Cards VS e-Wallets

Why in Russia, unlike the United States and European countries, e-currencies have developed strongly? In order to answer this question, we need to delve into the history of the emergence of credit cards in the United States.

History of MPS development

')

In America, the history of payment cards began with a credit card, from the beginning of the 1900s: the first consumer credit card was issued in 1914 by the Wester Union Telegraph Company for its best customers, and was a metal plate, and required to pay off expenses month. The clerks in the stores just made a print from this card and then received money from it at the bank. Similar cards were issued until the end of the 1950s.

In 1924, a network of California gas stations issued the world's first cardboard credit card. It was an important invention. The growing popularity of cars in those days ignited the desire of residents to travel and be able to pay for gasoline anywhere.

In 1950, the Dinners Club card was born in New York, the originality of the idea was that instead of paying bills at the end of the month for various restaurants in New York, the cardholder received an invoice once a month for all the restaurants he visited.

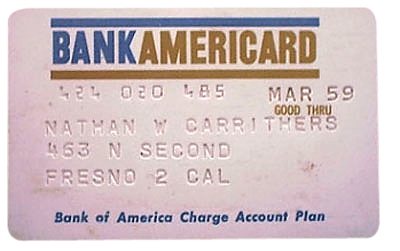

At that time, the birth of the credit card industry and its rapid development were taking place; many banks tried their pilot projects. But really successful was the launch of Bank Bank of America's own BankAmericard cards in 1958 (the progenitor of Visa). It was then that the cards became widespread.

At first, the BankAmerciard program was distributed to other banks through the franchise system. But in 1970, the BankAmericard system was transformed into the independent organization National BankAmericard Inc. (NBI), managed by member banks.

The first cards were sent by banks by regular mail as a bank offer, even if the consumer did not ask for such an opportunity. In pursuit of an increase in the number of customers, banks sent cards through telephone directories and other available information, which sometimes even led to comical results — even children and pets received a credit card.

In turn, credit cards generated a wave of fraud - the cards were removed from the mailboxes, as well as by unscrupulous mail workers in the branches themselves, the card numbers were copied, the cards were dug out of wallets, etc. Banks suffered huge losses.

In 1970, the US Congress responded by adopting a law prohibiting sending credit cards by mail. Then the next round of fraud began - the theft of documents for receiving credit cards.

In general, the credit card industry faced problems and overcame them, changing laws and payment system rules. Clearly, the distribution of the maps required consumer protection laws. According to this, the Fair Credit Billing Act was adopted in 1974, designed to protect consumers' rights from unfair outlets, which mistakenly debited money from credit / debit cards for non-existent or mistakenly presented goods. Thus was born the chargeback and the right of the cardholder to challenge the transaction.

The law gave the consumer the right to apply to the issuer and request a refund. The main reason for the return was “unauthorized cardholder payment for a product or service”. At the same time, TSP had the right to challenge such a refund. Further laws reflected in the rules of the IPU. Although, the laws of some countries impose their limitations. But in fact, the rule “for an unauthorized transaction by the card holder is the responsibility of the outlet” rooted in the heads of the Americans.

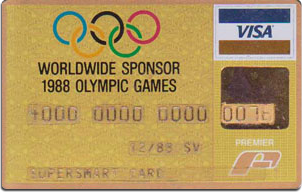

Absolutely differently, the industry developed in Russia. The history of maps begins in 1969, back in the USSR. A planned economy did not need to sell loans to the public on a competitive basis (which is exactly what a credit card did). Therefore, in the USSR, the industry was reduced to servicing foreign cards in several foreign exchange stores (“Birch”) and Intourist hotels. In 1980, at the initiative of VISA International and Intourist, terminals were installed in large Moscow hotels. This innovation was supported - the capital was preparing to accept the Olympics. Since 1988, the VISA system began to accept Russian banks in the association. In the same year, the first maps were received by Russian athletes - participants of the Olympics in Seoul.

Banking crisis

After the collapse of the USSR, in the period from 1991 to 1995, quite a few banks appeared on the Russian financial market. By 1996, banks received the bulk of their income from trading in government short-term liabilities (GKO) securities and federal loan bonds (OFZ). The share of income from credit investments was small.

By the end of the 1990s, due to the financial crisis, there was a tendency to reduce the number of Russian banks. Thus, as of January 1, 1997, there were 2007 banks in Russia that had the right to conduct banking operations, and as of May 1, 2009, there were 1041 of them left.

The first Visa cards in Russia appeared in 1990. The transition period from planned to a market economy, the distrust of Russians towards banks (high inflation in 1992) left their imprints - in Russia, most of the cards issued were debit.

The payment systems Visa, MasterCard are owned by member banks, and they also change their rules. In Russia, laws like the Fair Credit Billing Act were not adopted, and the banks participating in the MPS did not focus on the rules that allow the cardholder to challenge the transaction fairly easily.

Our banks made a profit by issuing (an interchange fee from each transaction), and not many wanted to deal with the claim work. By the way, even now, particularly inventive banks offer for an additional fee “to insure a card against fraudulent operations”, to actually carry out a refund (for example, your card’s magnetic strip was copied, and someone made a purchase with a fake card) cardholder to your issuing bank.

Wage

In early 2000, most of the salary in Russia was paid in cash (half in black, the second half through the cash offices of organizations).

Money transfers

Western Union and MoneyGram are leaders in the US money transfer market, together serving more than half of the money transfer market. WesterUnion first offered money transfer services in October 1871.

And in Russia it was possible to transfer money through the offices of the Post Office. Mail transfer is a type of mailing, which involves sending money by mail at established rates (depending on the amount, etc.). The state Russian post began operations on remittances back in 1896.

P2p translations

In March 2006, Visa International made available to Russian banks a service of transferring funds from one card to another via ATMs, regardless of who issued them. In order to send money to the client, it is enough to know the 12-digit number of the recipient's account. Previously, local credit organizations allowed the possibility of moving funds exclusively between "their" credit cards. And that's not all.

The cost of connecting the service from Visa to banks was only $ 2,000, and you can count on the fact that most of the domestic cardholders will soon be able to share the contents of the account with their neighbor. Although the service is spreading more slowly than you might expect. Over the entire summer, only one Credit Ural Bank Magnitogorsk has connected to the Visa Money Transfer system. Tariffs for the service for customers amount to 2% of the transfer amount plus 30 additional rubles if the money goes to a card issued by another bank. You can transfer no more than one hundred thousand rubles at a time. Translation is not instantaneous - the process can take up to three days.

And by the autumn with a similar offer to Russia came the eternal rival of Visa - MasterCard. He broke already 30 thousand euros for the connection, as he is sure that the issuing banks will sooner or later add the service to their service package, since even at such a price it remains extremely profitable for banks and convenient for customers.

Although Visa Money Transfer and MasterCard MoneySend appeared in the early 2000s, they began to receive widespread distribution in Russia around 2010.

findings

Virtual currencies were formed in Russia thanks to:

- The banking crisis of the 90s - banks opened and closed in batches;

- The lack of confidence of Russians in the banks;

- Salaries that were paid in cash. Cash still needed to be carried either to the exchange office or to the bank in order to pay online;

- Fear of card fraud and lack of regulatory legislation in the United States;

- Virtual currencies in Russia replaced money transfers between people, and Visa Money Transfer and MasterCard MoneySend came to Russia much later.

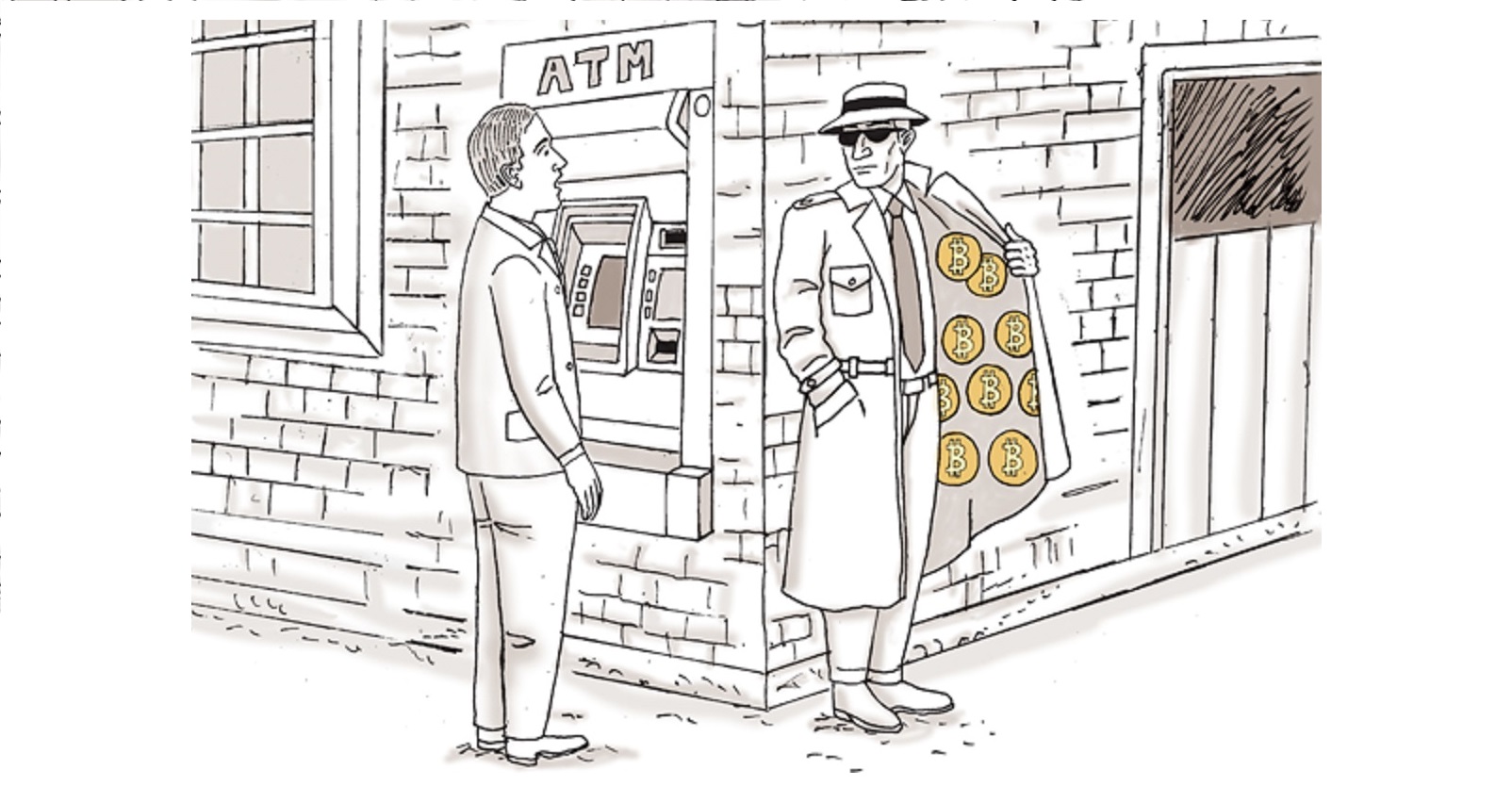

Another distinctive moment in the development of virtual currencies is anonymity. For example, WebMoney have risen on the fact that they immediately gained immense popularity among webmasters engaged in “gray” types of business (adult, pharma, etc.).

A significant difference between virtual currencies and payment systems such as Visa is their centralized management structure. Visa's IPMs belong to their member banks (Di Hoke called this structure haordic , from the English words chaos and order), and decisions are made by vote, thereby ensuring both healthy competition and consistency in work. The structure of Visa showed a huge potential for growth, at the moment it is the largest payment system in the world, and Visa cards are accepted in more than 200 countries around the world. Visa participating banks themselves are interested in distributing cards (increasing emissions and, consequently, their profits).

Virtual currencies Qiwi, Yandex Dengi, WebMoney, PayPal belong to a finite number of shareholders and usually do not go beyond one country (in general, the same PayPal grew only at the expense of eBay). The lack of healthy competition within these systems also leaves its mark. For example, there are frequent cases of blocking WebMoney wallets for unflattering user feedback on the system in the network.

Therefore, in conclusion, I can say that in comparison with Visa / MasterCard cards, virtual currencies will continue to exist locally to solve specific specific problems. Example bitcoin confirmation.

Source: https://habr.com/ru/post/323882/

All Articles