course the original documents for us are closed NDA with the participants. But NSPK kindly copied the rules for the formation of insurance funds and put them in open access .

So, the acquirer must keep in the insurance fund 5 days of turnover, which he pays towards the issuers (for example, interchange - but this is a rather insignificant amount). This is especially true for those acquirers who make payments to cards or return funds. So, 30% of returns from a five-day turnover are money that does not work. At the refinancing rate of the Central Bank, this will add 0.04%, although of course the bank could issue this money on credit and make a profit twice as high. I believe that experts from banks can name hundreds more of any payments (such as an annual audit) that the bank has to pay. But we are not a bank, so we can not say for sure.

Let's make it easier, let's calculate that four large customers need 1 seller, 1 support person (of course, support is round-the-clock and works in shifts) and 1 programmer. Salaries of 90, 70 and 120, respectively. And this will be another ~ 0.07%.

Total total rate (excluding audit, promotional costs, etc.) ~ 1.655%

So, if someone offers a rate of 1.7% for Internet acquiring, then there are only two options: either he just does not know how to count, or he is Sberbank.

By the way, from the super “cool” ideas of the same retail (in particular, AKIT) - to introduce taxes / duties on purchases in foreign online stores. Yes, protectionism existed in Europe / USA even 150-200 years ago, only he defended his production. But when one retail trade in Chinese goods requires another retail trade in Chinese goods to be levied, this already, IMHO, seems to be a

Although of course that “other retail” (the enemy of all Russian retail is aliexpress) is good. It violates the same rules of the IPU with Yandex Money - here it is miscoding (a false indication of the type of payment: the MCC of the electronic wallet, instead of the outlet) and the connection of non-residents. Moreover, the Central Bank, named by the regulator in 161 FZ, does not seem to notice this, just as it does not notice a large flow of money leaving the NPO not directly to the resident - and this is clearly not 5% of the turnover.

Source: https://habr.com/ru/post/325056/

All Articles