How clouds change the colocation market in data centers

Prepared by Data Center Knowledge

Large cloud service providers are taking more and more client operations from data centers and at the same time taking up more and more of their capacity to meet this burden, making major adjustments to the global market for collocation services in data centers.

According to the latest StructureResearch report, one of the most significant changes was the slowdown in retail colocation and the revitalization of the wholesale data distribution market. Analysts predict growth in retail colocation by 14.3 percent and by 17.9 percent in the wholesale market for the period from 2016 to 2017, while retail colocation accounts for 75 percent of the market and the remaining market share for the wholesale market.

According to estimates by StructureResearch, in 2016 the volume of the global colocation market, including its retail and wholesale sectors, reached $ 33.59 billion, and the projected growth is 15.2 percent per year.

')

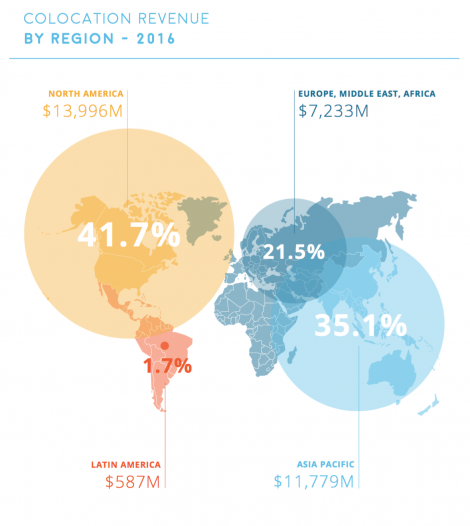

Here's how the data center market revenue is distributed by region (diagram provided by StructureResearch):

The change in the growth rate of the retail and wholesale markets is caused by a number of factors, but, according to Structure Research, the large-scale cloud services of companies such as Amazon and Microsoft played the most significant role. For example, according to the data of the North American Data Centers commercial real estate agency, last year Microsoft signed agreements for the lease of data center sites with a total capacity of more than 125 MW only in the USA.

Not wanting to lag behind competitors, in 2016, Oracle entered into seven wholesale agreements in the United States for the rental of sites in data centers with a total capacity of more than 30 MW. Microsoft’s capacity is far away, but Oracle hasn’t rented so much. Recently, after the opening of the first accessibility zone in Phoenix (USA), the company opened several sites in northern Virginia, in London and in Turkey. There are at least two or three data centers per several megawatts in each region, and the process of expanding the geographical coverage of the new Oracle cloud platform is far from complete.

According to NADC, about two-thirds of the 30 largest lease transactions for data center resources signed in North America in 2016 were made with hyper-scalable cloud service providers. In addition to Microsoft and Oracle, these include Salesforce, IBM SoftLayer and Box.

Slowing the growth of small players

Structure Research emphasizes that this trend does not mean a decline in the retail market for collocation services in the data center. The market condition is still favorable and the growth dynamics is positive.

However, in an interview with Data Center Knowledge, Director of Research for Structure Research and co-author of the report, Jabez Tan reports that the main development is driven by the growth of the top of the market and stimulated by the largest suppliers. In the lower and middle segments of the market, a decrease in growth rates is observed when the share of income from retail colocation to cloud service providers goes down.

The target audience of small enterprises, colocation service providers, which do not work in several regions, is declining, since they are essentially aimed at working with small and medium-sized businesses, and it is for such enterprises that it makes sense to transfer applications to the cloud in the first place. Many small providers seek to accelerate revenue growth by offering more sophisticated managed services, but, as Tan points out, “many of them are not growing so fast.”

From provider neutrality to cloud neutrality

Other important changes brought about by cloud technologies include a shift in focus from provider neutrality to cloud neutrality. As more and more enterprises transfer operations to the cloud, according to data center forecasts, there will be a growing need for the ability to use the services of several providers, and providing convenient access to the maximum number of cloud providers will become an essential component of the colocation service providers strategy.

Some providers (especially Equinix) have for several years been talking about the need to provide customers with the opportunity to develop a strategy based on several cloud services. However, there is no reason to believe that multi-cloud placement is already widely used. Today it seems that providing access to a variety of cloud services for colocation providers is just part of the starting strategy. Tan said: “This trend is at an early stage of development. Over time, the situation will change. "

Asia-Pacific region will overtake North America

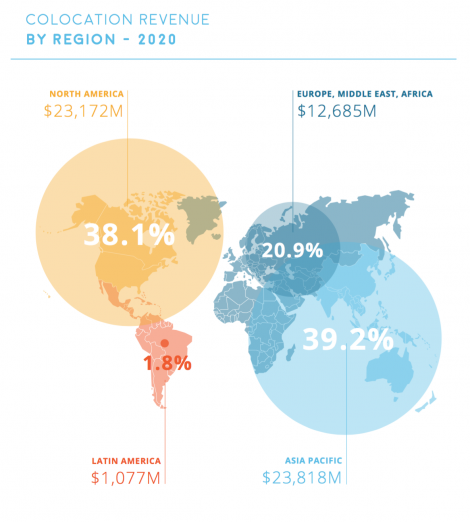

According to forecasts by Structure Research, the Asia-Pacific region will soon overtake North America in terms of its share in the colocation market in the data center.

According to Tan, China will continue to stimulate growth, but the region is saturated with emerging market countries, such as Malaysia and Thailand, which will feed on the inertia of countries with mature markets such as India, Japan, Singapore and Australia. All this will lead to the fact that according to forecasts of Structure Research, by 2020 the volume of the Asian-Pacific region will exceed the North American market in terms of the share of the colocation services market in the data center.

Here's how the distribution of forces in the colocation market will change in the next three years according to the forecasts of Structure Research:

Choose a virtual server or hosting ? Try a search at HOSTING.cafe .

Source: https://habr.com/ru/post/324442/

All Articles